Global Lithium Ion Electric Vehicle Market

Market Size in USD Billion

CAGR :

%

USD

55.29 Billion

USD

131.15 Billion

2024

2032

USD

55.29 Billion

USD

131.15 Billion

2024

2032

| 2025 –2032 | |

| USD 55.29 Billion | |

| USD 131.15 Billion | |

|

|

|

|

Lithium-Ion Electric Vehicle Market Size

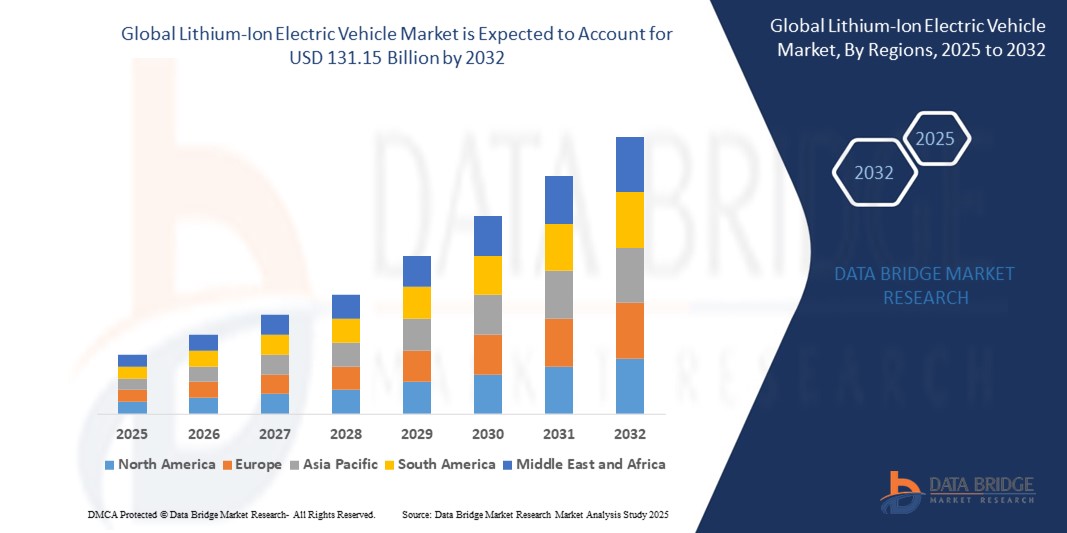

- The global lithium-ion electric vehicle market size was valued at USD 55.29 billion in 2024 and is expected to reach USD 131.15 billion by 2032, at a CAGR of 11.40% during the forecast period

- The market growth is largely fuelled by the increasing demand for zero-emission vehicles, supported by government incentives, advancements in lithium-ion battery technologies, and expanding charging infrastructure worldwide

- The rising investments by automakers in electric mobility, along with strategic collaborations for battery supply chains, are significantly accelerating the adoption of lithium-ion electric vehicles across major global markets

Lithium-Ion Electric Vehicle Market Analysis

- The lithium-ion electric vehicle market is witnessing rapid expansion due to consistent improvements in energy density, battery lifespan, and charging speed which support broader applications across various vehicle types

- Increased consumer interest in sustainable transportation is encouraging automakers to scale up production, resulting in greater market penetration and competitive pricing of lithium-ion powered electric vehicles

- North America dominated the lithium-ion electric vehicle market with the largest revenue share in 2024, driven by strong government incentives, emission regulations, and rapid advancements in electric mobility infrastructure

- The Asia-Pacific region is expected to witness the highest growth rate in the global lithium-ion electric vehicle market, driven by rapid urbanization, strong government support for electric mobility, and the presence of key battery manufacturers across countries such as China, Japan, and South Korea

- The battery electric vehicle segment accounted for the largest revenue share in 2024, driven by the rising consumer preference for zero-emission vehicles and favorable government policies supporting clean transportation. The market benefits from expanding infrastructure for charging and advances in battery technology that improve driving range and affordability

Report Scope and Lithium-Ion Electric Vehicle Market Segmentation

|

Attributes |

Lithium-Ion Electric Vehicle Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

