Global Management System Certification Market

Market Size in USD Billion

CAGR :

%

USD

35.00 Billion

USD

48.26 Billion

2024

2032

USD

35.00 Billion

USD

48.26 Billion

2024

2032

| 2025 –2032 | |

| USD 35.00 Billion | |

| USD 48.26 Billion | |

|

|

|

|

Management System Certification Market Size

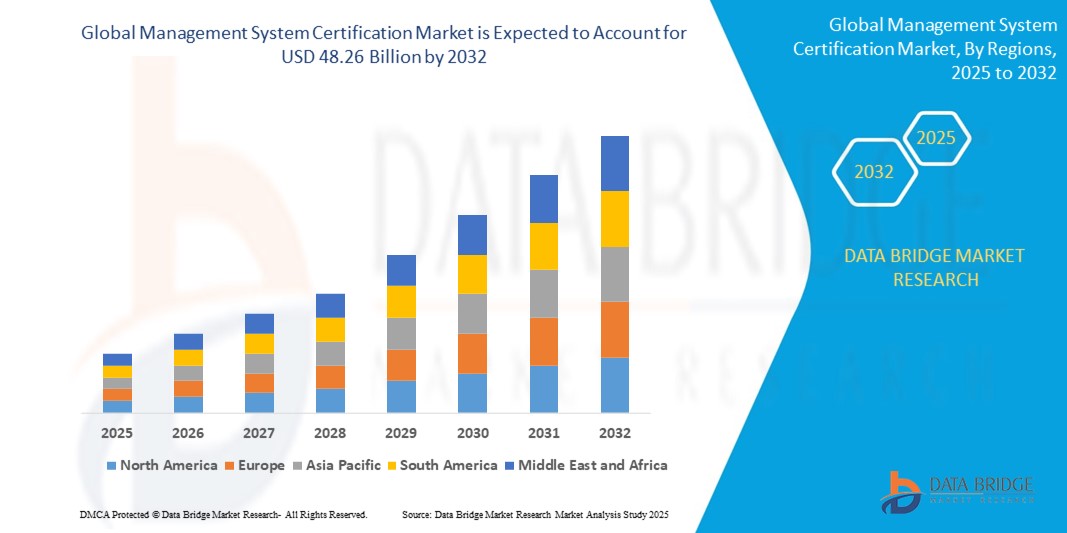

- The global management system certification market size was valued at USD 35 billion in 2024 and is expected to reach USD 48.26 billion by 2032, at a CAGR of 4.10% during the forecast period

- The market’s growth is primarily driven by increasing regulatory requirements and growing consumer demand for standardized quality, environmental, and information security management practices across industries

- Other sources indicate slightly different figures, with valuations around USD 2.82 billion in 2023 and projections reaching USD 3.49 billion by 2033, with a CAGR of approximately 2.15%. Despite minor variations, the overall growth trajectory is consistent across sources

Management System Certification Market Analysis

- Management system certifications, such as ISO 9001, ISO 14001, and ISO 27001, are becoming indispensable for organizations. They offer robust frameworks that boost operational efficiency, ensure strict regulatory adherence, minimize risks, and foster crucial trust with all stakeholders. These certifications validate an organization's commitment to best practices in an increasingly complex business environment

- The increasing demand for these certifications is primarily driven by stricter regulatory mandates across various sectors, compelling businesses to seek validated compliance. Heightened expectations from consumers and stakeholders for ethical and sustainable practices also play a significant role. Furthermore, the growing integration of digital tools and automation within the certification process is enhancing accessibility and efficiency, thereby significantly contributing to market expansion

- Asia-Pacific dominates the management system certification market with the largest revenue share of 35.77% in 2025, reflecting the region’s vast industrial base, rising regulatory compliance, and growing adoption of quality and sustainability standards across key economies like China, India, and Japan

