Global Lithium Drug Market

Market Size in USD Million

CAGR :

%

USD

148.29 Million

USD

215.77 Million

2024

2032

USD

148.29 Million

USD

215.77 Million

2024

2032

| 2025 –2032 | |

| USD 148.29 Million | |

| USD 215.77 Million | |

|

|

|

|

Lithium Drug Market Size

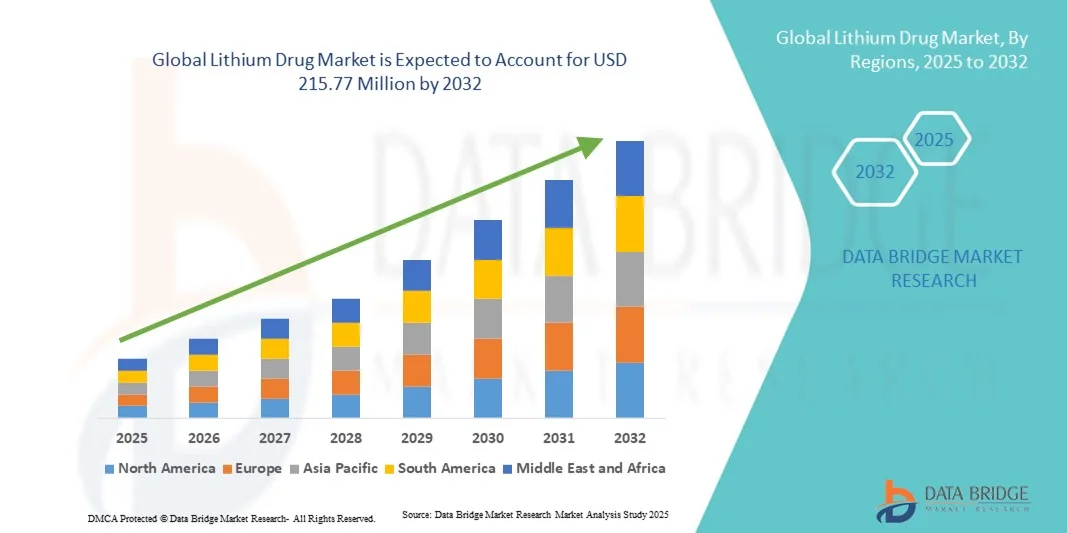

- The global lithium drug market size was valued at USD 148.29 million in 2024 and is expected to reach USD 215.77 million by 2032, at a CAGR of 4.30% during the forecast period

- The market growth is largely fueled by the increasing prevalence of mental health disorders, especially bipolar disorder, and the rising demand for effective mood-stabilizing treatments, driving the adoption of lithium-based drugs in both clinical and outpatient settings

- Furthermore, advancements in psychiatric care, growing awareness of mental health issues, and strict regulatory frameworks for pharmaceutical-grade lithium compounds are strengthening the market’s credibility and adoption, thereby significantly boosting the industry’s growth

Lithium Drug Market Analysis

- Lithium drugs, including pharmaceutical-grade lithium carbonate and other lithium compounds, are increasingly vital in the management of mood disorders such as bipolar disorder, depression, schizophrenia, mania, and attention-deficit hyperactivity disorder, providing effective mood stabilization and prevention of manic episodes in both inpatient and outpatient setting

- The growing prevalence of mental health disorders, rising awareness of psychiatric treatments, and increasing demand for clinically proven mood stabilizers are the primary factors driving the adoption of lithium drugs globally

- North America dominated the lithium drug market with the largest revenue share of 39.6% in 2024, supported by advanced healthcare infrastructure, high awareness of mental health issues, and widespread adoption of evidence-based psychiatric treatments, with the U.S. witnessing significant growth in lithium prescriptions due to early diagnosis and expanded access to mental health care

- Asia-Pacific is expected to be the fastest-growing region in the lithium drug market during the forecast period, driven by increasing healthcare access, rising mental health awareness, and expanding pharmaceutical manufacturing capabilities

- Tablets segment dominated the lithium drug market with a market share of 52.8% in 2024, owing to its established efficacy, ease of administration, and widespread availability across hospitals, specialty clinics, home healthcare settings, and pharmacies

Report Scope and Lithium Drug Market Segmentation

|

Attributes |

Lithium Drug Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Lithium Drug Market Trends

