Global Managed Pressure Drilling Services Market

Market Size in USD Billion

CAGR :

%

USD

4.55 Billion

USD

8.76 Billion

2025

2033

USD

4.55 Billion

USD

8.76 Billion

2025

2033

| 2026 –2033 | |

| USD 4.55 Billion | |

| USD 8.76 Billion | |

|

|

|

|

Managed Pressure Drilling Services Market Size

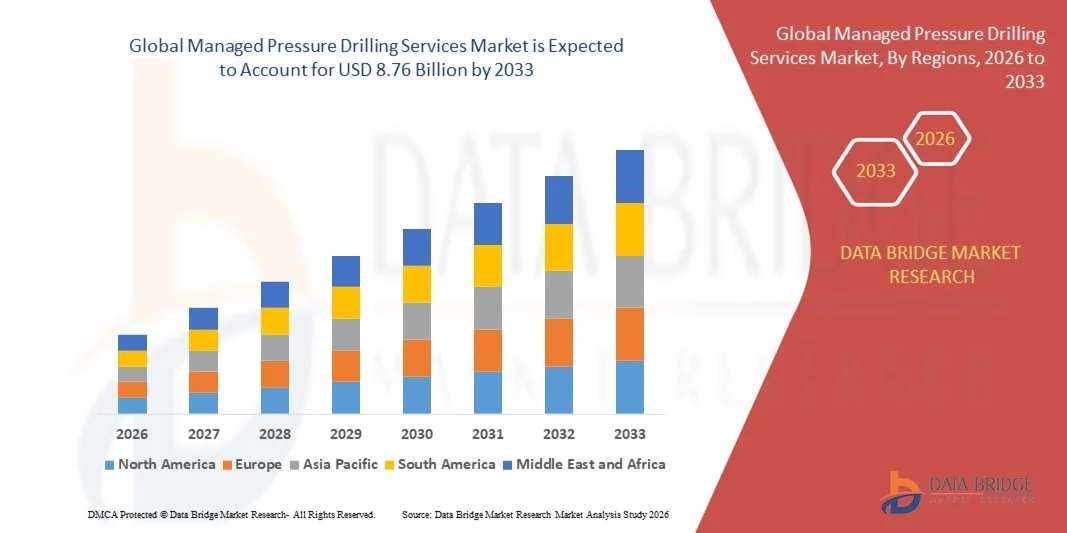

- The global managed pressure drilling services market size was valued at USD 4.55 billion in 2025 and is expected to reach USD 8.76 billion by 2033, at a CAGR of 8.51% during the forecast period

- The market growth is largely fuelled by the increasing demand for safe and efficient drilling operations in deepwater and complex reservoirs, where conventional drilling techniques face limitations

- Rising investments in offshore exploration and production, coupled with the need to optimize drilling performance and minimize non-productive time (NPT), are further driving market adoption

Managed Pressure Drilling Services Market Analysis

- Managed pressure drilling is increasingly preferred in challenging drilling environments, such as high-pressure, high-temperature (HPHT) wells, depleted reservoirs, and unconventional formations, due to its ability to maintain wellbore stability and improve safety

- The market is witnessing strong demand for integrated drilling services and equipment, supported by oilfield service companies offering end-to-end solutions that combine software, hardware, and expert operational support

- North America dominated the managed pressure drilling (MPD) services market with the largest revenue share of 38.45% in 2025, driven by the increasing demand for safe and efficient drilling operations, coupled with the presence of established oil and gas infrastructure and service providers.

- Asia-Pacific region is expected to witness the highest growth rate in the global managed pressure drilling services market, driven by rising energy demand, expansion of deepwater exploration, government initiatives to enhance domestic oil and gas production, and increasing adoption of technologically advanced drilling solutions

- The constant bottom hole pressure segment held the largest market revenue share in 2025, driven by its ability to maintain wellbore stability, reduce non-productive time, and minimize drilling hazards. This technology is widely adopted in conventional, deepwater, and high-pressure reservoirs due to its operational efficiency and safety benefits

Report Scope and Managed Pressure Drilling Services Market Segmentation

|

Attributes |

Managed Pressure Drilling Services Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Managed Pressure Drilling Services Market Trends

