Global Lung Cancer Screening Software Market

Market Size in USD Billion

CAGR :

%

USD

47.38 Billion

USD

195.75 Billion

2024

2032

USD

47.38 Billion

USD

195.75 Billion

2024

2032

| 2025 –2032 | |

| USD 47.38 Billion | |

| USD 195.75 Billion | |

|

|

|

|

Lung Cancer Screening Software Market Size

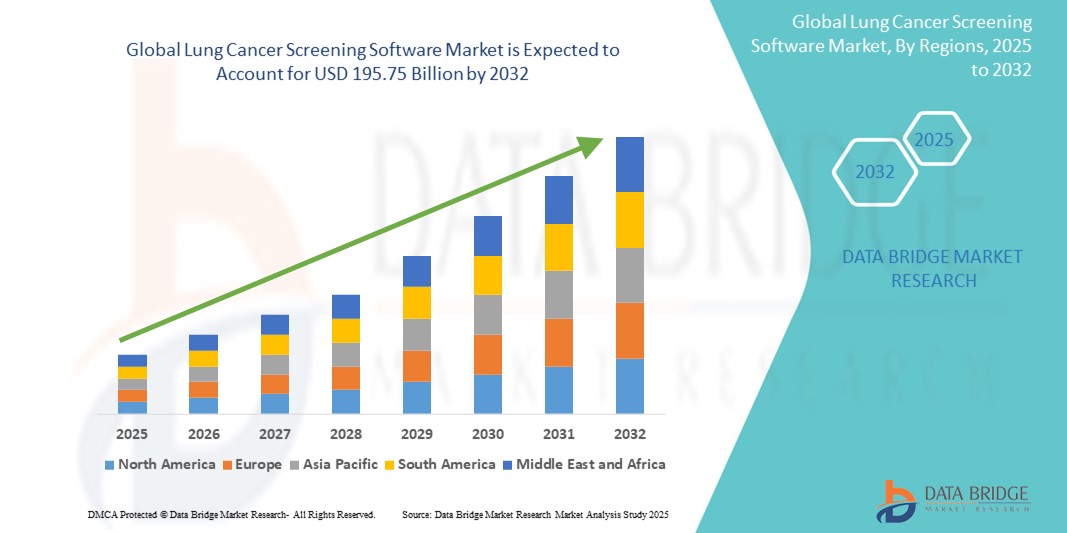

- The global lung cancer screening software market size was valued at USD 47.38 billion in 2024 and is expected to reach USD 195.75 billion by 2032, at a CAGR of 19.40% during the forecast period

- The market growth is primarily driven by the increasing prevalence of lung cancer and the growing emphasis on early detection and diagnosis, supported by advancements in imaging technologies and artificial intelligence integration

- Furthermore, supportive government initiatives and screening guidelines, coupled with rising awareness among healthcare providers about the importance of early-stage lung cancer diagnosis, are bolstering demand for sophisticated screening software solutions. These elements collectively enhance workflow efficiency and diagnostic accuracy, fueling the steady expansion of the global lung cancer screening software market

Lung Cancer Screening Software Market Analysis

- Lung cancer screening software, offering advanced digital tools for early detection and diagnosis, is increasingly vital components of modern oncology and diagnostic systems in both hospital and clinical settings due to their enhanced workflow efficiency, integration with imaging systems, and support for guideline-based screening protocols

- The escalating demand for lung cancer screening software is primarily fueled by the rising incidence of lung cancer, growing emphasis on early diagnosis, and increasing adoption of AI-powered imaging tools to improve accuracy and streamline decision-making

- North America dominates the lung cancer screening software market with the largest revenue share of 55.2% in 2024, characterized by early adoption of advanced healthcare IT, strong oncology infrastructure, and a robust presence of key industry players, with the U.S. experiencing substantial growth in screening program implementation, particularly across large hospital networks and cancer centers, driven by innovations in automated reporting and radiology integration

- Asia-Pacific is expected to be the fastest growing region in the lung cancer screening software market during the forecast period due to increasing healthcare investments, increasing awareness of early cancer detection, and expanding access to imaging technologies

