Global Marine Salvage Services Market

Market Size in USD Million

CAGR :

%

USD

474.48 Million

USD

948.92 Million

2025

2033

USD

474.48 Million

USD

948.92 Million

2025

2033

| 2026 –2033 | |

| USD 474.48 Million | |

| USD 948.92 Million | |

|

|

|

|

Marine Salvage Services Market Size

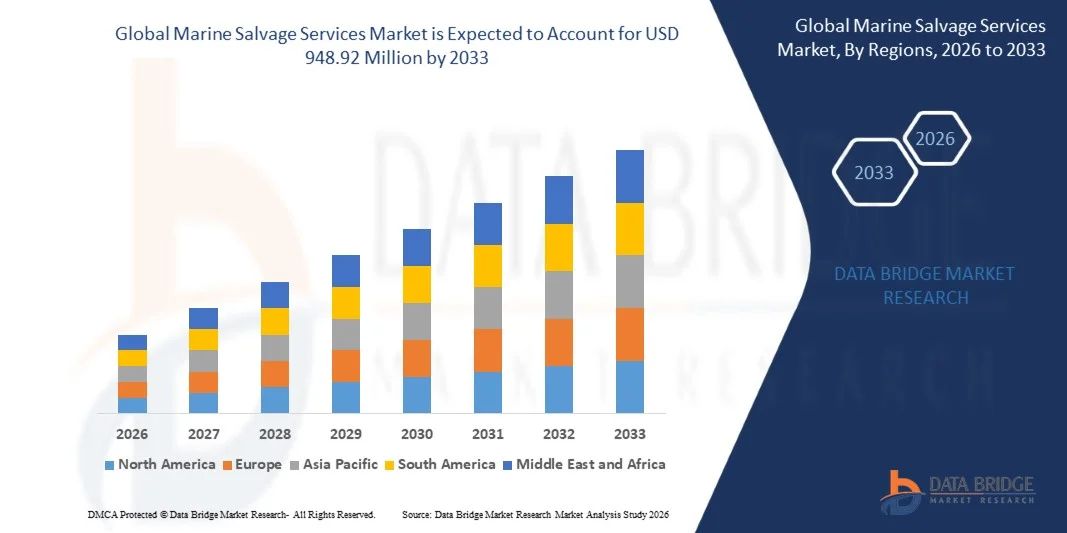

- The global marine salvage services market size was valued at USD 474.48 million in 2025 and is expected to reach USD 948.92 million by 2033, at a CAGR of 9.05% during the forecast period

- The market growth is largely fuelled by the increasing number of maritime accidents and shipwrecks, rising global trade and shipping activities, and stricter environmental regulations that require safe removal of stranded vessels

- Growing demand for specialized salvage operations and advanced technology adoption in wreck recovery further supports market expansion

Marine Salvage Services Market Analysis

- The market is witnessing steady growth due to heightened awareness of maritime safety and environmental protection

- Increasing investments in salvage infrastructure and equipment modernization are enhancing operational efficiency

- North America dominated the marine salvage services market with the largest revenue share of 38.45% in 2025, driven by the presence of a large commercial shipping fleet, stringent maritime safety regulations, and increasing investments in advanced salvage infrastructure

- Asia-Pacific region is expected to witness the highest growth rate in the global marine salvage services market, driven by rapid expansion of seaborne trade, increasing shipping activities, port modernization initiatives, and rising regulatory focus on environmental protection and maritime safety

- The Wreck Removal segment held the largest market revenue share in 2025, driven by the increasing number of maritime accidents and shipwrecks, as well as the growing emphasis on clearing navigational routes and minimizing environmental impact. Wreck removal operations often involve specialized vessels, advanced equipment, and certified personnel, making them a critical and high-demand service across commercial shipping and government sectors

Report Scope and Marine Salvage Services Market Segmentation

|

Attributes |

Marine Salvage Services Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

• Expansion Of Offshore Shipping Activities |

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Marine Salvage Services Market Trends

“Rising Demand for Advanced Salvage Operations and Environmental Compliance”

