Global Liquid Filtration Market

Market Size in USD Billion

CAGR :

%

USD

46.02 Billion

USD

90.01 Billion

2024

2032

USD

46.02 Billion

USD

90.01 Billion

2024

2032

| 2025 –2032 | |

| USD 46.02 Billion | |

| USD 90.01 Billion | |

|

|

|

|

Liquid Filtration Market Size

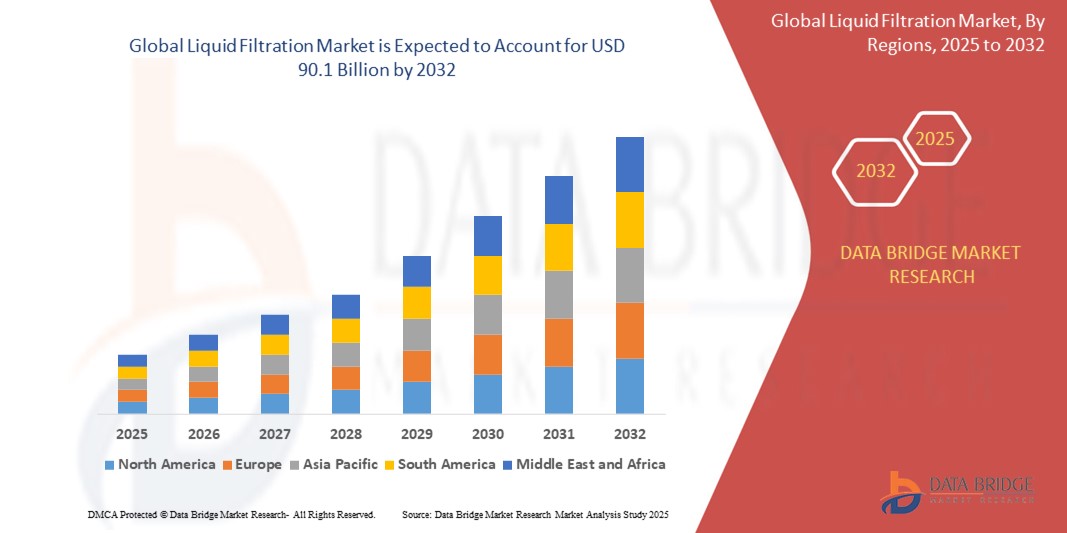

- The Global Liquid Filtration Market size was valued at USD 46.2 Billion in 2024 and is expected to reach USD 90.1 Billion by 2032, at a CAGR of6.70% during the forecast period

- This growth is driven by factors such as growing demand for cotton-based and aramid-based liquid filtrations due to their durability, heat resistance, and high conductivity

Liquid Filtration Market Analysis

- Liquid Filtration refers to the process of separating solids from liquids using various filtration media, such as woven fabrics, nonwovens, meshes, and membranes, in industries including food & beverage, pharmaceuticals, chemicals, and municipal water treatment. It plays a vital role in ensuring product purity, process efficiency, and environmental compliance

- The demand for Liquid Filtration is significantly driven by tightening environmental regulations regarding wastewater discharge, increased investments in industrial water treatment infrastructure, and rising awareness of sustainability practices in industrial processes

- Asia-Pacific is expected to dominate the Liquid Filtration market due to rapid industrialization, urbanization, and a growing manufacturing base in countries like China, India, and Southeast Asia. The region also benefits from expanding municipal and industrial water treatment projects to address pollution and water scarcity

- North America is expected to be the fastest-growing region in the Liquid Filtration market during the forecast period, owing to technological advancements in membrane and filter media, stringent environmental regulations enforced by bodies such as the EPA, and increasing adoption in pharmaceuticals, food processing, and chemicals

- The Polymer segment is expected to dominate the market with a projected market share of 36.24% in 2025, due to its high efficiency, low operational cost, and widespread application in water treatment, food & beverage processing, and chemical filtration systems

Report Scope and Liquid Filtration Market Segmentation

|

Attributes |

Liquid Filtration Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Liquid Filtration Market Trends

