Global Liquid Packaging Carton Market

Market Size in USD Billion

CAGR :

%

USD

28.03 Billion

USD

44.07 Billion

2024

2032

USD

28.03 Billion

USD

44.07 Billion

2024

2032

| 2025 –2032 | |

| USD 28.03 Billion | |

| USD 44.07 Billion | |

|

|

|

|

Liquid Packaging Carton Market Size

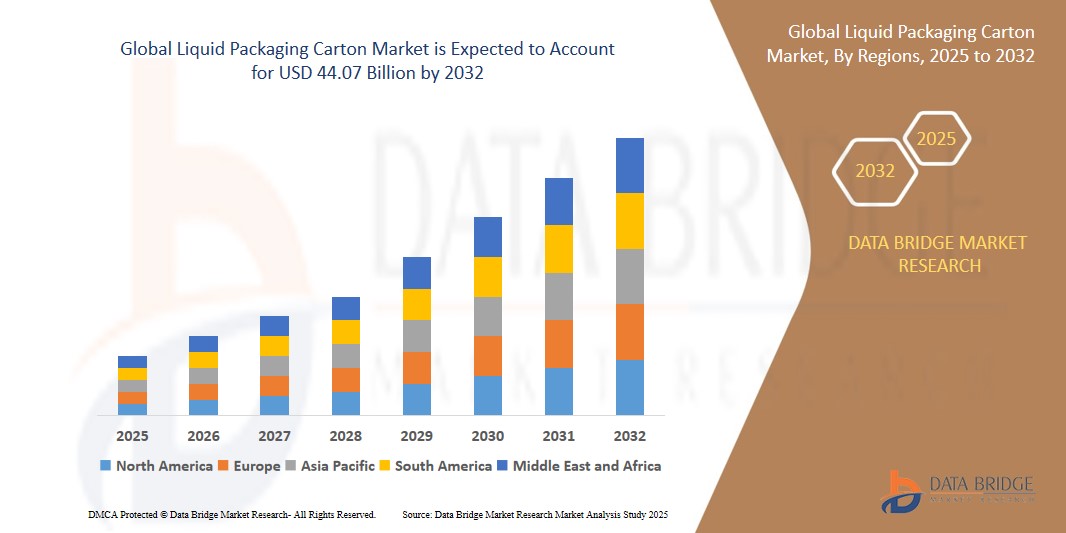

- The global liquid packaging carton market size was valued at USD 28.03 billion in 2024 and is expected to reach USD 44.07 billion by 2032, at a CAGR of 5.85% during the forecast period

- Market expansion is largely supported by increasing consumer demand for sustainable, cost-effective, and convenient packaging solutions, especially in the food and beverage sector. This encompasses dairy products, fruit juices, plant-based beverages, and nutritional drinks that benefit from extended shelf life and enhanced preservation properties delivered by carton packaging.

- Additionally, growing trends towards single-serve packaging formats and adoption of on-the-go consumption habits, combined with heightened regulatory emphasis on reducing plastic waste, are propelling the shift towards liquid cartons globally.

Liquid Packaging Carton Market Analysis

- Liquid packaging cartons offer superior product protection by effectively shielding contents from moisture, oxygen, and light, which significantly extends the shelf life of perishable liquids. The materials used are predominantly renewable paperboard, which is recyclable, reinforcing their environmental appeal.

- The dairy sector dominates by volume, driven by surging consumption globally of packaged milk, flavored milks, and yogurt beverages. The aseptic and long shelf life technologies further secure product freshness.

- Growth in e-commerce and online grocery shopping has increased demand for durable, lightweight, and easy-to-handle cartons suited for delivery and consumer convenience.

- The Asia-Pacific region holds the leading market share, benefiting from expanding food and beverage manufacturing industries, increased disposable income levels, and rising consumer awareness regarding sustainable packaging in major economies such as China, India, Japan, and Southeast Asia.

Report Scope and Liquid Packaging Carton Market Segmentation

|

Attributes |

Liquid Packaging Carton Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Liquid Packaging Carton Market Trends

Sustainability and Convenience Driving Innovation

- Increasing consumer and regulatory focus on environmentally friendly packaging fuels innovations in recyclable, renewable, fiber-based cartons aimed at minimizing plastic consumption and waste.

- Convenience trends propel the development of single-serve and resealable carton formats, enhancing consumer usability and portability in an increasingly on-the-go lifestyle.

