Global Medical Device And Accessories Market

Market Size in USD Billion

CAGR :

%

USD

150.51 Billion

USD

247.41 Billion

2025

2033

USD

150.51 Billion

USD

247.41 Billion

2025

2033

| 2026 –2033 | |

| USD 150.51 Billion | |

| USD 247.41 Billion | |

|

|

|

|

Medical Device and Accessories Market Size

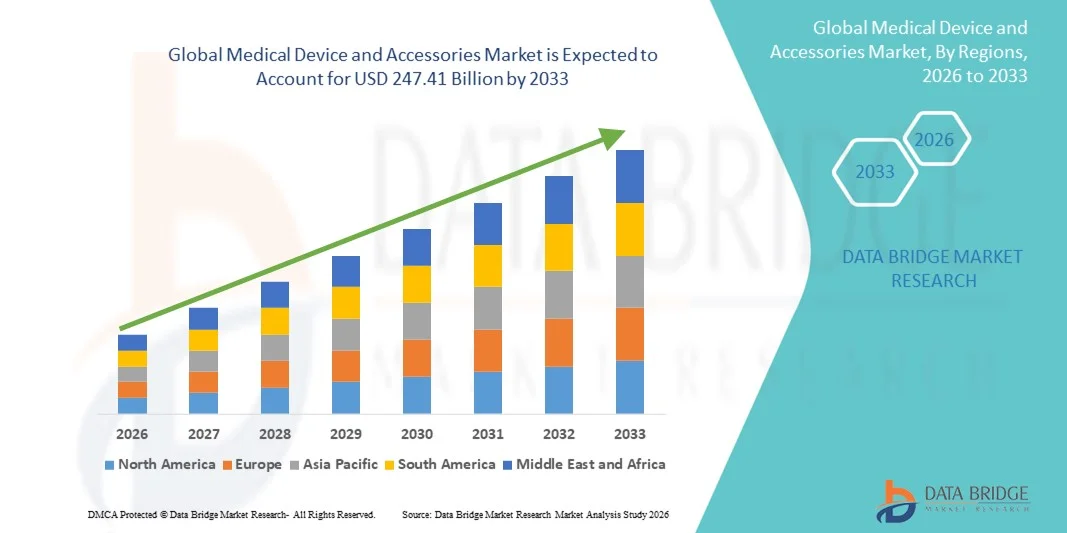

- The global medical device and accessories market size was valued at USD 150.51 billion in 2025 and is expected to reach USD 247.41 billion by 2033, at a CAGR of6.41% during the forecast period

- The market growth is largely fueled by the rising adoption of advanced medical technologies, increasing prevalence of chronic and acute diseases, and growing demand for improved patient care across hospitals, clinics, and home healthcare settings

- Furthermore, increasing investment in healthcare infrastructure, continuous technological innovation in medical devices, and rising demand for user-friendly, precise, and connected medical accessories are accelerating the uptake of medical device and accessories solutions, thereby significantly boosting the overall growth of the market

Medical Device and Accessories Market Analysis

- Medical devices and accessories, including diagnostic instruments, surgical tools, monitoring equipment, and supportive healthcare products, are increasingly vital in modern healthcare due to rising disease prevalence, the need for accurate diagnostics, and the growing emphasis on improved patient outcomes across hospitals, clinics, and home healthcare settings

- The escalating demand for medical devices and accessories is primarily driven by technological advancements, increasing healthcare expenditure, growing adoption of connected and wearable medical technologies, and rising awareness of precision healthcare solutions among patients and providers

- North America dominated the medical device and accessories market with the largest revenue share of 41.7% in 2025, supported by advanced healthcare infrastructure, strong government and private investments, high adoption of innovative medical technologies, and widespread availability of specialized medical equipment, particularly in the U.S.

