Global Long Term Evolution Lte Internet Of Things Market

Market Size in USD Billion

CAGR :

%

USD

3.66 Billion

USD

27.96 Billion

2024

2032

USD

3.66 Billion

USD

27.96 Billion

2024

2032

| 2025 –2032 | |

| USD 3.66 Billion | |

| USD 27.96 Billion | |

|

|

|

|

What is the Global Long-Term Evolution (LTE) Internet of Things (IoT) Market Size and Growth Rate?

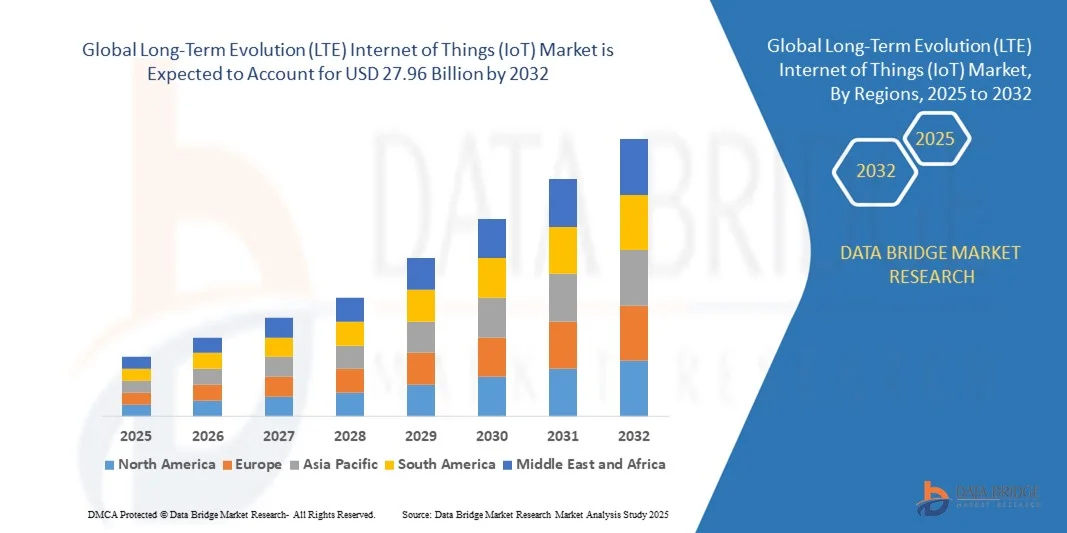

- The global long-term evolution (LTE) internet of things (IoT) market size was valued at USD 3.66 billion in 2024 and is expected to reach USD 27.96 billion by 2032, at a CAGR of 28.9% during the forecast period

- Easy deployment on the present cellular network infrastructure and growing demand for smart inventory management are the major factors that will influence the market growth rate

- Furthermore, surge in the demand for defined network qualities, surge in the number of connected devices and increase in the need for long range connectivity amongst IoT devices are the factors that will accelerate growth of the long-term evolution (LTE) internet of things (IoT) market

What are the Major Takeaways of Long-Term Evolution (LTE) Internet of Things (IoT) Market?

- Rise in the demand for safe connectivity for IoT applications will boost the beneficial opportunities for the long-term evolution (LTE) internet of things (IoT) market growth

- However, operation failure owing to network infrastructure upgrade will impede the long-term evolution (LTE) internet of things (IoT) market growth. Also, the incapability of protecting new forms of attacks will challenge the long-term evolution (LTE) internet of things (IoT) market

- Asia-Pacific dominated the long-term evolution (LTE) internet of things (IoT) market with the largest revenue share of 43.36% in 2024, driven by rapid urbanization, increasing digitalization, and growing investments in smart city initiatives

- The North America LTE IoT market is projected to grow at the fastest CAGR of 6.78% during 2025–2032, driven by widespread adoption of connected devices, smart manufacturing initiatives, and advanced industrial IoT applications

- The NB-IoT segment dominated the market with a revenue share of 55% in 2024, driven by its low-power wide-area (LPWA) capabilities, extended coverage in remote areas, and suitability for massive IoT deployments such as smart meters, environmental sensors, and asset tracking devices

Report Scope and Long-Term Evolution (LTE) Internet of Things (IoT) Market Segmentation

|

Attributes |

Long-Term Evolution (LTE) Internet of Things (IoT) Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Long-Term Evolution (LTE) Internet of Things (IoT) Market?

