Global Marine Composites Market

Market Size in USD Billion

CAGR :

%

USD

5.83 Billion

USD

21.31 Billion

2024

2032

USD

5.83 Billion

USD

21.31 Billion

2024

2032

| 2025 –2032 | |

| USD 5.83 Billion | |

| USD 21.31 Billion | |

|

|

|

|

Marine Composites Market Size

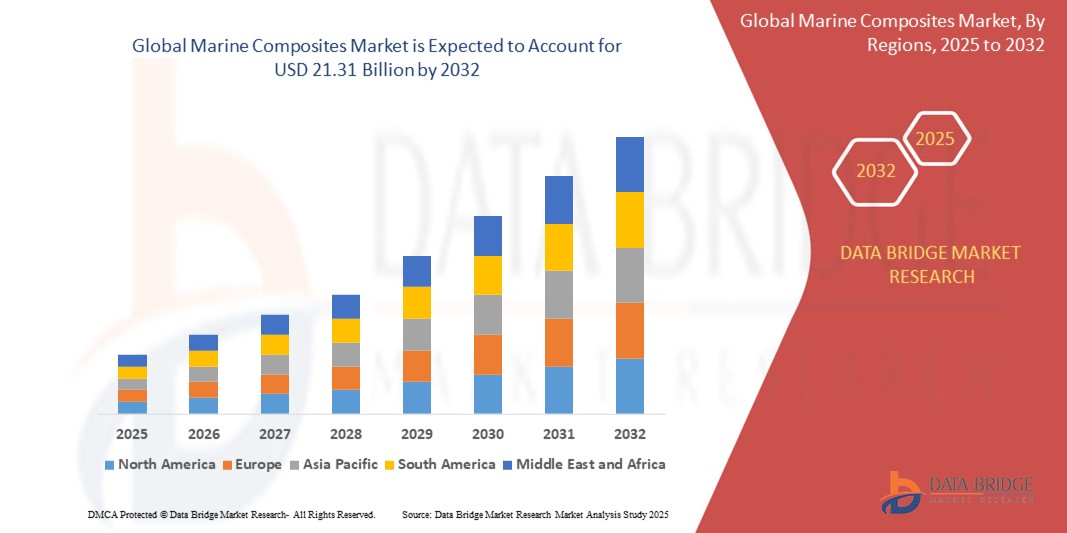

- The global marine composites market size was valued at USD 5.83 billion in 2024 and is expected to reach USD 21.31 billion by 2032, at a CAGR of 7.40% during the forecast period

- The market growth is largely fueled by the rising demand for lightweight and corrosion-resistant materials to improve fuel efficiency and vessel performance

- Increased production of recreational boats and luxury yachts is driving demand for advanced composites that offer design flexibility, durability, and reduced maintenance requirements

- Military and commercial sectors are adopting marine composites to enhance vessel stealth capabilities, structural strength, and operational longevity under harsh marine environments

Marine Composites Market Analysis

- This growth is significantly driven by the rising adoption of polymer matrix composites, which are favored for their high strength, corrosion resistance, and lightweight properties, making them ideal for various marine applications

- Tae use of polymer matrix composites in cruise ships and power boats has been instrumental in enhancing fuel efficiency and reducing maintenance costs, thereby contributing to their increased demand in the marine industry

- Asia-pacific dominates the marine composites market with the largest revenue share of 39.05% in 2024, due to rapidly expanding shipbuilding industry supported by growing international trade and government investments in port infrastructure the region’s focus on lightweight and durable materials boosts demand for marine composites across commercial and defense sector

- North America is expected to be the fastest growing region in the marine composites market during the forecast period due to increasing demand for lightweight, fuel-efficient vessels and advanced materials in recreational and defense sectors the focus on reducing emissions and operational costs

- The cruise ships segment holds the largest market share of 31.40%, driven by the increasing popularity of recreational boating and the demand for high-speed, fuel-efficient vessels

Report Scope and Marine Composites Market Segmentation

|

Attributes |

Marine Composites Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Marine Composites Market Trends

“Growing Use of Polymer Matrix in Marine Applications”

- The marine composites market is witnessing a significant trend towards the adoption of polymer matrix composites, which offer a combination of high strength, corrosion resistance, and lightweight properties, making them ideal for various marine applications

- Polymer matrix composites are increasingly favored in shipbuilding due to their ease of manufacturing and cost-effectiveness compared to metal matrix and ceramic matrix composites

- The use of glass fiber within polymer matrix composites is projected to dominate the market, attributed to its lower cost and favorable mechanical properties

- Polyester resin, a key component in polymer matrix composites, is anticipated to hold the largest market share due to its excellent mechanical, thermal, and electrical properties, along with its affordability

- The dominance of polymer matrix composites in the marine industry is further reinforced by their application in constructing various marine structures such as boat hulls and decks, enhancing vessel performance and fuel efficiency

- For instance, the integration of polymer matrix composites in power boats has led to improved fuel efficiency and reduced maintenance costs, highlighting their growing significance in the marine sector

- In conclusion, the marine composites market is increasingly leaning towards polymer matrix composites, driven by their superior properties and cost advantages, positioning them as a preferred choice for modern marine applications

