Global Managed Services Market

Market Size in USD Billion

CAGR :

%

USD

366.59 Billion

USD

752.19 Billion

2025

2033

USD

366.59 Billion

USD

752.19 Billion

2025

2033

| 2026 –2033 | |

| USD 366.59 Billion | |

| USD 752.19 Billion | |

|

|

|

|

Managed Services Market Size

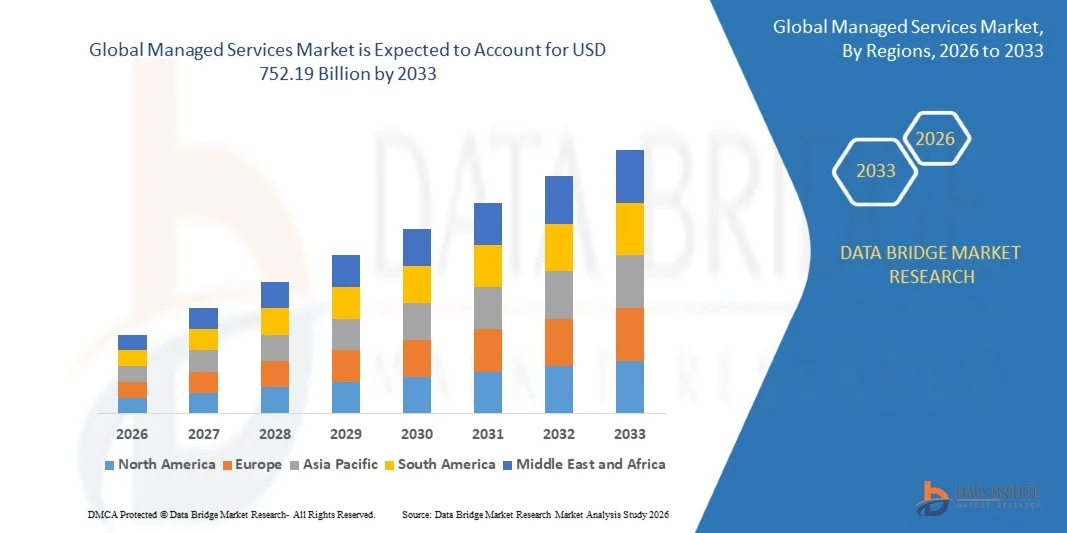

- The global managed services market size was valued at USD 366.59 billion in 2025 and is expected to reach USD 752.19 billion by 2033, at a CAGR of 9.40% during the forecast period

- The market growth is largely fueled by the increasing adoption of cloud computing, digital transformation initiatives, and IT outsourcing across industries, leading to greater demand for managed services that optimize operations, enhance security, and reduce operational costs

- Furthermore, rising enterprise reliance on scalable, secure, and cost-effective IT solutions is driving the adoption of managed services. Organizations are increasingly prioritizing services such as managed security, network management, data center operations, and backup & recovery to ensure business continuity, operational efficiency, and compliance, thereby significantly boosting market growth

Managed Services Market Analysis

- Managed services, offering outsourced management of IT infrastructure, networks, security, and applications, are becoming essential for enterprises aiming to streamline operations, reduce IT complexity, and focus on core business objectives across various sectors

- The escalating demand for managed services is primarily fueled by growing cybersecurity concerns, the need for seamless multi-cloud operations, and increasing digitalization across BFSI, healthcare, manufacturing, and IT & telecom industries, which are driving enterprises to adopt comprehensive, end-to-end managed solutions

- North America dominated the managed services market with a share of 33.5% in 2025, due to the growing demand for IT optimization, cloud adoption, and enterprise digital transformation

- Asia-Pacific is expected to be the fastest growing region in the managed services market during the forecast period due to rapid digital transformation, urbanization, and increasing IT infrastructure investments in countries such as China, Japan, and India

