Global Loss Of Libido Treatment Market

Market Size in USD Billion

CAGR :

%

USD

3.60 Billion

USD

5.31 Billion

2025

2033

USD

3.60 Billion

USD

5.31 Billion

2025

2033

| 2026 –2033 | |

| USD 3.60 Billion | |

| USD 5.31 Billion | |

|

|

|

|

Loss of Libido Treatment Market Size

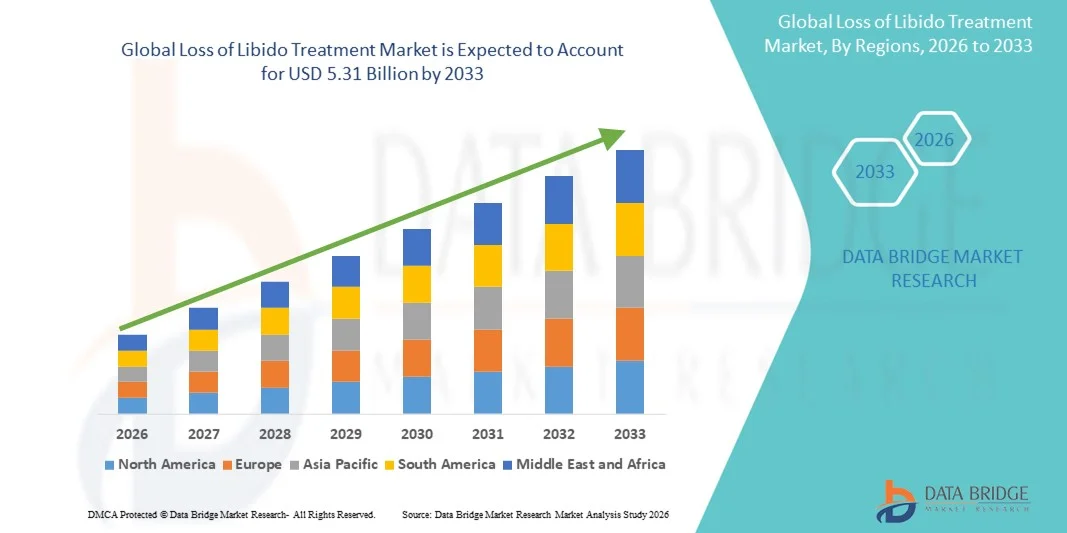

- The global loss of libido treatment market size was valued at USD 3.60 billion in 2025 and is expected to reach USD 5.31 billion by 2033, at a CAGR of 5.00% during the forecast period

- The market growth is largely fueled by increasing awareness of sexual health issues, rising prevalence of hormonal imbalances, and growing acceptance of therapeutic interventions for sexual dysfunction among both men and women

- Furthermore, expanding availability of advanced treatment options, including hormonal therapies, prescription medications, and alternative therapies, is driving demand. These converging factors are accelerating the adoption of loss of libido treatments, thereby significantly boosting the industry's growth

Loss of Libido Treatment Market Analysis

- Loss of libido treatments, encompassing flibanserin, bremelanotide, hormone therapy, counseling, and other interventions, are increasingly essential in managing sexual dysfunction in both men and women due to their effectiveness in restoring sexual desire, improving quality of life, and addressing underlying physiological and psychological causes

- The escalating demand for these treatments is primarily fueled by rising awareness of sexual health, increasing prevalence of hormonal imbalances and psychological stress, and growing acceptance of medical interventions for sexual dysfunction

- North America dominated the loss of libido treatment market with the largest revenue share of 38.5% in 2025, characterized by early adoption of sexual health therapies, well-established healthcare infrastructure, and a strong presence of key pharmaceutical players, with the U.S. witnessing substantial growth in treatment uptake, driven by innovations in flibanserin and bremelanotide therapies

- Asia-Pacific is expected to be the fastest-growing region in the loss of libido treatment market during the forecast period due to rising awareness of sexual wellness, increasing healthcare access, and growing acceptance of modern therapeutic approaches

- Hormone therapy segment dominated the loss of libido treatment market with a market share of 45.7% in 2025, driven by its proven efficacy in addressing hormonal deficiencies and its established position as a frontline therapeutic option

Report Scope and Loss of Libido Treatment Market Segmentation

|

Attributes |

Loss of Libido Treatment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Loss of Libido Treatment Market Trends

