Global Lithium Ion Batterys Electrolyte Solvent Market

Market Size in USD Million

CAGR :

%

USD

535.50 Million

USD

828.07 Million

2024

2032

USD

535.50 Million

USD

828.07 Million

2024

2032

| 2025 –2032 | |

| USD 535.50 Million | |

| USD 828.07 Million | |

|

|

|

|

Lithium-Ion Battery’s Electrolyte Solvent Market Size

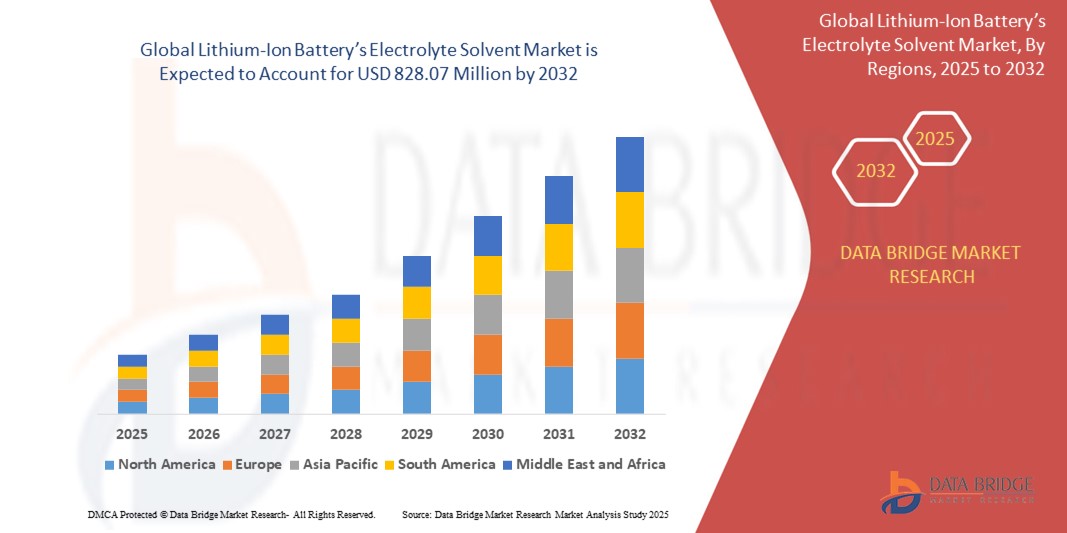

- The global lithium-Ion battery’s electrolyte solvent market size was valued at USD 535.50 million in 2024 and is expected to reach USD 828.07 million by 2032, at a CAGR of 5.6% during the forecast period

- The market growth is primarily driven by the increasing demand for lithium-ion batteries in electric vehicles (EVs), renewable energy storage systems, and consumer electronics, fueled by advancements in battery technology and the global push for sustainable energy solutions

- Rising consumer and industrial demand for high-performance, energy-efficient, and eco-friendly battery solutions is positioning electrolyte solvents as critical components in modern energy storage systems, significantly boosting industry growth

Lithium-Ion Battery’s Electrolyte Solvent Market Analysis

- Electrolyte solvents are essential components of lithium-ion batteries, enabling ion transfer between the cathode and anode, enhancing battery efficiency, safety, and performance in applications ranging from consumer electronics to electric vehicles and grid storage

- The growing adoption of electric vehicles, increasing investments in renewable energy, and rising demand for portable electronics are key drivers of the electrolyte solvent market

- Asia-Pacific dominated the lithium-ion battery’s electrolyte solvent market with the largest revenue share of 42.5% in 2024, driven by the region’s leadership in battery manufacturing, high production capacities in countries such as China, Japan, and South Korea, and strong government support for EV adoption and renewable energy initiatives

- North America is expected to be the fastest-growing region during the forecast period, propelled by increasing investments in EV infrastructure, advancements in battery technology, and growing demand for energy storage solutions in the U.S. and Canada

- The Ethylene Carbonate (EC) segment dominated the largest market revenue share of 29% in 2024, driven by its high dielectric constant and ability to form stable solid electrolyte interphase (SEI) layers, enhancing battery performance and safety

Report Scope and Lithium-Ion Battery’s Electrolyte Solvent Market Segmentation

|

Attributes |

Lithium-Ion Battery’s Electrolyte Solvent Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Lithium-Ion Battery’s Electrolyte Solvent Market Trends

