Global Medical Batteries Market

Market Size in USD Billion

CAGR :

%

USD

1.98 Billion

USD

2.95 Billion

2024

2032

USD

1.98 Billion

USD

2.95 Billion

2024

2032

| 2025 –2032 | |

| USD 1.98 Billion | |

| USD 2.95 Billion | |

|

|

|

|

Medical Batteries Market Analysis

The medical batteries market is experiencing significant growth, driven by the rising adoption of advanced medical devices and increasing demand for home healthcare solutions. Medical batteries are critical components in a wide range of devices, including implantable cardiac devices, ventilators, infusion pumps, and portable monitoring systems. The market's expansion is fueled by the growing prevalence of chronic diseases, aging populations worldwide, and advancements in medical technology requiring reliable and efficient power solutions. Lithium-ion and lithium-manganese dioxide batteries dominate the market due to their high energy density, long lifecycle, and lightweight properties. Innovations in battery chemistry, such as solid-state batteries, are further enhancing device performance and patient safety. Additionally, regulatory requirements for medical device safety and reliability are driving manufacturers to develop more robust and sustainable battery technologies.

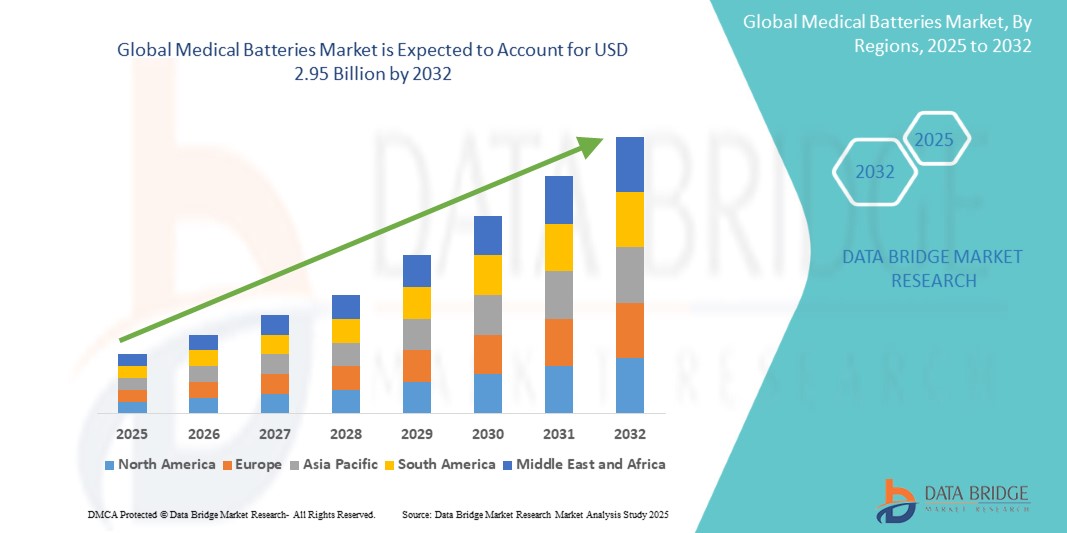

Medical Batteries Market Size

Global medical batteries market size was valued at USD 1.98 billion in 2024 and is projected to reach USD 2.95 billion by 2032, with a CAGR of 5.2% during the forecast period of 2025 to 2032. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

Medical Batteries Market Trends

“Shift Toward Rechargeable Lithium-Ion Batteries in Medical Devices”

The shift toward rechargeable lithium-ion batteries in the global medical batteries market is a notable trend driven by several factors. Lithium-ion batteries are increasingly preferred in medical devices due to their superior energy density, extended lifespan, and lightweight design. These features make them particularly suitable for advanced, portable, and implantable medical equipment such as pacemakers, defibrillators, and portable monitors. The shift is primarily motivated by the need for reliable, efficient, and compact power solutions in modern healthcare technologies.

Rechargeable lithium-ion batteries offer numerous advantages, including longer operational life, the ability to be recharged multiple times, and minimal maintenance requirements compared to traditional disposable batteries. This makes them ideal for devices that require long-term power support and high performance in critical medical applications. Moreover, the trend aligns with the industry’s focus on reducing waste and enhancing the sustainability of medical devices. Regulatory pressures and increasing patient demand for convenience and safety are further accelerating the adoption of lithium-ion batteries in medical applications.