- Asia-Pacific is expected to be the fastest-growing region in the medical device and accessories market during the forecast period, driven by increasing urbanization, rising healthcare spending, growing access to modern healthcare facilities, and increasing adoption of advanced medical technologies in countries such as China, India, and Japan

- The diagnostic devices segment dominated the largest market revenue share of 57.3% in 2025, driven by the rising demand for early disease detection and continuous patient monitoring across hospitals and clinics

Report Scope and Medical Device and Accessories Market Segmentation

|

Attributes |

Medical Device and Accessories Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

• Medtronic plc (Ireland) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Medical Device and Accessories Market Trends

Advancements in Device Innovation and Integrated Healthcare Solutions

- A significant and accelerating trend in the global medical device and accessories market is the increasing adoption of advanced, minimally invasive, and connected medical devices that improve clinical outcomes and patient care. Healthcare providers are focusing on devices that offer better precision, enhanced usability, and integration with hospital information systems

- For instance, wearable patient monitoring devices and connected diagnostic tools are gaining popularity, enabling continuous tracking of vital signs and early detection of health anomalies. These technologies help clinicians make timely interventions and personalize patient care

- Innovations in device design, such as portable imaging systems, robotic-assisted surgical instruments, and smart implantable accessories, are transforming surgical and diagnostic procedures, reducing recovery time, and improving procedural accuracy

- In addition, interoperability and integration with electronic health records (EHRs) and telehealth platforms are facilitating better clinical workflows, remote monitoring, and real-time data analysis for both inpatient and outpatient settings

- The trend toward patient-centric and technology-enabled devices is also driving the development of portable, user-friendly, and minimally invasive accessories that support home healthcare and chronic disease management

- Overall, this shift toward precision, accessibility, and connectivity in medical devices is reshaping healthcare delivery, encouraging manufacturers to invest in research, development, and digital integration strategies

- Consequently, medical device companies are increasingly focusing on innovative product portfolios that address unmet clinical needs, enhance patient safety, and improve overall healthcare efficiency

Medical Device and Accessories Market Dynamics

Driver

Rising Healthcare Demand and Technological Advancements

- The growing global demand for advanced healthcare services, combined with rapid technological innovations, is a major driver of the Medical Device and Accessories market. Increasing prevalence of chronic diseases, aging populations, and rising surgical procedures are fueling demand for sophisticated medical devices

- For instance, in 2025, several leading medical device manufacturers announced expansions in diagnostic imaging and surgical equipment portfolios to cater to rising hospital and clinic demand, driving market growth

- Advances in device technology, such as robotic-assisted surgery, minimally invasive instruments, and portable diagnostic systems, are enabling better clinical outcomes and patient satisfaction

- Furthermore, rising government investments in healthcare infrastructure, improved reimbursement policies, and adoption of smart hospital systems are further accelerating the market

- The need for real-time monitoring, patient safety improvements, and operational efficiency continues to propel the adoption of medical devices and their associated accessories across hospitals, clinics, and home healthcare settings

Restraint/Challenge

High Costs, Regulatory Hurdles, and Limited Accessibility in Emerging Markets

- High costs associated with advanced medical devices and their accessories remain a significant restraint, particularly in developing regions. Sophisticated diagnostic equipment, surgical instruments, and connected devices require substantial capital investment, limiting adoption among smaller hospitals and clinics

- For instance, robotic-assisted surgical systems and high-end imaging devices involve not only high purchase prices but also ongoing maintenance and staff training costs, making them inaccessible to some healthcare providers

- In addition, stringent regulatory approvals and compliance requirements for device safety and efficacy can slow product launches and market penetration

- Limited availability of skilled healthcare professionals trained to operate complex devices also constrains adoption, especially in regions with underdeveloped healthcare infrastructure.

- Overcoming these challenges through cost-effective device development, simplified training programs, and supportive healthcare policies will be critical for ensuring sustained growth in the global medical device and accessories market

Medical Device and Accessories Market Scope

The market is segmented on the basis of type, device type, application, and end user.