• The growing complexity of maritime operations and increased global shipping traffic is significantly shaping the marine salvage services market, as shipping companies and governments seek efficient, safe, and environmentally responsible recovery solutions. Marine salvage services are gaining traction due to their ability to mitigate financial losses, prevent environmental damage, and restore navigational safety. This trend strengthens their adoption across commercial shipping, offshore, and government sectors, encouraging service providers to invest in advanced technologies and specialized teams

• Increasing regulatory pressure on maritime safety and environmental protection has accelerated the demand for professional salvage operations. Authorities and insurance companies are actively requiring certified salvage providers to handle shipwrecks, oil spills, and stranded vessels, prompting collaboration between service providers and port authorities to improve response efficiency and compliance standards

• Safety and sustainability trends are influencing operational decisions, with shipping companies emphasizing certified procedures, eco-friendly recovery techniques, and risk mitigation strategies. These factors are helping service providers differentiate offerings in a competitive market while building trust with clients, and driving the adoption of advanced monitoring and salvage technologies

• For instance, in 2024, Titan Salvage in the U.S. and Smit Salvage in the Netherlands expanded their service portfolios by incorporating ROV-assisted operations and environmentally safe wreck removal solutions. These projects were executed in response to increasing regulatory and insurance requirements, with operations spanning commercial shipping, offshore platforms, and port authorities. The services were also promoted as safe, efficient, and environmentally compliant, enhancing client loyalty and long-term contracts

• While demand for marine salvage services is growing, sustained market expansion depends on continuous investment in technology, specialized training, and compliance with international safety and environmental standards. Service providers are also focusing on improving operational scalability, reducing response time, and developing innovative solutions to handle complex salvage scenarios efficiently

Marine Salvage Services Market Dynamics

Driver

“Growing Focus on Maritime Safety and Environmental Compliance”

• Increasing global shipping traffic, maritime accidents, and offshore activities is a major driver for the marine salvage services market. Companies and governments are actively investing in professional salvage operations to minimize environmental impact and financial loss while ensuring navigational safety. This trend is also encouraging research into new equipment, technology, and operational protocols, supporting service diversification

• Expanding applications in shipwreck removal, oil spill recovery, offshore platform salvage, and emergency towing operations are influencing market growth. Marine salvage services help prevent environmental hazards, reduce economic losses, and maintain shipping routes, enabling clients to meet regulatory and operational expectations. The growing number of international maritime regulations further reinforces this trend

• Salvage service providers are actively promoting technologically advanced operations through ROVs, sonar mapping, and specialized vessels. These efforts are supported by increasing client demand for fast, safe, and environmentally responsible services, and they also encourage partnerships between salvage companies, insurance firms, and port authorities to enhance operational efficiency and compliance

• For instance, in 2023, Smit Salvage in the Netherlands and Resolve Marine Group in the U.S. reported increased adoption of advanced salvage technologies and environmentally compliant operations. This expansion followed rising global shipping traffic and stricter maritime regulations, driving repeat contracts and operational differentiation. Both companies also highlighted safety, traceability, and environmental protection in client communications to strengthen trust and long-term partnerships

• Although rising maritime activity and environmental regulations support growth, wider adoption depends on investment in specialized equipment, trained personnel, and adherence to complex international standards. Improving operational efficiency, rapid response capability, and advanced monitoring technology will be critical for meeting global demand and maintaining competitive advantage

Restraint/Challenge

“High Operational Costs And Complex Regulatory Requirements”

• The relatively high cost of marine salvage operations compared to standard towing or repair services remains a key challenge, limiting adoption among smaller shipping companies. High equipment, manpower, and insurance costs contribute to elevated pricing. In addition, compliance with international and local maritime regulations can further increase operational complexity and costs

• Awareness and availability of certified professional salvage services remain uneven, particularly in developing maritime regions where regulatory enforcement is limited. Limited understanding of specialized salvage procedures restricts adoption across certain shipping routes or offshore operations. This also leads to slower market growth in regions lacking established maritime safety frameworks

