Global Lithium Chemical Market

Market Size in USD Billion

CAGR :

%

USD

34.76 Billion

USD

53.75 Billion

2024

2032

USD

34.76 Billion

USD

53.75 Billion

2024

2032

| 2025 –2032 | |

| USD 34.76 Billion | |

| USD 53.75 Billion | |

|

|

|

|

Lithium Chemical Market Size

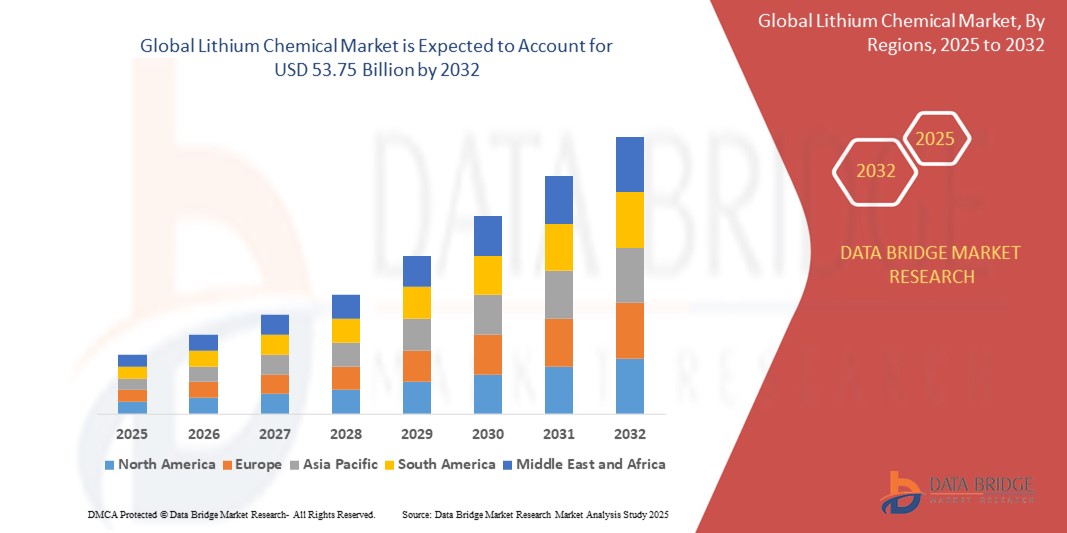

- The global Lithium Chemical market size was valued at USD 34.76 billion in 2024 and is expected to reach USD 53.75 billion by 2032, at a CAGR of 5.60% during the forecast period

- The market expansion is largely driven by the surging demand for lithium-ion batteries, fueled by the rapid electrification of the automotive sector and the global shift towards renewable energy storage systems

- Furthermore, the rising integration of lithium-based solutions in consumer electronics, including smartphones, laptops, and wearable devices, contributes to sustained market demand

Lithium Chemical Market Analysis

- Lithium chemicals, particularly lithium carbonate and lithium hydroxide, are increasingly critical in powering electric vehicles (EVs), portable electronics, and large-scale renewable energy storage systems due to their essential role in lithium-ion battery production

- The soaring demand for EVs and the global transition toward low-carbon energy solutions are the primary drivers of lithium chemical market growth, supported by aggressive policy frameworks and rising investments in battery technologies

- North America dominates the lithium chemical market with the largest revenue share of 40.01% in 2025, backed by strong EV adoption, advanced lithium extraction infrastructure, and significant investments in domestic lithium processing. The U.S. leads with rapid expansion in lithium installations, spurred by federal funding, sustainability mandates, and initiatives from key players such as Albemarle and Livent

- Europe is expected to be the fastest-growing region in the lithium chemical market during the forecast period, driven by the European Union’s stringent carbon emission targets, substantial funding for battery gigafactories, and growing demand from leading automakers transitioning to electric fleets. Countries such as Germany, France, and the U.K. are at the forefront of this transformation, supported by strategic partnerships for raw material security

- The lithium carbonate segment is projected to dominate the market with a market share of 43.2% in 2025, due to its wide-scale application in lithium-ion battery cathode manufacturing. Its cost-effectiveness and chemical performance make it a preferred choice across battery industries

Report Scope and Lithium Chemical Market Segmentation

|

Attributes |

Lithium Chemical Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework |

Lithium Chemical Market Trends

“Strategic Technological Advancements and Supply Chain Integration”

- A key and accelerating trend in the global Lithium Chemical market is the integration of advanced technologies such as AI, IoT, and process automation across the lithium value chain—from exploration to refining—enabling greater operational efficiency, predictive maintenance, and real-time quality control

