Global Mass Spectrometry Software Market

Market Size in USD Billion

CAGR :

%

USD

1.20 Billion

USD

2.02 Billion

2025

2033

USD

1.20 Billion

USD

2.02 Billion

2025

2033

| 2026 –2033 | |

| USD 1.20 Billion | |

| USD 2.02 Billion | |

|

|

|

|

Mass Spectrometry Software Market Size

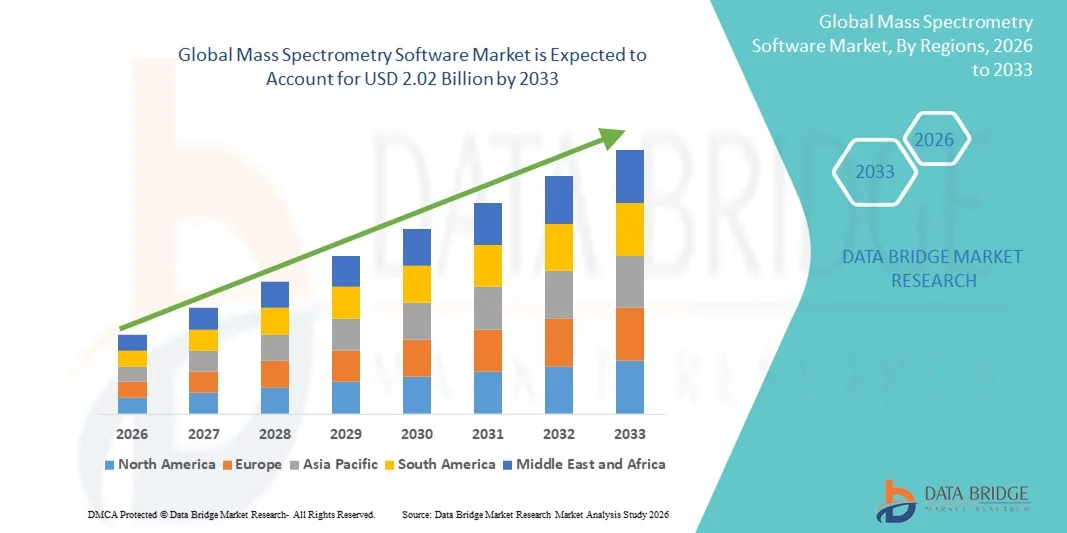

- The global mass spectrometry software market size was valued at USD 1.20 billion in 2025 and is expected to reach USD 2.02 billion by 2033, at a CAGR of 6.75% during the forecast period

- The market growth is largely fueled by the increasing adoption of advanced analytical instruments and the rising need for accurate, high-resolution data analysis across pharmaceutical, biotechnology, environmental, and clinical research applications

- Furthermore, rising demand for automated, user-friendly, and integrated data processing platforms is establishing mass spectrometry software as an essential component for modern analytical workflows. These converging factors are accelerating the uptake of Mass Spectrometry Software solutions, thereby significantly boosting the industry's growth

Mass Spectrometry Software Market Analysis

- Mass spectrometry software, enabling advanced data acquisition, processing, and interpretation, is becoming an increasingly vital component of analytical workflows across pharmaceutical, biotechnology, environmental, and clinical research sectors due to its enhanced automation, accuracy, and integration with modern laboratory systems

- The escalating demand for mass spectrometry software is primarily fueled by the rising need for high-precision analytical results, growing adoption of mass spectrometers in drug discovery and diagnostics, and a strong shift toward digital, cloud-based, and AI-enabled laboratory data management

- North America dominated the mass spectrometry software market with the largest revenue share of 38.5% in 2025, supported by advanced research infrastructure, high investment in biotechnology and pharma R&D, and strong presence of leading software vendors. The U.S. continues to experience significant adoption of AI-driven analytical software and cloud-enabled platforms, particularly across pharmaceutical labs, academic institutions, and CROs

- Asia-Pacific is expected to be the fastest-growing region in the mass spectrometry software market during the forecast period, driven by rapid expansion of healthcare research, increasing government R&D funding, growing pharmaceutical manufacturing, and rising adoption of mass spectrometry tools in clinical testing

