Global Malt Based Hot Drinks Market

Market Size in USD Billion

CAGR :

%

USD

5.50 Billion

USD

8.37 Billion

2024

2032

USD

5.50 Billion

USD

8.37 Billion

2024

2032

| 2025 –2032 | |

| USD 5.50 Billion | |

| USD 8.37 Billion | |

|

|

|

|

Malt-based Hot Drinks Market Size

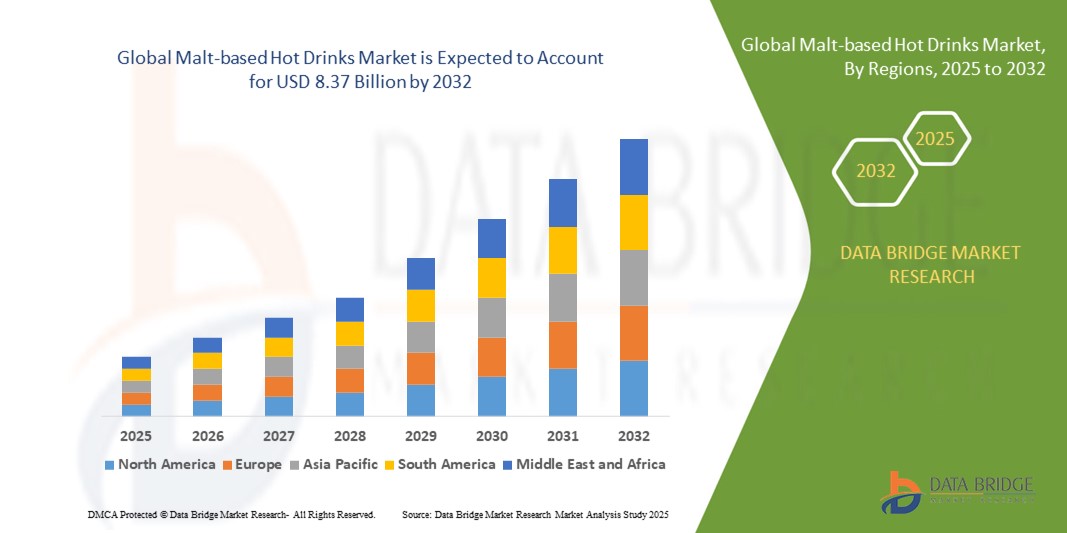

- The global malt-based hot drinks market size was valued at USD 5.50 billion in 2024 and is expected to reach USD 8.37 billion by 2032, at a CAGR of 5.40% during the forecast period

- The market growth is largely fueled by increasing consumer preference for convenient, nutritious, and flavorful beverages

- Rising awareness about the health benefits of malt, such as improved energy levels and digestive support, is further driving demand

Malt-based Hot Drinks Market Analysis

- The global malt-based hot drinks market is witnessing steady growth due to increasing consumer preference for convenient, flavorful, and nutritious beverages. Rising awareness about the health benefits of malt, such as energy provision and digestive support, is further driving demand

- In addition, the growing popularity of malt-based drinks among all age groups, combined with innovative product offerings and easy availability through retail and online channels, is contributing to market expansion

- Europe dominated the malt-based hot drinks market with the largest revenue share of 38.5% in 2024, driven by growing health awareness, increasing demand for functional beverages, and the popularity of fortified nutrition products

- Asia-Pacific region is expected to witness the highest growth rate in the global malt-based hot drinks market, driven by technological advancements in production, expanding distribution networks, and rising consumer inclination toward functional and health-oriented beverages

- The flavored beverages segment held the largest market revenue share in 2024, driven by growing consumer preference for taste-enhanced functional drinks. Flavored malt-based drinks offer a combination of nutrition and enjoyable taste, making them particularly popular among children, young adults, and health-conscious consumers

Report Scope and Malt-based Hot Drinks Market Segmentation

|

Attributes |

Malt-based Hot Drinks Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Malt-based Hot Drinks Market Trends

Growing Preference For Nutritional And Functional Beverages

- The rising consumer inclination toward nutritional and functional beverages is transforming the malt-based hot drinks landscape by encouraging product innovation and diversification. Enhanced formulations offer added vitamins, minerals, and plant-based ingredients, driving higher consumption among health-conscious consumers. This trend is supporting steady market growth across regions

