Market Analysis and Insights Global Loan Servicing Software Market

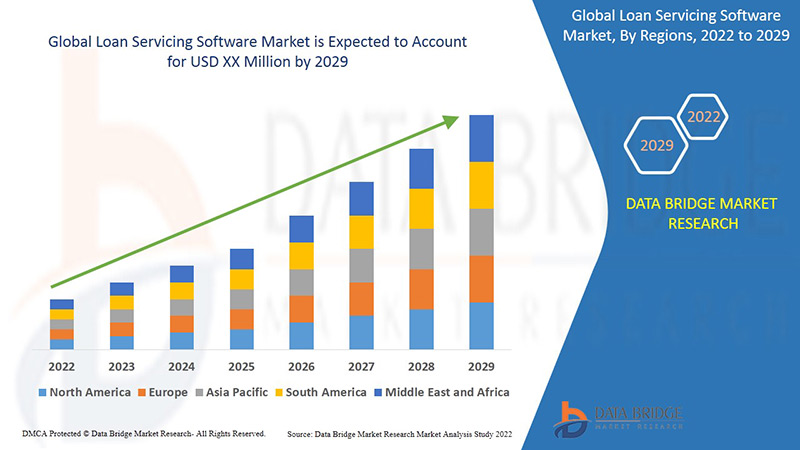

The loan servicing software market is expected to witness market growth at a rate of 12.62% in the forecast period of 2022 to 2029. Data Bridge Market Research report on loan servicing software market provides analysis and insights regarding the various factors expected to be prevalent throughout the forecast period while providing their impacts on the market's growth. The rise in the adoption of loan servicing software in order to automate, optimize, and improve their loan servicing functions, which, in turn, will improve the business performance is escalating the growth of loan servicing software market.

Loan services is referred to as the administrative characteristics of a loan, from the time the assets are distributed until the loan is paid off. It is a method a finance company or a lender operates a procedure of collecting principal, interest, and escrow payments. Additionally, it comprises of sending monthly payment statements, collecting monthly payments, maintaining records of payments and balances, collecting and paying taxes and insurance, remitting funds to the note holder, and following up any delinquencies. Currently, customers require several options for loan repayment. Loan management software provides customers several repayment modes including standing instructions, cash, and electronic payments.

Major factors that are expected to boost the growth of the loan servicing software market in the forecast period are the rise in the digitization of businesses. Furthermore, the growing demand by the financial institutions and banks to comply with multiple regulations is further anticipated to propel the growth of the loan servicing software market. Moreover, the arrival of advanced technology is further estimated to cushion the growth of the loan servicing software market. On the other hand, the security dangers regarding software service offerings is further projected to impede the growth of the loan servicing software market in the timeline period.

In addition, the growing internet penetration, rise in the adoption of smartphones and the increasing need for streamlining the loan process will further provide potential opportunities for the growth of the loan servicing software market in the coming years. However, the growing data security and privacy concerns which might further challenge the growth of the loan servicing software market in the near future.

This loan servicing software market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, the impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the loan servicing software market, contact Data Bridge Market Research for an Analyst Brief, Our team will help you take an informed market decision to achieve market growth.

Global Loan Servicing Software Market Scope and Market Size

The loan servicing software market is segmented on the basis of type and application. The growth among segments helps you analyze niche pockets of growth and strategies to approach the market and determine your core application areas and the difference in your target markets.

- On the basis of type, the loan servicing software market is segmented into cloud based, SaaS based and on-premises.

- On the basis of application, the loan servicing software market has been segmented into banks, credit unions, mortgage lenders and brokers and others.

Loan Servicing Software Market Country Level Analysis

The loan servicing software market is analysed, and market size, volume information is provided by country, type and application as referenced above.

The countries covered in the loan servicing software market report are the U.S., Canada, and Mexico in North America, Brazil, Argentina, and the rest of South America as part of South America, Germany, Italy, U.K., France, Spain, Netherlands, Belgium, Switzerland, Turkey, Russia, Rest of Europe in Europe, Japan, China, India, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of the Middle East and Africa (MEA).