- The integration of digital and smart packaging technologies like QR codes, NFC tags, and traceability features is gaining traction, enhancing consumer engagement and supply chain transparency.

- Expansion of the plant-based and functional beverages segment encourages customized carton solutions designed for enhanced shelf life and freshness retention.

Liquid Packaging Carton Market Dynamics

Driver

Growth in Packaged Food & Beverage Demand and Environmental Concerns

- The global surge in consumption of packaged dairy products, fruit juices, and non-carbonated beverages is a primary factor driving the increased adoption of liquid packaging cartons. These cartons offer superior shelf life extension, convenience, and product protection necessary for fragile liquid foods, meeting rising consumer expectations for freshness and safety.

- Growing environmental awareness and stringent regulations worldwide aimed at reducing plastic waste and enhancing sustainability are incentivizing manufacturers and brands to switch from conventional plastic and glass containers to recyclable, renewable paperboard-based cartons. This regulatory pressure is particularly strong in regions such as Europe and North America, accelerating carton adoption.

- Expansion of modern retail formats such as supermarkets, convenience stores, and the rapid rise of e-commerce platforms worldwide improve product availability and convenience, boosting demand for lightweight, portable, and durable liquid cartons suitable for transport and delivery.

Restraint/Challenge

High Cost of Advanced Packaging and Supply Chain Constraints

- While offering multiple benefits, advanced liquid packaging cartons, particularly aseptic and customized formats, generally carry higher production costs compared to traditional plastic or glass containers. This cost differential poses barriers in price-sensitive markets and restricts the penetration of premium cartons in some developing regions.

- Volatility in raw material prices, especially in paperboard and plastics used for liners and coatings, can impact production costs and constrain profit margins for manufacturers.

- Supply chain disruptions, which have become more frequent globally, affect the consistent availability of raw materials and components, leading to production delays and cost escalations.

- Recycling infrastructure and environmental policies vary widely across regions, with some developing countries lacking robust systems to recover and recycle cartons. Consumer recycling habits and awareness also differ, impacting the sustainability claims and acceptance of liquid cartons in various markets. These factors can dampen growth potential where recycling and disposal remain issues.

Liquid Packaging Carton Market Scope

The market is segmented on the basis of carton type, shelf life, and end-use industry.

- By Carton Type

On the basis of carton type, the global liquid packaging carton market is segmented into brick liquid cartons, gable top cartons, and shaped liquid cartons. The brick liquid cartons segment dominates the market volume in 2024 due to its versatile use in dairy and juice packaging, offering a cost-effective and efficient protection solution. Gable top cartons are favored for their resealability and convenience in everyday use, while shaped liquid cartons cater to specialty packaging needs, including premium and niche beverage formats.

- By Shelf Life

On the basis of shelf life, the market is categorized into long shelf life cartons (aseptic) and short shelf life cartons (refrigerated). Long shelf life cartons account for the larger revenue share in 2024, attributed to technological advances in aseptic packaging that preserve product freshness without preservatives, thus meeting consumer demands for safer and longer-lasting beverages.

- By End-Use Industry

On the basis of end-use industry, the liquid packaging carton market is segmented into food & beverages and industrial applications. The food & beverages segment commands the majority of the market share, driven by growing consumption of packaged dairy products, juices, plant-based beverages, and nutritional drinks worldwide. Industrial applications, although smaller, are gradually increasing, including uses in chemicals and other liquid products requiring safe and sustainable packaging.

Liquid Packaging Carton Market Regional Analysis

- Asia-Pacific dominates the global liquid packaging carton market with the largest revenue share in 2024, driven by rapid urbanization, rising disposable incomes, and the expansion of food & beverage manufacturing sectors in countries such as China, India, Japan, and Southeast Asia.

- Consumers and institutional buyers in the region are increasingly adopting liquid packaging cartons for dairy products, juices, plant-based beverages, and nutritional drinks, fueled by growing awareness of product safety, convenience, and sustainable packaging needs—especially in densely populated urban areas.

- The region’s growth is further supported by government initiatives promoting sustainability, improved recycling infrastructure, strong demand from modern retail and e-commerce channels, and the availability of cost-effective raw materials and manufacturing capabilities. Asia-Pacific’s robust export-oriented packaging industry and increasing adoption of innovative carton technologies also strengthen its leadership position in this market globally.

