Global Mecoprop Market

Market Size in USD Billion

CAGR :

%

USD

1.56 Billion

USD

2.21 Billion

2024

2032

USD

1.56 Billion

USD

2.21 Billion

2024

2032

| 2025 –2032 | |

| USD 1.56 Billion | |

| USD 2.21 Billion | |

|

|

|

|

Mecoprop Market Size

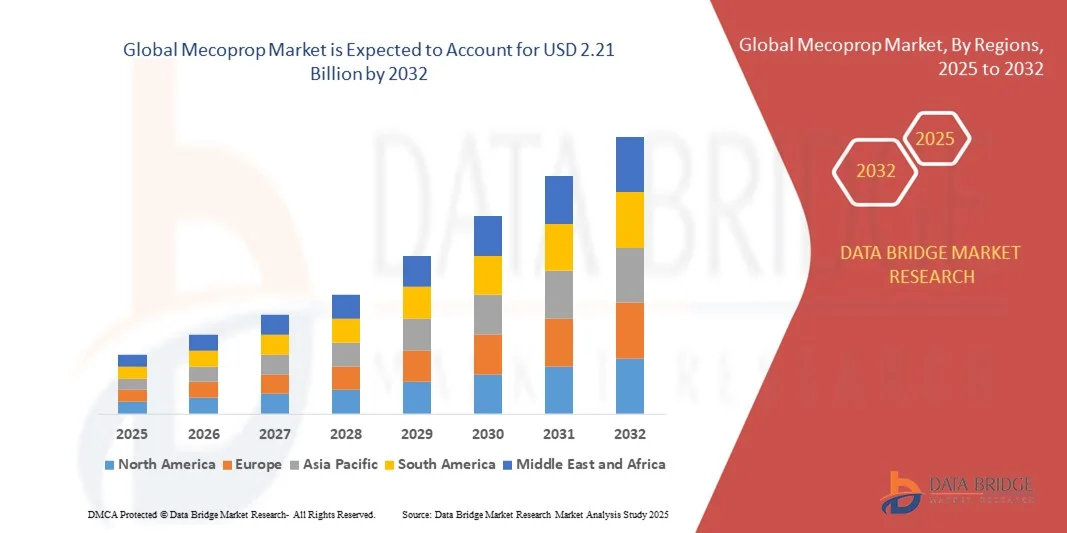

- The global mecoprop market size was valued at USD 1.56 billion in 2024 and is expected to reach USD 2.21 billion by 2032, at a CAGR of 4.50% during the forecast period

- The market growth is largely fueled by the rising demand for selective herbicides to control broadleaf weeds across various crops, ensuring higher yield and efficient land utilization in modern agriculture. The expanding use of Mecoprop in both agricultural and non-agricultural areas, such as turf and landscaping, is further supporting its growing adoption globally

- Furthermore, increasing investment in research and formulation technology by leading agrochemical companies is enhancing product performance and environmental safety. For instance, BASF SE and Bayer AG are focusing on developing advanced, low-toxicity Mecoprop formulations to meet stringent regulatory standards and promote sustainable weed management practices

Mecoprop Market Analysis

- Mecoprop, a widely used selective herbicide, plays a crucial role in controlling broadleaf weeds in cereal, turf, and horticultural crops, offering efficient weed suppression while maintaining crop safety. Its versatility and proven effectiveness have made it a preferred choice for both agricultural and commercial landscaping applications

- The growing Mecoprop market is primarily driven by the rising focus on sustainable crop protection, technological advancements in agrochemical formulation, and increasing adoption of modern farming techniques aimed at improving productivity and environmental compliance

- Asia-Pacific dominated the mecoprop market with a share of 42.5% in 2024, due to expanding agricultural production, increasing adoption of chemical weed control, and the rising need for effective herbicide solutions across developing economies

- North America is expected to be the fastest growing region in the mecoprop market during the forecast period due to high adoption of advanced weed control technologies, strong agricultural productivity, and growing demand for selective herbicides

- Herbicide segment dominated the market with a market share of 72.1% in 2024, due to the extensive use of Mecoprop-based formulations for controlling annual and perennial broadleaf weeds in cereal crops, grasslands, and non-crop areas. The compound’s effectiveness in enhancing crop quality and yield while minimizing competition from unwanted vegetation has strengthened its market position. Its integration into tank mixes and compatibility with other herbicides have also driven large-scale usage in conventional and commercial farming

Report Scope and Mecoprop Market Segmentation

|

Attributes |

Mecoprop Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Mecoprop Market Trends