Seamless Connectivity and AI-Driven Automation

- A major and accelerating trend in the global long-term evolution (LTE) internet of things (IoT) market is the increasing integration of LTE networks with artificial intelligence (AI) and cloud-based platforms. This synergy is enhancing device interoperability, real-time analytics, and automated decision-making across industries

- For instance, Telstra’s LTE IoT modules allow smart infrastructure systems to collect and analyze data while connecting seamlessly with AI platforms, improving operational efficiency and predictive maintenance

- AI-driven LTE IoT solutions are capable of monitoring usage patterns, providing predictive alerts, and optimizing energy or resource consumption. Companies such as Sierra Wireless are deploying LTE IoT modules with AI-enabled telemetry for industrial applications

- The integration of LTE IoT with AI platforms enables centralized management of multiple devices, from smart meters to industrial sensors, delivering automated, responsive, and scalable solutions

- This trend of intelligent LTE IoT networks is reshaping enterprise expectations, leading providers such as Qualcomm Technologies to develop LTE IoT solutions that offer enhanced automation, predictive insights, and remote monitoring

- The demand for LTE IoT solutions with AI and cloud integration is surging in smart cities, industrial automation, and logistics, driven by the need for real-time monitoring and intelligent decision-making

What are the Key Drivers of Long-Term Evolution (LTE) Internet of Things (IoT) Market?

- Growing industrial digitalization and the increasing adoption of smart infrastructure are driving the demand for LTE IoT solutions. Organizations are seeking reliable connectivity and real-time data insights to optimize operations

- In April 2024, Vodafone Group Plc announced a rollout of LTE IoT solutions for smart city applications, highlighting how LTE networks can integrate traffic monitoring, street lighting, and utility management systems, which is expected to boost market growth

- LTE IoT devices provide remote monitoring, predictive maintenance, and enhanced operational efficiency, offering a substantial upgrade over legacy systems

- The rising preference for automated, connected systems in manufacturing, logistics, and healthcare is fostering LTE IoT adoption. LTE-based connectivity ensures consistent, low-latency communication for mission-critical applications

- The convenience of real-time data access, remote management, and integration with cloud platforms is propelling LTE IoT deployment across both commercial and industrial sectors. The growing trend of Industry 4.0 and smart infrastructure further accelerates market adoption

Which Factor is Challenging the Growth of the Long-Term Evolution (LTE) Internet of Things (IoT) Market?

- Cybersecurity concerns remain a significant barrier, as LTE IoT devices are susceptible to hacking, data breaches, and unauthorized access due to network connectivity and software reliance

- High-profile incidents of IoT vulnerabilities have made enterprises cautious about deploying LTE IoT networks without robust security measures

- Addressing security challenges through advanced encryption, authentication protocols, and firmware updates is critical for trust. Companies such as Ericsson emphasize cybersecurity features in their LTE IoT solutions to reassure clients

- High initial deployment costs of LTE IoT infrastructure compared to traditional monitoring systems can also hinder adoption, especially in small and medium enterprises or developing regions

- Although LTE IoT solutions are gradually becoming more cost-effective, the perceived premium of advanced AI and predictive analytics features may slow market penetration. Overcoming these barriers through affordable, secure, and scalable LTE IoT solutions is crucial for sustained growth

How is the Long-Term Evolution (LTE) Internet of Things (IoT) Market Segmented?

The market is segmented on the basis of technology, service, and industry.

