Global Low Voltage Energy Distribution Market

Market Size in USD Billion

CAGR :

%

USD

14.37 Billion

USD

24.42 Billion

2024

2032

USD

14.37 Billion

USD

24.42 Billion

2024

2032

| 2025 –2032 | |

| USD 14.37 Billion | |

| USD 24.42 Billion | |

|

|

|

|

Low Voltage Energy Distribution Market Size

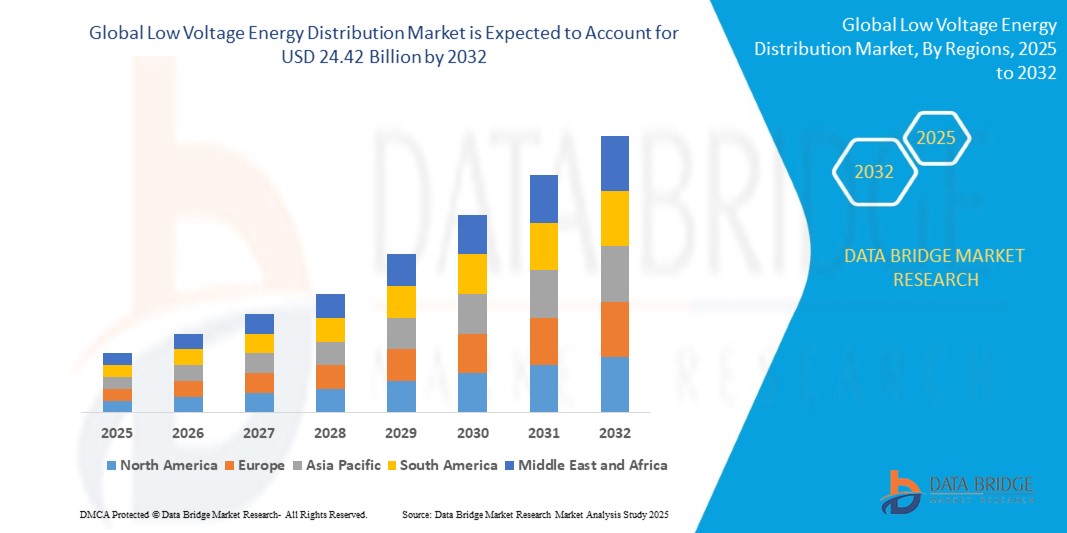

- The global low voltage energy distribution market size was valued at USD 14.37 billion in 2024 and is expected to reach USD 24.42 billion by 2032, at a CAGR of 6.85% during the forecast period

- The market is primarily driven by the increasing deployment of decentralized energy systems, such as rooftop solar and microgrids, which require reliable and flexible low-voltage networks for distribution and control. The ongoing global transition toward clean and distributed energy sources is significantly elevating demand for low-voltage infrastructure.

- Additionally, urbanization and rapid expansion of smart cities across emerging economies are contributing to market growth, as these projects require advanced, digitally managed low-voltage systems for efficient and safe power distribution in residential, commercial, and industrial buildings.

Low Voltage Energy Distribution Market Analysis

- Low Voltage Energy Distribution systems, comprising circuit breakers, switchboards, panels, and metering solutions, have become essential infrastructure across modern buildings, industrial units, and renewable energy systems due to their reliability, safety, and compatibility with digital automation tools. Their role is especially critical in managing short-circuit protection, overload handling, and power quality in low-voltage electrical networks.

- The market's growth is being driven by global trends toward electrification, energy decentralization, and digitization of energy systems. As governments and enterprises commit to clean energy transitions, low-voltage systems are being deployed to support rooftop solar, battery storage, and microgrids — particularly in urban and commercial developments.

- North America dominates the global Low Voltage Energy Distribution market, accounting for the largest revenue share of 40.01% in 2024, propelled by robust investments in smart grid infrastructure, retrofitting of aging power systems, and widespread smart building deployment. The U.S. leads the region with significant adoption in both commercial and residential segments, as tech companies introduce AI-enabled energy monitoring and smart circuit control systems.

- Asia-Pacific is expected to be the fastest-growing region during the forecast period, driven by rapid urbanization, increasing infrastructure development, and rising investments in industrial automation. Countries like China, India, and Southeast Asian nations are accelerating their efforts in grid modernization and energy access, leading to significant growth in low-voltage distribution system installations.

- The Circuit Breakers segment holds the largest market share of 35.2% in 2024, thanks to its critical function in electrical safety and its adaptability for both new installations and retrofits. Demand is further bolstered by innovations in smart breakers equipped with real-time fault detection, energy usage analytics, and remote operability.