Rising Adoption of Personalized and Multimodal Sexual Wellness Therapies

- A significant and accelerating trend in the global loss of libido treatment market is the growing shift toward personalized, multimodal therapeutic approaches that combine hormonal, psychological, and lifestyle-based interventions to improve treatment precision and overall outcomes

- For instance, Flibanserin- and Bremelanotide-based therapies are increasingly being paired with individualized counseling programs to address both physiological and emotional triggers of low libido

- AI-enabled digital health platforms now analyze patient symptoms, hormonal patterns, and behavioral inputs to offer tailored treatment recommendations and monitor progress, helping clinicians optimize therapy plans

- The integration of virtual counseling, remote diagnostics, and app-based tracking tools enables seamless continuity of care, particularly for individuals hesitant to seek in-person sexual health consultations

- This trend toward holistic, data-driven, and highly personalized care is reshaping expectations in sexual wellness, prompting companies to develop hybrid therapy models combining medication, telehealth, and behavioral support

- The demand for customized libido treatment pathways is rapidly increasing across both male and female patient groups as consumers increasingly prioritize privacy, convenience, and clinically validated outcomes

- A growing trend toward natural and plant-based sexual wellness supplements is emerging as consumers seek safer, non-pharmacological options with fewer side effects, driving companies to expand research into herbal libido-enhancing formulations

- For instance, digital sexual wellness brands are integrating wearable device data such as stress indicators and sleep patterns into treatment algorithms to improve personalization and enhance therapy effectiveness.

Loss of Libido Treatment Market Dynamics

Driver

Growing Treatment Demand Due to Rising Sexual Health Awareness and Expanding Therapeutic Options

- The increasing awareness of sexual health issues among both men and women, coupled with expanding access to specialized treatments, is a significant driver of the rising demand for loss of libido therapies

- For instance, in 2025, several pharmaceutical companies advanced research on hormone-based and neuromodulator therapies aimed at addressing complex biological contributors to reduced sexual desire

- As consumers become more knowledgeable about sexual wellness and treatment options, evidence-based therapies such as Flibanserin, Bremelanotide, and hormone regulation solutions are gaining strong traction

- Furthermore, the growing acceptance of sexual health consultations and the integration of libido treatments within broader wellness programs are making clinical care more accessible and socially normalized

- The convenience of oral and injectable therapies, along with virtual counseling services and remote diagnosis tools, is propelling treatment uptake across diverse demographic groups. The expansion of online pharmacies and telehealth-powered care pathways further supports market growth

- Rising mental health awareness is also fueling demand, as more patients understand the link between psychological factors such as stress, depression, and relationship strain—and reduced libido, driving greater adoption of counseling-based treatments

- For instance, employers and insurance providers are increasingly incorporating sexual wellness benefits into healthcare plans, expanding access to libido treatments for a wider patient population and supporting sustainable market expansion

Restraint/Challenge

Side-Effect Concerns and Regulatory Compliance Hurdle

- Concerns surrounding potential side effects associated with pharmacological libido treatments, including nausea, fatigue, and blood pressure fluctuations, pose a significant barrier to broader adoption

- For instance, reports of adverse reactions in early-stage clinical studies have made some patients cautious about using prescription-based libido enhancement therapies

- Addressing these safety concerns through improved formulations, clearer risk communication, and extensive post-market surveillance is essential for building patient confidence. Companies offering Flibanserin and Bremelanotide emphasize clinical safety data and proper dosage guidance to reassure users

- In addition, stringent regulatory requirements for sexual health medications and the need for extensive clinical validation often result in longer approval timelines and higher development costs for manufacturers

- While innovative therapies continue to emerge, regulatory standards and lingering safety perceptions can still slow adoption, especially among first-time users or those seeking non-pharmacological alternatives

- Concerns surrounding the potential dependency on long-term hormonal treatments pose another challenge, as prolonged use may lead to metabolic fluctuations or decreased natural hormone production, limiting patient willingness to initiate or continue therapy

- Limited awareness and stigma related to sexual health in certain regions also slow market penetration, as cultural barriers often discourage individuals from seeking diagnosis or treatment for low libido

Loss of Libido Treatment Market Scope

The market is segmented on the basis of treatment, diagnosis, symptoms, dosage, route of administration, end-users, and distribution channel.

