Global Marrionberry Market

Market Size in USD Billion

CAGR :

%

USD

1.42 Billion

USD

3.04 Billion

2024

2032

USD

1.42 Billion

USD

3.04 Billion

2024

2032

| 2025 –2032 | |

| USD 1.42 Billion | |

| USD 3.04 Billion | |

|

|

|

|

Marionberry Market Size

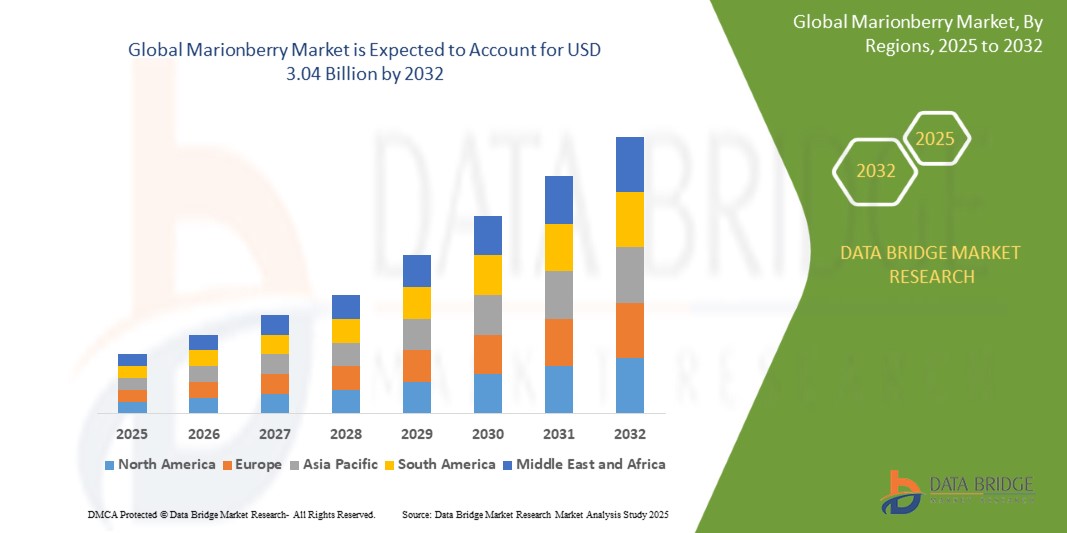

- The global marionberry market size was valued at USD 1.42 billion in 2024 and is expected to reach USD 3.04 billion by 2032, at a CAGR of 9.90% during the forecast period

- The market growth is largely fuelled by the rising demand for organic and antioxidant-rich fruits, increasing consumer preference for natural flavoring in beverages and desserts, and expanding applications of marionberries in nutraceuticals and functional food products

- In addition, the growing inclination towards clean-label and farm-to-table produce is encouraging retailers and food processors to incorporate marionberries in their product offerings, thereby boosting overall market demand

Marionberry Market Analysis

- Rising awareness regarding the health benefits of marionberries, such as high levels of anthocyanins and dietary fiber, is positively influencing consumption in both developed and emerging markets

- The increasing use of marionberries in jams, pies, yogurts, and smoothies, along with their growing popularity in artisanal food production, is further propelling market expansion across North America and Europe

- North America dominated the marionberry market with the largest revenue share of 38.26% in 2024, driven by increasing consumer inclination toward natural and functional food products, along with a growing demand for antioxidant-rich berries in beverages and bakery applications

- Asia-Pacific region is expected to witness the highest growth rate in the global marionberry market, driven by urbanization, growing consumer preference for premium and imported food products, and investments by food manufacturers in berry-infused offerings across countries such as China, Japan, South Korea, and Australia

- The liquid segment dominated the market with the largest market revenue share in 2024, driven by its widespread use in ready-to-drink beverages, sauces, and dessert toppings. Liquid marionberry formats offer ease of incorporation in commercial foodservice and home consumption, maintaining the fruit’s original flavor and color. Manufacturers prefer liquid extracts for their versatility and fast formulation compatibility across a wide range of food and beverage products

Report Scope and Marionberry Market Segmentation

|

Attributes |

Marionberry Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Marionberry Market Trends

Surging Popularity of Marionberry in Functional Beverages and Plant-Based Products

- The marionberry market is witnessing rising interest due to its incorporation into functional beverages and wellness drinks, driven by consumer preference for antioxidant-rich, natural fruit ingredients. Beverage brands are leveraging marionberry’s deep flavor profile and nutrient content to attract health-conscious consumers seeking alternatives to synthetic flavors or additives

- Increasing popularity of plant-based diets is further propelling demand for marionberry in dairy-free yogurt, protein bars, and vegan desserts. Manufacturers are integrating marionberry puree, concentrates, and powders in innovative formulations that cater to clean-label trends and nutritional transparency

- Food scientists and product developers are exploring marionberry’s polyphenol and vitamin C content in functional formulations targeting immunity and gut health. This trend is especially strong in North America and Europe where wellness-positioned foods dominate supermarket aisles

