Global Lisinopril Market

Market Size in USD Billion

CAGR :

%

USD

226.43 Billion

USD

317.12 Billion

2024

2032

USD

226.43 Billion

USD

317.12 Billion

2024

2032

| 2025 –2032 | |

| USD 226.43 Billion | |

| USD 317.12 Billion | |

|

|

|

|

Lisinopril Market Size

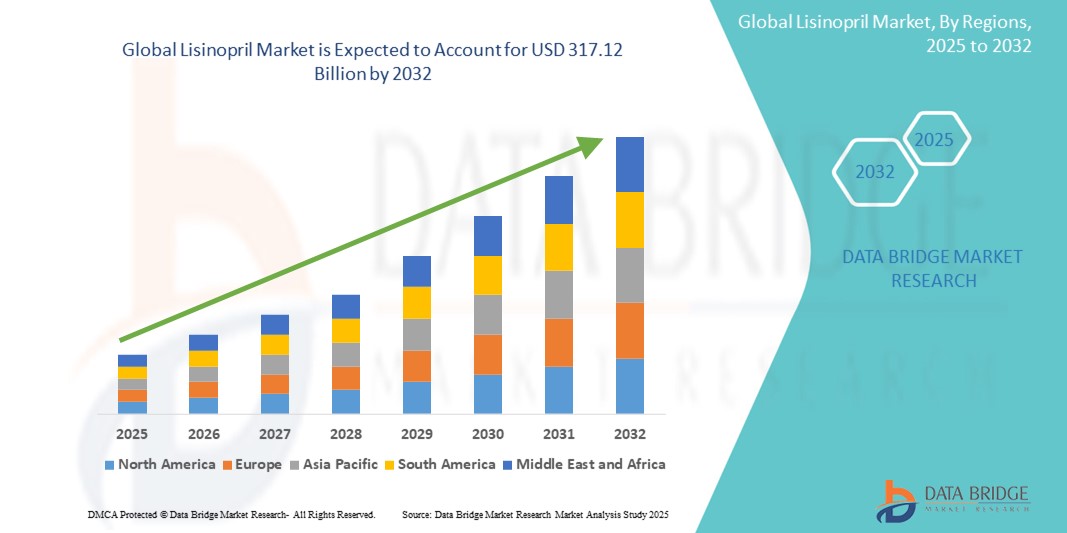

- The global lisinopril market size was valued at USD 226.43 billion in 2024 and is expected to reach USD 317.12 billion by 2032, at a CAGR of 4.30% during the forecast period

- The market growth is largely fueled by the increasing prevalence of hypertension and cardiovascular diseases, alongside advancements in pharmaceutical formulation and distribution technologies. These factors are contributing to the rising adoption of Lisinopril in both clinical and at-home treatment settings

- Furthermore, growing patient demand for effective, accessible, and affordable antihypertensive medications is establishing Lisinopril as a preferred choice in the ACE inhibitor segment. These converging factors are accelerating the uptake of Lisinopril therapies, thereby significantly boosting the industry's growth

Lisinopril Market Analysis

- Lisinopril, an angiotensin-converting enzyme (ACE) inhibitor, is widely used for the treatment of hypertension, heart failure, and post-myocardial infarction management, playing a critical role in cardiovascular therapy across global healthcare systems

- The growing prevalence of hypertension and cardiovascular diseases, coupled with an aging population and increased awareness of preventive healthcare, are the primary drivers fueling demand in the Lisinopril market

- North America dominated the lisinopril market with the largest revenue share of 41.7% in 2024, owing to high disease prevalence, advanced healthcare infrastructure, widespread use of generic medications, and robust government support for chronic disease management. The U.S. contributed significantly to this growth, supported by large-scale prescriptions in outpatient and clinical settings

- Asia-Pacific is expected to be the fastest-growing region with a CAGR of 7.9% in the lisinopril market during the forecast period due to rising incidences of hypertension, improving healthcare access, increased generic drug manufacturing, and growing healthcare expenditure in countries such as India and China

- The tablet segment dominated the lisinopril market with a market share of 81.6% in 2024, favored for its stability, affordability, and high patient compliance

Report Scope and Lisinopril Market Segmentation

|

Attributes |

Lisinopril Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Lisinopril Market Trends

