Global Liver Fibrosis Drugs Market

Market Size in USD Billion

CAGR :

%

USD

15.38 Billion

USD

36.51 Billion

2024

2032

USD

15.38 Billion

USD

36.51 Billion

2024

2032

| 2025 –2032 | |

| USD 15.38 Billion | |

| USD 36.51 Billion | |

|

|

|

|

Liver Fibrosis Drugs Market Size

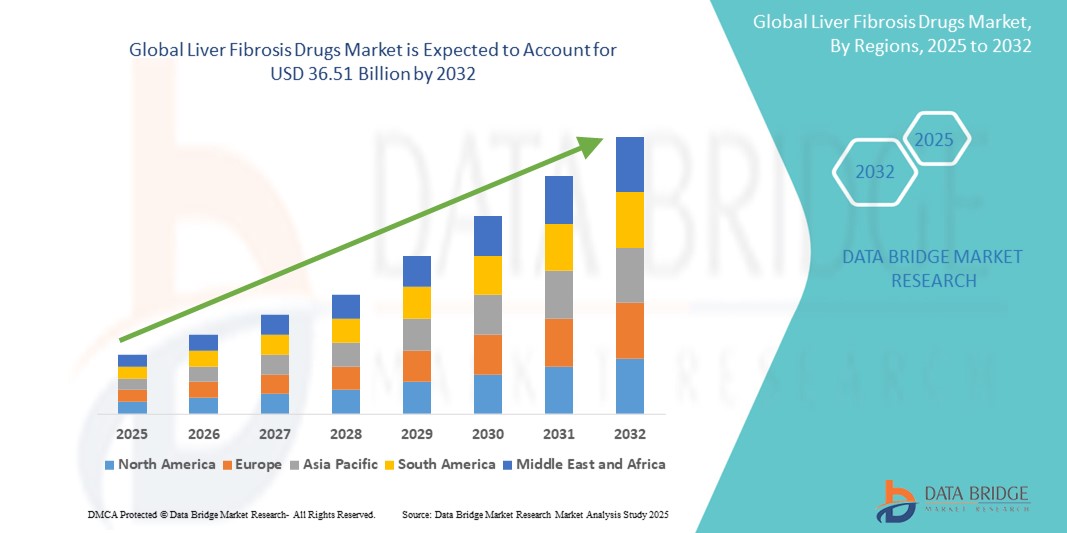

- The global liver fibrosis drugs market was valued at USD 15.38 billion in 2024 and is expected to reach USD 36.51 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 11.41%, primarily driven by rising prevalence, drug advancements, investments.

- This growth is driven by factors such as increasing prevalence of chronic liver diseases and advancements in drug development and approvals

Liver Fibrosis Drugs Market Analysis

- Liver fibrosis drugs are medications designed to slow, halt, or reverse the progression of liver fibrosis, a condition characterized by excessive scarring of liver tissue due to chronic liver diseases such as hepatitis, non-alcoholic fatty liver disease (NAFLD), and alcohol-related liver damage. These drugs aim to reduce inflammation, inhibit fibrotic pathways, and promote liver regeneration.

- The global liver fibrosis drugs market is experiencing significant growth, projected to expand at a CAGR of 11.41% in the coming years. This growth is primarily driven by the increasing prevalence of liver diseases, advancements in drug development, and rising healthcare investments. In addition, growing awareness about early diagnosis and treatment of liver fibrosis further supports market expansion.

- For instance, FGF19 analogs, a novel class of drugs, have shown promising results in clinical trials for treating liver fibrosis associated with NAFLD. These drugs help regulate bile acid metabolism and reduce liver inflammation, potentially reversing fibrosis progression.

- North America currently dominates the market due to high healthcare expenditure and strong research activities, while Asia-Pacific is expected to witness rapid growth due to rising liver disease cases and improved healthcare infrastructure. The future of liver fibrosis treatment looks promising with continued innovation and regulatory support.

Report Scope and Liver Fibrosis Drugs Market Segmentation

|

Attributes |

Liver Fibrosis Drugs Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Liver Fibrosis Drugs Market Trends

“Increasing Adoption of Anti-Fibrotic Therapies”

- One major trend in the liver fibrosis drugs market is the increasing adoption of anti-fibrotic therapies, which target fibrosis progression by inhibiting fibrogenic pathways.

- Traditional treatments mainly focused on managing underlying liver diseases, but emerging therapies now aim to directly reverse fibrosis and promote liver regeneration. Advances in biotechnology and drug development have led to promising candidates in clinical trials, particularly small-molecule inhibitors and monoclonal antibodies.

- For instance, Galectin-3 inhibitors, such as Belapectin, are being developed to reduce liver fibrosis by blocking galectin proteins involved in fibrosis progression. This drug has shown potential in early-stage trials for patients with non-alcoholic steatohepatitis (NASH)-related fibrosis.

