Global Logistics Nodes Market

Market Size in USD Billion

CAGR :

%

USD

34.03 Billion

USD

100.53 Billion

2024

2032

USD

34.03 Billion

USD

100.53 Billion

2024

2032

| 2025 –2032 | |

| USD 34.03 Billion | |

| USD 100.53 Billion | |

|

|

|

|

Logistics Nodes Market Size

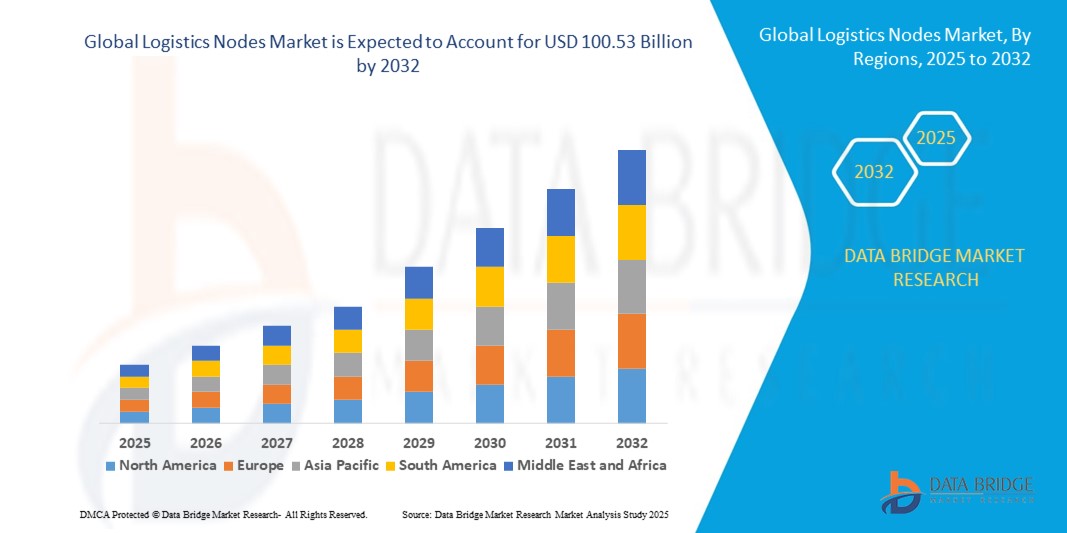

- The global logistics nodes market size was valued at USD 34.03 billion in 2024 and is expected to reach USD 100.53 billion by 2032, at a CAGR of 14.50% during the forecast period

- The market growth is primarily driven by increasing demand for efficient supply chain solutions, rising global trade, and the need for enhanced connectivity across transportation modes

- Growing adoption of advanced technologies, such as IoT, AI, and blockchain, for real-time tracking and optimization of logistics operations is further propelling market demand across various industries

Logistics Nodes Market Analysis

- The logistics nodes market is experiencing robust growth due to the rising need for seamless integration of transportation modes to support global supply chains and e-commerce expansion

- The surge in demand for faster and more reliable logistics solutions across automotive, retail, and healthcare sectors is encouraging investments in smart logistics infrastructure and automation

- Asia-Pacific dominates the logistics nodes market with the largest revenue share of 31.2% in 2024, driven by rapid industrialization, a booming e-commerce sector, and significant investments in logistics infrastructure in countries such as China, India, and Japan

- North America is expected to be the fastest-growing region during the forecast period, fueled by advancements in logistics technologies, increasing adoption of automation, and growing demand for efficient last-mile delivery solutions, particularly in the U.S. and Canada

- The road segment dominated the largest market revenue share of 39.0% in 2024, driven by its flexibility, cost-effectiveness, and extensive connectivity. Road transport enables seamless door-to-door delivery, making it ideal for e-commerce, retail, and perishable goods

Report Scope and Logistics Nodes Market Segmentation

|

Attributes |

Logistics Nodes Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Logistics Nodes Market Trends

Increasing Integration of AI and Big Data Analytics

- The global logistics nodes market is experiencing a significant trend toward integrating Artificial Intelligence (AI) and Big Data analytics

- These technologies enable advanced data processing and analysis, offering deeper insights into logistics operations, supply chain efficiency, and predictive demand forecasting

- AI-powered logistics solutions facilitate proactive decision-making, identifying bottlenecks or inefficiencies in transportation nodes before they disrupt operations

- For instance, companies are developing AI-driven platforms that optimize rotting across road, rail, air, and sea transport modes, factoring in real-time variables such as traffic, weather, and port congestion

- This trend enhances the efficiency and reliability of logistics nodes, making them more appealing to organizations of all sizes, particularly in high-demand verticals such as retail and e-commerce

- AI algorithms can analyze vast datasets, including shipment patterns, delivery times, and operational costs, to optimize resource allocation and reduce delays

Logistics Nodes Market Dynamics

Driver

Rising Demand for Efficient Supply Chains and Real-Time Tracking

- The growing demand for seamless, connected supply chain solutions, including real-time tracking, inventory management, and last-mile delivery, is a major driver for the global logistics nodes market

- Logistics nodes enhance operational efficiency by providing features such as automated cargo tracking, real-time shipment updates, and predictive delivery scheduling

- Government initiatives, particularly in the Asia-Pacific region, which dominates the market, are promoting smart logistics infrastructure to support growing trade volumes.

