Global Luxury Jewellery Market

Market Size in USD Billion

CAGR :

%

USD

93.66 Billion

USD

149.28 Billion

2025

2033

USD

93.66 Billion

USD

149.28 Billion

2025

2033

| 2026 –2033 | |

| USD 93.66 Billion | |

| USD 149.28 Billion | |

|

|

|

|

Luxury Jewellery Market Size

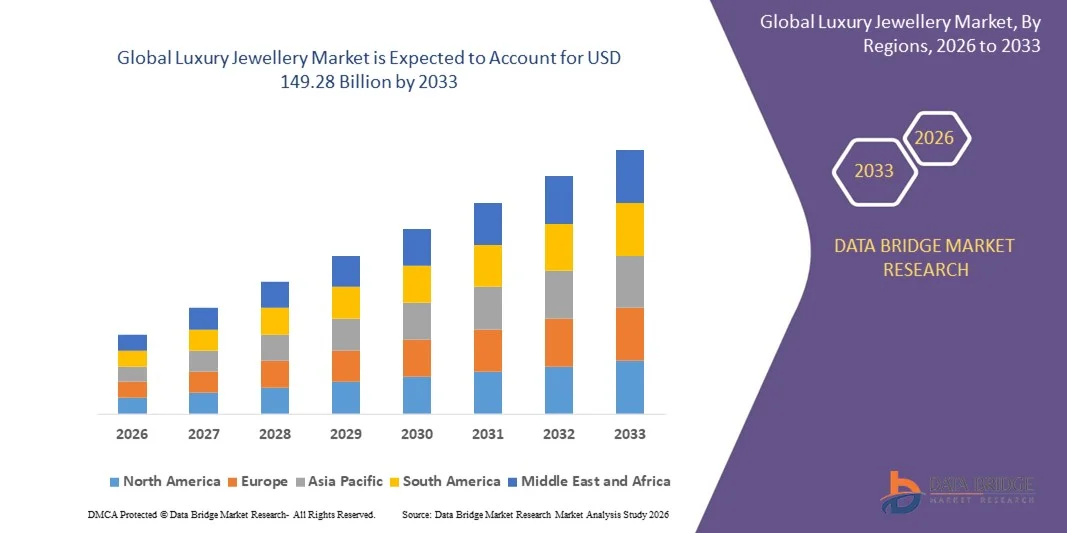

- The global luxury jewellery market size was valued at USD 93.66 billion in 2025 and is expected to reach USD 149.28 billion by 2033, at a CAGR of 6.0% during the forecast period

- The market growth is largely fueled by rising disposable incomes, increasing urbanization, and expanding high-net-worth populations, which are driving higher spending on premium and luxury jewellery across both mature and emerging economies

- Furthermore, growing consumer inclination toward branded, certified, and design-driven jewellery, along with the rising influence of fashion trends and luxury gifting culture, is strengthening demand. These combined factors are accelerating the adoption of luxury jewellery, thereby significantly supporting overall market growth

Luxury Jewellery Market Analysis

- Luxury jewellery, encompassing high-value products crafted from precious metals and gemstones, remains a key symbol of status, heritage, and personal expression, sustaining strong demand across bridal, festive, and occasion-based purchases

- The increasing preference for customized designs, ethically sourced materials, and omnichannel retail experiences is reshaping buying behavior, while global brand expansion and digital luxury platforms continue to enhance market accessibility and consumer engagement

- Asia-Pacific dominated luxury jewellery market with a share of 67.1% in 2025, due to strong cultural affinity toward precious jewellery, rising disposable incomes, and high demand for bridal and festive jewellery

- North America is expected to be the fastest growing region in the luxury jewellery market during the forecast period due to high consumer spending on luxury goods and strong demand for diamond and designer jewellery

- Gold segment dominated the market with a market share of 33.6% in 2025, due to its cultural significance, long-standing value perception, and wide acceptance across regions. Gold luxury jewellery is preferred for weddings, festivals, and investment purposes, which sustains consistent demand across both developed and emerging markets. Its design versatility and compatibility with precious stones further strengthen its dominance among consumers seeking timeless yet premium products

Report Scope and Luxury Jewellery Market Segmentation

|

Attributes |

Luxury Jewellery Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Luxury Jewellery Market Trends