- By Treatment

On the basis of treatment, the global loss of libido treatment market is segmented into flibanserin, bremelanotide, hormone therapy, counseling, and others. The hormone therapy segment dominated the loss of libido treatment market with a market share of 45.7% in 2025, driven by its effectiveness in addressing hormonal imbalances that are among the most common underlying causes of low sexual desire. Hormone therapies such as testosterone replacement, estrogen therapy, and combination hormone protocols are widely prescribed in both men and women, supporting their strong clinical adoption. The segment benefits from extensive research backing and long-standing physician familiarity with hormonal management in sexual dysfunction. Growing demand from aging populations and rising awareness of menopausal and andropausal symptoms further strengthen its leadership. Hormone therapy’s availability across hospitals, clinics, and specialized hormone centers increases accessibility and enhances patient uptake

The Bremelanotide segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by its on-demand dosing benefits and strong efficacy in women who prefer flexible use rather than daily medication. Clinical trials demonstrating rapid onset of action strengthen its appeal among both patients and healthcare providers. Its unique melanocortin receptor mechanism allows it to target desire pathways without altering hormonal levels, expanding its acceptance among patients cautious of hormone-related therapies. Increasing availability across specialty pharmacies and commercialization efforts in multiple regions further support rapid uptake. As awareness grows and more prescribers gain experience with the drug, Bremelanotide is expected to deliver the strongest CAGR within the treatment category.

- By Diagnosis

On the basis of diagnosis, the market is segmented into blood tests, pelvic exam, and others. Blood tests dominated the diagnosis segment in 2025 due to their essential role in identifying hormonal imbalances, thyroid issues, and underlying metabolic factors contributing to low libido. Physicians rely heavily on blood tests to rule out medical causes such as low testosterone, anemia, and vitamin deficiencies, making them a routine first-line diagnostic tool. Their wide availability across hospitals, clinics, and diagnostic centers increases patient access and affordability. Moreover, advancements in hormone panel testing and greater integration with digital lab platforms support broader clinical adoption. As personalized treatment becomes more important, blood tests continue to serve as the foundation for tailoring therapy. These reasons reinforce their leadership in the diagnosis segment.

The pelvic exam segment is projected to grow at the fastest rate from 2026 to 2033 due to rising recognition of gynecological factors such as vaginal atrophy, infections, and pelvic disorders that can contribute to diminished libido. Healthcare providers increasingly include pelvic exams as part of comprehensive sexual health assessments, especially among women experiencing pain or discomfort during intercourse. Growing public health initiatives related to reproductive health drive greater screening participation, supporting segment expansion. The approach’s non-invasive nature and ability to identify structural or physiological issues make pelvic exams increasingly valuable. With more women seeking care for libido-related concerns, pelvic exams are becoming a central component of diagnostic pathways. These trends contribute to its superior growth prospects.

- By Symptoms

On the basis of symptoms, the market is segmented into includes depression, anxiety, fatigue, and others. Depression dominated the symptoms segment in 2025 as it is one of the most commonly associated psychological factors reducing libido across both men and women. Antidepressant-induced sexual dysfunction also amplifies market demand for libido-specific treatments. Growing mental health awareness worldwide has driven increased diagnosis of depressive disorders, indirectly increasing the number of individuals seeking libido-related care. Healthcare providers often identify libido loss as one of the major secondary symptoms when evaluating mood disorders, which further builds segment strength. The high prevalence of depression among reproductive-age adults supports steady demand within this category. Increased integration of mental health evaluation in sexual wellness clinics also drives segment dominance.

The anxiety segment is expected to witness the fastest growth from 2026 to 2033 due to rising lifestyle stress, workplace pressure, and relationship-related concerns that significantly impact sexual desire. Patients with anxiety disorders frequently report reduced libido, leading to increased need for targeted treatment interventions. Therapy adoption among younger populations, who are more open to seeking psychological support, further accelerates growth. Digital mental health platforms, online counseling, and telemedicine services are making anxiety management more accessible, indirectly boosting libido diagnosis and treatment. As public understanding of the link between anxiety and sexual well-being improves, this category is projected to expand rapidly. These drivers position anxiety as the fastest-growing symptom segment.

