Global Liquid Damage Insurance Market

Market Size in USD Billion

CAGR :

%

USD

13.20 Billion

USD

33.15 Billion

2024

2032

USD

13.20 Billion

USD

33.15 Billion

2024

2032

| 2025 –2032 | |

| USD 13.20 Billion | |

| USD 33.15 Billion | |

|

|

|

Liquid Damage Insurance Market Analysis

The liquid damage insurance market is gaining traction as electronic devices become integral to daily life and increasingly susceptible to liquid-related accidents. This specialized insurance covers repair or replacement costs arising from liquid exposure to smartphones, laptops, and other gadgets, ensuring financial protection for users. The rising dependency on electronic devices, coupled with the growing trend of remote work and online education, has propelled the demand for such policies. Recent advancements in claim processing, such as instant claim approvals and digital documentation, are further streamlining customer experiences. In addition, partnerships between insurance providers and electronics retailers are enhancing product accessibility. The market is also witnessing innovations, including bundled protection plans offering comprehensive device coverage. However, challenges such as limited consumer awareness and regional disparities in policy adoption persist. With increasing device penetration and awareness campaigns, the liquid damage insurance market is poised for substantial growth in the coming years.

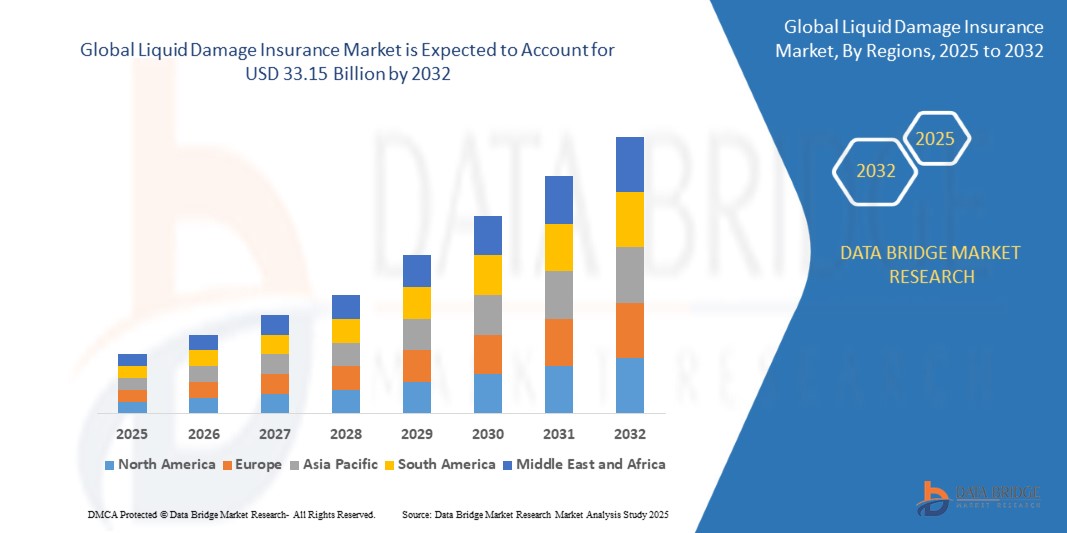

Liquid Damage Insurance Market Size

The global liquid damage insurance market size was valued at USD 13.20 billion in 2024 and is projected to reach USD 33.15 billion by 2032, with a CAGR of 12.20% during the forecast period of 2025 to 2032. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

Liquid Damage Insurance Market Trends

“Integration of Insurance Policies with Device Purchases”

The liquid damage insurance market is evolving rapidly, driven by the increasing reliance on electronic devices and the rising risks of liquid-related accidents. This insurance provides financial protection for repairing or replacing devices damaged by liquid exposure, catering to a growing consumer need. A notable trend is the integration of insurance policies with device purchases, enabling seamless protection plans at the point of sale. Innovations such as digital claims processing and AI-based damage assessment tools are enhancing efficiency and customer satisfaction. In addition, subscription-based models offering bundled coverage for multiple devices are gaining popularity. These advancements, coupled with growing awareness of device protection, are shaping the liquid damage insurance market, ensuring its steady expansion globally.

Report Scope and Liquid Damage Insurance Market Segmentation

|

Attributes |

Liquid Damage Insurance Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America. |

|

Key Market Players |

Progressive Casualty Insurance Company (U.S.), Bolttech (Singapore), Asurion (U.S.), Bajaj Allianz Life Insurance Co. Ltd. (India), OneAssist Consumer Solutions Pvt. Ltd. (India), AT&T Intellectual Property (U.S.), SquareTrade, Inc. (U.S.), Worth Ave. Group (U.S.), Apple Inc. (U.S.), American International Group, Inc. (U.S.), Assurant, Inc. (U.S.), AmTrust Financial (U.S.), Chubb (India), Singtel (Singapore), Securranty (U.S.), Gadget Cover (U.K.), HL Assurance (Singapore), Insurance2go (U.K.), Allianz Partners (Germany) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Liquid Damage Insurance Market Definition

Liquid damage insurance is a specialized insurance policy designed to provide financial protection for electronic devices and other assets damaged by exposure to liquids. This coverage typically includes accidental spills, submersion, or water-related incidents that can impair the functionality of gadgets such as smartphones, laptops, and other personal or commercial electronics. Liquid damage insurance helps mitigate repair or replacement costs, offering consumers peace of mind and safeguarding against unexpected expenses arising from liquid-related mishaps.

