Global Managed Network Services Market

Market Size in USD Billion

CAGR :

%

USD

75.69 Billion

USD

150.28 Billion

2024

2032

USD

75.69 Billion

USD

150.28 Billion

2024

2032

| 2025 –2032 | |

| USD 75.69 Billion | |

| USD 150.28 Billion | |

|

|

|

|

Managed Network Services Market Size

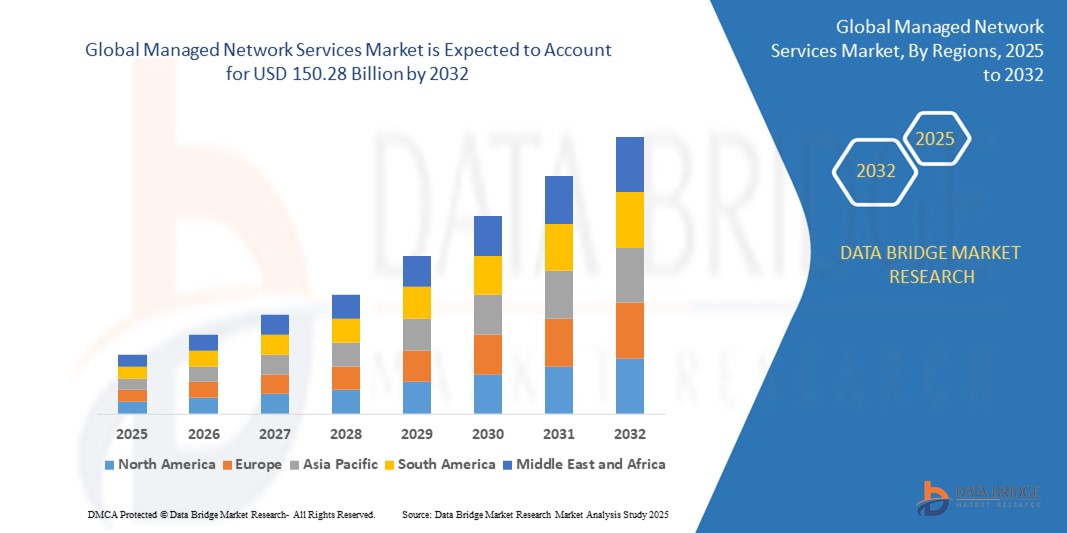

- The global managed network services market size was valued at USD 75.69 billion in 2024 and is expected to reach USD 150.28 billion by 2032, at a CAGR of 8.95% during the forecast period

- This growth is driven by increased demand for effective security solutions and growing mobile and internet penetration

Managed Network Services Market Analysis

- Managed Network Services are revolutionizing enterprise communication infrastructures by delivering centralized network control, robust security protocols, and streamlined service management, helping organizations enhance operational efficiency and reduce overhead costs across diverse industry verticals

- The increasing reliance on cloud-based infrastructure, combined with the surge in IoT device deployments and the growing need for low-latency connectivity, is accelerating the demand for scalable, flexible, and agile managed network solutions among global enterprises

- North America is expected to dominate the managed network services market, with the largest market share of 36.22%, driven by the presence of major telecom providers, high levels of digital adoption, and strong demand for network management solutions across sectors such as healthcare, IT, and manufacturing, where secure and reliable network services are critical

- Asia-Pacific is expected to witness the fastest growth in the managed network services market, due to rapid digital transformation, and increasing telecom service demands across urban and rural areas, prompting enterprises to invest in more efficient and secure network infrastructure

- The managed LAN/WAN segment is expected to dominate the managed network services market with the largest market share of 26.25% in 2025 due to the rising demand for high-speed, secure, and scalable enterprise networking solutions, the growing complexity of IT infrastructure, and the need for seamless connectivity across distributed enterprise locations

Report Scope and Managed Network Services Market Segmentation

|

Attributes |

Managed Network Services Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis |

Managed Network Services Market Trends

“Growing Adoption of AI and Automation in Network Management”

