Global Marine Lubricants Market

Market Size in USD Billion

CAGR :

%

USD

6.10 Billion

USD

7.50 Billion

2024

2032

USD

6.10 Billion

USD

7.50 Billion

2024

2032

| 2025 –2032 | |

| USD 6.10 Billion | |

| USD 7.50 Billion | |

|

|

|

|

Marine Lubricants Market Size

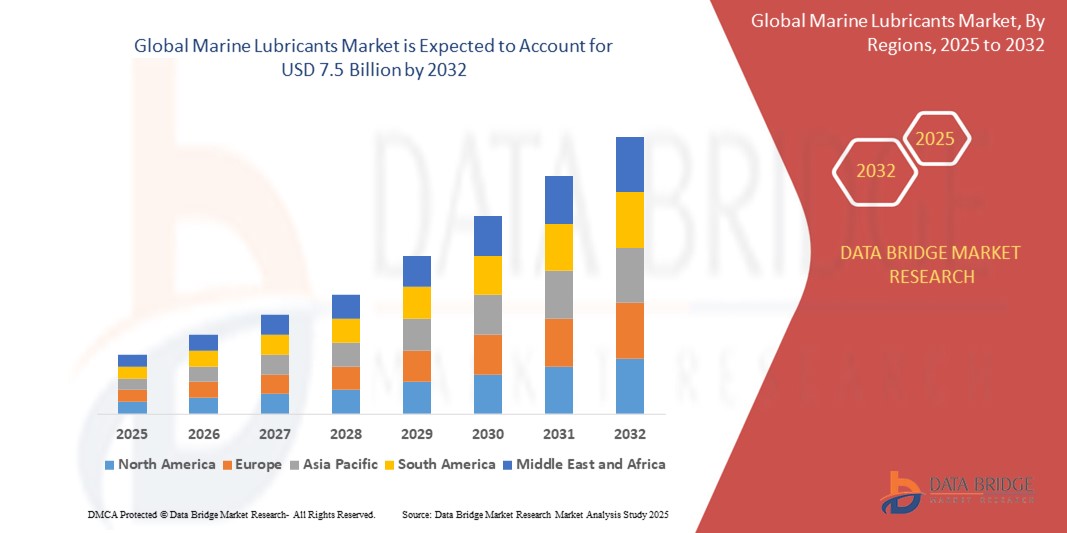

- The global marine lubricants market size was valued at USD 6.1 billion in 2024 and is expected to reach USD 7.5 billion by 2032, at a CAGR of 2.51% during the forecast period

- The market growth is largely fuelled by the increasing adoption of bio-based and environmentally acceptable lubricants (EALs), driven by stringent international regulations and rising environmental consciousness across the shipping industry.

- Furthermore, continued expansion of the maritime fleet are key drivers fuelling the demand for marine lubricants, which are essential for ensuring the optimal performance and longevity of marine engines and equipment.

Marine Lubricants Market Analysis

- Marine lubricants, which include mineral, synthetic, and bio-based oils designed to reduce friction and wear in marine engines and equipment, are essential for ensuring the efficient operation and longevity of vessels across commercial, industrial, and recreational applications.

- The rising global maritime trade, increasing offshore oil and gas exploration, and growing environmental regulations are key factors driving demand for advanced and eco-friendly marine lubricants.

- North America dominates the marine lubricants market with the largest revenue share of 40.2% in 2024, supported by a strong shipping industry, well-established ports, and significant investments in offshore operations. The U.S. leads the regional growth, fueled by modernization of fleets and adoption of synthetic lubricants to meet stricter emission standards.

- Asia-Pacific is anticipated to be the fastest-growing region in the marine lubricants market during the forecast period, driven by rapid expansion of the shipping sector, increasing investments in port infrastructure, and rising demand for bio-based and synthetic lubricants to comply with environmental regulations.

- The mineral oil segment holds the largest market share of 55.35% in 2024, owing to its long-standing use and cost-effectiveness, though synthetic and bio-based oils are gaining traction due to superior performance and sustainability benefits.

Report Scope and Marine Lubricants Market Segmentation

|

Attributes |

Marine Lubricants Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Marine Lubricants Market Trends

“Enhanced Convenience Through AI and Voice Integration”

- A prominent and accelerating trend in the global marine lubricants market is the increasing adoption of bio-based and environmentally acceptable lubricants (EALs), driven by stringent international regulations and rising environmental consciousness across the shipping industry. This transition is significantly influencing product innovation and procurement strategies within both commercial and naval fleets

- For instance, in compliance with the U.S. Environmental Protection Agency’s Vessel General Permit (VGP), vessels operating in U.S. waters are now required to use EALs in all oil-to-sea interface applications, unless technically infeasible. This regulation has pushed major shipping operators and lubricant manufacturers to prioritize biodegradable and non-toxic alternatives over traditional mineral oil-based lubricants