U.S. Liquid Packaging Carton Market Insight

The U.S. leads the North American liquid packaging carton market in 2024, supported by advanced packaging technologies and strong consumer preference for sustainable and convenient solutions. High demand from dairy, juice, and plant-based beverage sectors is furthered by growing e-commerce penetration and rising environmental awareness. Major players continue to innovate with bio-based cartons, resealable formats, and digital traceability features to meet evolving consumer and regulatory expectations.

Europe Liquid Packaging Carton Market Insight

Europe’s liquid packaging carton market is expected to grow steadily, driven by stringent regulations aimed at reducing plastic waste and promoting recyclable packaging materials. Strong consumer demand for sustainable and biodegradable solutions supports growth across dairy, juice, and beverage segments. Countries such as Germany, France, and the U.K. contribute significantly due to their progressive environmental policies and robust food and beverage industries.

U.K. Liquid Packaging Carton Market Insight

The U.K. liquid packaging carton market is witnessing notable growth, propelled by regulatory initiatives targeting plastic reduction and moves toward circular economy models. Retailers and manufacturers increasingly favor carton packaging for beverages, leveraging improved recycling infrastructure and consumer demand for eco-friendly packaging.

Germany Liquid Packaging Carton Market Insight

Germany plays a leading role in liquid packaging carton adoption, driven by industry innovation and comprehensive recycling programs. The country’s emphasis on sustainability and environmental responsibility fosters the use of recyclable cartons in dairy, juice, and other liquid food applications, supported by strong manufacturing and technological expertise.

Asia-Pacific Liquid Packaging Carton Market Insight

Asia-Pacific dominates the global liquid packaging carton market in 2024, fueled by rapid growth in food and beverage consumption, urbanization, and rising disposable incomes in China, India, Japan, and Southeast Asia. Government regulations promoting sustainable packaging and investments in local manufacturing capacities accelerate carton adoption. Increasing demand for aseptic packaging solutions and plant-based beverages further bolster market expansion.

India Liquid Packaging Carton Market Insight

India is projected to experience a substantial growth over the forecast period, driven by expanding organized retail, increasing consumption of packaged beverages, and rising awareness about product safety and sustainability. Government initiatives encouraging eco-friendly packaging and growth in plant-based and functional beverages present significant growth opportunities.

China Liquid Packaging Carton Market Insight

China leads the Asia-Pacific liquid packaging carton market in revenue share, supported by its vast beverage manufacturing industry and robust domestic demand. Proactive government policies aimed at reducing plastic waste and encouraging sustainable packaging solutions, coupled with rapid urbanization and rising health-conscious consumers, drive widespread adoption. China’s export-oriented production infrastructure further strengthens its market dominance.

Liquid Packaging Carton Market Share

The liquid packaging carton industry is primarily led by well-established companies, including:

- Tetra Pak International S.A. (Switzerland)

- Elopak AS (Norway)

- SIG Combibloc Group AG (Switzerland)

- Nippon Paper Industries Co. Ltd. (Japan)

- Uflex Limited (India)

- Mondi plc (United Kingdom/Ireland)

- Smurfit Kappa (Ireland)

- Billerud AB (Sweden)

- Adam Pack S.A. (Greece)

- Pactiv Evergreen Inc. (United States)

- Amcor plc (Switzerland)

- Greatview Aseptic Packaging Co. Ltd. (China)

- IPI S.r.l. (Italy)

- Stora Enso Oyj (Finland)

- Refresco Group (Netherlands)

Latest Developments in Global Liquid Packaging Carton Market

- In March 2024 Tetra Pak International S.A. introduced a new bio-based carton product line that reduces carbon footprint by 30%, addressing rising sustainability trends in beverage packaging.

- In September 2023 SIG Combibloc Group AG launched smart packaging solutions incorporating in QR-code traceability features to enhance consumer engagement and supply chain transparency.

- In June 2023 Elopak AS expanded its production capacity in the Asia-Pacific region to meet growing demand for aseptic cartons in dairy and plant-based beverage sectors.

- In November 2022 Mondi plc unveiled innovative lightweight carton board materials that improve recyclability without compromising package strength and durability.

- In August 2022 Uflex Limited entered into strategic partnerships with regional beverage companies to supply eco-friendly and sustainable liquid packaging carton solutions.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Liquid Packaging Carton Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Liquid Packaging Carton Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Liquid Packaging Carton Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.