Rising Demand for Branded and Customized Luxury Jewellery

- A prominent trend in the luxury jewellery market is the increasing demand for branded and customized jewellery, driven by consumers seeking exclusivity, personal expression, and superior craftsmanship. Branded luxury jewellery is gaining preference as buyers associate established maisons with authenticity, design heritage, and long-term value, especially for high-value purchases

- For instance, Cartier and Van Cleef & Arpels have expanded their bespoke and made-to-order offerings, allowing clients to personalize gemstones, settings, and design elements while maintaining brand identity. These initiatives strengthen customer loyalty and elevate the perceived exclusivity of luxury jewellery collections

- Customization is becoming particularly influential among younger high-net-worth consumers who favor unique designs over mass-produced luxury items. Brands are responding by offering modular designs, limited-edition collections, and personalized engravings that align with individual style preferences

- The growing prominence of luxury gifting for milestones such as weddings, anniversaries, and achievements is further reinforcing this trend. Customized luxury jewellery enhances emotional value, making it a preferred choice for commemorative purchases

- Digital tools and in-store design consultations are enabling luxury brands to streamline customization while preserving craftsmanship standards. This integration is reshaping the buying experience and strengthening consumer engagement

- Overall, the rising emphasis on branded and customized luxury jewellery is reinforcing brand differentiation, supporting premium pricing, and shaping long-term demand patterns across global luxury markets

Luxury Jewellery Market Dynamics

Driver

Growing Disposable Income and Expansion of High-Net-Worth Individuals

- The growth of the luxury jewellery market is strongly driven by rising disposable incomes and the expanding population of high-net-worth individuals across key regions. Increased purchasing power allows consumers to allocate higher spending toward premium lifestyle products, including fine and high jewellery

- For instance, brands such as Bulgari and Tiffany & Co. have reported strong demand in regions with rising wealth concentration, supported by increased spending on diamond and precious metal jewellery. This reflects how income growth directly translates into higher luxury consumption

- Emerging economies are witnessing a rapid rise in affluent consumers, supported by economic growth and urbanization. This is expanding the customer base for luxury jewellery beyond traditional mature markets

- Established luxury consumers are also increasing repeat purchases, driven by investment-oriented buying and portfolio diversification into precious jewellery. This behavior supports steady demand even during moderate economic fluctuations

- This sustained increase in purchasing power is positioning disposable income growth as a core driver supporting the market’s expansion

Restraint/Challenge

High Price Sensitivity and Volatility in Precious Metal Prices

- The luxury jewellery market faces a significant challenge from price sensitivity caused by volatility in precious metal and gemstone prices. Fluctuations in gold, platinum, and diamond prices directly impact product pricing and profit margins for manufacturers and retailers

- For instance, companies such as Chow Tai Fook Jewellery Group are exposed to global gold price movements, which influence inventory valuation and consumer purchasing decisions. Sudden price increases can lead to deferred purchases, particularly for investment-driven buyers

- Rising raw material costs often require brands to adjust pricing strategies, which may affect demand in price-sensitive markets. This creates pressure to balance exclusivity with affordability while maintaining luxury positioning

- Consumers may shift purchasing behavior toward lighter designs or alternative materials during periods of high price volatility. This can temporarily impact demand for traditional heavy gold and gemstone jewellery

- Overall, fluctuations in precious metal prices continue to challenge market stability by influencing costs, consumer sentiment, and purchasing timelines across the luxury jewellery value chain

Luxury Jewellery Market Scope

The market is segmented on the basis of material, product, distribution channel, and end user.

- By Material

On the basis of material, the luxury jewellery market is segmented into gold, platinum, diamond, and others. The gold segment dominated the market with the largest revenue share of 33.6% in 2025, supported by its cultural significance, long-standing value perception, and wide acceptance across regions. Gold luxury jewellery is preferred for weddings, festivals, and investment purposes, which sustains consistent demand across both developed and emerging markets. Its design versatility and compatibility with precious stones further strengthen its dominance among consumers seeking timeless yet premium products.