Marine Composites Market Dynamics

Driver

“Rising Demand for Fuel-Efficient Marine Vessels”

- The marine composites market is gaining momentum due to the growing demand for fuel-efficient vessels driven by rising fuel costs and strict emission norms

- Marine composites such as fiberglass and carbon fiber are replacing traditional metals as they reduce vessel weight, leading to lower fuel consumption and operating costs

- Lightweight composite panels are being adopted in ferries and coast guard patrol boats to extend operational range and decrease engine load

- The emphasis on eco-friendly marine solutions has pushed shipbuilders to adopt composite materials that align with sustainability goals and emission compliance

- In conclusion, the shift toward lightweight and energy-saving vessel components continues to strongly influence the expansion of the marine composites market

Restraint/Challenge

“High Initial Production and Repair Costs”

- A major challenge in the marine composites market is the high initial production cost due to the need for specialized equipment, skilled labor, and complex fabrication processes such as vacuum infusion

- Smaller shipbuilders and budget-sensitive companies often struggle to adopt composites because of the significant upfront investment required for manufacturing and design

- Repairing marine composites is also costly and time-consuming since damage often calls for expert inspection and advanced techniques, unsuch as the simpler welding methods used with metals

- The lack of widespread repair training and standard repair protocols in many marine service centers limits the use of composites, especially in regions with fewer technical resources

- In conclusion, unless repair methods become simpler and production more cost-effective, the high expenses involved will continue to challenge widespread adoption of marine composites

Marine Composites Market Scope

The market is segmented on the basis of type, communication protocol, unlocking mechanism, and application.

By Composite Type

On the basis of composite type, the marine composites market is segmented into metal matrix composite, ceramic matrix composite, and polymer matrix composite. The polymer matrix composite (PMC) segment currently holds the largest market share, driven by its excellent balance of properties such as high strength, corrosion resistance, lightweight, and impact resistance, along with relatively lower manufacturing costs. PMCs are extensively used in various marine applications, including boat hulls, decks, and other structural components.

The ceramic matrix composite (CMC) segment is anticipated to witness the fastest growth rate in the forecast period. This growth is attributed to cmc's superior properties such as high stiffness, chemical inertness, and thermal stability, which are increasingly sought after for specialized, high-performance marine applications where extreme conditions are encountered.

By Fiber Type

On the basis of fiber type, the marine composites market is segmented into glass fiber, carbon fiber, natural fibers, and others. The glass fiber segment dominates the market, primarily due to its cost-effectiveness, good mechanical properties (high tensile strength, rigidity), and excellent impact resistance. Glass fiber reinforced plastics (GFRPS) are widely used in the construction of various marine vessels, offering a lightweight and durable alternative.

The carbon fiber segment is expected to witness the fastest growth during the forecast period. This accelerated growth is fueled by the demand for ultra-lightweight and high-strength components, particularly in high-speed boats, luxury yachts, and naval vessels. Carbon fiber composites offer superior performance, leading to improved fuel efficiency and enhanced vessel dynamics, despite their higher cost.

By Resin Type

On the basis of resin type, the marine composites market is segmented into polyester, vinyl ester, epoxy, thermoplastic, phenolic, acrylic, and others. The polyester resin segment accounts for the largest market share, largely due to its cost-effectiveness and good balance of mechanical, thermal, and electrical properties. Polyester resins are widely utilized in the manufacturing of boat hulls and yachts.

The epoxy resin segment is expected to witness significant growth, driven by its exceptional strength, superior adhesion to fibers, and excellent resistance to corrosive marine environments. Epoxy resins are crucial in crafting high-performance boat hulls, decks, and other critical components, offering enhanced durability and longevity. The thermoplastic resin segment is also projected to show strong growth due to their recyclability and improved processing characteristics.

By Vessel Type

On the basis of vessel type, the marine composites market is segmented into power boats, sailboats, cruise ships, cargo vessels, naval boats, jet boats, personal watercraft, and others. The cruise ships segment holds the largest market share of 31.40%, driven by the increasing popularity of recreational boating and the demand for high-speed, fuel-efficient vessels. Marine composites are extensively used in powerboat construction for their lightweight and performance-enhancing properties.

The cargo vessels segment is anticipated to witness the fastest growth rate from 2025 to 2032. This growth is driven by the global reliance on seaborne trade, which necessitates the construction and maintenance of a vast fleet of cargo vessels. The adoption of marine composites in cargo vessels aims to improve fuel efficiency, reduce maintenance costs, and enhance the overall lifespan and performance of these large ships.