“Enhanced Convenience Through Digital Advancements”

- A significant and accelerating trend in the global lisinopril market is the growing incorporation of advanced digital technologies in medication management systems and healthcare infrastructure. These advancements are enhancing patient convenience, adherence, and physician oversight in chronic disease treatment

- For instance, digital health platforms are being integrated with prescription systems to enable patients on Lisinopril to receive reminders, dosage tracking, and teleconsultation support. This fusion of medication with digital tools ensures better compliance and health outcomes

- Some smart pill dispensers now include features that learn user medication habits, suggest dosage optimizations, and provide intelligent alerts for missed doses. These systems benefit from algorithms that track medication routines and flag anomalies, particularly useful for elderly or high-risk patients

- The seamless integration of lisinopril therapy within broader digital health ecosystems supports centralized control and monitoring, where patients can manage their medication schedule along with other chronic care elements such as blood pressure, diet, and exercise through a single digital interface

- This trend toward more intelligent, intuitive, and connected pharmaceutical care systems is fundamentally reshaping expectations for chronic disease management. Consequently, pharmaceutical companies and health tech providers are developing solutions that integrate Lisinopril therapy with digital apps and wearable health monitors to ensure adherence and provide real-time feedback

- The demand for such smart, convenience-oriented healthcare solutions is growing rapidly across both developed and developing markets, as consumers increasingly prioritize personalized, reliable, and tech-enabled treatment options for long-term conditions such as hypertension and heart failure

Lisinopril Market Dynamics

Driver

“Growing Need Due to Rising Cardiovascular Disease Burden and Geriatric Population”

- The increasing prevalence of cardiovascular diseases such as hypertension, heart failure, and stroke, combined with the expanding global geriatric population, is significantly driving the demand for Lisinopril. This ACE inhibitor plays a critical role in managing these chronic conditions effectively and affordably

- For instance, in April 2024, Aurobindo Pharma Ltd. announced the expansion of its cardiovascular drug portfolio, including enhanced formulations of Lisinopril for better patient compliance and outcomes. Such strategic initiatives by key players are expected to fuel the growth of the Lisinopril industry during the forecast period

- As more patients seek long-term, effective management options for chronic cardiovascular and renal conditions, Lisinopril offers proven benefits such as blood pressure reduction, kidney protection in diabetic patients, and improved cardiac function, making it a preferred choice for physicians and patients alike

- Furthermore, growing awareness campaigns and improved diagnostic capabilities are increasing early detection of hypertension and related conditions, driving higher prescription rates of Lisinopril, especially in primary and secondary healthcare settings

- The convenience of once-daily oral administration, availability in combination therapies, and wide accessibility across both generic and branded formats are key factors supporting the adoption of Lisinopril in both hospital and retail pharmacy channels. In addition, the growing trend toward home-based healthcare and chronic disease self-management further contributes to the market’s upward trajectory

Restraint/Challenge

“Side Effects, Patent Expirations, and Generic Competition”

- Despite its effectiveness, concerns surrounding the side effects of Lisinopril—such as dry cough, dizziness, and, in rare cases, angioedema—can limit its long-term use in certain patient populations. This may prompt physicians to consider alternative therapies, thus restraining market growth

- For instance, increased patient sensitivity reports and adverse drug reaction monitoring by regulatory agencies have led to growing caution in prescribing ACE inhibitors such as Lisinopril in favor of ARBs (angiotensin II receptor blockers) in specific cases

- In addition, the expiration of key patents has opened the door for an influx of generic versions, intensifying price competition and reducing profit margins for original drug manufacturers. Companies are challenged to maintain market share amid this growing generic competition

- While generics improve affordability and accessibility, they also pressure branded drug manufacturers to innovate or differentiate through combination products, improved delivery mechanisms, or patient-centric packaging

- Overcoming these challenges requires continuous pharmacovigilance, strategic product differentiation, and patient education initiatives to reinforce Lisinopril’s therapeutic value and safety profile in the broader cardiovascular treatment landscape

Lisinopril Market Scope

The market is segmented on the basis of disease, dosage, dosage strength, brand, population type, end-users, and distribution channel.