The diamond segment is anticipated to witness the fastest growth rate from 2026 to 2033, driven by rising disposable incomes and increasing preference for high-end, statement jewellery. Growing demand for certified diamonds, customized designs, and luxury gifting trends among younger consumers is accelerating adoption. In addition, strong marketing by global luxury brands and the emotional association of diamonds with exclusivity and status continue to support rapid segment growth

- By Product

On the basis of product, the luxury jewellery market is segmented into necklace, ring, bracelet, earing, and others. The ring segment accounted for the largest market revenue share in 2025, primarily due to its strong association with engagements, weddings, and milestone celebrations. Luxury rings are frequently purchased as symbols of commitment and personal expression, ensuring steady demand across genders. The availability of personalized and gemstone-embedded designs further reinforces the dominance of this segment.

The necklace segment is expected to register the fastest growth during the forecast period, fueled by rising demand for bold, designer pieces and layered jewellery trends. Luxury necklaces are increasingly viewed as fashion statements that complement both traditional and contemporary attire. Growing influence of celebrities and fashion houses in promoting high-value necklace collections is further accelerating segment expansion

- By Distribution Channel

On the basis of distribution channel, the luxury jewellery market is segmented into online and offline. The offline segment dominated the market in 2025, driven by consumer preference for in-store purchasing experiences that allow physical inspection, customization discussions, and trust-building. High-value luxury jewellery purchases often involve personalized services, certification verification, and brand-exclusive boutiques, which strengthen offline channel leadership. Established retail networks and flagship stores continue to play a critical role in purchase decisions.

The online segment is projected to witness the fastest growth from 2026 to 2033, supported by increasing digitalization and improved online authentication technologies. Luxury brands are investing in immersive digital platforms, virtual try-ons, and secure payment solutions to enhance consumer confidence. Expanding reach to younger, tech-savvy consumers and cross-border shoppers is further driving online channel growth

- By End User

On the basis of end user, the luxury jewellery market is segmented into male and female. The female segment held the largest market revenue share in 2025, attributed to traditionally higher jewellery consumption and wider product offerings tailored for women. Luxury jewellery for women spans daily wear, bridal collections, and occasion-based designs, ensuring continuous demand across age groups. Strong influence of fashion trends and gifting culture further supports segment dominance.

The male segment is expected to grow at the fastest pace over the forecast period, driven by changing fashion norms and increasing acceptance of luxury accessories among men. Rising demand for premium rings, bracelets, and statement pieces is expanding the male consumer base. Luxury brands are increasingly launching gender-focused collections, which is accelerating adoption and market growth among male end users

Luxury Jewellery Market Regional Analysis

- Asia-Pacific dominated the luxury jewellery market with the largest revenue share of 67.1% in 2025, driven by strong cultural affinity toward precious jewellery, rising disposable incomes, and high demand for bridal and festive jewellery

- Rapid urbanization, growing middle- and high-net-worth populations, and increasing influence of global luxury brands are accelerating market expansion across the region

- Expanding retail networks, growth of organized luxury outlets, and rising preference for premium and customized jewellery designs are supporting sustained consumption

China Luxury Jewellery Market Insight

China held the largest share of 67.07% in the Asia-Pacific luxury jewellery market in 2025, supported by a large consumer base, rising wealth levels, and strong demand for gold and diamond jewellery. The country’s growing luxury retail ecosystem, increasing gifting culture, and expansion of international and domestic luxury brands are key growth drivers. In addition, digital luxury platforms and omnichannel strategies are strengthening market penetration.

India Luxury Jewellery Market Insight

India is witnessing the fastest growth in the Asia-Pacific region, fueled by strong demand for gold jewellery, expanding bridal jewellery consumption, and rising aspirational spending. Increasing disposable incomes, urbanization, and a shift toward branded luxury jewellery are supporting rapid market growth. In addition, growing acceptance of diamond and platinum jewellery among younger consumers is accelerating expansion.

Europe Luxury Jewellery Market Insight

The Europe luxury jewellery market is expanding steadily, driven by high consumer preference for craftsmanship, heritage brands, and premium design aesthetics. Strong demand for diamond and platinum jewellery, coupled with established luxury fashion houses, supports market stability. Increasing focus on sustainable sourcing and ethically certified jewellery is further shaping regional demand.

Germany Luxury Jewellery Market Insight

Germany’s luxury jewellery market is supported by high purchasing power, preference for minimalist and premium designs, and strong demand for certified precious stones. The presence of well-established luxury retailers and emphasis on quality and precision craftsmanship are key contributors. Growing interest in investment-grade jewellery is also supporting market growth.

