Global Liquid Feed Supplements For Ruminants Market

Market Size in USD Billion

CAGR :

%

USD

6.78 Billion

USD

10.32 Billion

2024

2032

USD

6.78 Billion

USD

10.32 Billion

2024

2032

| 2025 –2032 | |

| USD 6.78 Billion | |

| USD 10.32 Billion | |

|

|

|

|

Liquid Feed Supplements for Ruminants Market Size

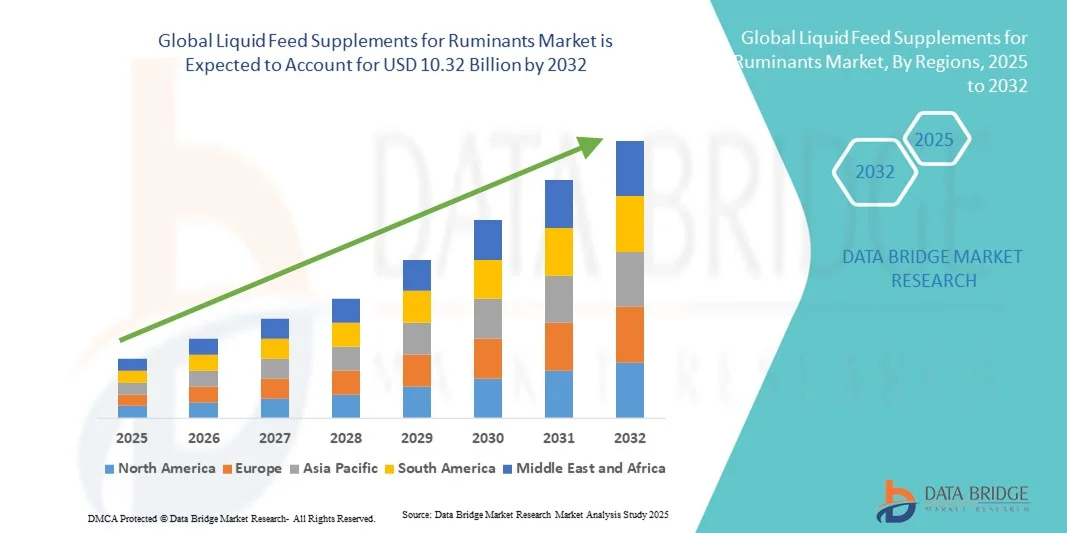

- The global liquid feed supplements for ruminants market size was valued at USD 6.78 billion in 2024 and is expected to reach USD 10.32 billion by 2032, at a CAGR of 5.40% during the forecast period

- The market growth is largely fuelled by the rising demand for high-quality livestock products, such as milk and meat, coupled with the need to enhance animal health and productivity

- Increasing adoption of precision nutrition practices and growing awareness regarding feed efficiency are also contributing to the market expansion

Liquid Feed Supplements for Ruminants Market Analysis

- The liquid feed supplements for ruminants market is witnessing significant growth due to the increasing focus on sustainable livestock nutrition and cost-effective feeding solutions

- Growing industrial livestock production, particularly in dairy and beef sectors, is boosting the demand for energy-rich and nutrient-dense liquid feed supplements that improve digestion and performance

- North America dominated the liquid feed supplements for ruminants market with the largest revenue share of 38.26% in 2024, driven by the well-established livestock industry, high focus on animal nutrition, and increasing adoption of balanced feeding practices among farmers

- Asia-Pacific region is expected to witness the highest growth rate in the global liquid feed supplements for ruminants market, driven by increasing livestock production, expanding feed industry capacity, and growing awareness of nutritional supplementation among farmers

- The protein segment held the largest market revenue share in 2024, driven by the increasing demand for high-protein feed formulations that enhance muscle growth, milk yield, and overall productivity in ruminants. Protein-based liquid supplements are widely adopted due to their superior digestibility and ability to improve feed efficiency in dairy and beef cattle operations