- The demand for anti-fibrotic therapies is expected to grow as research progresses and regulatory approvals increase. With pharmaceutical companies focusing on novel drug targets, the market is poised for significant expansion in the coming years.

Liver Fibrosis Drugs Market Dynamics

Driver

“Increasing Prevalence of Chronic Liver Diseases”

- The increasing prevalence of chronic liver diseases such as non-alcoholic fatty liver disease (NAFLD), non-alcoholic steatohepatitis (NASH), hepatitis, and alcohol-related liver damage is significantly fueling the demand for liver fibrosis drugs.

- As lifestyle-related risk factors such as obesity, diabetes, and excessive alcohol consumption rise globally, more individuals are developing liver fibrosis, necessitating effective treatment options.

- NAFLD and NASH, in particular, have emerged as major concerns, with NASH progressing to advanced fibrosis and cirrhosis if left untreated, creating an urgent need for targeted therapies.

- The growing burden of liver fibrosis has intensified research efforts, leading to the development of novel antifibrotic drugs and biologics aimed at reversing fibrosis and improving liver function.

- As healthcare providers and governments recognize the impact of liver diseases on public health, increased investments in drug research and development are further driving market growth.

For instance,

- According to a 2022 study published by the National Center for Biotechnology Information, the global prevalence of NAFLD is estimated to be 32.4%, with a significant percentage of cases progressing to fibrosis, underscoring the urgent demand for effective liver fibrosis treatments.

- In October 2023, the U.S. FDA granted breakthrough therapy designation to a leading pharmaceutical company's antifibrotic drug targeting NASH-related fibrosis, highlighting the growing focus on liver fibrosis treatment.

- As chronic liver diseases continue to rise, the demand for liver fibrosis drugs will escalate, driving market expansion and innovation in treatment options.

Opportunity

“Emerging Potential in Gene and Cell Therapy for Liver Fibrosis”

- Gene and cell therapy present a promising opportunity in the liver fibrosis drugs market by offering potential curative treatments rather than just symptomatic relief.

- Advanced gene-editing technologies, such as CRISPR and RNA-based therapies, can target fibrosis-related genes, reducing fibrotic progression and promoting liver regeneration.

- Stem cell-based therapies are also being explored for their ability to repair damaged liver tissue and replace fibrotic cells with healthy hepatocytes.

- With increasing investments in regenerative medicine, biotech companies and research institutions are actively developing innovative gene and cell-based therapies for liver fibrosis treatment.

For instance,

- In March 2023, according to a study published in the Journal of Hepatology, researchers successfully used CRISPR-based gene editing to suppress fibrotic pathways in animal models, demonstrating significant potential for future human treatments.

- In August 2023, a biotechnology company announced the initiation of clinical trials for a stem cell therapy aimed at reversing liver fibrosis, marking a major step toward regenerative treatment options.

- The continued advancements in gene and cell therapy hold immense potential for revolutionizing liver fibrosis treatment, offering long-term benefits and improved patient outcomes.

Restraint/Challenge

“High Development and Treatment Costs”

- The high cost of developing and administering liver fibrosis drugs poses a significant challenge for market growth, particularly affecting affordability and accessibility for patients.

- Research and development (R&D) of novel liver fibrosis therapies involve extensive clinical trials, regulatory approvals, and advanced biotechnological approaches, leading to high production costs.

- Many of the emerging antifibrotic drugs and biologics require complex manufacturing processes, making them expensive for both healthcare providers and patients.

- Limited reimbursement policies in several regions further exacerbate the cost burden, restricting access to innovative liver fibrosis treatments.

For instance,

- In June 2023, according to an article published by the National Center for Biotechnology Information, the average cost of developing a new liver fibrosis drug, including clinical trials, exceeds USD 1 billion, making it challenging for smaller biotech firms to sustain long-term R&D efforts.

- In October 2023, a study in the Journal of Hepatology highlighted that high drug prices and limited insurance coverage have resulted in low adoption rates of recently approved liver fibrosis treatments in low- and middle-income countries.

- As a result, the high cost of liver fibrosis drugs continues to be a major barrier, limiting patient access to advanced therapies and slowing overall market expansion.

Liver Fibrosis Drugs Market Scope

The market is segmented on the basis of treatment type, condition, end user, and distribution channel.

|

Segmentation |

Sub-Segmentation |

|

By Treatment Type |

|

|

By Condition |

|

|

By End Users |

|

|

By Distribution Channel |

|

Liver Fibrosis Drugs Market Regional Analysis

“North America is the Dominant Region in the Liver Fibrosis Drugs Market”

- North America holds the dominant position in the liver fibrosis drugs market, driven by advanced healthcare infrastructure, strong research and development (R&D) activities, and high healthcare expenditure.