- Europe is expected to be the fastest-growing region in the management system certification market during the forecast period, driven by increasing regulatory stringency, rising ESG initiatives, and widespread digital transformation across industries demanding integrated and advanced certification solutions

- The quality management system (ISO 9001) segment continues to be a foundational and dominant area, holding a significant market share around 33.5% in 2023 for ISO 9001 alone. Information Security Management (ISO 27001) is experiencing accelerated growth due to escalating cyber threats and data privacy concerns

Report Scope and Management System Certification Market Segmentation

|

Attributes |

Management System Certification Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Management System Certification Market Trends

“Digital Integration for Resilient Governance”

- The global management system certification market trend is deep integration of diverse standards and advanced digital transformation for enhanced organizational resilience, governance, and sustainability in complex global operating environments. This improves comprehensive risk management and stakeholder trust for modern, multifaceted organizations

- Leading approaches in management system certification, such as Integrated Management Systems (IMS) combining ISO 9001 (Quality), ISO 14001 (Environment), ISO 45001 (Occupational Health & Safety), and ISO 27001 (Information Security), seamlessly address multiple compliance requirements. Digital platforms and AI-powered tools are increasingly utilized by certification bodies and organizations to ensure robust and efficient auditing and compliance

- The integration of multiple management system standards, facilitated by frameworks like Annex SL, enables streamlined processes and holistic risk perspectives. Enhanced digitalization, through AI, data analytics, cloud-based solutions, and remote auditing technologies, offers more efficient verification, continuous monitoring, and data-driven insights, bolstering assurance and operational integrity

- Seamless integration of various management system certifications with an organization's core processes and the adoption of digital compliance tools facilitate centralized oversight and proactive governance. This creates a unified approach to managing risks, demonstrating due diligence, and fostering a culture of continuous improvement in dynamic regulatory landscapes

- This trend towards more integrated, digitally-enabled, and forward-looking certification systems reshapes organizational expectations. Companies increasingly view certifications not just as a compliance necessity but as strategic assets for building resilience, ensuring business continuity, demonstrating ESG (Environmental, Social, Governance) commitments, and enhancing cybersecurity postures. Certification bodies are responding by developing new standards

- Demand for management system certifications offering integrated approaches, digital audit options, and robust assurance in areas like cybersecurity, data privacy, and sustainability is growing rapidly. Enterprises and SMEs alike are prioritizing these certifications to meet stringent regulatory demands, enhance supply chain integrity, build stakeholder confidence, and gain a competitive edge in a globalized market focused on transparency and responsible business practices

Management System Certification Market Dynamics

Driver

“Rising Demand Due to Network Modernization and Enhanced Security Requirements”

- The surge in digital transformation initiatives and the escalating frequency of data breaches have significantly heightened the demand for robust management system certifications. Organizations are increasingly adopting standards like ISO/IEC 27001 to fortify their information security frameworks and mitigate cyber threats

- The incorporation of technologies such as artificial intelligence (AI), blockchain, and remote auditing tools is revolutionizing the certification landscape. These innovations enhance transparency, efficiency, and security in certification processes, making them more accessible and reliable

- As businesses expand globally, the need to adhere to international standards becomes paramount. Management system certifications provide a universally recognized framework that facilitates compliance with diverse regulatory requirements, thereby enabling smoother international operations

- The growing focus on environmental, social, and governance (ESG) criteria is driving organizations to pursue certifications that reflect their commitment to sustainable and responsible practices. Standards like ISO 14001 and ISO 45001 are gaining traction as companies strive to meet stakeholder expectations and regulatory mandates

- Industries such as healthcare, information technology, and manufacturing are experiencing heightened regulatory scrutiny, necessitating specialized certifications to ensure compliance and operational excellence. This trend underscores the importance of tailored certification solutions to address industry-specific challenges

Restraint/Challenge

"Complexity of Integration and Security Vulnerabilities"

- Integrating diverse, evolving management systems (such as quality, environmental, information security) and addressing potential security vulnerabilities within certified frameworks presents a significant challenge to market adoption. These critical certifications can introduce complexity and security risks.

