Global Liquor Confectionery Market

Market Size in USD Million

CAGR :

%

USD

790.77 Million

USD

1,056.67 Million

2025

2033

USD

790.77 Million

USD

1,056.67 Million

2025

2033

| 2026 –2033 | |

| USD 790.77 Million | |

| USD 1,056.67 Million | |

|

|

|

|

Liquor Confectionery Market Size

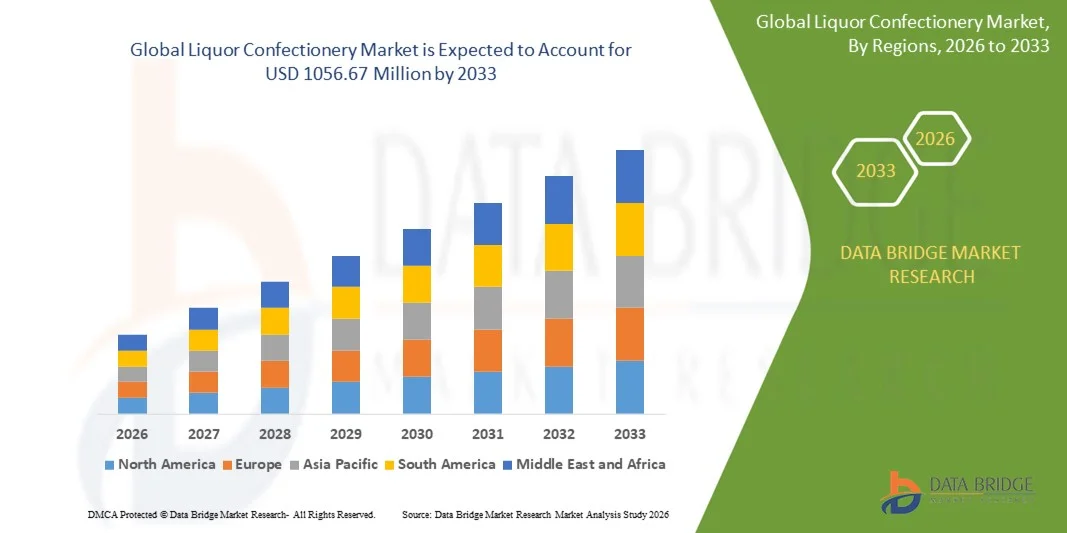

- The global liquor confectionery market size was valued at USD 790.77 million in 2025 and is expected to reach USD 1056.67 million by 2033, at a CAGR of 5.10% during the forecast period

- The market growth is largely fuelled by rising consumer preference for premium and novelty confectionery products infused with alcoholic flavours

- Increasing gifting culture and demand for indulgent treats during festive and celebratory occasions are supporting market expansion

Liquor Confectionery Market Analysis

- The market is characterised by strong demand for premium, artisanal, and flavour-differentiated products that combine confectionery with alcoholic taste profiles

- Manufacturers are focusing on innovation, brand positioning, and premium packaging to attract adult consumers seeking unique indulgence experiences

- Europe dominated the global liquor confectionery market with the largest revenue share in 2025, driven by a strong tradition of premium confectionery consumption and high demand for liquor-infused chocolates during festive and gifting occasions

- Asia-Pacific region is expected to witness the highest growth rate in the global liquor confectionery market, driven by expanding middle-class populations, rapid urbanisation, and growing demand for premium gifting and indulgent confectionery products

- The chocolates segment held the largest market revenue share in 2025 driven by strong consumer preference for premium liquor-infused chocolates, truffles, and pralines that offer rich flavour profiles and indulgent experiences. Liquor chocolates are widely used for gifting and festive occasions, supported by attractive packaging and the availability of diverse alcohol flavours such as rum, whisky, and liqueurs, making them the most commercially successful product category

Report Scope and Liquor Confectionery Market Segmentation

|

Attributes |

Liquor Confectionery Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

• Chocolaterie Abtey (France) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Liquor Confectionery Market Trends

