Global Location Of Things Market

Market Size in USD Billion

CAGR :

%

USD

51.67 Billion

USD

670.28 Billion

2024

2032

USD

51.67 Billion

USD

670.28 Billion

2024

2032

| 2025 –2032 | |

| USD 51.67 Billion | |

| USD 670.28 Billion | |

|

|

|

|

Location of Things Market Size

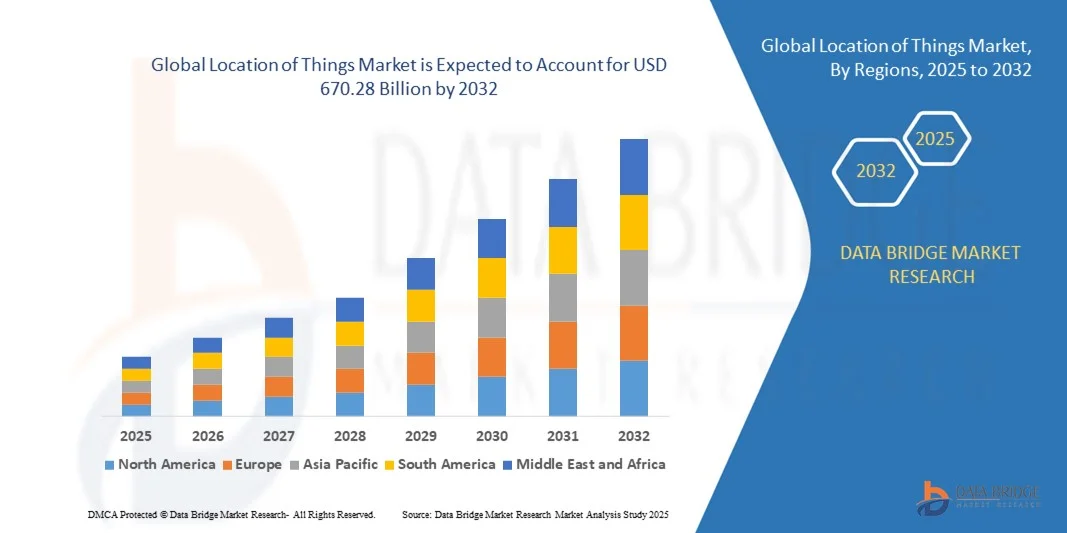

- The global location of things market size was valued at USD 51.67 billion in 2024 and is expected to reach USD 670.28 billion by 2032, at a CAGR of 37.76% during the forecast period

- The market growth is largely fueled by the increasing adoption of connected devices, IoT solutions, and real-time tracking technologies across multiple industries

- LoT solutions are enabling organizations to optimize operations, improve asset utilization, and enhance safety and security through precise location intelligence

Location of Things Market Analysis

- The increasing deployment of connected devices, IoT sensors, and smart systems is driving the LoT market. Organizations are leveraging location intelligence to optimize operations, track assets in real time, and improve supply chain efficiency, enhancing overall productivity and decision-making capabilities

- The incorporation of AI, machine learning, and cloud computing with LoT solutions is enhancing real-time tracking, predictive analytics, and actionable insights. This integration enables businesses to proactively manage resources, improve safety, and implement smarter operational strategies across industries

- North America dominated the global Location of Things (LoT) market with the largest revenue share of 36.5% in 2024, driven by the rapid adoption of IoT technologies, advanced analytics, and increasing demand for real-time asset tracking and operational visibility

- Asia-Pacific region is expected to witness the highest growth rate in the global location of things market, driven by rapid technological advancements, increasing smart city deployments, and expanding IoT ecosystem in countries such as China, Japan, and India. The region’s growing emphasis on digital transformation across industries accelerates market adoption and innovation

- The Outdoor Location segment held the largest market revenue share in 2024, driven by the widespread adoption of GPS, cellular networks, and long-range tracking solutions. Outdoor LoT solutions are extensively used for fleet monitoring, asset tracking, and logistics operations, enabling real-time visibility across expansive areas and improving operational efficiency

Report Scope and Location of Things Market Segmentation

|

Attributes |

Location of Things Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Location of Things Market Trends

Rise of Real-Time Location Intelligence and Tracking Solutions

- The growing adoption of real-time location tracking is transforming the Location of Things (LoT) landscape by enabling instantaneous visibility of assets, personnel, and vehicles. The integration of IoT sensors, GPS, and connectivity solutions allows businesses to make data-driven operational decisions, improving efficiency and reducing losses. In addition, predictive analytics from LoT platforms enable proactive maintenance and risk mitigation, reducing downtime and operational disruptions. Companies are leveraging these insights to optimize route planning, enhance resource allocation, and strengthen overall supply chain resilience

