Global Lithium Chloride Market

Market Size in USD Million

CAGR :

%

USD

111.20 Million

USD

174.57 Million

2024

2032

USD

111.20 Million

USD

174.57 Million

2024

2032

| 2025 –2032 | |

| USD 111.20 Million | |

| USD 174.57 Million | |

|

|

|

|

Lithium Chloride Market Size

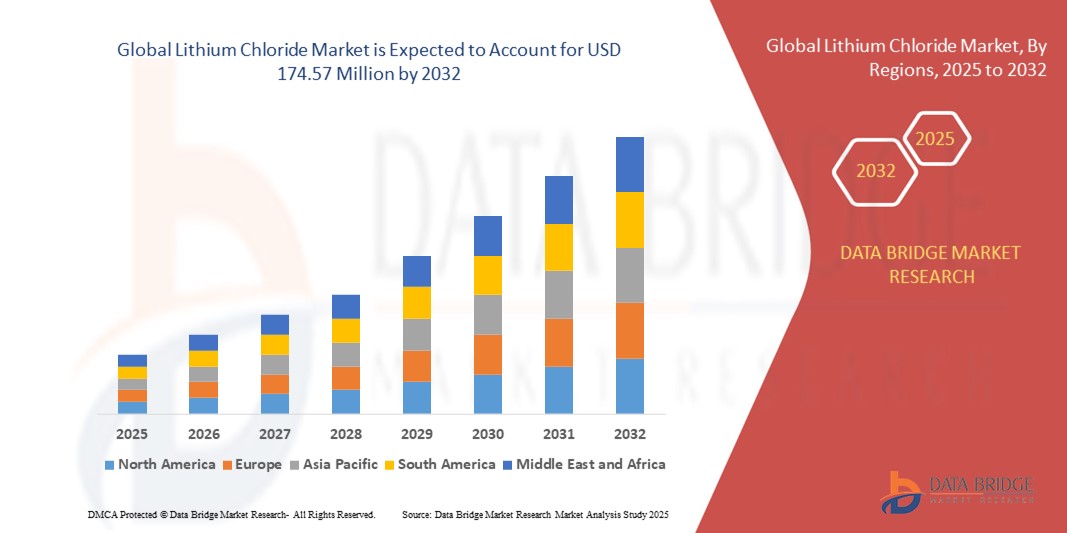

- The global lithium chloride market size was valued at USD 111.2 million in 2024 and is expected to reach USD 174.57 million by 2032, at a CAGR of 5.8% during the forecast period

- The market growth is largely fueled by the rising demand for lithium-ion batteries across electric vehicles, energy storage systems, and consumer electronics, driving increased consumption of battery-grade lithium chloride

- Furthermore, expanding applications in pharmaceuticals, glass & ceramics, and industrial chemicals are enhancing the overall demand for high-purity lithium chloride. These converging factors are accelerating production and adoption, significantly boosting the market’s growth

Lithium Chloride Market Analysis

- Lithium chloride is a versatile chemical compound used in battery manufacturing, pharmaceuticals, glass & ceramics, agrochemicals, and other industrial applications. It is available in high-purity forms suitable for specialized industrial and commercial needs

- The escalating demand for lithium chloride is primarily driven by the global push for clean energy, the rapid adoption of electric vehicles, rising investments in energy storage infrastructure, and increasing requirements for pharmaceutical-grade lithium compounds

- North America dominated the lithium chloride market with a share of 40.51% in 2024, due to the strong presence of battery manufacturers, pharmaceutical companies, and chemical industries

- Asia-Pacific is expected to be the fastest growing region in the lithium chloride market during the forecast period due to the region’s position as a hub for battery production and chemical manufacturing

- Solid segment dominated the market with a market share of 65.5% in 2024, due to its stability, ease of handling, and suitability for large-scale industrial applications such as battery production and glass manufacturing. Solid lithium chloride is preferred for long-term storage and transportation, as it maintains high purity and reduces the risk of degradation. Industrial end-users favor solid forms for their versatility and reliable performance across applications

Report Scope and Lithium Chloride Market Segmentation

|

Attributes |

Lithium Chloride Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Lithium Chloride Market Trends

Increased Use of Battery-Grade Lithium Chloride in EVs and Energy Storage

- Growing electric vehicle (EV) adoption and expanding energy storage applications are driving increased demand for battery-grade lithium chloride, a critical material for manufacturing lithium-ion battery electrolytes and enabling superior battery performance, safety, and durability