- By Technology

On the basis of technology, the LTE IoT market is segmented into LTE-M and NB-IoT. The NB-IoT segment dominated the market with a revenue share of 55% in 2024, driven by its low-power wide-area (LPWA) capabilities, extended coverage in remote areas, and suitability for massive IoT deployments such as smart meters, environmental sensors, and asset tracking devices. NB-IoT is particularly preferred for its ability to support a large number of low-data-rate devices while minimizing operational costs and extending battery life for several years.

The LTE-M segment is expected to witness the fastest CAGR of 24% from 2025 to 2032, fueled by its higher data rates, mobility support, and enhanced features for applications such as connected vehicles, wearables, and real-time industrial monitoring. LTE-M’s combination of low latency, seamless handover, and integration with existing LTE networks is boosting adoption across commercial and industrial sectors.

- By Service

On the basis of service, the LTE IoT market is segmented into Professional Service and Managed Service. The Professional Service segment held the largest market revenue share of 60% in 2024, primarily due to enterprises requiring expert consultation, deployment, integration, and maintenance of LTE IoT solutions across diverse applications. These services ensure proper network configuration, compliance with industry standards, and optimization of IoT device connectivity for maximum efficiency.

The Managed Service segment is projected to witness the fastest CAGR of 22% from 2025 to 2032, driven by growing demand for end-to-end LTE IoT management solutions that reduce operational complexity, offer 24/7 monitoring, and enhance data security. Managed services provide companies with scalable, subscription-based offerings that support multiple devices, real-time analytics, and seamless upgrades without requiring in-house technical expertise.

- By Industry

On the basis of industry, the LTE IoT market is segmented into Manufacturing, Energy and Utilities, Transportation and Logistics, Healthcare, and Agriculture. The Manufacturing segment dominated the market with a revenue share of 52% in 2024, fueled by the adoption of LTE IoT for predictive maintenance, smart factory automation, and real-time production monitoring. LTE IoT enables manufacturers to optimize equipment performance, reduce downtime, and enhance operational efficiency.

The Transportation and Logistics segment is expected to witness the fastest CAGR of 26% from 2025 to 2032, driven by the growing need for fleet management, cold chain monitoring, and supply chain tracking solutions. LTE IoT allows transportation companies to track vehicles, cargo, and assets in real-time, improving delivery accuracy, reducing operational costs, and ensuring compliance with safety and regulatory standards.

Which Region Holds the Largest Share of the Long-Term Evolution (LTE) Internet of Things (IoT) Market?

- Asia-Pacific dominated the long-term evolution (LTE) internet of things (IoT) market with the largest revenue share of 43.36% in 2024, driven by rapid urbanization, increasing digitalization, and growing investments in smart city initiatives

- Consumers and businesses in the region highly value the efficiency, scalability, and cost-effectiveness offered by LTE IoT solutions for applications across manufacturing, energy, transportation, and agriculture

- This widespread adoption is further supported by the expansion of domestic manufacturing capabilities, rising disposable incomes, and government programs promoting IoT infrastructure, positioning LTE IoT as a key enabler of industrial and residential digital transformation

China Long-Term Evolution (LTE) Internet of Things (IoT) Market Insight

The China LTE IoT market accounted for the largest share in Asia-Pacific in 2024, driven by its rapidly expanding middle class, high technological adoption, and focus on smart city projects. LTE IoT solutions are increasingly deployed across urban transportation, industrial automation, and utility management, offering real-time monitoring, predictive maintenance, and operational efficiency. The presence of leading domestic manufacturers and supportive government policies further propel market growth.

Japan Long-Term Evolution (LTE) Internet of Things (IoT) Market Insight

The Japan LTE IoT market is witnessing steady growth due to high technological maturity, rapid urbanization, and a strong focus on industrial automation. The aging population also encourages the adoption of user-friendly LTE IoT solutions in healthcare and smart homes. Integration with other IoT devices, such as sensors and monitoring systems, enhances operational efficiency and convenience for both commercial and residential sectors.

