Global Malt Whiskey Market

Market Size in USD Billion

CAGR :

%

USD

5.65 Billion

USD

8.23 Billion

2024

2032

USD

5.65 Billion

USD

8.23 Billion

2024

2032

| 2025 –2032 | |

| USD 5.65 Billion | |

| USD 8.23 Billion | |

|

|

|

|

Malt Whiskey Market Size

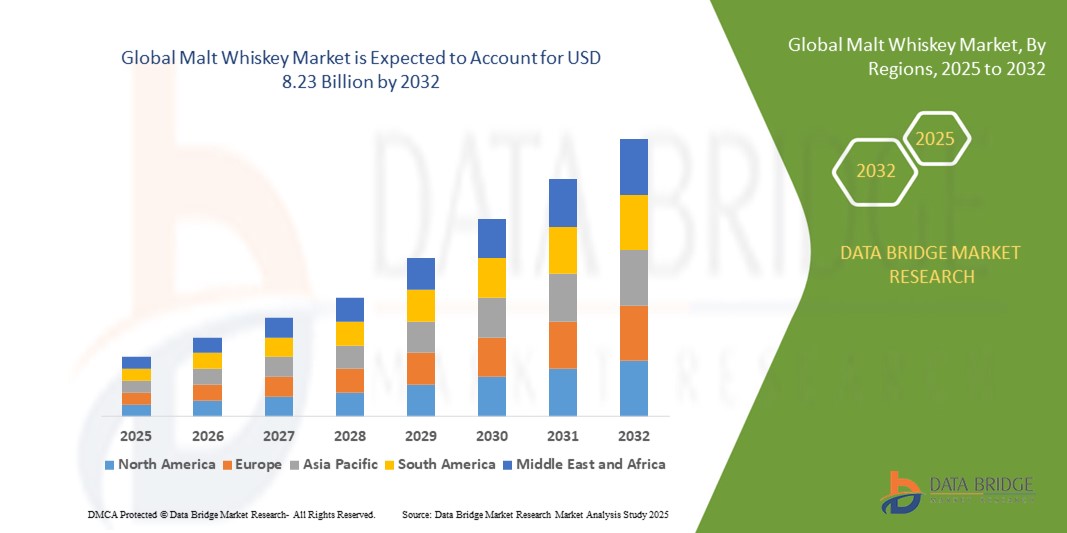

- The global malt whiskey market size was valued at USD 5.65 billion in 2024 and is expected to reach USD 8.23 billion by 2032, at a CAGR of 4.80% during the forecast period

- The market growth is largely fuelled by the rising preference for premium and aged whiskey among consumers, increasing global cocktail culture, and expanding distribution channels across emerging markets

- Growing tourism, luxury bar and restaurant culture, and the rise of e-commerce platforms for alcoholic beverages are further contributing to the market expansion

Malt Whiskey Market Analysis

- Increasing consumer inclination toward high-quality, craft, and single malt whiskeys is driving product innovation and brand diversification

- Rising disposable incomes and evolving lifestyles in North America, Europe, and Asia-Pacific are supporting higher consumption of malt whiskey in both on-trade and off-trade channels

- Europe dominated the malt whiskey market with the largest revenue share of 38.50% in 2024, driven by a rich heritage of whiskey production, rising tourism, and increasing global demand for premium spirits

- North America region is expected to witness the highest growth rate in the global malt whiskey market, driven by increasing demand for premium spirits, evolving consumer taste preferences, and a surge in cocktail culture across urban centers

- The Scotch Whiskey segment held the largest market revenue share in 2024, driven by its global recognition, premium positioning, and high consumer demand across North America and Europe. Scotch whiskey is particularly popular for its rich flavor profiles, aging techniques, and cultural heritage, making it a preferred choice among connoisseurs and collectors

Report Scope and Malt Whiskey Market Segmentation

|

Attributes |

Malt Whiskey Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

• Expansion of Premium and Aged Whiskey Segments |

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Malt Whiskey Market Trends

Rising Popularity of Premium and Aged Whiskey

- The growing preference for premium and aged malt whiskey is transforming the global market by driving demand for higher-quality products. Consumers are increasingly seeking unique flavors, heritage brands, and limited-edition releases, which boosts overall market growth and profitability

- The surge in whiskey tourism and tasting experiences is further fueling interest in premium malt whiskey. Distilleries offering guided tours, tastings, and exclusive releases are creating immersive experiences that attract connoisseurs and casual consumers alike

