Meat and Poultry Processing Market Analysis and Size

Consumption of animal meat products has skyrocketed in recent decades all over the world. The growing global population is a major contributor to this increase. As a result, consumers in urban areas have access to a much broader range of food options and better food availability than those in rural areas. This urbanisation trend contributes significantly to higher living standards and rising incomes, which in turn has a greater impact on the affordability of meat and poultry processed food products.

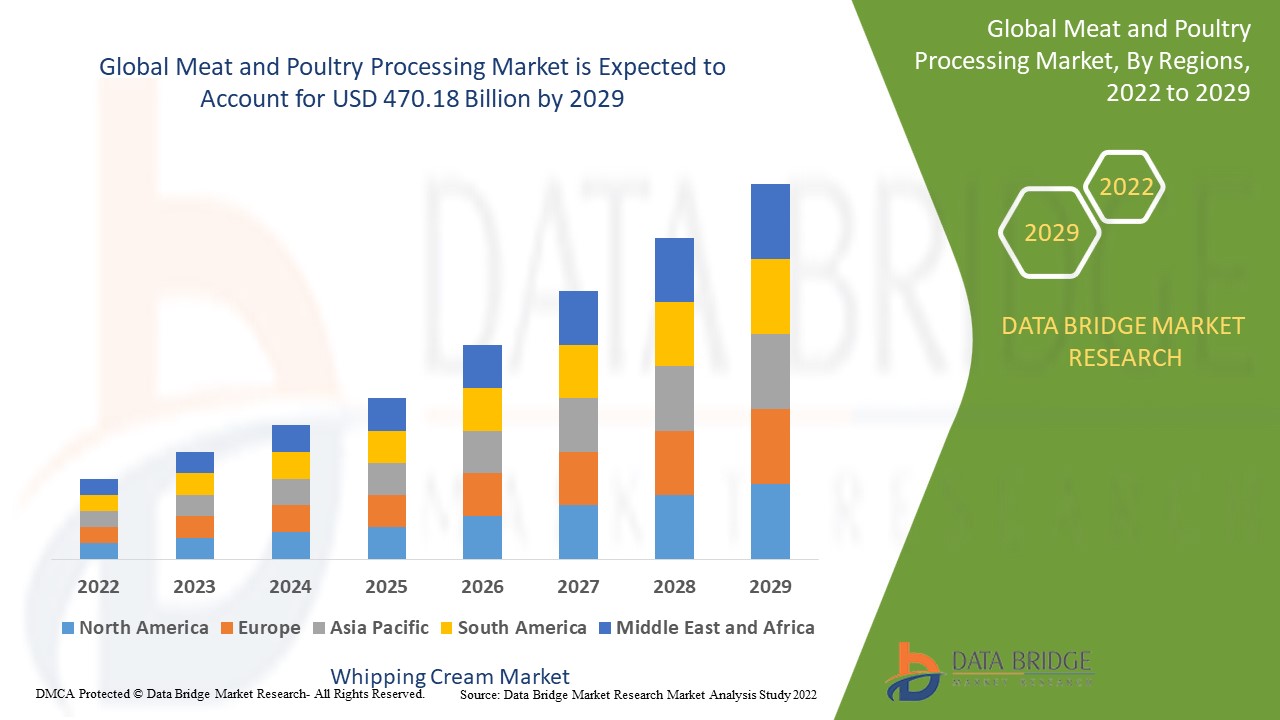

Data Bridge Market Research analyses that the meat and poultry processing market which was growing at a value of 288.4 billion in 2021 and is expected to reach the value of USD 470.18 billion by 2029, at a CAGR of 6.30% during the forecast period of 2022 to 2029.

Market Definition

Meat and poultry processing is defined as the systems in place that can be deployed for various processing mechanisms that help keep foods edible and nutritious throughout the stages of preparation to consumption. The processing primarily aids in the handling, packaging, storing, and preserving of food while it is being stored or transported from one location to another.