- For instance, major lithium chemical producers such as Albemarle Corporation, Livent Corporation, and Ganfeng Lithium are scaling up production of high-purity lithium chloride to meet supply agreements with leading battery manufacturers and EV OEMs focusing on high-energy density, long cycle life cells

- Expansion of renewable energy projects and grid-scale storage solutions further elevates the need for reliable lithium chloride supply to support next-generation battery chemistries and sustainable power infrastructures

- Technological advancements in lithium chloride purification and processing improve product consistency, facilitate faster charging capabilities, and enhance thermal stability in battery applications

- Increasing government policies incentivizing EV adoption, energy transition, and emission reductions encourage investments in lithium chloride supply chain development and vertical integration across battery value chains

- Rising interest in alternative battery technologies, including solid-state and lithium-sulfur batteries, reinforces the strategic importance of lithium chloride for electrolyte and material innovation

Lithium Chloride Market Dynamics

Driver

Rising Demand for Lithium-Ion Batteries

- The accelerating shift to electric mobility and renewable energy storage is significantly expanding lithium-ion battery production, boosting lithium chloride demand as a key raw material to manufacture battery electrolytes and other critical components

- For instance, global battery manufacturers such as CATL, Panasonic, and LG Energy Solution are increasing procurement of battery-grade lithium chloride to support capacity expansion in EV battery plants and energy storage system manufacturing facilities

- Growing consumer electronics markets also contribute to steady lithium chloride demand for rechargeable batteries powering smartphones, laptops, and portable devices

- The push for battery performance improvements, including higher energy density, faster charging, and safety enhancements, necessitates advanced lithium chloride purity and quality standards, driving innovation and market growth

- Investments in lithium refining, recycling, and circular economy initiatives sustain supply resilience and support long-term demand in the fast-growing battery sector

Restraint/Challenge

Limited High-Purity Lithium Supply

- Constraints in the availability of high-purity lithium sources capable of producing battery-grade lithium chloride hinder market growth, creating supply bottlenecks, price volatility, and raw material competition across industries

- For instance, lithium producers face challenges in scaling extraction and refining capacities with consistent quality from brine and hard rock sources to meet growing battery industry demand without compromising product specifications

- Dependence on a few key geographic regions, including Australia, South America, and China, exposes the supply chain to geopolitical risks, trade regulations, and export restrictions that affect market stability

- Growing demand from competing sectors such as pharmaceuticals, chemical synthesis, and air conditioning technologies intensifies pressure on limited high-purity lithium chloride volumes

- Supply constraints complicate investment decisions along the value chain, delay new capacity projects, and contribute to price fluctuations impacting end-users such as battery and EV manufacturers

Lithium Chloride Market Scope

The market is segmented on the basis of grade, application, sales channel, product form, and purity level.

- By Grade

On the basis of grade, the lithium chloride market is segmented into battery grade, industrial grade, and pharmaceutical grade. The battery grade segment dominated the largest market revenue share in 2024, owing to the booming demand for lithium-ion batteries across electric vehicles, consumer electronics, and energy storage systems. Its high purity and consistent performance make it a preferred choice for battery manufacturers aiming to ensure optimal efficiency and longevity. Moreover, the growing shift toward renewable energy and the electrification of transportation is further cementing battery grade lithium chloride as a key segment in the global market.

The pharmaceutical grade segment is anticipated to witness the fastest growth rate from 2025 to 2032, driven by rising demand in the healthcare sector for lithium-based medications used in the treatment of bipolar disorder and other neurological conditions. Increasing awareness about mental health treatments and stringent quality standards for pharmaceutical applications are prompting manufacturers to invest in high-purity lithium chloride. In addition, the expansion of the pharmaceutical industry in emerging economies is expected to accelerate adoption of this grade.

- By Application

On the basis of application, the lithium chloride market is segmented into lithium-ion batteries, pharmaceuticals, glass & ceramics, agrochemicals, and other industrial applications. The lithium-ion battery segment held the largest market revenue share in 2024, fueled by the rapid growth of the EV industry and energy storage solutions. Battery manufacturers prefer lithium chloride for its stability, high ionic conductivity, and ability to enhance overall battery efficiency. The ongoing global push for clean energy and electric mobility continues to support strong demand in this segment.

The pharmaceuticals segment is projected to register the fastest CAGR from 2025 to 2032, supported by increasing production of lithium-based drugs for mental health treatments. Rising incidences of neurological disorders and expanding healthcare infrastructure in emerging regions are driving the need for pharmaceutical-grade lithium chloride. Manufacturers are focusing on quality and regulatory compliance to cater to stringent medical standards, thereby boosting market adoption.

