Global Liquid Powder And Speciality Coating Equipment Market

Market Size in USD Billion

CAGR :

%

USD

2.90 Billion

USD

4.40 Billion

2024

2032

USD

2.90 Billion

USD

4.40 Billion

2024

2032

| 2025 –2032 | |

| USD 2.90 Billion | |

| USD 4.40 Billion | |

|

|

|

Liquid Powder and Speciality Coating Equipment Market Analysis

The liquid powder and specialty coating equipment market is experiencing a surge in demand due to the increasing need for high-performance coatings across various industries. The advancement of coating technologies, such as electrostatic spray systems and fluidized bed processes, is enabling manufacturers to achieve higher quality finishes and greater durability. In addition, the trend towards sustainable and eco-friendly coatings, which include low-VOC and water-based solutions, is driving growth in the market. These technologies not only reduce environmental impact but also enhance product lifespan, offering a significant advantage in industries like automotive, aerospace, and consumer electronics. The shift towards automation and robotics in coating application processes is further improving efficiency and reducing human error in manufacturing.

Furthermore, the adoption of smart coatings that respond to environmental stimuli, such as temperature and humidity, is contributing to innovation in the coating equipment industry. These intelligent coatings are particularly useful in sectors such as aerospace, where durability and functionality are paramount. The growing demand for enhanced performance and aesthetic quality in coatings is propelling the market forward, making liquid powder and specialty coating equipment an essential part of modern manufacturing systems.

Liquid Powder and Speciality Coating Equipment Market Size

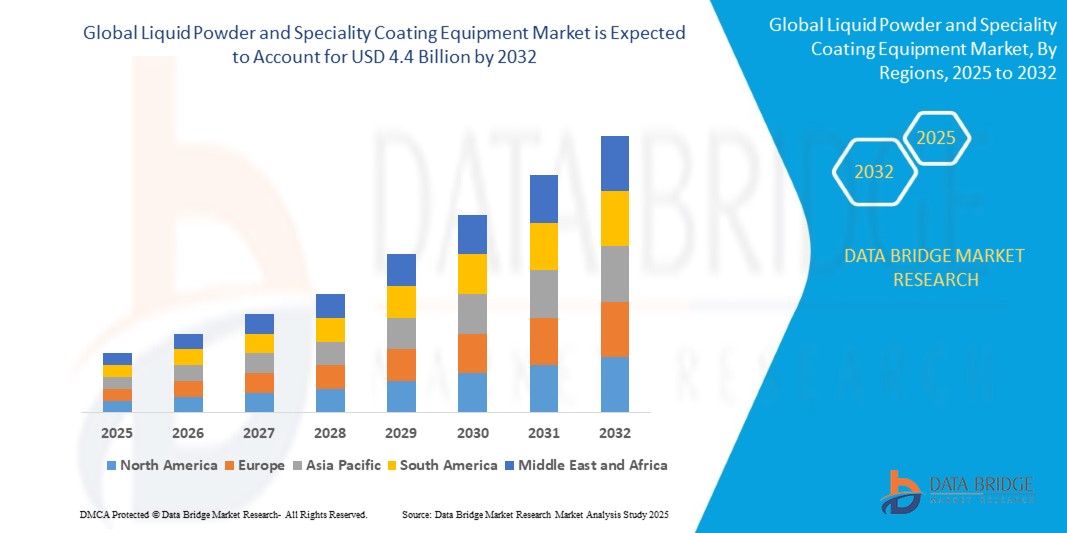

The global liquid powder and speciality coating equipment market size was valued at USD 2.9 billion in 2024 and is projected to reach USD 4.4 billion by 2032, with a CAGR of 5.40% during the forecast period of 2025 to 2032. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand.

Liquid Powder and Speciality coating Equipment Market Trends

"Integration of Automation and Robotics in Coating Systems"

A significant trend in the liquid powder and specialty coating equipment market is the increasing integration of automation and robotics in coating systems. This innovation enables manufacturers to achieve higher precision and consistency in coating applications, which is essential in industries where high-quality finishes are critical, such as automotive and electronics. Automated systems reduce the need for manual intervention, streamline production processes, and lower labor costs, driving efficiency. Companies like Nordson Corporation and Graco Inc. are leading the way in developing automated coating systems that enhance the production capabilities of manufacturers across the globe. This trend is expected to continue as the demand for high-quality coatings rises in emerging industries.

Report Scope and Liquid Powder and Speciality coating Equipment Market Segmentation

|

Attributes |

Liquid Powder and Speciality coating Equipment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Key Market Players |

Nordson Corporation (U.S.), Graco Inc. (U.S.), ITW (U.S.), Sames Kremlin (France), Asahi Sunac Corporation (Japan), Anest Iwata Corporation (Japan), Carlisle Fluid Technologies (U.S.), Wagner Group (Germany), Binks (U.S.), Exel Industries (France), Flow Coat Ltd. (U.K.), Ceresist, Inc. (U.S.), Gebr. Hesse GmbH & Co. (Germany), AkzoNobel N.V. (Netherlands), PPG Industries, Inc. (U.S.), Sherwin-Williams Company (U.S.), Jotun A/S (Norway), Hempel A/S (Denmark), BASF Coatings GmbH (Germany), and KCC Corporation (South Korea) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Liquid Powder and Speciality coating Equipment Market Definition

Liquid, powder, and specialty coating equipment are essential tools used to apply various types of coatings that enhance the appearance, durability, and functionality of surfaces across multiple industries. Liquid coating equipment applies protective or decorative finishes such as paints or varnishes through spraying, dipping, or brushing methods. Powder coating equipment, on the other hand, uses a dry powder applied electrostatically to surfaces, which is then heated to form a durable and high-performance finish. Specialty coating equipment is used for applications requiring advanced features like corrosion resistance, heat resistance, or non-stick properties.