- Ensuring seamless interoperability between various management system standards and maintaining the quality and credibility of certifications is complex. Sophisticated cyber threats targeting information systems (such as those covered by ISO 27001) make management system security a paramount concern

- Addressing integration complexities requires standardized certification processes, simplified implementation guidelines, and robust auditing. Mitigating security vulnerabilities demands strong data protection, regular standard updates, and continuous risk assessment within certified systems.

- High initial investment for advanced management system certification solutions can deter smaller organizations or budget-constrained regions. While costs are decreasing, perceived complexity and security risks (such as data breaches affecting certified entities) hinder widespread adoption.

Management System Certification Market Scope

The global management system certification market is segmented on the basis of certification standard, industry vertical, organization size, scope of certification, and certification body type.

By Certification Standard

On the basis of certification standard, the management system certification market is segmented into ISO 9001, ISO 14001, ISO 45001, ISO 27001, ISO 50001, and others. ISO 9001 (Quality Management) is expected to hold the largest market share, driven by its universal recognition and the fundamental need for quality assurance across all industries.

ISO 27001 (Information Security Management) is anticipated to witness fastest growth, fueled by increasing cybersecurity threats and the escalating importance of data protection for businesses globally. The demand for various ISO standards continues to rise as organizations prioritize operational excellence and compliance.

By Industry Vertical

On the basis of industry vertical, the management system certification market is segmented into automotive, healthcare, manufacturing, IT and telecom, retail, and others. The Manufacturing sector consistently demands a significant share of certifications, particularly for quality (ISO 9001) and environmental (ISO 14001) standards, to ensure production efficiency and compliance.

The IT and telecom segment is expected to show fastest growth due to the critical need for information security (ISO 27001) and service management certifications to protect data and maintain service quality in a highly digitalized environment.

By Organization Size

On the basis of organization size, the management system certification market is segmented into small and medium-sized enterprises (SMEs), Large enterprises, and government and public sector.

Large Enterprises contribute the largest revenue share, as they often have complex operations and a greater need for multiple certifications to manage risks and meet stakeholder expectations.

The small and medium-sized enterprises (SMEs) segment is anticipated to show the fastest growth due to increasing awareness among SMEs about the competitive advantages and operational improvements gained through certification, often driven by supply chain requirements.

By Scope of Certification

On the basis of scope of certification, the management system certification market is segmented into single site, multi-site, and global. The multi-site segment holds a significant market share, reflecting the operational structure of many larger organizations with multiple locations requiring consistent management system implementation.

The global scope of certification is anticipated to witness fastest growth due to multinational corporations seeking unified management system approaches across their worldwide operations, streamlining compliance and demonstrating consistent standards internationally.

By Certification Body Type

On the basis of certification body type, the management system certification market is segmented into accredited certification bodies and non-accredited certification bodies. Accredited certification bodies dominate the market, as their certifications carry greater credibility and are recognized by international accreditation forums, instilling higher confidence in stakeholders.

Non-accredited certification bodies is anticipated to witness fastest growth due to the assurance of impartiality, competence, and consistent certification processes they provide, reinforcing market trust.

Management System Certification Market Regional Analysis

- Asia-Pacific dominates the management system certification Market dominance with the largest revenue share of 35.77% in 2025, driven by robust industrial growth, expanding manufacturing sectors, and increasing regulatory compliance mandates in major economies like China, India, and Japan. These countries are witnessing a surge in ISO certification adoption across automotive, electronics, and healthcare industries, further fueling market growth

- Asia-Pacific’s leadership is supported by government initiatives promoting quality and safety standards. Programs such as “Make in India” and China’s “Made in China 2025” have intensified the need for globally recognized certifications to boost export readiness and operational excellence

