Global Medical Billing Outsourcing Market

Market Size in USD Billion

CAGR :

%

USD

3.07 Billion

USD

7.77 Billion

2024

2032

USD

3.07 Billion

USD

7.77 Billion

2024

2032

| 2025 –2032 | |

| USD 3.07 Billion | |

| USD 7.77 Billion | |

|

|

|

|

Medical Billing Outsourcing Market Size

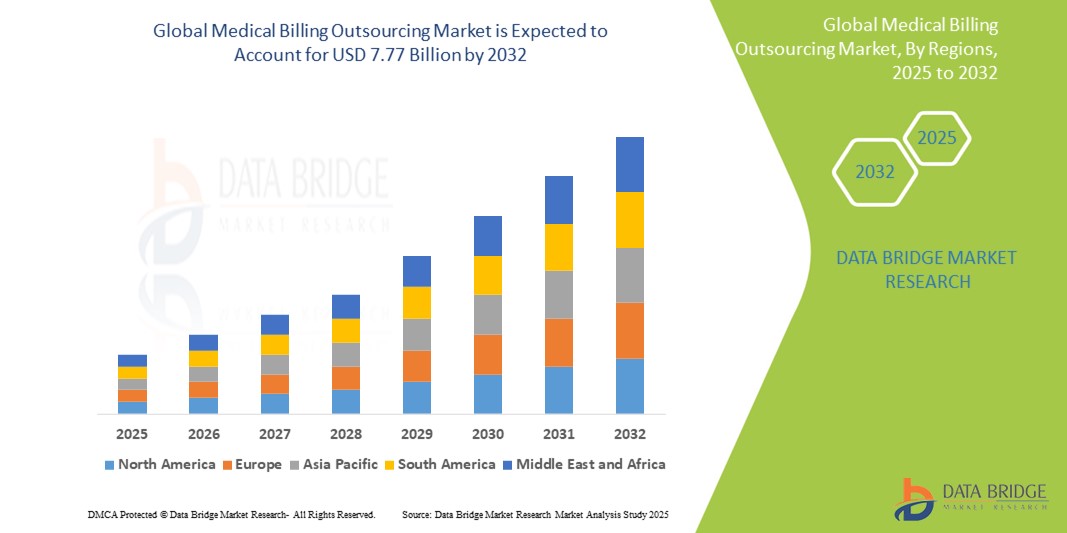

- The global medical billing outsourcing market was valued at USD 3.07 billion in 2024 and is expected to reach USD 7.77 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 12.3%, primarily driven by the by increasing healthcare cost pressures, the complexity of billing processes.

- This growth is driven by factors such as the rising need to reduce administrative burdens on healthcare providers, increasing demand for error-free and faster billing processes, and the expansion of healthcare infrastructure globally

Medical Billing Outsourcing Market Analysis

- Medical billing outsourcing involves contracting third-party service providers to manage complex billing processes, ensuring accurate claims processing, coding, and revenue cycle management for healthcare providers. It enhances efficiency and minimizes billing errors across hospitals, clinics, and physician practices

- The demand for medical billing outsourcing is significantly driven by the increasing administrative burden on healthcare providers, growing need to improve operational efficiency, and the rising incidence of billing-related errors

- North America stands out as one of the dominant regions for medical billing outsourcing, driven by its complex healthcare reimbursement structures, the presence of large healthcare providers, and widespread adoption of digital health technologies

- For instance, in the U.S., the growing use of electronic health records (EHRs) and the pressure to comply with evolving billing regulations have accelerated the adoption of outsourcing to specialized billing firms that ensure compliance and cost-efficiency

- Globally, medical billing outsourcing is regarded as a strategic move for healthcare providers to focus. on core clinical operations while ensuring faster reimbursements, reduced denials, and improved revenue cycle management

Report Scope and Medical Billing Outsourcing Market Segmentation

|

Attributes |

Medical Billing Outsourcing Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Medical Billing Outsourcing Market Trends

“Shift Toward Cloud-Based Solutions and Automation”

- One prominent trend in the global medical billing outsourcing market is the increasing shift toward cloud-based solutions and automation technologies

- These advancements streamline the billing process by offering centralized, accessible data management, improved data security, and real-time updates, reducing the risk of errors and improving operational efficiency