Report Scope and Liquid Feed Supplements for Ruminants Market Segmentation

|

Attributes |

Liquid Feed Supplements for Ruminants Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

• Cargill, Incorporated (U.S.) |

|

Market Opportunities |

• Rising Adoption Of Precision Livestock Nutrition |

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Liquid Feed Supplements for Ruminants Market Trends

Integration of Nutrigenomics in Liquid Feed Formulation

• The integration of nutrigenomics in liquid feed supplement development is reshaping how ruminant nutrition is optimized. By understanding the genetic makeup of livestock, feed manufacturers are creating tailored formulations that enhance digestion, immunity, and productivity. This precision approach improves feed efficiency while reducing waste and environmental impact, ultimately supporting sustainable livestock production practices across regions

• Nutrigenomic-based liquid feed supplements are gaining traction among dairy and beef producers aiming for consistent performance outcomes. These products allow nutrient delivery aligned with specific genetic traits, ensuring better growth, reproductive efficiency, and milk yield. The adoption is particularly strong in technologically advanced markets such as North America and Europe, where farmers are integrating genomic insights into precision livestock nutrition systems

• The growing availability of genomic data and advances in bioinformatics tools have accelerated this trend, enabling producers to develop more targeted and cost-effective feeding programs. By linking nutritional strategies to animal genetic profiles, producers can minimize health risks, optimize feed conversion, and reduce overall production costs, fostering long-term sustainability and profitability

• For instance, in 2023, several feed manufacturers in Europe introduced gene-responsive liquid supplements designed for high-yield dairy cattle, resulting in notable improvements in feed conversion, milk composition, and animal health. These innovations demonstrated how molecular-level customization in feed can lead to significant productivity gains and reduced environmental footprint

• While nutrigenomic integration offers immense potential, its success depends on data accessibility, farmer awareness, and affordability. The need for collaboration between geneticists, nutritionists, and feed producers is essential to bridge the knowledge gap, improve adoption rates, and deliver scalable solutions to both developed and emerging livestock markets

Liquid Feed Supplements for Ruminants Market Dynamics

Driver

Rising Demand for High-Performance and Cost-Efficient Feed Solutions

• The increasing global demand for dairy and meat products has intensified the need for performance-oriented feed supplements that improve nutrient absorption and animal productivity. Liquid feed supplements offer better palatability, precise nutrient delivery, and uniform distribution compared to dry feed additives, driving widespread adoption among ruminant farmers seeking higher efficiency and output

• Producers are increasingly turning to liquid feed supplements for consistent growth performance, enhanced milk yield, and improved feed conversion efficiency. These supplements enable balanced nutrition at lower costs, helping farmers sustain profitability amidst fluctuating feed ingredient prices and rising operational expenses. Their adaptability across dairy, beef, and sheep farms enhances their appeal in global markets

• Feed companies are focusing on enhancing formulation quality using amino acids, vitamins, enzymes, and trace minerals to ensure balanced nutrient profiles. This trend aligns with sustainability objectives by improving digestion, reducing methane emissions, and minimizing feed waste, thereby supporting eco-friendly livestock management practices across large and mid-scale farms

• For instance, in 2023, U.S.-based feed producers introduced molasses-based liquid supplements that improved feed intake, digestion rates, and nutrient utilization in beef cattle. The introduction of such innovative blends demonstrated measurable gains in weight, milk output, and reproductive performance, reinforcing liquid feed’s role in productivity optimization

• As livestock productivity becomes central to meeting global protein demand, the adoption of high-performance liquid feed supplements will continue to expand. Regions emphasizing technological innovation, such as North America, Europe, and Asia-Pacific, are expected to see significant growth as precision feeding technologies become integral to modern animal nutrition

Restraint/Challenge

Limited Infrastructure and High Transportation Costs in Rural Areas

• The transportation and storage of liquid feed supplements pose challenges in rural and remote regions due to inadequate logistics infrastructure and high fuel costs. These factors increase the final product price and make consistent supply difficult, particularly in developing economies with dispersed farming communities and limited access to storage technology