Report Scope and Medical Batteries Market Segmentation

|

Attributes |

Medical Batteries Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

U.S., Canada, Mexico, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific, Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of Middle East and Africa, Brazil, Argentina, Rest of South America |

|

Key Market Players |

Panasonic Holdings Corporation (Japan), Maxell Ltd. (Japan), Murata Manufacturing, Ltd. (Japan), EnerSys (U.S.), Energizer Holdings, Inc. (U.S.), Arotech Corporation (U.S.), Camelion Battery Co., Ltd. (China), Duracell Inc. (U.S.), EaglePicher Technologies LLC (U.S.), Guangzhou Battsys Co., Ltd. (China), Renata SA (Switzerland), Saft (France), Tadiran Batteries Ltd. (Israel), Toshiba Corporation (Japan), Ultralife Corporation (U.S.), Varta AG (Germany), Videndum Plc (U.K.) among others. |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Medical Batteries Market Definition

Medical batteries are specialized power sources designed for use in medical devices. They provide the necessary energy to operate equipment such as pacemakers, defibrillators, infusion pumps, and portable monitors. These batteries are typically lithium-ion or lithium-manganese dioxide due to their high energy density, longer life span, and lightweight nature. They are engineered to meet strict safety and performance standards required by medical regulations, ensuring reliable operation in critical healthcare applications. The use of rechargeable medical batteries is increasingly common, driven by advancements in battery technology and the need for portable, long-lasting medical devices.

Medical Batteries Market Dynamics

Drivers

- Growing Demand for Portable and Implantable Medical Devices

The increasing prevalence of chronic diseases such as diabetes, cardiovascular conditions, and respiratory disorders has driven the adoption of portable and implantable medical devices. These devices, such as insulin pumps, pacemakers, and defibrillators, require high-performance, long-lasting batteries, fuelling market growth. The growing demand for portable and implantable medical devices is a significant driver of the global medical batteries market. These devices require high-performance, long-lasting batteries to ensure reliability and uninterrupted functionality, which is fueling the market's growth.

- Advancements in Battery Technology

Continuous innovations in battery technologies, particularly lithium-ion batteries, have enhanced energy density, extended lifespan, and improved safety features. These advancements support the growing need for compact, efficient, and reliable power solutions in modern medical devices, boosting the global medical batteries market.

For instance, in May 2023, Medtronic plc, a one of global leader in healthcare technology, announced it has received U.S. Food and Drug Administration (FDA) approval of its Micra AV2 and Micra VR2, the next generation of its industry-leading miniaturized, leadless pacemakers.

Micra AV2 and Micra VR2, the world's smallest pacemakers, provide longer battery life and easier programming than prior Micra pacemakers, while still delivering the many benefits of leadless pacing such as reduced complications compared to traditional pacemakers.

This advancement significantly reduces the need for frequent surgical replacements, enhancing patient outcomes and reducing healthcare costs. The progress in battery miniaturization and increased energy density also enables compact designs, critical for implantable medical devices like continuous glucose monitors (CGMs) and cochlear implants.

Opportunities

- Growth of Wearable Health Devices

The growth of wearable health devices is significantly influencing the demand for specialized medical batteries. As consumers increasingly prioritize personal health management, devices like smartwatches, fitness trackers, and continuous glucose monitors (CGMs) are becoming more popular. These devices continuously track vital health metrics, requiring a reliable, long-lasting, and compact power source to ensure uninterrupted monitoring. Medical batteries play a crucial role in supporting these wearables, with a strong preference for those that offer high energy density and extended life cycles. The wearable health technology market’s expansion presents a significant opportunity for medical battery manufacturers to cater to these evolving power needs, particularly as consumers seek devices that can operate effectively without frequent charging.

- Advancement in Solid-State Battery Technology

The development of solid-state lithium batteries presents a significant opportunity for the medical batteries market. These batteries offer several advantages over traditional lithium-ion batteries, including faster charging, higher energy density, longer shelf life, and improved safety. The potential use of solid-state technology in implantable devices like pacemakers and hearing aids, which require small, durable, and reliable power sources, is expected to revolutionize the market. Additionally, solid-state batteries' ability to withstand higher temperatures and their longer operational lifespan position them as a key innovation in the medical device sector.

For instance, companies such as Ensurge Micropower are at the forefront of this technology, working on solid-state lithium microbatteries that are not only safer but also offer higher energy density, longer shelf life, and faster charging. These advancements are particularly significant for medical devices such as pacemakers and neurostimulators, which require compact and long-lasting power sources. The solid-state batteries are expected to provide improved safety, eliminating risks associated with liquid electrolytes in traditional batteries.

Advances in battery technology, such as lithium-ion and solid-state batteries, are helping to meet these demands by providing a balance of power and longevity. These innovations enable longer device operation times between charges, which is critical for the user experience and device functionality. Thus, the advances in battery technology provides opportunity for the growth of medical batteries market

Restraints/Challenges

- Regulatory Compliance and Safety Standards

Stringent regulatory requirements for safety and performance standards is the major challenge for medical batteries market. Medical devices, including those powered by batteries, must meet strict guidelines set by organizations like the FDA (U.S. Food and Drug Administration) and European Medicines Agency (EMA). These regulations ensure that batteries used in medical devices are safe, reliable, and effective. The complexity and cost of meeting these regulations can delay the time to market and increase development costs for manufacturers. For instance, ISO 13485, which dictates stringent quality management systems (QMS) for medical device manufacturers, including those producing medical batteries. This certification ensures that the products meet customer and regulatory demands consistently, which can be challenging due to the complexity of maintaining documentation, cleanliness, and performance standards. The medical battery industry must navigate these regulatory hurdles to ensure product safety and effectiveness, particularly in high-risk devices like pacemakers or insulin pumps.