- The region has a well-established pharmaceutical industry, with major players investing heavily in drug development for liver fibrosis treatment. In addition, the rising prevalence of liver diseases, particularly non-alcoholic fatty liver disease (NAFLD) and non-alcoholic steatohepatitis (NASH), has increased demand for innovative treatment options.

- U.S. in particular dominates the market, primarily due to its strong pharmaceutical industry, high healthcare expenditure, and advanced research and development (R&D) capabilities. The country has a significant prevalence of liver diseases, including non-alcoholic fatty liver disease (NAFLD) and non-alcoholic steatohepatitis (NASH), which has increased the demand for effective fibrosis treatments.

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- Asia-Pacific is projected to register the highest growth rate in the liver fibrosis drugs market due to the rising prevalence of liver diseases, increasing healthcare investments, and improving access to advanced treatments. The region has witnessed a surge in cases of non-alcoholic fatty liver disease (NAFLD) and hepatitis, particularly in countries such as China, India, and Japan, primarily due to changing lifestyles, obesity, and high alcohol consumption.

- Government initiatives to improve healthcare infrastructure, along with rising awareness about liver disease management, are driving market expansion. In addition, pharmaceutical companies are increasing their presence in the region through partnerships and clinical trials.

- China is projected to register the highest growth rate in the liver fibrosis drugs market due to the rising prevalence of liver diseases, increasing healthcare investments, and expanding pharmaceutical industry. The country has a growing burden of non-alcoholic fatty liver disease (NAFLD) and non-alcoholic steatohepatitis (NASH), driven by changing dietary habits, obesity, and metabolic disorders.

Liver Fibrosis Drugs Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Boehringer Ingelheim International GmbH (Germany)

- Gilead Sciences, Inc. (U.S.)

- Gyre Therapeutics, Inc. (U.S.)

- Galectin Therapeutics Inc. (U.S.)

- Hepion Pharmaceuticals (U.S.)

- Intercept Pharmaceuticals, Inc. (U.S.)

- Ionis Pharmaceuticals (U.S.)

- Inventiva (France)

- Lilly (U.S.)

- Madrigal Pharmaceuticals (U.S.)

- Merck & Co., Inc. (U.S.)

- Novo Nordisk A/S (Denmark)

- Novartis AG (Switzerland)

- Pfizer Inc. (U.S.)

- Pharmaxis Group USA (U.S.)

- Rivus Pharmaceuticals (U.S.)

- Torrent Pharmaceuticals Ltd. (India)

- VBShilpa (India)

- ZEALAND PHARMA (Denmark)

- Zydus Group (India)

Latest Developments in Global Liver Fibrosis Drugs Market

- In March 2025, Shilpa Medicare Limited announced that the Subject Expert Committee (SEC) of CDSCO has approved its Investigational New Drug (IND), Nor Ursodeoxycholic Acid (Nor UDCA) Tablets 500 mg, and recommended marketing authorization for the treatment of non-alcoholic fatty liver disease (NAFLD)

- In November 2024, Novo Nordisk announced the headline results from part 1 of the ongoing ESSENCE trial, a pivotal Phase 3, 240-week, double-blinded study involving 1,200 adults with metabolic dysfunction-associated steatohepatitis (MASH) and moderate to advanced liver fibrosis (stage 2 or 3). Part 1 of the trial assessed the impact of once-weekly semaglutide 2.4 mg on liver histology compared to a placebo, in addition to standard care, over a 72-week period for the first 800 randomized participants

- In June 2024, Zealand Pharma A/S announced that Boehringer Ingelheim reported breakthrough findings from a sub-analysis of the Phase 2 trial for survodutide. The results showed that up to 64.5% of adults with fibrosis stages F2 and F3 (moderate to advanced scarring) experienced fibrosis improvement without worsening metabolic dysfunction-associated steatohepatitis (MASH), compared to 25.9% in the placebo group after 48 weeks of treatment

- In March 2024, Madrigal Pharmaceuticals, Inc. announced that the U.S. Food and Drug Administration (FDA) granted accelerated approval for Rezdiffra (resmetirom) as a treatment for adults with noncirrhotic NASH with moderate to advanced liver fibrosis (stages F2 to F3), alongside diet and exercise. The continued approval for this indication may depend on the confirmation and demonstration of clinical benefits in ongoing confirmatory trials

- In November 2023, Torrent Pharmaceuticals Limited and Zydus Lifesciences Limited announced a licensing and supply agreement to co-market Saroglitazar Magnesium for the treatment of Non-Alcoholic Steatohepatitis (NASH) and Non-Alcoholic Fatty Liver Disease (NAFLD) in India. As the only approved drug for NASH and NAFLD in the country, Saroglitazar Magnesium is expected to play a crucial role in managing and mitigating these widespread and progressive liver disorders

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.