- Non-small cell lung cancer (NSCLC) segment dominates the lung cancer screening software market with a market share of 85.5% in 2024, driven by its high prevalence and the strong clinical focus on early detection and management of this most common lung cancer type

Report Scope and Lung Cancer Screening Software Market Segmentation

|

Attributes |

Lung Cancer Screening Software Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Lung Cancer Screening Software Market Trends

“AI-Powered Diagnostic Precision and Workflow Automation”

- A significant and accelerating trend in the global lung cancer screening software market is the deepening integration of artificial intelligence (AI) to enhance diagnostic precision and automate workflows, enabling healthcare providers to deliver faster and more accurate screening outcomes

- For instance, platforms such as Infervision AI and VUNO Med–LungCT AI integrate with CT imaging systems to automatically detect lung nodules, assist in risk stratification, and generate structured reports, reducing manual workload and improving early detection rates

- AI integration in lung cancer screening software enables features such as automated nodule detection, classification based on malignancy risk, and follow-up scheduling in accordance with Lung-RADS or institutional guidelines. Some systems also provide intelligent alerts for high-risk findings, enhancing clinical decision-making and patient tracking

- The seamless integration of these AI-powered tools with radiology PACS, hospital information systems (HIS), and electronic health records (EHRs) facilitates a streamlined and centralized workflow, allowing radiologists and clinicians to manage screening programs efficiently from image acquisition to report generation

- This trend toward more intelligent, intuitive, and workflow-integrated screening solutions is fundamentally reshaping clinical expectations in oncology diagnostics. Consequently, companies such as Siemens Healthineers and Riverain Technologies are developing advanced platforms that combine AI with comprehensive lung cancer management features

- The demand for lung cancer screening software that offers seamless AI integration and automated decision support is growing rapidly across hospitals, oncology centers, and diagnostic imaging facilities, as providers increasingly prioritize efficiency, accuracy, and early intervention in cancer care

Lung Cancer Screening Software Market Dynamics

Driver

“Growing Need Due to Rising Lung Cancer Incidence and AI Adoption”

- The increasing prevalence of lung cancer worldwide, coupled with the growing emphasis on early diagnosis and screening programs, is a significant driver for the rising demand for lung cancer screening software

- For instance, in March 2024, VUNO Inc. expanded deployment of its AI-powered lung cancer screening solution across multiple hospitals to improve diagnostic accuracy and workflow efficiency. Such initiatives by key companies are expected to drive market growth in the forecast period

- As healthcare providers seek more accurate and timely lung cancer detection, screening software offers advanced features such as AI-based nodule detection, risk stratification, and automated reporting, providing a significant upgrade over traditional methods

- Furthermore, increasing adoption of low-dose CT screening and supportive government initiatives are making lung cancer screening software a vital part of early cancer care, enhancing integration with hospital IT systems and clinical workflows

- The convenience of automated image analysis, seamless integration with radiology systems, and improved patient management capabilities are key factors propelling adoption across hospitals, oncology centers, and diagnostic facilities. The trend toward AI-enabled screening solutions and growing awareness among clinicians further support market expansion

Restraint/Challenge

“Concerns Regarding Data Security and High Implementation Cost”

- Concerns around data privacy and cybersecurity vulnerabilities in connected healthcare software, including lung cancer screening platforms, pose a significant challenge to broader market adoption. These systems process sensitive patient data and are susceptible to breaches, raising concerns among healthcare providers and patients about data protection

- For instance, reports of cybersecurity incidents in medical imaging and health IT systems have made some institutions cautious about fully adopting AI-driven screening software

- Addressing these data security concerns through robust encryption, secure user authentication, and compliance with healthcare regulations such as HIPAA and GDPR is critical to building trust. Companies such as Siemens Healthineers and Riverain Technologies emphasize their strict security protocols and compliance measures to reassure clients. In addition, the high initial costs of implementing advanced lung cancer screening software, especially AI-powered solutions, can be a barrier for smaller hospitals or facilities with limited budgets. While some basic software options are becoming more affordable, premium platforms with comprehensive AI and workflow integration tend to have higher price points

- Although costs are gradually decreasing, the perceived premium for cutting-edge screening technology can limit adoption, especially in developing regions or among institutions with constrained resources

Lung Cancer Screening Software Market Scope

The market is segmented on the basis of mode of delivery, product, type, application, platform, purchase mode, end user, and distribution channel.