- For instance, cloud-based billing platforms allow healthcare providers to access billing data remotely, enabling faster claim submissions and reducing delays in reimbursement processing. Automation tools, such as AI-powered coding and claim submission, significantly reduce human error and enhance accuracy in medical billing

- Automation also allows for improved denial management, automated claim follow-ups, and more accurate revenue cycle tracking, ensuring timely payments and reducing administrative costs

- This trend is transforming the medical billing landscape, making the outsourcing process more efficient, cost-effective, and aligned with the digital transformation in the healthcare industry

Medical Billing Outsourcing Market Dynamics

Driver

“Rising Administrative Burden and Regulatory Complexity in Healthcare”

- The increasing administrative burden on healthcare providers, combined with growing regulatory complexities, is a major driver for the medical billing outsourcing market. As healthcare systems become more intricate, accurate billing and coding have become essential to maintain financial sustainability

- Navigating changing reimbursement models, evolving coding standards (such as ICD-11 and CPT updates), and payer-specific requirements often overwhelms in-house billing departments, leading to errors and claim denials

- Outsourcing medical billing allows healthcare facilities to reduce operational inefficiencies, lower overhead costs, and focus. more on patient care, while ensuring billing compliance and faster reimbursements

- In addition, the transition to value-based care and integration of electronic health records (EHRs) has added layers of complexity, making specialized billing services even more vital for accuracy and streamlined revenue cycle management

- As providers seek to optimize their financial performance without compromising patient services, the demand for expert medical billing outsourcing partners continues to grow rapidly

For instance,

- In March 2023, a report by the American Medical Association highlighted that over 60% of physicians face increasing stress due to administrative tasks such as billing and coding, prompting a shift toward outsourcing these services for improved efficiency and compliance

- In September 2022, the Healthcare Financial Management Association reported that outsourcing billing functions reduced claim denial rates by up to 25% for U.S.-based hospitals, showcasing the tangible benefits of outsourced billing services

- As healthcare organizations strive to enhance revenue cycle performance and cope with administrative pressures, medical billing outsourcing emerges as a strategic solution driving market growth

Opportunity

“Leveraging Artificial Intelligence and Analytics to Optimize Revenue Cycle Management”

- The integration of artificial intelligence (AI) and advanced analytics presents a significant opportunity in the medical billing outsourcing market, enabling providers to streamline billing operations, reduce errors, and enhance revenue cycle performance

- AI-driven platforms can automate critical billing functions such as medical coding, claims submission, and denial management, while predictive analytics helps identify patterns in claim rejections and optimize billing practices accordingly

- These technologies also support real-time data analysis, enabling proactive decision-making, fraud detection, and financial forecasting, which are increasingly valued in a healthcare environment focused on efficiency and compliance.

For instance,

- In February 2024, a report published by Health IT Analytics highlighted that AI integration in medical billing reduced denial rates by 35% and improved claim processing times by over 50%, significantly boosting the financial health of healthcare providers

- In October 2023, according to an article by Becker’s Hospital Review, several leading U.S. healthcare systems adopted AI-enhanced billing platforms that provided real-time revenue insights and helped predict reimbursement delays, allowing for faster corrective action

- The adoption of AI not only minimizes manual interventions but also ensures higher accuracy, faster reimbursements, and improved patient satisfaction through smoother administrative experiences. As result, AI and analytics are reshaping the future of medical billing outsourcing, offering a key growth opportunity for vendors and providers alike

Restraint/Challenge

“Data Security and Privacy Concerns in Outsourced Billing”

- The data security and patient privacy concerns present a significant challenge for the medical billing outsourcing market, particularly as providers handle vast volumes of sensitive patient health information (PHI)

- Outsourcing medical billing to third-party vendors increases the risk of data breaches, unauthorized access, and non-compliance with regulatory frameworks such as HIPAA in the U.S. and GDPR in the EU

- These concerns can make healthcare providers hesitant to adopt outsourcing models, especially when working with offshore vendors where data protection laws may differ or be less stringent

For instance,

- In August 2023, according to a report by the Office for Civil Rights (OCR), over 80% of healthcare data breaches involved third-party vendors, including billing service providers, raising alarms about the security of outsourced operations

- In April 2024, a study published by the Journal of Healthcare Information Management emphasized that healthcare organizations ranked data privacy risks as one of the top three barriers to outsourcing administrative services