- Companies such as ExxonMobil have responded to this demand by launching products like Mobil SHC Aware, a range of EALs specifically engineered for marine applications that meet VGP requirements while maintaining high performance under extreme operating conditions. Similarly, TotalEnergies introduced its BIO Lubricants line, offering hydraulic fluids, greases, and stern tube oils that are biodegradable and suitable for environmentally sensitive marine environments

- The shift towards bio-based marine lubricants is further supported by port authorities and classification societies encouraging the use of sustainable lubricants as part of broader decarbonization initiatives. Additionally, ship owners are increasingly integrating EALs into their sustainability and ESG (Environmental, Social, and Governance) reporting, aligning lubricant selection with corporate environmental targets

- This trend is reshaping the marine lubricants landscape by driving R&D investments into bio-based formulations, prompting manufacturers to expand their green lubricant portfolios. The growing regulatory and market pressure to reduce marine pollution and protect aquatic ecosystems is expected to sustain the demand for EALs, making them a critical component of the marine lubricant supply chain moving forward

Marine Lubricants Market Dynamics

Driver

“Rising Global Seaborne Trade and Expanding Maritime Fleet”

- The growth of global seaborne trade and the continued expansion of the maritime fleet are key drivers fueling the demand for marine lubricants, which are essential for ensuring the optimal performance and longevity of marine engines and equipment. As international shipping remains the backbone of global trade, lubricants play a crucial role in maintaining operational efficiency and reducing maintenance costs across commercial vessels

- For instance, according to data from the United Nations Conference on Trade and Development (UNCTAD), global maritime trade volumes surpassed 12.4 billion tons in 2023, reflecting a strong post-pandemic rebound and increased demand for container shipping, dry bulk, and oil tankers. This surge in vessel activity directly translates into heightened consumption of engine oils, stern tube lubricants, and hydraulic fluids used in propulsion systems and auxiliary machinery

- In response to these growing needs, leading companies are enhancing their lubricant portfolios to cater to high-capacity engines and advanced marine technologies. For example, Shell Marine launched its Shell Alexia 40, a cylinder oil developed for engines running on low-sulfur fuels, aligning with IMO 2020 regulations. This product supports improved engine cleanliness and fuel efficiency while adapting to changing environmental norms

- Moreover, emerging shipping hubs and the expansion of port infrastructure in regions like Southeast Asia, the Middle East, and Africa are further driving demand for reliable marine lubrication solutions. The increase in shipbuilding activities—particularly for LNG carriers, container vessels, and bulk carriers—is also propelling lubricant consumption

- As ship operators increasingly focus on improving fuel economy, extending maintenance intervals, and ensuring compliance with emission standards, the role of high-performance marine lubricants becomes ever more critical. This dynamic interplay between trade growth, fleet expansion, and performance optimization is expected to sustain upward momentum in the marine lubricants market over the coming years

Restraint/Challenge

“Stringent Environmental Regulations and Shift Toward Alternative Propulsion Technologies”

- The marine lubricants market faces notable challenges from increasingly stringent environmental regulations and the accelerating transition toward alternative propulsion technologies. Regulatory frameworks aimed at minimizing marine pollution and greenhouse gas emissions are placing pressure on lubricant manufacturers to develop formulations that are both effective and environmentally compliant—often at increased R&D and production costs

- For instance, the International Maritime Organization (IMO) regulations, such as the IMO 2020 sulfur cap, mandate that ships must use fuels with a sulfur content of no more than 0.5%. These changes have required significant adjustments in lubricant formulations to ensure compatibility with new low-sulfur fuels and emission control systems. In response, companies like TotalEnergies Lubmarine introduced TALUSIA UNIVERSAL, a lubricant compatible with various fuel grades, helping ship operators comply with emission norms while minimizing cylinder liner wear. However, the rapid regulatory shifts can increase operational uncertainty and impose high compliance costs on lubricant providers and shipping companies alike

- Additionally, the maritime sector’s gradual pivot toward alternative propulsion systems, such as LNG, hydrogen fuel cells, and electric propulsion, presents a long-term challenge to traditional marine lubricant demand. These cleaner technologies typically require less or different types of lubrication, reducing the consumption of conventional marine lubricants. For example, as the adoption of dual-fuel engines grows—particularly in new vessel builds—the demand for specific traditional engine lubricants is expected to decline

- Moreover, as shipowners seek to meet decarbonization goals, investments are increasingly directed toward retrofitting vessels with eco-friendly systems or replacing them altogether, thereby disrupting the demand patterns for legacy lubricant solutions

- Overcoming these challenges will require lubricant manufacturers to accelerate innovation, collaborate closely with engine makers, and adapt their product portfolios to meet evolving propulsion needs while complying with diverse and tightening environmental standards across global jurisdictions

Marine Lubricants Market Scope

The market is segmented on the basis of product type, lubricant type, application, operation type, marine channel, and end use.