North America dominates the loan servicing software market due to the rise in the adoption of loan servicing software across several industries. Furthermore, the increasing banking sector and growing fintech start-up culture will further boost the growth of the loan servicing software market in the region during the forecast period.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impact the current and future trends of the market. Data points like downstream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs, and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Loan Servicing Software Market Share Analysis

The loan servicing software market competitive landscape provides details by a competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, regional presence, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to the loan servicing software market.

Some of the major players operating in the loan servicing software market are DownHome Solutions, AUTOPAL SOFTWARE, LLC, Nortridge Software, LLC., Fiserv, Inc., Q2 Software, Inc., Emphasys Software, NBFC Software., Shaw Systems Associates, LLC, Simnang LLC, Graveco Software Inc., Oracle, Sopra Banking Software, Altisource., Nucleus Software Exports Ltd., IBM, LOAN SERVICING SOFT INC., and PCFS Solutions among others.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL LOAN SERVICING SOFTWARE MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL LOAN SERVICING SOFTWARE MARKET

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 MARKET GUIDE

2.2.4 COMPANY POSITIONING GRID

2.2.5 COMAPANY MARKET SHARE ANALYSIS

2.2.6 MULTIVARIATE MODELLING

2.2.7 TOP TO BOTTOM ANALYSIS

2.2.8 STANDARDS OF MEASUREMENT

2.2.9 VENDOR SHARE ANALYSIS

2.2.10 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.11 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL LOAN SERVICING SOFTWARE MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHT

