Global Liquid Handling Technology Market

Market Size in USD Billion

CAGR :

%

USD

7.25 Billion

USD

14.76 Billion

2025

2033

USD

7.25 Billion

USD

14.76 Billion

2025

2033

| 2026 –2033 | |

| USD 7.25 Billion | |

| USD 14.76 Billion | |

|

|

|

|

Liquid Handling Technology Market Size

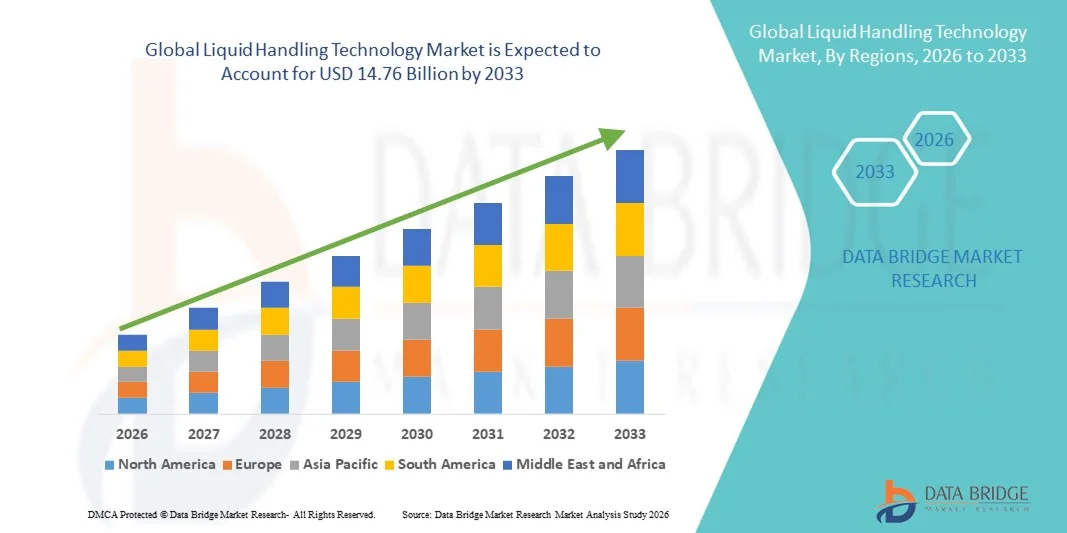

- The global liquid handling technology market size was valued at USD 7.25 billion in 2025 and is expected to reach USD 14.76 billion by 2033, at a CAGR of 9.30% during the forecast period

- The market growth is largely fueled by the rising adoption of advanced laboratory automation systems and continuous technological progress in life sciences, biotechnology, and pharmaceutical research, which is driving the need for precise, efficient, and high-throughput liquid handling solutions. Increasing workloads across diagnostic laboratories, drug discovery units, genomics facilities, and academic research centers are accelerating the shift toward automated and semi-automated instruments to minimize human error and ensure consistency in sample processing. This growing requirement for accuracy, speed, and reproducibility is significantly boosting the demand for liquid handling technologies

- Furthermore, the expanding demand for user-friendly, integrated, and workflow-efficient laboratory solutions is establishing liquid handling systems as essential tools across research and clinical environments. These converging factors—increasing R&D activities, growth in molecular biology applications, rising reagent consumption, and the widespread need for efficient sample preparation—are accelerating the uptake of Liquid Handling Technology solutions, thereby significantly boosting the industry’s growth

Liquid Handling Technology Market Analysis

- Liquid handling technologies, which enable precise, automated, and efficient transfer of liquids in laboratory workflows, are becoming increasingly essential across genomics, drug discovery, clinical diagnostics, and pharmaceutical research due to their high accuracy, reduced manual errors, and enhanced throughput

- The rising demand for liquid handling systems is primarily driven by the rapid expansion of life science research, increased adoption of automation in laboratories, growing needs for high-throughput screening, and the global shift toward standardized, reproducible analytical workflows