- The proliferation of IoT and advancements in 5G technology are further enabling logistics nodes to handle faster data transmission and lower latency, supporting sophisticated applications across transportation modes

- Large organizations, especially in automotive and retail sectors, are increasingly adopting integrated logistics node systems to streamline operations and meet customer expectations for faster delivery

Restraint/Challenge

High Implementation Costs and Data Security Concerns

- The growing demand for seamless, connected supply chain solutions, including real-time tracking, inventory management, and last-mile delivery, is a major driver for the global logistics nodes market

- Logistics nodes enhance operational efficiency by providing features such as automated cargo tracking, real-time shipment updates, and predictive delivery scheduling

- Government initiatives, particularly in the Asia-Pacific region, which dominates the market, are promoting smart logistics infrastructure to support growing trade volumes

- The proliferation of IoT and advancements in 5G technology are further enabling logistics nodes to handle faster data transmission and lower latency, supporting sophisticated applications across transportation modes (road, rail, air, and sea)

- Large organizations, especially in automotive and retail sectors, are increasingly adopting integrated logistics node systems to streamline operations and meet customer expectations for faster delivery

Logistics Nodes market Scope

The market is segmented on the basis of transportation mode, organization size, and vertical.

- By Transportation Mode

On the basis of transportation mode, the global logistics nodes market is segmented into road, rail, air, and sea. The road segment dominated the largest market revenue share of 39.0% in 2024, driven by its flexibility, cost-effectiveness, and extensive connectivity. Road transport enables seamless door-to-door delivery, making it ideal for e-commerce, retail, and perishable goods. The segment's dominance is further supported by advancements in telematics, GPS tracking, and route optimization, which enhance efficiency and reduce delivery times.

The air segment is expected to register the fastest growth rate from 2025 to 2032, propelled by the increasing demand for rapid delivery of high-value and time-sensitive goods. Air freight, including express air cargo and air logistics services, is critical for industries such as healthcare and electronics, where speed and reliability are paramount. The rise of global e-commerce and cross-border trade, coupled with investments in air cargo infrastructure, is driving this segment’s rapid expansion.

- By Organization Size

On the basis of organization size, the global logistics nodes market is categorized into large enterprises and small & medium enterprises (SMEs). The large enterprise segment accounted for the highest revenue share in 2024, fueled by the need for robust, scalable, and globally integrated logistics infrastructure. Large enterprises often operate across multiple regions, requiring logistics nodes that support multi-modal transportation, advanced warehousing, and seamless integration with supply chain management systems. The high transaction volumes and complex supply chains of these enterprises justify investments in automation, AI-driven analytics, and sustainable logistics solutions.

The SME segment is anticipated to grow at the fastest CAGR from 2025 to 2032, driven by the digital transformation of small businesses and their increasing participation in e-commerce. SMEs are adopting logistics nodes to streamline operations, reduce costs, and access global markets. Affordable, technology-driven solutions, such as cloud-based logistics platforms and API integrations, are enabling SMEs to scale efficiently without significant capital investment. The growing consumer demand for online shopping and last-mile delivery further accelerates this segment’s growth.

- By Vertical

On the basis of vertical, the global logistics nodes market is segmented into automotive, retail and e-commerce, healthcare, industrial, and others. The retail and e-commerce segment held the largest revenue share in 2024, attributed to the exponential growth of online shopping and the need for efficient, scalable logistics solutions. Logistics nodes play a critical role in reducing delivery times, optimizing last-mile delivery, and managing high-volume returns, which are essential for customer satisfaction in e-commerce. The adoption of automated warehouses and big data analytics further enhances the efficiency of this segment.

The healthcare segment is projected to grow at the fastest rate from 2025 to 2032, driven by the increasing demand for specialized logistics services, such as cold chain management and time-sensitive delivery of pharmaceuticals and medical devices. The rise of telemedicine, global healthcare supply chains, and stringent regulatory requirements for temperature-controlled logistics are key growth drivers. In addition, innovations in real-time tracking and IoT-enabled logistics nodes are supporting the sector’s rapid expansion, ensuring compliance and reliability in healthcare logistics.

Logistics Nodes Market Regional Analysis

- Asia-Pacific dominates the logistics nodes market with the largest revenue share of 31.2% in 2024, driven by rapid industrialization, a booming e-commerce sector, and significant investments in logistics infrastructure in countries such as China, India, and Japan

- The increasing adoption of logistics nodes in e-commerce, automotive, and healthcare verticals, along with government initiatives promoting smart transportation and infrastructure development, fuels market growth. The region’s dominance is further supported by advancements in sea and air transportation modes

Japan Logistics Nodes Market Insight

Japan’s logistics nodes market is witnessing significant growth, driven by consumer demand for high-quality, technology-driven logistics solutions and the presence of major automotive and electronics manufacturers. The integration of logistics nodes in OEM supply chains and the growing trend of aftermarket customization in retail and e-commerce sectors accelerate market penetration. Investments in rail and air transportation infrastructure further enhance market growth.