5.1 PORTERS FIVE FORCES

5.2 REGULATORY STANDARDS

5.3 TECHNOLOGICAL TRENDS

5.4 PATENT ANALYSIS

5.5 CASE STUDY

5.6 VALUE CHAIN ANALYSIS

5.7 COMPANY COMPARITIVE ANALYSIS

5.8 FEATURES OF LOAN SERVICING SOFTWARE

6 GLOBAL LOAN SERVICING SOFTWARE MARKET, BY OFFERING

6.1 OVERVIEW

6.2 SOFTWARE

6.2.1 LENDING & CREDIT SOFTWARE

6.2.2 LOAN ORIGINATION SYSTEM

6.2.3 LOAN MANAGEMENT SOFTWARE

6.2.4 OTHERS

6.3 SERVICES

6.3.1 PROFESSIONAL SERVICES

6.3.1.1. CONSULTING

6.3.1.2. IMPLEMENTATION & INTEGRATION

6.3.1.3. SUPPORT & MAINTENANCE

6.3.2 MANAGED SERVICES

7 GLOBAL LOAN SERVICING SOFTWARE MARKET, BY ENTERPRISE SIZE

7.1 OVERVIEW

7.2 SMALL & MEDIUM SIZE ENTERPRISE

7.3 LARGE SIZE ENTERPRISE

8 GLOBAL LOAN SERVICING SOFTWARE MARKET, BY DEPLOYMENT MODE

8.1 OVERVIEW

8.2 CLOUD

8.3 SAAS

8.4 ON-PREMISES

9 GLOBAL LOAN SERVICING SOFTWARE MARKET, BY LOAN TYPE

9.1 OVERVIEW

9.2 SECURED LOANS

9.2.1 SECURED LOANS, BY TYPE

9.2.1.1. HOME LOANS

9.2.1.2. LOAN AGAINST PROPERTY (LAP)

9.2.1.3. LOAN AGAINST INSURANCE POLICIES

9.2.1.4. GOLD LOANS

9.2.1.5. LOAN AGAINST MUTUAL FUNDS & SHARES

9.2.1.6. LOAN AGAINST FIXED DEPOSITS

9.3 UNSECURED LOANS

9.3.1 UNSECURED LOANS, BY TYPE

9.3.1.1. PERSONAL LOANS

9.3.1.2. SHORT TERM BUSINESS LOANS

9.3.1.3. VEHICLE LOANS

9.3.1.4. EDUCATION LOANS

9.4 DEMAND LOANS

9.5 SUBSIDIZED LOANS

9.6 CONCESSIONAL LOANS

9.7 OTHERS

10 GLOBAL LOAN SERVICING SOFTWARE MARKET, BY PURCHASING MODEL

10.1 OVERVIEW

10.2 SUBSCRIPTION BASED

10.2.1 MONTHLY SUBSCRIPTION

10.2.2 ANNUAL SUBSCRIPTION

10.3 ONE TIME LICENSE

10.4 FREE

11 GLOBAL LOAN SERVICING SOFTWARE MARKET, BY END USER

11.1 OVERVIEW

11.2 BANKS

11.2.1 BY ENTERPRISE SIZE

11.2.1.1. SMALL & MEDIUM SIZE ENTERPRISE

11.2.1.2. LARGE SIZE ENTERPRISE

11.3 FINANCIAL INSTITUTIONS

11.3.1 BY ENTERPRISE SIZE

11.3.1.1. SMALL & MEDIUM SIZE ENTERPRISE

11.3.1.2. LARGE SIZE ENTERPRISE

11.4 CREDIT UNIONS

11.4.1 BY ENTERPRISE SIZE

11.4.1.1. SMALL & MEDIUM SIZE ENTERPRISE

11.4.1.2. LARGE SIZE ENTERPRISE

11.5 MORTAGAGE LENDERS

11.5.1 BY ENTERPRISE SIZE

11.5.1.1. SMALL & MEDIUM SIZE ENTERPRISE

11.5.1.2. LARGE SIZE ENTERPRISE

11.6 BROKERS

11.6.1 BY ENTERPRISE SIZE

11.6.1.1. SMALL & MEDIUM SIZE ENTERPRISE

11.6.1.2. LARGE SIZE ENTERPRISE

11.7 OTHERS

12 GLOBAL LOAN SERVICING SOFTWARE MARKET, BY GEOGRAPHY

GLOBAL LOAN SERVICING SOFTWARE MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

