Global Low Pressure Separators Market

Market Size in USD Billion

CAGR :

%

USD

1.92 Billion

USD

3.01 Billion

2024

2032

USD

1.92 Billion

USD

3.01 Billion

2024

2032

| 2025 –2032 | |

| USD 1.92 Billion | |

| USD 3.01 Billion | |

|

|

|

|

Low-Pressure Separators Market Size

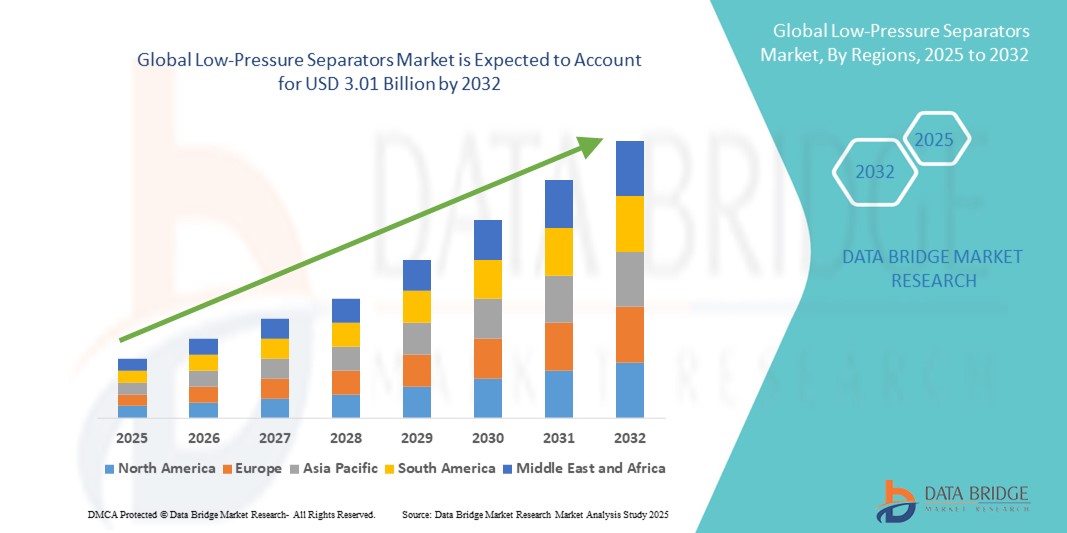

- The global low-pressure separators market size was valued at USD 1.92 billion in 2024 and is expected to reach USD 3.01 billion by 2032, at a CAGR of 5.8% during the forecast period

- The market growth is largely fueled by the rising demand for efficient oil, gas, and water separation systems, driven by increasing upstream exploration activities and the need for enhanced production efficiency in both onshore and offshore operations

- Furthermore, growing investments in unconventional energy sources, coupled with strict environmental regulations requiring effective fluid separation and disposal, are accelerating the adoption of advanced low-pressure separator systems, thereby significantly boosting the industry's growth

Low-Pressure Separators Market Analysis

- Low-pressure separators are essential production equipment used to separate well fluids into gas, oil, and water phases under reduced pressure conditions. These systems are widely deployed in oilfields to ensure stable flow, reduce emissions, and improve equipment performance downstream

- The rising demand for low-pressure separators is primarily driven by increasing global energy consumption, continued investment in mature and marginal oilfields, and the adoption of separation technologies that enhance process reliability and reduce operational risks

- North America dominated the low-pressure separators market with a share of 37.6% in 2024, due to a surge in upstream oil and gas activities and investments in shale exploration

- Asia-Pacific is expected to be the fastest growing region in the low-pressure separators market during the forecast period due to rising energy demand, rapid industrialization, and increasing investments in oil and gas exploration across emerging economies

- Oil and gas segment dominated the market with a market share of 75.3% in 2024, due to the high demand for efficient phase separation systems in upstream operations. Oilfield operators prioritize low-pressure separators for their ability to separate production fluids into oil, gas, and water, ensuring optimal reservoir management and downstream processing efficiency

