Global Macrolide Antibiotics Market

Market Size in USD Billion

CAGR :

%

USD

79.77 Billion

USD

212.07 Billion

2024

2032

USD

79.77 Billion

USD

212.07 Billion

2024

2032

| 2025 –2032 | |

| USD 79.77 Billion | |

| USD 212.07 Billion | |

|

|

|

|

Macrolide Antibiotics Market Size

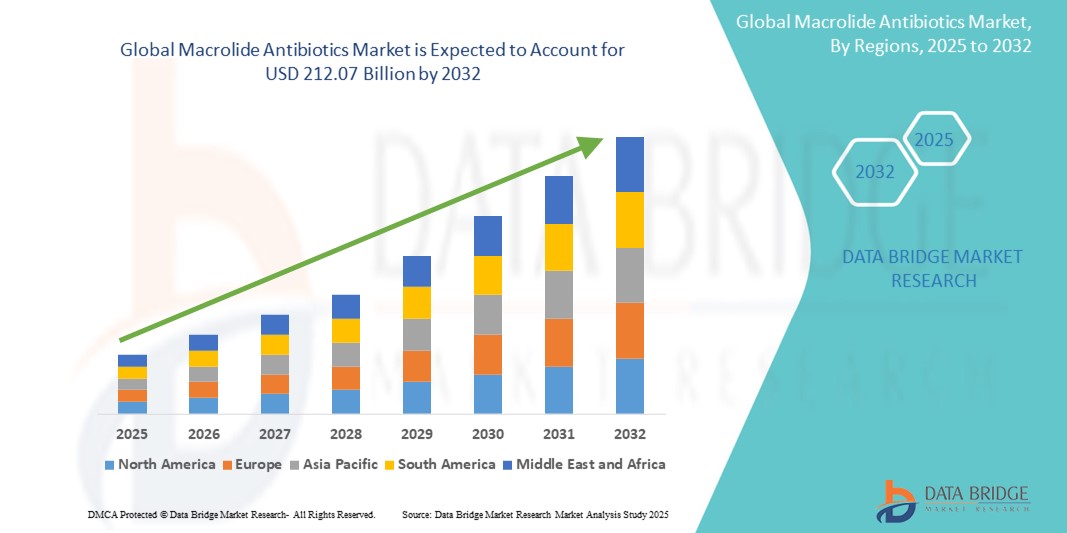

- The global macrolide antibiotics market size was valued at USD 79.77 billion in 2024 and is expected to reach USD 212.07 billion by 2032, at a CAGR of 13.00% during the forecast period

- This growth is driven by factors such as the rising incidence of bacterial infections, the availability of cost-effective generic medications, and increasing demand from emerging economies with large populations and expanding healthcare access

Macrolide Antibiotics Market Analysis

- Macrolide antibiotics are a class of antibiotics effective against a wide range of bacterial infections, especially respiratory tract infections, skin infections, and sexually transmitted diseases. They function by inhibiting bacterial protein synthesis

- The market growth is driven by rising incidence of bacterial infections, growing demand for broad-spectrum antibiotics, and the availability of cost-effective generics

- North America is expected to dominate the macrolide antibiotics market with a market share of 45.85%, due to advanced healthcare infrastructure, high adoption of cutting-edge medical technologies, and a strong presence of key pharmaceutical players

- Asia-Pacific is expected to be the fastest growing region in the macrolide antibiotics market with a market share of 30.5%, during the forecast period due to the rapid expansion in healthcare infrastructure, increasing awareness about antibiotic use, and rising infection rates

- Oral segment segment is expected to dominate the market with a market share of 65.9% due to its convenience, ease of administration, and patient preference for non-invasive treatment options

Report Scope and Macrolide Antibiotics Market Segmentation

|

Attributes |

Macrolide Antibiotics Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Macrolide Antibiotics Market Trends

“Advancements in Drug Formulations & Generic Accessibility”

- A prominent trend in the macrolide antibiotics market is the increasing development and availability of generic formulations, enhancing accessibility and reducing treatment costs

- These innovations improve patient access to essential antibiotics, particularly in emerging economies, thereby expanding market reach

- For instance, Teva Pharmaceuticals offers generic products such as Azithromycin for Oral Suspension and Tablets, providing affordable options for patients worldwide