- North America dominated the liquid handling technology market with the largest revenue share of 39.7% in 2025, driven by strong R&D investment, advanced laboratory automation infrastructure, and high usage of automated liquid handling systems in biotech and pharmaceutical research

- Asia-Pacific is expected to be the fastest-growing region in the liquid handling technology market, projected to expand at a CAGR of during the forecast period, supported by expanding biotech research, increasing laboratory automation adoption, and growing healthcare expenditure across India, China, and Southeast Asia

- The automated liquid handling segment dominated the largest market revenue share of 52.8% in 2025, driven by the expanding need for accuracy, reproducibility, and high-throughput performance across advanced laboratories

Report Scope and Liquid Handling Technology Market Segmentation

|

Attributes |

Liquid Handling Technology Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Liquid Handling Technology Market Trends

Increasing Shift Toward Automation and High-Precision Liquid Handling

- A significant and accelerating trend in the global liquid handling technology market is the growing transition from manual pipetting to fully automated, high-precision liquid handling systems across research, clinical diagnostics, and pharmaceutical laboratories. This shift is being driven by the need to minimize human error, improve reproducibility, and enhance operational efficiency in workflows such as genomics, proteomics, drug discovery, and high-throughput screening

- For instance, laboratories are increasingly adopting automated liquid handling workstations that can perform complex pipetting tasks with superior accuracy, reducing assay variability and enabling researchers to process larger sample volumes in less time

- Automated systems are also integrating advanced software for protocol optimization, error correction, and data traceability, ensuring compliance with stringent regulatory standards. Features such as real-time monitoring, reagent tracking, and automated calibration contribute to enhanced workflow reliability and precision

- The demand for flexible liquid handling solutions capable of supporting miniaturized assays, multi-plate workflows, and high-density reaction formats is rising rapidly. These systems allow laboratories to scale their operations efficiently while reducing reagent consumption and operational costs

- Companies are also focusing on hybrid platforms that combine manual and automated functionalities, enabling laboratories to transition smoothly from low-volume to high-throughput operations. These solutions support diverse applications ranging from PCR preparation to cell-based assays

- The growing emphasis on reducing lab-related ergonomic injuries and worker fatigue is further accelerating the adoption of automated liquid handling systems, as they eliminate repetitive pipetting tasks and improve overall laboratory productivity

Liquid Handling Technology Market Dynamics

Driver

Rising Adoption Due to Growing R&D Activities and Need for Workflow Standardization

- The increasing volume of research activities in biotechnology, pharmaceuticals, and life sciences is a major driver contributing to rising demand for liquid handling technologies. Expanding research in genomics, oncology, cell therapy, and molecular diagnostics requires precise, reproducible, and contamination-free liquid dispensing systems

- For instance, ongoing expansion of drug discovery pipelines and clinical diagnostic capabilities has accelerated the deployment of automated and semi-automated liquid handling platforms to support high-sample throughput and standardized assay workflows

- As laboratories aim to reduce human error and improve reproducibility, liquid handling systems offer accurate volume control, contamination-free dispensing, and digital documentation, providing a substantial upgrade over conventional manual pipetting

- Furthermore, the increasing adoption of high-throughput screening, next-generation sequencing workflows, and multiplexed assays drives the need for advanced solutions capable of supporting high-volume and complex liquid handling tasks

- The ability to streamline sample preparation, minimize reagent wastage, and reduce turnaround times further enhances adoption across research institutes, CROs, pharmaceutical companies, and diagnostic centers. The growing preference for scalable and user-friendly liquid handling systems continues to strengthen market growth

Restraint/Challenge

High Equipment Cost and Technical Complexity

- Despite strong growth, the high acquisition cost of automated liquid handling systems remains a significant barrier for small and mid-sized laboratories. These advanced platforms require substantial investment in hardware, software, maintenance, and training, which can limit uptake in cost-sensitive regions

- In addition, users often face challenges related to technical complexity, including system setup, protocol optimization, software configuration, and ongoing troubleshooting. This may discourage adoption among labs lacking skilled personnel or dedicated technical support teams

- Concerns regarding instrument downtime, calibration accuracy, and compatibility with diverse reagents or labware further contribute to hesitation among potential buyers

- Furthermore, while automation reduces human error, improper programming or complex workflows can introduce new sources of error, impacting assay reliability if not carefully managed

- Overcoming these challenges through cost-effective scalable solutions, user-friendly interfaces, comprehensive training programs, and improved system flexibility will be critical for broader adoption of liquid handling technologies in both developed and emerging markets

Liquid Handling Technology Market Scope

The market is segmented on the basis of type, communication protocol, unlocking mechanism, and application.