Meat and Poultry Processing Market Scope and Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2014 - 2019) |

|

Quantitative Units |

Revenue in USD Billion, Volumes in Units, Pricing in USD |

|

Segments Covered |

Equipment Type (Killing & De feathering, Evisceration, Cut-Up, Deboning & Skinning, Marinating & Tumbling, Other Equipment), Poultry Type (Chicken Meat, Turkey Meat, Duck Meat, Others), Product Type (Fresh Processed, Raw Cooked, Pre-Cooked, Raw Fermented Sausages, Cured, Dried, Others), End User (Retail, Food Service, Others) |

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, Sweden, Poland, Denmark, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Market Players Covered |

Marel (Iceland), GEA Group Aktiengesellschaft (Germany), Bühler (Switzerland), JBT (US), The Middleby Corporation (US), Heat and Control, Inc. (US), Alfa Laval (Sweden), TNA Australia Pty Ltd. (Australia), Bucher Industries (Switzerland), Equipamientos Cárnicos, S.L (Spain), Clextral (France), SPX FLOW (US), Bigtem Makine (Turkey), FENCO Food Machinery (Italy), Krones Group (Germany), Finis Meat and Poultry Processing B.V. (Netherlands), Bettcher Industries, Inc. (US), Anko Food Machine Co. Ltd. (Taiwan), Heat and Control, Inc. (US), BAADER (Germany), and Dover Corporation (US) |

|

Opportunities |

|

Meat and Poultry Processing Market Dynamics

Drivers

- Rising population as well as rise in per capita income

Population growth, combined with rising per capita disposable income, is expected to increase demand for meat and poultry processing market and consumption of processed foods, boosting market growth over the forecast period. Increasing demand from the fast food outlets and chains and the continuous demand for the poultry products will further adds to the market growth.

Growing demand in various applications

Due to their inherent advantages, such as quality control, durability, hygiene, and preservation, these systems are widely used in various applications, including bakery and confectionery, meat, seafood, poultry, dairy, and grains. The product is becoming more widely used in end-use industries, particularly in Asia Pacific, where rising domestic manufacturing and consumer income levels are driving innovation in this sector.

Opportunity

To improve global food security, one must increase pollution control measures and reduce food losses. Standard and advanced processing equipment can easily achieve these solutions. Over the forecast period, this is expected to create opportunities for equipment manufacturers.

Restraints

The global meat and poultry processing market faces significant market challenges due to a lack of skilled labour. Lockdowns imposed as a result of the COVID-19 pandemic have shut down operations across economies, causing significant market restraint. The incorporation of IoT Technology in the food processing space, such as revamping meat and poultry processing into modern digital solutions to create an automated food chain, is expected to drive the market positively in the coming years.

This meat and poultry processing market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the meat and poultry processing market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

COVID-19 Impact on Meat and Poultry Processing Market

The virus has significantly impacted the meat and poultry processing manufacturing industry, causing production and factory operations to be halted. It all started in China, the global hub for supplying raw materials to companies, and then spread to the entire supply chain for manufacturing companies. Furthermore, the United Nations Conference on Trade and Development (UNCTAD) predicts that global FDI will fall by 5% to 15% as a result of a drop in manufacturing company operations due to factory shutdown. As a result, the COVID-19 outbreak is expected to slow global investment in the meat and poultry processing manufacturing sector. This scenario has reduced demand for meat and poultry processing, particularly in 2020.

Recent Development

- Gea will introduce its new Xtru Twin 140 extruder in October 2021, rounding out its line of high-capacity output equipment. The Gea Xtru twin extruders allowed for the production of a wide range of products, including cereal-based snack pellets die-cut, 2D, 3D, multilayers, square shape, punched, and direct expanded; breakfast cereals; dry pet food; and any other extruded food product. The most recent Xtru Twin 140 had a capacity of more than 3 tonnes of pellets and 10 tonnes of pet food kibbles per hour.

- SPX FLOW launched the New APV Pilot 4T Homogenizer equipment in June 2021, allowing customers to test a wide range of recipes in a single compact unit. This product would benefit food and beverage manufacturers. APV aided in the homogenization of an immiscible liquid into an emulsion

Global Meat and Poultry Processing Market Scope

The meat and poultry processing market is segmented on the basis of, equipment type, poultry type, product type and end users. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Equipment type

- Killing & De feathering

- Evisceration

- Cut-Up

- Deboning & Skinning

- Marinating & Tumbling

- Other Equipment

Poultry type

- Chicken Meat

- Turkey Meat

- Duck Meat

- Others

Product type

- Fresh Processed

- Raw Cooked

- Pre-Cooked

- Raw Fermented Sausages

- Cured

- Dried

- Others

End users

- Retail

- Food Service

- Others

Meat and Poultry Processing Market Regional Analysis/Insights

The Meat and Poultry processing market is analysed and market size insights and trends are provided by country, equipment type, poultry type, product type and end users as referenced above.