- These advancements in macrolide antibiotics, particularly the development of generic formulations and innovative drug combinations, are transforming the landscape of bacterial infection treatment

Macrolide Antibiotics Market Dynamics

Driver

“Increasing Prevalence of Bacterial Infections”

- The rising prevalence of bacterial infections, including respiratory tract infections, sexually transmitted diseases, and skin infections, is significantly contributing to the increased demand for macrolide antibiotics

- As the global population grows and the burden of infectious diseases rises, the need for effective antibiotics continues to expand, with macrolides being a key therapeutic class due to their broad-spectrum activity

- As more individuals seek treatment for bacterial infections, the demand for macrolide antibiotics rises, improving treatment outcomes and reducing the risks associated with untreated infections

For instance,

- According to a 2021 article published by the World Health Organization, the rise in antimicrobial resistance (AMR) is exacerbating the need for effective antibiotics such as macrolides, particularly in developing regions where access to healthcare is limited.

- As a result of the growing incidence of bacterial infections, there is a significant increase in the demand for macrolide antibiotics, driving market growth

Opportunity

“Leveraging Artificial Intelligence for Drug Discovery & Development”

- AI-driven technologies can significantly accelerate the discovery and development of new macrolide antibiotics, enhancing the speed and accuracy of identifying novel compounds and predicting their effectiveness

- AI algorithms can analyze vast amounts of data from clinical trials, patient records, and existing antibiotics to identify patterns and predict the success of new formulations or drug combinations

- In addition, AI can assist in optimizing dosing regimens and monitoring antibiotic resistance patterns, enabling more personalized and effective treatments

For instance,

- In a 2024 article published by the Journal of Antibiotics, AI tools were shown to enhance the identification of novel antibiotic candidates, facilitating the development of more potent macrolides. AI models can predict bacterial resistance and help design antibiotics capable of overcoming resistance mechanisms

- The integration of AI into the macrolide antibiotics market could lead to the development of next-generation drugs that are more effective, have fewer side effects, and can address emerging antibiotic-resistant infections. This can potentially revolutionize the way bacterial infections are treated, improving patient outcomes and expanding treatment options

Restraint/Challenge

“Antibiotic Resistance and Regulatory Challenges”

- The growing issue of antibiotic resistance presents a significant challenge for the global macrolide antibiotics market, as resistant strains of bacteria reduce the effectiveness of these drugs

- The overuse and misuse of antibiotics, particularly in regions with less stringent regulations, have led to the development of resistant pathogens, making treatment more difficult and limiting the efficacy of macrolides

- In addition, stringent regulatory requirements and lengthy approval processes for new antibiotics can delay the introduction of novel macrolide drugs to the market, preventing rapid responses to emerging resistant infections

For instance,

- In a 2024 report published by the Centers for Disease Control and Prevention (CDC), antibiotic resistance has been identified as one of the leading threats to public health, with resistance to macrolides increasing among key bacterial pathogens such as Streptococcus pneumoniae and Haemophilus influenzae

- These challenges have prompted regulatory bodies to tighten rules around the prescription and sale of antibiotics, further limiting market growth and delaying the development of new macrolide formulations that can combat resistant infections. The combination of resistance and regulatory hurdles presents a critical barrier to expanding the macrolide antibiotics market

Macrolide Antibiotics Market Scope

The market is segmented on the basis of drugs, route of administration, infection, and end user.

|

Segmentation |

Sub-Segmentation |

|

By Drugs |

|

|

By Route of administration |

|

|

By Infection |

|

|

By End User |

|

In 2025, the oral segment is projected to dominate the market with a largest share in route of administration segment

The oral segment is expected to dominate the macrolide antibiotics market with the largest share of 65.9% due to its convenience, ease of administration, and patient preference for non-invasive treatment options. Oral formulations of macrolides, such as azithromycin and clarithromycin, are widely used for outpatient treatments, offering effective alternatives for managing infections without the need for hospital visits. In addition, the growing demand for at-home treatments, especially in outpatient care and for chronic conditions, further drives the market for oral macrolide antibiotics

The azithromycin is expected to account for the largest share during the forecast period in drugs market