• Many small-scale farmers lack access to bulk delivery systems, suitable containers, or proper storage facilities, leading to issues of product spoilage and nutrient degradation. This limits the widespread use of liquid feed supplements, as maintaining product integrity during transit becomes a major operational challenge for suppliers and cooperatives

• The reliance on regional distribution networks and intermediaries adds logistical complexity, especially in areas with poor connectivity or unreliable electricity. These conditions often disrupt timely deliveries and affect seasonal feed availability, ultimately hampering livestock health and productivity in remote agricultural zones

• For instance, in 2023, livestock cooperatives in Southeast Asia reported frequent delivery delays and spoilage incidents due to inadequate cold chain infrastructure and lack of standardized transport protocols. This resulted in feed shortages during critical periods, affecting production efficiency and increasing dependency on traditional dry feeds

• To address these limitations, manufacturers are investing in concentrated formulations and decentralized production units closer to key livestock regions. Establishing regional hubs and adopting sustainable packaging can reduce transportation dependency, enhance accessibility, and promote consistent usage of liquid feed supplements among rural farmers worldwide

Liquid Feed Supplements for Ruminants Market Scope

The liquid feed supplements for ruminants market is segmented on the basis of type and source.

- By Type

On the basis of type, the liquid feed supplements for ruminants market is segmented into protein, minerals, vitamins, and others. The protein segment held the largest market revenue share in 2024, driven by the increasing demand for high-protein feed formulations that enhance muscle growth, milk yield, and overall productivity in ruminants. Protein-based liquid supplements are widely adopted due to their superior digestibility and ability to improve feed efficiency in dairy and beef cattle operations.

The minerals segment is expected to witness the fastest growth rate from 2025 to 2032, driven by rising awareness of micronutrient deficiencies and their impact on animal health. Liquid mineral supplements provide balanced nutrition, improve immunity, and enhance reproductive performance in ruminants. Their convenience of blending with other feed components and uniform nutrient distribution is contributing to their increasing adoption in both large-scale and smallholder livestock farms.

- By Source

On the basis of source, the liquid feed supplements for ruminants market is segmented into molasses, corn, urea, and others. The molasses segment dominated the market in 2024, supported by its role as an energy-rich base ingredient that enhances palatability and nutrient absorption. Molasses-based liquid supplements are cost-effective, easily mixable, and serve as an ideal carrier for delivering essential nutrients in balanced feed formulations.

The corn segment is expected to witness the fastest growth rate from 2025 to 2032, attributed to its high carbohydrate content and energy efficiency for ruminants. Corn-derived liquid supplements improve energy intake, weight gain, and milk fat content, making them a preferred choice for dairy and beef farmers. The segment’s growth is further bolstered by expanding corn production and advancements in liquid feed blending technologies worldwide.

Liquid Feed Supplements for Ruminants Market Regional Analysis

- North America dominated the liquid feed supplements for ruminants market with the largest revenue share of 38.26% in 2024, driven by the well-established livestock industry, high focus on animal nutrition, and increasing adoption of balanced feeding practices among farmers

- The region benefits from advanced animal husbandry techniques and strong awareness regarding livestock productivity and health enhancement through liquid supplements

- The growing demand for high-quality dairy and meat products, coupled with rising investments in feed formulation innovations, continues to support market growth across the region

U.S. Liquid Feed Supplements For Ruminants Market Insight

The U.S. liquid feed supplements for ruminants market captured the largest revenue share in 2024 within North America, driven by the expansion of cattle farming and strong demand for protein-enriched diets to boost milk yield and weight gain. Increasing adoption of molasses-based liquid feeds and focus on optimizing feed conversion ratios are key contributors to growth. Moreover, technological advancements in feed formulation and efficient distribution networks are supporting the widespread adoption of liquid feed supplements in the U.S.