Growing Shift Toward Eco-Friendly Herbicide Formulations

- The global mecoprop market is gradually shifting toward environmentally friendly and sustainable herbicide formulations in response to increasing regulatory scrutiny and rising awareness of ecological safety. Manufacturers are focusing on developing biodegradable and low-toxicity variants that reduce environmental residue while maintaining weed control efficiency in agricultural and turf management applications

- For instance, Nufarm Limited has been advancing its portfolio of selective herbicides by incorporating eco-compatible mecoprop-based formulations designed to minimize soil and water contamination while preserving biodiversity in treated areas. Such innovations reflect an industry-wide transition toward green chemistry practices aimed at balancing performance with environmental responsibility

- Research efforts are intensifying to enhance formulation stability and improve herbicide uptake mechanisms under varying climatic conditions. The development of water-based and reduced-solvent mecoprop formulations is supporting improved safety profiles and easier handling for farmers and commercial applicators

- The adoption of precision agriculture technologies is further promoting the shift toward efficient herbicide use. By integrating mecoprop formulations with sensor-based and automated spraying systems, producers can precisely target weed populations, minimizing chemical wastage and improving sustainability outcomes in crop protection

- Companies are increasingly investing in collaborative R&D partnerships to develop integrated weed management solutions combining mecoprop with other selective herbicides and adjuvants for better spectrum control. For instance, Corteva Agriscience has been evaluating synergistic combinations of mecoprop with 2,4-D for reduced application frequency and improved field efficacy

- The continued shift toward eco-friendly mecoprop formulations underscores the industry's focus on sustainable agriculture. As environmental performance becomes a key driver in agrochemical innovation, these advanced formulations will play an essential role in supporting efficient weed management while aligning with evolving global environmental standards

Mecoprop Market Dynamics

Driver

Rising Demand for Broadleaf Weed Control in Major Crops

- The increasing prevalence of broadleaf weeds in cereal and oilseed crops is driving strong demand for mecoprop-based herbicides across global agricultural markets. Mecoprop’s selective action and compatibility with other herbicides make it an effective solution for maintaining crop yields and preventing weed resistance development in intensive farming systems

- For instance, BASF SE has expanded its herbicide offerings to include mecoprop formulations specifically targeted at controlling broadleaf weeds in wheat, barley, and corn. These products provide farmers with versatile and cost-effective options for integrated weed management in both pre- and post-emergence applications

- The expansion of mechanized and large-scale farming across regions such as North America, Europe, and Asia-Pacific is reinforcing the need for reliable herbicide solutions capable of ensuring consistent weed suppression across diverse climatic zones. Mecoprop’s adaptability to different soil types and tank-mix compatibility enhance its application flexibility for farmers

- Rising adoption of high-yield hybrid crop varieties has also intensified weed competition, increasing the reliance on selective herbicides for optimal field productivity. The cost-effectiveness and established performance record of mecoprop make it a preferred choice among farmers seeking long-term weed control solutions

- As global agricultural production continues to intensify, the demand for effective broadleaf weed management will remain a primary growth driver for the mecoprop market. Continued technological advancements and formulation improvements are expected to further strengthen mecoprop’s position in sustainable and integrated weed management systems

Restraint/Challenge

Strict Regulations on Chemical Herbicide Use

- The tightening of regulatory frameworks governing chemical herbicides presents a significant restraint to the global mecoprop market. Authorities in several regions are implementing stringent guidelines to restrict the use of synthetic herbicides due to their environmental persistence and potential impact on non-target organisms

- For instance, the European Food Safety Authority (EFSA) and the U.S. Environmental Protection Agency (EPA) have established strict limits on permissible residue levels and application rates for phenoxy herbicides, including mecoprop. Such regulations often require extensive product re-registration and compliance testing, increasing operational overhead for manufacturers

- Public concern over groundwater contamination and biodiversity loss is prompting policymakers to prioritize sustainable alternatives, thereby limiting the long-term market expansion of traditional mecoprop formulations. Regulatory reviews and phase-out schedules also delay product approvals and increase costs for producers

- Adherence to evolving toxicological and environmental safety norms requires continued R&D investment to reformulate existing products and ensure compliance with national and international regulatory benchmarks. This can hinder market entry for smaller agrochemical firms lacking sufficient R&D infrastructure

- To overcome these regulatory challenges, key companies are investing in the development of low-residue, high-efficiency formulations and are focusing on expanding biobased product portfolios. The successful alignment of product innovation with environmental policy frameworks will be essential for sustaining long-term growth and competitiveness in the mecoprop herbicide market

Mecoprop Market Scope

The market is segmented on the basis of form, application, and end use.

