Global Luxury Hair Care Market

Market Size in USD Billion

CAGR :

%

USD

16.38 Billion

USD

26.91 Billion

2024

2032

USD

16.38 Billion

USD

26.91 Billion

2024

2032

| 2025 –2032 | |

| USD 16.38 Billion | |

| USD 26.91 Billion | |

|

|

|

|

Luxury Hair Care Market Size

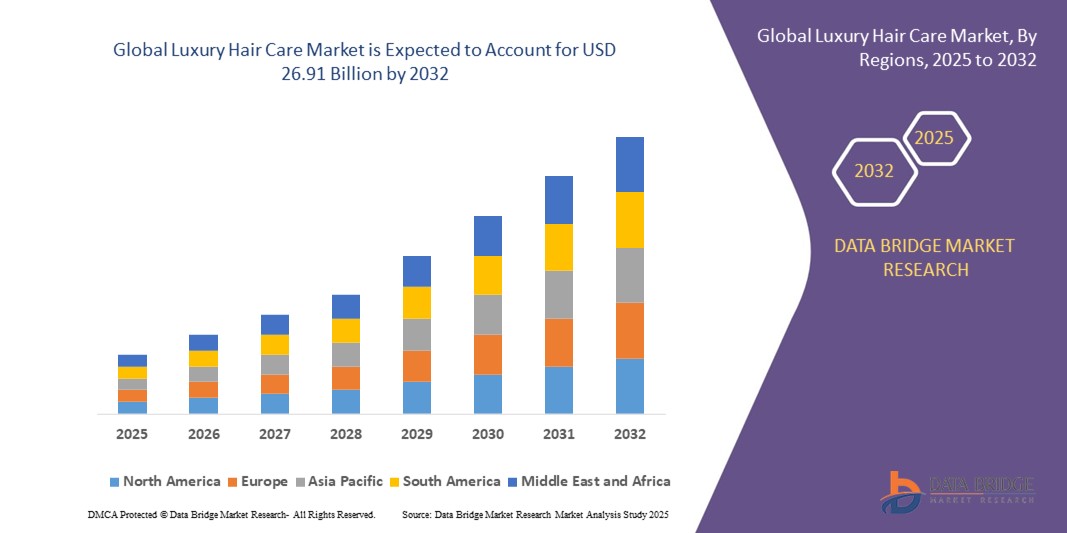

- The global luxury hair care market size was valued at USD 16.38 billion in 2024 and is expected to reach USD 26.91 billion by 2032, at a CAGR of 6.40% during the forecast period

- The market growth is primarily driven by increasing consumer inclination toward premium and salon-quality hair care products, supported by rising disposable incomes and heightened awareness of personal grooming

- In addition, growing demand for clean-label, organic, and sustainable formulations especially among millennials and Gen Z alongside expanding e-commerce penetration is accelerating the shift toward luxury offerings. These factors collectively are propelling the adoption of high-end hair care products, thereby fueling market expansion

Luxury Hair Care Market Analysis

- Luxury hair care products, which include premium shampoos, conditioners, hair oils, and treatments, are gaining traction among consumers seeking high-quality formulations, salon-such as experiences at home, and targeted solutions for hair health and aesthetics

- The rising demand for luxury hair care is largely driven by increased awareness of personal grooming, a growing preference for natural and organic ingredients, and the influence of beauty influencers and social media on consumer behavior

- North America dominated the luxury hair care market with the largest revenue share of 39.9% in 2024, driven by high consumer spending on personal care, strong brand presence, and a growing demand for clean, sustainable, and salon-grade hair products, particularly in the U.S. where premium product adoption is further supported by online retail growth and professional salon collaborations

- Asia-Pacific is projected to be the fastest growing region in the luxury hair care market during the forecast period, fueled by rising disposable incomes, increasing urbanization, and growing consumer interest in high-end, customized hair care routines

- The shampoos segment dominated the luxury hair care market with a market share of 42.1% in 2024, driven by its high usage frequency and the availability of diverse product offerings addressing specific hair concerns

Report Scope and Luxury Hair Care Market Segmentation

|

Attributes |

Luxury Hair Care Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Luxury Hair Care Market Trends