- By Type

On the basis of type, the Medical Device and Accessories market is segmented into diagnostic devices and therapeutic devices. The diagnostic devices segment dominated the largest market revenue share of 57.3% in 2025, driven by the rising demand for early disease detection and continuous patient monitoring across hospitals and clinics. Diagnostic devices, including imaging systems, in vitro diagnostic tools, and wearable monitors, are increasingly essential for preventive healthcare. The segment benefits from technological advancements such as AI-assisted imaging, portable diagnostic tools, and remote monitoring solutions. Hospitals and ambulatory centers are rapidly upgrading diagnostic equipment to improve patient outcomes. Growing prevalence of chronic diseases such as diabetes, cardiovascular disorders, and cancer further drives adoption. Integration with hospital IT systems enhances workflow efficiency, supporting high utilization. Regulatory approvals and reimbursement policies for diagnostic testing also bolster growth. Increased patient awareness of early detection strengthens market penetration.

The therapeutic devices segment is anticipated to witness the fastest CAGR of 8.7% from 2026 to 2033, fueled by the rising adoption of advanced treatment modalities in cardiology, oncology, and neurology. Therapeutic devices include catheters, cochlear implants, nerve stimulators, and other interventional technologies. Increasing minimally invasive procedures and home-based therapeutic solutions contribute to growth. Technological innovations, including robotics-assisted surgeries and smart infusion devices, are expanding the market. Rising geriatric populations demand more continuous therapy options. Growing insurance coverage for therapeutic procedures supports increased adoption. Emerging economies are investing heavily in therapeutic device infrastructure, driving rapid CAGR in this segment.

- By Device Type

On the basis of device type, the market is segmented into coronary pressure monitors, catheters, therapeutic medical guides, cochlear implants, cardiovascular applications, dental implants, nerve stimulators, diabetes monitors, and suture needles. The catheters segment held the largest market revenue share of 22.9% in 2025, driven by its widespread use in cardiovascular, urological, and interventional procedures. Catheters are essential for both diagnostic and therapeutic applications, including angiography, dialysis, and cardiac interventions. High procedure volumes and repeat use in chronic disease management contribute to dominant revenue share. Continuous innovation in catheter design, including drug-eluting and minimally invasive variants, enhances performance. Hospitals and surgical centers prefer catheters due to their proven clinical efficacy. Rising cardiovascular disease prevalence globally further supports strong demand. Regulatory support for advanced interventional devices reinforces market penetration. Training and familiarity among clinicians sustain adoption.

The nerve stimulators segment is expected to witness the fastest CAGR of 9.5% from 2026 to 2033, driven by rising incidence of chronic pain, neurological disorders, and Parkinson’s disease. Advanced neuromodulation devices provide targeted therapy for pain management, epilepsy, and movement disorders. Home-use and implantable devices are expanding the patient base. Integration with digital health platforms allows for remote monitoring and therapy adjustment. Technological innovation, including rechargeable and miniaturized stimulators, is accelerating adoption. Increasing reimbursement coverage for neurostimulation therapies supports growth. Awareness campaigns among clinicians and patients further boost penetration. These factors collectively drive rapid growth in this segment.

- By Application

On the basis of application, the market is segmented into urology, wound care, radiology, respiratory, infection control, cardiology, in vitro diagnostics, and others. The cardiology segment dominated the market with a revenue share of 28.4% in 2025, fueled by the rising prevalence of cardiovascular diseases globally. Cardiology applications include diagnostic imaging, interventional devices, implantable pacemakers, and monitoring systems. Hospitals and specialized cardiac centers heavily invest in advanced cardiac devices to improve patient outcomes. Aging populations and lifestyle-related cardiovascular risk factors drive higher device usage. Technological advancements, including AI-assisted diagnostics and minimally invasive devices, enhance adoption. Government initiatives promoting cardiovascular health further support the market. Increased clinical awareness and early intervention programs strengthen penetration. High procedure volumes and recurring device usage maintain revenue dominance.