- By Product Type

On the basis of product type, the marine lubricants market is segmented into mineral oil, synthetic oil, and bio-based oil. The mineral oil segment dominates the largest market revenue share of around 55.35% in 2024, owing to its wide availability, cost-effectiveness, and proven performance across a broad range of marine engines and equipment. Mineral-based lubricants are the preferred choice in many commercial shipping applications due to their economic viability and compatibility with legacy engine technologies.

The synthetic oil segment is expected to register the fastest growth from 2025 to 2032, driven by increasing demand for high-performance lubricants that can withstand extreme temperatures, offer superior oxidation resistance, and extend service intervals. This trend is particularly evident in newer-generation engines and vessels operating in harsh offshore environments.

- By Lubricant Type

On the basis of lubricant type, the marine lubricants market is classified into system oil, marine cylinder lubricant, trunk piston engine oil, and others. The marine cylinder lubricant segment accounts for the highest revenue share, supported by its critical role in two-stroke engines used in large ocean-going vessels. These lubricants are specifically designed to neutralize the acidic byproducts of fuel combustion and reduce liner wear. The trunk piston engine oil segment is also prominent, primarily used in medium-speed four-stroke engines that power auxiliary systems or smaller vessels.

- By Application

On the basis of application, the marine lubricants market is segmented into diesel engine oil, hydraulic oil, turbine oil, gear oil, heat transfer fluids, compressor oil, grease, and others. Diesel engine oil dominates the segment, driven by the heavy reliance on diesel-powered engines in commercial shipping. These oils provide critical lubrication, thermal stability, and protection against deposits in high-load operations. Hydraulic oils form the second-largest segment due to their widespread use in cranes, winches, steering gear, and other shipboard hydraulic systems. The demand for turbine oil, gear oil, and compressor oil is also significant in marine vessels equipped with auxiliary systems and power generation equipment.

- By Operation Type

On the basis of operation type, the market is segmented into inland and offshore operations. Offshore operations hold the dominant share in 2024, driven by the high lubricant demand from vessels operating in deep-sea cargo transport, offshore oil & gas exploration, and international shipping routes. Inland operations, while comparatively smaller, are important in regions with significant riverine and coastal trade, particularly in emerging economies focusing on domestic logistics development.

- By Marine Channel

On the basis of marine channel, the market is segmented into recreational, industrial, and transportation. The transportation segment leads the market in terms of revenue share, propelled by the global expansion of maritime trade and the increasing number of container ships, tankers, and cargo vessels. The industrial segment includes vessels involved in fishing, dredging, and offshore exploration, requiring specialized lubricant formulations. The recreational segment, including private yachts and boats, is growing steadily with rising demand for leisure boating and maritime tourism.

- By End Use

On the basis of end use, the marine lubricants market is segmented into oil and gas, cargo ships, tanker, container, and others.

The cargo ships segment dominates the end-use landscape, driven by the sheer volume of bulk commodities transported across international waters. Tankers (for oil, gas, and chemicals) and container ships also contribute substantially, given their intensive operational requirements and higher engine workloads.

Marine Lubricants Market Regional Analysis

- North America dominates the marine lubricants market with the largest revenue share of approximately 40.2% in 2024, driven by the region's robust maritime trade infrastructure, significant offshore oil and gas activities, and stringent regulatory frameworks governing marine emissions and equipment performance

- The demand is further propelled by the presence of major ports, a sizable fleet of cargo and tanker vessels, and consistent investments in fleet modernization and fuel-efficient marine operations

- Additionally, the U.S. leads the region’s marine lubricants consumption owing to the Gulf of Mexico’s offshore exploration, the presence of a mature shipping industry, and increasing adoption of high-performance and environment-friendly lubricants to comply with emission standards such as IMO 2020

- The well-established supply chains, technological advancements in lubricant formulations, and active participation by leading marine lubricant manufacturers further strengthen North America’s leading position in the global market

U.S. Marine Lubricants Market Insight

The U.S. marine lubricants market captured the largest revenue share within North America in 2024, supported by the country’s extensive offshore oil & gas operations, advanced maritime infrastructure, and stringent regulatory frameworks. The Gulf Coast, in particular, plays a pivotal role due to its concentration of shipping activity and oil exploration. The demand is also fueled by ongoing investments in fleet modernization and the growing use of environment-compliant lubricants. The presence of major lubricant manufacturers and strong adherence to IMO 2020 sulfur limits further reinforce the country’s market leadership.