Personalized Psychiatric Care and Digital Health Integration

- A significant and accelerating trend in the global lithium drug market is the growing focus on personalized psychiatric care, with treatment plans and dosing increasingly tailored to individual patient profiles using digital health tools

- For instance, digital therapeutic platforms and electronic health records (EHRs) allow psychiatrists to monitor lithium blood levels and patient responses remotely, enabling optimized dosing and better adherence

- Integration with mental health apps and telepsychiatry services provides patients with reminders, symptom tracking, and direct communication with healthcare providers, enhancing treatment outcomes and patient engagement

- These digital health-enabled solutions support continuous monitoring of lithium therapy, facilitating early detection of adverse effects such as toxicity, and enabling timely intervention to improve safety and efficacy

- The trend towards more personalized and data-driven psychiatric treatment is reshaping patient expectations, prompting pharmaceutical companies and healthcare providers to develop solutions that combine lithium therapy with digital monitoring platforms

- The demand for lithium drugs integrated with digital health tools is growing rapidly across both clinical and outpatient settings, as patients and providers increasingly prioritize convenience, safety, and evidence-based personalized care

Lithium Drug Market Dynamics

Driver

Rising Prevalence of Mental Health Disorders and Treatment Awareness

- The increasing prevalence of mood disorders, particularly bipolar disorder and depression, coupled with greater awareness of psychiatric treatments, is a significant driver of lithium drug demand

- For instance, mental health initiatives and awareness campaigns in North America and Europe have led to earlier diagnosis and treatment of bipolar disorder, boosting lithium prescription rates

- Lithium remains a clinically proven and cost-effective mood stabilizer, offering long-term efficacy in preventing manic and depressive episodes, further fueling adoption among healthcare providers

- Rising healthcare access, expansion of psychiatric care facilities, and integration of lithium therapy into standard treatment protocols contribute to market growth in both developed and emerging regions

- Patient preference for evidence-based, guideline-supported treatments and the inclusion of lithium in mental health formularies strengthen its position as a first-line therapy

- The growing acceptance of telepsychiatry and remote patient monitoring is enhancing the ability of healthcare providers to prescribe and manage lithium therapy, driving further market adoption

Restraint/Challenge

Side Effects, Toxicity Risk, and Regulatory Hurdles

- Concerns regarding lithium’s narrow therapeutic index, potential side effects, and risk of toxicity pose significant challenges to broader market penetration

- For instance, reports of kidney or thyroid complications and the need for regular blood monitoring can make patients and prescribers cautious about initiating lithium therapy

- Strict regulatory requirements for lithium prescription, monitoring, and labeling across regions increase the complexity for manufacturers and healthcare providers

- High monitoring requirements, including periodic blood tests and dose adjustments, may limit patient adherence, particularly in regions with limited healthcare infrastructure

- While lithium’s efficacy is well-established, safety concerns and the need for continuous medical supervision can hinder widespread adoption, especially among elderly or comorbid patients

- Overcoming these challenges through patient education, improved formulations with lower toxicity risk, and digital monitoring solutions is critical for sustained market growth

Lithium Drug Market Scope

The market is segmented on the basis of disorders, drug type, dosage, end-users, and distribution channels.

- By Disorders

On the basis of disorders, the lithium drug market is segmented into bipolar disorder, depression, schizophrenia, mania, attention-deficit hyperactivity disorder (ADHD), and others. The bipolar disorder segment dominated the market with the largest revenue share of 44.5% in 2024, driven by lithium’s well-established efficacy in stabilizing mood swings and preventing manic episodes. Healthcare providers prefer lithium for long-term maintenance therapy in bipolar patients due to its proven clinical outcomes. The high prevalence of bipolar disorder in North America and Europe further strengthens this segment, along with increased awareness and early diagnosis programs. Lithium therapy for bipolar disorder is often included in standard treatment protocols, supporting consistent demand across hospitals and specialty clinics. Advanced formulations and patient monitoring programs also contribute to the segment’s stability and sustained adoption. The segment’s leadership is reinforced by insurance coverage and guideline recommendations from psychiatric associations worldwide.

The depression segment is anticipated to witness the fastest growth rate of 12.5% CAGR from 2025 to 2032, driven by rising recognition of lithium’s adjunctive role in treatment-resistant depression. Increasing mental health awareness campaigns in emerging markets, combined with expanding telepsychiatry services, are supporting wider access to lithium therapy for depressive disorders. Healthcare providers are increasingly adopting lithium as a complementary therapy for depression where standard antidepressants alone are insufficient. Clinical studies highlighting efficacy in reducing relapse rates and enhancing mood stabilization are boosting physician confidence. Digital health platforms allow closer monitoring of patients’ lithium levels and mood symptoms, further accelerating adoption. As pharmaceutical companies explore patient-centric programs and combination therapies, the depression segment is expected to continue its rapid expansion.