- By Mode of Delivery

On the basis of mode of delivery, the market is segmented into cloud-based solutions, on-premise solutions, and web-based solutions. The cloud-based solutions segment dominates with the largest market revenue share in 2024, driven by its scalability, cost-efficiency, and ability to enable real-time data sharing across multiple healthcare facilities, supporting large-scale screening programs.

The web-based solutions segment is expected to witness the fastest growth during the forecast period due to its accessibility via any internet-enabled device without the need for complex installations, making it attractive for smaller clinics and outpatient centers focusing on flexible deployment and ease of use.

- By Product

On the basis of product, the market includes lung cancer screening radiology solutions, patient management software, nodule management software, data collection and reporting, patient coordination and workflow, lung nodule computer-aided detection (CAD), pathology and cancer staging, statistical audit reporting, screening PACS, practice management, and audit log tracking. The lung cancer screening radiology solution segment dominates the market in 2024, fueled by its critical role in enhancing imaging accuracy and early tumor detection through integration with AI algorithms.

Meanwhile, the nodule management software segment is projected to be the fastest growing, due to rising clinical focus on longitudinal monitoring of lung nodules to guide timely intervention and improve patient outcome

- By Type

On the basis of type, the market is segmented into computer-assisted screening and traditional screening. The computer-assisted screening segment holds the dominant share in 2024, supported by rapid advancements in AI-driven image analysis and risk prediction models that significantly improve diagnostic accuracy and reduce false positives.

The traditional screening segment, is expected to grow steadily as legacy systems continue in use in less technologically advanced regions, with gradual digital upgrades offering new opportunities for hybrid screening models.

- By Application

On the basis of application, the market is segmented into non-small cell lung cancer (NSCLC) and small cell lung cancer (SCLC). The NSCLC segment dominates with a large market share of 85.5% in 2024, owing to the higher global incidence rate of NSCLC and greater emphasis on screening programs targeting high-risk populations such as smokers.

The SCLC segment is expected to experience the fastest growth rate during the forecast period, driven by increasing research investments and the development of novel screening protocols aimed at improving early detection despite the cancer’s aggressive progression.

- By Platform

On the basis of platform, the market is segmented into standalone and integrated platforms. The integrated platform segment dominates in 2024, supported by its ability to connect seamlessly with hospital information systems (HIS), radiology information systems (RIS), and PACS, streamlining workflows and improving clinician collaboration

The standalone platform segment is projected to grow at the fastest rate during the forecast period, due to its cost-effectiveness, ease of deployment, and suitability for smaller healthcare providers and emerging markets where comprehensive integration is less feasible.

- By Purchase Mode

On the basis of purchase mode, the market is segmented into institutional and individual purchases. The institutional purchase segment dominated the market in 2024 due to large healthcare facilities, oncology centers, and hospitals acquiring advanced, scalable solutions to manage high patient volumes and comply with screening guidelines.

The individual purchase segment is anticipated to witness the fastest growth during the forecast period, driven by smaller clinics and private practices investing in affordable and user-friendly software options to provide localized screening and diagnostics

- By End User

On the basis of end user, the market is segmented into oncology centers, hospitals, ambulatory surgical centers, and others. The hospitals segment held the largest market share in 2024, as hospitals house comprehensive diagnostic infrastructure and multidisciplinary teams required for large-scale lung cancer screening.

The ambulatory surgical centers segment is expected to register the fastest growth during the forecast period, fueled by their rising adoption of outpatient diagnostic services, convenience, and cost-effectiveness for patients, enabling expanded lung cancer screening coverage beyond traditional hospital settings.

- By Distribution channel

On the basis of distribution channel, the market is segmented into direct tender and third-party distributors. The direct tender segment dominates due to hospitals and large institutions preferring direct procurement to customize solutions and ensure compliance with local regulations and support requirements.

