Global Mechanized Irrigation Systems Market

Market Size in USD Billion

CAGR :

%

USD

8.38 Billion

USD

12.48 Billion

2024

2032

USD

8.38 Billion

USD

12.48 Billion

2024

2032

| 2025 –2032 | |

| USD 8.38 Billion | |

| USD 12.48 Billion | |

|

|

|

|

Mechanized Irrigation Systems Market Size

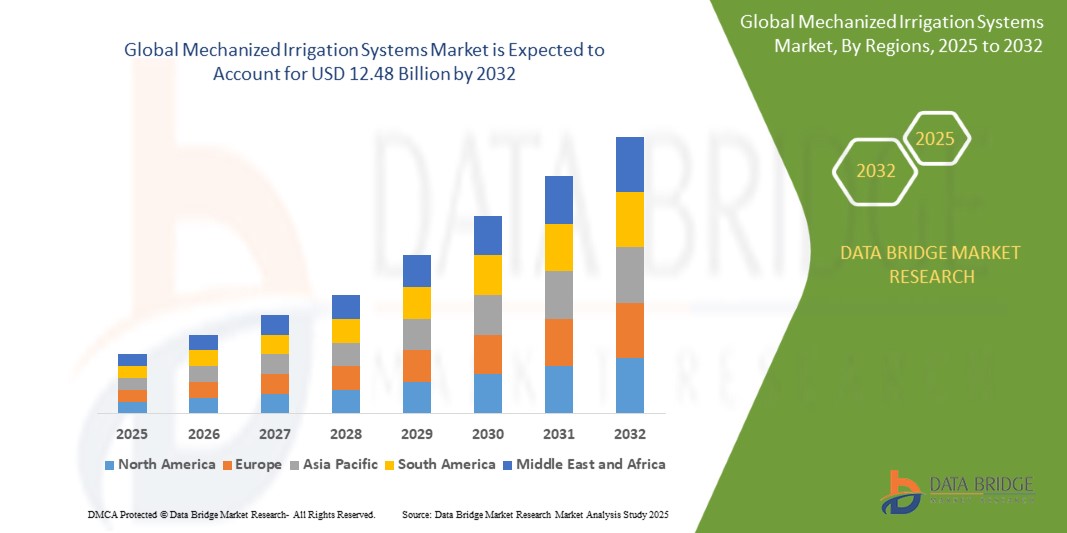

- The global mechanized irrigation systems market size was valued at USD 8.38 billion in 2024 and is expected to reach USD 12.48 billion by 2032, at a CAGR of 5.1% during the forecast period

- The market growth is largely fuelled by the increasing adoption of advanced irrigation technologies to enhance agricultural productivity, conserve water, and reduce labor dependency

- Rising demand for efficient water management solutions in arid and semi-arid regions, along with government initiatives promoting sustainable farming practices, is further driving market expansion

Mechanized Irrigation Systems Market Analysis

- Growing awareness about water scarcity, climate change impacts, and the need for sustainable farming practices is driving adoption of mechanized irrigation systems across global agricultural sectors

- Farmers and agribusinesses are increasingly investing in cost-effective and time-efficient irrigation solutions to improve crop quality and operational efficiency

- North America dominated the mechanized irrigation systems market with the largest revenue share of 34.5% in 2024, driven by the increasing adoption of precision agriculture, government subsidies for efficient water management, and growing awareness of sustainable farming practices

- Asia-Pacific region is expected to witness the highest growth rate in the global mechanized irrigation systems market, driven by rapid urbanization, rising demand for food security, expansion of commercial farming, and adoption of smart irrigation technologies in countries such as India, China, and Australia

- The drip irrigation system segment held the largest market revenue share in 2024, driven by its ability to deliver water directly to the root zone, reduce wastage, and enhance crop yield. Drip systems are particularly preferred in water-scarce regions and for high-value crops, making them a favored choice among small and large-scale farms

Report Scope and Mechanized Irrigation Systems Market Segmentation

|

Attributes |

Mechanized Irrigation Systems Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

• Increasing Adoption Of Smart And IoT-Enabled Irrigation Systems |

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Mechanized Irrigation Systems Market Trends

Adoption of Smart and Automated Irrigation Technologies

- The increasing adoption of smart and automated irrigation systems is transforming traditional farming practices by enabling precise water management and reducing labor dependency. These systems help optimize water usage, improve crop yields, and enhance overall farm productivity. The integration of real-time sensors, cloud analytics, and AI-driven scheduling is further boosting efficiency and reducing human error in irrigation management

- Growing demand for resource-efficient irrigation in water-scarce and drought-prone regions is accelerating the deployment of mechanized irrigation solutions. Farmers are leveraging mobile-controlled and IoT-enabled systems to monitor soil moisture and schedule irrigation efficiently. In addition, remote monitoring capabilities allow agronomists to provide guidance and optimize irrigation across multiple farms simultaneously