- Increasing demand for location analytics in logistics, retail, and industrial operations is accelerating the deployment of IoT-enabled tracking devices and platforms. These solutions are particularly valuable in remote or complex environments where asset mismanagement can cause delays and increased costs. Furthermore, real-time tracking improves customer satisfaction by providing accurate delivery updates and enhances transparency across multi-tier supply chains. Organizations also benefit from the ability to track environmental conditions, monitor compliance, and reduce inventory shrinkage

- The affordability and scalability of modern LoT devices are making them suitable for diverse applications, from enterprise fleet monitoring to smart city initiatives. Organizations benefit from actionable insights without significant infrastructure investment, enhancing operational decision-making. The modular design of many LoT platforms allows businesses to add or remove devices as needed, creating flexible solutions adaptable to changing operational needs. Integration with cloud-based platforms also supports advanced data analytics and AI-driven insights, enabling smarter business strategies

- For instance, in 2023, several logistics companies in Europe implemented LoT-based asset tracking systems, resulting in reduced delivery delays and optimized fleet management. The systems allowed real-time monitoring of shipments, improving supply chain efficiency and customer satisfaction. This also enabled predictive maintenance of vehicles, lower fuel consumption, and optimized workforce allocation, significantly reducing operational expenses. Enhanced data visualization dashboards helped managers identify bottlenecks and streamline processes across multiple locations

- While real-time location intelligence is driving operational improvements, its impact depends on continued innovation, data security, and integration with existing systems. Vendors must focus on scalable and interoperable solutions to fully capitalize on the growing market demand. Continuous updates to software and analytics platforms are essential for adapting to emerging technologies, such as 5G connectivity and AI-driven predictive tools. Collaboration between device manufacturers, platform providers, and end-users will be crucial to maintain seamless interoperability and maximize ROI

Location of Things Market Dynamics

Driver

Increasing Need for Asset Visibility and Operational Efficiency Across Industries

- Businesses are increasingly prioritizing real-time asset visibility to optimize workflows, reduce operational costs, and enhance productivity. The growing complexity of supply chains and multi-site operations has fueled investment in LoT technologies. Organizations are also leveraging predictive insights to prevent downtime, improve safety, and allocate resources efficiently. Integration of LoT platforms with ERP and SCM systems further enhances operational decision-making and cross-departmental collaboration

- Organizations recognize the strategic value of location insights in improving decision-making, reducing downtime, and ensuring regulatory compliance. Real-time monitoring helps prevent theft, loss, and operational inefficiencies. In addition, location intelligence supports sustainability initiatives, such as route optimization to reduce carbon emissions and energy consumption. Analytics derived from LoT platforms empower companies to forecast demand, optimize inventory levels, and enhance operational agility

- Governments and public sector agencies are leveraging LoT solutions for urban planning, traffic management, and public safety, further driving market adoption. Initiatives such as smart city projects are creating new opportunities for deployment. Moreover, LoT facilitates emergency response coordination, asset tracking for public infrastructure, and efficient resource allocation. The integration of LoT with AI and cloud platforms is helping authorities predict congestion, monitor environmental conditions, and improve city management

- For instance, in 2022, several European municipalities adopted LoT-enabled smart city systems to manage public transport and urban logistics, improving operational efficiency and reducing congestion. These implementations also allowed better monitoring of public resources, reducing misuse and operational delays. Enhanced real-time dashboards enabled authorities to coordinate traffic flow, emergency services, and public transit schedules effectively. Predictive analytics helped in anticipating urban challenges and making proactive policy decisions

- While awareness and adoption are rising, integration with existing IT systems, standardization, and interoperability remain key challenges for widespread deployment. Vendors must invest in flexible, cloud-compatible solutions to overcome these barriers. Cross-industry collaborations and adherence to standardized protocols are essential for achieving scalable, secure, and efficient deployment across sectors

Restraint/Challenge

Increasing Need for Asset Visibility and Operational Efficiency Across Industries

- Advanced LoT solutions, including sensors, tracking devices, and analytics platforms, require substantial investment for deployment and maintenance, limiting adoption among small and medium enterprises. Cost remains a major barrier to large-scale implementation. In addition, recurring expenses for software updates, cloud storage, and connectivity services can deter organizations from scaling solutions. Companies often struggle to justify ROI without clear cost-benefit analysis, particularly in price-sensitive sectors

