Global Lng Bunkering Market

Market Size in USD Billion

CAGR :

%

USD

1.38 Billion

USD

12.41 Billion

2024

2032

USD

1.38 Billion

USD

12.41 Billion

2024

2032

| 2025 –2032 | |

| USD 1.38 Billion | |

| USD 12.41 Billion | |

|

|

|

|

LNG Bunkering Market Size

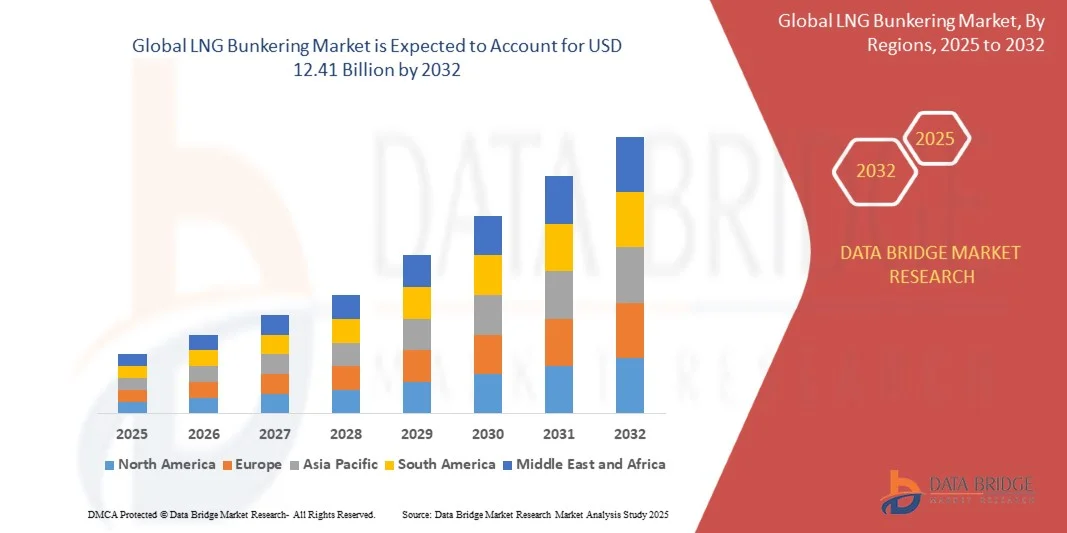

- The global LNG bunkering market size was valued at USD 1.38 billion in 2024 and is expected to reach USD 12.41 billion by 2032, at a CAGR of 31.6% during the forecast period

- The market growth is largely fuelled by the rising adoption of LNG as a cleaner marine fuel to meet strict International Maritime Organization (IMO) emission regulations and reduce sulfur and greenhouse gas emissions from shipping operations

- Increasing global trade, expansion of LNG-fueled vessel fleets, and investments in port bunkering infrastructure are further driving market growth

LNG Bunkering Market Analysis

- The global LNG bunkering market is witnessing rapid expansion due to the growing emphasis on cleaner marine fuels and stricter international regulations targeting sulfur and greenhouse gas emissions from ships. The adoption of LNG as an alternative to conventional marine fuels is driving investments in bunkering infrastructure and supply chains

- Increasing global trade and expansion of LNG-fueled vessel fleets are further accelerating market growth. Ports and shipping companies are prioritizing LNG bunkering capabilities to comply with the International Maritime Organization (IMO) emission regulations and reduce operational carbon footprints

- Europe dominated the LNG bunkering market with the largest revenue share in 2024, driven by stringent environmental regulations, growing adoption of LNG-powered vessels, and the presence of well-established port infrastructure

- Asia-Pacific region is expected to witness the highest growth rate in the global LNG bunkering market, driven by rapid fleet expansion, increasing adoption of LNG-powered vessels in China, Japan, and South Korea, and strong governmental support for clean shipping technologies

- The Port-to-Ship segment held the largest market revenue share in 2024, driven by the growing number of LNG-powered vessels and the establishment of port-based bunkering infrastructure. Port-to-Ship operations provide faster refueling, higher storage capacity, and more reliable supply, making them the preferred choice for commercial shipping fleets.