“Increasing Adoption of Advanced Electrolyte Formulations”

- The global lithium-ion battery’s electrolyte solvent market is experiencing a notable trend toward the development and integration of advanced electrolyte formulations, particularly for high-performance batteries

- Advanced solvents such as Ethylene Carbonate, Diethyl Carbonate, Dimethyl Carbonate, Ethyl Methyl Carbonate, and Propylene Carbonate are being optimized to improve battery efficiency, thermal stability, and cycle life

- These formulations enable enhanced energy density and safety, catering to the growing demand for electric vehicles (EVs) and energy storage systems

- For instances, companies are focusing on solvent blends that support fast-charging capabilities and operate effectively under extreme temperatures, improving battery performance for automotive and industrial applications

- This trend is making electrolyte solvents more appealing to manufacturers in sectors such as Electrical & Electronics, Automotive, and Energy, driving innovation in battery technologies

- Advanced analytics and AI are being used to optimize solvent compositions, ensuring compatibility with various cathode and anode materials for improved battery longevity and performance

Lithium-Ion Battery’s Electrolyte Solvent Market Dynamics

Driver

“Rising Demand for Electric Vehicles and Renewable Energy Storage”

- The surge in demand for electric vehicles (EVs), hybrid vehicles, and renewable energy storage systems is a key driver for the Global Lithium-Ion Battery’s Electrolyte Solvent Market

- Electrolyte solvents play a critical role in enhancing battery performance by enabling efficient ion transport between the cathode and anode, improving overall battery safety and efficiency

- Government incentives and regulations promoting clean energy, particularly in the Asia-Pacific region, which dominates the market, are accelerating the adoption of lithium-ion batteries

- The rollout of 5G and IoT technologies is increasing the need for compact, high-performance batteries in consumer electronics and industrial applications, further boosting demand for advanced electrolyte solvents

- Major battery manufacturers are incorporating high-quality solvents such as Dimethyl Carbonate and Propylene Carbonate as standard components to meet the performance requirements of next-generation batteries

Restraint/Challenge

“High Production Costs and Supply Chain Constraints”

- The high cost of producing specialized electrolyte solvents, such as Ethylene Carbonate and Ethyl Methyl Carbonate, poses a significant barrier to market growth, particularly in cost-sensitive regions

- Complex manufacturing processes and the need for high-purity raw materials increase production costs, limiting adoption in emerging markets

- Supply chain disruptions, particularly for raw materials used in solvent production, can impact availability and pricing, creating challenges for manufacturers

- In addition, environmental and safety concerns related to the handling and disposal of electrolyte solvents, particularly in liquid and gel forms, raise regulatory challenges and compliance costs

- The fragmented regulatory landscape across regions, especially regarding chemical safety and environmental impact, complicates operations for global manufacturers and may hinder market expansion in regions with stringent regulations

Lithium-Ion Battery’s Electrolyte Solvent market Scope

The market is segmented on the basis of type, component, form, and application.

- By Type

On the basis of type, the global lithium-Ion battery’s electrolyte solvent market is segmented into Ethylene Carbonate (EC), Diethyl Carbonate (DEC), Dimethyl Carbonate (DMC), Ethyl Methyl Carbonate (EMC), Propylene Carbonate (PC), and Others. The Ethylene Carbonate (EC) segment dominated the largest market revenue share of 29% in 2024, driven by its high dielectric constant and ability to form stable solid electrolyte interphase (SEI) layers, enhancing battery performance and safety. Its widespread use in EV and consumer electronics batteries further supports its dominance.

The Ethyl Methyl Carbonate (EMC) segment is expected to witness the fastest growth rate of 18.3% from 2025 to 2032, owing to its high dielectric constant, low toxicity, and ability to optimize electrolyte viscosity and volatility, improving ionic conductivity and battery efficiency for EV applications.

- By Component

On the basis of component, the global lithium-Ion battery’s electrolyte solvent market is segmented into Cathode, Anode, Electrolytic Solution, and Others. The Electrolytic Solution segment is expected to hold the largest market revenue share of 60% in 2024, as it serves as the critical medium for lithium-ion transport between the cathode and anode, directly impacting battery performance, safety, and longevity. The increasing demand for high-performance batteries in EVs and energy storage systems drives this segment's dominance.

The Cathode segment is anticipated to experience robust growth from 2025 to 2032, fueled by advancements in cathode materials and the need for higher energy density and longer cycle life in lithium-ion batteries for automotive and industrial applications.