- In many regions, integrating LoT platforms with legacy systems can be complex, requiring technical expertise and robust IT support. Improper integration may lead to system inefficiencies and incomplete data capture. Organizations face challenges in harmonizing data formats, ensuring network compatibility, and maintaining consistent communication between devices and platforms. The need for skilled IT personnel and specialized training further increases operational complexity and expenditure

- Data security and privacy concerns are significant, as LoT solutions collect sensitive operational and location data. Organizations must implement strong encryption, access control, and monitoring protocols to mitigate risks. Cybersecurity breaches can result in operational disruptions, financial losses, and reputational damage. Compliance with regional and international data privacy regulations, such as GDPR, adds an additional layer of complexity for global implementations

- For instance, in 2023, several logistics companies in Asia delayed LoT system deployment due to concerns over data privacy and integration complexity, slowing operational digitization efforts. This resulted in missed opportunities to improve efficiency, reduce losses, and enhance customer satisfaction. Regulatory audits and compliance checks further increased implementation timelines, requiring additional resources for system validation. Companies had to balance innovation with stringent security and operational requirements

- While LoT technologies continue to advance, addressing cost, security, and integration challenges is critical. Market participants must focus on scalable, secure, and interoperable solutions to fully realize the potential of the Location of Things market. Ongoing collaboration between vendors, regulatory bodies, and end-users is essential to ensure reliable, cost-effective, and secure deployment at scale

Location of Things Market Scope

The market is segmented on the basis of location type, application, and vertical.

- By Location Type

On the basis of location type, the LoT market is segmented into Indoor Location and Outdoor Location. The Outdoor Location segment held the largest market revenue share in 2024, driven by the widespread adoption of GPS, cellular networks, and long-range tracking solutions. Outdoor LoT solutions are extensively used for fleet monitoring, asset tracking, and logistics operations, enabling real-time visibility across expansive areas and improving operational efficiency.

The Indoor Location segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by the adoption of Bluetooth Low Energy (BLE), Wi-Fi, and ultra-wideband (UWB) technologies for indoor navigation, smart buildings, and retail analytics. Indoor LoT solutions allow precise tracking within confined spaces, enhancing customer experience, workflow optimization, and inventory management.

- By Application

On the basis of application, the market is segmented into Mapping and Navigation, Location-Based Customer Engagement and Advertising Platform, Location-Based Social Media Monitoring, IoT Asset Management, and Location Intelligence. The IoT Asset Management segment held the largest market revenue share in 2024, driven by the need for real-time tracking of assets, equipment, and personnel across industries. These solutions reduce operational losses, improve utilization, and provide actionable insights for predictive maintenance.

The Location-Based Customer Engagement and Advertising Platform segment is expected to witness the fastest growth from 2025 to 2032, fueled by the increasing adoption of location-aware marketing and personalized engagement strategies. Businesses leverage LoT data to deliver context-aware promotions, improve customer experiences, and drive revenue growth through targeted campaigns.

- By Vertical

On the basis of vertical, the market is segmented into BFSI, Defense, Government and Public Utilities, Healthcare and Life Sciences, Industrial Manufacturing, Media and Entertainment, Retail and E-Commerce, Transportation and Logistics, and Others. The Transportation and Logistics segment held the largest market revenue share in 2024, driven by the growing demand for fleet tracking, route optimization, and supply chain visibility. Real-time location monitoring ensures timely delivery, reduces operational costs, and enhances customer satisfaction.

The Retail and E-Commerce segment is expected to witness the fastest growth from 2025 to 2032, fueled by the increasing adoption of location analytics to enhance in-store navigation, optimize inventory placement, and deliver personalized customer experiences. Integration of LoT with mobile apps and IoT devices enables retailers to gather actionable insights and improve business decision-making.

Location of Things Market Regional Analysis

- North America dominated the global Location of Things (LoT) market with the largest revenue share of 36.5% in 2024, driven by the rapid adoption of IoT technologies, advanced analytics, and increasing demand for real-time asset tracking and operational visibility

- Businesses and government agencies in the region highly value LoT solutions for enhancing supply chain efficiency, improving asset utilization, and enabling smarter urban infrastructure

- This widespread adoption is further supported by robust technological infrastructure, high digital literacy, and increasing investment in smart city projects, positioning LoT solutions as a key enabler of operational efficiency and data-driven decision-making

U.S. Location of Things Market Insight

The U.S. LoT market captured the largest revenue share in North America in 2024, fueled by the growing implementation of IoT-enabled asset management systems across logistics, transportation, and industrial sectors. Enterprises are increasingly leveraging location intelligence to optimize workflows, reduce operational costs, and improve customer service. The integration of LoT with AI, cloud platforms, and mobile applications is further enhancing real-time decision-making, driving significant market growth.