Advancements in Managed Pressure Drilling Technologies

- The increasing adoption of managed pressure drilling (MPD) technologies is revolutionizing drilling operations by providing precise control over wellbore pressure. This approach allows for safer drilling in complex and high-pressure reservoirs, reducing non-productive time, minimizing the risk of blowouts, kicks, and lost circulation, and enhancing overall operational efficiency. The trend is particularly strong in deepwater, mature, and unconventional fields where pressure management is critical

- Growing demand for real-time monitoring and automation in drilling operations is accelerating the deployment of advanced MPD systems. These systems enable drillers to respond instantly to changing downhole conditions, improving operational efficiency and overall well safety, while also reducing human error and downtime. The adoption of integrated control systems and automated feedback loops further strengthens operational reliability

- The integration of MPD with digital twins and IoT-enabled monitoring tools is enhancing predictive capabilities, allowing operators to optimize drilling parameters, reduce operational costs, and improve decision-making accuracy. This trend is particularly strong in deepwater and unconventional oil and gas projects, where complex reservoir conditions demand precise pressure control, and predictive maintenance helps avoid costly disruptions

- For instance, in 2024, several oilfield service companies in the Gulf of Mexico reported reduced wellbore instability and improved drilling efficiency after implementing automated MPD systems. These deployments not only demonstrated operational and financial benefits but also helped in minimizing environmental risks and enhancing safety standards. Continuous improvements in system responsiveness have further boosted adoption rates

- While MPD technologies are gaining traction globally, their widespread adoption depends on operator training, system standardization, and the availability of skilled personnel to manage complex drilling operations. Industry collaborations, knowledge-sharing programs, and certification initiatives are being introduced to bridge the skills gap and ensure safer, more effective implementation

Managed Pressure Drilling Services Market Dynamics

Driver

Rising Demand For Safe And Efficient Drilling Operations

- The increasing complexity of oil and gas reservoirs is driving the demand for managed pressure drilling services to ensure wellbore stability and safety. MPD reduces the risk of drilling hazards, improves drilling accuracy, lowers non-productive time, and helps operators achieve higher operational efficiency across conventional, unconventional, and deepwater wells. This makes it a critical tool in high-risk and high-value drilling projects

- Operators are focusing on cost optimization and efficiency, with MPD offering reduced non-productive time, enhanced drilling performance, and better resource utilization. The ability to drill in challenging environments such as deepwater, high-pressure, and high-temperature wells is further fueling market growth. In addition, MPD helps in extending the life of drilling equipment and minimizing maintenance costs

- Regulatory requirements and stricter safety standards across the globe are encouraging oil and gas companies to adopt advanced drilling techniques such as MPD. Compliance with environmental, health, and safety regulations is driving investment in technologically advanced drilling solutions, which in turn reduces operational risk and ensures long-term sustainability of drilling operations

- For instance, in 2023, major operators in the North Sea leveraged MPD technologies to maintain well integrity in ultra-high-pressure wells. These deployments improved operational safety, reduced environmental risks, and provided operators with greater control over complex drilling scenarios. Continuous technology upgrades have further enhanced system reliability

- While the demand for safer drilling methods drives the market, companies must continue investing in training, technology upgrades, and real-time monitoring capabilities to maximize MPD effectiveness. Collaborative R&D, advanced simulation tools, and predictive analytics are being increasingly integrated to optimize drilling performance and ensure compliance

Restraint/Challenge

High Capital Investment And Technical Complexity

- The high initial investment required for MPD systems and associated equipment limits adoption among smaller operators. Advanced control systems, sensors, and specialized tools make MPD a capital-intensive service, requiring significant upfront capital expenditure and careful financial planning. The cost barrier can slow market penetration in emerging economies

- Technical complexity and the need for highly skilled personnel pose significant barriers to implementation. Operators must have trained engineers capable of managing automated systems, interpreting real-time data, and responding to unexpected wellbore conditions to prevent operational failures. Continuous workforce training is essential to keep pace with evolving technologies

- Supply chain limitations for specialized components and maintenance services can lead to downtime and operational delays, particularly in remote or offshore drilling locations. Logistics challenges, equipment lead times, and availability of spare parts directly impact drilling schedules and project profitability, especially in high-demand regions

- For instance, in 2023, several drilling projects in West Africa experienced delays due to limited availability of MPD equipment and qualified personnel. These disruptions highlighted operational challenges associated with adoption, including scheduling conflicts and extended project timelines, which also increased operational costs

- While technical and financial barriers exist, ongoing innovation, modular system designs, and operator training programs are expected to mitigate these challenges and support long-term market growth. Advances in system automation, remote monitoring, and predictive maintenance are further enhancing efficiency, safety, and return on investment for operators worldwide

Managed Pressure Drilling Services Market Scope

The market is segmented on the basis of technology, application, and tool.