- By Form

On the basis of form, the global lithium-Ion battery’s electrolyte solvent market is segmented into Solid, Liquid, and Gel. The Liquid segment dominated the market with a revenue share of 74.4% in 2024, due to its high ionic conductivity, ease of manufacturing, and widespread use in lithium-ion batteries for EVs, consumer electronics, and energy storage systems. Liquid electrolytes, primarily composed of organic solvents such as EC and DMC, enable efficient ion transport.

The Gel segment is expected to witness the fastest growth rate from 2025 to 2032, driven by its enhanced safety profile and flexibility in battery design, particularly for portable electronics and emerging solid-state battery applications.

- By Application

On the basis of application, the global lithium-Ion battery’s electrolyte solvent market is segmented into Electrical & Electronics, Automotive, Industrial, Consumer Goods, Energy, Healthcare, Aerospace, Defense Sectors, and Others. The Automotive segment held the largest market revenue share of 43.6% in 2023, driven by the surging demand for EVs, where lithium-ion batteries are preferred for their high energy density and efficiency. Government incentives and the global push for sustainable transportation further bolster this segment.

The Energy segment is anticipated to witness rapid growth of 18.1% from 2025 to 2032, fueled by the increasing adoption of lithium-ion batteries in grid-scale energy storage systems and renewable energy integration, requiring high-performance electrolyte solvents for improved battery lifespan and efficiency.

Lithium-Ion Battery’s Electrolyte Solvent Market Regional Analysis

- Asia-Pacific dominated the lithium-ion battery’s electrolyte solvent market with the largest revenue share of 42.5% in 2024, driven by the region’s leadership in battery manufacturing, high production capacities in countries such as China, Japan, and South Korea, and strong government support for EV adoption and renewable energy initiatives

- Consumers prioritize electrolyte solvents for improving battery performance, enhancing safety, and extending battery lifespan, particularly in regions with rapid EV adoption and diverse industrial applications

- Growth is supported by advancements in solvent technology, such as high-purity and thermally stable formulations, alongside increasing adoption in both OEM and aftermarket segments

Japan Lithium-Ion Battery’s Electrolyte Solvent Market Insight

Japan’s lithium-ion battery’s electrolyte solvent market is expected to witness rapid growth due to strong consumer preference for high-quality, technologically advanced solvents that enhance battery performance and safety. The presence of major battery manufacturers and integration of advanced solvents in OEM EV production accelerate market penetration. Rising interest in aftermarket energy storage solutions also contributes to growth.

China Lithium-Ion Battery’s Electrolyte Solvent Market Insight

China holds the largest share of the Asia-Pacific lithium-ion battery’s electrolyte solvent market, propelled by rapid urbanization, rising EV ownership, and increasing demand for efficient and safe battery solutions. The country’s growing middle class and focus on smart mobility support the adoption of advanced electrolyte solvents. Strong domestic manufacturing capabilities and competitive pricing enhance market accessibility.

North America Lithium-Ion Battery’s Electrolyte Solvent Market Insight

North America is the fastest-growing region in the global lithium-ion battery’s electrolyte solvent market, driven by increasing investments in EV infrastructure and renewable energy storage. The U.S. leads the region, supported by technological advancements in solvent formulations and growing consumer demand for sustainable energy solutions. Regulatory incentives and rising adoption in automotive and industrial applications further accelerate market growth.

U.S. Lithium-Ion Battery’s Electrolyte Solvent Market Insight

The U.S. lithium-Ion battery’s electrolyte solvent market is expected to witness significant growth, fueled by strong demand in the EV and energy storage sectors. Growing consumer awareness of battery efficiency and safety benefits drives market expansion. The trend towards sustainable energy solutions and supportive government policies promoting clean energy further boost market growth. Battery manufacturers’ increasing integration of advanced electrolyte solvents complements aftermarket demand, creating a robust product ecosystem.

Europe Lithium-Ion Battery’s Electrolyte Solvent Market Insight

The Europe lithium-ion battery’s electrolyte solvent market is expected to witness significant growth, supported by regulatory emphasis on sustainable energy and battery safety standards. Consumers seek solvents that enhance battery efficiency while ensuring thermal stability. The growth is prominent in both EV production and energy storage projects, with countries such as Germany and France showing significant uptake due to rising environmental concerns and urban electrification trends.

