Global Low Temperature Co Fired Ceramic Ltcc Market

Market Size in USD Billion

CAGR :

%

USD

4.86 Billion

USD

10.42 Billion

2024

2032

USD

4.86 Billion

USD

10.42 Billion

2024

2032

| 2025 –2032 | |

| USD 4.86 Billion | |

| USD 10.42 Billion | |

|

|

|

|

What is the Global Low Temperature Co-Fired Ceramic Market Size and Growth Rate?

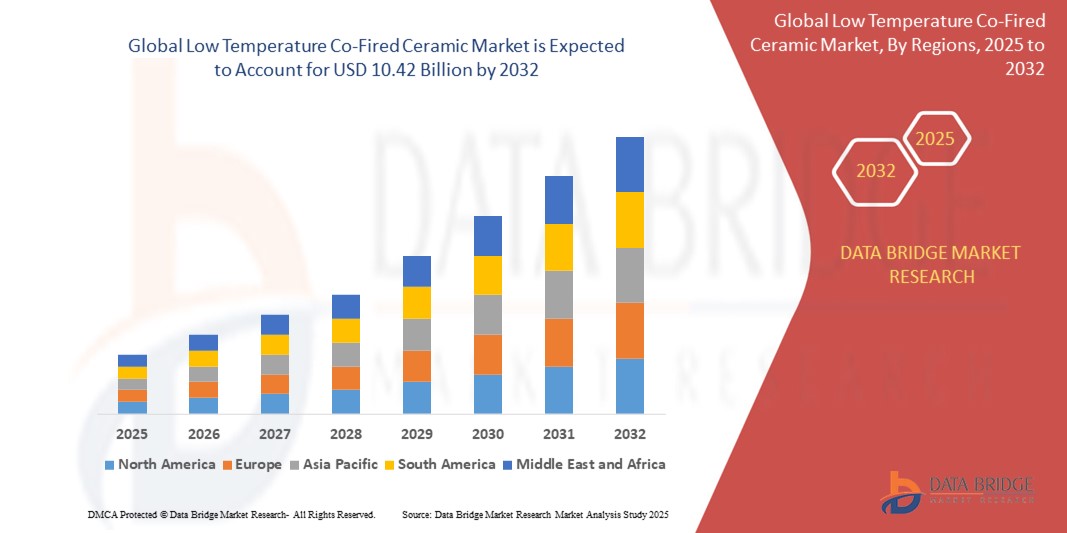

- The global low temperature co-fired ceramic market size was valued at USD 4.86 billion in 2024 and is expected to reach USD 10.42 billion by 2032, at a CAGR of 10.00% during the forecast period

- The global low temperature co-fired ceramic (LTCC) market is expanding due to its application in advanced electronics and communication technologies. The increasing demand for miniaturized and high-performance electronic devices drives growth, as LTCC materials are crucial for producing compact, reliable, and high-frequency components

- Technological advancements in LTCC processing and materials, along with the growing adoption of Internet of Things (IoT) devices, contribute to market development. The market is competitive with continuous innovation from key players aiming to improve product performance and reduce production costs

What are the Major Takeaways of Low Temperature Co-Fired Ceramic Market?

- The demand for low temperature co fired ceramic (LTCC) is significantly driven by advancements in electronics and the need for miniaturization. LTCC materials are essential in the electronics industry due to their excellent electrical insulation, thermal stability, and ability to support complex circuit designs. They are used in applications such as multilayer ceramic packages, antennas, and filters. As electronic devices become smaller and more sophisticated, the requirement for high-density, reliable, and compact circuit substrates increases

- LTCC technology allows for the integration of multiple layers in a compact form factor, facilitating the miniaturization of electronic components and enabling the development of advanced electronic devices. This trend drives the growth of the LTCC market as manufacturers seek to meet the evolving demands of the electronics industry

- North America dominated the low temperature co-fired ceramic (LTCC) market with the largest revenue share of 39.7% in 2024, driven by strong demand for miniaturized, high-performance electronic components across telecommunications, automotive, aerospace, and defense industries

- Asia-Pacific low temperature co-fired ceramic market is expected to register the fastest CAGR of 13.6% from 2025 to 2032, fueled by rapid industrialization, expanding consumer electronics production, and growing investments in 5G networks, electric vehicles, and semiconductor manufacturing across countries such as China, Japan, South Korea, and India

- The stone wool segment dominated the low temperature co-fired ceramic market with the largest market revenue share of 52.4% in 2024, owing to its superior fire resistance, thermal insulation, and acoustic performance

Report Scope and Low Temperature Co-Fired Ceramic Market Segmentation

|

Attributes |

Low Temperature Co-Fired Ceramic Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Low Temperature Co-Fired Ceramic Market?