Marine Composites Market Regional Analysis

- Asia Pacific dominates the marine composites market with the largest revenue share of 39.05% in 2024, driven by a rapidly expanding shipbuilding industry supported by growing international trade and government investments in port infrastructure The region’s focus on lightweight and durable materials boosts demand for marine composites across commercial and defense sectors

- The increasing adoption of advanced composites for corrosion resistance and fuel efficiency in vessels further strengthens market growth manufacturers in countries such as China, Japan, and South Korea are innovating to produce high-performance marine composites tailored for various marine applications

- The rising environmental regulations and the push for sustainable maritime operations encourage the use of eco-friendly composite materials This shift towards greener solutions is expected to accelerate market expansion in the Asia Pacific marine composites industry

U.S. Marine Composites Market Insight

The U.S. marine composites market is growing steadily in 2025, driven by increasing demand for lightweight, fuel-efficient vessels and advanced materials in recreational and defense sectors the focus on reducing emissions and operational costs is encouraging shipbuilders to adopt carbon fiber and glass fiber composites in hulls and decks. In addition, the rise of electric and hybrid boats is pushing manufacturers to innovate with stronger, lighter composites that improve battery efficiency.

Europe Marine Composites Market Insight

Europe is witnessing strong growth in the marine composites market, supported by stringent environmental regulations and the drive towards sustainable shipping the use of eco-friendly composites in commercial and passenger vessels is expanding rapidly, with governments incentivizing low-emission technologies urbanization and maritime trade growth are further encouraging the adoption of composites for their durability and maintenance advantages in shipbuilding and offshore applications.

U.K. Marine Composites Market Insight

The U.K. market is advancing in marine composites, propelled by increasing investments in modernizing the navy and commercial fleets the country’s emphasis on innovation and green technology supports the use of composites in lightweight structures and hybrid marine propulsion systems the shipbuilding sector is integrating composites to enhance vessel performance while meeting emission reduction targets.

Germany Marine Composites Market Insight

Germany’s marine composites market is expanding due to its strong engineering base and commitment to sustainable maritime solutions the market benefits from demand in commercial shipping, offshore wind installations, and defense applications composite materials are preferred for their corrosion resistance and energy-saving potential, aligning with Germany’s goals for eco-conscious infrastructure and advanced manufacturing.

Asia-Pacific Marine Composites Market Insight

Asia-Pacific leads the global market in growth rate for marine composites, fueled by rapid industrialization, urbanization, and rising disposable incomes countries such as China, Japan, and India are increasing investments in shipbuilding and smart marine technologies the region’s emergence as a manufacturing hub is improving affordability and accessibility of composites, further boosting demand across commercial, military, and recreational vessels.

Japan Marine Composites Market Insight

Japan’s marine composites market is driven by its technological leadership and high demand for innovative, lightweight marine solutions the integration of composites in smart ships and automated marine systems is prominent the aging population also supports demand for accessible vessel designs that use composites for ease of handling and safety in both residential and commercial maritime sectors.

China Marine Composites Market Insight

China holds the largest revenue share in Asia-pacific due to its rapid urbanization, expanding middle class, and strong domestic manufacturing capabilities the government’s push for smart cities and sustainable development is accelerating the adoption of composites in residential, commercial, and rental marine properties the availability of cost-effective composite solutions and large-scale shipbuilding projects continue to drive the market forward.

Marine Composites Market Share

The marine composites industry is primarily led by well-established companies, including:

- Owens Corning (U.S.)

- SGL Group - The Carbon Company (Germany)

- TORAY INDUSTRIES, INC. (Japan)

- Cytec Solvay Group (Belgium)

- Mitsubishi Chemical Corporation (Japan)

- TEIJIN LIMITED. (Japan)

- Hexcel Corporation (U.S.)

- DuPont (U.S.)

- HYOSUNG (South Korea)

- Gurit (U.K.)

- ZOLTEK (U.S.)

- Premier Composite Technologies (PCT) (UAE)

- PJSC TATNEFT (Russia)

- ADVANCED CUSTOM MANUFACTURING (U.S.)

- Aeromarine Industries Ltd (Canada)

- Airborne (Netherlands)

- Composites One (U.S.)

- Hexion (U.S.)

- Marine Concepts/Design Concepts (U.S.)

- Airex AG (Switzerland)

- Fleming Marine Composites (U.S.)

- Multimarine Manufacturing Ltd (U.K.)

Latest Developments in Global Marine Composites Market

- In December 2024, Owens Corning launched a new series of glass fiber composites for marine applications. These composites are engineered to provide enhanced mechanical properties and resistance to environmental factors, catering to the increasing demand for durable and lightweight materials in the marine industry

- In March 2025, CarboMat Inc. announced the launch of its sustainable carbon fiber products derived from petroleum refining by-products. This innovative material offers a 60% reduction in production costs and a 50% decrease in associated greenhouse gas emissions compared to traditional PAN-based carbon fibers. The new carbon fibers are designed for advanced lightweight composite applications in marine industries, including racing yachts and offshore structures

- In February 2025, Teijin Limited introduced a new line of high-performance carbon fiber composites tailored for marine applications. These composites are engineered to enhance the structural integrity and durability of marine vessels, addressing the growing demand for lightweight and corrosion-resistant materials in the industry

- In January 2025, Hexcel Corporation unveiled its latest carbon fiber composites designed specifically for marine environments. These materials are optimized for use in high-performance marine applications, including racing yachts and offshore structures, offering improved strength-to-weight ratios and resistance to harsh marine conditions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Marine Composites Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Marine Composites Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Marine Composites Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.