Global Magneto Resistive Ram Market

Market Size in USD Billion

CAGR :

%

USD

2.60 Billion

USD

61.52 Billion

2024

2032

USD

2.60 Billion

USD

61.52 Billion

2024

2032

| 2025 –2032 | |

| USD 2.60 Billion | |

| USD 61.52 Billion | |

|

|

|

|

Magneto Resistive RAM Market Size

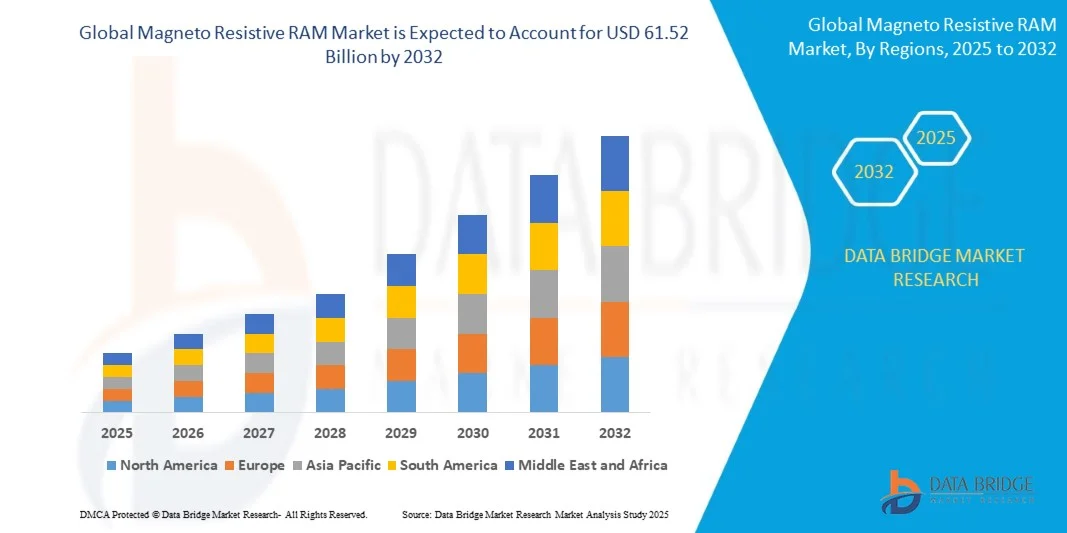

- The global magneto resistive RAM market size was valued at USD 2.60 billion in 2024 and is expected to reach USD 61.52 billion by 2032, at a CAGR of 48.51% during the forecast period

- The market growth is largely fuelled by the increasing demand for high-speed, non-volatile memory solutions across consumer electronics, automotive, and industrial applications

- The rising adoption of IoT devices, edge computing systems, and AI-driven data centers is further boosting the need for energy-efficient memory technologies such as MRAM

Magneto Resistive RAM Market Analysis

- The magneto resistive RAM market is witnessing rapid growth due to its superior endurance, low power consumption, and fast data access compared to traditional flash and DRAM technologies

- Enterprises are increasingly shifting toward MRAM for embedded systems, wearables, and automotive control units where durability and reliability are critical

- North America dominated the magneto resistive RAM (MRAM) market with the largest revenue share in 2024, driven by the strong presence of key semiconductor manufacturers and increasing adoption of MRAM in industrial and automotive applications

- Asia-Pacific region is expected to witness the highest growth rate in the global magneto resistive RAM market, driven by expanding electronics manufacturing hubs, government support for semiconductor development, and rising demand for AI-driven applications in countries such as China, Japan, and South Korea

- The STT-MRAM segment held the largest market revenue share in 2024, driven by its superior scalability, energy efficiency, and compatibility with advanced CMOS manufacturing processes. Its ability to deliver faster write speeds and higher endurance makes it a preferred choice for embedded memory solutions in industrial, automotive, and consumer applications. The demand for STT-MRAM continues to rise as manufacturers focus on developing high-density, low-power memory for next-generation computing architectures

Report Scope and Magneto Resistive RAM Market Segmentation

|

Attributes |

Magneto Resistive RAM Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Magneto Resistive RAM Market Trends

“Advancement Of Spin-Transfer Torque (STT) Technology In MRAM Development”

- The ongoing shift toward Spin-Transfer Torque (STT) technology is reshaping the magneto resistive RAM (MRAM) market by offering faster write speeds, higher endurance, and reduced power consumption compared to traditional memory types. This innovation enables MRAM to serve as a universal memory solution bridging the gap between DRAM and flash memory, combining non-volatility with low latency. The continuous miniaturization of magnetic tunnel junctions (MTJs) and advancements in spintronic materials are further enhancing MRAM’s commercial viability and density