Report Scope and LNG Bunkering Market Segmentation

|

Attributes |

LNG Bunkering Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

LNG Bunkering Market Trends

“Increasing Adoption of LNG as a Marine Fuel”

- The growing shift toward LNG as an alternative marine fuel is transforming the shipping industry by enabling lower emissions and compliance with IMO regulations. LNG-powered vessels reduce sulfur oxide (SOx), nitrogen oxide (NOx), and particulate matter emissions, helping operators meet environmental standards while improving operational efficiency

- Rising demand for cleaner energy in ports and shipping lanes is accelerating the adoption of LNG bunkering infrastructure, including trucks, barges, and onshore terminals. This trend is particularly strong in regions with stringent emission regulations, helping reduce greenhouse gas impact from maritime operations

- The cost-effectiveness and long-term sustainability of LNG fuel are making it attractive for shipping companies and port operators, leading to increased fleet conversions and newbuild LNG vessels. Operational efficiency and reduced fuel costs further drive adoption

- For instance, in 2023, several European and Asian shipping operators reported lower operating costs and emission levels after switching to LNG-powered vessels, highlighting the impact on sustainability and regulatory compliance

- While LNG adoption is accelerating in marine operations, market growth depends on continued investment in bunkering infrastructure, safety training, and supply chain optimization. Ports and operators must focus on scalable solutions to fully capitalize on this growing demand

LNG Bunkering Market Dynamics

Driver

“Rising Environmental Regulations and Focus on Sustainable Shipping”

- Increasing global regulations, such as the IMO 2020 sulfur cap, are pushing ship owners to adopt cleaner fuels such as LNG to reduce emissions. Regulatory compliance is a key driver for fleet operators seeking to avoid penalties and ensure long-term operational viability. These regulations are also encouraging the modernization of fleets and retrofitting older vessels with LNG-compatible systems

- Growing awareness of environmental sustainability and corporate responsibility is encouraging shipping companies to invest in LNG-powered vessels and bunkering infrastructure. This trend is supported by international agencies, port authorities, and shipbuilders promoting cleaner fuel solutions. Companies are leveraging LNG adoption as a strategic differentiator for green logistics and eco-friendly branding

- Governments and private organizations are offering incentives, subsidies, and funding for LNG infrastructure development, helping reduce initial investment barriers for shipping companies and fueling adoption. These measures also promote research and innovation in LNG storage, handling, and distribution technologies, further accelerating market growth

- For instance, in 2022, several ports in Northern Europe implemented LNG bunkering incentives and infrastructure upgrades, resulting in increased adoption of LNG-powered vessels across commercial shipping routes. This example highlights the effectiveness of policy-driven adoption strategies and the role of public-private collaboration in scaling LNG bunkering

- While environmental regulations and incentives drive market growth, continued focus on infrastructure expansion, safety compliance, and fuel price stability remains critical for sustained adoption in the global LNG bunkering market. Companies must also invest in crew training and standardized bunkering protocols to ensure operational efficiency and safety across regions

Restraint/Challenge

“High Infrastructure Costs and Limited Availability of LNG Supply”

- The high investment required to develop LNG bunkering terminals, trucks, and storage facilities restricts adoption among smaller ports and shipping operators. Initial capital expenditures remain a significant barrier to entry, and long payback periods can discourage investment, especially in developing markets

- Limited availability of LNG supply in certain regions can impact consistent fuel provision, leading to operational delays and route planning challenges. Shipping operators often face uncertainty regarding fuel access in emerging markets, which may hinder fleet expansion and scheduled operations

- Complex logistical requirements, including storage, transportation, and safety protocols for LNG, increase operational costs and limit rapid expansion of bunkering networks. Efficient coordination between ports, suppliers, and vessel operators is critical to maintaining smooth supply chains and reducing downtime