- The increasing adoption of ready-to-drink malt beverages in urban and semi-urban areas is accelerating sales, particularly through cafes, convenience stores, and retail chains. These beverages offer convenience, taste, and energy-boosting properties, appealing to busy professionals and students. Government campaigns promoting fortified beverages further strengthen market adoption

- Product affordability and ease of preparation are making malt-based hot drinks attractive for daily consumption across various demographics. Consumers benefit from both nutritional supplementation and enjoyable taste without additional effort or cost. The trend contributes to higher repeat purchases and brand loyalty

- For instance, in 2023, several global beverage companies reported increased sales of fortified malt drinks in North America and Europe following campaigns highlighting their energy-boosting and nutritional benefits. This adoption helped expand consumer base and awareness

- While product innovation and convenience are driving market growth, sustained adoption depends on consistent quality, new flavor developments, and educational campaigns highlighting health benefits to maintain consumer interest

Malt-based Hot Drinks Market Dynamics

Driver

Increasing Health Awareness And Shift Toward Functional Beverages

• Rising awareness of the health benefits of malt-based drinks, including energy support, immunity enhancement, and nutritional supplementation, is driving market demand. Consumers are increasingly prioritizing beverages that deliver functional benefits alongside taste, fueling product innovation. The growing focus on wellness and preventive nutrition is further reinforcing the adoption of fortified malt beverages across age groups

• Urban lifestyles and busy routines are pushing consumers toward ready-to-drink and instant malt beverages for convenience and quick nutrition. The trend is further supported by fitness enthusiasts and health-conscious individuals seeking functional drink options that are both tasty and beneficial. Increasing online availability and promotional campaigns are making these beverages more accessible to a wider audience

• Public initiatives and wellness campaigns promoting fortified and nutritious beverages strengthen market penetration. Subsidized nutrition programs and growing media coverage highlight malt-based drinks as healthy daily options, reinforcing adoption. Schools, corporate wellness programs, and government-led campaigns are actively educating consumers on the benefits, creating long-term demand

• For instance, in 2022, several schools and corporate wellness programs across Europe and North America promoted fortified malt drinks as part of balanced diets, boosting visibility and consumer trust. Positive reviews and endorsements by nutrition experts further amplified adoption in both urban and semi-urban markets

• While health awareness is a key driver, ongoing market growth depends on enhancing distribution, product accessibility, and continuous innovation to meet evolving consumer expectations. Brands focusing on flavored and functional variants, combine

Restraint/Challenge

High Cost Of Premium Malt-Based Products And Limited Availability In Developing Regions

• The relatively higher price of premium or fortified malt-based hot drinks limits adoption among price-sensitive consumers, particularly in developing countries. Affordability remains a key barrier for widespread consumption. In addition, imported brands often carry premium pricing, making them inaccessible to a large portion of the population

• In many emerging markets, supply chain and distribution challenges restrict access to quality malt beverages in remote areas. Limited retail presence, storage constraints, and logistical barriers hinder timely availability, impacting market growth. Seasonal fluctuations in raw material supply also affect consistent product availability in these regions

• Lack of consumer awareness regarding nutritional content and proper preparation methods further limits adoption, with many consumers relying on conventional hot drinks with lower functional benefits. Misconceptions about taste, preparation, or efficacy can also prevent new consumers from trying premium malt-based drinks

• For instance, in 2023, beverage distributors in Sub-Saharan Africa reported low penetration of premium malt drinks due to high import costs and limited distribution networks, reducing overall market reach. Retailers noted that inconsistent supply and insufficient marketing support slowed brand recognition and consumer trust

• While product innovation continues to advance, addressing pricing, distribution, and educational barriers is critical. Scalable, affordable, and informative solutions are essential to unlock long-term growth potential in the global malt-based hot drinks market. Collaboration between local manufacturers, governments, and educational campaigns can improve accessibility and awareness significantly

Malt-based Hot Drinks Market Scope

The market is segmented on the basis of type, form, distribution channel, and packaging.

- By Type

On the basis of type, the malt-based hot drinks market is segmented into flavored beverages and unflavored beverages. The flavored beverages segment held the largest market revenue share in 2024, driven by growing consumer preference for taste-enhanced functional drinks. Flavored malt-based drinks offer a combination of nutrition and enjoyable taste, making them particularly popular among children, young adults, and health-conscious consumers.