Report Scope and Low-Pressure Separators Market Segmentation

|

Attributes |

Low-Pressure Separators Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Low-Pressure Separators Market Trends

“Increasing Energy Demand”

- The low-pressure separators market is expanding due to rising global energy demand, which fuels the need for efficient separation of oil, gas, and water phases in upstream and midstream oil and gas operations

- For instance, companies such as Emerson Electric Co., Schlumberger Limited, and Honeywell International Inc. are developing advanced low-pressure separator systems with integrated automation and smart sensors to enhance separation efficiency while supporting growing energy production requirements

- Increasing exploration and production activities, especially in mature and unconventional fields, drive deployment of separators that optimize hydrocarbon recovery while managing operational safety implications

- Rising regulations require optimized separation to minimize environmental impact via better gas flaring reduction and produced water handling, further elevating the demand for sophisticated low-pressure separators

- The trend toward modular and compact separator designs enables easier installation in remote or offshore facilities, aligning with the expanding energy infrastructure globally

- Adoption of digital technologies such as IoT and real-time monitoring improves operational uptime, predictive maintenance, and performance analytics, making low-pressure separators more efficient and reliable

Low-Pressure Separators Market Dynamics

Driver

“Advancements in Oil and Gas Recovery Technologies”

- Technological improvements in enhanced oil recovery (EOR), artificial lift systems, and multiphase processing are increasing the need for more efficient phase separation at low pressures

- For instance, operators integrating solutions from companies such as Schlumberger, Baker Hughes, and Aker Solutions leverage state-of-the-art low-pressure separators with smart controls and improved fluid handling to increase oil and gas recovery rates and optimize field economics

- Developments in separation technologies allow handling of complex fluid compositions and harsher operating environments, essential for deepwater, shale, and tight oil plays

- The integration of separators into automated process systems reduces downtime and maintenance costs, improving overall operational efficiency

- Innovations in materials and design reduce internal corrosion and wear, extending equipment lifespan and supporting continuous production gains

Restraint/Challenge

“High Operational Costs”

- The operation and maintenance of low-pressure separators are capital-intensive, involving significant costs for equipment, installation, and ongoing upkeep, particularly in challenging environments such as offshore platforms and remote sites

- For instance, companies such as Emerson and Honeywell report that advanced separators with integrated sensors and automation require skilled technical personnel for monitoring, calibration, and repairs, and face high costs linked to spare parts and technical service contracts

- Energy consumption for auxiliary systems such as compressors, heaters, and control units adds to operational expenditure, impacting profit margins especially during volatile oil price cycles

- Unplanned downtime or equipment failure due to fouling, corrosion, or pressure fluctuations increases repair costs and disrupts production schedules

- Smaller operators and those in emerging markets may find the upfront and ongoing operational costs prohibitive, limiting adoption or forcing use of less efficient, lower-cost alternatives

Low-Pressure Separators Market Scope

The market is segmented on the basis of product type, application, technology, end-user industry, and material type.

- By Product Type

On the basis of product type, the low-pressure separators market is segmented into horizontal low pressure separators and vertical low pressure separators. The horizontal low pressure separators segment accounted for the largest market revenue share in 2024, primarily due to its superior liquid handling capacity and suitability for high gas-to-liquid ratio applications. These separators are widely preferred in onshore installations and large-scale production facilities where space is not a constraint, offering operational efficiency, easier maintenance, and cost-effective performance across extended flow periods.

The vertical low pressure separators segment is projected to register the fastest growth rate from 2025 to 2032, driven by increasing adoption in offshore and space-constrained environments. Their compact design makes them ideal for offshore platforms, mobile units, and locations with vertical installation preferences. Their ability to handle fluctuating flow conditions and maintain consistent separation performance under variable load conditions further boosts their relevance in dynamic operational settings.

