Global Makgeolli Market

Market Size in USD Million

CAGR :

%

USD

659.30 Million

USD

1,202.36 Million

2024

2032

USD

659.30 Million

USD

1,202.36 Million

2024

2032

| 2025 –2032 | |

| USD 659.30 Million | |

| USD 1,202.36 Million | |

|

|

|

|

Makgeolli Market Size

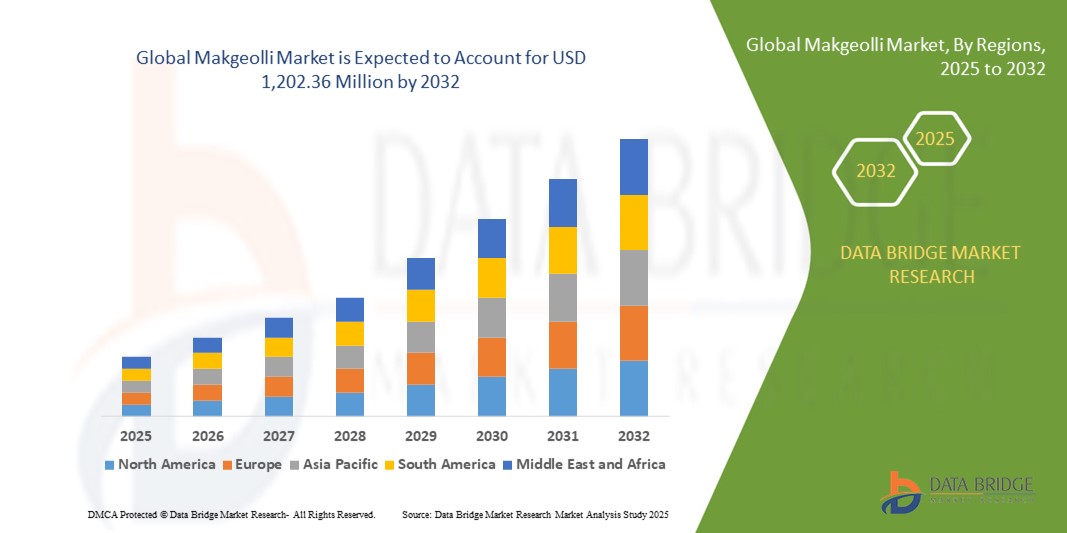

- The global makgeolli market size was valued at USD 659.30 million in 2024 and is expected to reach USD 1,202.36 million by 2032, at a CAGR of 7.80% during the forecast period

- The market growth is largely fueled by the rising global popularity of traditional Korean beverages, increasing consumer interest in fermented and naturally brewed drinks, and the growing demand for low-alcohol, health-oriented alcoholic beverages

- In addition, innovations in flavors, packaging, and premium product offerings are driving the appeal of makgeolli among younger consumers and international markets

Makgeolli Market Analysis

- The makgeolli market is witnessing significant growth as consumers seek authentic cultural beverages with functional health benefits such as probiotics and antioxidants derived from natural fermentation

- Rising awareness about low-alcohol and gluten-free drink options, along with the globalization of Korean cuisine and K-culture, is accelerating product adoption across diverse consumer groups

- Asia-Pacific dominated the Makgeolli market with the largest revenue share of 68.4% in 2024, driven by the growing popularity of traditional fermented beverages, rising health consciousness, and the cultural significance of Makgeolli in countries such as South Korea and Japan

- North America region is expected to witness the highest growth rate in the global makgeolli market, driven by growing demand for low-alcohol, probiotic-rich beverages, and strategic collaborations between Korean brewers and international retailers

- The Traditional segment held the largest market revenue share in 2024 driven by its cultural heritage, affordability, and strong domestic demand in South Korea. Traditional Makgeolli continues to be a staple in local households and restaurants, supported by long-standing consumer familiarity and preference for authentic taste profiles

Report Scope and Makgeolli Market Segmentation

|

Attributes |

Makgeolli Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

Expansion Into International Markets Development Of Innovative Flavored Variants |

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Makgeolli Market Trends

Rising Global Popularity of Traditional and Fermented Beverages

• The growing consumer interest in traditional and naturally fermented beverages is boosting the global demand for Makgeolli. Its unique flavor profile, probiotic content, and cultural heritage appeal to both health-conscious consumers and those seeking authentic drinking experiences

• Expanding interest in Asian cuisines, coupled with increasing exposure through restaurants, social media, and travel, is introducing Makgeolli to international markets. This has accelerated demand in regions such as North America and Europe where fermented drinks are gaining traction

• The rising trend of low-alcohol, functional beverages is further supporting Makgeolli adoption among millennials and Gen Z consumers seeking alternatives to high-strength liquors. Its relatively low alcohol content, combined with health benefits, positions it as a versatile social drink

• For instance, in 2023, several Korean beverage companies reported double-digit growth in Makgeolli exports to the U.S. and European Union, driven by rising retail availability and participation in international food and beverage expos

• While the popularity of Makgeolli is increasing, manufacturers must focus on modern packaging, flavor innovation, and marketing strategies that preserve its traditional identity while appealing to younger demographics worldwide