In 2025, the azithromycin segment is expected to dominate the market with the largest market share of 25.5% in 2025 due to its broad-spectrum efficacy, particularly in treating respiratory infections, sexually transmitted diseases, and skin infections. Its favorable safety profile, convenience with shorter treatment durations, and the availability of both oral and injectable forms contribute to its widespread use. In addition, the increasing prevalence of conditions such as pneumonia and bronchitis further drive demand for Azithromycin, positioning it as a leading drug in the macrolide class

Macrolide Antibiotics Market Regional Analysis

“North America Holds the Largest Share in the Macrolide Antibiotics Market”

- North America dominates the macrolide antibiotics market with a market share of estimated 45.85%, driven, by advanced healthcare infrastructure, high adoption of cutting-edge medical technologies, and a strong presence of key pharmaceutical players

- U.S. holds a market share of 45.4%, due to increasing demand for broad-spectrum antibiotics to treat various infections, a well-established healthcare system, and significant investments in research and development

- The availability of well-established healthcare policies and the rapid adoption of generics further strengthen the market, alongside the continuous growth in outpatient care and treatment options

- In addition, the rising prevalence of respiratory infections, sexually transmitted diseases, and skin infections across North America is fueling demand for macrolide antibiotics

“Asia-Pacific is Projected to Register the Highest CAGR in the Macrolide Antibiotics Market”

- Asia-Pacific is expected to witness the highest growth rate in the macrolide antibiotics market with a market share of 30.5%, driven by the rapid expansion in healthcare infrastructure, increasing awareness about antibiotic use, and rising infection rates

- Countries such as China, India, and Japan are emerging as key markets due to their large populations, the rising burden of bacterial infections, and increased healthcare access.

- China, with its expanding healthcare system and rising demand for antibiotic treatments, remains a crucial market for macrolide antibiotics. The country continues to lead in the adoption of affordable generics to treat respiratory and sexually transmitted infections

- India is projected to register the highest CAGR in the macrolide antibiotics market, driven by expanding healthcare infrastructure, rising infection rates, and an increasing adoption of generics and innovative antibiotic therapies

Macrolide Antibiotics Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- GSK plc. (U.S.)

- F. Hoffmann-La Roche Ltd (Switzerland)

- Novartis AG (Switzerland)

- Lilly (U.S.)

- Pfizer Inc. (U.S.)

- Merck & Co., Inc. (U.S.)

- Bristol-Myers Squibb Company (U.S.)

- Teva Pharmaceutical Industries Ltd. (Israel)

- Novartis AG (Switzerland)

- Boehringer Ingelheim International GmbH (Germany)

- Sanofi (France)

- AstraZeneca (U.K.)

- AbbVie Inc. (U.S.)

- Abbott (U.S.)

- Bayer AG (Germany)

- Sandoz International GmbH (Germany)

- Johnson & Johnson Services, Inc. (U.S.)

- Zhejiang Guobang Pharmaceutical Co., Ltd. (China)

Latest Developments in Global Macrolide Antibiotics Market

- In May 2025, the Financial Times reported that Xellia Pharmaceuticals, Europe's last manufacturer of key antibiotic ingredients, announced the closure of its largest domestic factory in Copenhagen and the relocation of production to China due to unsustainable competition. This decision is expected to result in 500 job losses

- In March 2025, Reuters reported that the European Commission proposed the Critical Medicines Act, aiming to reduce reliance on Asia for antibiotics and other critical drugs. This initiative seeks to secure the supply of 270 medicines identified as critical for health security in the EU

- In August 2024, a study published on arXiv discussed advancements in drug delivery systems for macrolide antibiotics. The research focused on programmable lipid nanoparticles, which are expected to improve the efficacy, patient compliance, and therapeutic outcomes of treatments

- In February 2024, the U.S. Food and Drug Administration (FDA) approved a new macrolide antibiotic, Solithromycin, for the treatment of community-acquired bacterial pneumonia (CABP). This approval provides an alternative for patients with macrolide-resistant infections

- In April 2022, Teva Pharmaceutical Industries Ltd. expanded its line of economical treatment alternatives for bacterial infections by launching a generic version of the popular macrolide antibiotic clarithromycin. This action supports Teva's objective to address the growing need for effective antibiotics while guaranteeing their accessibility and affordability for patients everywhere, hence fostering the company's expansion in the global market for macrolide antibiotics

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.