- By Sales Channel

On the basis of sales channel, the lithium chloride market is segmented into direct sales, distribution channels, and online marketplaces. The direct sales segment dominated the market revenue share in 2024, primarily due to long-term contracts and partnerships between lithium chloride producers and end-use industries. Direct sales enable better pricing, reliable supply, and customized solutions for bulk buyers in battery manufacturing and industrial sectors. Companies prefer this channel for large-scale procurement to ensure consistency and quality.

The online marketplaces segment is expected to witness the fastest growth rate from 2025 to 2032, driven by the increasing adoption of e-commerce for chemical procurement. Small- and medium-sized enterprises and research institutions are leveraging online platforms for convenient ordering, quick delivery, and access to diverse grades and purities. Digitalization and the ease of tracking orders are further supporting the growth of this channel.

- By Product Form

On the basis of product form, the lithium chloride market is segmented into liquid and solid forms. The solid segment dominated the largest market revenue share of 65.5% in 2024, owing to its stability, ease of handling, and suitability for large-scale industrial applications such as battery production and glass manufacturing. Solid lithium chloride is preferred for long-term storage and transportation, as it maintains high purity and reduces the risk of degradation. Industrial end-users favor solid forms for their versatility and reliable performance across applications.

The liquid segment is anticipated to witness the fastest growth rate from 2025 to 2032, driven by the increasing demand in battery electrolytes and chemical processing industries. Liquid lithium chloride allows precise dosing and rapid dissolution, making it suitable for high-performance applications in pharmaceuticals and specialty chemicals. Growing investments in advanced manufacturing processes are accelerating adoption of liquid forms.

- By Purity Level

On the basis of purity level, the lithium chloride market is segmented into 99.0%–99.9%, 99.95%–99.99%, and greater than 99.99%. The 99.95%–99.99% segment dominated the largest market revenue share in 2024, owing to its optimal balance between cost and high performance for lithium-ion batteries and industrial applications. This purity range meets the quality requirements of most battery manufacturers, glass producers, and industrial chemical processes. The segment benefits from widespread adoption in EVs and energy storage systems that demand consistent, high-quality material.

The greater than 99.99% purity segment is projected to witness the fastest CAGR from 2025 to 2032, fueled by increasing demand in pharmaceutical and high-precision electronic applications. Ultra-high purity lithium chloride ensures superior safety, performance, and regulatory compliance, particularly in sensitive medical and technological processes. Expansion of high-end industrial applications is supporting rapid growth of this segment.

Lithium Chloride Market Regional Analysis

- North America dominated the lithium chloride market with the largest revenue share of 40.51% in 2024, driven by the strong presence of battery manufacturers, pharmaceutical companies, and chemical industries

- The region benefits from high adoption of electric vehicles and energy storage solutions, which significantly increases demand for battery-grade lithium chloride

- North American industries are also investing in advanced manufacturing facilities and R&D for high-purity lithium products, further strengthening market growth

U.S. Lithium Chloride Market Insight

The U.S. lithium chloride market captured the largest revenue share in North America in 2024, fueled by the growing production of lithium-ion batteries and expanding pharmaceutical applications. Strong government support for clean energy initiatives, coupled with rising EV adoption, is driving the demand for high-quality lithium chloride. In addition, the presence of major battery and chemical manufacturers, along with investments in lithium extraction and processing, is enhancing the country’s position as the dominant market player in the region.

Europe Lithium Chloride Market Insight

The Europe lithium chloride market is expected to witness significant growth during the forecast period, supported by stringent environmental regulations and increasing adoption of EVs and energy storage systems. The region’s pharmaceutical and chemical industries are driving demand for high-purity lithium chloride. Countries such as Germany, France, and the Netherlands are increasingly incorporating lithium chloride into advanced battery technologies and industrial processes, fostering steady market expansion.

U.K. Lithium Chloride Market Insight

The U.K. lithium chloride market is projected to grow at a notable CAGR during the forecast period, driven by the country’s focus on renewable energy, electric mobility, and high-quality chemical production. The U.K.’s growing pharmaceutical sector, alongside increasing industrial applications, is boosting demand for both industrial- and battery-grade lithium chloride. Investments in clean energy infrastructure and research initiatives further support the market’s expansion.

Germany Lithium Chloride Market Insight

Germany dominates the lithium chloride market within Europe, fueled by rapid industrialization, a strong automotive sector, and investments in battery manufacturing. The country’s emphasis on energy transition and sustainability is promoting the use of lithium chloride in lithium-ion batteries and other industrial applications. German manufacturers are also integrating high-purity lithium chloride into chemical processes and advanced technology solutions, reinforcing the region’s leading position.

