Global Manga Market

Market Size in USD Billion

CAGR :

%

USD

14.84 Billion

USD

22.26 Billion

2024

2032

USD

14.84 Billion

USD

22.26 Billion

2024

2032

| 2025 –2032 | |

| USD 14.84 Billion | |

| USD 22.26 Billion | |

|

|

|

|

Manga Market Size

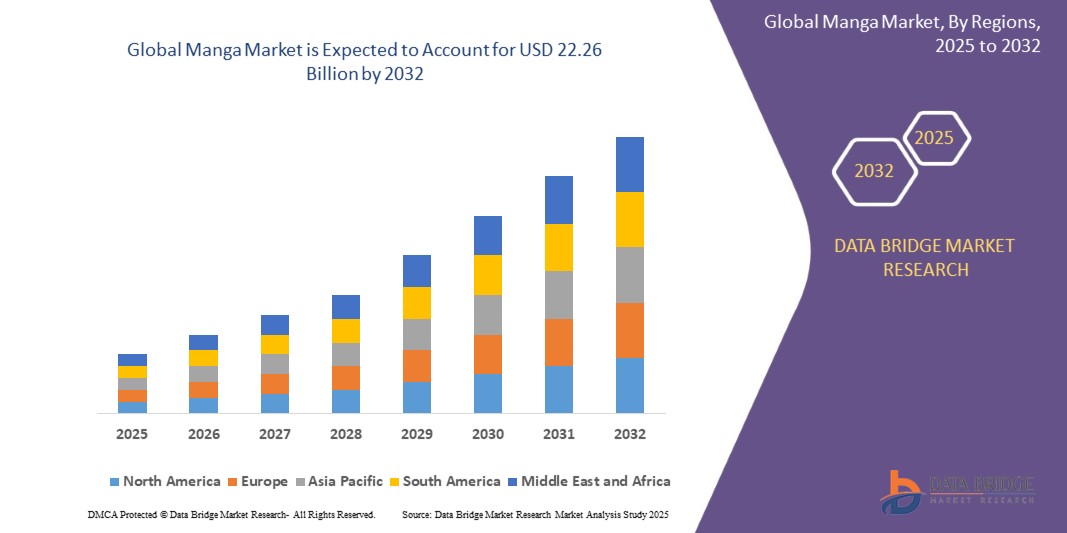

- The global manga market size was valued at USD 14.84 billion in 2024 and is expected to reach USD 22.26 billion by 2032, at a CAGR of 5.2% during the forecast period

- The market growth is largely fueled by the increasing global popularity of manga as a cultural and entertainment medium, coupled with the expansion of digital platforms and mobile applications that make manga more accessible to readers worldwide

- Furthermore, rising consumer demand for diverse genres, interactive storytelling, and localized content is encouraging publishers to expand both print and digital offerings. These converging factors are accelerating the adoption of manga, thereby significantly boosting the industry's growth

Manga Market Analysis

- Manga comprises Japanese-style comics and graphic novels that span multiple genres, including action, romance, fantasy, and sci-fi. These works are consumed via printed volumes, serialized publications, and digital platforms, catering to readers of all ages

- The escalating demand for manga is primarily driven by increased smartphone and internet penetration, global exposure to Japanese pop culture, and the popularity of anime adaptations. The growing interest in digital subscriptions, interactive reading experiences, and international licensing deals further strengthens market expansion

- Asia-Pacific dominated manga market with a share of 85.5% in 2024, due to Japan’s long-standing manga culture, increasing digital adoption, and a strong presence of publishing houses

- Europe is expected to be the fastest growing region in the manga market during the forecast period due to rising popularity of Japanese pop culture, strong demand for translated manga content, and growing investments in digital publishing platforms

- Digital segment dominated the market with a market share of 78.5% in 2024, due to increasing smartphone penetration, tablets, and e-reader usage globally. Digital manga provides convenience with instant access to a wide range of titles, subscription models, and interactive reading experiences. The adoption of online platforms offering multi-language support has expanded accessibility for international audiences. Digital formats also appeal to younger readers who prefer mobile consumption and on-the-go reading. Integration with social media and community features for sharing and recommendations further drives engagement. The scalability and cost-effectiveness of digital distribution continue to propel its rapid adoption in emerging and mature markets

Report Scope and Manga Market Segmentation

|

Attributes |

Manga Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Manga Market Trends

Rising Popularity of Digital and Mobile Manga Platforms

- The manga market is increasingly driven by the popularity of digital and mobile platforms that offer accessibility and convenience to readers worldwide. These platforms provide on-demand content, subscription models, and interactive features that enhance engagement, transforming how manga is consumed today