- By Form

On the basis of form, the Mecoprop market is segmented into Mecoprop and Mecoprop-P. The Mecoprop segment dominated the market with the largest revenue share in 2024 due to its wide application in controlling broadleaf weeds across cereals, turf, and lawns. Its effectiveness in mixed herbicide formulations and cost efficiency has led to consistent adoption in large-scale farming operations. Farmers prefer Mecoprop because of its compatibility with other phenoxy herbicides, enabling enhanced weed management and yield optimization across different crop types. The segment also benefits from long-established commercial use and regulatory acceptance in major agricultural economies.

The Mecoprop-P segment is anticipated to witness the fastest growth rate from 2025 to 2032, driven by its higher herbicidal activity and reduced environmental impact compared to conventional Mecoprop. It is increasingly preferred in precision agriculture for targeted weed control, aligning with global sustainability goals and stringent regulatory standards. Mecoprop-P’s ability to provide effective weed management at lower dosages reduces chemical load on soil, promoting eco-friendly farming practices. The growing demand for selective and efficient herbicides in developed markets further supports its accelerated growth.

- By Application

On basis of application, the Mecoprop market is segmented into herbicide, pesticide, and others. The herbicide segment dominated the market with the largest revenue share of 72.1% in 2024 owing to the extensive use of Mecoprop-based formulations for controlling annual and perennial broadleaf weeds in cereal crops, grasslands, and non-crop areas. The compound’s effectiveness in enhancing crop quality and yield while minimizing competition from unwanted vegetation has strengthened its market position. Its integration into tank mixes and compatibility with other herbicides have also driven large-scale usage in conventional and commercial farming.

The pesticide segment is expected to witness the fastest growth rate from 2025 to 2032, supported by the increasing need for versatile chemical agents that provide dual benefits of pest and weed management. The shift toward integrated pest management (IPM) practices is promoting the use of Mecoprop-based pesticides due to their stability and lower phytotoxicity. Furthermore, growing demand for multifunctional agrochemicals in horticulture and turf management sectors is fostering innovation in Mecoprop formulations designed for broader pest control applications.

- By End Use

On the basis of end use, the Mecoprop market is segmented into agricultural, non-agricultural, and others. The agricultural segment dominated the market with the largest revenue share in 2024 due to extensive utilization in cereal, corn, and turf crop production. Farmers rely on Mecoprop for its proven efficacy against broadleaf weeds, ensuring improved crop productivity and reduced manual labor costs. The segment’s growth is further strengthened by the rising adoption of chemical weed control methods in emerging agricultural economies and the increasing focus on crop protection to enhance food security.

The non-agricultural segment is anticipated to record the fastest growth from 2025 to 2032, propelled by expanding use in urban landscapes, golf courses, sports fields, and public green areas. Mecoprop’s ability to provide quick, visible control of invasive weed species makes it a preferred choice for municipal and commercial landscaping applications. Growing investments in turf and ornamental plant management, coupled with the trend of sustainable landscape maintenance, are likely to drive consistent demand for Mecoprop in this category.

Mecoprop Market Regional Analysis

- Asia-Pacific dominated the mecoprop market with the largest revenue share of 42.5% in 2024, driven by expanding agricultural production, increasing adoption of chemical weed control, and the rising need for effective herbicide solutions across developing economies

- The region’s strong agrochemical manufacturing base, growing government initiatives to enhance crop yield, and the presence of major market participants are fueling regional expansion

- Rapid industrialization, large-scale farming practices, and the adoption of advanced crop protection technologies are further contributing to the high consumption of Mecoprop across the Asia-Pacific region

China Mecoprop Market Insight

China held the largest share in the Asia-Pacific Mecoprop market in 2024, owing to its strong agricultural sector and significant production capacity for herbicides and agrochemicals. The country’s vast cultivation area, coupled with increasing adoption of modern weed management techniques, supports consistent demand for Mecoprop. Government support for high-efficiency and environment-friendly crop protection chemicals further accelerates domestic market growth, making China a leading producer and consumer of Mecoprop-based products.

India Mecoprop Market Insight

India is witnessing the fastest growth in the Asia-Pacific Mecoprop market, driven by increasing agricultural activities, rising awareness of weed control benefits, and growing government support for improving crop productivity. Initiatives promoting sustainable farming and the expansion of agrochemical manufacturing under the “Make in India” campaign are strengthening market prospects. The rising need for selective herbicides that support higher yield with minimal crop damage is also propelling Mecoprop demand in the country.

Europe Mecoprop Market Insight

The Europe Mecoprop market is expanding steadily, supported by strong regulatory frameworks promoting safe herbicide use, high adoption of advanced crop protection products, and an established agricultural infrastructure. The region focuses on sustainable farming practices and eco-friendly formulations to comply with stringent environmental standards. The growing demand for selective herbicides across turf management and cereal production is further enhancing Mecoprop consumption in Europe.