- By Dosage Form

On the basis of dosage form, the market is segmented into tablet, injection, and others. The tablet segment dominated the market in 2025 due to strong patient preference for oral therapies such as Flibanserin and various hormonal medications. Tablets offer ease of administration, convenience, and predictable dosing, making them the most widely prescribed option among clinicians. Many leading pharmaceutical companies focus on tablet-form drugs, supporting widespread availability across pharmacies. Tablets also ensure better patient compliance compared with invasive or time-consuming dosage forms. Cost-effectiveness and broad insurance coverage for oral medications further strengthen demand. As oral therapies remain the first-line option in loss of libido treatment, the tablet category continues to lead.

The injection segment is anticipated to grow at the fastest CAGR from 2026 to 2033, driven primarily by the expanding use of injectable Bremelanotide and certain hormone therapies. Injections allow for rapid absorption and faster onset of action, which appeals to patients seeking immediate symptom relief. The increasing shift toward on-demand treatments supports growth within the injectable category. Technological improvements in autoinjectors and prefilled syringes are making administration easier and safer. As more clinical trials evaluate long-acting injectable libido treatments, market momentum continues to build. These factors contribute to the strong projected growth of injectable dosage forms.

- By Route of Administration

On the basis of route of administration, the market is segmented into oral, intravenous, and others. The oral route dominated in 2025 because most widely used libido-enhancing therapies, including Flibanserin and several hormone-based medicines, are administered orally. Patients prefer oral medication due to convenience, familiarity, and non-invasive usage. Pharmaceutical companies prioritize oral formulations because they support high manufacturing scalability and lower distribution costs. Oral therapies also exhibit strong adherence rates, which positively impacts treatment outcomes. Expanded availability in retail and online pharmacies further supports market dominance. As oral medications continue to be the standard treatment modality, this route maintains the leading market share.

The intravenous segment is projected to grow the fastest from 2026 to 2033 due to increasing use of IV hormone therapies and nutrient infusions in wellness clinics. Many IV protocols aim to address deficiencies linked to low libido, such as vitamin, mineral, or amino acid deficits, which attract patients seeking comprehensive wellness solutions. The rise of medical spas and integrative health centers offering IV libido-boosting therapies contributes to this growth. IV administration delivers rapid systemic absorption, making it appealing for individuals requiring immediate therapeutic effects. Though niche, rising consumer interest in premium health optimization services supports segment acceleration. As wellness-based IV therapies expand globally, this route shows strong future growth.

- By End-Users

On the basis of end users, the market is segment include clinics, hospitals, and others. Clinics dominated the market in 2025, supported by the rapid expansion of sexual wellness centers, gynecology clinics, urology practices, and hormone therapy clinics. These facilities specialize in diagnosing and treating libido-related issues, making them the preferred choice for patients seeking personalized care. Clinic-based settings provide privacy and convenience, encouraging more individuals to seek treatment. Many clinics also offer comprehensive services including counseling, hormonal evaluations, and follow-up therapy plans, strengthening their market role. The rise of boutique hormone clinics and telehealth-supported clinic networks further supports this dominance. These attributes ensure clinics remain the leading end-user category.

The hospital segment is anticipated to show the fastest growth from 2026 to 2033 due to increasing recognition of libido loss as a symptom associated with chronic illness, endocrine disorders, and mental health conditions treated in hospital settings. Hospitals offer multidisciplinary evaluation, allowing them to manage complex cases requiring integrated care. Growing hospital-based sexual medicine departments and specialized endocrine units also boost treatment demand. With more patients undergoing comprehensive diagnostic panels for chronic diseases, hospitals increasingly identify libido-related concerns. In addition, expansion of outpatient sexual health programs in hospitals contributes to accelerated adoption. These developments position hospitals as the fastest-growing end-user segment.

- By Distribution Channel

On the basis of distribution channel, the market includes hospital pharmacy, retail pharmacy, and online pharmacy. Hospital pharmacies dominated in 2025 due to strong physician-driven prescribing patterns in hospital settings, especially for hormone therapies and injectable libido treatments. Patients treated for underlying medical conditions often receive prescriptions directly through hospital pharmacies, ensuring controlled and safe dispensing. Hospital pharmacies maintain streamlined procurement systems for specialized medications, supporting high availability. The involvement of hospital-based sexual health programs further reinforces reliance on hospital dispensing channels. Strong clinical oversight in hospitals increases patient trust in obtaining medications through these pharmacies. These factors collectively contribute to hospital pharmacies’ leading market share.