Liquid Damage Insurance Market Dynamics

Drivers

- Increasing Reliance on Electronics

The increasing use of smartphones, laptops, tablets, and wearable devices in daily life has significantly boosted the demand for insurance coverage against accidental liquid damage. These devices have become essential tools for communication, work, and entertainment, making them vulnerable to accidents, especially spills or exposure to water. As the value of these devices rises, so does the need for protection. Liquid damage insurance provides consumers with peace of mind, offering a safety net against potentially costly repairs or replacements. This growing reliance on technology and the associated risk of damage drives the demand for liquid damage insurance, propelling market growth.

- Rising Awareness of Insurance Benefits

Enhanced consumer awareness of the financial benefits offered by liquid damage insurance is driving market growth. Many consumers are now more informed about the potential cost savings associated with insurance coverage, including the reduced financial burden of repairs or replacements for liquid-damaged devices. With increasing repair costs and device prices, liquid damage insurance is seen as a valuable service that can prevent unexpected expenses. This awareness has spurred a higher adoption rate among consumers, especially those who rely heavily on smartphones, laptops, and wearables in their daily lives. As a result, the growing understanding of the economic advantages of such insurance continues to fuel demand and expand the market.

Opportunities

- Rising Smartphone and Electronics Sales

The increased demand for smartphones, laptops, and other portable electronics has significantly contributed to the growth of the liquid damage insurance market. As consumers rely more on these devices for daily tasks, the risk of accidental liquid spills or water exposure has become a growing concern. Electronics are particularly vulnerable to liquid damage, which can lead to costly repairs or replacements. This heightened susceptibility drives the need for protective insurance to safeguard valuable devices. As the number of electronics users rises globally, especially in emerging markets, the demand for liquid damage insurance continues to present a significant market opportunity for providers.

- Subscription-Based Models

The introduction of flexible subscription or pay-per-use models for liquid damage insurance presents a key market opportunity, particularly in regions where consumers are less inclined to make outright purchases of insurance. These models allow users to pay for coverage only when they need it, making it more accessible and affordable for a broader range of consumers. This flexibility appeals to cost-conscious individuals, especially those in emerging markets or younger demographics who prefer on-demand services. By offering affordable, customizable insurance options, companies can attract a larger customer base and expand their reach in the competitive electronics insurance market.

Restraints/Challenges

- Limited Coverage Scope

Some insurance policies in the liquid damage insurance market may exclude certain types of liquid damage, such as those caused by specific liquids or under certain conditions, which can undermine customer trust. This exclusion can lead to dissatisfaction among consumers who expect comprehensive coverage for all potential accidents. As a result, customers may hesitate to invest in such policies, fearing they won’t be fully protected. This lack of clarity and limitations in coverage reduces the overall appeal of the market, making it harder for insurers to gain consumer confidence and increase market share in a competitive industry.

- High Claim Costs

The high cost of processing claims for liquid damage is a significant restraint in the liquid damage insurance market, especially when expensive electronics such as smartphones, laptops, and tablets are involved. These devices often require extensive repairs or replacements, which can result in substantial financial losses for insurers. As a result, insurance providers may be hesitant to offer liquid damage coverage due to the potential for high claim payouts. This financial risk can deter market participation, limiting the availability of insurance policies and reducing the overall growth potential of the market. It creates a barrier for insurers looking to expand their offerings.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Liquid Damage Insurance Market Scope

The market is segmented on the basis of policy duration, target customer segment, claim process, and distribution channel. The growth amongst these segments will help you analyse meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Policy Duration

- Monthly

- Annual

- Multi-Year

Target Customer Segment

- Individuals

- Small Businesses

- Large Corporations

Claim Process

- Instant Claim Processing

- Traditional Claim Processing

- Third-Party Claim Handling

Distribution Channel

- Direct Sales

- Online Platforms

- Retail Partnerships

Liquid Damage Insurance Market Regional Analysis

The market is analysed and market size insights and trends are provided by country, policy duration, target customer segment, claim process, and distribution channel as referenced above.

The countries covered in the market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

North America dominated the market, driven by rising disposable income, shifting consumer lifestyles, and greater awareness of the advantages of gadget insurance. The region's strong market share is further supported by the presence of numerous prominent insurance providers. These factors are anticipated to continue driving growth in the personal gadget insurance sector within North America.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Liquid Damage Insurance Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Liquid Damage Insurance Market Leaders Operating in the Market Are:

- Progressive Casualty Insurance Company (U.S.)

- Bolttech (Singapore)

- Asurion (U.S.)

- Bajaj Allianz Life Insurance Co. Ltd. (India)

- OneAssist Consumer Solutions Pvt. Ltd. (India)

- AT&T Intellectual Property (U.S.)

- SquareTrade, Inc. (U.S.)

- Worth Ave. Group (U.S.)

- Apple Inc. (U.S.)

- American International Group, Inc. (U.S.)

- ASSURANT, INC (U.S.)

- AmTrust Financial (U.S.)

- Chubb (India)

- Singtel (Singapore)

- Securranty (U.S.)

- Gadget Cover (U.K.)

- HL Assurance (Singapore)

- Insurance2go (U.K.)

- Allianz Partners (Germany)

Latest Developments in Liquid Damage Insurance Market

- In March 2022, Airtel Payments Bank partnered with ICICI Lombard General Insurance Company to offer smartphone insurance via the Airtel Thanks app. This collaboration enhances Airtel Payments Bank's digital insurance offerings, providing customers with a seamless, paperless, and secure way to purchase coverage for their devices

- In June 2020, Samsung launched Samsung Care+ in India, a protection plan designed for Galaxy phone users. The plan includes benefits such as extended warranty, screen protection, accidental damage, liquid damage coverage, and safeguards against technical and mechanical failures, ensuring comprehensive protection for Samsung Galaxy phones

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.