Report Scope and Low Voltage Energy Distribution Market Segmentation

|

Attributes |

Low Voltage Energy Distribution Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Low Voltage Energy Distribution Market Trends

“Digitally-Enabled Distribution Networks for Smarter Energy Management”

- A major and ongoing trend in the global Low Voltage Energy Distribution market is the transition toward digitally connected distribution networks integrated with IoT, AI, and edge computing to enhance grid resilience, enable predictive maintenance, and support renewable energy integration.

- For instance, in May 2024, ABB launched its NeoGear Digital low-voltage switchgear platform, which combines advanced sensors and cloud analytics to provide real-time monitoring and predictive maintenance. This launch is designed to reduce downtime and energy losses across commercial and industrial applications.

- Similarly, Schneider Electric, in April 2023, unveiled the next-generation PrismaSeT Active low-voltage panelboards, equipped with connectivity to the EcoStruxure platform. These smart panels allow building operators to optimize electrical distribution and detect potential faults proactively, enhancing operational continuity and energy efficiency.

- Digital LV systems now often feature remote diagnostics, wireless communication modules, and energy intelligence software, enabling facility managers to access energy data in real-time, configure systems remotely, and prevent failures. This integration is especially critical in manufacturing plants, data centers, and smart buildings.

- In September 2023, Siemens introduced its new SENTRON series of intelligent circuit breakers, which offer modular IoT gateways, embedded metering, and load analysis—catering to users looking to enhance safety and sustainability through smarter power distribution.

- This trend is fostering a shift from passive energy distribution to active energy management, enabling greater control, adaptability, and sustainability in both commercial and industrial infrastructures.

Low Voltage Energy Distribution Market Dynamics

Driver

“Rising Electrification and Industrial Automation Demands”

- The surging global electrification efforts and the adoption of Industry 4.0 practices are driving robust demand for efficient, safe, and intelligent low-voltage energy distribution systems. These systems are crucial in enabling safe operations in smart factories, automated warehouses, and renewable energy infrastructures.

- In March 2024, Legrand launched its “Digital Electrician” campaign promoting advanced LV panels and distribution boxes tailored for the evolving demands of energy-intensive sectors like e-mobility charging stations and industrial IoT.

- The growth of EV infrastructure is another key driver. For example, Eaton announced in January 2023 its collaboration with ChargeLab to provide low-voltage electrical components optimized for commercial EV charging stations, where precision power management and surge protection are critical.

- Moreover, in February 2024, Hitachi Energy expanded its LV product portfolio with smart digital breakers and distribution boards as part of its “FutureGrid” initiative targeting decentralized renewable energy grids.

- The global shift to net-zero targets and sustainable power systems is pushing utilities and industries to invest in flexible, scalable LV distribution systems capable of managing renewable inputs, enabling peak load shaving, and ensuring operational continuity.

Restraint/Challenge

“Complex Integration and Fragmented Ecosystem”

- A primary challenge in the Low Voltage Energy Distribution market is the integration complexity of smart distribution components within legacy systems and a fragmented ecosystem of proprietary platforms.

- For instance, in 2023, reports from Navigant Research highlighted implementation delays in several commercial retrofitting projects due to compatibility issues between new digital panels and outdated mechanical breakers.

- The lack of universal interoperability standards among vendors often leads to increased costs, extended downtime, and difficulties in unified energy monitoring across systems.

- In June 2024, industry analysts noted that many small to mid-sized firms were delaying smart LV upgrades due to integration hurdles, cybersecurity concerns, and a shortage of skilled technicians familiar with IoT-based electrical systems

- Additionally, as smart systems become more complex, ensuring data security and system reliability becomes more difficult. For example, an October 2023 vulnerability disclosure affecting third-party IoT modules embedded in LV circuit monitors raised alarms about the cybersecurity preparedness of industrial control environments.

- Resolving these challenges will require greater industry collaboration on open standards, enhanced cybersecurity frameworks, and improved training initiatives for electrical professionals to manage the digital transition effectively.

Low Voltage Energy Distribution Market Scope

The market is segmented on the basis of product type, component, application, and sales channel.

By Product Type

On the basis of product type, the Low Voltage Energy Distribution market is segmented into Fixed Type and Drawer Type. The Fixed Type segment dominated the market in 2024 with the largest revenue share, driven by its widespread use in commercial and residential power systems due to simplicity, cost-effectiveness, and minimal maintenance requirements. These units are especially popular in smaller installations where space-saving and straightforward functionality are key factors.