• By Disease

On the basis of disease, the lisinopril market is segmented into hypertension, heart failure, heart attack, strokes, diabetic kidney disease, and others. Hypertension dominated with the largest market revenue share of 47.5% in 2024, due to its high global prevalence and Lisinopril’s effectiveness in first-line treatment.

Diabetic kidney disease is expected to register the fastest CAGR of 22.3% from 2025 to 2032, owing to the growing use of Lisinopril for renal protection in diabetic patients.

• By Dosage

On the basis of dosage, the lisinopril market is segmented into tablet, liquid, and others. The tablet segment held the largest share of 81.6% in 2024, favored for its stability, affordability, and high patient compliance.

The liquid segment is projected to grow at the fastest CAGR of 18.9% during the forecast period, particularly in pediatric and geriatric use cases.

• By Dosage Strength

On the basis of dosage strength, the market is segmented into 10mg/12.5mg, 20mg/12.5mg, 20mg/25mg, and others. 20mg/12.5mg dosage strength accounted for the largest market share of 34.1% in 2024, commonly used for moderate to severe hypertension cases.

10mg/12.5mg is projected to witness the fastest CAGR of 16.4% during the forecast period, due to increasing prescription rates for initial therapy and elderly patients.

• By Brand

On the basis of brand, the lisinopril market is segmented into Zestoretic, Prinivil, Zestril, and Others.

Zestril captured the largest share of 38.6% in 2024, supported by its global brand recognition and clinical efficacy.

Zestoretic is expected to register the fastest CAGR of 19.1% during the forecast period, owing to rising adoption of fixed-dose combination therapies.

• By Population Type

On the basis of population type, the lisinopril market is segmented into children and adults. Adults segment dominated the market with a share of 91.4% in 2024, reflecting the high burden of cardiovascular conditions in adults and seniors.

The children segment is expected to grow at a CAGR of 14.7% during the forecast period, supported by pediatric formulation approvals and increasing awareness.

• By End-Users

On the basis of end-users, the market is segmented into hospitals, specialty clinics, home healthcare, and others. Hospitals accounted for the largest share of 48.2% in 2024 during the forecast period, driven by their role in diagnosis, treatment initiation, and patient monitoring.

Home healthcare is projected to grow at the fastest CAGR of 20.3% during the forecast period, fueled by the shift toward home-based chronic disease management.

• By Distribution Channel

On the basis of distribution channel, the market is segmented into direct tender, hospital pharmacy, retail pharmacy, online pharmacy, and others. Retail Pharmacy dominated the market with a market share of 42.7% in 2024, due to its accessibility and routine medication refills.

Online pharmacy is expected to grow at the fastest CAGR of 24.6% from 2025 to 2032, owing to rising digital adoption and convenience-driven purchasing behavior.

Lisinopril Market Regional Analysis

- North America dominated the lisinopril market with the largest revenue share of 41.7% in 2024, driven by a growing prevalence of hypertension and cardiovascular diseases, as well as increased awareness of preventive healthcare measures

- Consumers in the region highly value the affordability, clinical effectiveness, and widespread availability of Lisinopril, especially in generic form. The strong presence of retail pharmacies, health insurance coverage, and government healthcare programs further supports this demand

- This widespread adoption is further supported by high healthcare spending, a well-established pharmaceutical distribution network, and a growing elderly population, establishing Lisinopril as a preferred solution for managing chronic cardiovascular conditions

U.S. Lisinopril Market Insight

The U.S. lisinopril market captured the largest revenue share of 61% in 2024 within North America, fueled by the high burden of hypertension, the aging demographic, and robust generic drug penetration. The market is expected to grow at a CAGR of 5.8% from 2025 to 2032, driven by continued healthcare digitization, widespread use of fixed-dose combinations, and expanding chronic disease management initiatives.

Europe Lisinopril Market Insight

The Europe lisinopril market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by increasing cardiovascular disease incidence and growing preference for cost-effective, evidence-based therapies. National health insurance schemes and patient access to generics will continue to support market expansion.

U.K. Lisinopril Market Insight

The U.K. lisinopril market is anticipated to grow at a noteworthy CAGR during the forecast period. Growth is supported by rising adoption of preventive care, NHS-backed hypertension management programs, and growing consumer demand for trusted, affordable medications.

