Global Medical Device Clinical Investigation Advisory Solutions Market

Market Size in USD Million

CAGR :

%

USD

186.21 Million

USD

446.13 Million

2025

2033

USD

186.21 Million

USD

446.13 Million

2025

2033

| 2026 –2033 | |

| USD 186.21 Million | |

| USD 446.13 Million | |

|

|

|

|

Medical Device Clinical Investigation Advisory Solutions Market Size

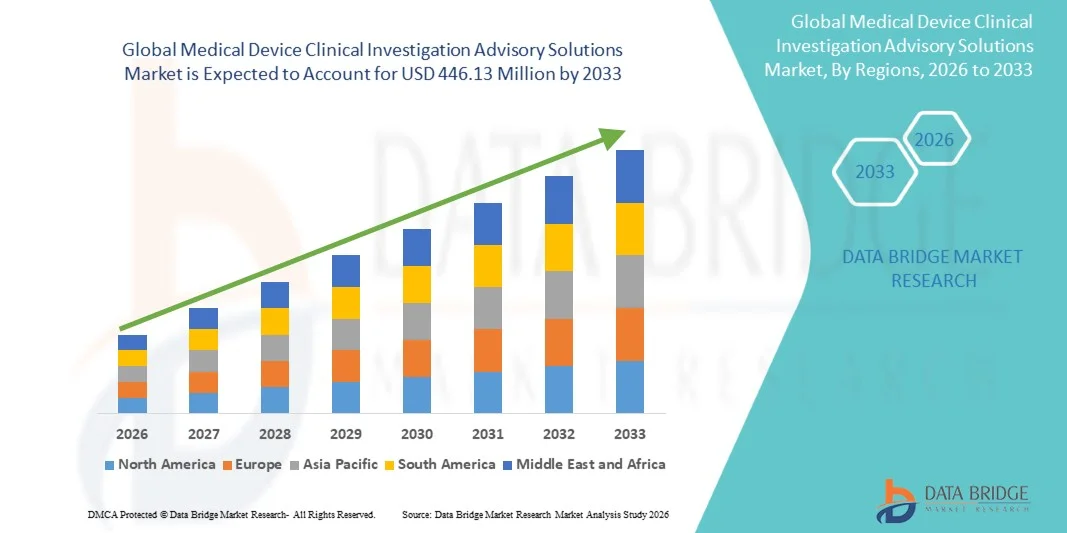

- The global Medical Device Clinical Investigation Advisory Solutions market size was valued at USD 186.21 Million in 2025 and is expected to reach USD 446.13 Million by 2033, at a CAGR of 11.54% during the forecast period

- The market growth is largely fueled by the increasing complexity of regulatory frameworks in the medical device industry, coupled with the rising adoption of outsourcing clinical investigation advisory services to ensure faster product approvals and compliance across global markets

- Furthermore, growing demand for cost-efficient and expert-led clinical trial guidance is driving medical device manufacturers to rely on specialized advisory solutions, thereby significantly boosting the industry's growth

Medical Device Clinical Investigation Advisory Solutions Market Analysis

- Medical Device Clinical Investigation Advisory Solutions, offering expert-led guidance and regulatory support for clinical trials, are increasingly vital for medical device manufacturers to accelerate product approvals, ensure compliance, and optimize clinical operations across global markets

- The escalating demand for these advisory solutions is primarily fueled by the growing complexity of regulatory frameworks, the need for faster time-to-market, and rising adoption of outsourcing by medical device companies seeking cost-efficient and specialized trial support

- North America dominated the medical device clinical investigation Advisory Solutions market with the largest revenue share of 39.2% in 2025, characterized by a strong presence of key medical device companies, mature clinical research infrastructure, and strict regulatory requirements

- Asia-Pacific is expected to be the fastest growing region in the market during the forecast period due to rapid medical device industry growth, increasing clinical trial activities, and higher outsourcing of regulatory and advisory services

- The Regulatory Advisory segment dominated the largest market revenue share of 58.4% in 2025, driven by the increasing complexity of medical device regulations across regions such as North America, Europe, and Asia-Pacific

Report Scope and Medical Device Clinical Investigation Advisory Solutions Market Segmentation

|

Attributes |

Medical Device Clinical Investigation Advisory Solutions Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Medical Device Clinical Investigation Advisory Solutions Market Trends

“Increasing Adoption of Advanced Clinical Investigation Advisory Services”