- The expansion of cocktail culture and mixology trends is encouraging the use of malt whiskey in high-end beverages, increasing its visibility and desirability. Bartenders and restaurants are experimenting with aged whiskey in creative drinks, enhancing brand recognition and market adoption

- For instance, in 2023, several Scottish distilleries reported record sales of aged single malt whiskey, driven by increasing international demand and collector interest. These trends have bolstered the prominence of malt whiskey in both domestic and export markets

- While premiumization and experiential marketing are propelling growth, sustained innovation, limited edition releases, and effective global distribution remain crucial for maintaining long-term momentum in the malt whiskey sector

Malt Whiskey Market Dynamics

Driver

Increasing Global Demand for Premium Spirits and Whiskey Culture

• Rising disposable incomes and growing consumer awareness of premium spirits are driving demand for malt whiskey worldwide. Consumers are increasingly willing to pay a premium for quality, authenticity, and unique aging processes

• The proliferation of whiskey clubs, tasting events, and social media engagement is boosting awareness and encouraging new buyers to explore malt whiskey varieties. The trend is particularly strong among millennials and affluent consumers seeking sophisticated drinking experiences

• Governments and trade organizations are promoting regional whiskey brands through tourism and export initiatives, expanding the global footprint and adoption of malt whiskey. These efforts strengthen brand presence and consumer trust in the market

• For instance, in 2022, Japan’s whiskey exports surged by 15%, reflecting growing global recognition and increasing international consumer preference for high-quality malt whiskey. This growth was supported by expanding distribution networks, participation in international spirits competitions, and the rising popularity of Japanese whiskey in North America and Europe, further solidifying its position in the premium spirits segment

• While consumer interest and promotional initiatives are driving growth, ongoing innovation in flavor profiles, packaging, and branding is essential to retain market share and attract new buyers. Crafting limited-edition releases, exploring barrel-aging techniques, and creating visually appealing packaging can differentiate brands, enhance perceived value, and sustain consumer engagement

Restraint/Challenge

High Cost and Regulatory Constraints in the Alcohol Market

• The premium pricing of aged and single malt whiskey limits accessibility for price-sensitive consumers, which can restrict market penetration in emerging regions. High taxation and import duties further exacerbate the affordability issue

• Strict alcohol regulations in certain countries limit production, distribution, and advertising of malt whiskey. Compliance costs and licensing requirements pose significant challenges for both established and emerging brands

• Supply constraints due to aging requirements and limited raw material availability, such as barley and casks, can delay production and impact market stability. These limitations hinder scalability for high-demand products

• For instance, in 2023, several Scottish distilleries reported production bottlenecks due to aging stock shortages, limiting the availability of popular single malt releases and creating temporary price surges.

• While the market continues to grow, addressing pricing, regulatory compliance, and production constraints is vital for sustaining long-term expansion and meeting increasing global demand.

Malt Whiskey Market Scope

The market is segmented on the basis of type and distribution channel.

- By Type

On the basis of type, the malt whiskey market is segmented into Scotch Whiskey, American Whiskey, Irish Whiskey, and Others. The Scotch Whiskey segment held the largest market revenue share in 2024, driven by its global recognition, premium positioning, and high consumer demand across North America and Europe. Scotch whiskey is particularly popular for its rich flavor profiles, aging techniques, and cultural heritage, making it a preferred choice among connoisseurs and collectors.

The American Whiskey segment is expected to witness the fastest growth rate from 2025 to 2032, driven by rising interest in bourbon and rye varieties, innovative small-batch productions, and expanding international distribution. American whiskey is gaining traction due to its distinct flavor, mixology applications, and growing presence in on-trade and off-trade channels, making it increasingly popular among younger and premium-seeking consumers.

- By Distribution Channel

On the basis of distribution channel, the malt whiskey market is segmented into On Trade and Off Trade. The Off Trade segment held the largest revenue share in 2024, fueled by supermarket and retail store sales, online e-commerce platforms, and easy accessibility to premium whiskey brands.

The On Trade segment is expected to witness the fastest growth rate from 2025 to 2032, driven by bars, restaurants, and hotels promoting tasting experiences, premium cocktails, and curated whiskey selections to enhance consumer engagement

Malt Whiskey Market Regional Analysis

• Europe dominated the malt whiskey market with the largest revenue share of 38.50% in 2024, driven by a rich heritage of whiskey production, rising tourism, and increasing global demand for premium spirits.