12.1 NORTH AMERICA

12.1.1 U.S.

12.1.2 CANADA

12.1.3 MEXICO

12.2 EUROPE

12.2.1 GERMANY

12.2.2 FRANCE

12.2.3 U.K.

12.2.4 ITALY

12.2.5 SPAIN

12.2.6 RUSSIA

12.2.7 TURKEY

12.2.8 BELGIUM

12.2.9 NETHERLANDS

12.2.10 NORWAY

12.2.11 FINLAND

12.2.12 SWITZERLAND

12.2.13 DENMARK

12.2.14 SWEDEN

12.2.15 POLAND

12.2.16 REST OF EUROPE

12.3 ASIA PACIFIC

12.3.1 JAPAN

12.3.2 CHINA

12.3.3 SOUTH KOREA

12.3.4 INDIA

12.3.5 AUSTRALIA

12.3.6 NEW ZEALAND

12.3.7 SINGAPORE

12.3.8 THAILAND

12.3.9 MALAYSIA

12.3.10 INDONESIA

12.3.11 PHILIPPINES

12.3.12 TAIWAN

12.3.13 VIETNAM

12.3.14 REST OF ASIA PACIFIC

12.4 SOUTH AMERICA

12.4.1 BRAZIL

12.4.2 ARGENTINA

12.4.3 REST OF SOUTH AMERICA

12.5 MIDDLE EAST AND AFRICA

12.5.1 SOUTH AFRICA

12.5.2 EGYPT

12.5.3 SAUDI ARABIA

12.5.4 U.A.E

12.5.5 OMAN

12.5.6 BAHRAIN

12.5.7 ISRAEL

12.5.8 KUWAIT

12.5.9 QATAR

12.5.10 REST OF MIDDLE EAST AND AFRICA

12.6 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

13 GLOBAL LOAN SERVICING SOFTWARE MARKET,COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: GLOBAL

13.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

13.3 COMPANY SHARE ANALYSIS: EUROPE

13.4 COMPANY SHARE ANALYSIS: ASIA PACIFIC

13.5 MERGERS & ACQUISITIONS

13.6 NEW PRODUCT DEVELOPMENT AND APPROVALS

13.7 EXPANSIONS

13.8 REGULATORY CHANGES

13.9 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

14 GLOBAL LOAN SERVICING SOFTWARE MARKET, SWOT & DBMR ANALYSIS

15 GLOBAL LOAN SERVICING SOFTWARE MARKET, COMPANY PROFILE

15.1 FINASTRA

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 GEOGRAPHIC PRESENCE

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENT

15.2 FIS

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 GEOGRAPHIC PRESENCE

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENT

15.3 LENDFOUNDRY

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 GEOGRAPHIC PRESENCE

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT DEVELOPMENT

15.4 SALESFORCE, INC

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 GEOGRAPHIC PRESENCE

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT DEVELOPMENT

15.5 LOANPRO.

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 GEOGRAPHIC PRESENCE

15.5.4 PRODUCT PORTFOLIO

15.5.5 RECENT DEVELOPMENT

15.6 CHETU INC.

15.6.1 COMPANY SNAPSHOT

15.6.2 REVENUE ANALYSIS

15.6.3 GEOGRAPHIC PRESENCE

15.6.4 PRODUCT PORTFOLIO

15.6.5 RECENT DEVELOPMENT

15.7 MARGILL / JURISMEDIA INC.

15.7.1 COMPANY SNAPSHOT

15.7.2 REVENUE ANALYSIS

15.7.3 GEOGRAPHIC PRESENCE

15.7.4 PRODUCT PORTFOLIO

15.7.5 RECENT DEVELOPMENT

15.8 SAGENT M&C, LLC

15.8.1 COMPANY SNAPSHOT

15.8.2 REVENUE ANALYSIS

15.8.3 GEOGRAPHIC PRESENCE

15.8.4 PRODUCT PORTFOLIO

15.8.5 RECENT DEVELOPMENT

15.9 APPLIED BUSINESS SOFTWARE, INC

15.9.1 COMPANY SNAPSHOT

15.9.2 REVENUE ANALYSIS

15.9.3 GEOGRAPHIC PRESENCE

15.9.4 PRODUCT PORTFOLIO

15.9.5 RECENT DEVELOPMENT