- For instance, in 2023, several ports in Latin America and Africa reported delays in LNG bunkering projects due to high capital requirements and lack of local LNG production, affecting fleet adoption timelines. These delays also impacted the competitive positioning of regional shipping hubs in global trade routes

- While technological innovations and public-private partnerships are helping improve accessibility, addressing high infrastructure costs, supply constraints, and regulatory compliance is essential to unlock the full growth potential of the global LNG bunkering market. Ongoing investments in modular bunkering solutions, small-scale LNG plants, and digital monitoring systems are key to overcoming these challenges and accelerating adoption

LNG Bunkering Market Scope

The market is segmented on the basis of product type and application.

• By Product Type

On the basis of product type, the LNG bunkering market is segmented into Truck-to-Ship, Port-to-Ship, Ship-to-Ship, and Portable Tanks. The Port-to-Ship segment held the largest market revenue share in 2024, driven by the growing number of LNG-powered vessels and the establishment of port-based bunkering infrastructure. Port-to-Ship operations provide faster refueling, higher storage capacity, and more reliable supply, making them the preferred choice for commercial shipping fleets.

The Truck-to-Ship segment is expected to witness the fastest growth rate from 2025 to 2032, driven by its flexibility and ability to serve smaller ports or vessels that cannot access fixed bunkering terminals. Truck-to-Ship LNG delivery allows rapid deployment of fuel in remote or emerging markets, supporting localized operations and enabling wider adoption of LNG-powered vessels.

• By Application

On the basis of application, the LNG bunkering market is segmented into Container Fleet, Tanker Fleet, Cargo Fleet, Ferries, Inland Vessels, and Others. The Container Fleet segment held the largest share in 2024, fueled by the expansion of global trade and the increasing shift of container ships to cleaner fuel alternatives. Container shipping companies are prioritizing LNG bunkering to comply with stricter emission regulations and optimize operational efficiency.

The Ferries segment is expected to witness the fastest growth rate from 2025 to 2032, driven by rising environmental regulations and government initiatives encouraging cleaner marine transportation. LNG-fueled ferries offer reduced emissions and operational cost benefits, making them increasingly attractive for passenger transport and short-haul shipping routes.

LNG Bunkering Market Regional Analysis

- Europe dominated the LNG bunkering market with the largest revenue share in 2024, driven by stringent environmental regulations, growing adoption of LNG-powered vessels, and the presence of well-established port infrastructure

- Shipping companies and port authorities in the region are prioritizing cleaner fuels, enhancing LNG bunkering facilities, and integrating safety and operational standards to meet international compliance

- This widespread adoption is further supported by government incentives, public-private partnerships, and the strong presence of LNG suppliers, positioning Europe as a leading hub for LNG bunkering services globally

Germany LNG Bunkering Market Insight

The Germany LNG bunkering market captured a significant revenue share in 2024, fueled by the country’s advanced port infrastructure, strict emission regulations, and strong commitment to green shipping. Investments in LNG fueling facilities, coupled with increasing adoption of LNG-powered vessels, are driving market expansion. Moreover, Germany’s focus on sustainable logistics and environmental compliance is attracting global shipping operators to adopt LNG solutions.

U.K. LNG Bunkering Market Insight

The U.K. LNG bunkering market is expected to witness the fastest growth rate from 2025 to 2032, driven by environmental regulations and the need for low-emission fuels in commercial shipping. Strategic ports, government-backed incentives, and growing fleet modernization are encouraging adoption. The U.K.’s emphasis on clean energy and decarbonization, combined with supportive policies for LNG infrastructure, is expected to continue to stimulate market growth.

North America LNG Bunkering Market Insight

North America is expected to witness the fastest growth rate from 2025 to 2032. Rising environmental concerns, expansion of LNG terminals, and government incentives for cleaner fuels are accelerating market adoption. The integration of LNG bunkering into existing shipping logistics and increasing investment in fleet modernization further strengthens regional dominance.