Rising Demand for Clean Beauty and Personalized Hair Care Solutions

- A significant and accelerating trend in the global luxury hair care market is the growing consumer preference for clean-label, natural, and personalized hair care products that cater to individual hair types and concerns. This shift is reshaping product development strategies and positioning brands that emphasize sustainability, ingredient transparency, and customization at the forefront

- For instance, brands such as Oribe and Rahua are gaining traction by offering sulfate-free, paraben-free, and cruelty-free formulations with premium botanical ingredients. Similarly, Function of Beauty and Prose offer customized luxury hair care products based on individual hair goals and lifestyle, using AI-powered quizzes and data-driven formulations

- The demand for organic and plant-based hair care products has grown in response to increasing concerns over harmful chemicals, scalp sensitivity, and environmental sustainability. Consumers are seeking eco-conscious packaging, responsibly sourced ingredients, and multifunctional products that align with a holistic wellness lifestyle

- Digital personalization and AI-driven diagnostics are enabling luxury hair care brands to create bespoke regimens tailored to user-specific needs. Through online platforms, consumers can now receive tailored product recommendations or build their own formulas, enhancing engagement and brand loyalty

- This trend toward personalized, clean, and sustainable hair care solutions is elevating consumer expectations and fostering innovation in product offerings. Luxury brands are responding by investing in R&D, enhancing ingredient sourcing transparency, and adopting eco-friendly packaging, aligning with the values of today’s conscious consumers

- The demand for high-performance, personalized, and environmentally responsible luxury hair care products is growing rapidly across global markets, especially among millennials and Gen Z, who prioritize ingredient integrity, social responsibility, and product effectiveness

Luxury Hair Care Market Dynamics

Driver

Premiumization and Influence of Social Media and Celebrity Branding

- The increasing consumer inclination toward premium hair care experiences, influenced heavily by beauty influencers, social media trends, and celebrity-endorsed product lines, is a major driver of growth in the luxury hair care market

- For instance, in March 2024, celebrity brand JVN Hair (by Jonathan Van Ness) expanded its luxury product line globally, emphasizing clean beauty and inclusivity, which significantly boosted its market presence. Such strategic brand positioning and celebrity influence are propelling the growth of aspirational purchases in the luxury segment

- Consumers are willing to pay a premium for salon-quality products that offer visible results, superior ingredients, and brand prestige. This trend is particularly evident in urban areas where consumers seek convenient, professional-level solutions that deliver both aesthetic and therapeutic benefits

- The rise of e-commerce platforms and direct-to-consumer models has further enabled luxury hair care brands to reach wider audiences, providing easy access to high-end offerings and enhancing the buying experience with personalized recommendations and virtual consultations

- Increased brand awareness, coupled with the perception of hair care as an extension of self-care and wellness, continues to boost the popularity of luxury products that deliver both functionality and indulgence

Restraint/Challenge

High Cost and Accessibility Constraints in Price-Sensitive Markets

- The relatively high price point of luxury hair care products poses a significant barrier to widespread adoption, particularly in developing regions or among price-sensitive consumer segments

- For instance, while niche brands such as Christophe Robin and Philip B have garnered strong brand loyalty in developed countries, their availability and visibility remain limited in emerging markets

- While consumers in mature markets are more accustomed to spending on high-end grooming products, affordability remains a key issue in markets where personal care spending is still focused on essential needs

- In addition, limited access to luxury hair care brands in offline retail settings, especially in rural or underserved regions, restricts market reach. Although e-commerce is bridging this gap, logistical challenges and lack of product education can hinder penetration

- Moreover, the effectiveness of some premium offerings is often questioned by consumers who may not perceive a substantial benefit over mid-range alternatives, especially without personalized consultations or sampling opportunities

- Addressing these challenges through strategic pricing, sampling programs, tiered product lines, and greater retail distribution will be essential for luxury hair care brands aiming for global expansion and long-term growth

Luxury Hair Care Market Scope

The market is segmented on the basis of product and distribution channel.

- By Product

On the basis of product, the global luxury hair care market is segmented into hair colorants, hair spray, shampoos, conditioners, hair loss treatment products, hair styling products, and perms and relaxants. The shampoos segment dominated the market with the largest market revenue share of 42.1% in 2024, driven by their frequent use and the increasing demand for premium, sulfate-free, and ingredient-conscious formulations. Consumers are opting for high-performance shampoos that not only cleanse but also address specific concerns such as hair thinning, dryness, and scalp sensitivity. Luxury brands are capitalizing on this by offering a wide variety of targeted and sensorial shampoo options that align with clean beauty standards.