- By Product

On the basis of product, the Liquid Handling Technology market is segmented into automated workstations, small devices, and consumables. The automated workstations segment dominated the largest market revenue share of 46.5% in 2025, driven by its essential role in high-throughput workflows across drug discovery, genomic research, and advanced clinical testing. Automated workstations reduce manual pipetting errors, enhance reproducibility, and support fully standardized workflows that comply with strict laboratory regulations. Their ability to automate plate preparation, compound management, PCR setup, sequencing workflows, and ELISA processes makes them indispensable in large research and biopharmaceutical labs. Adoption is further strengthened by increasing demand for walkaway automation, improved robotics integration, and compatibility with digital laboratory information systems. The shift toward precision medicine, rapid assay development, and faster drug screening pipelines also increases reliance on automated platforms. In addition, biopharma companies increasingly prioritize flexible, modular systems that can handle varying volumes and assay formats, boosting market dominance. Overall, high performance, user-friendly design, and scalability ensure the continued leading position of automated workstations.

The consumables segment is anticipated to witness the fastest CAGR of 14.2% from 2026 to 2033, fueled by the continuous and recurring need for pipette tips, plates, tubes, reservoirs, and sterile plastics essential for every workflow. Consumables are used across all assay types, from genomics and proteomics to diagnostics and bioprocessing, driving constant replacement demand. The surge in PCR testing, sequencing activities, and high-throughput screening contributes to a dramatic rise in consumables consumption globally. Growing emphasis on contamination-free workflows in clinical labs increases demand for filtered tips and sterile disposables. The expansion of automated systems further accelerates specialized consumable usage compatible with robotics. Increasing research output, rising academic funding, and growing biotechnology investments also strengthen this growth. Disposable consumables offer high margins, ensure operational reliability, and support regulatory compliance, making them the fastest-growing product category.

- By Type

On the basis of type, the Liquid Handling Technology market is segmented into automated liquid handling, manual liquid handling, and semi-automated liquid handling. The automated liquid handling segment dominated the largest market revenue share of 52.8% in 2025, driven by the expanding need for accuracy, reproducibility, and high-throughput performance across advanced laboratories. Automated systems eliminate variability associated with manual pipetting and enable precise nanoliter to microliter dispensing across assays such as qPCR, NGS library prep, ELISA, and compound screening. Their integration with robotics, machine vision, and advanced scheduling software enhances workflow standardization and speeds up research timelines. Automated systems support complex multistep protocols, reduce labor dependency, and ensure regulatory-grade documentation. Growing adoption in pharmaceutical R&D, biotechnology, CROs, and diagnostic labs further strengthens dominance. The increasing complexity of assays, rise in sample volumes, and need for quick turnaround in clinical workflows continue to drive dependence on fully automated platforms.

The semi-automated liquid handling segment is projected to witness the fastest growth rate, registering a CAGR of 12.9% from 2026 to 2033, primarily due to its cost-effectiveness and suitability for small to mid-sized laboratories. Semi-automated systems bridge the gap between manual tools and high-cost automated workstations, making them ideal for labs transitioning toward automation. These systems provide improved accuracy, reduced operator fatigue, and enhanced repeatability compared to manual methods. Their affordability and ease of use attract academic institutions, regional diagnostic labs, and emerging biotechnology companies. Semi-automated platforms also support scalable workloads, allowing labs to expand capacity without high capital investment. Increased focus on ergonomic workflows, need for partially automated assay preparation, and rising research output contribute to rapid adoption. Overall, the balance between automation, precision, and affordability positions semi-automated systems as the fastest-growing segment.