- By Technology

On the basis of technology, the managed pressure drilling (MPD) services market is segmented into constant bottom hole pressure, dual gradient drilling, pressurized or mud cap drilling, and returns flow control. The constant bottom hole pressure segment held the largest market revenue share in 2025, driven by its ability to maintain wellbore stability, reduce non-productive time, and minimize drilling hazards. This technology is widely adopted in conventional, deepwater, and high-pressure reservoirs due to its operational efficiency and safety benefits.

The dual gradient drilling segment is expected to witness the fastest growth rate from 2026 to 2033, driven by its capability to manage complex pressure environments and enable safer drilling in deepwater and ultra-deepwater wells. Dual gradient systems help optimize mud weight profiles and reduce formation damage, making them increasingly preferred for high-value projects.

- By Application

On the basis of application, the managed pressure drilling services market is segmented into onshore and offshore. The offshore segment held the largest market revenue share in 2025, driven by the growing exploration and production of deepwater and ultra-deepwater oil and gas fields that require precise pressure management and well control solutions. Offshore MPD services improve drilling efficiency, reduce non-productive time, and enhance operational safety in challenging environments.

The onshore segment is expected to witness the fastest growth rate from 2026 to 2033, fueled by the rising adoption of MPD services in unconventional and mature fields. Onshore drilling operators are increasingly implementing MPD technologies to optimize wellbore stability, reduce formation damage, and enhance overall productivity in both shale and tight reservoirs.

- By Tool

On the basis of tool, the managed pressure drilling services market is segmented into rotating control devices (RCD), non-return valves (NRV), and choke manifold systems. The rotating control device segment held the largest market revenue share in 2025, attributed to its ability to provide efficient wellbore fluid control, reduce environmental risks, and enhance operational safety during drilling operations. RCDs are widely implemented across offshore and high-pressure wells due to their reliability and effectiveness.

The non-return valves segment is expected to witness the fastest growth rate from 2026 to 2033, driven by the increasing need for backflow prevention and reliable pressure control solutions in both onshore and offshore drilling operations. NRVs help ensure smooth drilling processes, minimize operational downtime, and enhance overall drilling efficiency.

Managed Pressure Drilling Services Market Regional Analysis

- North America dominated the managed pressure drilling (MPD) services market with the largest revenue share of 38.45% in 2025, driven by the increasing demand for safe and efficient drilling operations, coupled with the presence of established oil and gas infrastructure and service providers.

- Operators in the region prioritize advanced drilling technologies to optimize wellbore stability, reduce non-productive time, and minimize operational risks in both onshore and offshore fields.

- The widespread adoption is further supported by regulatory compliance requirements, high investment capacity, and the presence of technologically advanced service providers, establishing MPD as a preferred solution for complex drilling projects

U.S. Managed Pressure Drilling Services Market Insight

The U.S. MPD services market captured the largest revenue share in 2025 within North America, fueled by rapid technological adoption and increasing deepwater drilling activities. Operators are increasingly using automated MPD systems and real-time monitoring solutions to enhance drilling efficiency and reduce operational hazards. Strong investment in oilfield services and the demand for environmentally safe and compliant drilling practices are further propelling market growth. Moreover, the U.S.’s mature oil and gas sector and advanced infrastructure support widespread adoption of MPD services across both conventional and unconventional wells.

Europe Managed Pressure Drilling Services Market Insight

The Europe MPD services market is expected to witness the fastest growth rate from 2026 to 2033, primarily driven by stringent safety and environmental regulations, along with growing offshore drilling activities in regions such as the North Sea. Operators are increasingly adopting advanced MPD technologies to comply with safety standards and enhance wellbore control. European companies are also leveraging automated and IoT-enabled drilling solutions to optimize efficiency and reduce operational costs, with increasing adoption in both mature and developing oil and gas fields.