- A rising trend in the managed network services market is the integration of Artificial Intelligence (AI) and automation technologies to improve real-time network monitoring, fault detection, and self-healing capabilities

- AI-driven platforms enable predictive maintenance, reducing downtime and ensuring better service availability, while automation simplifies complex network operations and minimizes human error

- These technologies are helping service providers deliver proactive network optimization and enhanced service delivery to enterprise customers

- For instance, in March 2024, IBM launched an AI-powered managed network analytics platform designed to provide automated insights and optimize enterprise network performance in real time

- The adoption of AI and automation is reshaping how managed networks are operated, offering intelligent, cost-effective, and scalable solutions that meet modern business demands

Managed Network Services Market Dynamics

Driver

“Rising Demand for Unified Communication Solutions”

- As businesses increasingly operate in hybrid and remote environments, there is a growing demand for integrated communication platforms that unify voice, video, messaging, and data services.

- Managed Network Services are enabling this by offering centralized management of communication tools, which simplifies IT operations and enhances user collaboration.

- Enterprises are looking to minimize fragmented platforms by adopting unified communications as a service (UCaaS) bundled with managed network offerings.

- For instance, in 2023, BT Group introduced its new managed UCaaS offering, combining voice, video, and conferencing services into a single, cloud-managed platform for business clients.

- The push for unified communications is accelerating the integration of collaboration tools within managed network services, fostering productivity and cost savings

Opportunity

“Rising Demand from the Healthcare and Financial Sectors”

- The healthcare and financial industries are increasingly adopting managed network services to ensure secure, real-time data exchange, comply with stringent regulatory standards, and improve service delivery

- These sectors require high-performance, low-latency, and secure communication networks, which managed services are uniquely positioned to provide

- Growing investments in telemedicine, digital banking, and cybersecurity compliance are expanding the scope of managed network services in these high-growth verticals

- For instance, in 2024, Infosys partnered with a leading healthcare group in the U.S. to provide managed network infrastructure with end-to-end encryption and real-time data support for remote diagnostics

- The increasing digitalization of healthcare and finance represents a key growth opportunity for providers specializing in sector-specific managed network services

Restraint/Challenge

“Vendor Lock-in and Limited Customization Options”

- One of the critical challenges in the managed network services market is vendor lock-in, where clients become overly dependent on a single provider's infrastructure, tools, or protocols

- This can limit the organization’s ability to switch providers, customize solutions, or integrate third-party tools, ultimately reducing flexibility and long-term cost efficiency

- Organizations with complex or evolving network needs may struggle to adapt vendor-specific solutions to their changing requirements

- For instance, in 2023, a Southeast Asian telecom company reported operational inefficiencies after being unable to integrate third-party analytics tools into its vendor-managed network system

- Addressing customization needs and enabling multi-vendor integration will be essential for the sustained growth and customer retention in the managed network services sector

Managed Network Services Market Scope

The market is segmented on the basis of component, service type, deployment type, organization size, and end user.

|

Segmentation |

Sub-Segmentation |

|

By Component |

|

|

By Service Type |

|

|

By Deployment Type |

|

|

By Organization Size |

|

|

By End User |

|

In 2025, the managed data center services is projected to dominate the market with a largest share in component segment

The managed LAN/WAN segment is expected to dominate the managed network services market with the largest market share of 26.25% in 2025 due to the rising demand for high-speed, secure, and scalable enterprise networking solutions, the growing complexity of IT infrastructure, and the need for seamless connectivity across distributed enterprise locations.

The small and medium enterprises is expected to account for the largest share during the forecast period in organization size segment

In 2025, the small and medium enterprises segment is expected to dominate the market with the largest market share of 66.12% due to increasing digital transformation initiatives, growing reliance on cloud-based infrastructure, and the need for cost-effective network management solutions.