Rising Demand For Premium And Novelty Confectionery Products

- The growing inclination toward premium and indulgent food products is significantly shaping the global liquor confectionery market, as adult consumers increasingly seek unique taste experiences that combine confectionery with alcoholic flavours. Liquor-infused chocolates, gummies, and candies are gaining popularity due to their novelty appeal, premium positioning, and suitability for gifting and celebratory consumption. This trend is encouraging manufacturers to experiment with flavours, textures, and alcohol pairings to cater to evolving consumer preferences

- Increasing urbanisation, rising disposable incomes, and exposure to global confectionery trends are accelerating demand for liquor confectionery across developed and emerging markets. Consumers are showing a strong preference for artisanal, handcrafted, and limited-edition products that offer differentiated taste profiles. This has supported product launches across chocolates, pralines, truffles, and filled candies infused with spirits, wine, and liqueurs

- Premiumisation and gifting trends are influencing purchasing behaviour, with manufacturers focusing on attractive packaging, seasonal offerings, and festive assortments. Transparent labelling, quality ingredients, and brand storytelling are helping companies differentiate products in a competitive market and build consumer trust. Marketing strategies increasingly emphasise indulgence, exclusivity, and adult-oriented consumption occasions

- For instance, in 2024, Ferrero in Italy and Lindt & Sprüngli in Switzerland expanded their liquor confectionery portfolios by introducing premium chocolate assortments infused with liqueurs and spirits. These products were launched ahead of festive seasons and distributed through retail, duty-free, and specialty confectionery stores, strengthening brand visibility and consumer engagement

- While demand for liquor confectionery continues to grow, sustained market expansion depends on continuous product innovation, compliance with alcohol regulations, and maintaining balance between flavour intensity and confectionery appeal. Manufacturers are also focusing on controlled alcohol content, shelf stability, and broader distribution to support long-term growth

Liquor Confectionery Market Dynamics

Driver

Growing Preference For Premium And Indulgent Confectionery

- Rising consumer demand for premium and experiential food products is a major driver for the global liquor confectionery market. Manufacturers are leveraging alcohol-infused formulations to enhance flavour complexity, product differentiation, and premium appeal, particularly among adult consumers. This trend is also driving innovation in flavour combinations and confectionery formats

- Expanding consumption during festive seasons, celebrations, and gifting occasions is supporting market growth. Liquor confectionery products are increasingly perceived as luxury treats and alternative gifting options, encouraging higher spending and repeat purchases. Growth in duty-free retail and travel retail channels further reinforces this demand

- Confectionery manufacturers are actively promoting liquor-infused products through limited-edition launches, premium packaging, and targeted marketing campaigns. These efforts are supported by changing consumer lifestyles and increasing acceptance of alcohol-flavoured sweets, while collaborations with spirit brands are helping enhance product authenticity and brand value

- For instance, in 2023, Mondelez International in the U.S. and Läderach in Switzerland reported increased sales of liquor-infused chocolates during festive periods. These products benefited from premium positioning, innovative flavour profiles, and strong marketing campaigns highlighting indulgence and exclusivity

- Although premiumisation supports growth, wider adoption depends on regulatory compliance, controlled alcohol content, and effective positioning to appeal to diverse consumer segments. Investment in product development, branding, and distribution will be critical for sustaining market momentum

Restraint/Challenge

Regulatory Restrictions And Limited Consumer Acceptance

- Regulatory constraints related to alcohol content, labelling, and distribution remain a key challenge for the liquor confectionery market. Strict regulations across several countries limit alcohol concentration in food products, increasing compliance costs and restricting market entry for manufacturers. Variations in regional regulations further complicate global expansion strategies

- Consumer acceptance remains uneven, particularly in markets with cultural or religious sensitivities toward alcohol consumption. Limited awareness and perception of liquor confectionery as niche or premium products can restrict demand in certain regions, affecting overall market penetration

- Supply chain and production challenges also impact growth, as liquor confectionery requires careful handling to maintain flavour stability, shelf life, and consistent alcohol content. Higher production costs, specialised packaging, and storage requirements add to operational complexity for manufacturers