The unflavored beverages segment is expected to witness the fastest growth rate from 2025 to 2032, driven by demand for versatile options that can be mixed with other ingredients or consumed plain for health benefits. Unflavored malt-based drinks are preferred by fitness enthusiasts and consumers seeking customizable nutritional solutions without added flavors or sugars.

- By Form

On the basis of form, the malt-based hot drinks market is segmented into powder and liquid. The powder segment held the largest market revenue share in 2024 due to its longer shelf life, ease of storage, and convenience in preparation. Powdered malt drinks are widely used in households, cafes, and health-focused outlets for their flexibility in portioning and mixing.

The liquid segment is expected to witness the fastest growth rate from 2025 to 2032, driven by ready-to-drink convenience and rising demand for instant beverages. Liquid malt-based drinks are particularly popular among busy urban consumers and students seeking quick nutrition with minimal preparation time.

- By Distribution Channel

On the basis of distribution channel, the malt-based hot drinks market is segmented into convenience stores, supermarkets, discount stores, and specialty stores. The supermarket segment held the largest market revenue share in 2024, driven by wide product variety, attractive promotions, and strong retail presence. Supermarkets offer easy access to both premium and mass-market malt drinks, enhancing visibility and adoption.

The convenience store segment is expected to witness the fastest growth rate from 2025 to 2032, driven by the growing trend of on-the-go consumption and impulse purchases. Convenience stores provide quick access to ready-to-drink and single-serve malt beverages, particularly in urban and semi-urban regions.

- By Packaging

On the basis of packaging, the malt-based hot drinks market is segmented into bottles, cans, and liquid cartons. The bottle segment held the largest market revenue share in 2024, owing to its portability, durability, and suitability for both retail and on-the-go consumption. Bottled malt drinks are widely preferred for single-serve consumption and convenient storage.

The liquid carton segment is expected to witness the fastest growth rate from 2025 to 2032, driven by demand for eco-friendly packaging and cost-effective bulk options. Cartons are increasingly favored by health-conscious consumers and institutional buyers seeking sustainable and convenient packaging solutions.

Malt-based Hot Drinks Market Regional Analysis

- Europe dominated the malt-based hot drinks market with the largest revenue share of 38.5% in 2024, driven by growing health awareness, increasing demand for functional beverages, and the popularity of fortified nutrition products

- Consumers in the region value the nutritional benefits, convenience, and taste offered by malt-based hot drinks, especially in ready-to-drink and instant formats

- This widespread adoption is further supported by high disposable incomes, urban lifestyles, and the rising preference for health-oriented beverages, establishing malt-based drinks as a preferred choice across adults and children

U.K. Malt-Based Hot Drinks Market Insight

The U.K. malt-based hot drinks market dominates with the largest revenue share, driven by increasing health awareness, busy lifestyles, and the rising preference for functional and fortified beverages. Consumers are choosing malt-based drinks to support nutrition, immunity, and energy needs. The strong presence of supermarkets, convenience stores, and online platforms ensures product accessibility, driving adoption across different consumer segments.

Germany Malt-Based Hot Drinks Market Insight

The Germany malt-based hot drinks market is expected to witness the fastest growth rate from 2025 to 2032, fueled by growing demand for healthy beverages and fortified drink options. consumers are adopting malt drinks as part of balanced diets and wellness routines. Germany’s developed retail infrastructure, combined with awareness campaigns highlighting nutritional benefits, supports market growth. Both powdered and liquid forms are gaining traction across households and institutional consumption.

Asia-Pacific Malt-Based Hot Drinks Market Insight

The Asia-Pacific malt-based hot drinks market is expected to witness the fastest growth rate from 2025 to 2032, driven by rising disposable incomes, urbanization, and growing health consciousness in countries such as China, India, and Japan. The region’s increasing adoption of fortified and ready-to-drink beverages is boosting market demand. Government initiatives promoting nutritional awareness and functional foods further support the growth of malt-based hot drinks. Affordability and local manufacturing of malt products are expanding accessibility to a broader consumer base.