- The Cloud-Based segment dominated the largest market revenue share of 62.4% in 2025, driven by rapid digital transformation across laboratories, increasing adoption of cloud-enabled analytical workflows, and the growing demand for centralized data storage and accessibility

Report Scope and Mass Spectrometry Software Market Segmentation

|

Attributes |

Mass Spectrometry Software Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

• Thermo Fisher Scientific (U.S.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Mass Spectrometry Software Market Trends

Enhanced Convenience Through AI and Automation Integration

- A significant and accelerating trend in the global mass spectrometry software market is the deepening integration of artificial intelligence (AI), machine learning (ML), and automated data-processing workflows. This technological convergence is significantly enhancing analytical accuracy, reducing manual interpretation errors, and enabling faster decision-making for users across pharmaceutical, clinical, environmental, and food safety laboratories

- For instance, leading software platforms such as Thermo Fisher’s AcquireX and SCIEX OS software algorithm-driven automation that minimizes manual tuning, optimizes data acquisition, and streamlines complex analytical sequences for high-throughput labs. Similarly, Bruker’s “MetaboScape” and Waters’ “Progenesis QI” utilize advanced multivariate statistical tools to support comprehensive data interpretation

- AI integration in mass spectrometry software enables features such as automated peak detection, molecular pattern recognition, spectral library matching, and predictive modeling. For instance, modern platforms now employ machine-learning algorithms to improve fragmentation pattern prediction and reduce false-positive identifications, while also offering intelligent alert systems for quality-control deviations. Furthermore, cloud-based AI workflows allow researchers to process large datasets remotely with improved speed and reproducibility

- The seamless integration of mass spectrometry software with laboratory information management systems (LIMS), ELN platforms, cloud servers, and automated sample-prep instruments facilitates a centralized analytical environment. Through a unified interface, users can manage data acquisition, workflow scheduling, quality checks, and reporting, enabling end-to-end digitalization of laboratory operations

- This trend toward more intelligent, automated, and interconnected software platforms is fundamentally reshaping expectations for analytical instrumentation. Consequently, companies such as Thermo Fisher, Bruker, Agilent, and Waters are developing next-generation AI-driven software tools with features such as full workflow automation, cloud collaboration, and real-time spectral interpretation to improve laboratory efficiency

- The demand for Mass Spectrometry Software that offers seamless AI-powered automation and integrated data-management capabilities is growing rapidly across pharmaceutical, biotechnology, chemical, food testing, environmental, and forensic laboratories, as organizations increasingly prioritize accuracy, speed, and regulatory compliance

Mass Spectrometry Software Market Dynamics

Driver

Growing Need for High-Throughput Analysis and Rising Use in Drug Discovery

- The increasing demand for high-throughput and high-sensitivity analytical techniques in pharmaceuticals, clinical diagnostics, and biotechnology is a major driver of the global Mass Spectrometry Software market

- For instance, in June 2024, Thermo Fisher Scientific introduced new software upgrades for Orbitrap platforms, enhancing data-processing speed and improving peptide-mapping efficiency for biopharmaceutical development. Such advancements by leading companies are expected to drive market growth during the forecast period

- As clinical research, proteomics, metabolomics, and drug-discovery workflows expand, laboratories require software capable of handling large, complex datasets with greater accuracy and automation

- Mass spectrometry software offers remote data processing, advanced quantification tools, regulatory-compliant reporting, and real-time monitoring, which significantly enhance laboratory productivity

- Furthermore, the rapid growth of biologics and precision medicine has increased the need for sophisticated analytical tools that provide deeper insights into molecular structures, biomarker profiles, and cell-based responses

- The integration of MS software with automated sample-prep platforms and cloud-enabled collaboration tools supports faster research cycles and reproducibility, driving widespread adoption across R&D facilities

- The push toward digital transformation, regulatory standardization, and AI-supported decision-making is further boosting the demand for advanced Mass Spectrometry Software across both established laboratories and emerging biotech companies

Restraint/Challenge

Data Complexity, High Software Costs, and Cybersecurity Concerns

- The increasing complexity of mass spectrometry datasets poses a significant challenge for laboratories, especially those lacking advanced computational resources or trained analytical personnel. Large-scale proteomic or metabolomic studies often require high-performance software and specialized algorithms, creating technical and cost barriers