The hair loss treatment products segment is anticipated to witness the fastest growth rate of 22.3% from 2025 to 2032, fueled by rising awareness about hair health, the growing influence of social media beauty trends, and increasing consumer willingness to invest in specialized care. This segment benefits from technological innovations and the inclusion of scientifically-backed active ingredients in premium formulations, attracting consumers seeking visible and long-term results.

- By Distribution Channel

On the basis of distribution channel, the global luxury hair care market is segmented into direct selling, hypermarkets/supermarkets, retail chains, online stores, pharmacies/drug stores, convenience stores, and other distribution channels. The online stores segment held the largest market revenue share in 2024, owing to the growing consumer preference for convenience, access to a wide range of global brands, and personalized product recommendations through AI-powered platforms. E-commerce offers a seamless shopping experience with subscription models, influencer-driven marketing, and exclusive online launches, making it the most dynamic and accessible sales channel for luxury hair care products.

The retail chains segment is expected to witness the fastest CAGR from 2025 to 2032, driven by the expanding presence of luxury hair care brands in premium beauty stores and salons. Physical retail environments offer experiential purchasing, professional consultations, and product trials, which enhance consumer confidence and brand loyalty. In addition, strategic placement in luxury sections of retail chains helps elevate brand positioning and visibility.

Luxury Hair Care Market Regional Analysis

- North America dominated the luxury hair care market with the largest revenue share of 39.9% in 2024, driven by high consumer spending on personal care, strong brand presence, and a growing demand for clean, sustainable, and salon-grade hair products, particularly in the U.S. where premium product adoption is further supported by online retail growth and professional salon collaborations

- Consumers in the region place high value on ingredient transparency, product efficacy, and brand prestige, fueling the popularity of clean, sustainable, and performance-oriented luxury hair care products

- This widespread adoption is further supported by high disposable incomes, a well-established salon industry, and robust e-commerce infrastructure, positioning luxury hair care as an essential component of the broader personal wellness and self-care movement across both urban and suburban market

U.S. Luxury Hair Care Market Insight

The U.S. luxury hair care market captured the largest revenue share of 78% in 2024 within North America, fueled by the increasing demand for high-performance, salon-quality products and the rise of clean beauty trends. Consumers are increasingly investing in premium hair care solutions that offer targeted benefits, natural ingredients, and brand prestige. The growth of e-commerce, influencer marketing, and direct-to-consumer brands is further propelling market expansion. In addition, the strong salon network and widespread adoption of personalized beauty routines support continued demand for luxury hair care across diverse consumer segments.

Europe Luxury Hair Care Market Insight

The Europe luxury hair care market is projected to expand at a substantial CAGR throughout the forecast period, driven by increasing beauty consciousness, demand for sustainable formulations, and a well-established premium personal care industry. European consumers are highly attentive to ingredient quality, eco-friendly packaging, and ethical sourcing, encouraging the adoption of luxury hair care products that align with these values. The region’s advanced retail infrastructure and high per capita spending on beauty support robust market penetration across both urban and suburban markets.

U.K. Luxury Hair Care Market Insight

The U.K. luxury hair care market is anticipated to grow at a noteworthy CAGR during the forecast period, supported by a growing interest in clean, high-efficacy hair care solutions and rising demand for gender-neutral and inclusive beauty products. The prevalence of fashion-forward consumers and strong influence of social media trends are accelerating premium product adoption. Moreover, the availability of global luxury brands in retail chains and online platforms ensures widespread access, helping the market capture a broad consumer base seeking premium grooming experiences.

Germany Luxury Hair Care Market Insight

The Germany luxury hair care market is expected to expand at a considerable CAGR during the forecast period, fueled by a culture that values quality, sustainability, and innovation in personal care. German consumers are increasingly drawn to high-end products that offer functional benefits, natural ingredients, and ethical production processes. The country's strong salon network and preference for scientifically backed, dermatologist-tested formulations position Germany as a key market for luxury hair care brands looking to scale in Europe.