- For instance, in 2023, a U.S.-based beverage startup launched a probiotic marionberry tonic infused with adaptogens and prebiotics, marketed for daily wellness and digestive support. Similarly, a Scandinavian food company introduced a marionberry chia pudding that quickly gained traction in retail outlets for its nutrient-dense profile

- While the health-driven use of marionberry is increasing, its future potential hinges on standardized sourcing, efficient cold-chain logistics, and clear communication of its benefits. Consistent supply and collaborations with health-focused brands are critical to sustaining this trend and reaching broader global markets

Marionberry Market Dynamics

Driver

Rising Demand for Organic and Locally Sourced Berries

- The growing preference for organic and locally sourced produce is significantly driving the global marionberry market. Consumers are increasingly conscious of traceability, pesticide-free cultivation, and sustainability, which benefits marionberries given their strong regional cultivation base, particularly in the U.S. Pacific Northwest

- Local farmers’ markets, co-ops, and farm-to-table food services are contributing to rising retail visibility and sales of marionberries. Buyers often favor regionally grown berries for freshness and flavor, and marionberries fulfill both expectations while supporting local agricultural economies

- Certifications such as USDA Organic or Non-GMO Project Verified are helping build consumer trust and brand premium for marionberry products. Many producers are leveraging these credentials in packaging and marketing to justify higher price points and compete in premium berry segments

- For instance, in 2022, an Oregon-based organic marionberry farm reported a 40% year-over-year sales increase after partnering with specialty food retailers and online subscription platforms. Demand spiked during peak season, driven by customers seeking regionally sourced, chemical-free fruit

- As sustainability and clean eating trends continue to grow, the marionberry market is well-positioned to benefit. However, scaling organic production and ensuring consistent seasonal supply are critical to maintaining momentum and meeting export potential

Restraint/Challenge

Limited Shelf Life and Seasonal Supply Constraints

- Marionberries have a short shelf life, making them vulnerable to spoilage during transport and distribution. This limits their availability in fresh form beyond local or regional markets and poses a major challenge for large-scale commercialization across distant geographies

- Seasonal dependency also restricts market expansion, as marionberries are typically harvested in a short summer window. This hampers year-round availability and puts pressure on processors and retailers to rely on frozen or preserved alternatives, which may lack the same appeal or nutritional freshness

- Infrastructure gaps such as inadequate cold-chain facilities, especially in emerging economies, further hinder marionberry exports. Without timely post-harvest handling and temperature control, product degradation accelerates, impacting both quality and profitability

- For instance, in 2023, a Canadian berry exporter faced logistics setbacks due to transport delays during peak harvest, resulting in 25% spoilage of fresh marionberry shipments before they reached retail partners in Asia

- Addressing these challenges requires investment in cold storage solutions, expansion of frozen product formats, and exploration of extended shelf-life preservation techniques. Collaborations between growers, logistics firms, and food processors will be crucial for overcoming seasonal and perishability-related hurdles

Marionberry Market Scope

The market is segmented on the basis of form, nature, and application.

• By Form

On the basis of form, the marionberry market is segmented into liquid, powder, and syrup. The liquid segment dominated the market with the largest market revenue share in 2024, driven by its widespread use in ready-to-drink beverages, sauces, and dessert toppings. Liquid marionberry formats offer ease of incorporation in commercial foodservice and home consumption, maintaining the fruit’s original flavor and color. Manufacturers prefer liquid extracts for their versatility and fast formulation compatibility across a wide range of food and beverage products.

The powder segment is expected to witness the fastest growth rate from 2025 to 2032, fuelled by rising demand for shelf-stable, lightweight, and easy-to-store ingredients in the nutraceuticals and dietary supplement industries. Powdered marionberry is gaining popularity in smoothies, nutritional bars, and health blends due to its high antioxidant content, long shelf life, and convenience in transport and dosage customization.

• By Nature

On the basis of nature, the marionberry market is segmented into natural and synthetic. The natural segment accounted for the largest market share in 2024, driven by increasing consumer preference for clean-label and organic products. Growing awareness of health benefits associated with naturally sourced berries, along with their alignment with wellness and sustainability trends, has significantly boosted demand. Food and beverage manufacturers are increasingly incorporating naturally extracted marionberry flavors and colors to cater to health-conscious consumers seeking authenticity and transparency.

The synthetic segment is expected to witness the fastest growth rate from 2025 to 2032, primarily due to its affordability, extended shelf life, and consistent sensory profiles. In cost-sensitive markets and large-scale commercial applications, synthetic marionberry flavors are utilized to meet flavoring needs without relying on seasonal harvests or natural availability, offering greater pricing stability.

• By Application

On the basis of application, the marionberry market is segmented into functional beverages, confectionery, dairy product, bakery, and others. The functional beverages segment held the largest revenue share in 2024, driven by the rising popularity of antioxidant-rich fruit drinks and wellness-oriented beverages. Marionberries are widely used in infused waters, smoothies, and health tonics due to their nutritional content and distinctive flavor. Consumer demand for plant-based and immunity-boosting beverages continues to support segment expansion.