- Rising awareness regarding corporate governance, sustainability, and occupational health & safety is accelerating certification uptake. The proliferation of environmental (ISO 14001), quality (ISO 9001), and safety (ISO 45001) management standards across SMEs and large enterprises bolsters the region’s dominant market position

Japan Management System Certification Market Insight

Japan’s management system certification market is witnessing steady growth, driven by its advanced manufacturing sector, regulatory rigor, and commitment to quality and sustainability. Industries such as automotive, electronics, and healthcare are leading adopters of certifications like ISO 9001, ISO 14001, and ISO/IEC 27001 to enhance operational efficiency and global credibility. Japan’s corporate culture emphasizes continuous improvement, precision, and compliance, making management system certifications essential. In addition, the country’s focus on digital transformation and ESG (Environmental, Social, and Governance) initiatives is accelerating the demand for integrated certifications that support transparency, risk management, and sustainable practices across both large enterprises and SMEs.

China Management System Certification Market Insight

China’s management system certification market is expanding rapidly, driven by strong industrial growth, government regulations, and the push for global competitiveness. Major sectors such as manufacturing, construction, energy, and IT are increasingly adopting certifications like ISO 9001, ISO 14001, and ISO 45001 to ensure quality, environmental responsibility, and workplace safety. Government initiatives such as “Made in China 2025” and smart manufacturing policies are accelerating certification uptake to meet international standards. With growing emphasis on export compliance, digital governance, and ESG transparency, both large enterprises and SMEs in China are embracing integrated management systems to enhance efficiency, credibility, and sustainable development.

North America Management System Certification Market Insight

The North America management system certification market is experiencing stable growth, fueled by strict regulatory frameworks, advanced industrial practices, and increasing emphasis on corporate accountability. Key sectors such as healthcare, IT, manufacturing, and finance are widely adopting certifications like ISO 9001, ISO/IEC 27001, and ISO 45001 to enhance quality, data security, and workplace safety. The region's focus on risk management, ESG reporting, and sustainability is further driving demand for integrated certification solutions. In addition, the presence of globally recognized certification bodies and increasing digital transformation across enterprises are promoting widespread certification adoption to ensure compliance, operational excellence, and stakeholder trust.

U.S. Management System Certification Market Insight

The U.S. management system certification market is witnessing strong growth, driven by stringent regulatory requirements, increasing corporate governance, and a focus on quality and sustainability. Key industries like healthcare, manufacturing, IT, and finance extensively adopt certifications such as ISO 9001, ISO 14001, and ISO/IEC 27001 to improve operational efficiency and risk management. The rise of digital transformation, ESG reporting, and cybersecurity concerns further accelerates certification demand. Robust infrastructure, innovation leadership, and the presence of numerous certification bodies make the U.S. a critical market for integrated management system solutions that support compliance, transparency, and competitive advantage.

Europe Management System Certification Market Insight

The Europe management system certification market is experiencing strong growth, driven by increasing regulatory requirements, sustainability initiatives, and digital transformation across industries. Businesses in manufacturing, automotive, energy, and healthcare are actively adopting certifications such as ISO 9001, ISO 14001, ISO 45001, and GDPR-compliant standards to enhance quality, environmental responsibility, and data privacy. The region’s strict compliance landscape and emphasis on corporate social responsibility (CSR) are key drivers. In addition, the rise of integrated management systems to streamline multiple certifications supports operational efficiency. Europe’s mature market with well-established certification bodies continues to encourage widespread certification adoption across enterprises.

U.K. Management System Certification Market Insight

The U.K. management system certification market is steadily growing, supported by stringent regulatory frameworks and strong emphasis on quality, safety, and sustainability. Key sectors such as manufacturing, healthcare, and finance actively pursue certifications like ISO 9001, ISO 14001, and ISO 27001 to meet compliance and enhance operational performance. The U.K.’s leadership in digital innovation and early adoption of cloud technologies drive demand for integrated management systems that ensure data security and environmental responsibility. Increasing focus on ESG initiatives and supply chain transparency further boosts certification uptake among businesses of all sizes across the country.