- On-premise segment dominated the market with a market share of 51.5% in 2025, due to organizations’ need for greater control, data privacy, and customization of IT resources. Enterprises in highly regulated sectors such as BFSI and government prefer on-premise solutions to comply with stringent security and compliance requirements. The ability to tailor infrastructure and maintain full ownership of data and processes makes on-premise managed services increasingly attractive for large-scale operations

Report Scope and Managed Services Market Segmentation

|

Attributes |

Managed Services Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Managed Services Market Trends

“Growing Adoption of Cloud-Native Managed Services”

- The managed services market is witnessing a strong trend toward the adoption of cloud-native solutions as enterprises accelerate digital transformation initiatives. Organizations are increasingly embracing containerized environments, microservices architectures, and cloud orchestration platforms to enhance scalability, flexibility, and operational efficiency through managed service providers (MSPs)

- For instance, IBM Corporation and Accenture plc have expanded their cloud-native managed service portfolios to support hybrid and multi-cloud operations across complex enterprise ecosystems. These offerings leverage container orchestration tools such as Kubernetes and Red Hat OpenShift to deliver continuous deployment and unified management of cloud workloads

- The shift toward cloud-native managed services is also being driven by the growing use of Software-as-a-Service (SaaS), Platform-as-a-Service (PaaS), and Infrastructure-as-a-Service (IaaS) models. Enterprises are partnering with MSPs to manage cloud costs, optimize resource utilization, and maintain compliance across distributed systems, thereby improving business agility

- Ongoing advancements in cloud monitoring, automation, and integration technologies are enabling seamless coordination of cross-cloud environments. This evolution allows organizations to dynamically allocate workloads, reduce latency, and minimize downtime through intelligent management solutions tailored to diverse cloud vendor frameworks

- In addition, the adoption of managed container security, AI-driven observability, and DevOps automation services is strengthening the role of managed service providers in enterprise IT ecosystems. Such solutions empower organizations to enhance development speed, ensure continuous security compliance, and maintain resilient IT operations

- As businesses continue transitioning toward hybrid and cloud-first strategies, the adoption of cloud-native managed services is expected to accelerate globally. The ability to ensure real-time scalability, enhanced reliability, and lower operational overhead will make cloud-native management an indispensable part of enterprise IT modernization strategies

Managed Services Market Dynamics

Driver

“Increasing Enterprise Demand for Cybersecurity and IT Optimization”

- Rising enterprise demand for cybersecurity and IT infrastructure optimization is a key factor propelling the managed services market. Organizations are increasingly outsourcing their IT management functions to address growing complexity, mitigate cyber threats, and ensure regulatory compliance without expanding internal IT budgets

- For instance, Kyndryl Holdings and Tata Consultancy Services (TCS) have collaborated with major enterprises to provide end-to-end managed security and cloud optimization services. Their solutions integrate network management, threat detection, and compliance automation to strengthen digital infrastructure resilience against evolving cyber risks

- With increasing cyberattacks and data breaches targeting enterprises across industries, proactive management of IT systems has become fundamental for business continuity. Managed service providers help organizations implement advanced security operations centers (SOCs), continuous threat monitoring, and incident response frameworks using AI and predictive analytics

- In addition, growing adoption of remote work models and distributed IT environments has increased the need for centralized service management. Managed services ensure consistent network visibility, efficient maintenance, and optimized cloud resource utilization, reducing downtime and operational inefficiencies

- The continuous evolution of the digital landscape and the rising importance of secure, efficient IT ecosystems will sustain demand for managed services. As enterprises prioritize strategic IT partnerships for resilience, cybersecurity, and cost control, managed service providers are well positioned to play a central role in global IT optimization frameworks

Restraint/Challenge

“High Dependence on Skilled IT Professionals”

- The heavy dependence on skilled IT professionals remains a major challenge for managed service providers. Delivering advanced services such as cloud orchestration, cybersecurity management, and AI-driven analytics requires a specialized workforce proficient in multi-domain technologies and emerging digital tools