Liquid Powder and Speciality coating Equipment Market Dynamics

Drivers

- Increased Demand for High-Performance Coatings

The growing need for high-performance coatings is driven by industries like automotive, aerospace, and industrial equipment, where product longevity, aesthetic appeal, and resilience to environmental stress are crucial. Automotive manufacturers, for example, prefer powder coatings due to their durability against extreme weather conditions and scratch resistance. In aerospace, coatings that offer corrosion resistance are critical for prolonging the lifespan of aircraft exposed to harsh weather and atmospheric conditions. Similarly, industrial equipment manufacturers opt for coatings that protect against wear and tear, ensuring machinery operates efficiently for extended periods in harsh industrial environments.

- Technological Advancements in Coating Equipment

Recent technological advancements in coating equipment, such as automation and precision spraying, are driving growth in the liquid powder and specialty coating market. Electrostatic spray systems, widely used in automotive manufacturing, improve coating uniformity and reduce overspray, enhancing quality and minimizing waste. For example, Tesla uses electrostatic coating in vehicle production for better finish quality and efficiency. In aerospace, advanced equipment applies thermal barrier coatings (TBCs) on engine components to protect against high heat, improving performance and lifespan. Additionally, the demand for specialty coatings, such as heat-resistant and UV-sensitive formulations, is pushing innovation, especially in electronics and defense industries.

Opportunities

- Growth in Emerging Markets

Emerging markets, particularly in Asia-Pacific, Latin America, and the Middle East, represent a significant opportunity for the liquid powder and specialty coating equipment market. As industrialization and manufacturing sectors in countries like China, India, and Brazil expand, there is a surge in demand for advanced coating solutions. For example, in China, the automotive and electronics sectors are rapidly growing, creating a need for high-quality coatings that enhance product durability and appearance. This growth, coupled with increasing infrastructure development in the Middle East, provides ample opportunity for coating equipment suppliers to enter new markets and expand their global footprint.

- Demand for Eco-Friendly Coatings

The increasing emphasis on sustainability is transforming the coating industry, with a strong shift toward eco-friendly solutions. This includes low-VOC (volatile organic compounds) coatings and water-based formulations, which are less harmful to the environment compared to traditional solvent-based options. Manufacturers are focusing on developing green technologies that align with stringent environmental regulations, such as the European Union’s REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) regulations. An example of this trend is the automotive industry’s adoption of water-based coatings that reduce harmful emissions, enabling manufacturers to meet environmental standards while enhancing the durability and appeal of their products.

Restraints/Challenges

- High Initial Investment Costs

A significant challenge for the liquid powder and specialty coating equipment market is the high upfront cost of advanced equipment. Automated coating systems, robotic arms, and advanced technologies like electrostatic spraying are expensive investments that can be a barrier for small and medium-sized enterprises (SMEs), particularly in developing economies. For instance, a small automotive parts manufacturer in India might struggle with the initial cost of robotic spraying systems, which could prevent them from upgrading their production lines. As a result, some companies may delay or forgo these advancements, impacting the adoption of cutting-edge technologies in certain regions..

- Maintenance and Repair Costs

Another challenge for the coating equipment market is the high maintenance and repair costs associated with specialized machinery. Automated and advanced systems require regular upkeep to maintain performance, and the absence of skilled technicians in some regions can exacerbate this issue. In industries like aerospace, where precision is crucial, downtime due to equipment failure can lead to significant financial losses. For example, in a Brazilian automotive plant, if coating equipment breaks down and skilled repair personnel are unavailable, production schedules could be delayed, impacting the manufacturer’s delivery timelines and profitability. This challenge underscores the need for well-trained professionals and effective maintenance strategies in the industry.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Liquid Powder and Speciality Coating Equipment Market Scope

The market is segmented on the basis of type, application, Technology, end user, distribution channel Automation Level. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- Liquid Coating