- Consequently, despite the efficiency and financial advantages of outsourcing, data security concerns remain a major restraint, particularly for smaller providers with limited resources to manage vendor oversight and compliance

Medical Billing Outsourcing Market Scope

The market is segmented on the basis of component, service and end user.

|

Segmentation |

Sub-Segmentation |

|

By Component |

|

|

By Service |

|

|

By End User |

|

Medical Billing Outsourcing Market Regional Analysis

“North America is the Dominant Region in the Medical Billing Outsourcing Market”

- North America dominates the global medical billing outsourcing market, driven by its highly developed healthcare system, complex reimbursement landscape, and increasing demand for efficient revenue cycle management solutions

- U.S. holds a major share of the market due to the widespread adoption of electronic health records (EHRs), frequent changes in billing codes and regulations, and the growing pressure on healthcare providers to reduce operational cost

- The presence of leading outsourcing firms, along with well-defined HIPAA regulations and a strong emphasis on compliance, further strengthens the market position

- In addition, the rising physician burnout linked to administrative overload and the need for faster claim processing have prompted a significant shift toward third-party billing service providers in the region

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- Asia-Pacific is expected to witness the highest growth rate in the medical billing outsourcing market, fueled by expanding healthcare infrastructure, growing medical tourism, and increased digitization of healthcare service

- Countries such as India, the Philippines, and China are emerging as major hubs for medical billing outsourcing due to their cost-effective services, skilled workforce, and improving regulatory frameworks

- India, in particular, has become a preferred outsourcing destination with its large pool of trained medical coders, favorable government policies, and strong IT capabilities

- In addition, rising healthcare awareness, increased healthcare expenditure, and growing demand for accurate billing and coding services in urban hospitals and clinics across the region are contributing to rapid market expansion

- The entry of global outsourcing firms and partnerships with regional healthcare providers further enhance the market’s growth potential in Asia-Pacific

Medical Billing Outsourcing Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- R1 (U.S.)

- Oracle (U.S.)

- Veradigm LLC(U.S.)

- Experian (U.S.)

- eClinicalWorks (U.S.)

- GE HealthCare (U.S.)

- Genpact (U.S.)

- Tebra Technologies, Inc. (U.S.)

- McKesson Corporation (U.S.)

- Quest Diagnostics Incorporated (U.S.)

- The SSI Group LLC (U.S.)

- athenahealth, Inc. (U.S.)

- 5 Star Billing Services, Inc. (U.S.)

- Experian Information Solutions, Inc. (U.S.)

- GeBBS (U.S.)

- AdvancedMD, Inc. (U.S.)

- CareCloud, Inc. (U.S.)

- EverHealth Solutions Inc. (U.S.)

- PracticeSuite, Inc. (U.S.)

- ProMantra, Inc. (U.S.)

Latest Developments in Global Medical Billing Outsourcing Market

- In September 2024, Swedish investment firm EQT announced its agreement to acquire a controlling stake in GeBBS Healthcare Solutions, a leading provider of revenue cycle management and medical billing services. The acquisition, valued at over USD 850 million, aims to support GeBBS' next phase of growth and innovation in the healthcare outsourcing sector

- In August 2024, R1 RCM, a prominent revenue cycle management company, completed the acquisition of CloudMed, a provider of revenue intelligence solutions. This strategic move enhances R1 RCM's AI-driven analytics and automation capabilities, aiming to improve billing accuracy and financial performance for healthcare providers

- In July 2024, Cerner Corporation announced a collaboration with AWS to migrate its billing and revenue cycle management solutions to the cloud. This partnership is expected to offer scalable, secure, and efficient billing services, leveraging AWS's cloud infrastructure to optimize healthcare financial operations.

- In June 2024, Change Healthcare introduced a new AI-powered platform designed to streamline claims management processes. The platform utilizes machine learning algorithms to predict claim denials, automate corrections, and expedite reimbursements, thereby enhancing revenue cycle efficiency for healthcare organizations

- In May 2024, Cognizant Technology Solutions acquired TMG Health, a provider of business process services for government-sponsored health plans. This acquisition aims to broaden Cognizant's healthcare offerings, including medical billing and administrative services, to better serve the growing Medicare and Medicaid markets.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.