- The affordability and ease of use of modern mechanized irrigation equipment are encouraging adoption among small and medium-sized farms. This leads to improved water conservation, reduced operational costs, and enhanced crop quality. Moreover, modular system designs and plug-and-play components make it easier for farmers to scale and adapt systems according to changing farm sizes and crop types

- For instance, in 2023, several agribusinesses in India implemented center-pivot and drip irrigation systems equipped with IoT sensors, resulting in significant water savings and higher yield per hectare. These deployments also reduced labor requirements and allowed precise nutrient application, boosting both operational efficiency and crop quality

- While mechanized irrigation systems enhance productivity and sustainability, their impact depends on continued innovation, maintenance support, and farmer training. Manufacturers are focusing on localized solutions to address diverse climatic and crop conditions, while collaborations with agri-tech startups are accelerating adoption of advanced, cost-effective solutions

Mechanized Irrigation Systems Market Dynamics

Driver

Increasing Water Scarcity and Need for Efficient Farm Management

- Rising water scarcity and changing climatic conditions are pushing governments and farmers to adopt efficient irrigation solutions. Mechanized systems reduce water wastage, improve crop health, and support sustainable agricultural practices. The adoption of predictive irrigation scheduling based on weather forecasting further enhances water use efficiency and mitigates crop stress

- The growing demand for high-value crops and increased focus on farm productivity are encouraging the adoption of precision irrigation systems. Farmers benefit from optimized water application, reduced fertilizer runoff, and improved operational efficiency. Integration with crop management software allows for better monitoring of irrigation schedules and maximizes overall yield potential

- Government subsidies, incentive programs, and awareness campaigns are further accelerating mechanized irrigation adoption, particularly in developing countries. Public-private partnerships are also promoting large-scale deployment of drip and sprinkler systems. These initiatives often include technical training programs for farmers to ensure effective system utilization and maintenance

- For instance, in 2022, several states in the U.S. rolled out subsidy programs for farmers adopting mechanized irrigation, boosting market demand and fostering water-efficient practices. Similar programs in Latin America and Southeast Asia have also accelerated the adoption of advanced irrigation systems, supporting sustainable agriculture goals

- While water scarcity and productivity needs drive market growth, manufacturers must address affordability, ease of operation, and maintenance challenges to sustain long-term adoption. Continuous development of low-cost, energy-efficient systems and modular components is key to reaching smaller farms and underserved regions

Restraint/Challenge

High Initial Costs and Technical Complexity

- The upfront investment for mechanized irrigation systems, including pumps, sprinklers, and control units, remains high, particularly for small and medium-sized farms. This limits adoption despite long-term savings on water and labor. Financing solutions, leasing models, and government incentives are becoming increasingly important to help overcome these cost barriers

- Complex installation, calibration, and maintenance requirements, along with the need for skilled personnel, can hinder widespread deployment. Farmers may face operational inefficiencies if not properly trained. Lack of standardized training modules and local service providers in rural areas further compounds these challenges, making continuous technical support critical

- Limited availability of spare parts and technical support in remote agricultural regions restricts adoption. Many farms still rely on traditional irrigation methods due to cost and accessibility constraints. Delays in repair or component replacement can disrupt irrigation schedules, negatively impacting crop productivity and water efficiency

- For instance, in 2023, several smallholder farms in Sub-Saharan Africa experienced delays in mechanized irrigation deployment due to high costs and lack of technical expertise. These issues resulted in prolonged reliance on traditional flood irrigation and inefficient water use

- While technology continues to evolve, addressing cost, training, and support challenges is crucial for unlocking the full potential of mechanized irrigation systems globally. Strengthening local service networks, developing low-maintenance systems, and introducing remote diagnostics and automation can help overcome these barriers

Mechanized Irrigation Systems Market Scope

The market is segmented on the basis of type and crop type.

• By Type

On the basis of type, the mechanized irrigation systems market is segmented into Drip Irrigation System, Sprinkler Irrigation System, and Others. The Drip Irrigation System segment held the largest market revenue share in 2024, driven by its ability to deliver water directly to the root zone, reduce wastage, and enhance crop yield. Drip systems are particularly preferred in water-scarce regions and for high-value crops, making them a favored choice among small and large-scale farms.

The Sprinkler Irrigation System segment is expected to witness the fastest growth rate from 2025 to 2032, owing to its versatility, ease of installation, and ability to cover large areas efficiently. Sprinkler systems are increasingly adopted for cereals, grains, and pasture crops, providing uniform water distribution while reducing manual labor and improving operational efficiency.

• By Crop Type

On the basis of crop type, the mechanized irrigation systems market is segmented into Cereals & Grains, Pulses & Oilseeds, Fruits & Vegetables, and Others. The Fruits & Vegetables segment held the largest revenue share in 2024, driven by the high water requirements and precision irrigation needs of horticultural crops. Mechanized systems in this segment enable better growth, higher yields, and improved crop quality.

The Cereals & Grains segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by the increasing adoption of mechanized irrigation in large-scale cereal farming operations. The use of automated systems allows for optimized water usage, reduced labor, and enhanced productivity, supporting sustainable and efficient agricultural practices.