U.K. Luxury Jewellery Market Insight

The U.K. market is driven by strong demand for branded luxury jewellery, rising online luxury sales, and a mature gifting culture. London’s position as a global luxury hub and the presence of renowned jewellery houses support consistent demand. Increasing interest in bespoke and sustainably sourced jewellery is further strengthening the market.

North America Luxury Jewellery Market Insight

North America is projected to grow at the fastest CAGR from 2026 to 2033, driven by high consumer spending on luxury goods and strong demand for diamond and designer jewellery. The region benefits from a mature luxury retail infrastructure and growing acceptance of personalized and statement jewellery. Rising influence of digital channels and celebrity endorsements is accelerating market expansion.

U.S. Luxury Jewellery Market Insight

The U.S. accounted for the largest share in the North America market in 2025, supported by a strong luxury consumer base and high demand for premium diamond and gold jewellery. Presence of leading luxury brands, advanced retail experiences, and strong online sales channels are key growth factors. Increasing preference for customized and ethically sourced jewellery further reinforces the U.S.’s leading position.

Luxury Jewellery Market Share

The luxury jewellery industry is primarily led by well-established companies, including:

- Chopard International SA (Switzerland)

- Harry Winston, Inc. (U.S.)

- CARTIER (France)

- Guccio Gucci S.p.A. (Italy)

- T&CO. – Tiffany & Co. (U.S.)

- Buccellati Holding SPA (Italy)

- Bulgari S.p.A. (Italy)

- Piaget (Switzerland)

- VAN CLEEF & ARPELS (France)

- MIKIMOTO (Japan)

- Compagnie Financière Richemont SA (Switzerland)

- GRAFF (U.K.)

- Pandora Jewelry, LLC. (Denmark)

- Chow Tai Fook Jewellery Company Limited (Hong Kong)

- Rajesh Exports Ltd. (India)

- Signet Jewelers (U.S.)

- CHANEL (France)

- LVMH Moët Hennessy – Louis Vuitton (France)

Latest Developments in Global Luxury Jewellery Market

- In September 2025, PureJewels became the first luxury jeweller to launch Hallmarking 2.0 with digital product passports, marking a major advancement in transparency and traceability within the luxury jewellery market. The initiative enables consumers to digitally verify purity, origin, and craftsmanship details, which enhances confidence in high-value purchases and aligns with evolving regulatory standards. This move positions PureJewels as a technology-led luxury brand and sets a benchmark for digital authentication across the premium jewellery segment

- In August 2025, Sabyasachi jewellery launched online on Tata CliQ Luxury with starting prices of ₹55,000, significantly strengthening its omnichannel retail strategy. By entering a curated luxury e-commerce platform, the brand expanded its reach beyond physical boutiques and engaged digitally savvy, high-income consumers. The launch reflects the broader shift toward online luxury jewellery adoption while reinforcing Tata CliQ Luxury’s role as a key gateway for heritage luxury brands

- In February 2025, Aesop collaborated with jeweler Patcharavipa Bodiratnangkura to introduce a limited-edition rhodium-plated ear cuff inspired by its floral fragrance “Aurner.” The collaboration highlights the convergence of fragrance, art, and jewellery, creating a collectible luxury accessory rooted in creative expression. Such design-led partnerships enhance brand differentiation and appeal to consumers seeking unique, story-driven luxury jewellery offerings

- In February 2025, Tanishq made its debut at New York Fashion Week through a collaboration with designer Bibhu Mohapatra, presenting over 40 jewellery creations aligned with the designer’s Fall 2025 collection. This global showcase elevated Tanishq’s international brand presence and emphasized the versatility of Indian craftsmanship in high-fashion contexts. The collaboration supports Tanishq’s strategy to position Indian luxury jewellery alongside global fashion houses

- In May 2022, Tata CliQ Luxury introduced fine jewellery on its platform with the launch of De Beers Forevermark, expanding its luxury assortment into certified diamond jewellery. The addition improved consumer access to ethically sourced and authenticated diamonds through a trusted digital platform. This milestone supported the digital transformation of luxury jewellery retail in India and strengthened Tata CliQ Luxury’s competitive positioning in the premium segment

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.