- By Drug Type

On the basis of drug type, the lithium drug market is segmented into branded and generic drugs. The generic segment dominated the market with the largest revenue share of 57.8% in 2024, owing to wider accessibility and cost-effectiveness, particularly in emerging markets. Generic lithium drugs are preferred by hospitals and home healthcare providers due to their affordability and bioequivalence to branded alternatives. The segment benefits from the expiration of patents on major branded lithium products, increasing market penetration. Hospitals often stock generic lithium as a first-line option, while specialty clinics prescribe it for long-term management of bipolar disorder. The widespread availability across retail and online pharmacies enhances patient adherence and convenience. In addition, favorable regulatory approvals for generic lithium formulations support consistent market growth.

The branded segment is expected to witness the fastest CAGR of 11.8% from 2025 to 2032, fueled by strong brand recognition, physician trust, and targeted marketing strategies. Branded products such as Eskalith and Lithobid are often prescribed for patients requiring close monitoring or complex dosage regimens. The segment benefits from continued innovation in formulation, such as extended-release tablets and improved bioavailability, appealing to prescribers and patients asuch as. Physician preference for branded lithium for certain patient subgroups drives adoption in specialty clinics and hospitals. Patient support programs, including monitoring and adherence services, further enhance the segment’s attractiveness. Expansion in developed regions with higher healthcare expenditure is expected to sustain this rapid growth trajectory.

- By Dosage

On the basis of dosage, the lithium drug market is segmented into tablets, capsules, solutions, and others. The tablets segment dominated the market with a share of 52.8% in 2024, driven by ease of administration, accurate dosing, and patient preference for oral therapy. Tablets are widely used across hospitals, specialty clinics, and home healthcare settings due to their convenience and established efficacy. They support precise dosing adjustments required for lithium therapy and are compatible with electronic pill monitoring systems. Physicians often favor tablets for long-term maintenance therapy, as they provide predictable absorption and pharmacokinetics. The segment also benefits from high patient adherence and availability of generic options. Widespread distribution through hospital and retail pharmacies reinforces its dominant position.

The solutions segment is expected to witness the fastest CAGR of 13.2% from 2025 to 2032, driven by pediatric and geriatric applications where liquid formulations improve dosing flexibility and swallowing ease. Hospitals and home healthcare providers are increasingly adopting solutions for patients with difficulty swallowing tablets or requiring precise titration. Telehealth and remote monitoring programs often recommend liquid lithium for individualized dosing adjustments. The segment also benefits from the development of more palatable formulations and ready-to-use doses, improving patient compliance. Expansion in emerging markets with growing awareness of specialized care for children and elderly patients supports rapid growth.

- By End-Users

On the basis of end-users, the lithium drug market is segmented into hospitals, specialty clinics, home healthcare, and others. The hospitals segment dominated the market with the largest revenue share of 45.7% in 2024, driven by higher patient volumes, access to specialized psychiatric care, and structured monitoring facilities. Hospitals provide comprehensive lithium therapy management, including blood level monitoring and dose adjustments. They often serve as primary prescribers for newly diagnosed bipolar and depressive disorder patients. Integration with electronic health records and telepsychiatry platforms further enhances patient safety and adherence. Hospitals also benefit from insurance reimbursements and government support programs for mental health treatment. The presence of psychiatric units and trained professionals strengthens hospitals’ dominant role.

The home healthcare segment is expected to witness the fastest CAGR of 14.1% from 2025 to 2032, fueled by increasing outpatient treatment adoption and patient preference for home-based care. Remote monitoring solutions, telepsychiatry consultations, and digital adherence tools allow healthcare providers to safely manage lithium therapy at home. Growing awareness of mental health and the convenience of avoiding hospital visits drive adoption. Home healthcare services also support geriatric and mobility-limited patients, providing tailored dosing and monitoring. The segment is expanding rapidly in developed and emerging regions, offering a cost-effective and patient-centric alternative to traditional hospital care.