- For instance, platforms such as Shonen Jump and ComiXology have expanded their digital subscriber base by offering vast catalogs, simulpub releases, and exclusive content. These innovations have broadened the manga reach beyond traditional print audiences to mobile and global users

- The rise of webtoons and digital-first manga has diversified storytelling formats and attracted younger, tech-savvy audiences who prefer digital consumption over physical copies. This shift enables creators to experiment with new styles and serialized releases that suit mobile reading

- Increasing localization and translation efforts on digital manga platforms are helping penetrate non-Japanese markets, fueling global popularity. Regional platforms customize content with cultural adaptation, enabling broader international consumption and fandom growth

- In addition, technological advancements such as AI-driven recommendation engines and social sharing tools are enhancing discoverability and community building around manga titles. Readers can find personalized content more easily, contributing to higher retention and engagement metrics

- The availability of multi-language releases and simultaneous worldwide launches is creating a more connected global manga community. This development supports large-scale fandom and merchandising opportunities, driving commercial growth across territories

Manga Market Dynamics

Driver

Increasing Global Demand and Consumption of Manga

- The expanding global interest in Japanese pop culture, anime, and manga is directly driving demand for manga content worldwide. International audiences are showing growing enthusiasm for manga as a primary entertainment source, contributing to rising sales and digital platform subscriptions

- For instance, VIZ Media has capitalized on this trend by licensing popular titles such as "My Hero Academia" and "Demon Slayer" for English-speaking audiences. Their strategic digital and print distribution has significantly increased manga consumption across North America and Europe

- The proliferation of anime adaptations also stimulates manga consumption by introducing storylines to broader audiences who subsequently engage with the original manga content. This symbiotic relationship fuels sustained market growth

- In addition, social media and influencer culture play roles in popularizing manga worldwide, enabling titles to go viral and increasing demand for translations, merchandise, and spin-off content. This trend nurtures deeper connections between fans and creators

- The growing number of manga-focused events such as conventions, book fairs, and online festivals enhances visibility and community engagement, further stimulating consumption and market expansion

Restraint/Challenge

Competition from Other Forms of Entertainment

- The manga market faces strong competition from other digital entertainment formats including video games, streaming services, and social media content. These alternatives compete for consumer attention and spending, creating challenges for manga publishers and platforms

- For instance, younger demographics often prefer fast-paced mobile games and short-form video content on platforms such as TikTok and YouTube over traditional reading, limiting the time and resources they allocate to manga consumption

- The growing popularity of Western comic books and graphic novels also creates competitive pressure, especially in markets where manga is still emerging as a mainstream form of entertainment

- In addition, issues such as screen fatigue and changing leisure habits mean consumers seek more diverse experiences, sometimes at the expense of longer-format content such as manga

- Piracy and unauthorized distribution of manga further threaten revenue streams and publisher investments, posing a persistent challenge requiring technological and legal countermeasures

Manga Market Scope

The market is segmented on the basis of format, genre, audience, and distribution channel.

• By Format

On the basis of format, the manga market is segmented into printed, digital, and serialized. The digital segment dominated the largest market revenue share of 78.5% in 2024, driven by increasing smartphone penetration, tablets, and e-reader usage globally. Digital manga provides convenience with instant access to a wide range of titles, subscription models, and interactive reading experiences. The adoption of online platforms offering multi-language support has expanded accessibility for international audiences. Digital formats also appeal to younger readers who prefer mobile consumption and on-the-go reading. Integration with social media and community features for sharing and recommendations further drives engagement. The scalability and cost-effectiveness of digital distribution continue to propel its rapid adoption in emerging and mature markets.

The printed segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by the enduring popularity of physical manga volumes among collectors and traditional readers. Readers often prefer printed manga for the tactile experience, cover art, and collectible value, which contributes to sustained demand. Brick-and-mortar bookstores and libraries continue to support the sales of printed manga, reinforcing its market presence. In addition, limited edition releases and high-quality printings enhance its appeal, making printed manga a core revenue generator. The physical ownership factor also encourages gifting and long-term retention of collections, which strengthens the segment’s market dominance.

• By Genre

On the basis of genre, the manga market is segmented into action and adventure, sci-fi and fantasy, sports, romance and drama, adult/mature themes, and others. The action and adventure segment dominated the largest market revenue share in 2024, driven by the universal appeal of high-paced storytelling, immersive plots, and visually dynamic art styles. Readers are drawn to engaging narratives and character-driven arcs, which encourage binge-reading and long-term series loyalty. This genre’s consistent adaptation into anime, games, and merchandise further amplifies its popularity. Its cross-generational appeal ensures sustained demand across both casual and dedicated manga audiences. Publishers also prioritize action and adventure titles due to their potential for multimedia expansion and commercial success.