- For instance, in 2024, confectionery distributors in the Middle East and parts of Asia reported restricted sales of liquor-infused chocolates due to regulatory limitations and consumer hesitancy. Retailers in these regions often limited shelf space for alcohol-containing confectionery, affecting product visibility and sales performance

- Addressing these challenges will require regulatory adaptation, product reformulation with lower alcohol content, and targeted marketing to educate consumers. Strategic focus on premium markets, innovation in flavour delivery, and collaboration with retail partners will be essential to unlock long-term growth opportunities in the global liquor confectionery market

Liquor Confectionery Market Scope

The market is segmented on the basis of product type and distribution channel

- By Product Type

On the basis of product type, the global liquor confectionery market is segmented into chocolates, candies, and gums. The chocolates segment held the largest market revenue share in 2025 driven by strong consumer preference for premium liquor-infused chocolates, truffles, and pralines that offer rich flavour profiles and indulgent experiences. Liquor chocolates are widely used for gifting and festive occasions, supported by attractive packaging and the availability of diverse alcohol flavours such as rum, whisky, and liqueurs, making them the most commercially successful product category.

The candies and gums segment is expected to witness steady growth during the forecast period, supported by increasing innovation in flavours, formats, and alcohol infusions. These products appeal to consumers seeking novelty, convenience, and portion-controlled indulgence, particularly in travel retail and impulse purchase settings.

- By Distribution Channel

On the basis of distribution channel, the global liquor confectionery market is segmented into supermarkets and hypermarkets, specialty stores, online stores, and others. Supermarkets and hypermarkets accounted for the largest share in 2025 due to their wide product availability, strong brand visibility, and high consumer footfall, especially during festive seasons and promotional periods. These channels enable manufacturers to reach a broad consumer base while offering competitive pricing and bundled offerings.

The online stores segment is expected to record the fastest growth over the forecast period, driven by increasing e-commerce penetration, convenience of home delivery, and access to premium and niche liquor confectionery brands. Online platforms also support product discovery through targeted marketing, seasonal promotions, and customised gifting options, contributing to rising adoption among urban and younger consumers.

Liquor Confectionery Market Regional Analysis

- Europe dominated the global liquor confectionery market with the largest revenue share in 2025, driven by a strong tradition of premium confectionery consumption and high demand for liquor-infused chocolates during festive and gifting occasions

- Consumers in the region place high value on artisanal quality, premium ingredients, and sophisticated flavour profiles, supporting steady demand for liquor chocolates and confectionery products

- This strong market position is further supported by high disposable incomes, well-established confectionery brands, and widespread availability across specialty stores, supermarkets, and duty-free retail, positioning liquor confectionery as a preferred indulgent treat

Germany Liquor Confectionery Market Insight

The Germany liquor confectionery market captured a significant revenue share in 2025 within Europe, supported by strong consumer preference for premium chocolates and alcohol-infused confectionery products. German consumers increasingly seek high-quality, artisanal offerings, particularly during seasonal celebrations such as Christmas and Easter. The presence of well-established confectionery manufacturers, combined with strong retail distribution and gifting culture, continues to drive market growth.

U.K. Liquor Confectionery Market Insight

The U.K. liquor confectionery market is expected to witness notable growth from 2026 to 2033, supported by rising demand for premium gifting products and growing acceptance of alcohol-flavoured sweets among adult consumers. Seasonal consumption during holidays and celebrations, along with strong online and specialty retail presence, is encouraging manufacturers to expand product offerings and limited-edition assortments.

North America Liquor Confectionery Market Insight

The North America liquor confectionery market accounted for a substantial revenue share in 2025, driven by increasing consumer interest in premium and novelty confectionery products. The region benefits from rising disposable incomes, strong gifting culture, and growing demand for indulgent treats with unique flavour experiences. Expansion of specialty stores and online platforms is further supporting market penetration.

U.S. Liquor Confectionery Market Insight

The U.S. liquor confectionery market held the largest share in North America in 2025, fuelled by strong demand for premium chocolates and innovative alcohol-infused products. Consumers increasingly favour unique and experiential confectionery, particularly for gifting and festive occasions. Growth in e-commerce, specialty retail, and collaborations between confectionery and liquor brands continues to strengthen market performance.