- By Application

On the basis of application, the Liquid Handling Technology market is segmented into drug discovery & ADME-Tox research, cancer & genomic research, bioprocessing/biotechnology, and others. The drug discovery & ADME-Tox research segment dominated the largest market revenue share of 41.7% in 2025, driven by increasing pharmaceutical R&D pipelines and extensive compound screening activities. Liquid handling systems play a vital role in assay setup, serial dilutions, dose-response testing, and high-content screening workflows. Automated workstations accelerate hit identification and reduce human error, enabling pharmaceutical companies to shorten early-stage development timelines. Rising demand for predictive toxicology, high-throughput screening (HTS), and miniaturized assay formats further increases dependency on precision liquid handling. The expansion of CRO services and rapid growth in small-molecule and biologics discovery also strengthen the dominance of this segment. In addition, increased focus on reducing reagent consumption and improving reproducibility across drug discovery workflows supports its leading position.

The cancer & genomic research segment is expected to witness the fastest CAGR of 15.4% from 2026 to 2033, driven by the global expansion of NGS, PCR, RNA-seq, gene expression analysis, and molecular diagnostics. Genomics laboratories require highly accurate, contamination-free, and scalable liquid handling systems for library preparation, sample normalization, and amplification workflows. Rising prevalence of cancer, demand for precision oncology, and growth in biomarker identification drive the need for high-throughput genomic workflows. Increased investments in genomic medicine programs, national sequencing initiatives, and personalized medicine research accelerate adoption. Liquid handling platforms supporting nanoliter dispensing, miniaturization, and automation gain significant traction in this segment. Overall, genomics-driven research intensity makes this the fastest-growing application area.

- By Technology

On the basis of technology, the Liquid Handling Technology market is segmented into valve dispensing technology, syringe solenoid technology, inkjet-technology, glass capillary technology, and automated liquid handling technology. The automated liquid handling technology segment dominated the largest market revenue share of 48.9% in 2025, driven by its crucial role in enabling precise, high-speed, and highly reproducible liquid transfer essential for modern drug discovery, genomic workflows, proteomics, and advanced diagnostic applications. Automated systems utilize robotic arms, intelligent software, and real-time calibration to ensure accuracy across nanoliter to milliliter volumes, minimizing variability associated with manual or semi-manual processes. Their integration with AI-guided optimization, multi-deck platforms, and modular accessories supports increasingly complex and multistep assays. The expanding need for complete standardization in regulated environments such as biopharmaceutical manufacturing, clinical genomics, and large reference laboratories further strengthens dominance. Rising demand for high-throughput screening, automated NGS library preparation, and sample tracking also reinforces this technology’s leadership, making it the core backbone of modern laboratory automation.

The inkjet-technology segment is anticipated to witness the fastest growth rate, registering a CAGR of 14.8% from 2026 to 2033, driven by increasing demand for ultra-low-volume dispensing, miniaturized assay formats, and cost-efficient reagent usage. Inkjet systems enable precise, contactless droplet ejection, supporting nanoliter dispensing critical for genomics, proteomics, microarrays, and synthetic biology. This technology reduces waste, enhances speed, and enables high-density microplate operations, making it ideal for high-throughput and high-complexity assays. Inkjet platforms are increasingly adopted for DNA printing, assay miniaturization, organ-on-chip applications, and microfluidic workflows. Rising emphasis on sustainable laboratory practices and cost optimization further accelerates adoption. The compatibility of inkjet systems with advanced software, automation platforms, and new assay chemistries positions them as the fastest-growing technology segment.