- The increasing adoption of STT-MRAM in next-generation consumer electronics and industrial systems highlights its scalability and efficiency. The ability to deliver non-volatility with DRAM-like performance makes it an attractive option for embedded and standalone applications across computing and IoT sectors. In addition, its capability to withstand high read/write cycles supports its growing use in automotive controllers, wearables, and AI-driven devices requiring energy-efficient storage

- The compatibility of STT-MRAM with standard CMOS manufacturing processes is accelerating its integration into mass production, reducing fabrication costs and improving yield. This trend is further supported by collaborations between semiconductor manufacturers and material science innovators focusing on MRAM enhancement. As a result, global foundries are increasingly expanding production capacity to meet demand from embedded memory applications in advanced system-on-chip (SoC) architectures

- For instance, in 2024, Everspin Technologies announced a collaboration with GlobalFoundries to expand production of its 28nm STT-MRAM chips for automotive and industrial use, significantly improving data retention and write endurance in extreme environments. The initiative also aimed to reduce latency and enhance scalability for applications in edge computing and sensor-driven systems. This collaboration demonstrates the strategic industry focus on developing next-generation MRAM capable of replacing conventional memory in high-performance systems

- While STT-MRAM continues to gain commercial traction, ongoing challenges related to scaling, thermal stability, and write error rates require continuous research and material optimization to sustain the technology’s momentum in the broader semiconductor memory ecosystem. Manufacturers must focus on improving magnetic anisotropy and spin polarization efficiency to enable higher-density memory modules. Furthermore, ensuring stable performance across varying environmental conditions remains a key technical priority for developers

Magneto Resistive RAM Market Dynamics

Driver

“Growing Demand For Non-Volatile Memory In Automotive And Industrial Applications”

- The rapid rise of connected vehicles, advanced driver-assistance systems (ADAS), and industrial automation has amplified the need for reliable, non-volatile memory capable of retaining data without power. MRAM offers high-speed performance, low latency, and exceptional durability, making it ideal for harsh operational environments. It also provides faster start-up times and improved fault tolerance, essential for critical embedded control systems in modern automotive and industrial electronics

- Automotive and industrial sectors are adopting MRAM to replace traditional flash and SRAM due to its endurance and ability to operate under extreme temperatures and high workloads. This shift ensures real-time data retention, faster boot-up, and increased system reliability, reducing the risk of data corruption. The technology’s resilience to magnetic interference and radiation also positions it as a preferred solution in aerospace and defense-grade electronics

- Manufacturers are increasingly investing in MRAM-based solutions to enhance performance in mission-critical applications such as predictive maintenance, robotics, and autonomous systems. The trend aligns with the growing demand for memory technologies that support edge computing and artificial intelligence workloads. MRAM’s combination of endurance and non-volatility also enables next-generation industrial systems to perform continuous data logging and adaptive learning without frequent maintenance

- For instance, in 2023, Infineon Technologies introduced MRAM-based microcontrollers for automotive ECUs, improving real-time data access and reducing power consumption, which enhanced vehicle efficiency and performance. This launch represented a major step toward integrating MRAM in embedded applications, offering improved performance over EEPROM and flash. The microcontrollers also demonstrated strong reliability under temperature fluctuations and vibration stress, critical for long-term automotive applications

- While demand from industrial and automotive domains is propelling market expansion, ensuring cost-effective scalability and optimizing write efficiency remain critical factors for sustaining long-term adoption. To address this, manufacturers are focusing on developing hybrid memory architectures that combine MRAM with other technologies. Collaborations with foundries and material suppliers are also underway to lower production costs and improve uniformity across wafers

Restraint/Challenge

“High Manufacturing Costs And Integration Complexity In MRAM Production”

- The production of MRAM involves complex multilayer deposition and precision fabrication processes, leading to higher costs compared to traditional flash and DRAM technologies. These cost barriers limit its accessibility for lower-end consumer electronics and small-scale manufacturers. The intricate alignment of magnetic layers and tunnel barriers also requires advanced sputtering techniques, adding to capital investment and operational complexity

- Integration challenges with existing semiconductor architectures further complicate MRAM deployment, particularly in large-scale systems where compatibility and performance tuning are crucial. Manufacturers must invest heavily in design adaptation and testing to ensure seamless functionality. In addition, the lack of standardized integration protocols across foundries leads to increased development cycles and higher prototyping costs

- The limited availability of specialized production facilities and high dependence on advanced lithography technologies hinder large-scale commercialization. This also increases the price volatility of MRAM components across global supply chains. Furthermore, the need for tight quality control during wafer-level fabrication and annealing makes it difficult for new entrants to achieve competitive pricing and yield