- A notable trend in the global medical device clinical investigation advisory solutions market is the growing adoption of specialized advisory services to support clinical trials, regulatory submissions, and post-market surveillance for medical devices

- Companies are increasingly investing in solutions that help streamline clinical study design, protocol development, and regulatory compliance to reduce time-to-market and mitigate risks

- For instance, in 2024, several medical device manufacturers in North America partnered with advisory solution providers to optimize their clinical trial strategies and ensure faster regulatory approvals

- There is also a rising demand for integrated solutions that combine scientific, regulatory, and operational expertise to assist manufacturers in conducting high-quality, compliant clinical investigations efficiently

- This trend reflects the increasing complexity of regulatory frameworks and the need for expert guidance throughout the product lifecycle, driving adoption of clinical investigation advisory services globally

Medical Device Clinical Investigation Advisory Solutions Market Dynamics

Driver

“Growing Need for Regulatory Compliance and Efficient Clinical Trial Management”

- The rising regulatory requirements for medical devices, including stringent safety and efficacy standards, are a primary driver for advisory solution adoption

- Manufacturers are seeking expert support to navigate complex regulations, prepare submissions, and ensure compliance with bodies such as the FDA, EMA, and other regional authorities

- For instance, in early 2025, a European medical device firm engaged advisory services to facilitate compliance with new EU MDR regulations, reducing the risk of approval delays

- In addition, the need to optimize clinical trial efficiency, reduce operational costs, and shorten product development cycles is propelling demand for these solutions

- Increasing awareness of patient safety, clinical evidence quality, and risk management is further encouraging manufacturers to rely on professional advisory services to strengthen study designs and outcomes

Restraint/Challenge

“High Costs and Limited Availability of Specialized Expertise”

- The relatively high cost of engaging medical device clinical investigation advisory services can be a barrier for small and mid-sized manufacturers, particularly in emerging markets

- Advanced advisory solutions often require long-term contracts or retainers, which may be prohibitive for organizations with limited budgets

- For instance, several startups in Asia delayed contracting advisory services in 2023 due to budget constraints, affecting the pace of their clinical investigations

- Limited availability of qualified and experienced advisors in certain regions also restricts market penetration and may lead to project delays

- Addressing these challenges through cost-effective service models, regional expansion of advisory firms, and remote consulting options will be key for sustained market growth

Medical Device Clinical Investigation Advisory Solutions Market Scope

The market is segmented on the basis of service type and end users.

• By Service Type

On the basis of service type, the Medical Device Clinical Investigation Advisory Solutions market is segmented into Regulatory Advisory and Clinical Trial Management. The Regulatory Advisory segment dominated the largest market revenue share of 58.4% in 2025, driven by the increasing complexity of medical device regulations across regions such as North America, Europe, and Asia-Pacific. Medical device companies rely heavily on regulatory advisory services to navigate pre-market approvals, post-market compliance, and submission processes. The growing emphasis on patient safety and product quality standards fuels demand. Regulatory consultants provide guidance on risk management, labeling, and documentation, ensuring faster market access. Strict compliance requirements from bodies like FDA, EMA, and PMDA enhance reliance on these services. Technological advancements in e-submissions and digital regulatory tracking further increase efficiency. The segment benefits from long-term contracts with top-tier medical device manufacturers. Rising launch volumes of innovative devices and high-value diagnostic instruments drive consistent demand. Regulatory advisory services reduce legal and operational risks for manufacturers. Increasing focus on global harmonization of standards supports segment dominance. Outsourcing regulatory expertise allows companies to optimize costs and accelerate time-to-market. These factors collectively make regulatory advisory the largest service type segment.

The Clinical Trial Management segment is expected to witness the fastest CAGR of 11.3% from 2026 to 2033, driven by the rising number of clinical trials and post-market studies for new and innovative medical devices. Growing adoption of digital trial management platforms ensures streamlined trial planning, patient recruitment, monitoring, and reporting. Outsourcing clinical trial management to specialized providers reduces operational burden on device companies. Increasing complexity of multi-center trials and need for real-time data capture support growth. Regulatory authorities are emphasizing data integrity, audit readiness, and risk-based monitoring, which enhances demand. Expansion of medical device R&D pipelines in emerging markets fuels adoption. CROs increasingly offer end-to-end trial management solutions for efficiency. Advanced analytics and AI-driven monitoring in trial management improve accuracy and reduce timelines. Demand for cost-effective solutions during device development supports adoption. Integration with electronic health records and wearable devices accelerates clinical trial efficiency. Growing trend of patient-centric trials enhances adoption. These factors collectively make clinical trial management the fastest-growing service type segment.