- For instance, in October 2023, SQM and Rio Tinto announced AI-driven initiatives to optimize lithium extraction from brine resources, improving yield and minimizing environmental impact. These efforts signal a broader industry shift toward digital transformation to address rising demand and sustainability pressures

- Battery manufacturers and automakers are increasingly forming vertical integration strategies with lithium producers to secure raw material supply. In May 2024, General Motors expanded its partnership with Lithium Americas Corp to jointly develop the Thacker Pass project in Nevada, a major lithium resource critical for GM’s EV roadmap

- The adoption of direct lithium extraction (DLE) technologies is another major trend, allowing faster, cleaner, and more scalable production of lithium. Companies such as Lilac Solutions and EnergyX are deploying DLE pilot projects across South America and North America with promising results

- The push for battery recycling and closed-loop lithium supply chains is gaining traction as manufacturers seek to recover lithium from end-of-life batteries. In 2024, Redwood Materials and Ascend Elements scaled up their lithium recovery capacities in the U.S., reinforcing the trend toward circular economy practices

- These advancements are reshaping expectations in the battery and clean energy industries, as stakeholders prioritize sustainability, efficiency, and security of lithium supply. As a result, lithium chemical producers are investing in digital tools, strategic alliances, and clean extraction technologies to stay competitive in this fast-evolving market

Lithium Chemical Market Dynamics

Driver

“Growing Need Due to Rising EV Demand and Clean Energy Transition”

- The surging global demand for electric vehicles (EVs) and the accelerating clean energy transition are significant drivers of the growing need for lithium chemicals, particularly lithium carbonate and lithium hydroxide, which are critical raw materials for lithium-ion batteries

- For instance, in April 2024, Stellantis announced a strategic supply agreement with Controlled Thermal Resources (CTR) to secure sustainably sourced lithium from its California geothermal facility for future EV battery production. Such partnerships are helping secure supply while promoting environmentally responsible sourcing

- As countries set increasingly ambitious net-zero emissions targets and introduce bans on internal combustion engine vehicles, lithium demand is projected to grow exponentially. Lithium chemicals play a key role in battery production for EVs, consumer electronics, and large-scale energy storage systems

- In addition, rapid advancements in battery technology and the rising popularity of grid-scale energy storage are making lithium chemicals indispensable in the renewable energy infrastructure

- The expanding global footprint of battery gigafactories, supported by both public and private investment, further boosts lithium chemical consumption. This includes Tesla’s Gigafactories, CATL’s expansions in Europe and China, and LG Energy Solution’s new U.S. plants

- Overall, lithium chemical demand is rising not only in the automotive sector but also across industrial and consumer applications, underpinned by a global push for electrification and energy sustainability

Restraint/Challenge

“Concerns Over Supply Chain Instability and High Production Costs”

- Despite booming demand, the lithium chemical market faces significant challenges related to supply chain instability, high production costs, and geopolitical risks that threaten consistent global supply

- For instance, political unrest and water scarcity issues in Chile and Argentina, two of the world’s top lithium-producing nations, have disrupted lithium mining operations, affecting supply and pricing

- Lithium extraction and processing, especially from hard rock and brine sources, require significant water, energy, and time, which adds to production costs and environmental concerns

- The volatile pricing of lithium chemicals, as seen in the sharp price fluctuations between 2022 and 2024, has made it difficult for downstream manufacturers to plan long-term investments or secure stable procurement contracts

- Furthermore, the lack of sufficient refining capacity outside China poses a strategic risk. Although mining may be expanding in regions such as Australia and the U.S., much of the lithium hydroxide processing is still concentrated in China, leading to supply bottlenecks

- The initial capital investment required to establish lithium mines or DLE-based plants remains high, deterring new entrants, especially in developing regions

- Overcoming these challenges will require diversification of supply sources, increased investment in refining and recycling technologies, and global collaboration to stabilize pricing and streamline permitting and production timelines

Lithium Chemical Market Scope

The market is segmented on the basis of type, grade, application, and end-user.