- For instance, in 2024, several memory manufacturers in Japan and South Korea reported delayed MRAM production due to high material costs and limited fabrication capacity, slowing down commercial adoption in mid-range electronics. The shortage of high-purity magnetic materials and sputtering targets further aggravated supply chain disruptions. These factors collectively delayed mass production timelines and affected pricing strategies across multiple product categories

- While MRAM holds strong potential as a universal memory, addressing cost inefficiencies and improving manufacturing yields remain vital to achieving economies of scale and ensuring sustainable market penetration. Continued investment in research partnerships and advanced manufacturing infrastructure is key to overcoming these challenges. The development of next-generation wafer tools and automation solutions will also play a crucial role in driving MRAM affordability and global adoption

Magneto Resistive RAM Market Scope

The market is segmented on the basis of product and application.

• By Product

On the basis of product, the magneto resistive RAM (MRAM) market is segmented into Spin-Transfer Torque (STT) MRAM and Toggle MRAM. The STT-MRAM segment held the largest market revenue share in 2024, driven by its superior scalability, energy efficiency, and compatibility with advanced CMOS manufacturing processes. Its ability to deliver faster write speeds and higher endurance makes it a preferred choice for embedded memory solutions in industrial, automotive, and consumer applications. The demand for STT-MRAM continues to rise as manufacturers focus on developing high-density, low-power memory for next-generation computing architectures.

The Toggle MRAM segment is expected to witness steady growth from 2025 to 2032, supported by its proven reliability and established use in aerospace, defense, and industrial control systems. Known for its robustness and ability to withstand radiation and extreme temperatures, Toggle MRAM remains a trusted choice for mission-critical applications requiring long-term data retention. Although newer technologies are emerging, Toggle MRAM continues to hold relevance in niche applications where durability and non-volatility are paramount.

• By Application

On the basis of application, the magneto resistive RAM (MRAM) market is segmented into aerospace & defense, automotive, robotics, consumer electronics, and enterprise storage. The consumer electronics segment held the largest market revenue share in 2024, attributed to the growing integration of MRAM in smartphones, wearables, and smart devices for faster data access and energy-efficient performance. The rising demand for high-speed, non-volatile memory in compact electronics continues to drive MRAM adoption in this sector.

The automotive segment is expected to witness the fastest growth rate from 2025 to 2032, fuelled by the rapid expansion of electric vehicles, autonomous systems, and advanced driver-assistance technologies. MRAM’s ability to retain data without power and function reliably under extreme environmental conditions makes it ideal for vehicle control systems and real-time data processing. In addition, increasing demand for durable, high-performance memory solutions in ADAS and infotainment systems is expected to further boost MRAM adoption in the automotive industry.

Magneto Resistive RAM Market Regional Analysis

- North America dominated the magneto resistive RAM (MRAM) market with the largest revenue share in 2024, driven by the strong presence of key semiconductor manufacturers and increasing adoption of MRAM in industrial and automotive applications

- The region’s technological advancements and significant investments in research and development have accelerated the commercialization of MRAM technologies across diverse end-use industries

- High demand for non-volatile, high-speed memory solutions in data centers, autonomous vehicles, and aerospace systems continues to fuel market growth, establishing North America as a leading hub for MRAM innovation and production

U.S. Magneto Resistive RAM Market Insight

The U.S. magneto resistive RAM market captured the largest revenue share in 2024 within North America, driven by robust semiconductor infrastructure and early adoption of next-generation memory technologies. Growing demand for MRAM in defense, automotive, and industrial sectors is promoting large-scale integration into embedded systems and microcontrollers. Furthermore, the presence of leading manufacturers, such as Everspin Technologies and Avalanche Technology, along with collaborations between foundries and research institutions, is propelling domestic MRAM advancements. The increasing use of MRAM in AI-driven computing and IoT devices is also expected to further enhance market potential across the country.

Europe Magneto Resistive RAM Market Insight

The Europe magneto resistive RAM market is expected to witness substantial growth from 2025 to 2032, fueled by strong industrial automation trends and rising focus on energy-efficient memory technologies. European countries are increasingly adopting MRAM in aerospace and defense applications due to its reliability and radiation-resistant properties. Moreover, initiatives supporting digital transformation and smart manufacturing are fostering MRAM adoption in robotics and automotive electronics. The growing emphasis on sustainable electronics manufacturing further strengthens the region’s position in advanced memory technology development.

U.K. Magneto Resistive RAM Market Insight

The U.K. magneto resistive RAM market is expected to witness a strong growth rate from 2025 to 2032, supported by rising investments in semiconductor research and innovation. The country’s expanding focus on data security, artificial intelligence, and defense technologies is driving the demand for MRAM solutions offering high endurance and fast access speed. Collaborations between universities, technology startups, and global semiconductor players are further accelerating product development. In addition, the integration of MRAM into enterprise storage and industrial systems is expanding rapidly as part of the country’s digital infrastructure evolution.