The third-party distributors segment is expected to witness the fastest CAGR from 2025 to 2032, as distributors play a crucial role in emerging markets by providing localized sales, technical support, and training, helping software providers penetrate new regions and smaller healthcare facilities more effectively.

Lung Cancer Screening Software Market Regional Analysis

- North America dominates the lung cancer screening software market with the largest revenue share of 55.2% in 2024, driven by early adoption of advanced healthcare IT, strong oncology infrastructure, and a robust presence of key industry players

- Healthcare providers in the region highly value the accuracy, workflow optimization, and integration of lung cancer screening software with existing imaging and hospital systems.

- This widespread adoption is further supported by high healthcare spending, robust infrastructure, and growing emphasis on AI-enabled screening solutions, establishing lung cancer screening software as a preferred choice in hospitals and oncology centers across the region.

U.S. Lung Cancer Screening Software Market Insight

The U.S. lung cancer screening software market captured the largest revenue share in 2024 within North America, driven by widespread adoption of advanced diagnostic technologies and rising awareness of lung cancer screening benefits. Increasing integration of AI-powered imaging tools and cloud-based platforms enhances diagnostic accuracy and workflow efficiency. Growing initiatives to promote early lung cancer detection among high-risk populations, such as smokers, are further propelling market growth. In addition, strong healthcare infrastructure and high healthcare expenditure support the adoption of sophisticated lung cancer screening solutions.

Europe Lung Cancer Screening Software Market Insight

The Europe lung cancer screening software market is expected to grow steadily at a notable CAGR throughout the forecast period, supported by increasing healthcare digitization and regulatory emphasis on early cancer detection. The region's rising investment in healthcare IT infrastructure and growing adoption of AI in medical imaging bolster market expansion. Moreover, national screening programs in countries such as the UK, Germany, and France are accelerating the use of lung cancer screening software. The emphasis on interoperability and data privacy standards further shapes software development and deployment in Europe.

U.K. Lung Cancer Screening Software Market Insight

The U.K. lung cancer screening software market is projected to expand significantly, driven by government-led screening initiatives and increased public health awareness. The NHS's focus on lung health and preventive care encourages the integration of computer-assisted screening tools in diagnostic pathways. Adoption of cloud-based and AI-enhanced screening software is rising, supported by robust digital health policies and a well-established healthcare IT ecosystem. In addition, growing collaboration between healthcare providers and technology firms fosters innovation and market growth.

Germany Lung Cancer Screening Software Market Insight

The Germany’s lung cancer screening software market is expected to witness strong growth, underpinned by increasing healthcare digitization and investments in AI-driven diagnostics. The country’s advanced healthcare system and commitment to precision medicine drive adoption of lung cancer screening software across hospitals and specialized centers. Emphasis on data security and compliance with stringent EU regulations promotes the development of secure, reliable software solutions. The integration of screening software with hospital information systems is also a key growth factor

Asia-Pacific Lung Cancer Screening Software Market Insight

The Asia-Pacific lung cancer screening software market is poised to grow at the fastest CAGR from 2025 to 2032, fueled by rising healthcare expenditure, expanding healthcare infrastructure, and growing awareness about lung cancer. Rapid urbanization and increasing government initiatives for cancer screening, particularly in China, India, and Japan, support market expansion. Technological advancements, including AI and cloud computing, are accelerating adoption in the region. In addition, improving affordability and increasing private healthcare investments further drive market growth.

Japan Lung Cancer Screening Software Market Insight

The Japan’s lung cancer screening software market is gaining momentum due to a high aging population and widespread adoption of digital healthcare solutions. The emphasis on early diagnosis and integration of AI-powered screening tools enhances market growth. Japan's robust healthcare infrastructure and government support for advanced medical technologies facilitate rapid adoption. The market also benefits from strong collaborations between healthcare providers and tech companies, focusing on improving screening accuracy and patient management.