- By Application

On the basis of application, the market is segmented into oil and gas and water treatment. The oil and gas segment dominated the largest revenue share of 75.3% in 2024, supported by the high demand for efficient phase separation systems in upstream operations. Oilfield operators prioritize low-pressure separators for their ability to separate production fluids into oil, gas, and water, ensuring optimal reservoir management and downstream processing efficiency.

The water treatment segment is expected to experience the highest CAGR from 2025 to 2032, driven by growing concerns over water resource sustainability and environmental compliance. The application of low-pressure separators in removing oil and suspended solids from wastewater enhances treatment outcomes in both industrial and municipal settings, making them integral to modern water treatment infrastructure.

- By Technology

On the basis of technology, the market is segmented into gravity separation technology and mechanical separation technology. Gravity separation technology held the largest share in 2024, owing to its widespread use in conventional separation units and its cost-effective, energy-efficient operation. This technology relies on natural density differences between fluid components, making it ideal for large-scale, continuous operations across oilfields.

Mechanical separation technology is anticipated to witness the fastest growth rate during the forecast period, supported by its ability to enhance separation speed and performance in challenging fluid compositions. It incorporates internals such as coalescers, mist extractors, and cyclonic devices that improve throughput and efficiency, making it suitable for high-demand environments with complex separation requirements.

- By End-User Industry

On the basis of end-user industry, the market is divided into oil & gas exploration companies and refineries. The oil & gas exploration companies segment secured the largest revenue share in 2024, driven by the growing global demand for crude oil and the need for robust separation systems at the production stage. Low-pressure separators are essential for preparing reservoir fluids for transportation and storage by efficiently removing gas and water.

The refineries segment is expected to exhibit the fastest growth rate from 2025 to 2032, fueled by the increasing need to process and upgrade crude oil into refined products with precision. In refineries, these separators play a key role in pre-treatment units to enhance product quality and reduce contamination, aligning with tightening product standards and operational efficiency targets.

- By Material Type

On the basis of material type, the market is segmented into carbon steel and stainless steel. The carbon steel segment dominated the largest revenue share in 2024 due to its affordability, structural strength, and suitability for handling high-volume, low-pressure flows in stable operating conditions. It remains the material of choice for standard applications in onshore oilfields and industrial installations.

The stainless steel segment is anticipated to witness the fastest CAGR from 2025 to 2032, attributed to its superior corrosion resistance and durability in harsh chemical and saline environments. Its usage is rapidly increasing in offshore operations, water treatment, and high-contaminant fluid handling, where long-term material integrity and hygiene are critical.

Low-Pressure Separators Market Regional Analysis

- North America dominated the low-pressure separators market with the largest revenue share of 37.6% in 2024, driven by a surge in upstream oil and gas activities and investments in shale exploration

- The region benefits from advanced infrastructure, mature hydrocarbon production operations, and favorable regulatory frameworks supporting enhanced oil recovery methods

- Growing demand for efficient phase separation equipment to improve well productivity and reduce operational downtime continues to fuel market expansion across both onshore and offshore assets

U.S. Low-Pressure Separators Market Insight

The U.S. low-pressure separators market captured the largest revenue share in 2024 within North America, primarily due to the country's dominance in shale oil and gas production. The market is supported by extensive drilling activity in regions such as the Permian Basin and the Gulf of Mexico, where efficient fluid separation is critical for sustained production. The adoption of advanced separator technologies and the presence of major oilfield service companies further accelerate the market’s growth.

Europe Low-Pressure Separators Market Insight

The Europe low-pressure separators market is projected to grow at a steady CAGR during the forecast period, fueled by the resurgence of exploration activities in the North Sea and the shift toward maximizing existing oilfield recovery. Stringent environmental standards and increasing investments in offshore assets are encouraging the adoption of efficient separation systems. In addition, rising interest in water treatment applications further supports regional demand.

U.K. Low-Pressure Separators Market Insight

The U.K. low-pressure separators market is anticipated to grow moderately over the forecast period, driven by ongoing developments in the North Sea basin and brownfield asset optimization efforts. With operators focusing on cost-effective production and compliance with environmental standards, demand for reliable separation equipment is expected to increase. Government incentives aimed at extending the life of mature fields also support market stability.