Germany Magneto Resistive RAM Market Insight

The Germany magneto resistive RAM market is expected to witness the fastest growth rate from 2025 to 2032, propelled by advancements in automotive electronics and industrial automation. The country’s strong engineering and manufacturing base, coupled with its emphasis on innovation and Industry 4.0, supports the rapid adoption of MRAM in embedded and robotics applications. German automotive OEMs are increasingly using MRAM to enhance vehicle computing reliability and performance. Moreover, the government’s support for semiconductor independence and R&D initiatives is expected to further bolster MRAM technology deployment across multiple industrial sectors.

Asia-Pacific Magneto Resistive RAM Market Insight

The Asia-Pacific magneto resistive RAM market is expected to witness the fastest growth rate from 2025 to 2032, driven by large-scale semiconductor manufacturing and growing adoption in consumer electronics. Countries such as China, Japan, and South Korea are leading global production and research in memory technologies, positioning the region as a major MRAM innovation center. Rapid industrialization, strong government support for digital transformation, and the increasing integration of MRAM into automotive and enterprise storage applications are accelerating regional growth. Expanding demand for efficient, low-power memory solutions across IoT and mobile devices further enhances market potential.

Japan Magneto Resistive RAM Market Insight

The Japan magneto resistive RAM market is projected to experience significant growth from 2025 to 2032 due to its established semiconductor industry and early focus on MRAM innovation. Japanese companies are actively integrating MRAM into automotive electronics, robotics, and consumer devices to improve speed and power efficiency. The country’s strong culture of technological advancement and emphasis on miniaturized, high-performance electronics are key growth drivers. In addition, collaborations between domestic chipmakers and global technology providers are boosting MRAM commercialization and large-scale production capabilities.

China Magneto Resistive RAM Market Insight

The China magneto resistive RAM market accounted for the largest share in the Asia-Pacific region in 2024, supported by its expanding semiconductor manufacturing capacity and government initiatives promoting self-reliance in chip production. The rising adoption of MRAM in industrial automation, consumer electronics, and data storage sectors is strengthening the country’s position in the global memory market. Domestic firms are investing heavily in MRAM fabrication and R&D to reduce import dependency. Furthermore, the rapid development of 5G, AI, and cloud computing infrastructure is propelling large-scale MRAM deployment across China’s high-tech industries.

Magneto Resistive RAM Market Share

The Magneto Resistive RAM industry is primarily led by well-established companies, including:

- Toshiba Corporation (Japan)

- NVE Corporation (U.S.)

- Everspin Technologies Inc. (U.S.)

- Avalanche Technology Inc. (U.S.)

- Spin Memory, Inc. (U.S.)

- Honeywell International Inc. (U.S.)

- Samsung Electronics Co. Ltd (South Korea)

- Numem Inc. (U.S.)

- Taiwan Semiconductor Manufacturing Company Limited (Taiwan)

Latest Developments in Global Magneto Resistive RAM Market

- In December 2022, Toshiba Electronic Devices and Storage Corporation announced the construction of a new back-end production facility for power semiconductors at its Himeji Operations in Hyogo Prefecture, Japan. The facility, set to begin production in spring 2025, aims to strengthen Toshiba’s manufacturing capacity and enhance its contribution to the semiconductor supply chain

- In September 2022, Avalanche Technology collaborated with United Microelectronics Corporation (UMC) to launch P-SRAM memory devices utilizing UMC’s 22nm process technology. This development offers higher density, endurance, and energy efficiency, reinforcing Avalanche’s leadership in next-generation STT-MRAM innovation

- In 2022, Samsung Electronics unveiled a breakthrough application of Magneto-resistive Random Access Memory (MRAM) to revolutionize data processing systems. Conducted by Samsung’s Advanced Institute of Technology with its Foundry Business and Semiconductor R&D Center, this initiative advances AI chip development and strengthens Samsung’s position in intelligent memory technology

- In May 2022, Everspin Technologies introduced the EMxxLX xSPI MRAM solution for Industrial IoT and embedded systems. Designed as an alternative to SPI NOR/NAND flash, it delivers data rates up to 400MB/s, providing high-performance, non-volatile memory ideal for mission-critical applications

- In January 2022, Samsung Electronics showcased the world’s first in-memory computing system based on MRAM technology. Developed in collaboration with the Samsung Advanced Institute of Technology and its Semiconductor divisions, the innovation integrates memory and processing functions, enabling faster AI computing and enhancing market competitiveness

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Magneto Resistive Ram Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Magneto Resistive Ram Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Magneto Resistive Ram Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.