- By Distribution Channel

On the basis of distribution channel, the lithium drug market is segmented into direct tender, hospital pharmacy, retail pharmacy, online pharmacy, and others. The hospital pharmacy segment dominated the market with the largest revenue share of 48.2% in 2024, driven by direct access for inpatients, structured prescription protocols, and integration with clinical monitoring systems. Hospitals ensure proper dosing, blood monitoring, and patient adherence through their pharmacy networks. The segment benefits from insurance reimbursements and bulk procurement agreements with manufacturers. Frequent prescription refills, availability of generic and branded formulations, and on-site pharmacist support reinforce its dominant position. Hospital pharmacies also facilitate controlled dispensing for patients with high-risk profiles.

The online pharmacy segment is expected to witness the fastest CAGR of 15.3% from 2025 to 2032, fueled by the rise of e-pharmacy platforms, telemedicine prescriptions, and growing patient preference for home delivery. Digital platforms provide convenient access to lithium drugs, subscription services for chronic therapy, and automated reminders for refills. Online pharmacies are increasingly partnering with telepsychiatry providers to ensure compliance and monitoring. Expansion in urban and semi-urban regions, along with awareness campaigns, supports rapid adoption. The convenience, competitive pricing, and accessibility offered by online pharmacies are accelerating growth across all patient demographics.

Lithium Drug Market Regional Analysis

- North America dominated the lithium drug market with the largest revenue share of 39.6% in 2024, supported by advanced healthcare infrastructure, high awareness of mental health issues, and widespread adoption of evidence-based psychiatric treatments, with the U.S. witnessing significant growth in lithium prescriptions due to early diagnosis and expanded access to mental health care

- Patients and healthcare providers in the region highly value lithium’s proven efficacy in stabilizing mood, preventing manic episodes, and its inclusion in standard treatment protocols for bipolar disorder and depression

- This widespread adoption is further supported by advanced healthcare infrastructure, high mental health awareness, strong insurance coverage, and the availability of specialized psychiatric care facilities, establishing lithium drugs as a preferred treatment option across both hospitals and outpatient settings

U.S. Lithium Drug Market Insight

The U.S. lithium drug market captured a dominant share of the global revenue in 2024, driven by an extensive prevalence of mental health disorders, well-established healthcare infrastructure, and strong government support for mental health awareness programs. The growing acceptance of psychiatric medications, combined with innovations in extended-release lithium formulations, continues to enhance patient compliance and treatment outcomes. Moreover, the rising adoption of telepsychiatry and remote patient monitoring tools is expanding access to lithium therapy across diverse demographics. Strategic partnerships among pharmaceutical manufacturers and healthcare providers are also expected to boost research, development, and distribution efficiency within the U.S. market.

Europe Lithium Drug Market Insight

The Europe lithium drug market is projected to grow at a robust CAGR throughout the forecast period, primarily due to an increasing focus on mental health reforms and rising healthcare investments. The demand for lithium medications in Europe is reinforced by heightened awareness among both patients and practitioners regarding the long-term management of mood disorders. Countries such as Germany, France, and the U.K. are leading this growth, supported by favorable reimbursement policies and strong clinical adoption. Furthermore, Europe’s expanding mental healthcare infrastructure and inclusion of digital therapeutics for psychiatric care are driving broader integration of lithium-based treatments across clinical settings.

U.K. Lithium Drug Market Insight

The U.K. lithium drug market is anticipated to expand steadily during the forecast period, propelled by the growing incidence of bipolar and depressive disorders and the rising preference for well-established psychiatric treatments. The country’s National Health Service (NHS) continues to emphasize early intervention and long-term care programs, encouraging consistent lithium therapy use. In addition, technological advancements such as e-prescription systems and remote mental health consultations are improving treatment accessibility and adherence. The increasing number of private psychiatric clinics and heightened mental health awareness campaigns are expected to further accelerate market growth across the U.K.

Germany Lithium Drug Market Insight

The Germany lithium drug market is expected to grow at a considerable pace during the forecast period, driven by a growing emphasis on mental health management and rising availability of psychiatric care services. Germany’s healthcare ecosystem prioritizes evidence-based treatments and continuous research in psychopharmacology, supporting broader adoption of lithium therapy. The growing integration of digital health applications for medication adherence and therapy monitoring, along with favorable clinical guidelines, continues to shape the market positively. In addition, strong government funding for mental health programs and the presence of well-established pharmaceutical manufacturers contribute to sustained market expansion in Germany.