• Logistical and environmental challenges also impact market growth, as salvage operations require specialized vessels, trained personnel, and strict adherence to safety and environmental standards. Remote locations, unpredictable weather, and complex wreck conditions increase operational risks and costs. Companies must invest in advanced planning, monitoring, and coordination to maintain service reliability

• For instance, in 2024, salvage operators in Southeast Asia handling stranded vessels and offshore platform incidents reported higher costs and operational delays due to strict environmental regulations and limited local infrastructure. Remote locations, availability of certified equipment, and specialized manpower were additional barriers. These factors also prompted some shipping companies to delay salvage operations, affecting market revenue

• Overcoming these challenges will require investment in cost-efficient technologies, regional infrastructure, and specialized training programs. Collaboration with insurance companies, government authorities, and port operators can help unlock the long-term growth potential of the global marine salvage services market. Furthermore, improving operational efficiency and compliance with environmental standards will be essential for broader adoption

Marine Salvage Services Market Scope

The market is segmented on the basis of services and end-user.

• By Services

On the basis of services, the marine salvage services market is segmented into Wreck Removal, General Salvage, Emergency Response, Pollution Control, and Cargo Recovery. The Wreck Removal segment held the largest market revenue share in 2025, driven by the increasing number of maritime accidents and shipwrecks, as well as the growing emphasis on clearing navigational routes and minimizing environmental impact. Wreck removal operations often involve specialized vessels, advanced equipment, and certified personnel, making them a critical and high-demand service across commercial shipping and government sectors.

The Emergency Response segment is expected to witness the fastest growth rate from 2026 to 2033, driven by rising global shipping traffic and the need for rapid intervention during maritime accidents. Emergency response services are particularly valued for their ability to provide immediate assistance, prevent environmental hazards, and reduce financial losses, often operating under high-pressure scenarios requiring quick mobilization and expert coordination.

• By End-user

On the basis of end-user, the marine salvage services market is segmented into Private Ship Owners, Insurance Companies, Government Agencies, and Shipping Companies. The Shipping Companies segment held the largest market share in 2025, driven by the high volume of commercial maritime operations and the need to safeguard assets, comply with safety regulations, and maintain uninterrupted trade routes.

The Insurance Companies segment is expected to witness the fastest growth rate from 2026 to 2033, fueled by increasing claims related to maritime accidents and growing reliance on professional salvage services to minimize financial exposure. Insurance-backed salvage operations are increasingly coordinated with certified providers to ensure risk mitigation, environmental compliance, and efficient asset recovery.

Marine Salvage Services Market Regional Analysis

• North America dominated the marine salvage services market with the largest revenue share of 38.45% in 2025, driven by the presence of a large commercial shipping fleet, stringent maritime safety regulations, and increasing investments in advanced salvage infrastructure

• Stakeholders in the region highly value rapid response capabilities, environmental compliance, and advanced technology deployment, including ROV-assisted operations and specialized salvage vessels

• This widespread adoption is further supported by strong regulatory frameworks, high maritime traffic, and the growing emphasis on minimizing environmental impact, establishing marine salvage services as a critical requirement for both private and commercial operations

U.S. Marine Salvage Services Market Insight

The U.S. marine salvage services market captured the largest revenue share in 2025 within North America, fueled by the country’s extensive shipping operations, busy ports, and strict environmental regulations. Ship owners and insurance companies are increasingly relying on professional salvage providers to handle emergencies, wreck removal, and pollution control. The growing integration of advanced salvage technologies, such as sonar mapping and remote-operated vehicles, further enhances operational efficiency. In addition, collaboration between salvage companies, government agencies, and private operators is strengthening service adoption and driving market growth.

Europe Marine Salvage Services Market Insight

The Europe marine salvage services market is expected to witness the fastest growth rate from 2026 to 2033, primarily driven by rising maritime traffic, stringent environmental policies, and increasing investment in port safety and emergency preparedness. European countries are emphasizing rapid response to accidents and environmentally responsible salvage operations. The market is growing across commercial shipping, offshore platforms, and government-led maritime initiatives, with salvage services increasingly integrated into port and coastal safety programs.