- For instance, high-end MS software platforms with enterprise-level features, advanced AI modules, and regulatory-compliant capabilities often require substantial licensing costs and ongoing subscription fees

Addressing this challenge requires robust data-processing engines, user-friendly interfaces, and automated assistance modules that reduce dependency on highly skilled analysts

- For instance, high-end MS software platforms with enterprise-level features, advanced AI modules, and regulatory-compliant capabilities often require substantial licensing costs and ongoing subscription fees

- Another major restraint is cybersecurity risk. As laboratories increasingly adopt cloud-based MS platforms, concerns arise regarding data privacy, intellectual-property protection, and potential breaches in clinical or pharmaceutical datasets

- Companies such as Agilent, Waters, and Thermo Fisher emphasize secure encryption protocols, role-based access control, and compliance with data-security standards (such as GDPR and HIPAA) to mitigate these concerns

- In addition, the high cost of software upgrades, training, and integration with existing LIMS or instrument control systems can be a barrier for small and mid-sized laboratories, limiting widespread adoption

- Overcoming these challenges through cost-effective licensing models, enhanced cybersecurity frameworks, and AI-driven simplification of complex workflows will be essential for sustainable market growth

Mass Spectrometry Software Market Scope

The market is segmented on the basis of deployment type, application, and marketing channel.

- By Deployment Type

On the basis of deployment type, the Mass Spectrometry Software market is segmented into Cloud-Based and On-Premise. The Cloud-Based segment dominated the largest market revenue share of 62.4% in 2025, driven by rapid digital transformation across laboratories, increasing adoption of cloud-enabled analytical workflows, and the growing demand for centralized data storage and accessibility. Cloud platforms support collaborative research, remote processing of high-volume datasets, and seamless integration with LIMS, ELN, and AI-based data-analysis tools. The dominance of cloud deployment is also supported by rising use of multi-site research frameworks, where cloud systems enable synchronized data exchange and real-time analytics. Moreover, pharmaceutical companies increasingly prefer cloud environments to streamline multi-regional drug development programs and accelerate regulatory documentation. Cloud deployment also enhances computational efficiency for proteomics, metabolomics, toxicology, and biopharma QC workflows, reducing infrastructure burden on laboratories. Continuous updates and cybersecurity enhancements offered by cloud vendors further strengthen adoption. Overall, the scalability, speed, security, and collaborative capabilities of cloud platforms have firmly positioned them as the dominating deployment model in 2025.

The On-Premise segment is anticipated to witness the fastest growth rate of 18.9% CAGR from 2026 to 2033, fueled by increasing concerns over data confidentiality, especially within pharmaceutical companies, government laboratories, and academic institutions handling sensitive research information. On-premise software allows full internal control over data storage, encryption protocols, and instrument integration, making it suitable for regulated environments such as GMP labs. The growth of on-premise solutions is supported by organizations with strict compliance requirements, including HIPAA, FDA 21 CFR Part 11, and GDPR. Many research labs continue to prefer on-site deployment due to performance reliability, especially when processing extremely large datasets generated by high-resolution mass spectrometry platforms. The ability to customize analytical workflows, integrate legacy systems, and maintain protected internal networks further drives adoption. Additionally, regions with limited cloud infrastructure or data localization regulations contribute to accelerating demand for on-premise MS software. As organizations prioritize security and full operational control, the segment is projected to expand significantly through 2033.

- By Application

On the basis of application, the Mass Spectrometry Software market is segmented into Pharmaceutical Companies, Research Organizations & Institutions, and Others. The Pharmaceutical Companies segment accounted for the largest market revenue share of 48.7% in 2025, driven by expanding biopharmaceutical pipelines, growing reliance on mass spectrometry in drug discovery, and strict quality-control requirements in biologics and small-molecule development. Pharma companies use MS software for protein characterization, metabolomic profiling, impurity detection, stability studies, and advanced bioanalytical workflows. The dominance of this segment is reinforced by heavy investment in R&D across leading pharma hubs globally, coupled with increasing adoption of automated, AI-integrated MS solutions to accelerate pharmacokinetic and toxicological studies. Regulatory compliance requirements also push pharma firms to adopt advanced data-management tools for audit trails, documentation, and reporting. The surge in personalized medicine, cell and gene therapies, and complex biologics manufacturing further elevates demand for sophisticated MS analytics. As pharma companies expand global clinical programs, the need for standardized, high-accuracy software platforms keeps this segment in a leading position.