The online pharmacy segment is expected to witness the fastest growth from 2026 to 2033 due to the rising preference for privacy when purchasing libido-related medications. Digital platforms offer discreet delivery, price transparency, and broad product availability, which significantly appeals to consumers. The expansion of teleconsultation services integrated with online pharmacies accelerates prescription fulfillment. As regulatory reforms in many countries support legal online medicine sales, consumer confidence continues to rise. Online pharmacies also market wellness supplements and hormonal products more aggressively than offline channels. These advantages position online pharmacies as the fastest-growing distribution channel

Loss of Libido Treatment Market Regional Analysis

- North America dominated the loss of libido treatment market with the largest revenue share of 38.5% in 2025, characterized by early adoption of sexual health therapies, well-established healthcare infrastructure, and a strong presence of key pharmaceutical players, with the U.S. witnessing substantial growth in treatment uptake, driven by innovations in flibanserin and bremelanotide therapies

- Consumers in the region increasingly seek professional guidance for sexual wellness, supported by open conversations around mental health, hormonal imbalance, and lifestyle-related issues that impact libido

- The market is further strengthened by well-established healthcare infrastructure, high diagnosis rates, and the presence of specialized clinics offering personalized sexual health therapies

U.S. Loss of Libido Treatment Market Insight

The U.S. loss of libido treatment market captured the largest revenue share within North America in 2025, driven by high awareness of sexual wellness, strong availability of prescription therapies, and widespread access to hormone replacement treatments. Consumers increasingly seek medical solutions for sexual dysfunction as openness toward discussing intimacy and mental health continues to rise. The growing adoption of telehealth platforms is making counseling, consultations, and prescription refills more accessible. Moreover, rising diagnosis of hormonal imbalances, menopause, and antidepressant-induced sexual dysfunction significantly boosts treatment demand. The integration of digital health tools for sexual wellness monitoring is further propelling market growth across both men and women.

Europe Loss of Libido Treatment Market Insight

The Europe loss of libido treatment market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by strong healthcare infrastructure, standardized diagnostic practices, and growing emphasis on holistic sexual wellness. Increasing urbanization and heightened stress levels contribute to rising cases of libido-related concerns. European consumers are becoming more receptive to professional counseling, hormone therapy, and combination treatment programs that improve both physical and psychological factors. The region is witnessing notable adoption across gynecology clinics, urology centers, and sexual health facilities, supported by favorable reimbursement structures. Treatment integration into both new digital health ecosystems and established clinical pathways further accelerates market expansion.

U.K. Loss of Libido Treatment Market Insight

The U.K. loss of libido treatment market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by a rising focus on mental health, hormonal wellbeing, and sexual health education. Increasing cases of stress, anxiety, and lifestyle-related disorders continue to elevate the need for libido-enhancing therapies. Concerns regarding relationship satisfaction and overall wellness are encouraging individuals to pursue medical and therapeutic interventions. The U.K.’s robust digital healthcare system, including online prescription services and virtual sexual health consultations, is supporting widespread accessibility. These factors collectively create strong momentum for treatment adoption across both men and women.

Germany Loss of Libido Treatment Market Insight

The Germany loss of libido treatment market is expected to expand at a considerable CAGR during the forecast period, supported by increasing awareness of hormonal health and rising acceptance of psychological counseling for sexual dysfunction. Germany’s advanced healthcare infrastructure and emphasis on preventive wellness promote early diagnosis of underlying conditions linked to loss of libido. Demand is particularly strong for hormone therapies, personalized treatment plans, and integrative medical approaches that combine psychological and physiological care. The country’s preference for evidence-based and privacy-focused solutions aligns well with medically supervised libido treatments. Growing digitalization in healthcare also supports easier access to therapy and monitoring tools.

Asia-Pacific Loss of Libido Treatment Market Insight

The Asia-Pacific loss of libido treatment market is poised to grow at the fastest CAGR during 2026 to 2033, driven by rapid urbanization, changing lifestyle patterns, and increasing awareness of sexual health across major countries such as China, India, and Japan. Rising disposable incomes and growing acceptance toward discussing intimate health issues are enabling more individuals to seek clinical treatment. Governments and private healthcare providers are investing in digital health platforms, making counseling and hormone therapy more accessible. As APAC emerges as a major hub for wellness products and supplements, affordability and availability of libido-related treatments are improving across diverse population segments.