The wound care segment is anticipated to witness the fastest CAGR of 8.9% from 2026 to 2033, driven by the rising incidence of diabetes, chronic ulcers, and post-surgical wound management needs. Advanced wound care products, including negative pressure therapy systems, bioengineered skin substitutes, and antimicrobial dressings, are expanding adoption. Growing home healthcare and ambulatory care settings contribute to market growth. Technological innovations in dressings and infection control enhance clinical outcomes. Rising awareness among patients and caregivers drives frequent use. Insurance coverage for chronic wound treatment further supports adoption. Emerging markets are increasingly investing in wound care infrastructure. Collectively, these factors fuel rapid segment growth.

- By End User

On the basis of end user, the market is segmented into hospitals, ambulatory surgical centers, clinics, and others. The hospitals segment dominated the market with a revenue share of 63.1% in 2025, driven by the high adoption of medical devices for diagnosis, treatment, and monitoring. Hospitals serve as the primary setting for advanced interventional procedures, chronic disease management, and surgical therapies. Investment in infrastructure, skilled workforce, and integration of hospital IT systems boosts device utilization. Higher procedure volumes in inpatient and outpatient departments sustain revenue dominance. Government and private hospital expansions further strengthen adoption. Continuous upgrades and replacement of medical devices maintain market stability. Advanced devices for cardiology, radiology, and wound care are heavily used in hospital settings.

The ambulatory surgical centers segment is expected to witness the fastest CAGR of 9.2% from 2026 to 2033, fueled by the growing preference for outpatient procedures and minimally invasive surgeries. Cost efficiency, convenience, and shorter recovery times attract patients. Increasing adoption of diagnostic and therapeutic devices in ASCs drives growth. Technological advancements enabling portable and compact devices support rapid market penetration. Insurance coverage for outpatient procedures encourages patient flow. Emerging markets are increasingly establishing ASCs to improve accessibility. These factors collectively contribute to the high growth rate in this segment.

Medical Device and Accessories Market Regional Analysis

- North America dominated the medical device and accessories market with the largest revenue share of 41.7% in 2025

- Supported by advanced healthcare infrastructure, strong government and private investments, high adoption of innovative medical technologies, and widespread availability of specialized medical equipment, particularly in the U.S.

- The region benefits from a technologically inclined population, robust regulatory frameworks, and well-established healthcare delivery systems, which together facilitate the adoption of advanced medical devices across hospitals, clinics, and diagnostic centers

U.S. Medical Device and Accessories Market Insight

The U.S. medical device and accessories market accounted for the largest revenue share within North America in 2025, driven by high healthcare expenditure, rapid technological innovation, and strong presence of leading medical device manufacturers. Increasing adoption of minimally invasive surgical tools, diagnostic imaging systems, and connected healthcare devices is fueling market growth. In addition, government initiatives supporting modern healthcare infrastructure and reimbursement policies for advanced medical equipment are further encouraging the adoption of medical devices and accessories across both hospital and outpatient settings.

Europe Medical Device and Accessories Market Insight

The Europe medical device and accessories market is projected to expand at a substantial CAGR throughout the forecast period, driven by increasing healthcare expenditure, aging populations, and growing demand for advanced medical technologies. Rising investments in hospital infrastructure, stringent quality and safety regulations, and widespread awareness of modern medical devices are supporting market growth. The region is witnessing increased adoption across diagnostic, surgical, and therapeutic applications, with medical devices being incorporated into both new facilities and modernization projects.

U.K. Medical Device and Accessories Market Insight

The U.K. medical device and accessories market is expected to grow at a noteworthy CAGR during the forecast period, driven by government initiatives to modernize healthcare services, increasing adoption of innovative medical technologies, and high demand for specialized equipment in hospitals and clinics. Rising prevalence of chronic and lifestyle-related diseases, along with a focus on improving patient outcomes and operational efficiency, is encouraging healthcare providers to invest in advanced medical devices and accessories.