• By End Users

On the basis of end users, the Medical Device Clinical Investigation Advisory Solutions market is segmented into Medical Device Companies and Contract Research Organizations (CROs). The Medical Device Companies segment accounted for the largest market revenue share of 64.7% in 2025, driven by the rising number of medical device launches globally and the need to comply with stringent regulatory standards. Companies rely heavily on external advisory services to accelerate market entry and maintain compliance. The increasing complexity of product classifications, safety testing, and post-market surveillance fuels demand. Large and mid-sized device manufacturers outsource regulatory and clinical expertise to optimize costs and ensure speed-to-market. Rapid innovation in diagnostic, surgical, and implantable devices increases dependence on advisory solutions. Companies require continuous support for label changes, reporting adverse events, and audit preparation. Global harmonization initiatives such as ISO 13485 and MDR increase adoption. Partnerships with CROs and advisory firms enhance operational efficiency. Regulatory delays are minimized, reducing commercial risk. High-value contracts and long-term advisory partnerships strengthen segment dominance. Companies in North America and Europe lead adoption, but emerging markets are increasingly contributing. These factors collectively make medical device companies the dominant end-user segment.

The Contract Research Organizations (CROs) segment is expected to witness the fastest CAGR of 10.2% from 2026 to 2033, driven by the growing trend of outsourcing clinical trials and regulatory support services. CROs increasingly seek advisory solutions to expand their service offerings and improve operational efficiency. Rising multi-center and global clinical trials demand efficient trial management and compliance guidance. Increasing collaboration between device manufacturers and CROs fuels growth. Technological advancements, such as AI-driven monitoring and digital trial platforms, enhance adoption. CROs aim to reduce timelines and operational costs while ensuring data quality and regulatory compliance. Expansion of services to emerging markets supports adoption. Strong demand for specialized expertise in high-risk device categories accelerates growth. CROs rely on advisory services to ensure successful regulatory submissions and mitigate risks. Growing healthcare infrastructure investments and innovative device launches further enhance market potential. Adoption of virtual and hybrid trial models promotes reliance on advisory solutions. These factors collectively make CROs the fastest-growing end-user segment.

Medical Device Clinical Investigation Advisory Solutions Market Regional Analysis

- North America dominated the medical device clinical investigation advisory solutions market with the largest revenue share of 39.2% in 2025

- Driven by a mature healthcare ecosystem, a high concentration of medical device companies, and strong regulatory frameworks supporting clinical research

- The region benefits from advanced clinical trial infrastructures, highly skilled research professionals, and well-established regulatory compliance systems, which encourage outsourcing of advisory services for medical device development, clinical validation, and regulatory submissions

U.S. Medical Device Clinical Investigation Advisory Solutions Market Insight

The U.S. medical device clinical investigation advisory solutions market captured the majority of North America’s revenue in 2025, driven by high adoption of outsourced clinical advisory services and a growing need for regulatory expertise in medical device approvals. Companies increasingly leverage specialized advisory firms to design clinical studies, develop regulatory strategies, and manage submissions efficiently. This is particularly important for novel devices requiring pre-market approval or compliance with FDA regulations. The country’s strong research infrastructure, coupled with a focus on innovation and expedited device approvals, continues to propel market growth.

Europe Medical Device Clinical Investigation Advisory Solutions Market Insight

The Europe medical device clinical investigation advisory solutions market is projected to expand at a substantial CAGR during the forecast period, fueled by stringent regulations such as the EU Medical Device Regulation (MDR), rising adoption of innovative medical devices, and growing clinical research initiatives. Companies are increasingly outsourcing clinical advisory services to navigate complex compliance requirements, manage multi-center trials, and accelerate regulatory submissions.

U.K. Medical Device Clinical Investigation Advisory Solutions Market Insight

The U.K. medical device clinical investigation advisory solutions market is anticipated to grow steadily, supported by a mature healthcare ecosystem, robust clinical research infrastructure, and government initiatives promoting medical device innovation. The country’s regulatory environment encourages outsourcing to specialized advisory firms for clinical trial management, regulatory strategy, and compliance with both UK MDR and global standards. The rise in minimally invasive and technologically advanced medical devices has also increased demand for expert guidance in clinical validation and market entry strategies.