Japan Loss of Libido Treatment Market Insight

The Japan loss of libido treatment market is gaining momentum due to the country’s aging population, high stress levels, and strong cultural emphasis on health and longevity. Rising menopause- and andropause-related symptoms are significantly increasing demand for hormone therapy and clinical evaluation of libido issues. Japan’s advanced digital ecosystem supports widespread integration of telehealth, IoT-based health monitoring, and online counseling, further encouraging treatment adoption. In addition, increasing awareness of mental health’s impact on libido is leading to greater uptake of combined psychological and medical interventions. These dynamics position Japan as a key growth market within the region.

India Loss of Libido Treatment Market Insight

The India loss of libido treatment market accounted for a major revenue share within Asia-Pacific in 2025, driven by rapid urbanization, rising income levels, and increased openness toward sexual wellness. As one of the fastest-growing markets for telemedicine and digital health, India is witnessing strong demand for virtual sexual health consultations, hormonal evaluations, and counseling services. The growing middle-class population is increasingly seeking treatments for stress-induced sexual dysfunction, hormonal imbalance, and fatigue. Government initiatives supporting healthcare digitalization and the presence of emerging domestic pharmaceutical players are also propelling market expansion. These factors collectively strengthen India’s position as a leading market in the region.

Loss of Libido Treatment Market Share

The Loss of Libido Treatment industry is primarily led by well-established companies, including:

- AbbVie Inc. (U.S.)

- Pfizer Inc. (U.S.)

- Eli Lilly and Company (U.S.)

- GSK plc (U.K.)

- Teva Pharmaceutical Industries Ltd. (Israel)

- Sprout Pharmaceuticals, Inc. (U.S.)

- Palatin Technologies, Inc. (U.S.)

- Bayer AG (Germany)

- AMAG Pharmaceuticals, Inc. (U.S.)

- Endoceutics, Inc. (U.S.)

- Emotional Brain (Netherlands)

- S1 Biopharma (U.S.)

- Trimel Pharmaceuticals (U.S.)

- Novo Nordisk A/S (Denmark)

- Mithra Pharmaceuticals (Belgium)

- Allergan plc (Ireland)

- VIVUS, Inc. (U.S.)

- Duchesnay Inc. (Canada)

- Cipla (India)

- Dr Reddy’s Laboratories Ltd. (India)

What are the Recent Developments in Global Loss of Libido Treatment Market?

- In June 2024, Bremelanotide (in combination with a phosphodiesterase‑5 inhibitor) entered a Phase 2 clinical trial for erectile dysfunction (ED) in PDE5i non‑responders an expansion of its use beyond female hypoactive sexual desire disorder. This move is important because it reflects a strategic repositioning: a libido‑modulating therapy being tested for a broader sexual‑dysfunction indication, which could enlarge the molecule’s commercial footprint and encourage further investment in R&D and marketing

- In January 2024, Cosette Pharmaceuticals acquired Vyleesi from Palatin a strategic industry-level transaction: Cosette, a women’s‑health–focused specialty pharma, took over the product, gaining all associated patents and commercial rights. This acquisition may accelerate marketing, distribution, and awareness of libido‑treatment in broader geographies

- In August 2023, Palatin initiated a new clinical program to evaluate bremelanotide in combination with a PDE5 inhibitor (PDE5i) for erectile dysfunction (ED) in PDE5i non-responders indicating research expansion beyond female HSDD into broader sexual‑dysfunction markets. It reflects strategic repositioning of the drug’s mechanism toward male sexual dysfunction, which could broaden the overall commercial footprint of the molecule

- In February 2023, Palatin secured a new U.S. patent broadening the use of Vyleesi to include patients with controlled hypertension: U.S. Patent No. 11,590,209 covers use of bremelanotide injection in hypoactive sexual desire disorder (HSDD) among patients with controlled hypertension. This development reinforces the IP and commercial defensibility of Vyleesi, signaling to investors and potential marketing partners that the product enjoys patent‑backed exclusivity for an extended period

- In October 2022, Palatin published a clinical neuroscience study demonstrating that Vyleesi affects brain activity tied to sexual desire: the fMRI study (“Melanocortin 4 receptor agonism enhances sexual brain processing in women with HSDD”) showed significant enhancement of sexual‑brain processing and increased sexual desire up to 24 hours post-dosing vs placebo

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.