Global Livestock Monitoring Market

Market Size in USD Billion

CAGR :

%

USD

4.61 Billion

USD

14.29 Billion

2024

2032

USD

4.61 Billion

USD

14.29 Billion

2024

2032

| 2025 –2032 | |

| USD 4.61 Billion | |

| USD 14.29 Billion | |

|

|

|

|

Livestock Monitoring Market Size

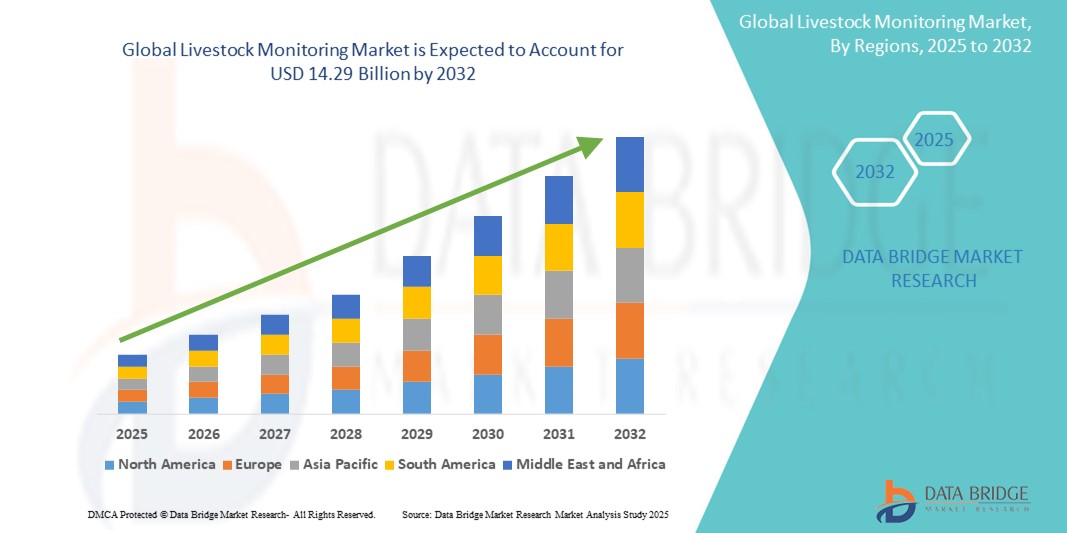

- The global livestock monitoring market was valued at USD 4.61 billion in 2024 and is expected to reach USD 14.29 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 15.20%, primarily driven by the increasing demand for real-time animal health tracking and the adoption of advanced technologies such as IoT and AI in livestock management

- This growth is driven by factors such as the rising concerns over animal health and productivity, growing adoption of precision livestock farming, and increasing demand for automated monitoring systems

Livestock Monitoring Market Analysis

- Livestock monitoring systems are essential tools used to track the health, behavior, and productivity of farm animals in real time, leveraging technologies such as IoT sensors, RFID, and GPS. These systems support data-driven decisions in herd management, disease prevention, and resource optimization

- The demand for livestock monitoring is significantly driven by the need to improve animal welfare, reduce operational costs, and increase productivity in the face of rising global meat and dairy consumption. Automation and precision livestock farming are becoming increasingly vital, especially in large-scale farming operations

- The North America region stands out as one of the dominant regions for livestock monitoring, supported by its strong technological infrastructure, high awareness among farmers, and favorable government initiatives promoting smart farming practices

- For instance, the U.S. farms have increasingly adopted wearable sensors and automated feeding and milking systems, enabling real-time data collection and improved farm efficiency. North America's leadership in agri-tech continues to drive innovation in livestock monitoring solutions

- Globally, livestock monitoring systems are among the top technological priorities in modern agriculture, following precision crop monitoring systems, and are critical in ensuring sustainable and efficient livestock management practices

Report Scope and Livestock Monitoring Market Segmentation

|

Attributes |

Livestock Monitoring Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Livestock Monitoring Market Trends

“Rising Integration of IoT and AI for Real-Time Livestock Management”

- One prominent trend shaping the global livestock monitoring market is the increasing integration of Internet of Things (IoT) devices and Artificial Intelligence (AI) for real-time tracking and predictive analytics in animal health and farm operations

- These technologies enable continuous monitoring of vital parameters such as body temperature, activity levels, feeding patterns, and reproductive status, allowing farmers to detect abnormalities early and make informed decisions