Asia-Pacific Lithium Drug Market Insight

The Asia-Pacific lithium drug market is set to grow at the fastest CAGR of 12–14% between 2025 and 2032, fueled by rising mental health awareness, rapid urbanization, and improving access to healthcare services. Countries such as China, Japan, and India are witnessing increasing demand for psychiatric treatments as healthcare infrastructure develops and societal attitudes toward mental illness evolve. Government-led programs promoting mental wellness, coupled with the availability of cost-effective generic lithium formulations, are supporting widespread adoption. Moreover, the expansion of telemedicine and digital therapy platforms across emerging economies is expected to significantly enhance lithium drug accessibility and compliance in the region.

Japan Lithium Drug Market Insight

The Japan lithium drug market is gaining notable traction, supported by the country’s focus on high-quality psychiatric care, technological sophistication, and growing mental health awareness. Japan’s healthcare institutions are integrating lithium therapy with AI-enabled mental health monitoring systems, ensuring more precise and personalized treatment. The country’s aging population, coupled with a rise in stress-related disorders, is also contributing to higher prescription volumes. Continuous research on improved lithium delivery systems and hospital–university collaborations are fostering innovation and expanding the therapeutic landscape within Japan’s mental health sector.

India Lithium Drug Market Insight

The India lithium drug market accounted for the largest market revenue share in the Asia-Pacific region in 2024, attributed to the expanding middle-class population, rapid urbanization, and growing government focus on mental healthcare access. The adoption of lithium-based medications is increasing across both public and private healthcare facilities, driven by rising diagnosis rates of mood disorders and broader acceptance of psychiatric treatments. Affordable pricing of generic lithium formulations, combined with the presence of strong domestic pharmaceutical manufacturers, further enhances availability. In addition, national initiatives under the Mental Healthcare Act and digital health expansion are playing a crucial role in strengthening lithium drug uptake across the country.

Lithium Drug Market Share

The Lithium Drug industry is primarily led by well-established companies, including:

- Alembic Pharmaceuticals Limited (India)

- Apotex Inc. (Canada)

- Bayer AG (Germany)

- Dr. Reddy’s Laboratories Ltd. (India)

- Glenmark Pharmaceuticals Ltd. (India)

- Hikma Pharmaceuticals PLC (U.K.)

- Livent Corporation (U.S.)

- Mangrove Lithium Inc. (Canada)

- Novartis AG (Switzerland)

- Pfizer Inc. (U.S.)

- Solvay (Belgium)

- Stardust Power Inc. (U.S.)

- Sun Pharmaceutical Industries Ltd. (India)

- Teva Pharmaceutical Industries Ltd. (Israel)

- The United States Pharmacopeial Convention (U.S.)

- Watson Laboratories, Inc. (U.S.)

- Zydus Lifesciences Ltd. (India)

- Ganfeng Lithium Co., Ltd. (China)

- China Sun Group High-Tech Co., Ltd. (China)

- Ligand Pharmaceuticals Incorporated. (U.S.)

What are the Recent Developments in Global Lithium Drug Market?

- In August 2025, a paper published in Nature reported that replenishing natural lithium stores in the brain reversed memory loss in mice models of Alzheimer’s disease, suggesting new therapeutic roles for lithium beyond mood disorders and opening possibilities for expansion of lithium-related drug research and applications

- In March 2025, Alzamend Neuro, Inc. announced a collaboration with Massachusetts General Hospital to conduct a Phase II clinical trial of its next-generation lithium-delivery system, AL001, aimed at improving brain targeting of lithium and reducing systemic side-effects compared to marketed lithium salts

- In March 2025, a clinical article “A New Tool to Refine Lithium Therapy: A Simple Formula for a Complex Problem” was published, describing a novel equation (eLi₁₂) designed to estimate 12-hour serum lithium levels from patient-reported dosing time, aiming to simplify monitoring and thereby potentially improve uptake of lithium in therapy

- In October 2024, research under the headline “Experiments Point to Possible Next-Gen Drug Therapies for Bipolar Disorder, Including for Lithium Non-Responders” reported findings of stem-cell based technologies identifying signalling pathways (Akt, AMPK) as potential targets for patients who do not respond to conventional lithium therapy, indicating a shift towards new formulations or adjunctive approaches

- In March 2024, Saptalis Pharmaceuticals, LLC announced the FDA approval and commercial launch of its new product, Lithium Oral Solution USP, 8 mEq/5 mL, which restores availability of a previously discontinued liquid lithium formulation and fills a shortage in the U.S. market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.