The countries covered in the meat and poultry processing market report are U.S., Canada and Mexico in North America, Germany, Sweden, Poland, Denmark, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

The Asia-Pacific market is experiencing rapid growth due to its expanding economy, expanding industrial base of food processing units driven by rapid urbanisation, and increasing demand for convenience food, driven by consumers' increasing disposable income and purchasing power. The region is expected to see a significant increase in demand for advanced food processing machinery that helps reduce processing time and improve manufacturing efficiency. The anticipated increase in the number of food processing units in this region is expected to boost the supply and consumption of food and beverage processing equipment. This is expected to have a positive impact on the region's food and beverage processing equipment market.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Meat and Poultry Processing Market Share Analysis

The meat and poultry processing market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to meat and poultry processing market.

Some of the major players operating in the meat and poultry processing market are:

- Marel (Iceland)

- GEA Group Aktiengesellschaft (Germany)

- Bühler (Switzerland)

- JBT (US)

- The Middleby Corporation (US)

- Heat and Control, Inc. (US)

- Alfa Laval (Sweden)

- TNA Australia Pty Ltd. (Australia)

- Bucher Industries (Switzerland)

- Equipamientos Cárnicos, S.L (Spain)

- Clextral (France)

- SPX FLOW (US)

- Bigtem Makine (Turkey)

- FENCO Food Machinery (Italy)

- Krones Group (Germany)

- Finis Meat and Poultry Processing B.V. (Netherlands)

- Bettcher Industries, Inc. (US)

- Anko Food Machine Co. Ltd. (Taiwan)

- Heat and Control, Inc. (US)

- BAADER (Germany)

- Dover Corporation (US)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL MEAT AND POULTRY PROCESSING MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL MEAT AND POULTRY PROCESSING MARKET SIZE

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 MARKET GUIDE

2.2.4 COMPANY POSITIONING GRID

2.2.5 COMAPANY MARKET SHARE ANALYSIS

2.2.6 MULTIVARIATE MODELLING

2.2.7 DEMAND AND SUPPLY-SIDE VARIABLES

2.2.8 CONSUMPTION TREND OF END PRODUCTS

2.2.9 TOP TO BOTTOM ANALYSIS

2.2.10 STANDARDS OF MEASUREMENT

2.2.11 VENDOR SHARE ANALYSIS

2.2.12 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.13 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL MEAT AND POULTRY PROCESSING MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 RAW MATERIAL COVERAGE