Asia-Pacific Liquor Confectionery Market Insight

The Asia-Pacific liquor confectionery market is expected to witness the fastest growth rate from 2026 to 2033, driven by rising urbanisation, increasing disposable incomes, and growing exposure to premium confectionery trends. Expanding middle-class populations and growing acceptance of western-style indulgent products are encouraging market growth across major economies.

Japan Liquor Confectionery Market Insight

The Japan liquor confectionery market is expected to witness strong growth from 2026 to 2033, supported by high demand for premium, aesthetically packaged confectionery products. Japanese consumers value quality, innovation, and gifting appeal, making liquor-infused chocolates particularly popular during seasonal events and corporate gifting. Continuous product innovation and limited-edition launches are key growth drivers.

China Liquor Confectionery Market Insight

The China liquor confectionery market accounted for the largest revenue share in Asia Pacific in 2025, driven by rapid urbanisation, rising disposable incomes, and growing demand for premium gifting products. Increasing popularity of western-style chocolates, expansion of online retail channels, and strong domestic and international brand presence are key factors supporting market growth in China.

Liquor Confectionery Market Share

The Liquor Confectionery industry is primarily led by well-established companies, including:

Here’s the corrected list with the copyright symbol removed and the same format maintained

• Chocolaterie Abtey (France)

• BAISERS DE CHOCOLAT (France)

• Lollyphile! (U.S.)

• Neuhaus (Belgium)

• Oy Karl Fazer (Finland)

• Toms Gruppen (Denmark)

• VINOOS BY AMS (U.K.)

• Mars, Incorporated (U.S.)

• Brookside (U.S.)

• THE HERSHEY COMPANY (U.S.)

• Mondelez International (U.S.)

• Ferrero (Italy)

• Liqueur Fills (U.K.)

• Godiva (Belgium)

• SIPSMITH (U.K.)

• Aviation American Gin (U.S.)

• Charbonnel et Walker (U.K.)

• reservebar.com (U.S.)

• R&A BAILEY & CO (Ireland)

• Tempus Fugit (U.S.)

• Bourbon Dark Chocolate Caramels (U.S.)

Latest Developments in Global Liquor Confectionery Market

- In December 2024, Mondelez International engaged in potential acquisition discussions with The Hershey Company, reflecting a strategic consolidation move aimed at strengthening market presence, expanding product portfolios, and enhancing competitive positioning, with a combined market value nearing USD 50 billion, which could significantly reshape competitive dynamics within the global confectionery market

- In October 2024, Swiss Miss partnered with Hotel Tango Distillery to launch Cocoa-infused Toasted Marshmallow Bourbon, a premium limited-edition product priced at USD 27.99, designed to drive cross-category innovation, attract adult consumers, and expand premium offerings by blending confectionery flavours with spirits, thereby boosting brand differentiation and market engagement

- In October 2024, Manchester Distillery introduced Sweetie Chocolate Liqueur, marking its entry into confectionery-inspired spirits, aimed at diversifying its product portfolio, appealing to evolving flavour preferences, and strengthening premium positioning, while contributing to broader market expansion through innovative flavour convergence between confectionery and alcoholic beverages

- In July 2024, Neuhaus undertook a product and packaging innovation initiative by investing in luxury gifting and destination-focused packaging, including the launch of its History Box for travelers, aimed at enhancing premium brand appeal, strengthening gifting-led sales, and increasing visibility in travel retail channels, thereby supporting higher-value purchases and brand differentiation in the global confectionery market

- In December 2021, The Hershey Company completed the acquisition of Dot’s Pretzels and Pretzels Inc., a strategic expansion move designed to bring production capabilities in-house, support Dot’s long-term growth, and leverage operational expertise to accelerate snacking innovation, broaden product offerings, and strengthen Hershey’s competitive position in the evolving global snacks and confectionery market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Liquor Confectionery Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Liquor Confectionery Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Liquor Confectionery Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.