“In the same format please provide for Global Liquid Filtration Market”

- One of the prominent trends in the Global Liquid Filtration Market is the shift toward advanced filtration materials that offer higher durability, efficiency, and sustainability. Innovations in membrane technology, nanofiber media, and bio-based filter fabrics are gaining traction across industries

- Manufacturers are developing filters that provide enhanced chemical resistance, higher flow rates, and improved particulate retention to meet the complex needs of industries such as pharmaceuticals, food & beverage, and wastewater treatment

- For instance, companies are introducing PTFE-coated and polymeric filter media to replace traditional woven fabrics in harsh chemical environments for better performance and longevity

- Sustainability is also becoming a key focus, with end-users seeking recyclable, reusable, and energy-efficient filtration solutions to comply with environmental regulations and ESG (Environmental, Social, Governance) goals

Liquid Filtration Market Dynamics

Driver

“Stringent Environmental Regulations and Industrial Growth”

- Global tightening of regulations related to wastewater discharge and air pollution is a major driver of the Liquid Filtration market, particularly in sectors like chemicals, mining, and municipal utilities

- Governments and regulatory bodies such as the U.S. EPA and the European Environment Agency are enforcing strict standards for industrial emissions and effluent treatment

- Rapid growth in industrial output, especially in developing economies, has increased the need for efficient filtration systems to manage wastewater and reduce environmental impact

For instance,

- China's "Made in China 2025" and India's "Make in India" initiatives are encouraging investments in local manufacturing, increasing demand for industrial filtration systems

- This rising emphasis on sustainable waste management practices is boosting the adoption of high-performance liquid filtration systems

Opportunity

“Growth in Emerging Economies and Infrastructure Development”

- One of the key opportunities in the Global Liquid Filtration Market is the rapid urbanization and infrastructure expansion in emerging markets across Asia-Pacific, Latin America, and Africa

- Increased spending on water treatment facilities, food processing units, and pharmaceutical manufacturing plants presents vast growth potential

- Governments are increasingly investing in upgrading water treatment infrastructure to address clean water shortages and environmental concerns

For instance,

- The Indian government’s Jal Jeevan Mission and similar clean water programs in Southeast Asia are generating demand for advanced filtration technologie.

- This creates opportunities for filtration solution providers to supply scalable, cost-effective, and durable filtration systems.

Restraint/Challenge

“High Installation and Maintenance Costs”

- One of the main challenges in the Liquid Filtration market is the high capital investment required for installing advanced filtration systems and replacing worn-out components

- Industries operating in cost-sensitive environments may hesitate to adopt new technologies due to the perceived high initial outlay and ongoing maintenance demands

- Additionally, frequent filter replacement cycles, energy-intensive operations, and the need for skilled labor for system upkeep can increase operational costs

For instance,

- In chemical processing, replacing specialized membrane cartridges and managing fouling or clogging issues may result in downtime and additional expense

- These factors may restrain market penetration in small and medium enterprises (SMEs), particularly in regions with limited technical expertise or infrastructure

Liquid Filtration Market Scope

The market is segmented on the basis of basis of fabric material, filter media and end user.

|

Segmentation |

Sub-Segmentation |

|

By Fabric Material |

|

|

By Filter Media |

|

|

By End User |

|

In 2025, the nonwoven segment is projected to dominate the market with a largest share in filter media segment

The nonwoven segment is expected to dominate the Liquid Filtration market with the largest share of 32.4% in 2025, owing to its widespread usage across municipal water treatment, pharmaceuticals, and food & beverage industries. Nonwoven filter media offer several advantages, such as high flow rates, uniform pore size, and ease of customization for specific filtration needs.

The polymer is expected to account for the largest share during the forecast period in fabric material market

In 2025, the polymer segment is expected to dominate the market with the largest market share of 51.31% due to its excellent chemical resistance, mechanical strength, and versatility across diverse industrial filtration applications. Polymers such as polypropylene, polyester, and polyamide are widely used in filter media due to their durability and compatibility with harsh operating environments.

