Global Mammalian Polyclonal Igg Antibody Market

Market Size in USD Billion

CAGR :

%

USD

2.68 Billion

USD

3.95 Billion

2025

2033

USD

2.68 Billion

USD

3.95 Billion

2025

2033

| 2026 –2033 | |

| USD 2.68 Billion | |

| USD 3.95 Billion | |

|

|

|

|

Mammalian Polyclonal IgG Antibody Market Size

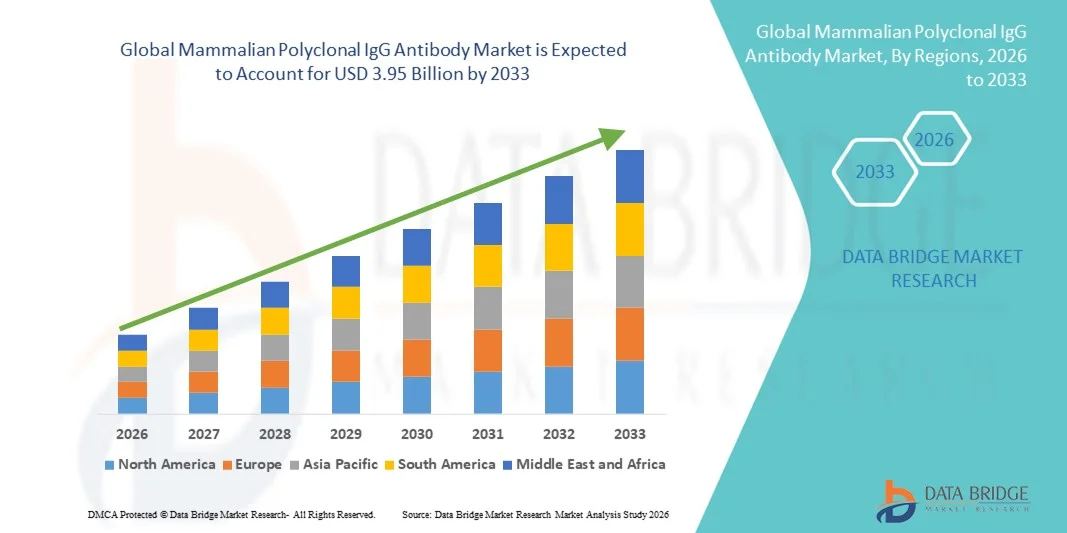

- The global Mammalian Polyclonal IgG Antibody market size was valued at USD 2.68 billion in 2025 and is expected to reach USD 3.95 billion by 2033, at a CAGR of 5.00% during the forecast period

- The market growth is largely fueled by increasing adoption of advanced biopharmaceutical research techniques and technological progress in antibody production, leading to higher demand for high-quality mammalian polyclonal IgG antibody solutions in both research and clinical application

- Furthermore, rising demand for sensitive, specific, and reliable immunoassay reagents and therapeutic antibody products is driving the growth of mammalian polyclonal IgG antibody solutions, thereby significantly boosting the industry's expansion

Mammalian Polyclonal IgG Antibody Market Analysis

- Mammalian Polyclonal IgG Antibodies, widely used in research, diagnostics, and therapeutic applications, are increasingly vital components of modern biomedical and biopharmaceutical workflows due to their high specificity, versatility, and reliability in detecting and targeting antigens

- The escalating demand for Mammalian Polyclonal IgG Antibodies is primarily fueled by the growing biopharmaceutical R&D activities, increasing prevalence of chronic and infectious diseases, and rising adoption of advanced immunoassays and therapeutic antibody applications

- North America dominated the mammalian polyclonal IgG antibody market with the largest revenue share of 41.5% in 2025, characterized by advanced research infrastructure, high funding in biopharmaceutical development, and a strong presence of key industry players, with the U.S. experiencing substantial growth in Mammalian Polyclonal IgG Antibody usage, particularly in biotechnology, clinical research, and diagnostics, driven by innovations from both established companies and startups focusing on high-throughput and high-purity antibody production

- Asia-Pacific is expected to be the fastest growing region in the mammalian polyclonal IgG antibody market during the forecast period due to increasing investment in life sciences research, expanding biopharmaceutical manufacturing capabilities, and rising healthcare expenditure in countries such as China, India, and Japan