- For instance, AI-driven systems can analyze behavioral patterns to predict disease onset or detect estrus in dairy cows, optimizing breeding cycles and reducing losses due to illness or missed productivity

- Digital IoT devices, such as smart collars, RFID tags, and automated feeding systems, allow seamless data collection and integration into centralized platforms for efficient herd management

- This trend is transforming livestock farming into a data-driven, proactive industry—enhancing animal welfare, improving productivity, and driving the demand for intelligent livestock monitoring solutions worldwide

Livestock Monitoring Market Dynamics

Driver

“Rising Demand for Animal Health and Productivity Optimization”

- The growing global demand for meat, dairy, and other animal-based products is driving the need for enhanced livestock management practices, significantly boosting the adoption of livestock monitoring systems

- With increasing herd sizes and industrial-scale farming, ensuring optimal animal health, productivity, and welfare has become a top priority, making continuous monitoring and data-driven decision-making essential

- Diseases, stress, and improper nutrition can severely impact livestock productivity and profitability, prompting the use of advanced technologies to monitor vital signs, behavioral patterns, and environmental conditions in real time

- Modern livestock monitoring systems offer early detection of illnesses, estrus cycles, and stress indicators, enabling timely interventions, reducing mortality rates, and improving overall efficiency

- The shift toward precision livestock farming is also fueled by the need to comply with stricter animal welfare regulations and to minimize environmental impact through more sustainable practices

For instance,

- In June 2022, according to a report by the Food and Agriculture Organization (FAO), livestock contributes approximately 40% of the global agricultural output, emphasizing the need for efficient monitoring systems to maximize productivity and ensure sustainability in animal farming

- According to a 2023 study published by the National Center for Biotechnology Information, the integration of wearable sensors and AI-based analytics in livestock farms led to a 20% reduction in disease-related losses and a 15% increase in milk yield, showcasing the tangible benefits of real-time monitoring systems

- As a result of the rising focus on animal health, productivity optimization, and sustainable farming practices is a significant driver propelling the growth of the global livestock monitoring market

Opportunity

“Leveraging Artificial Intelligence for Enhanced Farm Efficiency”

- The integration of Artificial Intelligence (AI) in livestock monitoring systems offers a significant opportunity to enhance farm efficiency by enabling predictive analytics, automation, and real-time decision-making for animal health and productivity

- AI-powered systems can analyze vast amounts of data from IoT sensors, including animal behavior, environmental conditions, and physiological indicators, to predict potential health issues and optimize breeding and feeding schedules

- AI algorithms can also provide real-time insights into livestock health, detect early signs of diseases, and offer actionable recommendations, allowing farmers to address issues before they escalate into costly problems

- In addition, the use of AI in data analysis also supports farm management practices by enabling the identification of trends, improving resource allocation, and reducing waste, all contributing to higher profitability and sustainability

For instance,

- In January 2024, a study published by the University of California demonstrated that AI-powered systems analyzing data from wearable sensors could predict disease outbreaks in livestock herds with up to 85% accuracy, helping farmers take preemptive action

- In September 2023, a report by the International Food Policy Research Institute highlighted that AI applications in livestock farming could increase productivity by up to 30%, through optimized feeding practices and real-time health monitoring, contributing to both economic growth and sustainability in agriculture

- The integration of AI in livestock monitoring systems is transforming farm operations, improving livestock welfare, increasing farm productivity, and offering opportunities for innovation in precision livestock farming. As these technologies become more accessible and affordable, they present significant growth opportunities in the global livestock monitoring market

Restraint/Challenge

“High Equipment and Implementation Costs Hindering Market Penetration”

- The high cost of livestock monitoring systems presents a significant barrier to widespread adoption, particularly among small and medium-sized farms in developing regions

- Advanced monitoring solutions—including IoT devices, sensors, RFID tags, and AI-powered analytics platforms—require substantial investment not only in equipment but also in infrastructure, training, and ongoing maintenance

- For many farmers with limited financial resources, the cost-benefit ratio may not seem immediately favorable, leading to hesitancy in adopting such technologies despite their long-term advantages

For instance,

- In August 2024, a report by the International Livestock Research Institute (ILRI) highlighted that the cost of fully integrated livestock monitoring systems can range from USD 500 to over USD 5,000 per animal unit, depending on the level of technology and scale of deployment, which remains a major obstacle for smallholder farmers in low-income countries