Germany Lisinopril Market Insight

The Germany lisinopril market is expected to expand at a considerable CAGR during the forecast period. The expansion is fueled by rising aging population figures, strong health infrastructure, and the emphasis on reliable chronic disease therapies within public health systems.

Asia-Pacific Lisinopril Market Insight

The Asia-Pacific lisinopril market is poised to grow at the fastest CAGR of 7.9% from 2025 to 2032, driven by increasing urbanization, rising prevalence of hypertension, and expanding access to affordable healthcare. The region accounted for a market share of 22.4% in 2024, with notable growth observed in both rural and urban segments due to government-led health reforms and improved access to generics.

Japan Lisinopril Market Insight

The Japan lisinopril market contributed 18.6% to the Asia-Pacific revenue share in 2024 and is expected to grow at a CAGR of 6.1% during the forecast period. The country’s aging population, high-tech pharmaceutical landscape, and focus on preventative cardiovascular treatment are core growth drivers.

China Lisinopril Market Insight

The China lisinopril market held the largest revenue share within Asia-Pacific at 34.8% in 2024, attributed to widespread hypertension prevalence, rising middle-class awareness, and government efforts to improve access to essential medicines. The market is expected to expand at a CAGR of 8.1% from 2025 to 2032, supported by large-scale generic drug manufacturing and adoption across all healthcare tiers.

Lisinopril Market Share

The lisinopril industry is primarily led by well-established companies, including:

- Lupin Pharmaceuticals, Inc. (India)

- AstraZeneca (U.K.)

- Merck & Co., Inc. (U.S.)

- Sun Pharmaceutical Industries Limited (India)

- Teva Pharmaceutical Industries Limited (Israel)

- Cipla Inc. (India)

- Apotex Inc. (Canada)

- Aurobindo Pharma Ltd. (India)

- Viatris Inc. (U.S.)

- Hikma Pharmaceuticals PLC (U.K.)

- Pfizer Inc. (U.S.)

- Bausch Health Companies, Inc. (Canada)

- AbbVie Inc. (U.S.)

- Torrent Pharmaceuticals (India)

- Zydus Group (India)

- Amneal Pharmaceuticals, Inc. (U.S.)

Latest Developments in Global Lisinopril Market

- In April 2023, Aurobindo Pharma Ltd., a prominent player in the global generics market, announced the expansion of its cardiovascular product line with an upgraded formulation of Lisinopril targeting improved patient compliance and shelf life. This strategic move demonstrates the company’s commitment to addressing the growing burden of cardiovascular diseases, particularly in emerging economies. The initiative also reinforces Aurobindo’s competitive positioning in the global Lisinopril market by aligning product innovation with evolving healthcare needs

- In March 2023, Teva Pharmaceutical Industries Ltd. launched a new generic version of Lisinopril-Hydrochlorothiazide tablets in the U.S. market. The launch enhances accessibility to cost-effective combination therapies for hypertension management, especially in underserved populations. This advancement underlines Teva’s strategic focus on expanding its generics portfolio and meeting high-demand therapeutic segments, thereby strengthening its foothold in the global Lisinopril space

- In March 2023, Pfizer Inc. announced results from a Phase IV real-world study comparing the effectiveness of Lisinopril against other ACE inhibitors in preventing secondary cardiovascular events among high-risk patients. The study showed a statistically significant improvement in patient outcomes with Lisinopril use, which is expected to influence clinical guidelines and prescribing patterns globally. This development underscores Pfizer’s role in generating evidence-based data to support optimal hypertension care

- In February 2023, Lupin Pharmaceuticals, Inc. received regulatory approval from the European Medicines Agency (EMA) for its Lisinopril oral solution, targeting pediatric and geriatric patients with swallowing difficulties. This marks a significant milestone in the company’s strategy to provide patient-centric dosage forms and expand its presence in niche formulations within the cardiovascular therapy space

- In January 2023, Cipla Inc. launched a digital patient support program across India focused on chronic disease management, including hypertension and heart failure. The program features educational content, medication reminders, and teleconsultation support for patients using Lisinopril. This initiative reflects Cipla’s commitment to enhancing therapy adherence and improving outcomes through digital innovation, further advancing the market penetration of Lisinopril in the Asia-Pacific region

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.