Germany Medical Device and Accessories Market Insight

The Germany medical device and accessories market is anticipated to expand at a considerable CAGR during the forecast period, fueled by a strong healthcare infrastructure, increasing demand for technologically advanced devices, and a well-established network of hospitals and research centers. Germany’s emphasis on precision medicine, innovation, and sustainable medical solutions promotes the adoption of advanced diagnostic, therapeutic, and surgical devices. The integration of digital and connected medical technologies is also becoming increasingly prevalent, aligning with the country’s patient-centric and technology-driven healthcare approach.

Asia-Pacific Medical Device and Accessories Market Insight

The Asia-Pacific medical device and accessories market is expected to grow at the fastest CAGR during the forecast period, driven by increasing urbanization, rising healthcare spending, growing access to modern healthcare facilities, and adoption of advanced medical technologies in countries such as China, India, and Japan. Expanding healthcare infrastructure, government-led initiatives to improve medical services, and rising awareness of innovative medical devices are accelerating market growth. In addition, the region is emerging as both a manufacturing hub and a key consumer market for medical devices and accessories, making advanced technologies more accessible to a wider population.

Japan Medical Device and Accessories Market Insight

The Japan medical device and accessories market experiencing steady growth due to the country’s advanced healthcare system, high adoption of medical technologies, and aging population. Strong focus on improving patient outcomes, increasing hospital investments in cutting-edge equipment, and adoption of connected medical devices are driving market expansion. Japan’s emphasis on innovation and precision medicine continues to support widespread use of medical devices in both hospital and outpatient care settings.

China Medical Device and Accessories Market Insight

The China medical device and accessories market accounted for a significant revenue share in Asia-Pacific in 2025, driven by rapid urbanization, increasing healthcare expenditure, and expanding access to modern medical facilities. Rising prevalence of chronic and lifestyle diseases, coupled with growing adoption of advanced medical technologies and government healthcare initiatives, is fueling market growth. In addition, China’s emergence as a manufacturing hub for medical devices is improving affordability and accessibility, further accelerating adoption in hospitals, clinics, and outpatient care centers.

Medical Device and Accessories Market Share

The Medical Device and Accessories industry is primarily led by well-established companies, including:

• Medtronic plc (Ireland)

• Abbott (U.S.)

• Siemens Healthineers AG (Germany)

• GE Healthcare (U.S.)

• Johnson & Johnson (U.S.)

• Philips Healthcare (Netherlands)

• Stryker Corporation (U.S.)

• B. Braun SE(Germany)

• Boston Scientific Corporation (U.S.)

• Canon Medical Systems Corporation (Japan)

• Zimmer Biomet Holdings, Inc. (U.S.)

• Smith & Nephew plc (U.K.)

• Terumo Corporation (Japan)

• Hologic, Inc. (U.S.)

• Baxter International Inc. (U.S.)

• Roche Diagnostics (Switzerland)

• Fresenius SE & Co. KGaA (Germany)

• Edwards Lifesciences Corporation (U.S.)

Latest Developments in Global Medical Device and Accessories Market

- In January 2025, Stryker launched the Insignia Hip Stem device in India, a next‑generation orthopedic implant that uses the Total Hip 4.1 software to capture a patient’s unique anatomy, enabling easier implantation and better outcomes in hemiarthroplasty and total hip procedures. This launch underscores Stryker’s commitment to personalized orthopedic care and expanding its footprint in emerging markets such as India, where demand for advanced implants is rising

- In June 2025, Tracky introduced India’s first Bluetooth‑connected continuous glucose monitor (CGM), compatible with iOS and Android devices, helping transform diabetes care by providing real‑time glucose tracking through an integrated transmitter and sensor system. This development reflects the growing adoption of connected health monitoring devices in diabetes management worldwide

- In January 2025, ResMed launched the AirSense 11 sleep apnea device in India, featuring remote software updates, care check‑ins, and a personal therapy assistant, supported by the AirView remote monitoring platform and myAir app to enhance patient compliance and therapy outcomes. This launch highlights the ongoing expansion of home‑based respiratory care solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.