- According to a 2023 survey conducted by the Global Dairy Farmers Network, over 60% of surveyed farmers in emerging economies cited high equipment and maintenance costs as the primary deterrent to adopting livestock monitoring technologies

- As a result, financial constraints and limited access to affordable solutions can hinder market penetration, slow down technological adoption, and create disparities in productivity and animal health outcomes between large commercial operations and small-scale farms

Livestock Monitoring Market Scope

The market is segmented on the basis of offering, farm size, livestock type, and application.

|

Segmentation |

Sub-Segmentation |

|

By Offering |

|

|

By Farm Size |

|

|

By Livestock Type |

|

|

By Application

|

|

Livestock Monitoring Market Regional Analysis

“North America is the Dominant Region in the Livestock Monitoring Market”

- North America leads the global livestock monitoring market, supported by a well-developed agricultural sector, widespread adoption of advanced farming technologies, and strong government support for precision livestock farming

- U.S. holds a major market share due to its large-scale commercial farms, high awareness about animal health and productivity, and increasing use of IoT, AI, and cloud-based livestock management systems

- The presence of leading agri-tech companies and research institutions, along with favorable policies promoting sustainable farming practices, further strengthens market dominance in the region

- In addition, the rising demand for high-quality meat and dairy products, coupled with a growing focus on animal welfare and traceability, is driving increased adoption of smart monitoring technologies across North American farms

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- Asia-Pacific is expected to experience the highest growth rate in the global livestock monitoring market, fueled by increasing livestock populations, rising demand for animal-based products, and the modernization of traditional farming practices

- Countries such as China, India, and Australia are key contributors to this growth, with significant investments being made in smart farming technologies and infrastructure development

- China is rapidly embracing intelligent livestock monitoring solutions to meet the growing demand for food safety, quality, and supply chain transparency, especially in its pork and dairy industries

- India, with its large dairy industry and government-led initiatives to improve animal health, is witnessing a surge in the adoption of wearable sensors, automated milking systems, and mobile-based herd management platforms

Livestock Monitoring Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Merck & Co., Inc. (U.S.)

- GEA Group Aktiengesellschaft (Germany)

- DeLaval (Sweden)

- Nedap N.V. (The Netherlands)

- Afimilk Ltd. (Israel)

- BouMatic (U.S.)

- Lely (The Netherlands)

- DAIRYMASTER (Ireland)

- Fancom BV (The Netherlands)

- HID Global Corporation (U.S.)

- Zoetis Services LLC (U.S.)

- Fullwood JOZ (U.K.)

- Cowmanager (The Netherlands)

- Sensaphone (U.S.)

- AGCO Corporation (U.S.)

- VDL Agrotech bv (The Netherlands)

- ENGS Systems (Israel)

- HerdInsights (Ireland)

- Datamars (U.S.)

- GALLAGHER GROUP LIMITED (New Zealand)

Latest Developments in Global Livestock Monitoring Market

- In March 2025, SkyKelpie, an Australian ag-tech company, introduced a drone-powered mustering system that has managed over 300,000 livestock. This innovation offers a return on investment of up to 251%, providing a cost-effective and efficient alternative to traditional mustering methods. The drones utilize heat-sensing technology for precise nighttime monitoring and are being further developed for autonomous mustering using AI

- In June 2024, the U.S. Department of Agriculture (USDA) launched a monitoring and surveillance program to track the spread of avian influenza in livestock populations. This initiative requires farmers to conduct weekly monitoring and testing, encouraging the adoption of innovative monitoring tools and technologies to ensure timely detection and treatment of the disease

- In February 2024, the Universitat Autònoma de Barcelona (UAB), with EU funding, developed ClearFarm—a platform that uses sensors to monitor various factors related to animal behavior, health, environmental impact, and productivity. The system provides farmers with real-time information, emphasizing indicators that help anticipate and address potential issues, thus improving animal welfare and farm efficiency

- In January 2024, Astrocast partnered with Digitanimal to develop a Satellite IoT (SatIoT) solution for livestock monitoring. This collaboration aims to commercialize a tracking device that connects to Astrocast's global satellite network, allowing farmers to remotely monitor their livestock, manage herds effectively, and implement remote farming techniques

- In April 2023, Advantech Co. Ltd. introduced a system utilizing artificial intelligence (AI) and infrared vision to monitor and detect health complications in livestock. This technology enables early detection of diseases by measuring each animal's body temperature and providing daily health scans, thereby enhancing overall farm management and food security

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.