• Consumers in the region value authentic production methods, traditional aging processes, and high-quality ingredients, which contribute to the perceived luxury and premium pricing of malt whiskey.

• This widespread adoption is further supported by established distribution networks, strong brand recognition, and growing interest in craft and limited-edition variants, establishing malt whiskey as a preferred choice among both domestic and international consumers.

U.K. Malt Whiskey Market Insight

The U.K. malt whiskey market captured the largest revenue share in 2024 within Europe, fueled by the country's historic whiskey heritage and strong global exports. Rising consumer interest in premium and super-premium whiskey variants, combined with tourism-driven demand, is expanding market growth. Moreover, the increasing number of whiskey festivals, tasting events, and marketing initiatives is significantly enhancing consumer awareness and engagement.

Scotland Malt Whiskey Market Insight

The Scotland malt whiskey market is expected to witness the fastest growth rate from 2025 to 2032, primarily driven by its global reputation for high-quality Scotch whiskey. The demand for aged and single-malt varieties is accelerating, alongside the rise of export markets in Asia and North America. Scottish distilleries are leveraging premiumization trends and sustainable production practices to attract both domestic and international consumers.

U.S. Malt Whiskey Market Insight

The U.S. malt whiskey market is expected to witness the fastest growth rate from 2025 to 2032, driven by the growing popularity of craft whiskey and rising disposable incomes. American consumers are increasingly exploring imported and locally produced malt whiskeys for tasting and collection purposes. The expanding cocktail culture, coupled with premium bar experiences, is further driving demand across urban centers and hospitality sectors.

Asia-Pacific Malt Whiskey Market Insight

The Asia-Pacific malt whiskey market is expected to witness the fastest growth rate from 2025 to 2032, driven by rising disposable incomes, expanding middle-class populations, and increasing urbanization in countries such as Japan, China, and India. The region's growing inclination toward premium alcoholic beverages, supported by expanding on-trade and off-trade channels, is accelerating adoption. Furthermore, promotional initiatives by global whiskey brands and emerging local craft distilleries are enhancing consumer awareness and accessibility.

Japan Malt Whiskey Market Insight

The Japan malt whiskey market is expected to witness the fastest growth rate from 2025 to 2032 due to the country’s high appreciation for craftsmanship, tradition, and premium spirits. Japanese consumers increasingly prefer aged and single-malt variants, while international recognition is boosting export demand. In addition, collaborations with global brands and the expansion of luxury bars and retail outlets are further stimulating market growth.

China Malt Whiskey Market Insight

The China malt whiskey market accounted for the largest market revenue share in Asia-Pacific in 2024, attributed to rising urbanization, a growing middle-class population, and expanding premium spirits consumption. Increasing exposure to Western culture and rising disposable incomes are encouraging consumers to explore imported and high-end malt whiskey. Strong distribution networks, online retail platforms, and marketing campaigns are key factors driving the adoption of malt whiskey in China.

Malt Whiskey Market Share

The Malt Whiskey industry is primarily led by well-established companies, including:

- Bacardi Limited (Bermuda)

- Suntory Holdings Limited (Japan)

- Rémy Cointreau (France)

- Diageo plc (U.K.)

- The Edrington Group (Scotland)

- William Grant & Sons (Scotland)

- Asahi Group Holdings, Ltd. (Japan)

- Alliance Global Group, Inc. (Philippines)

- Pernod Ricard (France)

- The Brown–Forman Corporation (U.S.)

Latest Developments in Global Malt Whiskey Market

- In 2021, Glen Fiddich, a single malt scotch whiskey brand owned by William Grant & Sons, initiated a sustainability project by transitioning its delivery fleet to renewable biogas generated from whiskey distillation leftovers. This development aims to reduce the company’s carbon footprint and promote eco-friendly logistics. By utilizing biogas from production waste, Glen Fiddich not only lowers greenhouse gas emissions but also demonstrates a circular economy approach within the spirits industry. The initiative enhances brand reputation among environmentally conscious consumers and sets a benchmark for sustainable practices in the global whiskey market, encouraging other producers to adopt similar green logistics strategies

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Malt Whiskey Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Malt Whiskey Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Malt Whiskey Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.