By Type

On the basis of type, the lithium chemical market is segmented into lithium carbonate, lithium chloride, lithium hydroxide, lithium fluoride, lithium bromide, and others. the lithium carbonate segment dominates the largest market revenue share of 43.2% in 2025, driven by its established reputation in battery production and ease of integration into existing lithium-ion cell manufacturing setups. Manufacturers often prioritize lithium carbonate for its perceived stability and performance in energy storage applications. the market also sees strong demand for lithium carbonate due to its compatibility with various cathode chemistries and the availability of diverse formulations enhancing energy density and efficiency

The lithium hydroxide segment is anticipated to witness the fastest growth rate of 21.7% from 2025 to 2032, fueled by increasing adoption in high-nickel battery chemistries used in electric vehicles (evs). lithium hydroxide offers higher thermal stability, making it suitable for next-generation batteries, and its integration into ev supply chains provides producers with long-term supply contracts and cost benefits. the increasing push toward high-performance ev batteries also contributes to its growing demand globally

• By Grade

On the basis of grade, the lithium chemical market is segmented into industrial grade, battery grade, and others. The battery grade held the largest market revenue share in 2025, driven by the widespread demand from the electric vehicle sector and consumer electronics for high-purity lithium compounds. battery grade lithium often offers consistent quality standards, making it a preferred choice for lithium-ion battery manufacturers across the globe

The industrial grade segment is expected to witness the fastest CAGR from 2025 to 2032, driven by its use in non-battery applications such as ceramics, glass, lubricants, and air treatment. industrial-grade lithium compounds are particularly popular for their cost-effectiveness and functional properties in diverse industrial operations

• By Application

On the basis of application, the lithium chemical market is segmented into battery, lubricant, aluminium smelting and alloy, air treatment, medical, glass and ceramics, metallurgy, polymer, greases, and others. the battery segment held the largest market revenue share in 2025, driven by the ubiquitous use of lithium in rechargeable batteries across evs, portable electronics, and energy storage systems. Battery applications offer long-term growth opportunities, driven by decarbonization goals and energy transition initiatives across economies

The lubricant segment is expected to witness the fastest CAGR from 2025 to 2032, favored for its expanding role in high-temperature lubricating greases used in industrial and automotive sectors. Lithium-based lubricants are particularly valued for their thickening properties and water resistance, making them ideal for performance-critical applications

• By End-User

On the basis of end-user, the lithium chemical market is segmented into industrial, electronics and electricals, transportation, medical, power plants, and others. The electronics and electricals segment accounted for the largest market revenue share in 2024, driven by the increasing penetration of lithium-powered devices, rising consumption of consumer electronics, and the growing demand for compact energy solutions. the rapid pace of digitalization and technological innovation continues to boost demand in this segment

The transportation segment is expected to witness the fastest CAGR from 2025 to 2032, driven by the electrification of vehicles, government mandates for low-emission transport, and rising investments in ev infrastructure. Automotive manufacturers benefit from high-performance lithium solutions that can be integrated into various battery platforms, offering flexibility and scalability

Lithium Chemical Market Regional Analysis

- North America dominates the global Lithium Chemical market, accounting for the largest revenue share of 40.01% in 2024, driven by robust growth in the electric vehicle (EV) sector, favorable government policies supporting battery manufacturing, and increasing investments in lithium refining and recycling infrastructure

- In addition, growing strategic partnerships between automakers and lithium suppliers ( GM–Lithium Americas, Ford–Albemarle) highlight the region’s commitment to building a resilient and vertically integrated lithium supply chain

- The regional market also benefits from increasing investment in battery recycling technologies, with companies such as Redwood Materials and Ascend Elements advancing lithium recovery efforts, helping to meet rising demand sustainably and locally

U.S. Lithium Chemical Market Insight

The U.S. Lithium Chemical market captured the largest revenue share of 81% within North America in 2025, fueled by the rising demand for electric vehicles (EVs), energy storage systems, and localized battery production. The country's focus on reshoring lithium supply chains—exemplified by the Biden Administration’s investments through the Inflation Reduction Act—is significantly boosting domestic lithium extraction, refining, and recycling. Leading companies such as Albemarle Corporation and Livent are expanding operations to meet surging demand from the automotive and energy sectors

Europe Lithium Chemical Market Insight

The European Lithium Chemical market is projected to expand at a substantial CAGR throughout the forecast period, driven by stringent environmental regulations, strong EV adoption mandates, and strategic raw material alliances. The European Union’s Critical Raw Materials Act and battery passport regulations are propelling local lithium sourcing and refining capacity. Countries such as France and Germany are investing in battery gigafactories and green lithium extraction to reduce dependency on imports and ensure sustainability

U.K. Lithium Chemical Market Insight

The U.K. Lithium Chemical market is anticipated to grow at a noteworthy CAGR during the forecast period due to increasing investment in battery technologies and growing interest in EVs. Government initiatives such as the UK Battery Industrialisation Centre (UKBIC) and exploration of domestic lithium sources (e.g., in Cornwall) are driving innovation. Moreover, rising energy storage demand in residential and commercial settings supports the growing need for lithium compounds