The romance and drama segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by growing interest among teenagers and adult female readers. This genre resonates with audiences seeking emotional narratives, relatable character interactions, and romantic plotlines. The rise of digital manga platforms has made romance and drama stories more accessible through serialized web releases and mobile apps. Integration with interactive storytelling elements, such as reader polls and alternate endings, boosts engagement. Moreover, the global popularity of shoujo and josei manga has contributed to market growth. Social media trends and influencer-driven recommendations have also increased visibility, accelerating adoption in international markets.

• By Audience

On the basis of audience, the manga market is segmented into kids, teenagers, and adults. The teenagers segment dominated the largest market revenue share in 2024, driven by the high engagement levels of this demographic with serialized manga publications and digital platforms. Teenagers are attracted to dynamic storytelling, relatable characters, and genre diversity, spanning action, romance, fantasy, and school-life narratives. The integration of manga content with anime adaptations, social media communities, and mobile apps has increased consumption frequency. Publishers often target teenagers with subscription services, collectible editions, and interactive reading experiences. Peer influence and fandom culture further amplify readership, making teenagers the core audience segment in terms of revenue contribution.

The adults segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by increasing interest in complex narratives, mature themes, and niche genres. Adult readers are drawn to manga exploring social issues, psychological plots, and sophisticated storytelling. The expansion of digital platforms and global translations has made adult-focused manga more accessible to international audiences. Online communities and discussion forums enhance engagement and discovery of diverse titles. In addition, collectors and enthusiasts of mature manga series contribute to growing demand for limited editions and premium releases. This rising consumption among adults is reshaping content strategies and broadening the market base.

• By Distribution Channel

On the basis of distribution channel, the manga market is segmented into offline and online. The offline segment dominated the largest market revenue share in 2024, driven by established bookstore networks, comic shops, and library circulation. Many readers continue to prefer the tangible experience of purchasing physical manga volumes, which also facilitates collectible editions and promotional events. Bookstore displays and local community events contribute to visibility and impulse purchases. Offline distribution remains crucial in regions where digital infrastructure is less pervasive or where traditional retail habits persist. Partnerships with international distributors also ensure widespread availability of printed manga, supporting sustained revenue growth.

The online segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by increasing smartphone usage, e-commerce platforms, and dedicated manga apps. Online distribution enables instant access to a vast library of titles, subscriptions, and serialized releases, catering to tech-savvy readers. Digital platforms also provide interactive reading experiences, global reach, and multi-language support. Convenience, portability, and cost-effectiveness drive adoption among younger demographics and international audiences. Monetization models such as in-app purchases, ad-supported content, and premium subscriptions accelerate growth. Online distribution also facilitates data-driven recommendations, enhancing user engagement and loyalty.

Manga Market Regional Analysis

- Asia-Pacific dominated the manga market with the largest revenue share of 85.5% in 2024, driven by Japan’s long-standing manga culture, increasing digital adoption, and a strong presence of publishing houses

- The region’s cost-effective printing infrastructure, rising investments in digital distribution platforms, and growing global export of manga content are accelerating market expansion

- The availability of skilled illustrators and writers, supportive government initiatives for creative industries, and a highly engaged reader base across developing economies are contributing to increased consumption of manga in both printed and digital formats

Japan Manga Market Insight

Japan held the largest share in the Asia-Pacific manga market in 2024, owing to its status as the birthplace of modern manga and its established publishing ecosystem. The country’s strong cultural affinity for manga, well-developed retail and digital distribution networks, and global popularity of anime adaptations are major growth drivers. Domestic consumption, combined with extensive international licensing and merchandising, further reinforces Japan’s leading position.

India Manga Market Insight

India is witnessing the fastest growth in the Asia-Pacific region, fueled by increasing smartphone penetration, rising internet accessibility, and a growing youth demographic interested in Japanese manga and locally produced content. The expanding digital platform ecosystem, coupled with initiatives to translate manga into regional languages, is driving adoption. Rising interest in anime culture, cosplay events, and online manga communities is further accelerating market growth in India.

North America Manga Market Insight

North America market is expanding steadily, driven by increasing digital manga consumption, popularity of Japanese pop culture, and strong presence of online subscription services. Expansion of e-commerce platforms and global licensing agreements with Japanese publishers is boosting market reach. Increasing collaboration between North American publishers and content creators supports localized adaptations. The growth of anime streaming platforms also encourages readers to explore original manga content.

U.S. Manga Market Insight

The U.S. accounted for the largest share in the North America market in 2024, underpinned by its expansive entertainment industry, widespread digital content consumption, and strong community engagement with anime and manga culture. The country’s focus on online platforms, e-commerce distribution, and subscription-based access enhances accessibility. Presence of major retailers, conventions, and fan communities further solidifies the U.S.’s leading position in the region.