Germany Low-Pressure Separators Market Insight

The Germany low-pressure separators market is gaining traction, particularly within the water treatment and downstream sectors. Growing environmental awareness and the need for efficient wastewater management in industrial operations are key drivers. The market also benefits from Germany’s advanced engineering capabilities and a strong emphasis on integrating sustainable process technologies.

Asia-Pacific Low-Pressure Separators Market Insight

The Asia-Pacific low-pressure separators market is poised to grow at the fastest CAGR from 2025 to 2032, fueled by rising energy demand, rapid industrialization, and increasing investments in oil and gas exploration across emerging economies. Countries such as China, India, and Indonesia are leading the regional demand, supported by large-scale infrastructure projects and a focus on energy security. Expanding refining capacities and the development of unconventional reserves further bolster market prospects.

Japan Low-Pressure Separators Market Insight

The Japan low-pressure separators market is experiencing moderate growth, supported by its mature refining industry and strict environmental regulations. As refineries upgrade their systems for improved efficiency and reduced emissions, demand for high-performance separation equipment is rising. Japan’s technological edge and focus on process innovation also contribute to market advancement.

China Low-Pressure Separators Market Insight

The China low-pressure separators market accounted for the largest revenue share in Asia Pacific in 2024, driven by robust domestic oil and gas production and an expanding network of refineries and petrochemical plants. China’s push for energy self-sufficiency and environmental sustainability is driving the integration of modern separation systems across upstream and downstream operations. Strong government backing and local manufacturing capabilities further support rapid market growth.

Low-Pressure Separators Market Share

The low-pressure separators industry is primarily led by well-established companies, including:

- UMC (U.S.)

- HC Petroleum Equipment (Malaysia)

- Saratov Reservoir Plant (Russia)

- Kimray (U.S.)

- Energy Weldfab (U.S.)

- Production Facilities Equipment (U.S.)

- OTSO (South Korea)

- Fox Tank Company (U.S.)

- Dragon Products (U.S.)

- LUDY Petrochemical Equipment (China)

Latest Developments in Global Low-Pressure Separators Market

- In March 2024, Exterran launched its Separon Produced Water Technology Suite, offering a comprehensive solution for treating up to 750,000 barrels of produced water per day through advanced separation methods including hydrocyclones, deoilers, desanders, and microbubble flotation units. This launch marks a significant step in addressing water treatment challenges in oil and gas operations. By integrating high-performance separation with remote monitoring and flexible operation models, Exterran reinforces its commitment to operational efficiency, environmental compliance, and innovation in fluid management systems across global markets

- In February 2024, Exterran introduced specialized Vapor Recovery Units (VRUs) and H₂S Eliminator systems designed specifically for the Eagle Ford Shale, enhancing the separation and treatment of high-API condensates and sour gas. This product launch reflects Exterran’s focus on addressing region-specific challenges with modular, field-ready equipment. The solution improves operational safety, environmental performance, and gas recovery rates—demonstrating the company's ability to adapt global expertise to meet evolving shale production needs

- In August 2021, Halliburton’s Summit ESP division unveiled the Hydro-Helical® Gas Separator, an innovative downhole separator that significantly enhances gas-handling efficiency and pump run-life in high-GOR wells. This technology uses a unique helical design to manage free gas more effectively before it reaches the pump intake. The development emphasizes Halliburton’s focus on increasing oil production performance while minimizing equipment wear, aligning with operators’ growing need for robust artificial lift and separation solutions in complex well environments

- In October 2020, Halliburton entered a strategic partnership with Microsoft and Accenture to accelerate digital transformation in oilfield operations through cloud-based platforms and AI integration. This alliance supports the advancement of intelligent oilfield systems—including digital separator monitoring and optimization. By leveraging cloud computing and advanced analytics, Halliburton is enabling real-time process control and predictive maintenance across separation units, enhancing operational visibility and long-term reliability

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.