Germany Lithium Chemical Market Insight

The German Lithium Chemical market is expected to expand at a considerable CAGR, propelled by the country’s strong automotive sector and push for electrification. Germany’s leadership in battery manufacturing and partnerships with lithium suppliers ensure consistent demand for lithium carbonate and hydroxide. The country’s emphasis on sustainable and ethical sourcing also supports investments in green lithium extraction technologies

Asia-Pacific Lithium Chemical Market Insight

The Asia-Pacific Lithium Chemical market is poised to grow at the fastest CAGR of over 24% in 2025, driven by massive EV production in China, India, and Japan, and the dominance of APAC in battery manufacturing. China alone accounts for a significant share of the global lithium demand due to its strong battery value chain and government-backed electrification policies. In addition, Australia—the world’s largest lithium producer—further fuels the regional lithium supply ecosystem

Japan Lithium Chemical Market Insight

The Japan Lithium Chemical market is gaining traction owing to its advanced manufacturing sector, rapid urbanization, and the push for renewable energy integration. Japan's strong presence in battery technology, especially from companies such as Panasonic, supports continuous demand for high-purity lithium compounds. Moreover, government incentives and technological innovation are helping drive local production of lithium-based energy storage systems

China Lithium Chemical Market Insight

The China Lithium Chemical market accounted for the largest revenue share in Asia-Pacific in 2025, underpinned by its dominance in the global battery manufacturing landscape and rapidly growing EV sector. China’s strategic investments in lithium mining (domestically and abroad), processing plants, and battery gigafactories, along with support from policies such as “Made in China 2025”, have positioned the country as a global leader in lithium chemical demand and production

Lithium Chemical Market Share

The lithium chemical industry is primarily led by well-established companies, including:

- Albemarle Corporation (U.S.)

- Livent (U.S.)

- SQM S.A. (Chile)

- SICHUAN BRIVO LITHIUM MATERIALS CO., LTD. (China)

- Lithium Americas Corp. (Canada)

- Pilbara Minerals Limited (Australia)

- Neometals Ltd (Australia)

- The Pallinghurst Group (U.K.)

- Ganfeng Lithium Co., Ltd. (China)

- Talison Lithium Pty Ltd (Australia)

- Mody Chemi-Pharma Limited (India)

- SOVEMA GROUP S.p.A. (Italy)

- Altura Mining (Australia)

- Infinity Lithium Corporation Limited ( Australia)

- ProChem, Inc International (U.S.)

- Critical Elements Lithium Corporation (Canada)

Latest Developments in Global Lithium Chemical Market

- In March 2024, Albemarle Corporation announced plans to expand its lithium hydroxide production capacity in the U.S. to support the increasing demand for electric vehicle (EV) batteries. The company’s Mega-Flex facility in South Carolina is expected to process diverse lithium feedstock, including recycled batteries, with an initial investment of at least $1.3 billion. The facility aims to produce approximately 50,000 metric tons of battery-grade lithium hydroxide annually, with potential expansion up to 100,000 metric tons

- In May 2024, Ganfeng Lithium successfully integrated new direct lithium extraction technology, achieving improved recovery rates and minimizing environmental impact. This advancement enhances lithium production efficiency while reducing water and chemical usage, aligning with sustainable industry practices

- In April 2024, SQM S.A. introduced a new brine extraction process aimed at enhancing production efficiency while minimizing water usage. This development aligns with sustainable lithium production practices, ensuring resource conservation while meeting growing industry demands

- In June 2024, Livent Corporation finalized long-term supply agreements with leading battery manufacturers to ensure a stable supply of high-purity lithium compounds. These agreements support the growing demand for lithium in electric vehicle (EV) batteries and energy storage solutions. Livent’s strategic partnerships reinforce its commitment to sustainable lithium production and global supply chain reliability

- In September 2024, Factorial Inc. introduced Solstice, an all-solid-state battery designed to enhance EV performance and sustainability. Developed in collaboration with Mercedes-Benz, Solstice achieves an impressive 450Wh/kg energy density, extending EV range by up to 80% while reducing vehicle weight and improving efficiency. The battery features a sulfide-based electrolyte system, ensuring greater safety compared to traditional liquid electrolytes. Factorial anticipates OEM adoption before the decade’s end

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Lithium Chemical Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Lithium Chemical Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Lithium Chemical Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.