Which Region is the Fastest Growing Region in the Long-Term Evolution (LTE) Internet of Things (IoT) Market?

The North America LTE IoT market is projected to grow at the fastest CAGR of 6.78% during 2025–2032, driven by widespread adoption of connected devices, smart manufacturing initiatives, and advanced industrial IoT applications. The growing emphasis on cybersecurity, remote monitoring, and real-time analytics is boosting demand. The U.S. and Canada are investing heavily in 5G networks, which further enhances LTE IoT deployment, allowing enterprises to leverage scalable, efficient, and highly connected systems across multiple sectors.

U.S. Long-Term Evolution (LTE) Internet of Things (IoT) Market Insight

The U.S. LTE IoT market captured the largest share in North America in 2024, fueled by industrial IoT adoption, smart grid modernization, and connected vehicle solutions. The integration of LTE IoT with cloud platforms and AI analytics enables enterprises to optimize operations, reduce downtime, and improve efficiency across manufacturing, healthcare, and transportation sectors.

Canada Long-Term Evolution (LTE) Internet of Things (IoT) Market Insight

The Canada LTE IoT market is growing steadily with increasing industrial automation and smart city projects. LTE IoT adoption in energy, logistics, and healthcare sectors is driven by the need for enhanced monitoring, predictive maintenance, and operational efficiency. Government incentives and technology-friendly policies further accelerate market growth across the country.

Which are the Top Companies in Long-Term Evolution (LTE) Internet of Things (IoT) Market?

The long-term evolution (LTE) internet of things (IoT) industry is primarily led by well-established companies, including:

- Vodafone Group Plc (U.K.)

- Telefonaktiebolaget LM Ericsson (Sweden)

- T-Mobile USA, Inc. (U.S.)

- Telstra (Australia)

- Orange Business Services (France)

- Sierra Wireless (Canada)

- PureSoftware (U.S.)

- SEQUANS (France)

- TELUS (Canada)

- MediaTek Inc (Taiwan)

- Athonet srl (Italy)

- NetNumber Inc. (U.S.)

- Telensa (U.K.)

- Actility S.A. (France)

- LINK LABS (U.S.)

- Telia Company (Sweden)

- Accent Advanced Systems, SLU (Spain)

- Halberd Bastion Pty Ltd (Australia)

- Qualcomm Technologies, Inc. (U.S.)

- u-blox (Switzerland)

What are the Recent Developments in Global Long-Term Evolution (LTE) Internet of Things (IoT) Market?

- In July 2022, ZTE Corporation (0763. HK / 000063.SZ), a leading global provider of telecommunications, enterprise, and consumer technology solutions for the mobile internet, signed a cooperation agreement with Banglalink, a prominent private operator in Bangladesh, for the 2.3 GHz spectrum. This collaboration enables Banglalink to leverage ZTE’s advanced products and technologies to enhance customer experiences and continually improve network speed and coverage across the country, strengthening the overall telecom infrastructure in Bangladesh

- In May 2022, Qualcomm Technologies, Inc. unveiled its next-generation powerline communication (PLC) device, the QCA7006AQ, designed to support the growing need for vehicle-to-charging station smart-grid communications for electric vehicles. The device addresses the expanding requirements of electric vehicle supply equipment (EVSE), enabling faster, more reliable, and efficient communication between EVs and charging stations, thus accelerating the adoption of connected and sustainable EV infrastructure

- In April 2022, Sierra Wireless (NASDAQ, SWIR; TSX, SW), a global IoT solutions provider, announced the launch of its next-generation 5G mobile broadband embedded modules, the RF-optimized EM92 Series. These modules are designed to serve the most demanding industrial, networking, and business-critical IoT applications, enhancing performance, reliability, and connectivity for enterprise and industrial use cases worldwide

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.