The Research Organizations & Institutions segment is expected to witness the fastest CAGR of 20.6% from 2026 to 2033, propelled by rising academic interest in proteomics, metabolomics, environmental science, forensic analysis, nutrigenomics, and molecular biology. Research institutes increasingly rely on MS software for complex data modeling, biomarker discovery, and computational biology experiments. The segment’s rapid growth is supported by government-funded research programs, collaborative scientific networks, and increasing adoption of cloud-based data-sharing tools within academic ecosystems. Universities and public research labs also benefit from AI-driven MS solutions that automate peak detection, spectral classification, and molecular interpretation, reducing manual analytical workloads. Expansion of national biobank projects, environmental surveillance systems, and disease-mapping initiatives further contributes to adoption. As MS instruments become more advanced and data-intensive, research bodies require more powerful software systems for high-throughput analysis, contributing to this segment becoming the fastest-growing from 2026 to 2033.

- By Marketing Channel

On the basis of marketing channel, the Mass Spectrometry Software market is segmented into Direct Marketing, Indirect Marketing, and Mass Spectrometry Software Customers. The Direct Marketing segment dominated the largest market revenue share of 57.3% in 2025, driven by the critical need for specialized technical demonstrations, instrument–software compatibility consulting, and direct engagement between suppliers and laboratories. Mass spectrometry software often requires tailored onboarding, workflow optimization, and performance validation, making direct sales channels essential for high-value customers such as pharma companies and research institutions. Direct marketing strengthens customer trust, reduces adoption barriers, and ensures efficient deployment through technical support teams. Additionally, leading manufacturers such as Thermo Fisher, Agilent, and Bruker prefer direct marketing for enterprise accounts that demand comprehensive service packages, customization, and long-term software licensing agreements. This channel also enables vendors to maintain brand differentiation and promote premium analytical solutions directly to decision-makers.

The Indirect Marketing segment is anticipated to witness the fastest growth rate of 17.4% CAGR from 2026 to 2033, fueled by the expanding role of distributors, digital marketplaces, third-party resellers, and academic procurement platforms in accelerating software accessibility. Indirect channels offer wider geographic penetration, especially in emerging markets where suppliers rely on local distributors for regulatory navigation and market reach. The rise of online technical stores, subscription-based software platforms, and integrated instrument–software bundles offered by distributors further supports growth. Educational institutions and mid-sized laboratories increasingly prefer indirect channels due to cost advantages, packaged deals, and flexible licensing structures. The growth of system integrators who combine MS software with LIMS, ELN, and laboratory automation solutions also boosts this segment. As laboratory digitalization expands globally, indirect marketing channels will play a key role in making Mass Spectrometry Software more accessible and affordable.

Mass Spectrometry Software Market Regional Analysis

- North America dominated the mass spectrometry software market with the largest revenue share of 38.5% in 2025

- Supported by advanced research infrastructure, high investment in biotechnology and pharmaceutical R&D, strong academic networks, and the presence of leading mass spectrometry software developers

- The region benefits from rapid adoption of AI-driven data processing tools, cloud-enabled analytical platforms, and automated workflows that enhance accuracy and efficiency in proteomics, metabolomics, clinical diagnostics, and drug discovery applications

U.S. Mass Spectrometry Software Market Insight

The U.S. mass spectrometry software market captured 81% of North America’s revenue share in 2025, driven by strong federal research funding (NIH, NSF), early adoption of cloud-based analysis platforms, and growing use of mass spectrometry in pharmaceutical development, toxicology, precision diagnostics, and environmental testing. The rapid integration of machine learning algorithms, real-time data analytics, and electronic laboratory systems (ELNs/LIMS) continues to further accelerate market growth across CROs, biotech firms, and universities.

Europe Mass Spectrometry Software Market Insight

The Europe mass spectrometry software market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by strong emphasis on clinical research, compliance with stringent regulatory standards (EMA), and growing investment in genomics, proteomics, and biomarker discovery. Countries across the region are increasingly adopting advanced analytical software solutions to support high-throughput research, precision medicine programs, and pharmaceutical quality control workflows. The demand is rising across academic laboratories, biopharma companies, and environmental monitoring agencies.