- The cardiac markers segment dominated the largest market revenue share of 41.3% in 2025, driven by the global prevalence of cardiovascular diseases and the critical need for early diagnosis and monitoring

Report Scope and Mammalian Polyclonal IgG Antibody Market Segmentation

|

Attributes |

Mammalian Polyclonal IgG Antibody Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Mammalian Polyclonal IgG Antibody Market Trends

Rising Demand for Multiplex and High-Specificity Assays

- A significant and accelerating trend in the global mammalian polyclonal IgG antibody market is the growing adoption of multiplex assays and high-specificity testing platforms. This trend is enhancing laboratory efficiency and improving the reliability of diagnostic and research results

- For instance, in June 2024, Thermo Fisher Scientific expanded its portfolio with high-specificity polyclonal antibodies optimized for multiplex ELISA and immunohistochemistry applications, enabling laboratories to detect multiple biomarkers in a single assay

- Polyclonal antibodies are increasingly preferred for applications requiring broad epitope recognition, which is crucial for detecting low-abundance proteins and novel targets

- The trend is also supported by the integration of these antibodies into automated laboratory systems, reducing manual intervention and increasing throughput

- Laboratories and research institutes are focusing on antibody reproducibility and batch-to-batch consistency, driving innovation in antibody development

- Furthermore, the expansion of proteomics and biomarker discovery research has increased demand for polyclonal antibodies capable of detecting diverse antigenic regions

- The versatility of these antibodies for multiple assay formats, including ELISA, Western blotting, immunohistochemistry, and immunocytochemistry, supports this trend

- Manufacturers are responding by launching tailored antibody products with higher specificity and reduced cross-reactivity

- The development of antibodies compatible with emerging diagnostic platforms, such as point-of-care testing and multiplex immunoassays, is also accelerating adoption

- Increasing demand from academic research and pharmaceutical development sectors reinforces this market trend

- Overall, laboratories are shifting toward high-throughput, multi-target analysis requiring high-quality polyclonal antibodies

- This trend is shaping product development strategies and market growth for the next several years

Mammalian Polyclonal IgG Antibody Market Dynamics

Driver

Expanding Research and Diagnostic Applications

- The increasing prevalence of chronic diseases, rising demand for diagnostic testing, and growing investment in life sciences research are key drivers for the Mammalian Polyclonal IgG Antibody market

- For instance, in March 2023, Abcam launched a series of polyclonal antibodies targeting metabolic and cardiac biomarkers, specifically designed for preclinical research and clinical diagnostic applications

- These antibodies are widely used for disease biomarker detection, drug development, and translational research, driving market adoption

- The increasing number of clinical studies and research programs requiring reliable detection of low-abundance proteins further fuels demand

- Academic and research institutes are expanding infrastructure for molecular biology, immunology, and oncology research, increasing antibody consumption

- The growing number of diagnostic centers in emerging markets is also contributing to higher usage

- Polyclonal antibodies are preferred for their broad epitope recognition, which supports sensitive detection in diverse sample types

- Pharmaceutical companies use them in preclinical and early-stage clinical trials to evaluate therapeutic targets

- The rising focus on personalized medicine and biomarker-driven therapies also reinforces their importance in research workflows

- In addition, integration with high-throughput assay systems improves operational efficiency and reduces turnaround times, making these antibodies essential for modern laboratories

- Overall, expanding applications across diagnostics, research, and therapeutic development drive sustained market growth

Restraint/Challenge

Concerns About Reproducibility and High Production Costs

- Challenges surrounding batch-to-batch variability, reproducibility, and high production costs pose significant hurdles for wider adoption of Mammalian Polyclonal IgG Antibodies

- For instance, laboratories often report variations in antibody performance across different batches, which can impact experimental outcomes and clinical diagnostics reliability

- Ensuring high-quality, reproducible antibodies requires advanced immunization protocols, extensive validation, and quality control, adding to production costs

- Smaller laboratories or academic institutes may find premium polyclonal antibodies expensive compared to alternatives, limiting accessibility in cost-sensitive regions

- Although standardized manufacturing protocols exist, variability in antigen sources and animal responses remains a challenge

- Inconsistent performance may necessitate additional validation steps, increasing workflow time and operational costs

- The market is responding by developing improved production techniques, recombinant alternatives, and enhanced quality control measures

- Regulatory compliance and documentation for clinical diagnostic applications further increase the cost and complexity of antibody production

- Limited availability of high-specificity antibodies for rare biomarkers also constrains growth in certain segments

- Despite these challenges, investment in R&D, quality assurance, and scalable production methods is gradually mitigating these limitations

Mammalian Polyclonal IgG Antibody Market Scope

The market is segmented on the basis of type, product, application, and end-use.