Europe Location of Things Market Insight

The Europe LoT market is expected to witness the fastest growth from 2025 to 2032, supported by smart city initiatives, digitalization of industries, and stringent regulatory requirements for asset management and tracking. Increased urbanization and demand for location-based analytics are fostering the adoption of LoT solutions across BFSI, healthcare, transportation, and government sectors. European enterprises are focusing on data-driven operations, which is further accelerating market expansion.

U.K. Location of Things Market Insight

The U.K. LoT market is expected to witness the fastest growth from 2025 to 2032, driven by investments in smart infrastructure, logistics optimization, and technology adoption in urban planning. Businesses and public agencies are deploying LoT solutions for real-time monitoring, predictive analytics, and location-based service delivery. The U.K.’s advanced IoT ecosystem, coupled with a strong retail and transportation sector, is expected to continue boosting market growth.

Germany Location of Things Market Insight

Germany’s LoT market is expected to witness the fastest growth from 2025 to 2032 due to the emphasis on Industry 4.0, smart manufacturing, and efficient supply chain management. German enterprises are increasingly adopting IoT-enabled tracking systems and analytics platforms to improve productivity, reduce downtime, and ensure compliance with regulatory standards. The integration of location intelligence with industrial automation and logistics systems is further supporting market adoption.

Asia-Pacific Location of Things Market Insight

The Asia-Pacific LoT market is expected to witness the fastest growth from 2025 to 2032, driven by rapid urbanization, rising IoT adoption, and growing investments in smart city initiatives across countries such as China, India, Japan, and South Korea. Enterprises and government agencies are increasingly leveraging LoT platforms for logistics, asset management, and location-based analytics to improve operational efficiency and reduce costs. The region’s expanding IoT ecosystem and increasing affordability of LoT solutions are further propelling market growth.

Japan Location of Things Market Insight

The Japan LoT market is expected to witness the fastest growth from 2025 to 2032 due to the country’s high-tech infrastructure, demand for smart city solutions, and the need for advanced logistics and fleet management systems. Enterprises are adopting LoT platforms integrated with AI and cloud analytics for real-time tracking, predictive maintenance, and operational optimization. Japan’s aging population is also driving demand for location-aware healthcare and assisted living solutions.

China Location of Things Market Insight

China accounted for the largest revenue share in the Asia-Pacific LoT market in 2024, attributed to rapid urbanization, technological adoption, and large-scale implementation of smart city projects. LoT solutions are increasingly used in transportation, retail, industrial manufacturing, and government applications. Government initiatives supporting digital transformation, coupled with domestic technology providers, are accelerating market penetration and driving competitive growth in the region.

Location of Things Market Share

The Location of Things industry is primarily led by well-established companies, including:

- Bosch.IO GmbH (Germany)

- Alphabet Inc. (U.S.)

- IBM (U.S.)

- Microsoft (U.S.)

- Qualcomm Technologies, Inc. (U.S.)

- Apple Inc. (U.S.)

- Esri (U.S.)

- Wireless Logic (U.K.)

- UBISENSE (U.K.)

- Pitney Bowes Inc. (U.S.)

- HERE (Netherlands)

- TruePosition, Inc. (U.S.)

- Verizon (U.S.)

- TIBCO Software Inc. (U.S.)

- Zebra Technologies Corp. (U.S.)

- CenTrak (U.S.)

- Navigine (Russia)

- Geofeedia, Inc. (U.S.)

- Trimble (U.S.)

Latest Developments in Global Location of Things Market

- In August 2023, NEC, a Smart City Solutions provider, launched a new urban development project in India aimed at integrating advanced IoT and connectivity technologies. The initiative focuses on enhancing data-driven urban planning, optimizing resource utilization, and deploying innovative location-based services. By improving infrastructure and smart service capabilities, the project is set to drive the growth of the Location of Things market. It enables municipalities to make real-time decisions, improve operational efficiency, and support sustainable city management. The development also encourages adoption of advanced location intelligence solutions, boosting the overall technological ecosystem in the region

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.