5.2 PRODUCTION CONSUMPTION ANALYSIS

5.3 IMPORT EXPORT SCENARIO

5.4 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS

5.5 PORTER’S FIVE FORCES

5.6 VENDOR SELECTION CRITERIA

5.7 PESTEL ANALYSIS

5.8 REGULATION COVERAGE

5.8.1 PRODUCT CODES

5.8.2 CERTIFIED STANDARDS

5.8.3 SAFETY STANDARDS

5.8.3.1. MATERIAL HANDLING & STORAGE

5.8.3.2. TRANSPORT & PRECAUTIONS

5.8.3.3. HARAD IDENTIFICATION

6 PRICING ANALYSIS

7 SUPPLY CHAIN ANALYSIS

7.1 OVERVIEW

7.2 LOGISTIC COST SCENARIO

7.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

8 CLIMATE CHANGE SCENARIO

8.1 ENVIRONMENTAL CONCERNS

8.2 INDUSTRY RESPONSE

8.3 GOVERNMENT’S ROLE

8.4 ANALYST RECOMMENDATIONS

9 GLOBAL MEAT AND POULTRY PROCESSING MARKET, BY EQUIPMENT TYPE, 2021-2030 (USD MILLION)

9.1 OVERVIEW

9.2 PORTIONING EQUIPMENT

9.2.1 SLICING MACHINES

9.2.2 MEAT GRINDERS

9.3 FRYING EQUIPMENT

9.3.1 TUBE TYPE FRYER

9.3.2 OPEN-POT FRYERS

9.3.3 FLAT-BOTTOM FRYERS

9.3.4 COMMERCIAL PRESSURE FRYERS

9.4 FILTERING EQUIPMENT

9.4.1 PLATE AND FRAME FILTER PRESS

9.4.2 LEAF FILTER

9.4.3 VACUUM FILTRATION

9.4.3.1. ROTARY DRUM FILTER

9.4.3.2. ROTARY DISC FILTER

9.5 COATING EQUIPMENT

9.6 WEIGHING EQUIPMENT

9.6.1 IN-LINE WEIGHING SYSTEM

9.6.1.1. MULTIHEAD WEIGHERS

9.6.1.2. DYNAMIC WEIGHING SYSTEM

9.6.2 SCALES

9.6.2.1. BENCH SCALES

9.6.2.2. FLOW SCALES

9.6.2.3. FLOOR SCALES

9.7 GRADING EQUIPMENT

9.7.1 OVERHEAD GRADER

9.7.2 VISION BASED GRADER

9.7.3 COMPACT GRADERS

9.8 BATCHERS EQUIPMENTS

9.8.1 HIGH VOLUME BATCHERS

9.8.2 FLOW PACK BATCHERS

9.8.3 OTHERS

9.9 COOKING EQIPMENT

9.9.1 OVENS

9.9.1.1. RACK OVEN

9.9.1.2. DECK OVEN

9.9.1.3. TUNNEL OVEN

9.9.2 GRIDDLES

9.9.2.1. GRILL TOP

9.9.2.2. FLAT TOP

9.9.3 COOKERS

9.1 SMOKING EQIPMENT

9.10.1 VERTICAL WATER SMOKER

9.10.2 HORIZONTAL OFFSET SMOKERS

9.10.3 BOX SMOKERS

9.10.4 DRUM SMOKERS

9.10.5 SMOKER OVENS

9.10.6 OTHERS

9.11 KILLING / SLAUGHTERING EQUIPMENTS

9.11.1 MEAT KILLING EQUIPMENT

9.11.2 MEAT SLAUGHTER EQUIPMENT

9.12 REFRIGERATION EQUIPMENTS

9.12.1 PRE-CHILLERS

9.12.2 LOW TEMPERATURE FROZEN CHAMBERS

9.12.3 BLAST FREEZERS

9.12.4 PLATE FREEZERS

9.12.5 OTHERS

9.13 HIGH PRESSURE PROCESSING (HIGH PRESSURE PROCESSOR)

9.13.1 BATCH PROCESS HPP EQUIPMENTS

9.13.2 CONTINUOUS PROCESS HPP EQUIPMENTS

9.13.3 SEMI-CONTINUOUS PROCESS HPP EQUIPMENTS