China Logistics Nodes Market Insight

China holds the largest share of the Asia-Pacific logistics nodes market, driven by rapid urbanization, increasing vehicle ownership, and a booming e-commerce sector. The country’s growing middle class and focus on smart mobility solutions support the adoption of advanced logistics nodes. Strong domestic manufacturing capabilities, competitive pricing, and government support for sustainable transportation infrastructure enhance market accessibility and growth.

U.S. Logistics Nodes Market Insight

The U.S. logistics nodes market is expected to witness significant growth, fueled by a strong e-commerce sector, technological innovation, and high demand for efficient last-mile delivery solutions. The trend toward automation and digitalization in logistics, coupled with rising consumer expectations for fast and reliable deliveries, boosts market growth. Investments in road and air transportation nodes, along with the integration of AI and IoT technologies, further enhance the U.S. market’s expansion.

Europe Logistics Nodes Market Insight

The European logistics nodes market is witnessing robust growth, driven by regulatory emphasis on sustainable transportation and increasing demand for efficient supply chain management. Countries such as Germany and France are key contributors, with significant investments in rail and road logistics nodes to support automotive and industrial sectors. The growing focus on green logistics and carbon-neutral transportation solutions is also accelerating the adoption of advanced logistics nodes across the region.

U.K. Logistics Nodes Market Insight

The U.K. market for logistics nodes is experiencing rapid growth, fueled by the rise of e-commerce and the need for efficient urban logistics solutions. Increased consumer demand for same-day delivery and sustainable transportation options drives the adoption of advanced logistics nodes. The U.K.’s focus on regulatory compliance and investments in rail and road infrastructure further supports market expansion, particularly in retail and e-commerce verticals.

Germany Logistics Nodes Market Insight

Germany is a key player in the European logistics nodes market, benefiting from its advanced manufacturing sector and strategic geographic position as a logistics hub. The country’s focus on energy-efficient transportation and smart logistics solutions, such as automated sorting and real-time tracking, drives market growth. The integration of logistics nodes in automotive and industrial verticals, combined with strong aftermarket demand, supports sustained market expansion.

Logistics Nodes Market Share

The logistics nodes industry is primarily led by well-established companies, including:

- United Parcel Service of America, Inc. (U.S.)

- Deutsche Post AG (Germany)

- FedEx (U.S.)

- A.P. Moller - Maersk (Denmark)

- Deutsche Bahn AG(Germany)

- C.H. Robinson Worldwide, Inc. (U.S.)

- XPO, Inc. (U.S.)

- Nippon Express Co., Ltd (Japan)

- YUSEN LOGISTICS CO., LTD (Japan)

- JDLogistics (China)

- DB Schenker (Germany)

- Expeditors International (U.S.)

- Sinotrans Logistics (China)

- GEODIS (France)

- Dachser Group SE & Co. KG (Germany)

- Penske Logistics (U.S.)

- Prologis Inc. (U.S.)

What are the Recent Developments in Global Logistics Nodes Market?

- In August 2025, DP World, a leading global supply chain solutions provider, launched two new domestic rail services in India connecting Bhimasar and Hazira in Gujarat to Kolkata in West Bengal. These services aim to accelerate cargo movement between western manufacturing hubs and eastern trade centers, supporting the "Make in India" initiative and enhancing regional integration. Each route operates twice monthly, with transit times of 7–8 days and a capacity of 90 TEUs. The initiative is part of DP World's rail freight infrastructure, reinforcing its commitment to building agile, multimodal logistics networks

- In May 2025, DP World unveiled a new integrated logistics and market-entry product specifically for vehicle manufacturers. The solution, initially developed and piloted with China's Foton Motor, is designed to help automotive original equipment manufacturers (OEMs) overcome entry barriers in sub-Saharan Africa by providing a turnkey platform that includes warehousing, distribution, regulatory compliance, and a digital dealer portal. This initiative highlights DP World's focus on creating tailored solutions for growing sectors in emerging markets

- In October 2024, GXO Logistics Inc., a prominent U.S.-based provider of contract logistics, acquired PFSweb. This strategic acquisition aimed to expand GXO's service offerings into high-growth sectors, particularly cosmetics and luxury goods. This move demonstrates the trend of large logistics companies seeking to diversify their portfolios and capture a larger share of the market by targeting specialized, high-value industries

- In March 2024, a study presented the "Smart Logistics Node" concept, which integrates physical logistics infrastructure with digital systems to enhance collaboration. The concept leverages data sharing, supporting infrastructure, and Connected and Automated Transport (CAT) technologies to improve efficiency, resilience, and sustainability within logistics networks. This development underscores the increasing focus on technology and digitalization to address modern logistics challenge

- In February 2024, DSV, a global transport and logistics company, announced its intent to acquire DB Schenker. This potential acquisition is a significant development in the market, as it would create one of the largest logistics providers globally and reflects the trend of industry consolidation through mega-deals. The move highlights a strategic focus on expanding global reach and strengthening competitive advantage through scale

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Logistics Nodes Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Logistics Nodes Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Logistics Nodes Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.