- By End-User

On the basis of end-user, the Liquid Handling Technology market is segmented into academic & research institutes, medical/forensics laboratories, pharmaceutical & biotechnology companies, contract research organizations, chemical industries, and others. The pharmaceutical & biotechnology companies segment dominated the largest market revenue share of 44.1% in 2025, driven by the rapid expansion of biologics development, cell and gene therapy research, drug discovery pipelines, and high-throughput screening operations. These companies rely heavily on automated and precise liquid handling systems to meet strict accuracy standards, minimize human error, and accelerate R&D timelines. Liquid handling systems support assays such as ADME-Tox testing, PCR setup, NGS workflows, ELISA, cell culture automation, and bioprocess sample preparation. Increased regulatory scrutiny, demand for improved reproducibility, and the need for automation-ready workflows strengthen reliance on advanced liquid handling technologies. Furthermore, rising investments in drug discovery, therapeutic innovation, and global expansion of biomanufacturing facilities enhance the segment’s dominance.

Contract research organizations (CROs) are expected to witness the fastest CAGR of 13.6% from 2026 to 2033, driven by the growing outsourcing of drug development, toxicology studies, genomic analysis, and compound screening by pharmaceutical and biotechnology companies. CROs require flexible, accurate, high-throughput liquid handling systems to support diverse sponsor needs across early-stage discovery, clinical testing, and bioanalytical workflows. Their need for rapid scalability, multi-project handling, and highly standardized operations fuels adoption of both automated workstations and advanced dispensing technologies. The rise of global clinical trials, cost pressures on pharma companies, and growing preference for outsourced R&D services further expand CRO demand. Increasing investments in automation infrastructure to improve turnaround times, data quality, and regulatory compliance positions CROs as the fastest-growing end-user segment.

Liquid Handling Technology Market Regional Analysis

- North America dominated the liquid handling technology market with the largest revenue share of 39.7% in 2025, driven by strong R&D investment, a well-established laboratory automation ecosystem, and the widespread use of automated liquid handling systems across pharmaceutical, biotechnology, and academic research facilities

- The region benefits from a high concentration of leading biopharma companies, CROs, and diagnostic laboratories that rely heavily on advanced liquid handling platforms for high-throughput screening, genomics workflows, and precision pipetting applications

- Continuous technological advancements, increasing adoption of robotics in labs, and growing demand for reproducibility and accuracy in life science research further enhance North America’s leadership position in the global market

U.S. Liquid Handling Technology Market Insight

The U.S. liquid handling technology market captured of the North American share in 2025, supported by rapid expansion in drug discovery programs, increased investments in genomics and precision medicine, and a strong shift toward automated, high-throughput laboratory systems. The U.S. also leads in integrating AI-enabled liquid handling platforms, cloud-connected laboratory systems, and data-driven automation, contributing significantly to market growth. Major pharmaceutical players, government-funded research projects, and CROs continue to accelerate adoption of advanced dispensing, pipetting, and microplate handling technologies.

Europe Liquid Handling Technology Market Insight

The Europe liquid handling technology market is projected to grow at a substantial CAGR during the forecast period, driven by rising laboratory automation demand, strong regulatory focus on data accuracy and reproducibility, and high adoption of liquid handling solutions in genomics, cancer research, and diagnostic laboratories.

The region also benefits from increased funding for biotechnology and life science research, along with modernization of academic and public health laboratories across Germany, the U.K., France, and the Nordics.

U.K. Liquid Handling Technology Market Insight

The U.K. liquid handling technology market is expected to grow at a noteworthy CAGR, supported by the country’s strong biotechnology ecosystem, increased investment in genomics and precision medicine, and growing emphasis on automated tools for reproducibility in research. The expansion of biobanks, CROs, and NHS-backed diagnostic modernization initiatives is further fueling demand for automated and semi-automated liquid handling systems.

Germany Liquid Handling Technology Market Insight

The Germany liquid handling technology market is anticipated to expand at a considerable CAGR, driven by the country’s leadership in life science R&D, strong presence of biotech manufacturing facilities, and rapid adoption of sustainable, high-precision laboratory automation tools. Germany’s advanced laboratory infrastructure and its focus on innovation and workflow accuracy continue to encourage the deployment of sophisticated liquid handling solutions across both industrial and academic laboratories.