The bakery segment is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing incorporation of marionberries in pastries, muffins, pies, and artisan breads. The visual appeal and tart-sweet flavor of marionberries complement a range of baked goods, while product innovation and consumer interest in gourmet flavors continue to drive demand across both retail and artisanal bakery formats.

Marionberry Market Regional Analysis

- North America dominated the marionberry market with the largest revenue share of 38.26% in 2024, driven by increasing consumer inclination toward natural and functional food products, along with a growing demand for antioxidant-rich berries in beverages and bakery applications

- The region benefits from well-established food and beverage processing industries, a rising focus on wellness diets, and high per capita fruit consumption, which collectively support the widespread usage of marionberries

- Moreover, innovation in marionberry-infused food formulations, coupled with strong retail infrastructure and the popularity of organic berry farming in the U.S. and Canada, further contributes to the market's robust position across both health-conscious and gourmet consumer segments

U.S. Marionberry Market Insight

The U.S. marionberry market held the largest revenue share in 2024 within North America, fueled by the high demand for clean-label ingredients and fruit-based product innovation in the food and beverage sector. Rising awareness of the health benefits associated with marionberries, such as improved digestive health and immune support, is encouraging their inclusion in smoothies, yogurts, jams, and dietary supplements. Furthermore, the country’s established berry farming and processing ecosystem, especially in the Pacific Northwest, provides a strong domestic supply chain that supports growing consumption

Europe Marionberry Market Insight

The Europe marionberry market is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing consumer preference for nutrient-dense fruits and plant-based diets. The demand for marionberries is rising in bakery, dairy, and confectionery sectors, with a focus on premium and functional product categories. Countries such as Germany, France, and the United Kingdom are witnessing growing interest in local berry sourcing, as well as organic fruit infusions. Expansion in retail distribution and growing interest in superfoods are further catalyzing marionberry sales in the region

U.K. Marionberry Market Insight

The U.K. marionberry market is expected to witness the fastest growth rate from 2025 to 2032, supported by the nation’s evolving food preferences and the rising trend of high-antioxidant, low-sugar fruit products. Consumers are increasingly seeking versatile berries for use in breakfast cereals, beverages, and baked goods. In addition, the growth of farmers’ markets and specialty health food stores is promoting access to marionberries, while premium positioning in retail is fostering brand differentiation and value-added product development

Germany Marionberry Market Insight

The Germany marionberry market is expected to witness the fastest growth rate from 2025 to 2032, driven by heightened consumer interest in natural fruit extracts and value-added berry products. Health-conscious Germans are turning toward clean, label-friendly foods that align with sustainable agriculture and eco-conscious consumption. Marionberries are being introduced in artisan desserts, jams, and probiotic beverages, with the country’s efficient logistics and cold-chain infrastructure enabling year-round availability. Innovation in berry-based health snacks and organic produce is also supporting market expansion

Asia-Pacific Marionberry Market Insight

The Asia-Pacific marionberry market is expected to witness the fastest growth rate from 2025 to 2032, driven by rising health awareness, increasing disposable incomes, and Western dietary influence in countries such as China, Japan, and South Korea. Growing adoption of superfruits in urban diets, coupled with expanding food retail and e-commerce networks, is boosting marionberry visibility and availability. Regional governments’ support for agricultural diversification and the introduction of functional beverages are also helping drive demand for marionberries in the region

Japan Marionberry Market Insight

The Japan marionberry market is expected to witness the fastest growth rate from 2025 to 2032 due to increasing demand for antioxidant-rich and functional food ingredients. Japanese consumers place a strong emphasis on food quality, traceability, and nutritional value, making marionberries an attractive option in dietary supplements, desserts, and health drinks. Culinary innovation and packaging appeal also play key roles in market growth, while premiumization trends in the country’s wellness sector continue to influence berry-based product adoption

China Marionberry Market Insight

The China marionberry market accounted for the largest revenue share within Asia Pacific in 2024, driven by the rapid expansion of health-oriented food consumption and the rising middle class’s interest in imported, nutrient-rich fruits. As functional beverages and fortified snacks gain popularity, marionberries are being incorporated into product portfolios by both domestic and international brands. China's growing focus on health, coupled with advances in food processing and cold storage capabilities, is expected to sustain robust growth in the coming years

Marionberry Market Share

The marionberry industry is primarily led by well-established companies, including:

- Firmenich SA (Switzerland)

- Takasago International Corporation (Japan)

- ADM (U.S.)

- Sensient Technologies Corporation (U.S.)

- Symrise(Germany)

- Kerry (Ireland)

- MANE (France)

- Dohler (Germany)

- Kanegrade (U.K.)

- Stringer Flavour Ltd. (U.K.)

- DuPont (U.S.)

- Synergy Flavors (U.S.)

- Tate & Lyle (U.K.)

- McCormick & Company, Inc. (U.S.)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Marrionberry Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Marrionberry Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Marrionberry Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.