- By Type

On the basis of type, the Mammalian Polyclonal IgG Antibody market is segmented into goat, rabbit, horse, mouse, and others. The rabbit segment dominated the largest market revenue share of 38.7% in 2025, driven by its high specificity, reproducibility, and wide adoption in various immunoassays and research applications. Rabbit antibodies are preferred for their strong affinity for target antigens and versatility in ELISA, immunohistochemistry, and Western blotting, making them critical for clinical diagnostics and laboratory research. The established supplier networks, proven reliability, and cost-effectiveness of rabbit antibodies in polyclonal preparations contribute to their continued dominance. Their adaptability across diverse testing platforms and consistent performance in large-scale studies further reinforce their market leadership. Additionally, academic and pharmaceutical research relies heavily on rabbit-derived antibodies due to their broad epitope recognition and compatibility with multiple detection systems. Researchers and diagnostics developers often favor rabbit antibodies for novel assay development, ensuring strong and sustained market demand.

The goat segment is anticipated to witness the fastest CAGR of 22.1% from 2026 to 2033, fueled by increasing adoption in large-scale diagnostic assays, immunoassay development, and therapeutic research. Goat antibodies offer advantages such as scalability, high yield, and compatibility with multiple conjugation methods, making them ideal for research and diagnostic purposes. The rising use of goat antibodies in multiplex assays, biomarker discovery, and preclinical studies supports their rapid growth. Increasing investment in biotechnology and pharmaceutical R&D, along with demand for customized polyclonal antibody production, further propels this segment. Additionally, goat antibodies are preferred for cross-species applications, enhancing their adoption in academic and commercial research laboratories.

- By Product

On the basis of product, the Mammalian Polyclonal IgG Antibody market is segmented into cardiac markers, metabolic markers, renal markers, and others. The cardiac markers segment dominated the largest market revenue share of 41.3% in 2025, driven by the global prevalence of cardiovascular diseases and the critical need for early diagnosis and monitoring. Antibodies targeting cardiac biomarkers, such as troponin and CK-MB, are extensively used in ELISA, immunohistochemistry, and clinical diagnostic kits, ensuring high demand across hospitals and diagnostic laboratories. The segment benefits from integration into automated immunoassay systems, enhancing efficiency and reproducibility. Rising cardiovascular disease incidence, aging populations, and government-led health initiatives also reinforce market leadership. The segment's revenue is supported by widespread adoption in routine cardiac testing and research applications globally, including preclinical and translational studies.

The metabolic markers segment is expected to witness the fastest CAGR of 20.8% from 2026 to 2033, fueled by the increasing prevalence of metabolic disorders such as diabetes and obesity. Antibodies targeting insulin, glucagon, and related metabolic proteins are critical for diagnostic panels, research studies, and therapeutic monitoring. Growth is further supported by the expansion of personalized medicine, multiplex testing, and automated diagnostic platforms. Rising awareness among healthcare providers, combined with technological advancements in high-throughput assays, drives rapid adoption. Increasing demand for accurate and early detection of metabolic diseases in both developed and emerging markets also contributes to the segment’s fast growth.

- By Application

On the basis of application, the Mammalian Polyclonal IgG Antibody market is segmented into ELISA, immunoturbidometry, immunoelectrophoresis, antibody identification, immunohistochemistry, immunocytochemistry, and Western blotting. The ELISA segment dominated the largest market revenue share of 36.5% in 2025, owing to its extensive use in diagnostics, clinical research, and high-throughput screening. ELISA provides sensitive, reproducible, and quantitative detection of antigens and antibodies, making it highly favored in hospitals, research labs, and pharmaceutical testing. Its adaptability to automated platforms and ease of integration with polyclonal antibodies strengthens its market position. Researchers rely on ELISA for early disease detection, biomarker quantification, and vaccine development, driving consistent demand. The segment benefits from global adoption across clinical and academic laboratories, as well as expanding applications in immunodiagnostics.