- Solvent-based Coatings

- Water-based Coatings

- UV-cured Coatings

- High-solids Coatings

- Epoxy Coatings

- Powder Coating

- Thermoset Powder Coating

- Thermoplastic Powder Coating

- Epoxy Powder Coating

- Polyester Powder Coating

- Hybrid Powder Coating

- Specialty Coating

- Anti-corrosion Coatings

- Fire-resistant Coatings

- Anti-fouling Coatings

- UV-resistant Coatings

- Conductive Coatings

- Heat-resistant Coatings

- Anti-microbial Coatings

Application

- Automotive

- Exterior Coatings

- Interior Coatings

- Underbody Coatings

- Engine Components Coatings

- Aerospace

- Aircraft Exterior Coatings

- Interior Coatings

- Engine and Mechanical Components Coatings

- Anti-icing/Anti-corrosion Coatings

- Industrial Equipment

- Machinery Coatings

- Tool Coatings

- Conveyor Systems Coatings

- Storage Tanks and Pipelines Coatings

- Consumer Electronics

- Others

- Medical Devices Coatings

- Marine Applications Coatings

- Architectural Coatings

- Furniture Coatings

- Packaging Coatings

Technology

- Electrostatic Spray

- Fluidized Bed

- Manual Spray

- Others

End User

- Manufacturers

- Service Providers

- Others

Distribution Channel

- Direct Sales

- Retail Sales

Automation Level

- Manual

- Semi-Automatic

- Automatic

- Fully Automated

Liquid Powder and Speciality Coating Equipment Market Regional Analysis

The market is analysed and market size insights and trends are provided by country, type, application, Technology, end user, distribution channel and Automation Level as referenced above.

The countries covered in the market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America

North America is expected to dominate the liquid powder and speciality coating equipment market due to significant investments in automotive and aerospace manufacturing, which are major consumers of coating equipment. The rapid technological advancements and demand for eco-friendly solutions in this region are also contributing to its market leadership.

Asia-Pacific, particularly China and India, is anticipated to exhibit the highest growth rate during the forecast period, driven by increasing industrialization and the growing automotive sector. In addition, government initiatives to improve infrastructure and expand the manufacturing sector in countries like China and India are expected to boost demand for advanced coating technologies.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Liquid Powder and Speciality Coating Equipment Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Liquid Powder and Speciality coating Equipment Market Leaders Operating in the Market Are:

- Nordson Corporation (U.S.)

- Graco Inc. (U.S.)

- ITW (U.S.)

- Sames Kremlin (France)

- Asahi Sunac Corporation (Japan)

- Anest Iwata Corporation (Japan)

- Carlisle Fluid Technologies (U.S.)

- Wagner Group (Germany)

- Binks (U.S.)

- Exel Industries (France)

- Flow Coat Ltd. (U.K.)

- Ceresist, Inc. (U.S.)

- Gebr. Hesse GmbH & Co. (Germany)

- AkzoNobel N.V. (Netherlands)

- PPG Industries, Inc. (U.S.)

- Sherwin-Williams Company (U.S.)

- Jotun A/S (Norway)

- Hempel A/S (Denmark)

- BASF Coatings GmbH (Germany)

- KCC Corporation (South Korea)

Latest Developments in Liquid Powder and Speciality coating Equipment Market

- In November 2024, Carlisle Fluid Technologies acquired Reinhardt-Technik GmbH, a specialist in bonding, dispensing, and potting technology. This acquisition enhances Carlisle Fluid Technologies' sealant and adhesive capabilities, strengthening its global platform for delivering innovative solutions. Reinhardt-Technik, established in 1962, was part of Wagner since 2012. The management team will continue operations under the Reinhardt-Technik brand

- In July 2024, Sheboygan Paint Company, a Wisconsin-based manufacturer of liquid industrial coatings, acquired Bradley Coatings Group from United Paint & Chemical Corporation. Bradley Coatings specializes in coatings for the transportation and industrial metal sectors. The acquisition enhances Sheboygan Paint’s product portfolio, particularly in water, solvent, and radiation cure technologies

- In February 2024, KANSAI HELIOS signed a share purchase agreement with GREBE Holding to acquire WEILBURGER Coatings, a renowned industrial coatings producer specializing in non-stick, high-temperature, and railway coatings. The acquisition includes WEILBURGER Coatings GmbH in Germany and WEILBURGER Asia Limited in Hong Kong. This strategic move strengthens KANSAI HELIOS' position in the industrial coatings sector, expanding its expertise, production capacity, and global reach

- In June 2022, PPG has introduced the industry’s first commercial retroreflective powder coating, PPG ENVIROCRON™ LUM. This patent-pending product enhances visibility in low-light conditions by incorporating retroreflective glass beads that redirect light back to its source. Suitable for various applications, including guardrails, bicycles, safety equipment, and shopping carts, the coating provides durability, chip and abrasion resistance, and corrosion protection. It is available in multiple colors and supports PPG's sustainability goal of achieving 40% of sales from sustainably advantaged products by 2025. PPG Envirocron LUM combines safety with the benefits of powder coating technology

- On February 2022, PPG (Pittsburgh, Pennsylvania) announced an agreement to acquire Arsonsisi's powder coatings business, a Milan-based company known for its specialty coatings for architectural and industrial markets. This acquisition includes Arsonsisi's automated manufacturing plant in Verbania, Italy, and will expand PPG’s offerings in the Europe, Middle East, and Africa (EMEA) region, particularly in metallic bonding

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Liquid Powder And Speciality Coating Equipment Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Liquid Powder And Speciality Coating Equipment Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Liquid Powder And Speciality Coating Equipment Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.