“Miniaturization and Integration for Advanced Electronic Application”

- A significant and rapidly emerging trend in the global low temperature co-fired ceramic (LTCC) market is the increasing demand for miniaturized, multifunctional, and high-frequency electronic components driven by 5G deployment, IoT expansion, and advanced automotive electronics

- Low temperature co-fired ceramic technology enables the integration of multiple passive components such as inductors, capacitors, and resistors into compact, multilayer ceramic modules, reducing device size while enhancing performance

- The growing adoption of LTCC-based antennas, filters, and sensors is transforming mobile communication, radar, and satellite systems, providing superior thermal stability, low loss, and high-frequency capability

- Automotive manufacturers are increasingly leveraging low temperature co-fired ceramic substrates for advanced driver-assistance systems (ADAS), EV power electronics, and vehicle radar modules to meet demands for reliability and miniaturization

- Leading players such as Murata Manufacturing, Kyocera, and TDK Corporation are investing heavily in low temperature co-fired ceramic innovations, developing next-generation modules for aerospace, 5G infrastructure, and automotive radar systems

- The accelerating demand for space-saving, high-performance electronic packaging is fundamentally reshaping the low temperature co-fired ceramic market, driving growth across communications, defense, and automotive sectors globally

What are the Key Drivers of Low Temperature Co-Fired Ceramic Market?

- The surge in 5G network deployments, automotive electronics, and advanced communication systems is a major driver for the low temperature co-fired ceramic market, with the technology offering superior thermal resistance, high-frequency performance, and component miniaturization

- For instance, in January 2024, TDK Corporation launched advanced low temperature co-fired ceramic antenna modules designed for millimeter-wave 5G applications, supporting high data transmission rates and compact device design

- The automotive industry's transition towards electrification, connected vehicles, and ADAS is fueling demand for low temperature co-fired ceramic substrates, which offer excellent reliability in harsh environments and compact form factors

- The proliferation of IoT devices, wearable technology, and compact medical electronics is boosting low temperature co-fired ceramic market growth, as manufacturers require high-density packaging solutions with minimal size and maximum performance

- In addition, the growing need for reliable electronic components in aerospace, defense, and satellite communication is driving the adoption of low temperature co-fired ceramic modules that can withstand extreme temperatures and frequencies

- The convergence of miniaturization trends, increasing electronic complexity, and performance demands is accelerating investments and innovation within the low temperature co-fired ceramic market globally

Which Factor is challenging the Growth of the Low Temperature Co-Fired Ceramic Market?

- The relatively high production cost and complex manufacturing processes of low temperature co-fired ceramic components present a significant challenge to widespread adoption, particularly for low-cost consumer electronics

- For instance, the requirement for specialized materials such as high-purity ceramics and precise multilayer alignment drives up production costs, limiting low temperature co-fired ceramic use in cost-sensitive applications

- The technical challenges associated with achieving consistent multilayer integration and ensuring high-frequency performance can lead to yield losses and higher prices for end product

- Competition from alternative packaging and substrate technologies such as organic laminates, HTCC (High Temperature Co-Fired Ceramics), and PCB-based solutions can limit low temperature co-fired ceramic market share in some applications

- Furthermore, supply chain complexities, including limited sources for specific low temperature co-fired ceramic materials and skilled workforce requirements, can create barriers to scaling production

- To overcome these challenges, manufacturers are focusing on production efficiency, material optimization, and expanding Zirconium applications into premium markets such as 5G infrastructure, automotive radar, and defense electronics to ensure sustained market growth

How is the Low Temperature Co-Fired Ceramic Market Segmented?

The market is segmented on the basis of material, type, product, packaging type, application, and end user.

• By Material

On the basis of material, the low temperature co-fired ceramic (LTCC) market is segmented into Ceramic, Glass, Silicon, Zirconium, and Aluminium. The Ceramic segment dominated the low temperature co-fired ceramic market with the largest market revenue share of 46.9% in 2024, attributed to its excellent dielectric properties, thermal stability, and suitability for high-frequency applications. Ceramic materials are extensively used in LTCC substrates, components, and modules due to their durability, reliability, and ability to support miniaturized electronics, particularly in telecommunications, automotive radar, and aerospace sectors.

The Zirconium segment is expected to witness the fastest CAGR from 2025 to 2032, driven by its growing use in specialized high-performance low temperature co-fired ceramic applications, such as medical devices and advanced defense electronics. Zirconium-based materials offer superior mechanical strength and thermal resistance, supporting their increasing demand in mission-critical environments.