India Lung Cancer Screening Software Market Insight

The India accounted for the largest market revenue share in Asia-Pacific in 2024, driven by rapid urbanization, increasing lung cancer incidence, and growing awareness of early detection benefits. The expanding middle class and improving healthcare infrastructure boost adoption of lung cancer screening software, especially in urban centers. Government programs promoting cancer awareness and screening initiatives support market growth. In addition, affordable software solutions and partnerships with domestic technology providers enable penetration into tier-2 and tier-3 cities.

Lung Cancer Screening Software Market Share

The lung cancer screening software industry is primarily led by well-established companies, including:

- Siemens Healthineers AG (Germany)

- GE HealthCare (U.S.)

- Koninklijke Philips N.V. (Netherlands)

- CANON MEDICAL SYSTEMS CORPORATION (Japan)

- Fujifilm Healthcare Corporation (Japan)

- Riverain Technologies (U.S.)

- InferVision (China)

- Median Technologies (France)

- ScreenPoint Medical BV (Netherlands)

- Coreline Soft Co., Ltd. (South Korea)

- 4DMedical (Australia)

- Aidoc (Israel)

- Zebra Medical (Israel)

- Lunit Inc. (South Korea)

- MeVis Medical Solutions AG (Germany)

- Agfa-Gevaert Group (Belgium)

- Vuno Inc. (South Korea)

- Imbio (U.S.)

- contextflow (Austria)

- DeepHealth (Netherlands)

Latest Developments in Global Lung Cancer Screening Software Market

- In April 2025, AstraZeneca, in collaboration with health-tech company Qure.ai, announced the successful completion of 5 million AI-enabled chest X-rays across over 20 countries in Asia, the Middle East, Africa, and Latin America. This initiative, part of AstraZeneca's commitment to the World Economic Forum's EDISON Alliance 1 Billion Lives Challenge, demonstrates the potential of AI to enhance lung cancer detection, particularly in resource-limited healthcare environments. The AI-enabled CXRs identified high-risk lung nodules in nearly 50,000 individuals, leading to further testing and potential diagnosis. This collaboration emphasizes the cost-effectiveness of AI as a triaging tool before low-dose CT scans (LDCT) and supports its integration into national health systems

- In May 2025, South Korean company Coreline Soft's flagship product, AVIEW LCS, an AI-powered lung cancer screening analysis software, has been added to Bayer's vendor-neutral, cloud-based marketplace for medical AI solutions, Calantic. This inclusion allows Coreline Soft to expand its reach, supplying its software to governments and hospitals across Europe, including an exclusive supply deal with the German government for its lung cancer screening trial, HANSE. This move signifies the growing trend of integrating specialized AI solutions into broader medical imaging platforms

- In April 2025, University Hospitals Cleveland Medical Center partners with Qure.ai for AI-enhanced lung cancer detection. A new collaboration between University Hospitals Cleveland Medical Center and Qure.ai focuses on deploying the FDA-cleared artificial intelligence (AI) qXR-LN for early lung cancer detection via chest X-rays. This AI tool acts as a "second read" for radiologists, aiming to improve the detection of subtle lung nodules. A prospective, randomized, control trial is underway to further assess and validate the AI's effectiveness in a real-world setting, highlighting the industry's commitment to rigorous validation of AI tools

- In July 2024, Bon Secours Mercy Health collaborates with Koninklijke Philips N.V. to enhance clinical workflows. This collaboration aims to improve clinical workflows through integrated solutions, including advanced imaging technologies and analytics platforms specifically designed for lung cancer detection. Such partnerships underscore the ongoing efforts to create comprehensive and efficient systems for early diagnosis and management of lung cancer

- In June 2024, UC Davis Health deploys new 3D CT imaging system for earlier lung cancer diagnosis. UC Davis Health became the first in its region to utilize a new mobile 3D CT imaging system, the Cios Spin by Siemens Healthineers, paired with Intuitive's robotic-assisted bronchoscopy system, Ion. This innovative combination allows for more precise biopsies by pinpointing potentially cancerous growths with real-time 3D images, addressing the challenge of lung movement during biopsies. This development signifies a focus on improving the accuracy and safety of diagnostic procedures

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.