Germany Management System Certification Market Insight

Germany’s management system certification market is experiencing steady growth, supported by its strong industrial base and rigorous regulatory environment. Key industries such as automotive, manufacturing, and engineering are major adopters of certifications like ISO 9001, ISO 14001, and ISO 45001 to ensure quality, environmental protection, and occupational safety. Germany’s leadership in digital transformation and Industry 4.0 initiatives further drives the need for integrated management systems that improve efficiency and compliance. The country’s focus on sustainability and risk management, combined with a mature certification ecosystem, sustains steady demand for management system certifications across enterprises of all sizes.

Management System Certification Market Share

The management system certification industry is primarily led by well-established companies, including:

- SGS Group (Switzerland)

- Bureau Veritas (France)

- Intertek Group (U.K.)

- TÜV SÜD (Germany)

- Eurofins Scientific (Luxembourg)

- DEKRA (Germany)

- DNV GL (Norway)

- Applus+ (Spain)

- TÜV Rheinland (Germany)

- British Standards Institution (BSI) (U.K.)

- Kiwa NV (Netherlands)

- DQS Holding GmbH (Germany)

- Lloyd's Register (U.K.)

- RINA S.p.A. (Italy)

- ABS Group (U.S.)

Latest Developments in Global Management System Certification Market

- In April 2025, TÜV Rheinland was officially recognized as a Notified Body under the EU Machinery Regulation. This designation allows the company to conduct conformity assessments for machinery products, ensuring compliance with the updated regulatory framework. The new standards emphasize digitalization, cybersecurity, and human-robot collaboration, helping manufacturers meet EU requirements and streamline market entry. TÜV Rheinland now offers comprehensive testing and certification services to support businesses in adapting to these changes. Early preparation is advised to avoid delays and additional costs

- In January 2025, SGS SA acquired RTI Laboratories, a Detroit-based provider of environmental and materials testing services. This strategic move strengthens SGS’s North American presence and enhances its certification capabilities for both commercial and federal standards. The acquisition also adds 30 skilled professionals to SGS’s team, expanding expertise in PFAS analysis, metallurgical testing, and failure analysis. With this integration, SGS aims to diversify its services and meet the growing demand for environmental and materials testing

- In January 2025, XYZ Robotics China Inc. secured CE-MD conformity certification from TÜV Rheinland (China) for its Mobile Manipulation Robot (MMR), RockyOne. This certification confirms compliance with the European Union Machinery Directive, ensuring RockyOne meets essential technical standards for market entry across Europe. Designed for high-capacity operations, RockyOne excels in autonomous loading and unloading tasks, leveraging advanced perception and intelligent planning technologies. TÜV Rheinland’s certification underscores XYZ Robotics’ commitment to safety and innovation in robotics

- In December 2024, Bureau Veritas acquired Luxury Brand Services (LBS Group), a leader in quality assurance and control for the luxury industry. This strategic move aligns with Bureau Veritas’ LEAP 28 initiative, strengthening its presence in the luxury and fashion sector while enhancing supply chain solutions across Italy. LBS Group, known for its expertise in accessories and raw materials, brings advanced sustainability and quality management capabilities to Bureau Veritas. The acquisition reinforces Bureau Veritas’ role as a premier service provider for high-end fashion brands

- In October 2024, TÜV SÜD awarded its first IEEE CertifAIEd certification to Austrian logistics startup Digicust GmbH, recognizing its AI application for ethical responsibility. This international certification assesses AI systems based on criteria such as accountability, privacy, algorithmic bias, and transparency. Digicust specializes in digitalizing and automating customs clearance, where ethical AI plays a crucial role in ensuring compliance and fairness. The certification process took approximately a year, culminating in mid-2024

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Management System Certification Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Management System Certification Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Management System Certification Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.