The immunohistochemistry (IHC) segment is expected to witness the fastest CAGR of 21.4% from 2026 to 2033, driven by increasing cancer prevalence and rising adoption of tissue-based diagnostics. IHC enables visualization of protein expression in tissues, supporting oncology research, pathology studies, and translational medicine. Expansion of cancer research initiatives, growing pathology lab infrastructure, and advancements in multiplex IHC techniques further fuel the growth. Increasing use in biomarker validation and drug discovery contributes to the rapid uptake.

- By End-Use

On the basis of end-use, the Mammalian Polyclonal IgG Antibody market is segmented into hospitals, diagnostic centers, and academic & research institutes. The academic & research institutes segment dominated the largest market revenue share of 39.8% in 2025, driven by extensive use in preclinical studies, fundamental immunology research, and pharmaceutical development. These institutes utilize polyclonal antibodies for ELISA, Western blotting, immunocytochemistry, and immunohistochemistry applications, contributing to consistent demand. Strong investments in research infrastructure, increasing government funding, and the growing number of academic studies drive market dominance. The segment benefits from high reproducibility, availability of diverse antibodies, and broad epitope recognition essential for experimental studies.

The diagnostic centers segment is expected to witness the fastest CAGR of 20.7% from 2026 to 2033, fueled by expanding clinical diagnostics, rising patient awareness, and the growing need for precise biomarker detection. Diagnostic centers increasingly rely on polyclonal antibodies for automated immunoassays and rapid testing panels. Technological advancements in point-of-care testing, laboratory automation, and multiplex diagnostics accelerate adoption. Rising demand in both developed and emerging regions further supports rapid growth.

Mammalian Polyclonal IgG Antibody Market Regional Analysis

- North America dominated the mammalian polyclonal IgG antibody market with the largest revenue share of 41.5% in 2025, characterized by advanced research infrastructure, high funding in biopharmaceutical development, and a strong presence of key industry players, with the U.S. experiencing substantial growth in Mammalian Polyclonal IgG Antibody usage, particularly in biotechnology, clinical research, and diagnostics, driven by innovations from both established companies and startups focusing on high-throughput and high-purity antibody production

- Consumers in the region highly value the reliability, specificity, and reproducibility offered by Mammalian Polyclonal IgG Antibodies in applications such as diagnostics, immunoassays, therapeutic research, and biotechnology development

- This widespread adoption is further supported by high investment in R&D, a technologically advanced research ecosystem, and the growing preference for high-quality antibody solutions in clinical and academic settings

U.S. Mammalian Polyclonal IgG Antibody Market Insight

The U.S. mammalian polyclonal IgG antibody market captured the largest revenue share in 2025 within North America, fueled by the rapid adoption of antibodies in clinical diagnostics, immunotherapy development, and academic research. The growing preference for high-throughput antibody production platforms, combined with robust funding for biotechnology and pharmaceutical R&D, further propels the Mammalian Polyclonal IgG Antibody industry. Moreover, increasing collaborations between research institutes, hospitals, and biotech companies are significantly contributing to the market's expansion

Europe Mammalian Polyclonal IgG Antibody Market Insight

The Europe mammalian polyclonal IgG antibody market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by increasing investments in life sciences research, growing adoption of advanced diagnostic tools, and rising demand for high-quality antibody solutions. European researchers and diagnostic centers are increasingly integrating Mammalian Polyclonal IgG Antibodies into immunoassays, biomarker studies, and therapeutic development, supporting steady market growth

U.K. Mammalian Polyclonal IgG Antibody Market Insight

The U.K. mammalian polyclonal IgG antibody market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by expanding biotechnology research programs, increasing government and private funding for diagnostics, and a strong academic research base. Rising awareness of antibody applications in clinical trials and therapeutic research is encouraging both research institutes and healthcare organizations to adopt these solutions

Germany Mammalian Polyclonal IgG Antibody Market Insight

The Germany mammalian polyclonal IgG antibody market is expected to expand at a considerable CAGR during the forecast period, fueled by well-developed research infrastructure, government support for biotech innovations, and a strong focus on precision medicine. Germany’s robust clinical and academic research ecosystem promotes the adoption of high-quality antibody solutions for diagnostics, immunoassays, and therapeutic research