Liquid Filtration Market Regional Analysis

“Asia-Pacific Holds the Largest Share in the Liquid Filtration Market”

- Asia-Pacific dominates the Liquid Filtration market with a significant share of 39.85% in 2025, driven by rapid industrialization, expanding manufacturing sectors, and growing investments in municipal and industrial wastewater treatment

- China leads the region due to its large-scale industrial output, stringent environmental regulations, and rising demand for efficient liquid-solid separation solutions in chemicals, pharmaceuticals, and food processing

- India is a key contributor, supported by major infrastructure projects focused on clean water access, government-led sanitation programs, and growth in the textile, mining, and steel sectors that require robust liquid filtration systems

- Additionally, countries like Indonesia, Vietnam, and Thailand are seeing increasing adoption of filtration technologies in their fast-growing industrial and urban sectors

- The presence of regional and international filtration system providers, along with favorable government initiatives for pollution control and sustainable water use, further solidify Asia-Pacific’s market dominance

“North America is Projected to Register the Highest CAGR in the Liquid Filtration Market”

- The North America region is expected to record the fastest growth during the forecast period, fueled by increasing regulatory compliance requirements, technological advancements in filter media, and demand for high-efficiency filtration systems in food & beverage, pharmaceuticals, and municipal water treatment

- The U.S. is the largest contributor to growth, driven by a mature industrial base, high investments in wastewater treatment infrastructure, and strong environmental policies enforced by the EPA

- Canada is also witnessing significant adoption of liquid filtration technologies due to rising water reuse initiatives, sustainable industrial practices, and support for clean technology solutions

- Growth is further supported by the presence of global filtration companies such as Eaton Corporation, Pall Corporation, and 3M, which are investing in R&D and expanding their filtration product portfolios to meet diverse industry needs

Liquid Filtration Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Valmet (Finland)

- Eaton (Ireland)

- Lydall, Inc. (USA)

- Sefar AG (Switzerland)

- Sandler AG (Germany)

- GKD Gebr. Kufferath AG (Germany)

- Freudenberg Filtration Technologies SE & Co. KG (Germany)

- Fibertex Nonwovens A/S (Denmark)

- American Fabric Filter Co. (USA)

- Autotech Nonwovens Pvt Ltd. (India)

- Ahlstrom-Munksjö (Finland)

- HL Filter USA LLC (USA)

Latest Developments in Global Liquid Filtration Market

- In January 2025, Pall Corporation unveiled its next-generation polymeric membrane filtration system designed for industrial wastewater treatment and chemical processing. The new system features enhanced fouling resistance, higher flow efficiency, and reduced energy consumption, aligning with sustainability goals and rising regulatory compliance needs. This innovation supports the company’s mission to offer high-performance solutions for complex liquid filtration challenges across industries

- In March 2025, Eaton Corporation announced the expansion of its liquid filtration product line with the introduction of EcoSure High-Efficiency Filter Bags, designed to reduce process contamination in food & beverage and pharmaceutical applications. These filters offer improved particle retention and are manufactured using sustainable, FDA-compliant materials

- In April 2025, SUEZ Water Technologies & Solutions launched a new membrane bioreactor (MBR) filtration module for municipal wastewater treatment plants. The new module increases throughput by 20% and reduces operational costs through energy-efficient filtration, supporting urban infrastructure development and water reuse initiatives

- In February 2025, Donaldson Company, Inc. introduced an intelligent filtration monitoring system integrated with IoT capabilities for real-time diagnostics in industrial filtration operations. This innovation aims to improve maintenance efficiency and extend filter life in manufacturing and chemical processing environments

- In January 2025, MANN+HUMMEL Group partnered with an Asian chemical manufacturer to deploy its HiQCell polymeric filter elements in large-scale liquid separation processes. This collaboration enhances MANN+HUMMEL’s presence in the Asia-Pacific region and supports the growing demand for advanced liquid filtration in emerging markets

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Liquid Filtration Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Liquid Filtration Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Liquid Filtration Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.