U.K. Lithium-Ion Battery’s Electrolyte Solvent Market Insight

The U.K. market for lithium-ion battery’s electrolyte solvents is expected to witness rapid growth, driven by demand for high-performance batteries in EVs and renewable energy applications. Increased focus on battery safety and efficiency encourages adoption. In addition, evolving regulations promoting sustainable energy solutions influence consumer choices, balancing performance with environmental compliance.

Germany Lithium-Ion Battery’s Electrolyte Solvent Market Insight

Germany is expected to witness rapid growth in the lithium-ion battery’s electrolyte solvent market, attributed to its advanced battery manufacturing sector and high consumer focus on energy efficiency and safety. German consumers prefer technologically advanced solvents that enhance battery lifespan and contribute to lower energy consumption. The integration of these solvents in premium EVs and energy storage systems supports sustained market growth.

Lithium-Ion Battery’s Electrolyte Solvent Market Share

The lithium-Ion battery’s electrolyte solvent industry is primarily led by well-established companies, including:

- Mitsubishi Chemical Corporation (Japan)

- UBE INDUSTRIES LTD (Japan)

- LANXESS (Germany)

- Beneq (Finland)

- Tracxn Technologies (India)

- Statista Inc (Germany)

- NEI Corporation (U.S.)

- Bureau van Dijk (Netherlands)

- Cymbet (U.S.)

- Soulbrain Co., Ltd (South Korea)

- Cuberg (U.S.)

- Panasonic Corporation (Japan)

- BASF SE (Germany)

- Mitsui Chemicals, Inc. (Japan)

- Capchem (China)

- Contemporary Amperex Technology Co., Limited (China)

- Prieto Battery Inc (U.S.)

- Shanshan Technology (China)

- LG Chem (South Korea)

- Iolitec Ionic Liquids Technologies GmbH (Germany)

- Central Glass Co., Ltd (Japan)

What are the Recent Developments in Global Lithium-Ion Battery’s Electrolyte Solvent Market?

- In March 2024, Dow Inc. revealed its intent to invest in ethylene derivatives capacity on the U.S. Gulf Coast, with a focus on producing carbonate solvents—key components in lithium-ion battery electrolytes. This strategic move aims to strengthen the domestic electric vehicle (EV) and energy storage markets, while also advancing Dow’s Decarbonize & Grow strategy. The planned facility will capture over 90% of CO₂ emissions from ethylene oxide production and repurpose it for solvent manufacturing, aligning with sustainability goals and supply chain resilience for U.S. battery production

- In January 2024, the Iveco Group partnered with BASF to launch its first lithium-ion battery recycling initiative for electric vehicles. This collaboration supports Iveco’s circular economy strategy, which follows the 4R Framework—Repair, Refurbish, Repurpose, and Recycling—to extend battery life and reduce environmental impact. BASF will oversee the entire recycling process, including collection, packaging, transport, and mechanical processing into black mass, from which critical materials such as nickel, cobalt, and lithium are recovered. The program spans multiple European countries, including France, Germany, and the UK, and contributes to the sustainability of battery components such as electrolyte solvents

- In January 2024, Umicore partnered with Microsoft to launch an AI-powered platform aimed at accelerating the development of battery materials technologies, particularly for electric vehicles. This initiative leverages Microsoft’s Azure OpenAI Service and proprietary scientific models to analyze decades of complex R&D data, enabling faster, more cost-efficient innovation. The platform is designed to synthesize internal and external datasets—including simulations and experimental results—within a secure environment to protect intellectual property

- In June 2023, BASF officially opened Europe’s first co-located battery materials production and recycling facility in Schwarzheide, Germany. The site includes a state-of-the-art cathode active materials (CAM) plant and a battery recycling unit designed to process end-of-life lithium-ion batteries and production scrap into black mass—a concentrated mix of valuable metals such as lithium, nickel, cobalt, and manganese

- In June 2023, POSCO Future M and General Motors expanded their Ultium CAM joint venture in North America by increasing Cathode Active Material (CAM) production and adding Precursor CAM (pCAM) capacity, with completion expected by 2026. While focused on cathode materials, such expansions in battery production directly drive the demand and innovation for electrolyte solvents

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Lithium Ion Batterys Electrolyte Solvent Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Lithium Ion Batterys Electrolyte Solvent Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Lithium Ion Batterys Electrolyte Solvent Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.