Mechanized Irrigation Systems Market Regional Analysis

- North America dominated the mechanized irrigation systems market with the largest revenue share of 34.5% in 2024, driven by the increasing adoption of precision agriculture, government subsidies for efficient water management, and growing awareness of sustainable farming practices

- Farmers and agribusinesses in the region highly value the efficiency, water conservation benefits, and productivity improvements offered by mechanized irrigation systems such as drip and sprinkler setups

- This widespread adoption is further supported by advanced agricultural infrastructure, high investment capacity, and a focus on maximizing crop yields, establishing mechanized irrigation systems as a preferred solution across commercial farms and large-scale agricultural operations

U.S. Mechanized Irrigation Systems Market Insight

The U.S. mechanized irrigation systems market captured the largest revenue share in 2024 within North America, fueled by technological advancements in irrigation solutions and the growing focus on water-efficient farming practices. Farmers are increasingly adopting automated drip and sprinkler systems to optimize water usage, reduce labor dependency, and improve crop yield. Government initiatives promoting precision agriculture, combined with financial incentives and awareness campaigns, are further propelling market growth. Moreover, integration with IoT and remote monitoring platforms is enhancing the efficiency and adoption of mechanized irrigation solutions.

Europe Mechanized Irrigation Systems Market Insight

The Europe mechanized irrigation systems market is expected to witness the fastest growth rate from 2025 to 2032, primarily driven by increasing water scarcity, stringent environmental regulations, and the need for resource-efficient farming practices. Adoption is further encouraged by modern agricultural infrastructure, rising awareness of sustainable farming techniques, and demand for high-value crops. European farmers are increasingly deploying advanced irrigation systems in both small and large-scale farms to optimize water use and improve productivity.

U.K. Mechanized Irrigation Systems Market Insight

The U.K. mechanized irrigation systems market is expected to witness the fastest growth rate from 2025 to 2032, driven by the rising emphasis on precision farming, efficient water management, and sustainable crop production. Government-backed initiatives, coupled with financial support programs, are promoting the deployment of drip and sprinkler irrigation solutions. The integration of smart irrigation technologies with soil and climate monitoring systems is further supporting market expansion in both arable and horticultural sectors.

Germany Mechanized Irrigation Systems Market Insight

The Germany mechanized irrigation systems market is expected to witness the fastest growth rate from 2025 to 2032, fueled by technological innovation, advanced agricultural practices, and government policies encouraging water-efficient farming. Mechanized systems, particularly drip and sprinkler solutions, are gaining traction across both commercial and research-based farms. The country’s focus on sustainable agriculture and high-value crop production is driving the adoption of automated irrigation solutions, often integrated with precision monitoring tools.

Asia-Pacific Mechanized Irrigation Systems Market Insight

The Asia-Pacific mechanized irrigation systems market is expected to witness the fastest growth rate from 2025 to 2032, driven by rapid urbanization, increasing agricultural mechanization, and rising demand for food security in countries such as India, China, and Japan. Government initiatives promoting modern irrigation practices, coupled with growing farmer awareness of water conservation and yield optimization, are fueling market adoption. Furthermore, the region’s expanding agricultural machinery manufacturing base is improving accessibility and affordability of mechanized irrigation solutions.

Japan Mechanized Irrigation Systems Market Insight

The Japan mechanized irrigation systems market is expected to witness the fastest growth rate from 2025 to 2032 growth due to the country’s focus on high-tech agriculture, water-efficient practices, and advanced farming infrastructure. Farmers increasingly adopt drip and sprinkler systems integrated with IoT sensors to optimize water usage, reduce operational costs, and increase crop yields. Japan’s aging farming population is also driving demand for automated and easy-to-operate irrigation solutions that reduce labor requirements and improve efficiency across small and medium-scale farms.

China Mechanized Irrigation Systems Market Insight

The China mechanized irrigation systems market accounted for the largest market revenue share in Asia-Pacific in 2024, attributed to rapid agricultural modernization, water scarcity challenges, and high adoption rates of technology-driven farming solutions. Large-scale and commercial farms are increasingly implementing drip and sprinkler irrigation systems equipped with automation and monitoring tools to enhance water efficiency and productivity. Government support, along with a growing manufacturing base for irrigation equipment, is further propelling the market in China.

Mechanized Irrigation Systems Market Share

The Mechanized Irrigation Systems industry is primarily led by well-established companies, including:

- Lindsay Corporation (U.S.)

- Nelson Irrigation (U.S.)

- Jain Irrigation Systems Ltd (India)

- Rivulis (Israel)

- Mahindra & Mahindra Ltd. (India)

- Premier Irrigation Adritec (India)

- Rain Bird Corporation (U.S.)

- Mexichem S.A.B. de C.V. (Mexico)

- T-L Irrigation Co. (U.S.)

- Alkhorayef Group (Saudi Arabia)

- Hunter Industries (U.S.)

- The Toro Company (U.S.)

- Valmont Industries, Inc. (U.S.)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.