The Drawer Type segment is expected to witness the fastest CAGR from 2025 to 2032, owing to its modular design, which facilitates quick replacement, easier maintenance, and enhanced safety. This type is increasingly preferred in industrial and power plant environments, where operational continuity and safety protocols demand components that can be serviced or replaced without system downtime.

• By Component

On the basis of component, the market is segmented into Switchgear, Circuit Breakers, Distribution Panels, Fuses, and Others. The Circuit Breakers segment held the largest market share of 35.2% in 2024, driven by its critical role in protecting electrical systems from overloads and faults. The increasing demand for smart circuit breakers with real-time monitoring and predictive analytics capabilities is further propelling the growth of this segment, especially in smart buildings and industrial automation.

The Distribution Panels segment is anticipated to witness the fastest growth rate during the forecast period due to growing investments in infrastructure development and the rising adoption of modular, intelligent panel boards that can support IoT and cloud-based energy monitoring systems. In March 2024, Schneider Electric’s launch of PrismaSeT Active smart panels exemplifies this shift toward connected energy distribution.

• By Application

On the basis of application, the market is segmented into Power Plants, Industrial Sites, Commercial Sites, Residential, and Others. The Residential segment accounted for the largest revenue share in 2024, owing to increasing urbanization, smart home installations, and growing consumer awareness regarding energy efficiency and home safety. Rising demand for solar energy integration in homes is also boosting adoption of smart LV distribution systems.

The Industrial Sites segment is projected to register the fastest CAGR from 2025 to 2032, fueled by the need for high-efficiency, intelligent power distribution systems that support automation, digital twins, and energy-intensive operations. In February 2024, ABB and Siemens expanded their digital LV offerings targeting manufacturing and process industries, which require precision and high reliability in distribution.

• By Sales Channel

On the basis of sales channel, the market is segmented into Direct Channel and Indirect Channel. The Direct Channel segment held the largest market share in 2024 due to the increasing number of turnkey projects, especially in large-scale commercial and industrial applications where custom solutions and integration services are crucial. Direct sales also facilitate closer collaboration between manufacturers and end-users for product customization.

The Indirect Channel segment is expected to grow at the fastest pace, driven by the proliferation of e-commerce platforms, distributors, and system integrators that make LV products more accessible to small businesses and homeowners. Partnerships with value-added resellers and online electrical B2B portals have further enhanced the reach of key manufacturers across emerging markets.

Low Voltage Energy Distribution Market Regional Analysis

- North America dominated the global Low Voltage Energy Distribution market with the largest revenue share of 40.01% in 2024, driven by rising energy efficiency mandates, robust smart grid infrastructure, and strong investment in residential and commercial building automation.

- The region benefits from a high level of electrification across sectors and early adoption of advanced distribution technologies. Furthermore, initiatives such as the U.S. Infrastructure Investment and Jobs Act are fueling grid modernization, contributing to rising demand for low voltage distribution systems. Rapid adoption of renewable energy sources like solar also necessitates the deployment of flexible, intelligent LV distribution solutions in residential and commercial setups.

U.S. Low Voltage Energy Distribution Market Insight

The U.S. accounted for 81% of North America's revenue share in 2024, led by consistent investment in residential energy systems, smart grid integration, and industrial automation. The surge in electrification of transportation and home energy systems has triggered significant demand for advanced LV circuit protection and panel distribution. In March 2024, Eaton announced expansion of its LV smart switchgear production in the U.S. to meet rising domestic demand. The country is also witnessing substantial demand for energy-efficient distribution panels and cloud-integrated circuit breakers in retrofit projects and new commercial constructions.

Europe Low Voltage Energy Distribution Market Insight

Europe is expected to witness steady growth in the Low Voltage Energy Distribution market throughout the forecast period, supported by EU directives on energy efficiency, increased construction of smart buildings, and the Electrification of Heat (EoH) initiatives in residential sectors. The region’s energy transition goals, particularly in countries like Germany and France, are accelerating the upgrade of traditional LV infrastructure to smart, connected systems. Moreover, sustainability-driven retrofitting in older European buildings is contributing to increasing adoption of LV switchgears, panels, and fuses.