U.S. LNG Bunkering Market Insight

The U.S. market is expected to witness the fastest growth rate from 2025 to 2032 due to significant investments in LNG terminals, development of bunkering infrastructure along key ports, and adoption of LNG-powered vessels across commercial and cargo fleets. Government initiatives promoting cleaner shipping fuels, combined with corporate sustainability strategies, are fueling demand. The growing importance of environmental compliance and global shipping connectivity further propels the U.S. LNG bunkering industry.

Asia-Pacific LNG Bunkering Market Insight

The Asia-Pacific LNG bunkering market is expected to witness the fastest growth rate from 2025 to 2032, driven by rising trade volumes, expanding container and tanker fleets, and the region’s strategic position in global shipping. Ports in China, Singapore, and South Korea are enhancing LNG bunkering infrastructure to accommodate increasing vessel demand. In addition, government policies promoting cleaner fuels and environmental sustainability are accelerating the adoption of LNG-powered vessels. The region is also witnessing growing investments from private players and international shipping companies, making APAC a key growth market for LNG bunkering.

China LNG Bunkering Market Insight

The China LNG bunkering market accounted for the largest market revenue share in Asia-Pacific in 2024, attributed to the country’s rapidly expanding maritime fleet, increasing focus on reducing emissions, and government-backed investments in LNG infrastructure. The development of LNG ports, storage facilities, and bunkering vessels is facilitating reliable fuel supply to domestic and international shipping lines. Moreover, China’s push toward sustainable shipping, combined with the presence of major LNG suppliers and shipbuilders, is driving adoption across container, tanker, and cargo fleets.

Japan LNG Bunkering Market Insight

The Japan LNG bunkering market is expected to witness the fastest growth rate from 2025 to 2032 due to government policies supporting clean fuel adoption, expanding LNG infrastructure, and a growing fleet of LNG-powered vessels. Japan’s commitment to environmental sustainability and decarbonization, along with rising demand from ferry and cargo operators, is driving market expansion. Integration of LNG fueling solutions with port and shipping operations is further facilitating growth across both domestic and international shipping routes.

LNG Bunkering Market Share

The LNG Bunkering industry is primarily led by well-established companies, including:

- TotalEnergies (France)

- Petronas (Malaysia)

- KOREA Gas Corporation (South Korea)

- Wartsila (Finland)

- Trelleborg AB (Sweden)

- Harvey Gulf International Marine, LLC (U.S.)

- SHELL PLC (U.K.)

- Gasum Oy (Finland)

- Chart Industries (U.S.)

Latest Developments in LNG Bunkering Market

- In November 2023, SHV Energy, Partnership Agreement, signed with Japanese companies Furukawa Electric Co., Ltd. and Astomos Energy Corporation to develop bio-LPG production solutions. The collaboration will convert carbon dioxide and methane from livestock manure into renewable bio-LPG, enhancing sustainable fuel availability, reducing greenhouse gas emissions, and strengthening SHV Energy’s position in the global renewable LPG market

- In October 2022, Trelleborg Group, Acquisition, finalized the purchase of US-based Minnesota Rubber & Plastics for USD 950 million. This company manufactures engineered polymer and thermoplastic components for medical, water management, food & beverage, and industrial applications. The acquisition expands Trelleborg’s North American footprint, diversifies its product portfolio, and strengthens its presence in high-growth technical markets

- In November 2022, Shell Petroleum NV, Acquisition, acquired 100% of Nature Energy Biogas A/S for nearly USD 2 billion (GBP1.9 billion) in collaboration with Davidson Kempner Capital Management, Pioneer Point Partners, and Sampension. The deal integrates renewable biogas into Shell’s portfolio, supports its energy transition strategy, and increases access to sustainable energy solutions, boosting Shell’s position in the European biogas market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.