- For instance, companies such as Infosys and Wipro have reported persistent challenges in scaling their managed service operations due to increasing competition for cloud architects, DevOps engineers, and cybersecurity analysts. The resulting talent constraints can impact service quality, response times, and overall project delivery efficiency

- Rapid technological evolution across cloud and automation ecosystems has widened the skill gap in key areas such as threat intelligence, identity management, and software containerization. MSPs must continuously invest in upskilling and certifications to maintain expertise in handling complex hybrid IT environments

- In addition, high employee turnover rates and contractor reliance can disrupt service continuity and client satisfaction, particularly in large-scale deployments requiring 24/7 support coverage. The shortage of trained professionals further restricts smaller providers from competing effectively with established global players

- Addressing workforce dependency challenges will require strategic talent development, partnerships with technology training institutes, and adoption of AI-based automation to minimize manual interventions. Developing a skilled and scalable IT workforce will remain critical for sustaining operational efficiency and ensuring long-term competitiveness in the managed services market

Managed Services Market Scope

The market is segmented on the basis of solution, MIS type, deployment, enterprise size, and end use.

• By Solution

On the basis of solution, the managed services market is segmented into managed data center, managed network, managed mobility, managed infrastructure, managed backup and recovery, managed communication, managed information, managed security, and managed information service (MIS). The managed data center segment dominated the market with the largest revenue share in 2025, driven by enterprises’ increasing need for scalable, secure, and energy-efficient data storage solutions. Organizations are prioritizing managed data center services to reduce IT complexity, optimize operational efficiency, and ensure uninterrupted business continuity. The rising adoption of cloud computing, virtualization, and hybrid IT infrastructure further fuels demand for managed data centers, supported by service providers offering comprehensive monitoring, maintenance, and security services.

The managed security segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by the increasing frequency and sophistication of cyber threats across industries. Businesses are investing in advanced security solutions such as threat detection, vulnerability management, and compliance monitoring to protect sensitive data and ensure regulatory adherence. The growth of remote work and connected devices has further accelerated demand for managed security services, making them critical for enterprises seeking robust cybersecurity strategies.

• By MIS Type

On the basis of MIS type, the market is segmented into business process outsourcing (BPO), business support systems, project & portfolio management, and others. The BPO segment held the largest market revenue share in 2025, driven by the outsourcing of non-core business functions to reduce operational costs, enhance efficiency, and focus on strategic initiatives. Enterprises increasingly rely on BPO services for payroll, HR, finance, and customer support processes, with global service providers delivering standardized solutions across geographies. The segment’s dominance is reinforced by its ability to offer flexible, scalable, and technology-enabled solutions that align with evolving business needs.

Project & portfolio management is expected to witness the fastest CAGR from 2026 to 2033, fueled by the growing emphasis on efficient resource allocation, risk mitigation, and project performance tracking. Organizations across industries are adopting PPM services to optimize project delivery, enhance collaboration, and achieve strategic objectives. Cloud-based PPM tools and real-time analytics further support the segment’s rapid adoption by enabling data-driven decision-making and transparency.

• By Deployment

On the basis of deployment, the market is segmented into hosted and on-premise solutions. The on-premise segment dominated the market with the largest revenue share of 51.5% in 2025, driven by organizations’ need for greater control, data privacy, and customization of IT resources. Enterprises in highly regulated sectors such as BFSI and government prefer on-premise solutions to comply with stringent security and compliance requirements. The ability to tailor infrastructure and maintain full ownership of data and processes makes on-premise managed services increasingly attractive for large-scale operations.

Hosted deployment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by enterprises’ preference for cloud-based services that reduce upfront capital expenditure and simplify IT management. Hosted managed services provide businesses with scalability, remote accessibility, and automatic updates, enabling rapid deployment and seamless integration with existing IT infrastructure. The segment’s growth is further supported by the widespread adoption of Software-as-a-Service (SaaS) models and the shift towards digital transformation initiatives across sectors.