Asia-Pacific Mammalian Polyclonal IgG Antibody Market Insight

The Asia-Pacific mammalian polyclonal IgG antibody market is poised to grow at the fastest CAGR of 11.2% during the forecast period, driven by increasing investments in biotechnology and life sciences research, expanding biopharmaceutical manufacturing capabilities, and rising healthcare expenditure in countries such as China, India, and Japan. The growing focus on early disease detection, immunotherapy development, and diagnostic innovations is propelling market adoption across the region

Japan Mammalian Polyclonal IgG Antibody Market Insight

The Japan mammalian polyclonal IgG antibody market is gaining momentum due to the country’s advanced life sciences research culture, high healthcare expenditure, and rising demand for reliable antibody solutions in diagnostics and therapeutic applications. The adoption of high-throughput antibody production platforms and collaborations with biotech firms are fueling market growth

China Mammalian Polyclonal IgG Antibody Market Insight

The China mammalian polyclonal IgG antibody market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to the country’s expanding biotechnology and pharmaceutical research infrastructure, rapid urbanization, and strong government support for life sciences. The increasing number of research institutes and biopharmaceutical companies integrating Mammalian Polyclonal IgG Antibodies into immunoassays, diagnostics, and therapeutic R&D is a key factor propelling the market in China

Mammalian Polyclonal IgG Antibody Market Share

The Mammalian Polyclonal IgG Antibody industry is primarily led by well-established companies, including:

• Sigma-Aldrich (U.S.)

• Thermo Fisher Scientific (U.S.)

• Cytiva (U.S.)

• Abcam (U.K.)

• Merck KGaA (Germany)

• Biovision (U.S.)

• GenScript (China)

• Santa Cruz Biotechnology (U.S.)

• Biorbyt (U.K.)

• Innovative Research (U.S.)

• Boster Biological Technology (China)

• Arigo Biolaboratories (U.S.)

• MyBioSource (U.S.)

• Invitrogen (U.S.)

• Pierce Biotechnology (U.S.)

• Abnova (Taiwan)

• Cell Signaling Technology (U.S.)

• LifeSpan BioSciences (U.S.)

• Affinity Biosciences (China)

• GenTex (U.S.)

Latest Developments in Global Mammalian Polyclonal IgG Antibody Market

- In March 2022, Absolute Antibody, a UK-based antibody specialist, launched new canine IgG isotype versions — specifically dog IgG2 and IgG4 — targeting oncology research and in vitro serological controls. These species-specific antibodies reduce anti-species immune responses in animal models, enhancing the reliability, efficacy, and reproducibility of experimental results. This launch addresses growing demand for high-quality polyclonal antibodies tailored for veterinary and translational research

- In October 2022, SAB Biotherapeutics entered into an exclusive partnership with Emergent BioSolutions to accelerate the production of polyclonal antibody-based therapies. The collaboration focuses on scaling up manufacturing for infectious disease and immune-mediated therapy pipelines, enabling faster clinical development and improved supply of therapeutic polyclonal IgG antibodies globally

- In February 2023, Fusion Antibodies introduced a commercial service designed for mammalian cell surface expression in antibody discovery programs. This service allows pharmaceutical and biotech companies to efficiently screen, identify, and optimize therapeutic antibodies from custom libraries, reducing the development cycle for new biologics and supporting personalized medicine initiatives

- In December 2023, Danaher Corporation completed its acquisition of Abcam plc, a leading provider of rabbit polyclonal antibodies. This strategic acquisition strengthens Danaher’s life sciences and diagnostics portfolio, broadening access to high-quality polyclonal antibodies for research, diagnostic applications, and therapeutic development

- In 2023, Murron secured a patent for a polyclonal IgG composition (IMM-529) targeting Clostridioides difficile infection. This development underscores the increasing focus on polyclonal IgG therapeutics for infectious disease treatment, enabling novel therapeutic applications and positioning Murron as a key player in the specialized antibody market

- In July 2024, researchers developed a technique to modify goat-derived IgG antibodies at the Fc domain while preserving antigen-binding functionality. This modification enables site-specific labeling and improves the versatility of goat polyclonal IgG for diagnostic assays and therapeutic applications, meeting the rising demand for customizable and high-precision antibodies

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.