• Growing Integration of Lithium-Ion Batteries in Public Transportation Fleets • Rising Demand for Energy-Dense and Fast-Charging Battery Technologies in Electric Vehicles |

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Lithium-Ion Electric Vehicle Market Trends

“Rise of Solid-State Lithium-Ion Batteries in Electric Vehicles”

- The lithium-ion electric vehicle market is increasingly shifting toward solid-state battery technology, driven by the need to address limitations such as safety concerns and slow charging times

- For instance, solid-state batteries can reduce fire risks due to their improved thermal stability

- These batteries use solid electrolytes instead of flammable liquid ones, offering enhanced safety and better performance under high temperatures, making them ideal for next-gen electric vehicles

- With higher energy density, solid-state batteries can significantly extend driving range, addressing range anxiety for consumers

- For instance, Toyota claims its prototypes can enable vehicles to travel over 700 km on a single charge

- Major automotive players such as BMW and Toyota are investing in solid-state battery development with plans for commercial deployment in the coming years

- Companies such as QuantumScape have reported promising early-stage results and have secured investments from Volkswagen, reinforcing the market’s confidence in this emerging technology

Lithium-Ion Electric Vehicle Market Dynamics

Driver

“Rising Demand for Environmentally Friendly Transportation Solutions”

- The growing global demand for sustainable and eco-friendly transportation is a major driver for lithium-ion electric vehicles, as consumers and governments seek alternatives to reduce emissions and dependence on fossil fuels

- For instance, cities such as Amsterdam plan to ban internal combustion engine vehicles by 2030

- Lithium-ion electric vehicles offer zero tailpipe emissions and align with climate goals when charged using renewable energy sources, making them a viable solution for reducing urban air pollution and carbon footprints

- Supportive government policies such as tax incentives, EV subsidies, and electrification mandates are accelerating adoption across both private and public transportation sectors

- For instance, India’s FAME II scheme provides incentives for EV purchases and infrastructure development

- Automakers are expanding their EV offerings across various segments, from luxury to affordable models, which increases availability and adoption among middle-income consumers

- The improvement of infrastructure, including public charging stations and battery-swapping systems, is making lithium-ion electric vehicles more practical for everyday use, further driving market expansion

Restraint/Challenge

“Limited Charging Infrastructure and Range Anxiety”

- Limited access to reliable and widespread charging infrastructure remains a key barrier for lithium-ion electric vehicle adoption, especially in rural or underdeveloped regions where public chargers are scarce

- Range anxiety among consumers is heightened by the lack of charging stations, discouraging long-distance travel

- For instance, in parts of Southeast Asia, EV users often avoid highway travel due to limited fast-charging options

- Urban areas, despite better infrastructure, still face issues such as overcrowded charging stations, long waiting times, and inconsistent charger availability

- Compatibility problems between different EV manufacturers and charging standards make it difficult for users to access all available charging points

- For instance, some European EVs may not align with older Asian charging plugs

- High costs and slow rollout of fast-charging stations reduce convenience and usability, requiring stronger public-private partnerships to accelerate network expansion and support EV growth

Lithium-Ion Electric Vehicle Market Scope

The market is segmented on the basis of vehicle type, capacity, product type, charging station type, bonding type, and vehicle class.

• By Vehicle Type

On the basis of vehicle type, the lithium-ion electric vehicle market is segmented into battery electric vehicle (BEV), plug-in hybrid electric vehicle (PHEV), and hybrid electric vehicle (HEV). The battery electric vehicle segment accounted for the largest revenue share in 2024, driven by the rising consumer preference for zero-emission vehicles and favorable government policies supporting clean transportation. The market benefits from expanding infrastructure for charging and advances in battery technology that improve driving range and affordability.

The plug-in hybrid electric vehicle segment is expected to witness a fastest growth rate from 2025 to 2032, due to its dual power source flexibility and enhanced fuel efficiency. PHEVs appeal to users looking for electric mobility with the extended range of an internal combustion engine, particularly in regions where charging infrastructure is still developing.