• By Enterprise Size

On the basis of enterprise size, the managed services market is segmented into small & medium enterprises (SMEs) and large enterprises. Large enterprises dominated the market with the largest revenue share in 2025, driven by their extensive IT infrastructure requirements, complex operations, and higher adoption of advanced managed solutions. Enterprises are increasingly leveraging managed services to optimize costs, enhance operational efficiency, and maintain uninterrupted business continuity while managing global IT environments. The availability of end-to-end service offerings and global support networks further reinforces the preference of large enterprises for managed services.

SMEs are expected to witness the fastest growth rate from 2026 to 2033, fueled by the rising need for affordable, scalable, and flexible IT solutions. SMEs are increasingly adopting managed services to access enterprise-grade technology, security, and support without heavy upfront investment. Cloud-based and hosted service models further enable SMEs to leverage managed services for business growth, digital transformation, and competitive advantage.

• By End Use

On the basis of end use, the managed services market is segmented into BFSI, government, healthcare, IT & telecommunication, manufacturing, media & entertainment, retail, and others. The BFSI segment dominated the market with the largest revenue share in 2025, driven by the sector’s reliance on secure, compliant, and high-performance IT infrastructure. Banks, insurance firms, and financial institutions are increasingly outsourcing IT operations, cybersecurity, and data management to ensure operational efficiency, regulatory compliance, and risk mitigation. The adoption of digital banking, mobile payments, and fintech solutions further drives demand for managed services in the BFSI sector.

The healthcare segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by the increasing digitization of medical records, telemedicine adoption, and the need for secure and reliable IT systems. Healthcare providers are leveraging managed services for data security, patient record management, and seamless integration of healthcare applications. The growing emphasis on patient-centric care, regulatory compliance, and technology-driven healthcare solutions further accelerates the adoption of managed services in this sector.

Managed Services Market Regional Analysis

- North America dominated the managed services market with the largest revenue share of 33.5% in 2025, driven by the growing demand for IT optimization, cloud adoption, and enterprise digital transformation

- Organizations in the region are increasingly outsourcing IT operations, network management, and security functions to focus on core business objectives while reducing operational costs

- The widespread adoption is further supported by advanced IT infrastructure, high awareness of managed services benefits, and the presence of leading global service providers offering end-to-end solutions

U.S. Managed Services Market Insight

The U.S. managed services market captured the largest revenue share within North America in 2025, fueled by rapid cloud adoption, growing cybersecurity concerns, and increasing enterprise reliance on managed IT solutions. Businesses are prioritizing managed security, backup, and network services to ensure seamless operations, compliance, and data protection. The rising demand for hybrid IT environments, combined with the integration of AI and analytics in service management, is further propelling market growth.

Europe Managed Services Market Insight

The Europe managed services market is projected to expand at a substantial CAGR during the forecast period, driven by the increasing need for digital transformation, IT outsourcing, and secure network solutions across industries. Stringent data privacy regulations, growing adoption of cloud services, and demand for operational efficiency are fostering the uptake of managed services. The market is witnessing notable growth in the BFSI, healthcare, and government sectors, supported by service providers delivering tailored, scalable solutions.

U.K. Managed Services Market Insight

The U.K. managed services market is anticipated to grow at a noteworthy CAGR, driven by enterprises’ focus on IT cost optimization, cybersecurity, and managed cloud adoption. Organizations are increasingly embracing managed services to enhance operational efficiency and meet regulatory requirements. The country’s robust IT infrastructure, high adoption of digital technologies, and strong presence of service providers are expected to sustain market growth.

Germany Managed Services Market Insight

The Germany managed services market is expected to expand at a considerable CAGR, fueled by the country’s emphasis on technological innovation, cybersecurity, and digital transformation. Enterprises in Germany are adopting managed IT solutions to enhance efficiency, protect sensitive data, and support hybrid IT environments. The strong industrial base, regulatory compliance requirements, and growing demand for advanced cloud and security services further drive market adoption.