Makgeolli Market Dynamics

Driver

Growing Health Consciousness and Demand for Probiotic-Rich Beverages

• The increasing awareness about gut health, immunity, and the benefits of probiotics is driving consumers toward naturally fermented beverages such as Makgeolli. This demand aligns with the global shift toward functional and clean-label drinks, creating opportunities for beverages offering both taste and wellness benefits. In addition, the growing popularity of probiotics in mainstream health and wellness sectors further supports this trend globally

• Consumers are actively seeking alternatives to synthetic alcoholic beverages, creating opportunities for Makgeolli producers to highlight its natural fermentation, lower alcohol content, and nutritional benefits. This positions Makgeolli as a premium, healthier substitute for traditional liquors, attracting millennials and health-conscious drinkers. Moreover, the demand for “better-for-you” alcoholic beverages is accelerating in markets such as the U.S. and Europe

• Government initiatives promoting traditional beverages and export incentives for local brewers are also fueling market growth in key Asian markets, particularly South Korea. These programs include subsidies, international trade fairs, and collaborations with global beverage distributors to boost Makgeolli’s international visibility. As a result, small and mid-sized producers gain access to resources previously limited to large-scale exporters

• For instance, in 2022, South Korea launched a global promotional campaign to position Makgeolli as a premium traditional beverage, boosting exports and international awareness. The campaign highlighted Makgeolli’s heritage, health benefits, and artisanal brewing techniques, attracting attention in emerging markets such as Southeast Asia and the Middle East. This expanded the drink’s footprint beyond its traditional strongholds

• Despite its growth potential, producers must focus on consistent quality control, standardized production methods, and global certifications to ensure widespread consumer trust and acceptance. Regulatory approvals, sustainable sourcing, and maintaining authentic taste profiles are also essential to compete in the growing functional beverage segment worldwide. Investing in branding and consumer education remains key to capturing long-term loyalty

Restraint/Challenge

Short Shelf Life and Limited Global Awareness

• The natural fermentation process and lack of preservatives often result in a relatively short shelf life for Makgeolli, posing challenges for large-scale exports and long-distance distribution. As freshness impacts both flavor and safety, international shipments require specialized cold chain logistics, increasing costs for manufacturers and importers. This limits product availability in regions with underdeveloped distribution infrastructure

• Limited consumer awareness outside Asia restricts its adoption in regions unfamiliar with traditional Korean beverages. Marketing efforts and product education remain insufficient in many potential markets, making it difficult to compete with established alcoholic beverages. As a result, Makgeolli’s cultural significance and health benefits often fail to reach target audiences in Western countries

• Supply chain and cold storage constraints further limit the availability of fresh Makgeolli in international markets, leading to reliance on pasteurized variants that may alter its authentic taste profile. Retailers in Europe and North America report challenges in balancing product quality with extended shelf life requirements. This affects consumer perception, especially among buyers seeking authentic, traditional flavors

• For instance, in 2023, several European distributors reported difficulties in maintaining Makgeolli’s freshness during import, affecting retail sales and consumer acceptance. Despite rising curiosity about Korean beverages, inconsistent quality standards and limited marketing budgets hindered long-term growth potential in premium retail segments. This underscores the need for technology-driven preservation solutions

• To overcome these barriers, producers need to invest in R&D for extended shelf life, international marketing campaigns, and strategic collaborations with global beverage distributors to reach wider audiences. Advanced fermentation technologies, innovative packaging methods, and influencer-led digital campaigns can help reposition Makgeolli as a trendy, health-oriented beverage worldwide

Makgeolli Market Scope

The market is segmented on the basis of product type, distribution channel, and type.

- By Product Type

On the basis of product type, the makgeolli market is segmented into Traditional, Premium, Flavoured, and Organic. The Traditional segment held the largest market revenue share in 2024 driven by its cultural heritage, affordability, and strong domestic demand in South Korea. Traditional Makgeolli continues to be a staple in local households and restaurants, supported by long-standing consumer familiarity and preference for authentic taste profiles.

The Flavoured segment is expected to witness the fastest growth rate from 2025 to 2032, driven by rising demand for innovative, fruit-infused, and health-oriented alcoholic beverages among younger consumers. Flavoured Makgeolli is gaining popularity in international markets as it caters to changing taste preferences and offers versatility in pairing with global cuisines.

- By Distribution Channel

On the basis of distribution channel, the makgeolli market is segmented into Online and Offline. The Offline segment dominated the market in 2024, supported by strong sales through supermarkets, specialty liquor stores, and traditional retail outlets across Asia-Pacific. Offline channels remain the primary mode of distribution due to immediate product availability and strong consumer trust in physical retail purchases.

The Online segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by the rapid expansion of e-commerce platforms and increasing consumer preference for doorstep delivery. Digital marketing campaigns and cross-border e-commerce partnerships are further boosting the online availability of Makgeolli in international markets.

- By Type

On the basis of type, the makgeolli market is segmented into Sake Wine, Makgeolli Wine, and Others. The Makgeolli Wine segment accounted for the largest market share in 2024, driven by its rising popularity as a probiotic-rich, naturally fermented alcoholic beverage with a lower alcohol content. This segment benefits from growing health consciousness and government initiatives promoting traditional Korean drinks worldwide.