Europe Manga Market Insight

Europe projected to grow at the fastest CAGR from 2025 to 2032, supported by rising popularity of Japanese pop culture, strong demand for translated manga content, and growing investments in digital publishing platforms. European readers increasingly seek action, romance, and fantasy genres, creating new opportunities for publishers. Collaborative efforts between European distributors and Japanese publishers to release localized editions are enhancing accessibility. Educational and cultural events focused on manga and anime also boost readership and engagement.

Germany Manga Market Insight

Germany’s manga market is driven by high consumer interest in graphic novels and Japanese pop culture, combined with well-established retail networks and online distribution channels. The country hosts manga and anime conventions, fostering community engagement and brand loyalty. Demand is particularly strong for action, adventure, and fantasy genres. Partnerships between publishers and bookstores for promotional events further encourage adoption.

U.K. Manga Market Insight

The U.K. market is supported by a mature comics and graphic novels readership, growing efforts to expand manga awareness in schools and libraries, and increasing availability of digital manga platforms. Rising interest in anime adaptations, cosplay culture, and fandom communities strengthens engagement. The U.K.’s focus on translated content and online subscriptions for manga ensures broader access to diverse genres.

Manga Market Share

The manga industry is primarily led by well-established companies, including:

- AKITA PUBLISHING CO.LTD. (Japan)

- BUNGEISHUNJU LTD. (Japan)

- GOOD SMILE COMPANY (Japan)

- HOUBUNSHA CO., LTD (Japan)

- KADOKAWA CORPORATION (Japan)

- Kodansha Ltd. (Japan)

- NIHONBUNGEISHA (Japan)

- Seven Seas Entertainment, Inc. (U.S.)

- SHUEISHA INC. (Japan)

- VIZ, Inc. (U.S.)

- Takeshobo Co., Ltd. (Japan)

- Hakusensha Inc. (Japan)

- Ohzora Publishing Co., Ltd. (Japan)

- Gakken (Japan)

- LEED PUBLISHING Co., Ltd. (Japan)

Latest Developments in Global Manga Market

- In June 2025, Kikkoman leveraged one of Japan’s most iconic cultural exports—manga—to showcase the unique qualities of its soy sauce to the owners of over 1.5 million restaurants in India. The campaign also targeted chefs, line and junior chefs, cooks, and culinary students, encouraging them through classic manga-style storytelling to adopt Kikkoman for richer, more flavorful dishes. The initiative represented a creative and engaging marketing strategy by the global Japanese brand, blending cultural appeal with product promotion to strengthen its presence in the Indian culinary market

- In February 2024, Viz Media and MANGA Plus by Shueisha published the first chapter of Shiro Moriya's Astro Baby manga, which was simultaneously launched on Shueisha's Shonen Jump+ website. This release highlights the growing influence of digital platforms in the manga industry, allowing simultaneous global access and increasing reader engagement across markets. The sci-fi narrative, exploring a post-pandemic dystopia with Cooper’s Disease, caters to mature and genre-specific audiences, strengthening the market for serialized digital content and reinforcing the trend of high-demand, niche storytelling that drives subscription-based readership

- In January 2024, Yen Press announced the upcoming publication of nine new manga titles scheduled for July 2024, including Black Butler 4, Savage Fang, Excellent Property, and others. This expansion reflects the publisher’s strategy to diversify content offerings and tap into various genre segments, from supernatural and action to drama and fantasy. By adding multiple titles at once, Yen Press is targeting increased consumer engagement, expanding its digital and print readership, and reinforcing its position in the competitive North American and global manga markets

- In January 2024, KADOKAWA Corporation announced a strategic joint venture with Média-Participations Paris and Éditions Dupuis S.A. to produce Japanese and Korean comic books, light novels, and other content for French-speaking markets. This collaboration demonstrates the globalization of the manga market and highlights opportunities for cross-border content localization. By leveraging established European distribution networks, KADOKAWA is strengthening its presence in international markets, enhancing revenue streams, and expanding the reach of Asian comics to Western audiences, fostering cultural exchange and broadening market penetration

- In November 2022, Popeye revealed plans to launch its first manga series, emphasizing the distinctive art and storytelling styles of its iconic cartoon characters. Marcus Williams’ new series, exploring narrative elements such as how Popeye lost his eye, indicates a trend of established Western franchises entering the manga segment. This initiative underscores the growing potential for hybrid content that merges traditional comic IP with manga formats, attracting new readers, expanding market demographics, and highlighting the diversification strategies within the global comics and manga market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.