• By Capacity

On the basis of capacity, the lithium-ion electric vehicle market is segmented into <50 kWh, 51–100 kWh, 101–300 kWh, and >300 kWh. The 51–100 kWh segment held the largest share in 2024 owing to its suitability for a wide range of mid-range passenger electric vehicles, offering a balance between cost, weight, and driving range. Automakers favor this category for mass-market electric cars catering to urban and suburban commutes.

The >300 kWh segment is expected to witness a fastest growth rate from 2025 to 2032, supported by growing demand for heavy-duty commercial electric vehicles and luxury electric cars. These high-capacity batteries provide long-range capability and faster acceleration, making them ideal for long-haul logistics and high-performance EVs.

• By Product Type

On the basis of product type, the market is segmented into passenger car, commercial vehicle, and two-wheeler. The passenger car segment dominated the market in 2024, owing to the surge in consumer demand for sustainable mobility, combined with rising fuel prices and urban air pollution concerns. Government mandates and subsidies for electric passenger vehicles further drive market growth.

The commercial vehicle segment is expected to witness a fastest growth rate from 2025 to 2032, due to increasing adoption by fleet operators and logistics companies seeking to reduce fuel costs and emissions. Companies such as Rivian and BYD are innovating in this space to meet the rising demand for electric delivery vans and trucks.

• By Charging Station Type

On the basis of charging station type, the market is segmented into normal charging and super charging. The normal charging segment captured the largest share in 2024, supported by the proliferation of affordable residential and workplace chargers. These stations are preferred for overnight or long-duration charging, especially in urban households.

The super charging segment is expected to witness a fastest growth rate from 2025 to 2032, due to increasing consumer preference for faster turnaround times and the expansion of high-speed public charging networks. Electric vehicle makers and charging service providers are aggressively deploying ultra-fast chargers along highways and in urban centers to address range anxiety.

• By Bonding Type

On the basis of bonding type, the market is segmented into wire and laser. The wire bonding segment led the market in 2024, as it is a cost-effective and well-established technique used in the assembly of battery packs. Its reliability and lower manufacturing complexity make it a common choice among battery manufacturers for standard electric vehicles.

The laser bonding segment is expected to witness a fastest growth rate from 2025 to 2032, driven by the increasing demand for compact, high-performance battery modules. This technique allows for higher precision and efficiency, making it suitable for advanced EV applications and premium battery systems where performance and space optimization are critical.

• By Vehicle Class

On the basis of vehicle class, the market is segmented into mid-priced and luxury. The mid-priced segment held the largest share in 2024 due to the increasing availability of affordable electric models and government incentives promoting EV adoption among the general population. Manufacturers are launching competitive models to meet growing demand from cost-conscious buyers.

The luxury segment is expected to witness a fastest growth rate from 2025 to 2032, driven by rising consumer interest in high-performance, feature-rich electric vehicles. Leading brands such as Tesla, Audi, and Mercedes-Benz continue to launch premium EVs with advanced technology, superior aesthetics, and extended range, capturing affluent consumer segments.

Lithium-Ion Electric Vehicle Market Regional Analysis

• North America dominated the lithium-ion electric vehicle market with the largest revenue share in 2024, driven by strong government incentives, emission regulations, and rapid advancements in electric mobility infrastructure

• The region is experiencing a rising preference for sustainable transportation among consumers, supported by investments in charging networks, battery technology, and vehicle electrification

• Key players in the market are launching new electric models with extended ranges and improved performance, further driving consumer adoption across urban and suburban areas

U.S. Lithium-Ion Electric Vehicle Market Insight

The U.S. lithium-ion electric vehicle market held the highest revenue share within North America in 2024, fueled by significant investments from automakers in electric mobility and growing environmental consciousness. The shift in consumer preference toward clean energy vehicles, coupled with federal tax credits and infrastructure development for charging stations, is supporting rapid adoption. The market is also driven by strong participation from technology firms collaborating with automobile manufacturers to enhance battery performance and vehicle range.