Asia-Pacific Lithium Chloride Market Insight

The Asia-Pacific lithium chloride market is poised to grow at the fastest CAGR during the forecast period of 2025 to 2032, driven by the region’s position as a hub for battery production and chemical manufacturing. Rapid urbanization, rising disposable incomes, and government initiatives promoting EV adoption are boosting lithium-ion battery demand. Countries such as China, Japan, and India are witnessing increased lithium chloride consumption in batteries, pharmaceuticals, and industrial applications, making APAC a key growth market.

Japan Lithium Chloride Market Insight

The Japan lithium chloride market is gaining traction due to the country’s technological advancements, high EV adoption, and emphasis on energy storage systems. Japanese industries are increasingly using high-purity lithium chloride for battery production and pharmaceutical applications. In addition, government incentives for clean energy and the growing number of smart industrial processes are supporting market growth in both commercial and residential applications.

China Lithium Chloride Market Insight

China accounted for the largest revenue share in the Asia-Pacific region in 2024, driven by rapid industrialization, a growing middle class, and increasing EV production. The country’s chemical and battery manufacturing sectors are heavily investing in lithium chloride for both domestic consumption and export. Strong government support for lithium resource development, coupled with the presence of major domestic lithium chloride producers, is accelerating market growth across multiple applications.

Lithium Chloride Market Share

The lithium chloride industry is primarily led by well-established companies, including:

- Albemarle Corporation. (U.S.)

- Nippon Chemical Industrial CO., LTD. (Japan)

- HARSHIL INDUSTRIES (India)

- Alfa Aesar (China)

- Honeywell International (U.S.)

- LEVERTON HELM LTD (U.K.)

- Suzhou Huizhi Lithium Energy Material Co. Ltd. (China)

- TOKYO CHEMICALS (Japan)

- LOBA CHEMIE (India)

- Altura Mining (Australia)

- Jiangxi Ganfeng Lithium Co. Ltd. (China)

- Arena Minerals Inc. (Canada)

Latest Developments in Global Lithium Chloride Market

- In 2024, Pilbara Minerals Limited unveiled an upgrade to its Pilgangoora Lithium-Tantalum Project in Western Australia, introducing a modular lithium chloride conversion plant powered by renewable energy. The facility employs advanced membrane electrolysis technology to convert spodumene concentrate into battery-grade lithium chloride with 98% purity, reducing chemical waste by 60% compared to traditional methods. This development strengthens Pilbara’s ability to supply high-quality lithium chloride efficiently, supporting the growing demand from the EV and energy storage sectors while promoting environmentally sustainable production practices

- In 2024, Orocobre Limited (now part of Allkem) launched an innovative selective lithium chloride crystallization technology at its Olaroz Lithium Facility in Argentina. Utilizing AI-controlled temperature and pH modulation, this patented process produces ultra-high-purity (>99.5%) lithium chloride directly from brine, eliminating the need for conventional carbonate intermediates. The advancement enhances production efficiency and positions Orocobre/Allkem as a key supplier of high-purity lithium chloride for battery manufacturers, catering to the accelerating EV market

- In 2024, Minera Exar S.A (a joint venture between Lithium Americas and Ganfeng) implemented a direct lithium extraction (DLE) system at its Caucharí-Olaroz project in Argentina, combining adsorption-based DLE with solar evaporation. This method reduces water usage by 70% compared to traditional techniques and increases lithium recovery rates to 90%. The innovation significantly boosts battery-grade lithium chloride output, meeting surging EV and energy storage demand while establishing Minera Exar as a leader in sustainable lithium production

- In October 2022, Albemarle Lithium U.K. Limited, a subsidiary of Albemarle Corporation, acquired Guangxi Tianyuan New Energy Materials Co., Ltd. The acquisition enhances Albemarle’s global capacity to supply battery-grade lithium, supporting its strategic position in the growing EV and energy storage markets and enabling the company to better meet rising global demand for high-quality lithium chloride

- In September 2020, the U.S. Department of Energy signed a partnership agreement with Albemarle Corporation to collaborate on lithium research projects focused on the Clayton Valley brine resources in Nevada. This initiative aimed to improve extraction efficiency and optimize lithium recovery, reinforcing Albemarle’s technological capabilities and strengthening the U.S. domestic supply of battery-grade lithium in response to increasing EV and energy storage requirements

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Lithium Chloride Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Lithium Chloride Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Lithium Chloride Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.