• By Type

On the basis of type, the low temperature co-fired ceramic market is segmented into 5-8 Ceramic Layers, 4-6 Ceramic Layers, and 10-25 Ceramic Layers. The 4-6 Ceramic Layers segment held the largest market revenue share of 38.3% in 2024, owing to its balance of performance, cost-effectiveness, and versatility across consumer electronics, IoT devices, and RF modules. These LTCC configurations provide sufficient electrical and thermal properties for mid-range devices, making them highly preferred in mass-market applications.

The 10-25 Ceramic Layers segment is projected to witness the fastest CAGR from 2025 to 2032, supported by rising demand for high-performance, multi-functional low temperature co-fired ceramic modules in automotive radar, aerospace systems, and 5G infrastructure. This type enables complex, compact, and high-frequency component integration essential for next-generation technologies.

• By Product

On the basis of product, the low temperature co-fired ceramic market is segmented into Substrates, Components, and Module. The Substrates segment dominated the market with the largest revenue share of 44.5% in 2024, driven by their critical role as the foundation for assembling high-frequency circuits and passive components. Low temperature co-fired ceramic substrates offer excellent miniaturization, high thermal conductivity, and reliable electrical performance, making them indispensable in telecommunications, automotive, and industrial applications.

The Module segment is anticipated to register the fastest CAGR from 2025 to 2032, fueled by the growing need for integrated low temperature co-fired ceramic modules combining multiple functionalities such as antennas, filters, and sensors within compact, high-performance packages for 5G devices, automotive radar, and aerospace applications.

• By Packaging Type

On the basis of packaging type, the low temperature co-fired ceramic market is segmented into Array Package, RF System Level Package, Optoelectronic Package, and Other Packaging Types. The RF System Level Package segment held the largest market revenue share of 42.1% in 2024, owing to its widespread use in wireless communication, mobile devices, and radar systems. These packages enable high-frequency performance, compact size, and system-level integration essential for 5G, IoT, and automotive electronics.

The Optoelectronic Package segment is projected to witness the fastest CAGR from 2025 to 2032, driven by the rising adoption of low temperature co-fired ceramic solutions in photonics, optical transceivers, and LED modules, where precise optical alignment and thermal management are critical.

• By Application

On the basis of application, the low temperature co-fired ceramic market is segmented into Front-End Transmitter, Duplexer, Bluetooth, Front-End Receiver, and Other Applications. The Front-End Transmitter segment dominated the market with the largest revenue share of 36.7% in 2024, supported by growing demand for high-frequency, compact, and thermally stable low temperature co-fired ceramic components in mobile networks, radar systems, and satellite communications. Front-End Transmitters require low temperature co-fired ceramic solutions to ensure signal integrity and device miniaturization.

The Bluetooth segment is expected to witness the fastest CAGR from 2025 to 2032, driven by increasing penetration of wireless consumer electronics, smart devices, and IoT applications requiring reliable, space-efficient low temperature co-fired ceramic -based Bluetooth modules.

• By End Users

On the basis of end users, the low temperature co-fired ceramic market is segmented into Computers and Peripherals, Medical, Automotive, Construction, Energy and Power, Industrial, Consumer Electronics, Automobile Electronics, Aerospace and Military, and Home Appliances. The Automobile Electronics segment dominated the market with the largest revenue share of 40.9% in 2024, attributed to the surging adoption of low temperature co-fired ceramic technology in ADAS, EV power modules, radar sensors, and infotainment systems. The need for reliable, miniaturized, and high-frequency components in vehicles is accelerating LTCC demand across the automotive sector.

The Aerospace and Military segment is anticipated to register the fastest CAGR from 2025 to 2032, fueled by increasing defense investments and space exploration activities requiring advanced LTCC solutions for high-reliability, lightweight, and thermally robust electronics operating in extreme environments.

Which Region Holds the Largest Share of the Low Temperature Co-Fired Ceramic Market?

- North America dominated the low temperature co-fired ceramic (LTCC) market with the largest revenue share of 39.7% in 2024, driven by strong demand for miniaturized, high-performance electronic components across telecommunications, automotive, aerospace, and defense industries. The region’s leadership in advanced manufacturing, along with significant investments in 5G infrastructure, autonomous vehicles, and defense technologies, is propelling LTCC adoption

- The presence of major semiconductor companies, technological innovation hubs, and government initiatives supporting electric mobility and next-generation electronics further solidify North America’s position as the dominant LTCC market

- The demand for low temperature co-fired ceramic solutions in radar systems, satellite communication, and medical devices is also contributing to steady market expansion across the region

U.S. Low Temperature Co-Fired Ceramic Market Insight

The U.S. low temperature co-fired ceramic market accounted for the largest revenue share within North America in 2024, supported by the nation’s strong presence of leading electronics manufacturers, defense contractors, and automotive innovators. The growing need for reliable, compact, and thermally stable components in 5G, IoT, and electric vehicle applications is fueling LTCC adoption. Furthermore, U.S. defense modernization programs and investments in high-frequency, rugged electronic systems are accelerating demand for LTCC in aerospace and military sectors.