Asia-Pacific Managed Services Market Insight

The Asia-Pacific managed services market is poised to grow at the fastest CAGR during the forecast period, driven by rapid digital transformation, urbanization, and increasing IT infrastructure investments in countries such as China, Japan, and India. Rising enterprise adoption of cloud, mobility, and cybersecurity solutions, along with government initiatives promoting digitalization, is fueling demand for managed services. The region’s growing IT outsourcing capabilities, combined with the presence of cost-competitive service providers, are accelerating market expansion.

Japan Managed Services Market Insight

The Japan managed services market is gaining momentum due to increasing enterprise adoption of cloud solutions, digital transformation initiatives, and IT infrastructure modernization. Organizations are prioritizing managed network, security, and backup services to optimize operations and ensure business continuity. The market is further supported by Japan’s technologically advanced environment, high enterprise IT spending, and focus on secure, efficient IT solutions across industries.

China Managed Services Market Insight

The China managed services market accounted for the largest revenue share in Asia-Pacific in 2025, driven by the rapid growth of digital enterprises, expanding IT infrastructure, and adoption of cloud and cybersecurity solutions. Chinese organizations are increasingly outsourcing IT operations to managed service providers for cost efficiency, operational reliability, and scalability. Government support for digital initiatives, growing smart city projects, and strong domestic service providers are key factors propelling market growth.

Managed Services Market Share

The managed services industry is primarily led by well-established companies, including:

- Accenture (U.S.)

- Aryaka Networks, Inc. (U.S.)

- AT&T Inc. (U.S.)

- BMC Software, Inc. (U.S.)

- Broadcom (U.S.)

- Cisco Systems, Inc. (U.S.)

- DXC Technology Company (U.S.)

- HP Development Company, L.P. (U.S.)

- International Business Machines Corporation (IBM) (U.S.)

- Atera Networks Ltd. (Israel)

- HCL Technologies Limited (India)

- Fujitsu (Japan)

- Lenovo (China)

- ScalePad Software Inc. (Canada)

- Telefonaktiebolaget LM Ericsson (Sweden)

Latest Developments in Global Managed Services Market

- In October 2023, Logicalis launched its Intelligent Connectivity suite, featuring SASE, SSE, SD‑WAN, and Private 5G powered by Cisco. This initiative expands Logicalis’s managed services offerings, enabling customers to access cloud-native, Cisco-powered connectivity solutions integrated with the Logicalis Digital Fabric Platform. The suite strengthens the company’s position in managed networking and secure access by offering enhanced operational efficiency, seamless cloud integration, and advanced security for enterprise clients

- In September 2023, Cloud5 Communications launched a dedicated managed services division to support IT requirements across industries such as hospitality, student housing, and senior living. This division allows clients to efficiently manage IT operations, technology infrastructure, and security, while enabling Cloud5 to expand its recurring revenue streams. The move positions the company as a specialized provider of tailored managed services for vertical markets with specific operational needs

- In May 2023, NTT Ltd. introduced its next-generation SPEKTRA managed network services platform, leveraging AIOps, predictive analytics, and automation to enhance service reliability and operational efficiency. The platform provides proactive incident management, greater visibility into application performance, and flexible SLAs aligned with business outcomes. This development strengthens NTT’s managed services portfolio and reinforces its leadership in delivering intelligent, automated IT solutions

- In May 2023, Alfar Capital and Walter Capital Partners completed the acquisition of Canadian MSP MSP Corp, merging it with Groupe Access. This consolidation enhances the combined company’s ability to deliver advanced IT and cybersecurity solutions, expands its service capabilities, and strengthens its competitive positioning in the Canadian managed services market

- In January 2023, Rackspace Technology launched Rackspace Technology Modern Operations, a managed public cloud service for Azure, AWS, and GCP. The service provides 24×7 managed support, cloud resiliency, and innovation capabilities, helping enterprises manage complex multi-cloud environments efficiently. This development reinforces Rackspace’s position as a key provider of comprehensive managed cloud services and supports enterprise digital transformation initiatives

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.