U.K. Managed Pressure Drilling Services Market Insight

The U.K. MPD services market is expected to witness significant growth from 2026 to 2033, driven by rising offshore exploration activities and the need for enhanced well safety in high-pressure reservoirs. Adoption of dual gradient drilling and constant bottom hole pressure technologies is increasing to mitigate risks associated with deepwater wells. In addition, the U.K.’s focus on environmental compliance and technologically advanced oilfield operations is supporting the growth of MPD services across commercial and government-backed projects

Germany Managed Pressure Drilling Services Market Insight

The Germany MPD services market is expected to witness substantial growth from 2026 to 2033, fueled by the country’s emphasis on technological innovation and safety in drilling operations. Increasing awareness of automated drilling systems, coupled with regulatory frameworks to ensure well integrity, promotes MPD adoption in both onshore and offshore fields. Operators in Germany are integrating MPD with digital monitoring and predictive analytics to optimize drilling parameters and reduce non-productive time, aligning with efficiency and sustainability goals.

Asia-Pacific Managed Pressure Drilling Services Market Insight

The Asia-Pacific MPD services market is expected to witness the fastest growth rate from 2026 to 2033, driven by rising offshore and onshore oilfield developments, particularly in China, India, and Australia. Increasing exploration and production activities in deepwater and ultra-deepwater regions are driving demand for advanced MPD solutions. Furthermore, government initiatives supporting energy security and technological modernization in the oil and gas sector are accelerating MPD adoption, making the region a key growth market.

Japan Managed Pressure Drilling Services Market Insight

The Japan MPD services market is expected to witness significant growth from 2026 to 2033 due to the country’s focus on advanced oilfield technologies and offshore energy exploration. Operators are adopting MPD systems for safer and more efficient drilling, particularly in high-pressure offshore reservoirs. Integration with IoT-based monitoring and predictive analytics is further enhancing operational efficiency and reducing risks, while government-backed initiatives and industry collaborations continue to support market expansion.

China Managed Pressure Drilling Services Market Insight

The China MPD services market accounted for the largest revenue share in Asia-Pacific in 2025, attributed to rapid offshore and onshore drilling expansion and increasing investments in technologically advanced drilling solutions. The country is adopting MPD systems to improve drilling efficiency, ensure well safety, and comply with environmental regulations. In addition, domestic service providers and equipment manufacturers are strengthening capabilities in automated and dual gradient drilling, making China a leading hub for MPD services in the region.

Managed Pressure Drilling Services Market Share

The Managed Pressure Drilling Services industry is primarily led by well-established companies, including:

• Baker Hughes Company (U.S.)

• Weatherford (U.S.)

• Archer (U.K.)

• Halliburton (U.S.)

• Schlumberger (U.S.)

• Nabors Industries (U.S.)

• OilSERV (U.S.)

• Ensign Energy Services (Canada)

• ADS Services LLC (U.S.)

• Salos Sunesis Limited (U.K.)

• BJ Services (U.S.)

• FTS International (U.S.)

• Valaris plc (U.K.)

• Noble Corporation (U.S.)

• DIAMOND OFFSHORE DRILLING, INC. (U.S.)

• Maersk Drilling (Denmark)

• Enhanced Drilling (U.K.)

• Aker Solutions (Norway)

• Stena Drilling Ltd (Sweden)

• Emerson Electric Co. (U.S.)

• AFG Holdings, Inc. (U.S.)

Latest Developments in Global Managed Pressure Drilling Services Market

- In April 2024, Halliburton secured a deepwater multi-well construction contract with Rhino Resources Ltd. in Namibia's Orange Basin. The development involves exploration and appraisal activities aimed at optimizing asset utilization. Leveraging Halliburton’s advanced drilling expertise, the project is expected to enhance operational efficiency, reduce non-productive time, and strengthen the company’s presence in the African offshore drilling market, positively impacting regional service demand and industry growth

- In March 2024, Schlumberger (SLB) signed a definitive agreement to acquire a majority stake in Aker Carbon Capture (ACC). This strategic move is designed to accelerate the deployment of cost-effective carbon capture technologies. The acquisition is expected to advance large-scale industrial decarbonization efforts, expand Schlumberger’s sustainable solutions portfolio, and reinforce its competitive position in the global energy transition market, supporting long-term growth in green services

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Managed Pressure Drilling Services Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Managed Pressure Drilling Services Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Managed Pressure Drilling Services Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.