U.K. Marine Salvage Services Market Insight

The U.K. marine salvage services market is expected to witness the fastest growth rate from 2026 to 2033, driven by increasing shipping activity, rising awareness of environmental compliance, and the adoption of advanced salvage technologies. Concerns over maritime accidents and environmental hazards are encouraging private ship owners, shipping companies, and government agencies to secure professional salvage contracts. The country’s well-developed maritime infrastructure and robust regulatory framework support rapid response and specialized recovery operations.

Germany Marine Salvage Services Market Insight

The Germany marine salvage services market is expected to witness the fastest growth rate from 2026 to 2033, fueled by high shipping traffic in the North Sea and Baltic ports, advanced technological adoption, and growing emphasis on environmental safety. Germany’s strong maritime regulations, combined with its focus on innovation and sustainable operations, are promoting the use of professional salvage services, particularly for offshore platforms and commercial shipping routes. Advanced equipment and skilled personnel are increasingly deployed to ensure safe and efficient recovery.

Asia-Pacific Marine Salvage Services Market Insight

The Asia-Pacific marine salvage services market is expected to witness the fastest growth rate from 2026 to 2033, driven by increasing maritime trade, rapid urbanization in port cities, and growing awareness of environmental compliance. Countries such as China, Japan, and India are investing in professional salvage services to mitigate risks from accidents, shipwrecks, and pollution. The region is also emerging as a manufacturing hub for salvage equipment, improving service availability and reducing operational costs, thereby expanding adoption across private and commercial shipping sectors.

Japan Marine Salvage Services Market Insight

The Japan marine salvage services market is expected to witness the fastest growth rate from 2026 to 2033 due to the country’s high maritime traffic, focus on environmental protection, and advanced technological infrastructure. Salvage operations are increasingly integrated with port safety protocols, offshore platform recovery, and emergency response planning. Japan’s aging shipping infrastructure and strong government oversight are also expected to spur demand for efficient, technology-driven, and environmentally compliant salvage services.

China Marine Salvage Services Market Insight

The China marine salvage services market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to the country’s expanding shipping fleet, rapid port development, and increasing regulatory requirements. China is investing heavily in professional salvage operations to handle shipwrecks, cargo recovery, and pollution control. The growth of smart ports, adoption of advanced salvage vessels, and availability of cost-efficient services are key factors driving market expansion in both commercial and offshore shipping operations.

Marine Salvage Services Market Share

The Marine Salvage Services industry is primarily led by well-established companies, including:

- African Marine Solutions Group (Pty) Ltd (AMSOL) (South Africa)

- Boluda Towage & Salvage SL (Spain)

- CPT Towage (South Africa)

- Detek Offshore Technology Ltd. Co. (U.K.)

- Donjon Marine Co., Inc. (U.S.)

- Fratelli Neri S.p.A. (Italy)

- Hongkong Salvage & Towage Services Ltd (Hong Kong)

- T&T Salvage LLC (U.S.)

- SMIT Salvage BV (Netherlands)

- United Salvage Pty, Ltd. (Australia)

- Ocean Infinity Group Limited (U.K.)

Latest Developments in Global Marine Salvage Services Market

- In February 2024, Boluda Towage & Salvage SL completed the acquisition of Resolve Salvage and Fire (Gibraltar), a towage operator active on both sides of the Strait of Gibraltar. This strategic acquisition is aimed at expanding Boluda Towage’s international footprint and strengthening its operational capabilities in high-traffic maritime corridors. The integration enhances the company’s presence in the Strait of Gibraltar, a critical gateway between the Atlantic Ocean and the Mediterranean Sea. In addition, the acquisition supports broader access to key global trade routes connected through the Suez Canal and the Red Sea to the Indian Ocean. This development is expected to improve service availability, response efficiency, and competitive positioning in the global marine salvage and towage services market.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.