U.K. Mass Spectrometry Software Market Insight

The U.K. mass spectrometry software market is anticipated to grow at a noteworthy CAGR, supported by the country’s strong life sciences sector, expanding proteomics and metabolomics research programs, and rising deployment of automated data processing tools in clinical diagnostics. Government support for biomedical innovation and increasing collaborations between universities and biopharma firms continue to strengthen software adoption.

Germany Mass Spectrometry Software Market Insight

The Germany mass spectrometry software market is expected to expand at a considerable CAGR, driven by the country’s leadership in pharmaceutical manufacturing, biotechnology innovation, and advanced analytical research. German laboratories increasingly prefer high-precision, AI-enabled software tools that support automation, compliance, reproducibility, and integration with digital laboratory systems. Adoption is strong across chemical analysis, food safety testing, clinical labs, and environmental institutions.

Asia-Pacific Mass Spectrometry Software Market Insight

The Asia-Pacific mass spectrometry software market is poised to grow at the fastest CAGR during 2026–2033, fueled by expanding healthcare research capacity, increasing government funding for R&D, rising pharmaceutical manufacturing activity, and the rapid adoption of advanced analytical instruments across China, Japan, India, and South Korea. Growing interest in clinical diagnostics, proteomic profiling, and personalized medicine is also accelerating demand for cloud-based and AI-integrated mass spectrometry software solutions.

Japan Mass Spectrometry Software Market Insight

The Japan mass spectrometry software market is gaining momentum due to the country’s strong technological foundation, sophisticated biomedical research ecosystem, and increasing use of mass spectrometry in clinical, pharmaceutical, and academic settings. Adoption is supported by rising interest in automated data interpretation, digital pathology integration, and high-throughput multi-omics analysis.

China Mass Spectrometry Software Market Insight

China mass spectrometry software market accounted for the largest revenue share in the Asia-Pacific region in 2025, driven by rapid expansion of pharmaceutical manufacturing, government initiatives supporting biotech growth, and increasing deployment of mass spectrometry in hospitals, research institutes, and environmental testing laboratories. Strong local software developers and favorable digitalization policies continue to accelerate market penetration.

Mass Spectrometry Software Market Share

The Mass Spectrometry Software industry is primarily led by well-established companies, including:

• Thermo Fisher Scientific (U.S.)

• Agilent Technologies (U.S.)

• SCIEX (Canada)

• Bruker Corporation (U.S.)

• Waters Corporation (U.S.)

• Shimadzu Corporation (Japan)

• PerkinElmer (U.S.)

• JEOL Ltd. (Japan)

• LECO Corporation (U.S.)

• OpenLab CDS (U.S.)

• LabSolutions (Japan)

• MassHunter (U.S.)

• ProteoWizard (U.S.)

• Bioinformatics Solutions Inc. (Canada)

• Nonlinear Dynamics (UK)

• Genedata (Switzerland)

• Peak Scientific (UK)

• Advion (U.S.)

• Markes International (UK)

• Mestrelab Research (Spain)

Latest Developments in Global Mass Spectrometry Software Market

- In June 2023, Bruker Corporation launched ProteoScape along with its new timsTOF Ultra mass spectrometer — offering “VistaScan” and enhanced 4D-Proteomics workflows enabling the identification of > 55,000 peptides and ~5,000 protein groups from ultra-sensitive, single-cell level inputs

- In September 2023, Bruker introduced a novel AI-powered quantification module, TIMSquant, in ProteoScape, enabling collision-cross-section (CCS)-aware, label-free quantification scalable across hundreds to thousands of samples — boosting high-throughput, reproducible proteomics and multi-omics workflows

- In June 2024, Thermo Fisher Scientific unveiled a major expansion of its software ecosystem at the 2024 ASMS conference. The update included enhanced connectivity across chromatography and mass-spectrometry platforms via its new Ardia Platform (with Ardia Core 1.1, Data Sync 1.1), updated support for Orbitrap Astral and Stellar MS, and improved integration with other tools like Compound Discoverer 3.4 and Skyline — giving users a more unified, enterprise-class data-management and analysis environment

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.