15.1 BLACK KNIGHT TECHNOLOGIES, LLC.

15.10.1 COMPANY SNAPSHOT

15.10.2 REVENUE ANALYSIS

15.10.3 GEOGRAPHIC PRESENCE

15.10.4 PRODUCT PORTFOLIO

15.10.5 RECENT DEVELOPMENT

15.11 BRYT SOFTWARE LCC

15.11.1 COMPANY SNAPSHOT

15.11.2 REVENUE ANALYSIS

15.11.3 GEOGRAPHIC PRESENCE

15.11.4 PRODUCT PORTFOLIO

15.11.5 RECENT DEVELOPMENT

15.12 TURNKEY LENDER

15.12.1 COMPANY SNAPSHOT

15.12.2 REVENUE ANALYSIS

15.12.3 GEOGRAPHIC PRESENCE

15.12.4 PRODUCT PORTFOLIO

15.12.5 RECENT DEVELOPMENT

15.13 FUNDINGO

15.13.1 COMPANY SNAPSHOT

15.13.2 REVENUE ANALYSIS

15.13.3 GEOGRAPHIC PRESENCE

15.13.4 PRODUCT PORTFOLIO

15.13.5 RECENT DEVELOPMENT

15.14 NORTRIDGE SOFTWARE, LLC.

15.14.1 COMPANY SNAPSHOT

15.14.2 REVENUE ANALYSIS

15.14.3 GEOGRAPHIC PRESENCE

15.14.4 PRODUCT PORTFOLIO

15.14.5 RECENT DEVELOPMENT

15.15 HES FINTECH.

15.15.1 COMPANY SNAPSHOT

15.15.2 REVENUE ANALYSIS

15.15.3 GEOGRAPHIC PRESENCE

15.15.4 PRODUCT PORTFOLIO

15.15.5 RECENT DEVELOPMENT

15.16 ABLE PLATFORM INC.

15.16.1 COMPANY SNAPSHOT

15.16.2 REVENUE ANALYSIS

15.16.3 GEOGRAPHIC PRESENCE

15.16.4 PRODUCT PORTFOLIO

15.16.5 RECENT DEVELOPMENT

15.17 HYLAND SOFTWARE, INC

15.17.1 COMPANY SNAPSHOT

15.17.2 REVENUE ANALYSIS

15.17.3 GEOGRAPHIC PRESENCE

15.17.4 PRODUCT PORTFOLIO

15.17.5 RECENT DEVELOPMENT

15.18 NUCLEUS SOFTWARE EXPORTS LTD

15.18.1 COMPANY SNAPSHOT

15.18.2 REVENUE ANALYSIS

15.18.3 GEOGRAPHIC PRESENCE

15.18.4 PRODUCT PORTFOLIO

15.18.5 RECENT DEVELOPMENT

15.19 ARYZA LTD.

15.19.1 COMPANY SNAPSHOT

15.19.2 REVENUE ANALYSIS

15.19.3 GEOGRAPHIC PRESENCE

15.19.4 PRODUCT PORTFOLIO

15.19.5 RECENT DEVELOPMENT

15.2 LOAN SERVICING SOFT INC

15.20.1 COMPANY SNAPSHOT

15.20.2 REVENUE ANALYSIS

15.20.3 GEOGRAPHIC PRESENCE

15.20.4 PRODUCT PORTFOLIO

15.20.5 RECENT DEVELOPMENT

15.21 GOLDPOINT SYSTEMS, INC.

15.21.1 COMPANY SNAPSHOT

15.21.2 REVENUE ANALYSIS

15.21.3 GEOGRAPHIC PRESENCE

15.21.4 PRODUCT PORTFOLIO

15.21.5 RECENT DEVELOPMENT

15.22 DHI COMPUTING SERVICE, INC. (FPS GOLD)

15.22.1 COMPANY SNAPSHOT

15.22.2 REVENUE ANALYSIS

15.22.3 GEOGRAPHIC PRESENCE

15.22.4 PRODUCT PORTFOLIO

15.22.5 RECENT DEVELOPMENT

15.23 INFINITY ENTERPRISE LENDING SYSTEMS

15.23.1 COMPANY SNAPSHOT

15.23.2 REVENUE ANALYSIS

15.23.3 GEOGRAPHIC PRESENCE

15.23.4 PRODUCT PORTFOLIO

15.23.5 RECENT DEVELOPMENT

15.24 VERGENT

15.24.1 COMPANY SNAPSHOT

15.24.2 REVENUE ANALYSIS

15.24.3 GEOGRAPHIC PRESENCE

15.24.4 PRODUCT PORTFOLIO

15.24.5 RECENT DEVELOPMENT

15.25 MORTGAGEFLEX

15.25.1 COMPANY SNAPSHOT

15.25.2 REVENUE ANALYSIS

15.25.3 GEOGRAPHIC PRESENCE

15.25.4 PRODUCT PORTFOLIO

15.25.5 RECENT DEVELOPMENT

15.26 BIZ CORE

15.26.1 COMPANY SNAPSHOT

15.26.2 REVENUE ANALYSIS

15.26.3 GEOGRAPHIC PRESENCE

15.26.4 PRODUCT PORTFOLIO

15.26.5 RECENT DEVELOPMENT

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

16 CONCLUSION

17 QUESTIONNAIRE

18 RELATED REPORTS

19 ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.