Canada Low Temperature Co-Fired Ceramic Market Insight

The Canada low temperature co-fired ceramic market is projected to grow steadily during the forecast period, driven by increasing demand for high-reliability electronic components in telecommunications, aerospace, and healthcare industries. Canada's focus on technological innovation, coupled with growing investments in smart infrastructure and advanced mobility solutions, is supporting LTCC market expansion. Rising R&D activities and collaborations with global semiconductor players further contribute to the country's LTCC market growth.

Which Region is the Fastest Growing Region in the Low Temperature Co-Fired Ceramic Market?

Asia-Pacific low temperature co-fired ceramic market is expected to register the fastest CAGR of 13.6% from 2025 to 2032, fueled by rapid industrialization, expanding consumer electronics production, and growing investments in 5G networks, electric vehicles, and semiconductor manufacturing across countries such as China, Japan, South Korea, and India. The region’s large-scale electronics manufacturing ecosystem, coupled with favorable government policies supporting advanced technology development, is accelerating LTCC adoption across various applications. Rising demand for high-frequency, miniaturized electronic components in smartphones, automotive radar, and aerospace systems further contributes to the region's rapid LTCC market growth.

China Low Temperature Co-Fired Ceramic Market Insight

The China low temperature co-fired ceramic market captured the largest revenue share within Asia-Pacific in 2024, supported by the country’s dominance in electronics manufacturing, rapid 5G deployment, and strong emphasis on automotive electrification. China's strategic focus on semiconductor self-sufficiency, coupled with growing demand for high-performance, compact components in smartphones, IoT devices, and electric vehicles, is significantly boosting LTCC adoption. The presence of key domestic manufacturers and government-driven technology initiatives further strengthen China's leadership position in the regional market.

Japan Low Temperature Co-Fired Ceramic Market Insight

The Japan low temperature co-fired ceramic market is witnessing steady growth, driven by the nation's technological expertise, advanced automotive industry, and rising demand for miniaturized, reliable electronic components. Japan's leadership in high-frequency device manufacturing, coupled with its growing focus on autonomous vehicles, smart infrastructure, and next-generation mobility, is fostering LTCC adoption. In addition, the country’s established aerospace and defense sectors further contribute to the increasing demand for LTCC solutions.

India Low Temperature Co-Fired Ceramic Market Insight

The India low temperature co-fired ceramic market is anticipated to grow at a robust CAGR during the forecast period, supported by rapid growth in telecommunications, automotive electronics, and consumer devices. The country's expanding electronics manufacturing ecosystem, along with government initiatives such as "Make in India" and digital infrastructure programs, is accelerating demand for high-performance LTCC components. Increasing adoption of 5G, electric vehicles, and smart devices, combined with rising R&D investments, is fueling India's LTCC market expansion.

Which are the Top Companies in Low Temperature Co-Fired Ceramic Market?

The low temperature co-fired ceramic industry is primarily led by well-established companies, including:

- KYOCERA Corporation (Japan)

- Yokowo Co., Ltd (Japan)

- NTK Technologies (Japan)

- NIKKO CORP. (Japan)

- Murata Manufacturing Co., Ltd. (Japan)

- KOA Speer Electronics, Inc. (U.S.)

- Hitachi Metals, Ltd. (Japan)

- DuPont (U.S.)

- API Microelectronics Limited (Singapore)

- Neo Tech Inc. (U.S.)

- ACX Corp. (Taiwan)

- Mirion Technologies (Selmic) Oy (Finland)

- TAIYO YUDEN CO., LTD (Japan)

- TDK Corporation (Japan)

- CeramTec GmbH (Germany)

- Adamant Namiki Precision Jewel Co., Ltd. (Japan)

What are the Recent Developments in Global Low Temperature Co-Fired Ceramic Market?

- In May 2022, NEOTech announced its investment in advanced Selective Wave Soldering Machines, aimed at enhancing manufacturing efficiency and improving product quality. This strategic move is expected to strengthen NEOTech’s production capabilities and support its commitment to delivering high-reliability electronics solutions

- In February 2022, NEOTech entered into a partnership with Hemisphere GNSS for the manufacturing of a portable and cost-effective Smart Antenna solution. This collaboration expands NEOTech’s role in the development of advanced connectivity products, reinforcing its presence in the global positioning and navigation market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Low Temperature Co Fired Ceramic Ltcc Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Low Temperature Co Fired Ceramic Ltcc Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Low Temperature Co Fired Ceramic Ltcc Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.