Europe Liquid Feed Supplements For Ruminants Market Insight

The Europe liquid feed supplements for ruminants market is expected to witness steady growth from 2025 to 2032, driven by stringent regulations promoting sustainable livestock nutrition and a shift toward natural feed ingredients. Rising awareness about reducing feed wastage and enhancing digestibility is boosting product adoption. The growing demand for trace minerals and vitamins in ruminant diets, along with the focus on animal welfare and health, is contributing to market expansion across European countries.

U.K. Liquid Feed Supplements For Ruminants Market Insight

The U.K. liquid feed supplements for ruminants market is expected to witness notable growth from 2025 to 2032, driven by the increasing focus on sustainable livestock production and nutritional efficiency. The rising demand for high-quality dairy and meat products is encouraging farmers to adopt liquid feed supplements to improve feed utilization and animal performance. In addition, the country’s strong regulatory framework promoting animal welfare and the growing trend toward environmentally responsible feeding solutions are further supporting market growth.

Germany Liquid Feed Supplements For Ruminants Market Insight

The Germany liquid feed supplements for ruminants market is expected to witness notable growth from 2025 to 2032, fuelled by increasing awareness regarding efficient feeding practices and high demand for sustainable feed solutions. The country’s strong dairy and beef sectors are emphasizing balanced nutrition to improve animal performance and reduce production costs. In addition, the presence of major feed producers and adoption of precision livestock farming technologies are accelerating market penetration.

Asia-Pacific Liquid Feed Supplements For Ruminants Market Insight

The Asia-Pacific liquid feed supplements for ruminants market is expected to witness the fastest growth rate from 2025 to 2032, driven by rapid livestock population growth, rising meat and dairy consumption, and modernization of farming practices in countries such as China, India, and Australia. Government initiatives supporting livestock productivity and increasing awareness about nutrient-enriched feeds are boosting the market. Furthermore, the region’s expanding feed manufacturing capabilities and the affordability of liquid supplements are supporting large-scale adoption.

China Liquid Feed Supplements For Ruminants Market Insight

The China liquid feed supplements for ruminants market accounted for the largest revenue share in Asia Pacific in 2024, attributed to its vast cattle and dairy industries, growing commercial feed production, and emphasis on livestock efficiency. The adoption of nutrient-rich liquid feeds to enhance digestion and animal growth is rapidly increasing. In addition, China’s investment in large-scale feed manufacturing infrastructure and strong government support for modern livestock management are propelling market expansion.

Japan Liquid Feed Supplements For Ruminants Market Insight

The Japan liquid feed supplements for ruminants market is expected to witness significant growth from 2025 to 2032, fuelled by the increasing emphasis on feed optimization and animal health improvement in the country’s advanced livestock sector. The growing preference for high-performance feeds that enhance milk quality and yield is driving adoption. Moreover, Japan’s technological advancement in feed formulation, coupled with a focus on sustainable and efficient farming practices, is contributing to the steady expansion of the liquid feed supplements market.

Liquid Feed Supplements for Ruminants Market Share

The Liquid Feed Supplements for Ruminants industry is primarily led by well-established companies, including:

• Cargill, Incorporated (U.S.)

• BASF SE (Germany)

• ADM (U.S.)

• Land O'Lakes, Inc. (U.S.)

• Ridley Corporation Limited (Australia)

• GrainCorp (Australia)

• Quality Liquid Feeds (U.S.)

• Performance Feeds (Australia)

• Westway Feed Products (U.S.)

• Dallas Keith (U.K.)

• Bundaberg Molasses (Australia)

• Gold River Feed (U.S.)

• Liquid Feeds Inc. (U.S.)

• Masterfeeds (Canada)

• Penny Newman Grain Company (U.S.)

• Voermol Feeds (South Africa)

• Double S Feed Services, Inc. (U.S.)

• DTN (U.S.)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.