The Sake Wine segment is expected to witness the fastest growth rate from 2025 to 2032. This growth is driven by rising global appreciation for traditional Asian alcoholic beverages, increasing premiumization trends in the alcoholic drinks sector, and expanding distribution channels across North America and Europe.

Makgeolli Market Regional Analysis

- Asia-Pacific dominated the Makgeolli market with the largest revenue share of 68.4% in 2024, driven by the growing popularity of traditional fermented beverages, rising health consciousness, and the cultural significance of Makgeolli in countries such as South Korea and Japan

- Consumers in the region are increasingly attracted to Makgeolli for its probiotic content, lower alcohol levels, and unique taste profile, which align with the global trend toward functional and clean-label beverages

- This dominance is further supported by government initiatives promoting traditional alcoholic drinks, expanding tourism, and the increasing availability of flavored and premium variants targeting younger consumers across Asian markets

Japan Makgeolli Market Insight

The Japan Makgeolli market is expected to witness the fastest growth rate from 2025 to 2032, driven by the country’s openness to Korean beverages, rising popularity of fermented health drinks, and increasing awareness of Makgeolli’s probiotic benefits. The trend toward low-alcohol and naturally fermented beverages in Japan is encouraging more importers and retailers to introduce premium Makgeolli variants to the local market.

China Makgeolli Market Insight

The China Makgeolli market accounted for the largest revenue share in Asia-Pacific after South Korea in 2024, driven by the country’s rapidly expanding middle-class population, growing interest in functional and low-alcohol beverages, and rising popularity of Korean cuisine and culture. Online retail platforms, specialty liquor stores, and cross-border e-commerce channels are significantly boosting the availability and visibility of Makgeolli in China. Furthermore, the increasing presence of premium and flavored Makgeolli variants is attracting younger consumers, while collaborations between Korean breweries and Chinese distributors are strengthening market penetration across urban centers.

North America Makgeolli Market Insight

The North America Makgeolli market is expected to witness the fastest growth rate from 2025 to 2032, supported by growing consumer demand for ethnic and craft beverages. Increasing awareness of Makgeolli’s health benefits, coupled with the rising popularity of Asian cuisine and beverages in the U.S. and Canada, is driving market growth. Moreover, the craft alcohol trend and rising interest in low-ABV beverages align with Makgeolli’s unique positioning in the functional alcoholic drinks segment.

U.S. Makgeolli Market Insight

The U.S. Makgeolli market is expected to witness the fastest growth rate from 2025 to 2032, driven by the rising interest in Asian fermented beverages, health-focused alcohol consumption trends, and the growing number of Korean restaurants and specialty liquor stores. Online retail channels and craft beverage festivals are further accelerating the visibility and availability of Makgeolli across the U.S.

Europe Makgeolli Market Insight

The Europe Makgeolli market is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing consumer interest in exotic and functional alcoholic beverages. Countries such as the U.K., Germany, and France are seeing growing demand for traditional Asian drinks through specialty stores, online platforms, and ethnic restaurants. However, limited awareness and shorter shelf life remain key challenges in achieving large-scale adoption across European markets.

U.K. Makgeolli Market Insight

The U.K. Makgeolli market is expected to witness the fastest growth rate from 2025 to 2032, supported by the country’s expanding multicultural consumer base and rising demand for low-alcohol, naturally fermented beverages. The growing presence of Asian foodservice chains and e-commerce platforms offering specialty beverages is creating new growth opportunities for Makgeolli producers.

Germany Makgeolli Market Insight

The Germany Makgeolli market is expected to witness the fastest growth rate from 2025 to 2032, fueled by the country’s preference for craft and artisanal alcoholic beverages, increasing health awareness, and openness to innovative low-alcohol drinks. The presence of premium alcoholic drink retailers and trade fairs focused on global beverages is also aiding the entry of Makgeolli into European markets.

Makgeolli Market Share

The Makgeolli industry is primarily led by well-established companies, including:

- HANA MAKGEOLLI (U.S.)

- BHD CO.,LTD (South Korea)

- KOOKSOONDANG BREWERY CO.LTD. (South Korea)

- Jeju Brewing Company (South Korea)

- Jinro (South Korea)

- Kumbokju Co. Ltd (South Korea)

- HITEJINRO CO.,LTD. (South Korea)

- Baesangmyun Brewery Co. (South Korea)

- LOTTE CHILSUNG BEVERAGE CO.LTD. (South Korea)

- Sool (South Korea)

Latest Developments in Global Makgeolli Market

- In May 2023, Jipyeong Brewery announced the establishment of a Korean rice beer factory in Seoul, equipped with advanced automated brewing facilities covering 9,900 square meters. The new facility focuses on producing sterilized makgeolli, ensuring improved product quality and consistency. This development aims to expand the company’s reach into international markets, including the U.S., Europe, and Southeast Asia, thereby boosting global awareness and demand for makgeolli

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Makgeolli Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Makgeolli Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Makgeolli Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.