9.14 MASSAGING EQUIPMENT

9.15 ROASTING EQUIPMENT

9.16 MIXING EQUIPMENT

9.17 TENDERING EQUIPMENT

9.18 SEASONINGS & INJECTORS

9.19 GRINDING EQUIPMENT

9.2 OTHERS

10 GLOBAL MEAT AND POULTRY PROCESSING MARKET, BY PROCESS, 2021-2030 (USD MILLION)

10.1 OVERVIEW

10.2 SIZE REDUCTION

10.3 SIZE ENLARGEMENT

10.4 HOMOGENIZATION

10.5 MIXING

10.6 OTHERS

11 GLOBAL MEAT AND POULTRY PROCESSING MARKET, BY MODE OF OPEARTION, 2021-2030 (USD MILLION)

11.1 OVERVIEW

11.2 AUTOMATIC

11.3 SEMI-AUTOMATIC

11.4 MANUAL

12 GLOBAL MEAT AND POULTRY PROCESSING MARKET, BY FUNCTION, 2021-2030 (USD MILLION)

12.1 OVERVIEW

12.2 CUTTING

12.3 WEIGHING

12.4 GRADING

12.5 MINCHING

12.6 BLENDING

12.7 TENDERIZING

12.8 FILLING

12.9 MARINATING

12.1 SLICING

12.11 GRINDING

12.12 SMOKING

12.13 KILLING & DE-FEATHERING

12.14 DEBONING & SKINNING

12.15 EVISCERATION

12.16 GUTTING

12.17 SCALING

12.18 FILLETING

12.19 OTHERS

13 GLOBAL MEAT AND POULTRY PROCESSING MARKET, BY APPLICATION , 2021-2030 (USD MILLION)

13.1 OVERVIEW

13.2 FRESH PROCESSED PRODUCTS

13.2.1 FRESH PROCESSED PRODUCTS, BY PROCESSED PRODUCTS TYPE

13.2.1.1. MEAT

13.2.1.2. POULTRY

13.3 RAW COOKED PRODUCTS

13.3.1 RAW COOKED PRODUCTS, BY PROCESSED PRODUCTS TYPE

13.3.1.1. MEAT

13.3.1.2. POULTRY

13.4 PRECOOKED PRODUCTS

13.4.1 PRECOOKED PRODUCTS, BY PROCESSED PRODUCTS TYPE

13.4.1.1. MEAT

13.4.1.2. POULTRY

13.5 RAW FERMENTED SAUSAGES PRODUCTS

13.5.1 RAW FERMENTED SAUSAGES PRODUCTS, BY PROCESSED PRODUCTS TYPE

13.5.1.1. MEAT

13.5.1.2. POULTRY

13.6 DRIED PRODUCTS

13.6.1 DRIED PRODUCTS, BY PROCESSED PRODUCTS TYPE

13.6.1.1. MEAT

13.6.1.2. POULTRY

13.7 CURED PRODUCTS

13.7.1 CURED PRODUCTS, BY PROCESSED PRODUCTS TYPE

13.7.1.1. MEAT

13.7.1.2. POULTRY

13.8 FROZEN PRODUCTS

13.8.1 FROZEN PRODUCTS, BY PROCESSED PRODUCTS TYPE

13.8.1.1. MEAT

13.8.1.2. POULTRY

13.9 OTHERS

14 GLOBAL MEAT AND POULTRY PROCESSING MARKET, BY PROCESSED PRODUCTS TYPE, 2021-2030 (USD MILLION)

14.1 OVERVIEW

14.2 MEAT

14.2.1 BEEF

14.2.2 PORK

14.2.3 MUTTTON

14.2.4 OTHERS

14.3 POULTRY

14.3.1 BOILERS

14.3.2 LAYERS

14.3.3 BREEDERS

14.3.4 CHICKS & POULTS

14.3.5 OTHERS

15 GLOBAL MEAT AND POULTRY PROCESSING MARKET, BY GEOGRAPHY, 2021-2030 (USD MILLION)

GLOBAL MEAT AND POULTRY PROCESSING MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