Managed Network Services Market Regional Analysis

“North America Holds the Largest Share in the Managed Network Services Market”

- North America is expected to dominate the managed network services market with the largest market share of 35.22%, driven by rapid adoption of cloud-based technologies, advanced telecom infrastructure, and a strong push for IT outsourcing to improve operational efficiency

- The U.S. leads the regional growth due to its robust telecom ecosystem, early adoption of digital services, and the presence of key players such as Verizon, AT&T, and T-Mobile

- There is growing demand across healthcare, financial services, and manufacturing sectors for scalable, secure, and flexible network solutions, driving up investment in managed network services

“Asia-Pacific is projected to register the Highest CAGR in the Managed Network Services Market”

- Asia-Pacific is expected to witness the highest growth rate in the managed network services market due to rapid digital transformation, increasing cloud adoption, and a strong emphasis on IT modernization in both private and public sectors

- Major contributors such as China, India, and Japan are benefiting from smart city initiatives, exponential growth in internet penetration, and widespread implementation of IoT and 5G

- Enterprises across the region are seeking to streamline operations, improve network performance, and boost cybersecurity, creating strong demand for managed network and security services

- With continued investment in digital infrastructure and support from government initiatives, Asia-Pacific is emerging as a strategic growth hub for global service providers in the Managed Network Services market

Managed Network Services Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- IBM (U.S.)

- Cisco Systems, Inc. (U.S.)

- Telefonaktiebolaget LM Ericsson (Sweden)

- Verizon (U.S.)

- Huawei Technologies Co., Ltd. (China)

- AT&T Intellectual Property. (U.S.)

- BT (U.K.)

- Telefónica S.A. (Spain)

- T-Systems International GmbH. (Germany)

- NTT Corporation. (Japan)

- Orange Business Services (France)

- FUJITSU (Japan)

- Lumen Technologies. (U.S.)

- Masergy Communications, Inc. (US)

- Colt Technology Services Group Limited (U.K.)

- Telstra (Australia)

- CommScope, Inc. (U.S.)

- Singtel (Singapore)

- GTT Communications, Inc. (U.S.)

Latest Developments in Global Managed Network Services Market

- In September 2024, US Signal Company, LLC, a leading digital infrastructure provider and portfolio company of Igneo Infrastructure Partners, completed its acquisition of OneNeck IT Solutions LLC and OneNeck Data Center Holdings LLC (OneNeck) from Telephone and Data Systems, Inc., strengthening its managed services capabilities and expanding its data center footprint across the U.S. This strategic acquisition is expected to enhance US Signal’s market position and accelerate its growth in the managed network services sector

- In June 2023, Wipro launched a managed private 5G-as-a-service solution in partnership with Cisco, allowing enterprises to integrate private 5G seamlessly into their existing LAN, WAN, and cloud infrastructure for improved business outcomes. This move highlights the growing convergence of 5G and managed services, offering enterprises more control and efficiency

- In May 2023, Cloudflare Inc. partnered with Kyndryl Holdings Inc., a major IT infrastructure services provider, to modernize and scale enterprise networks through managed WAN-as-a-Service and Cloudflare Zero Trust, enabling secure, large-scale cloud connectivity. This collaboration reflects the increasing demand for scalable and secure managed networking solutions across multi-cloud environments

- In May 2023, NTT announced its Next Generation Platform for Managed Network Services, providing businesses with a direct path to network transformation through NTT’s deep expertise and expansive technical resources. This platform positions NTT as a leading innovator in managed network services, focusing on flexibility and transformation

- In February 2023, Huawei launched a digitally managed network solution designed to drive new B2B service growth for telecom carriers, offering enhanced network intelligence and automation. This solution underscores Huawei’s commitment to supporting carrier evolution through advanced managed services

- In June 2021, AT&T Business and Cisco introduced Webex Calling with AT&T - Enterprise, integrating Cisco’s Unified Communications Manager Cloud (UCMC) to support flexible, cloud-based business communication. This integration showcases the trend of embedding unified communications into managed network offerings

- In May 2021, Cisco Webex and Box announced deeper integrations between their platforms, aimed at enabling customers to collaborate securely and efficiently in cloud environments. This partnership supports the continued shift toward cloud-native managed services that emphasize productivity and security

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.