- Battery Life and Reliability in Implantable Devices

Ensuring long-lasting and reliable performance in implantable medical devices, such as pacemakers and neurostimulators, remains a significant challenge. These devices require batteries that can function effectively over many years in environments where access for maintenance or replacement is limited. Current battery technologies, such as lithium-ion, are efficient but still prone to degradation over time. This degradation can lead to reduced device performance and increased risk of failure as the batteries age.

Developing longer-lasting batteries that do not compromise on size or safety is a critical hurdle for manufacturers. Innovations in battery technology, including solid-state batteries and new chemistries, are being explored to address these challenges. Solid-state batteries, for instance, offer higher energy densities and greater safety compared to traditional lithium-ion batteries. However, they are still in the early stages of development for medical applications and face hurdles such as cost, manufacturability, and regulatory approval. The industry is also exploring alternative chemistries and configurations to extend battery life without increasing the size or weight of implantable devices.

Medical Batteries Market Scope

The market is segmented on the basis of product, capacity, application, and end users. The growth amongst these segments will help you analyse meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Product

- Lithium Batteries

- Li Metal Batteries

- Li-ion Batteries

- Alkaline Batteries

- Zinc Air Batteries

- Nickel Metal Hydride Batteries

- Other Batteries

Capacity

- 600 mAh Or Below

- 600 – 1,200 mAh

- 1,200 mAh Or More

Application

- Implantable Medical Devices

- Non-implantable Medical Devices

End User

- Hospitals

- Home Healthcare Settings

- Ambulatory Surgical Centers

- Research Institutes

Medical Batteries Market Regional Analysis

The market is analyzed and market size insights and trends are provided by country, product, capacity, application, and end user as referenced above.

The countries covered in the market are U.S., Canada, Mexico, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, rest of Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, rest of Asia-Pacific, Saudi Arabia, U.A.E., South Africa, Egypt, Israel, rest of Middle East and Africa, Brazil, Argentina, and rest of South America.

North America is expected to dominate the market due to advancements in medical device technology and high prevalence of chronic diseases, presence of key players. Additionally, the high awareness and high adoption rate of wearable medical device are expected to further fuel the market's growth.

Asia-Pacific is expected to be the fastest growing due to the region's rapidly increasing population. Government initiatives and investments aimed at modernizing patient care sector, along with increasing awareness among people about the benefits of advanced medical device are contributing to the market's expansion.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Medical Batteries Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Medical Batteries Market Leaders Operating in the Market Are:

- Panasonic Holdings Corporation (Japan)

- Maxell Ltd. (Japan)

- Murata Manufacturing, Ltd. (Japan)

- EnerSys (U.S.)

- Energizer Holdings, Inc. (U.S.)

- Arotech Corporation (U.S.)

- Camelion Battery Co., Ltd. (China)

- Duracell Inc. (U.S.)

- EaglePicher Technologies LLC (U.S.)

- Guangzhou Battsys Co., Ltd. (China)

- Renata SA (Switzerland)

- Saft (France)

- Tadiran Batteries Ltd. (Israel)

- Toshiba Corporation (Japan)

- Ultralife Corporation (U.S.)

- Varta AG (Germany)

- Videndum Plc (U.K.)

Latest Developments in Medical Batteries Market

- October 2024, Murata Manufacturing (Japan) expanded its silicon capacitor production capabilities by introducing a new 200-mm mass production line in Caen, France. This expansion aims to meet growing global demand for advanced capacitor solutions

- May 2024, EnerSys (U.S.) announced the acquisition of Bren-Tronics, Inc., a leading provider of portable power solutions for military and defense sectors. This strategic acquisition is expected to bolster EnerSys' Specialty Aerospace & Defense division, enhancing revenue and profitability from lithium-based products by expanding its presence in critical defense applications

- March 2021, Duracell, the most trusted battery brand, announced today that it is teaming up with The American Academy of Pediatrics (AAP) to help educate parents and caregivers about the importance of lithium coin battersy safety to help prevent accidental lithium coin battery ingestions. With families spending more time at home combining work and home life into one, lithium coin battery safety is more essential than ever

- In November 2021, Renesas Electronics Corporation, a premier supplier of advanced semiconductor solutions, introduced a new family of multi-cell full battery front end (BFE) ICs for battery management systems (BMS) built for the larger, high-voltage battery packs that power e-scooters, energy storage, high-voltage power tools, and other high-voltage equipment. The new ICs provide fast, flexible, cell balancing up to 200 mA+, a critical function to enable fast recharging and high utilization in large battery packs with hot plug tolerance up to 62V

- In April 2024, Renesas Electronics Corporation, a premier supplier of advanced semiconductor solutions, today introduced the RA0 microcontroller (MCU) Series based on the Arm Cortex-M23 processor. The new, low-cost RA0 devices offer the industry’s lowest overall power consumption for general purpose 32-bit MCUs. The RA0 devices consume only 84.3μA/MHz of current in active mode and only 0.82 mA in sleep mode

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.