15.1 NORTH AMERICA

15.1.1 U.S.

15.1.2 CANADA

15.1.3 MEXICO

15.2 EUROPE

15.2.1 GERMANY

15.2.2 U.K.

15.2.3 ITALY

15.2.4 FRANCE

15.2.5 SPAIN

15.2.6 SWITZERLAND

15.2.7 RUSSIA

15.2.8 TURKEY

15.2.9 BELGIUM

15.2.10 NETHERLANDS

15.2.11 SWITZERLAND

15.2.12 DENMARK

15.2.13 NORWAY

15.2.14 FINLAND

15.2.15 SWEDEN

15.2.16 REST OF EUROPE

15.3 ASIA-PACIFIC

15.3.1 JAPAN

15.3.2 CHINA

15.3.3 SOUTH KOREA

15.3.4 INDIA

15.3.5 SINGAPORE

15.3.6 THAILAND

15.3.7 INDONESIA

15.3.8 MALAYSIA

15.3.9 PHILIPPINES

15.3.10 AUSTRALIA

15.3.11 NEW ZEALAND

15.3.12 HONG KONG

15.3.13 TAIWAN

15.3.14 REST OF ASIA-PACIFIC

15.4 SOUTH AMERICA

15.4.1 BRAZIL

15.4.2 ARGENTINA

15.4.3 COLOMBIA

15.4.4 BOLIVIA

15.4.5 PERU

15.4.6 CHILE

15.4.7 URUGUAY

15.4.8 REST OF SOUTH AMERICA

15.5 MIDDLE EAST AND AFRICA

15.5.1 SOUTH AFRICA

15.5.2 EGYPT

15.5.3 SAUDI ARABIA

15.5.4 UNITED ARAB EMIRATES

15.5.5 ISRAEL

15.5.6 BAHRAIN

15.5.7 KUWAIT

15.5.8 OMAN

15.5.9 QATAR

15.5.10 REST OF MIDDLE EAST AND AFRICA

16 GLOBAL MEAT AND POULTRY PROCESSING MARKET, COMPANY LANDSCAPE

16.1 COMPANY SHARE ANALYSIS: GLOBAL

16.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

16.3 COMPANY SHARE ANALYSIS: EUROPE

16.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

16.5 MERGERS & ACQUISITIONS

16.6 NEW PRODUCT DEVELOPMENT & APPROVALS

16.7 EXPANSIONS

16.8 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

17 GLOBAL MEAT AND POULTRY PROCESSING MARKET, COMPANY PROFILE

17.1 ARI MACHINERY

17.1.1 COMPANY OVERVIEW

17.1.2 REVENUE ANALYSIS

17.1.3 SWOT ANALYSIS

17.1.4 PRODUCTION CAPACITY OVERVIEW

17.1.5 PRODUCT PORTFOLIO

17.1.6 RECENT DEVELOPMENTS

17.2 GEA GROUP AKTIENGESELLSCHAFT

17.2.1 COMPANY OVERVIEW

17.2.2 REVENUE ANALYSIS

17.2.3 SWOT ANALYSIS

17.2.4 PRODUCTION CAPACITY OVERVIEW

17.2.5 PRODUCT PORTFOLIO

17.2.6 RECENT DEVELOPMENTS

17.3 THE MIDDLEBY CORPORATION

17.3.1 COMPANY OVERVIEW

17.3.2 REVENUE ANALYSIS

17.3.3 SWOT ANALYSIS

17.3.4 PRODUCTION CAPACITY OVERVIEW

17.3.5 PRODUCT PORTFOLIO

17.3.6 RECENT DEVELOPMENTS

17.4 JBT CORPORATION

17.4.1 COMPANY OVERVIEW

17.4.2 REVENUE ANALYSIS

17.4.3 SWOT ANALYSIS

17.4.4 PRODUCTION CAPACITY OVERVIEW

17.4.5 PRODUCT PORTFOLIO

17.4.6 RECENT DEVELOPMENTS

17.5 WELBIT (A PART OF ALI HOLDING SRL)

17.5.1 COMPANY OVERVIEW

17.5.2 REVENUE ANALYSIS

17.5.3 SWOT ANALYSIS

17.5.4 PRODUCTION CAPACITY OVERVIEW

17.5.5 PRODUCT PORTFOLIO

17.5.6 RECENT DEVELOPMENTS

17.6 ALFA LAVAL

17.6.1 COMPANY OVERVIEW

17.6.2 REVENUE ANALYSIS

17.6.3 SWOT ANALYSIS

17.6.4 PRODUCTION CAPACITY OVERVIEW

17.6.5 PRODUCT PORTFOLIO

17.6.6 RECENT DEVELOPMENTS

17.7 RISCO S.P.A.

17.7.1 COMPANY OVERVIEW

17.7.2 REVENUE ANALYSIS

17.7.3 SWOT ANALYSIS

17.7.4 PRODUCTION CAPACITY OVERVIEW

17.7.5 PRODUCT PORTFOLIO

17.7.6 RECENT DEVELOPMENTS

17.8 BAADER

17.8.1 COMPANY OVERVIEW

17.8.2 REVENUE ANALYSIS