Europe Lithium-Ion Electric Vehicle Market Insight

The Europe lithium-ion electric vehicle market is expected to witness a fastest growth rate from 2025 to 2032, driven by strict carbon emission norms and a robust commitment to the green energy transition. Countries across Europe are investing heavily in public and private EV charging infrastructure and incentivizing electric vehicle ownership. Increasing awareness about climate change and fuel dependency is also pushing consumers and fleet operators toward lithium-powered electric mobility.

U.K. Lithium-Ion Electric Vehicle Market Insight

The U.K. lithium-ion electric vehicle market is expected to witness a fastest growth rate from 2025 to 2032, spurred by national targets to ban the sale of new petrol and diesel cars in the coming years. Government-backed subsidies, expansion of charging facilities, and technological advancements in lithium battery capacity are driving growth. Consumers are also increasingly considering electric vehicles as a cost-effective and sustainable alternative for daily commuting.

Germany Lithium-Ion Electric Vehicle Market Insight

The Germany lithium-ion electric vehicle market is expected to witness a fastest growth rate from 2025 to 2032, supported by the country's established automotive sector and strong policy framework aimed at reducing carbon emissions. Germany's automakers are heavily investing in battery innovation and EV production facilities. Consumers are also becoming more inclined towards electric vehicles, influenced by high fuel prices and a growing emphasis on smart mobility solutions integrated with lithium-ion batteries.

Asia-Pacific Lithium-Ion Electric Vehicle Market Insight

The Asia-Pacific lithium-ion electric vehicle market is expected to witness a fastest growth rate from 2025 to 2032, driven by large-scale urbanization, economic development, and aggressive EV promotion policies across countries such as China, India, and Japan. The presence of prominent battery manufacturers and the expansion of domestic EV production capacity are accelerating market momentum. In addition, growing consumer awareness and the push toward sustainable urban transport are supporting widespread adoption of lithium-ion electric vehicles.

Japan Lithium-Ion Electric Vehicle Market Insight

The Japan lithium-ion electric vehicle market is expected to witness a fastest growth rate from 2025 to 2032, due to the country’s focus on energy efficiency and technological innovation. Major automotive brands in Japan are investing in EVs powered by lithium-ion batteries to meet both domestic and global demand. Consumer preference is shifting toward hybrid and battery-electric vehicles due to their environmental benefits, compact design, and long-term cost savings, making Japan a key market for EV development.

China Lithium-Ion Electric Vehicle Market Insight

The China lithium-ion electric vehicle market led the Asia-Pacific region in revenue share in 2024, driven by favorable government policies, extensive EV manufacturing infrastructure, and a growing middle-class population. China remains the largest producer and consumer of lithium-ion batteries, providing a competitive advantage in the EV market. The country's commitment to expanding smart cities, reducing pollution, and developing advanced battery technology is accelerating the adoption of lithium-ion electric vehicles across personal and public transportation.

Lithium-Ion Electric Vehicle Market Share

The Lithium-Ion Electric Vehicle industry is primarily led by well-established companies, including:

- A123 Systems LLC (U.S.)

- Panasonic Corporation (Japan)

- MITSUBISHI MOTORS CORPORATION (Japan)

- ENVISION AESC GROUP LTD. (China)

- BYD Company Ltd. (China)

- LG Chem (South Korea)

- Daimler AG (Germany)

- Robert Bosch GmbH (Germany)

- SAMSUNG SDI CO., LTD. (South Korea)

- Wanxiang (China)

- Johnson Controls (U.S.)

- GS Yuasa International Ltd. (Japan)

- Hitachi, Ltd. (Japan)

Latest Developments in Global Lithium-Ion Electric Vehicle Market

- In June 2024, at the Beijing Auto Show held in April, CATL, the world’s leading electric vehicle (EV) battery manufacturer, revealed a groundbreaking new product. The Shenxing Plus battery, as claimed by CATL, has the capability to power an EV for over 1,000 kilometers on a single charge. This range is sufficient to travel from Guangzhou to Wuhan or from London to Berlin

- In November 2023, Exxon Mobil Corporation (NYSE: XOM) unveiled its plans to become a prominent producer of lithium, an essential element for electric vehicle (EV) batteries. The company has initiated the first phase of its lithium production in southwest Arkansas, a region recognized for its substantial lithium reserves

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.