U.K. Low Voltage Energy Distribution Market Insight

The U.K. market is growing at a noteworthy pace due to ambitious net-zero emission targets and continued emphasis on building modernization. Adoption of smart meters, EV infrastructure, and solar panel installations is stimulating demand for compatible LV distribution panels and circuit breakers. The April 2024 launch of Schneider Electric’s Resi9 LV panelboard, tailored for UK homes, highlights the growing demand for modern, safe, and modular LV solutions.

Germany Low Voltage Energy Distribution Market Insight

Germany is witnessing considerable growth in the LV Energy Distribution market due to strong industrial demand and high investments in renewable energy integration. The government's “Energiewende” policy is encouraging energy efficiency upgrades across sectors. German manufacturers such as Siemens and Phoenix Contact are innovating with drawer-type smart distribution systems to cater to industrial sites and commercial buildings prioritizing modularity and automation.

Asia-Pacific Low Voltage Energy Distribution Market Insight

Asia-Pacific is projected to grow at the fastest CAGR of 24% from 2025 to 2032, fueled by rapid urbanization, ongoing smart city projects, and widespread industrial development. The region’s favorable policy environment—especially in China, India, and Southeast Asia—for electrification and infrastructure development is significantly expanding the scope of LV energy distribution. The affordability and scalability of drawer-type and modular LV systems also support the needs of varied infrastructure scales in APAC countries.

Japan Low Voltage Energy Distribution Market Insight

Japan’s market is advancing steadily with strong support for digital building automation systems, driven by a cultural emphasis on safety, energy savings, and convenience. In February 2024, Panasonic and Hitachi collaborated on developing compact LV switchgear systems for high-density urban residential units. The aging population also boosts demand for safer, intuitive power distribution systems.

China Low Voltage Energy Distribution Market Insight

China held the largest market revenue share in Asia-Pacific in 2024, driven by rapid infrastructure expansion, urban housing developments, and government-backed smart grid initiatives. The presence of leading domestic players like Chint Electric and Delixi Electric, alongside large-scale manufacturing of switchgear and circuit protection devices, is strengthening China’s position as both a producer and consumer in the LV distribution space. Government support for green building codes and smart cities, particularly in provinces like Guangdong and Jiangsu, is significantly boosting the adoption of intelligent LV distribution components..

Low Voltage Energy Distribution Market Share

The Low Voltage Energy Distribution industry is primarily led by well-established companies, including:

- Schneider Electric SE (France)

- ABB Ltd. (Switzerland)

- Siemens AG (Germany)

- Eaton Corporation plc (Ireland)

- General Electric Company (U.S.)

- Legrand SA (France)

- Mitsubishi Electric Corporation (Japan)

- Hitachi, Ltd. (Japan)

- Toshiba Corporation (Japan)

- Fuji Electric Co., Ltd. (Japan)

Latest Developments in Global Low Voltage Energy Distribution Market

- In March 2024, Schneider Electric unveiled its new generation of “FlexSeT” Low Voltage Switchboards tailored for North American commercial buildings. These modular switchboards enhance installation speed and flexibility, reduce downtime, and are equipped with EcoStruxure IoT integration for remote monitoring and energy analytics. This innovation reinforces Schneider Electric's focus on digitization and modular design, addressing growing demands for smart, safe, and scalable LV energy distribution systems.

- In February 2024, Siemens AG launched its SENTRON 3WA air circuit breakers across global markets, designed with enhanced digital capabilities, including remote diagnostics, predictive maintenance, and real-time energy monitoring. These LV breakers are targeted at industrial and commercial applications, supporting increased automation, uptime, and energy efficiency—critical in modern smart infrastructure setups.

- In January 2024, ABB Ltd. introduced the NeoGear Low Voltage switchgear system in India, aiming to reduce energy losses and enhance electrical safety in high-demand industries like oil & gas, data centers, and manufacturing. Built on BusPlate technology, NeoGear minimizes arc flash risk and supports compact footprint designs, representing ABB’s push for future-proof LV solutions in fast-developing economies.

- In October 2023, Legrand launched its XL³ S distribution panels in the European market, emphasizing tool-free installation, customizable layouts, and support for smart metering devices. The panels are designed for both residential and commercial properties, aligning with rising European building standards focused on energy efficiency and digital readiness.

- In August 2023, Eaton Corporation announced an investment of $150 million in its North American LV switchgear manufacturing capacity, citing rising demand from the renewable energy, EV charging, and data center segments. The expansion includes production of draw-out LV switchboards with built-in IoT sensors, aiming to serve complex, high-load distribution requirements with minimal downtime.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Low Voltage Energy Distribution Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Low Voltage Energy Distribution Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Low Voltage Energy Distribution Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.