17.8.3 SWOT ANALYSIS

17.8.4 PRODUCTION CAPACITY OVERVIEW

17.8.5 PRODUCT PORTFOLIO

17.8.6 RECENT DEVELOPMENTS

17.9 BETTCHER INDUSTRIES, INC

17.9.1 COMPANY OVERVIEW

17.9.2 REVENUE ANALYSIS

17.9.3 SWOT ANALYSIS

17.9.4 PRODUCTION CAPACITY OVERVIEW

17.9.5 PRODUCT PORTFOLIO

17.9.6 RECENT DEVELOPMENTS

17.1 MAREL

17.10.1 COMPANY OVERVIEW

17.10.2 REVENUE ANALYSIS

17.10.3 SWOT ANALYSIS

17.10.4 PRODUCTION CAPACITY OVERVIEW

17.10.5 PRODUCT PORTFOLIO

17.10.6 RECENT DEVELOPMENTS

17.11 ILLINOIS TOOL WORKS INC

17.11.1 COMPANY OVERVIEW

17.11.2 REVENUE ANALYSIS

17.11.3 SWOT ANALYSIS

17.11.4 PRODUCTION CAPACITY OVERVIEW

17.11.5 PRODUCT PORTFOLIO

17.11.6 RECENT DEVELOPMENTS

17.12 MEPACO

17.12.1 COMPANY OVERVIEW

17.12.2 REVENUE ANALYSIS

17.12.3 SWOT ANALYSIS

17.12.4 PRODUCTION CAPACITY OVERVIEW

17.12.5 PRODUCT PORTFOLIO

17.12.6 RECENT DEVELOPMENTS

17.13 MARLEN INTERNATIONAL

17.13.1 COMPANY OVERVIEW

17.13.2 REVENUE ANALYSIS

17.13.3 SWOT ANALYSIS

17.13.4 PRODUCTION CAPACITY OVERVIEW

17.13.5 PRODUCT PORTFOLIO

17.13.6 RECENT DEVELOPMENTS

17.14 TVI ENTWICKLUNG & PRODUKTION GMBH

17.14.1 COMPANY OVERVIEW

17.14.2 REVENUE ANALYSIS

17.14.3 SWOT ANALYSIS

17.14.4 PRODUCTION CAPACITY OVERVIEW

17.14.5 PRODUCT PORTFOLIO

17.14.6 RECENT DEVELOPMENTS

17.15 MAYEKAWA MFG. CO., LTD

17.15.1 COMPANY OVERVIEW

17.15.2 REVENUE ANALYSIS

17.15.3 SWOT ANALYSIS

17.15.4 PRODUCTION CAPACITY OVERVIEW

17.15.5 PRODUCT PORTFOLIO

17.15.6 RECENT DEVELOPMENTS

17.16 APACHE STAINLESS EQUIPMENT

17.16.1 COMPANY OVERVIEW

17.16.2 REVENUE ANALYSIS

17.16.3 SWOT ANALYSIS

17.16.4 PRODUCTION CAPACITY OVERVIEW

17.16.5 PRODUCT PORTFOLIO

17.16.6 RECENT DEVELOPMENTS

17.17 KEY TECHNOLOGY INC

17.17.1 COMPANY OVERVIEW

17.17.2 REVENUE ANALYSIS

17.17.3 SWOT ANALYSIS

17.17.4 PRODUCTION CAPACITY OVERVIEW

17.17.5 PRODUCT PORTFOLIO

17.17.6 RECENT DEVELOPMENTS

17.18 HEAT AND CONTROL INC

17.18.1 COMPANY OVERVIEW

17.18.2 REVENUE ANALYSIS

17.18.3 SWOT ANALYSIS

17.18.4 PRODUCTION CAPACITY OVERVIEW

17.18.5 PRODUCT PORTFOLIO

17.18.6 RECENT DEVELOPMENTS

17.19 MINERVA OMEGA GROUP S.R.L.

17.19.1 COMPANY OVERVIEW

17.19.2 REVENUE ANALYSIS

17.19.3 SWOT ANALYSIS

17.19.4 PRODUCTION CAPACITY OVERVIEW

17.19.5 PRODUCT PORTFOLIO

17.19.6 RECENT DEVELOPMENTS

17.2 TOMRA SYSTEMS ASA

17.20.1 COMPANY OVERVIEW

17.20.2 REVENUE ANALYSIS

17.20.3 SWOT ANALYSIS

17.20.4 PRODUCTION CAPACITY OVERVIEW

17.20.5 PRODUCT PORTFOLIO

17.20.6 RECENT DEVELOPMENTS

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

18 RELATED REPORTS

19 QUESTIONNAIRE

20 ABOUT DATA BRIDGE MARKET RESEARCH

Global Meat And Poultry Processing Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Meat And Poultry Processing Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Meat And Poultry Processing Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.