Europe Marine Lubricants Market Insight

The Europe marine lubricants market is projected to grow at a steady CAGR during the forecast period, underpinned by the region’s commitment to sustainability, decarbonization, and maritime innovation. Countries like the Netherlands, Germany, and Greece are spearheading the demand due to their prominent shipping sectors and regulatory-driven shift towards low-sulfur and bio-based lubricants. Furthermore, the European Union’s Green Deal and investments in alternative fuels are indirectly boosting the need for high-performance lubricants compatible with next-generation engines.

U.K. Marine Lubricants Market Insight

The U.K. marine lubricants market is anticipated to grow at a promising CAGR over the forecast period, driven by increased activity in offshore wind and energy projects in the North Sea, along with a focus on maritime decarbonization. The U.K.’s proactive policies aimed at reducing marine emissions and the resurgence of trade in major ports such as London and Southampton are pushing the demand for synthetic and hybrid lubricant solutions. The emphasis on sustainable maritime operations is also encouraging fleet owners to shift towards environmentally acceptable lubricants (EALs).

Germany Marine Lubricants Market Insight

The Germany marine lubricants market is expected to witness consistent growth, supported by the country’s leadership in port logistics, inland waterways, and shipbuilding innovations. As a key logistics hub in Central Europe, Germany’s emphasis on clean energy and digital fleet management is enhancing the demand for advanced marine lubrication solutions. Lubricants that offer enhanced fuel efficiency, lower emissions, and compatibility with hybrid propulsion systems are seeing higher adoption across commercial vessels and industrial fleets.

Asia-Pacific Marine Lubricants Market Insight

The Asia-Pacific marine lubricants market is poised to grow at the fastest CAGR during the forecast period of 2025 to 2032, fueled by the expansion of maritime trade, rising shipbuilding activities, and growing coastal energy infrastructure. Key economies such as China, South Korea, and India are witnessing an upsurge in marine lubricant demand, driven by increased investments in cargo handling, port infrastructure, and compliance with international emission regulations. The region also benefits from competitive manufacturing of lubricants and supportive government maritime policies.

Japan Marine Lubricants Market Insight

The Japan marine lubricants market is experiencing moderate but steady growth, attributed to the country’s aging shipping fleet undergoing modernization and a rising preference for environmentally responsible lubricants. Japan's maritime sector is closely aligned with energy efficiency and sustainability targets, spurring the adoption of synthetic and low-viscosity lubricant formulations. Moreover, innovations in autonomous shipping and marine digitalization are expected to boost the demand for high-performance, intelligent lubrication systems.

China Marine Lubricants Market Insight

The China marine lubricants market held the largest revenue share in Asia Pacific in 2024, driven by its dominant shipbuilding industry, expanding port facilities, and high volume of marine cargo movement. China’s rapid industrialization and coastal trade connectivity contribute to substantial lubricant consumption across merchant and industrial vessels. The government’s push for greener shipping practices, coupled with strong domestic lubricant production and innovation, continues to propel growth in both inland and offshore lubricant applications.

Marine Lubricants Market Share

The marine lubricants industry is primarily led by well-established companies, including:

- Bel-Ray Co. Inc. (U.S.)

- Quaker Chemical Corp. (U.S.)

- Zeller+Gmelin GmbH & Co. KG (Germany)

- Blaser Swisslube AG (Switzerland)

- Repsol (Spain)

- Kluber Lubrication (Germany)

- Pennzoil (U.S.)

- Phillips 66 (U.S.)

- PetroChina Co. Ltd. (China)

- JX Nippon Oil & Energy Corp. (Japan)

- Petrobras (Brazil)

- PetroFer Chemie (Germany)

- Buhmwoo Chemical Ind. Co. Ltd. (South Korea)

- Innospec (U.S.)

- Shell plc (U.K)

- ExxonMobil (U.S.)

- BP plc(U.K.)

- Total Energies (France)

- Gulf Oil International (U.K.)

- UniMarine Inc. (U.S.)

- Quepet Lubricants LLC (U.A.E.)

Latest Developments in Global Marine Lubricants Market

- In March 2022, Shell plc completed the acquisition of the Environmentally Considerate Lubricants (ECLs) business from the PANOLIN Group. The deal includes product formulations, intellectual property, the PANOLIN brand, global customer base, technology, and the entire ECL product portfolio

- In June 2021, BP p.l.c. expanded its operations by establishing a digital hub in Pune, India, aimed at enhancing its digital capabilities and delivering sustainable solutions to meet evolving market demands

- In January 2023, TotalEnergies SE signed an agreement with CEPSA to acquire its upstream business assets in the United Arab Emirates (UAE), strengthening its presence in the region

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Marine Lubricants Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Marine Lubricants Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Marine Lubricants Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.