Asia-Pacific Luxury Hair Care Market Insight

The Asia-Pacific luxury hair care market is poised to grow at the fastest CAGR of 23.6% during the forecast period of 2025 to 2032, driven by rising disposable incomes, a growing young population, and increasing awareness of hair wellness in countries such as China, Japan, and India. The demand for premium grooming products is rapidly expanding beyond metropolitan areas, supported by government-led digitalization and e-commerce initiatives. APAC is also emerging as a hotspot for beauty innovation, with regional consumers prioritizing products tailored to local hair types and climate conditions.

Japan Luxury Hair Care Market Insight

The Japan luxury hair care market is gaining momentum due to a strong culture of personal grooming, an aging population, and a preference for technologically advanced and minimalist formulations. Consumers value efficacy, safety, and elegance in packaging, favoring brands that combine tradition with innovation. The rise in demand for anti-aging and scalp health-focused products is boosting the market, while smart retail technologies and subscription models contribute to an elevated consumer experience.

India Luxury Hair Care Market Insight

The India luxury hair care market accounted for the largest market revenue share in Asia Pacific in 2024, supported by an expanding middle class, rising beauty awareness, and growing interest in international and Ayurvedic premium brands. Rapid urbanization, increased smartphone penetration, and social media influence are fueling the popularity of luxury hair care across urban and semi-urban areas. In addition, India’s cultural emphasis on hair wellness and traditional ingredients aligns well with luxury product innovation, positioning the country as a key growth market.

Luxury Hair Care Market Share

The luxury hair care industry is primarily led by well-established companies, including:

- Shiseido Company (Japan)

- Johnson & Johnson and its affiliates (U.S.)

- Unilever (U.K.)

- Amway Corp. (U.S.)

- Procter & Gamble (U.S.)

- L’Oréal S.A. (France)

- Revlon Group (U.S.)

- Beiersdorf AG (Germany)

- Natura & CO (South America)

- Conair LLC (U.S.)

- Goody (U.S.)

- Yves Rocher (France)

- Kao Corporation (Japan)

- Marico (India)

- AVEDA CORP. (U.S.)

- Henkel AG (Germany)

- COMBE (U.S.)

- AVON PRODUCTS (U.K.)

- OLAPLEX. (U.S.)

- Pai-Shau (Canada)

What are the Recent Developments in Global Luxury Hair Care Market?

- In May 2024, L’Oréal Professionnel launched its new Metal Detox Oil globally, expanding its premium in-salon and at-home treatment range. Designed to neutralize metal particles that accumulate in hair fibers due to water exposure, the product enhances color longevity and strengthens hair structure. This innovation underscores L’Oréal’s ongoing investment in advanced hair care science and its commitment to delivering salon-grade results in both professional and consumer segments

- In April 2024, Procter & Gamble’s premium brand OUAI collaborated with popular influencers to introduce its new Detox Shampoo Refill Pouch, targeting sustainability-conscious consumers. The product, which retains the original formula, is part of a larger move toward environmentally friendly packaging and waste reduction. This launch reflects growing consumer demand for luxury hair care solutions that are both effective and sustainable, positioning OUAI as a trendsetter in the clean beauty movement

- In March 2024, Shiseido’s luxury hair care division expanded its global footprint by launching its Sublimic range in key European markets. The line includes shampoos, treatments, and scalp serums focusing on damage repair, scalp balance, and anti-aging benefits. With its roots in Japanese beauty science, the brand’s global expansion reflects increased demand for holistic, science-backed luxury hair care solutions that address both hair and scalp health

- In February 2024, Unilever’s premium brand Nexxus introduced a new line of Bond Therapy shampoos and conditioners in North America, formulated with keratin protein and collagen to restore damaged hair. This innovation highlights the brand’s strategic focus on performance-based solutions in the luxury category and caters to a growing segment of consumers seeking targeted repair and professional-quality results at home

- In January 2024, Kérastase (a subsidiary of L’Oréal) unveiled its Symbiose anti-dandruff collection, merging dermatological science with luxury care. Featuring sulfate-free formulations and high-performance active ingredients such as salicylic acid and piroctone olamine, the collection aims to address dandruff without compromising hair beauty or luxury sensorial experiences. This launch illustrates the brand’s ability to bring functional skincare-such as solutions into the premium hair

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.