Japan Malt-Based Hot Drinks Market Insight

The Japan malt-based hot drinks market is expected to witness the fastest growth rate from 2025 to 2032 due to high health consciousness, busy lifestyles, and a preference for functional beverages. Japanese consumers are increasingly opting for fortified malt drinks to support energy, immunity, and overall wellness. The integration of malt drinks into daily routines, along with strong retail and e-commerce penetration, is driving market expansion. Moreover, product innovation, including flavored and instant malt drinks, is enhancing consumer adoption in both residential and institutional settings.

China Malt-Based Hot Drinks Market Insight

The China malt-based hot drinks market accounted for the largest market revenue share in Asia-Pacific in 2024, attributed to rising health awareness, a growing middle class, and rapid urbanization. Malt drinks are increasingly consumed for energy, nutrition, and wellness benefits across households and institutional sectors. The push for functional beverages, combined with local production and affordable pricing, is accelerating adoption. In addition, online retail growth and supermarket penetration are enhancing product accessibility, further propelling the market in China.

North America Malt-Based Hot Drinks Market Insight

North America is expected to witness the fastest growth rate from 2025 to 2032, driven by rising health awareness, increasing demand for functional beverages, and a preference for fortified nutrition products. Consumers in the region highly value the convenience, taste, and nutritional benefits offered by malt-based drinks, especially in ready-to-drink and instant formats. This widespread adoption is further supported by high disposable incomes, busy lifestyles, and a growing inclination toward health-focused beverages, establishing malt-based drinks as a preferred choice for both adults and children.

U.S. Malt-Based Hot Drinks Market Insight

The U.S. malt-based hot drinks market is expected to witness the fastest growth rate from 2025 to 2032, fueled by the popularity of functional and fortified beverages. Consumers are increasingly seeking energy-boosting, immunity-supporting, and nutritious drink options. The growing demand for convenient, ready-to-consume malt drinks, combined with the expansion of e-commerce and retail channels, further propels the market. Moreover, health campaigns and nutrition programs promoting malt-based beverages are significantly contributing to market growth.

Malt-based Hot Drinks Market Share

The Malt-based Hot Drinks industry is primarily led by well-established companies, including:

- Nestlé (Switzerland)

- Mondelez International (U.S.)

- Van Pur S.A. (Poland)

- RateBeer, LLC. (U.S.)

- Harboes Bryggeri A/S (Denmark)

- Cambscuisine (U.K.)

- CODY’s Drinks International GmbH (Germany)

- United Brands LLC (U.S.)

- PMV Maltings Pvt. Ltd. (India)

- Barbican (United Arab Emirates)

- Royal Unibrew A/S (Denmark)

- PureMalt Products Ltd (U.K.)

- ASAHI GROUP HOLDINGS, LTD. (Japan)

- Royal Swinkels (Netherlands)

- Drinks21 Ltd (South Korea)

- Molson Coors Beverage Company (U.S.)

- Moussy (Switzerland)

- Heineken N.V. (Netherlands)

- Constellation Brands, Inc. (U.S.)

- Van Pur S.A. (Poland)

Latest Developments in Global Malt-based Hot Drinks Market

- In July 2024, Farm Fresh Bhd launched Farm Fresh Choco Malt, a high-fiber, high-protein, and low-sugar chocolate malt drink, aimed at providing nutritious and convenient beverage options for health-conscious consumers. This launch, following its Farm Fresh Grow formula milk powder for children aged one to six, strengthens the company’s product portfolio and enhances its presence in the functional malt drinks segment, driving consumer adoption of healthy malt-based beverages

- In February 2024, Boulevard Brewing Co. introduced Quirktails, a new line of craft malt beverages available in three flavors, featuring 5.90% alcohol content and lower carbonation. This development allows the company to diversify beyond its Quirk hard seltzers, targeting adult consumers seeking flavorful, premium malt-based drinks, and is expected to expand its market share in the alcoholic malt beverage category

- In November 2022, Unilever acquired GlaxoSmithKline’s Health Food Drinks portfolio in Asia for USD 3.8 billion, including leading malt drink brands such as Horlicks and Boost. This strategic move enhances Unilever’s footprint in the Indian and broader Asian market, strengthens its portfolio of fortified malt beverages, and positions the company to capitalize on growing consumer demand for nutritious and functional drinks

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Malt Based Hot Drinks Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Malt Based Hot Drinks Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Malt Based Hot Drinks Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.