Germany Mecoprop Market Insight

Germany’s Mecoprop market is driven by its leadership in agricultural innovation, precision farming, and sustainable crop management. The country’s advanced research capabilities and strict adherence to environmental standards foster the use of low-impact, high-performance herbicides such as Mecoprop. Increasing application across cereals, turf, and grasslands, along with growing emphasis on productivity enhancement, continues to support Germany’s dominant position within the European market.

U.K. Mecoprop Market Insight

The U.K. market is supported by growing emphasis on sustainable land management, turf maintenance, and agricultural efficiency. The post-Brexit focus on self-sufficiency in agrochemical supply chains has encouraged greater domestic production and adoption of effective herbicides. Expanding horticultural applications and continuous innovation in selective weed control are driving steady Mecoprop demand in the U.K. agricultural and non-agricultural sectors.

North America Mecoprop Market Insight

North America is projected to grow at the fastest CAGR from 2025 to 2032, driven by high adoption of advanced weed control technologies, strong agricultural productivity, and growing demand for selective herbicides. Widespread use of Mecoprop in turf, lawn, and cereal crop management, along with increasing investments in sustainable agrochemical solutions, is boosting market expansion. The region’s well-developed distribution networks and focus on modern farming practices further reinforce its growth trajectory.

U.S. Mecoprop Market Insight

The U.S. accounted for the largest share in the North America Mecoprop market in 2024, supported by large-scale agricultural operations, robust R&D infrastructure, and strong focus on productivity improvement. High demand from both agricultural and landscaping sectors, along with innovations in herbicide formulations, sustains market leadership. Regulatory initiatives promoting efficient and environmentally safe herbicide use are also fostering Mecoprop adoption across key farming regions.

Mecoprop Market Share

The mecoprop industry is primarily led by well-established companies, including:

- BASF SE (Germany)

- Nufarm (Australia)

- Bayer AG (Germany)

- The Dow Chemical Company (U.S.)

- Syngenta (Switzerland)

- DuPont (U.S.)

- FMC Corporation (U.S.)

- ADAMA (Israel)

- MARUWA Biochemical Co., Ltd. (Japan)

- BOC Sciences (U.S.)

- Conier Chem & Pharma Limited (China)

- TRC-Canada (Canada)

- DAYANG CHEM (HANGZHOU) CO., LTD. (China)

- Henan Allgreen Chemical Co., Ltd. (China)

- Angene (China)

- Alfa Chemistry (U.S.)

- Interchim (France)

- Caledon Laboratories (Canada)

- Apollo Scientific Ltd (U.K.)

- VWR International, LLC (U.S.)

Latest Developments in Global Mecoprop Market

- In September 2025, 6W Research highlighted increased investments in eco-friendly Mecoprop formulations across the Philippines, driven by partnerships between agrochemical manufacturers, local distributors, and farming cooperatives. This development reflects a regional shift toward sustainable weed control practices that minimize chemical residue and soil degradation. It also signifies growing governmental and private-sector commitment to developing safer herbicide options suited for tropical agriculture, which is expected to significantly enhance Mecoprop’s penetration across Southeast Asian markets. By aligning with global sustainability goals, this initiative strengthens the region’s position as a fast-emerging market for bio-compatible herbicides

- In September 2025, Syngenta AG completed the acquisition of Italian biostimulant manufacturer Valagro S.p.A., marking a strategic expansion into sustainable crop protection solutions. This acquisition enhances Syngenta’s ability to integrate Mecoprop-based formulations into broader eco-friendly herbicide portfolios. The move strengthens the company’s presence in selective herbicides while aligning with global agricultural trends emphasizing reduced environmental impact and sustainable weed management practices

- In June 2024, Loveland Products Canada Inc. secured updated regulatory approval for its “Mecoprop-P Herbicide Liquid” (Reg. No. 27891), allowing broader application across turf and cereal crops. This revision enables expanded commercial use in both agricultural and non-agricultural sectors, including golf courses, lawns, and public green areas. The development underscores growing demand in North America for low-toxicity, selective herbicides that ensure high efficiency and environmental compliance. It also positions Loveland as a key player in advancing next-generation herbicide solutions catering to the dual needs of productivity and sustainability

- In March 2024, the U.S. Environmental Protection Agency (EPA) concluded a registration review for the EH1368 Weed & Feed product containing Mecoprop-P and 2,4-DP-P, marking a key regulatory advancement. This approval ensures continued market availability for dual-action herbicide formulations and strengthens compliance frameworks for U.S. manufacturers. It also provides a foundation for future innovation in multi-active herbicide blends, driving growth in residential and commercial lawn care markets

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Mecoprop Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Mecoprop Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Mecoprop Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.