Germany Medical Device Clinical Investigation Advisory Solutions Market Insight

Germany medical device clinical investigation advisory solutions market is a key contributor to Europe’s market growth, driven by its well-established healthcare infrastructure, high adoption of medical technologies, and strong emphasis on research and development. German medical device manufacturers increasingly rely on clinical investigation advisory solutions to comply with MDR regulations, design effective clinical trials, and gain faster approval for innovative devices. The country’s focus on precision medicine, digital health technologies, and cutting-edge diagnostics further accelerates demand for outsourced advisory services.

Asia-Pacific Medical Device Clinical Investigation Advisory Solutions Market Insight

Asia-Pacific medical device clinical investigation advisory solutions market is expected to be the fastest-growing region during the forecast period due to rapid expansion of the medical device industry, increased outsourcing of clinical advisory services, and rising regulatory requirements. Growing healthcare infrastructure, expanding medical device manufacturing, and cost-effective access to advisory expertise are key growth drivers. Countries such as China, India, and Japan are witnessing heightened demand for clinical advisory services to ensure timely compliance and market approval of innovative devices.

Japan Medical Device Clinical Investigation Advisory Solutions Market Insight

Japan’s medical device clinical investigation advisory solutions market growth is fueled by its advanced healthcare sector, aging population, and strong demand for innovative medical devices. Clinical advisory firms support device manufacturers with regulatory submissions, trial design, and compliance with local standards, enabling efficient clinical validation and faster market access.

China Medical Device Clinical Investigation Advisory Solutions Market Insight

China medical device clinical investigation advisory solutions market held the largest market revenue share in the Asia-Pacific region in 2025, driven by a rapidly expanding domestic medical device industry, government initiatives promoting regulatory compliance, and collaboration with global advisory firms. This environment has facilitated shorter approval cycles and improved market access for medical devices, further boosting demand for clinical investigation advisory solutions.

Medical Device Clinical Investigation Advisory Solutions Market Share

The Medical Device Clinical Investigation Advisory Solutions industry is primarily led by well-established companies, including:

- Medpace (U.S.)

- ICON plc (Ireland)

- PPD Inc. (U.S.)

- Parexel International (U.S.)

- Charles River Laboratories (U.S.)

- Covance Inc. (U.S.)

- Medtronic Clinical Trials Services (U.S.)

- Syneos Health (U.S.)

- Eurofins Scientific (Luxembourg)

- Pharmaceutical Product Development (PPD) (U.S.)

- Wuxi AppTec (China)

- SGS Life Sciences (Switzerland)

- Labcorp Drug Development (U.S.)

- Parexel International Corp (U.S.)

- CRF Health (U.K.)

- PRA Health Sciences (U.S.)

- Accenture Life Sciences (Ireland)

- Covance (U.S.)

- Clinipace (U.S.)

Latest Developments in Global Medical Device Clinical Investigation Advisory Solutions Market

- In January 2025, Tigermed extended its strategic partnership with Medidata to accelerate clinical trials of medical devices using Medidata’s digital platform, automating data capture and streamlining CRO operations across global clinical studies, enhancing trial management efficiency

- In January 2025, NAMSA acquired the U.S. medical device testing operations of WuXi AppTec, expanding its clinical research and testing solutions portfolio to provide more comprehensive preclinical and clinical advisory services for device manufacturers seeking regulatory approvals and market readiness

- In January 2025, Canyon Labs completed the acquisition of iuvo BioScience’s lab services and consulting business, strengthening its CRO support services like biocompatibility testing and analytical testing, which are essential components of advisory solutions across the medical device lifecycle

- In February 2025, Arterex acquired Phoenix, an Italy‑based medical device design and development company, enabling enhanced end‑to‑end clinical development support and advisory services for device testing and regulatory compliance in European markets

- In February 2025, Arterex also acquired Adroit, expanding its global contract research and manufacturing capabilities, thereby facilitating streamlined clinical development and regulatory advisory services for device companies

- In March 2025, InTandem Capital announced a strategic investment in Clinilabs, indicating growing investor interest in specialized CROs serving medical device research, which contributes indirectly to advisory services on investigational and regulatory strategy

- In March 2025, ICON plc expanded its regulatory outsourcing services in the Asia‑Pacific region, focusing on faster and region‑specific regulatory consultation and clinical test support for medical device clients in markets like China and India

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.