Asia-Pacific Liquid Handling Technology Market Insight

The Asia-Pacific liquid handling technology market is projected to grow at the fastest CAGR of 10.5% during the forecast period, propelled by expanding biotechnology and pharmaceutical research, rapid laboratory automation adoption, and increasing healthcare expenditure across China, India, Japan, and Southeast Asia. Government-backed digitalization initiatives, the expansion of regional biopharma manufacturing, and growing investment into genomics and molecular diagnostics are driving liquid handling adoption across both established and emerging markets in the region.

Japan Liquid Handling Technology Market Insight

The Japan liquid handling technology market is gaining momentum due to the country’s advanced technological culture, increasing genomics research activity, and strong demand for high-precision, automated laboratory workflows. Japan’s aging population and rising focus on diagnostic testing also contribute to increased adoption of automated pipetting systems, microplate handlers, and high-throughput liquid handling platforms across hospitals, research institutes, and biotech companies.

China Liquid Handling Technology Market Insight

The China liquid handling technology market accounted for the largest revenue share in the Asia-Pacific region in 2025, supported by rapid expansion of biotechnology parks, strong government investment in life science research, rising demand for automated laboratory equipment, and growth of domestic manufacturers offering affordable liquid handling solutions. China’s booming pharmaceutical industry, increasing clinical testing volume, and the rise of large-scale genomic sequencing centers are key factors accelerating market adoption.

Liquid Handling Technology Market Share

The Liquid Handling Technology industry is primarily led by well-established companies, including:

• Hamilton Company (U.S.)

• Tecan Group (Switzerland)

• Eppendorf SE (Germany)

• Thermo Fisher Scientific (U.S.)

• Agilent Technologies (U.S.)

• Beckman Coulter Life Sciences (U.S.)

• Gilson, Inc. (U.S.)

• Sartorius AG (Germany)

• Analytik Jena (Germany)

• Corning Incorporated (U.S.)

• Bio-Rad Laboratories (U.S.)

• Aurora Biomed (Canada)

• Labnet International (U.S.)

• Integra Biosciences (Switzerland)

• Hudson Robotics (U.S.)

• Formulatrix (U.S.)

• BRAND GMBH + CO KG (Germany)

• Opentrons Labworks Inc. (U.S.)

Latest Developments in Global Liquid Handling Technology Market

- In April 2021, Thermo Fisher Scientific launched the KingFisher Apex Purification System, a high-throughput automated instrument that uses magnetic-bead technology to extract DNA, RNA, proteins, and cells. This system dramatically reduces hands-on time, improves reproducibility, and offers the flexibility to run from 24 to 96 samples in a single run, making sample preparation more efficient for emending downstream applications

- In April 2022, Tecan introduced its MagicPrep™ NGS system, a benchtop automated solution for next-generation sequencing library preparation. With a “load-and-go” workflow, pre-packaged reagent cartridges, and intuitive touch-screen controls, this system simplifies and accelerates DNA- and mRNA-seq library prep, particularly for smaller labs that do not have full automation infrastructure

- In February 2023, Agilent Technologies released an on-deck thermal cycler (ODTC) accessory for its Bravo NGS liquid-handling platform. This integration enables thermal cycling directly on the deck, which streamlines NGS protocols by eliminating the need to transfer plates between devices, thereby increasing walk-away time and reducing manual intervention

- In February 2023, Hamilton Company launched the Microlab STAR V, a benchtop automated liquid handling workstation designed to balance high-throughput performance with a smaller footprint. The design makes it well-suited for laboratories that need automation but lack space for large robotic systems, offering both speed and flexibility

- In December 2023, Thermo Fisher announced the KingFisher Apex Dx system alongside its MagMAX Dx Viral/Pathogen NA Isolation Kit. This combination provides a fully automated, IVD-ready solution for nucleic acid purification from clinical respiratory samples. The system supports 24- and 96-well formats and offers both research-use and diagnostic-grade software modes, allowing labs to scale from research into regulated diagnostics

- In January 2024, Eppendorf enhanced its epMotion platform with a software extension that supports GxP compliance (Good Practice regulations). This update allows automated liquid handling processes to be used more easily in regulated environments by providing audit trails, electronic signatures, and other features needed for clinical and quality-controlled workflows

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.